January 2026

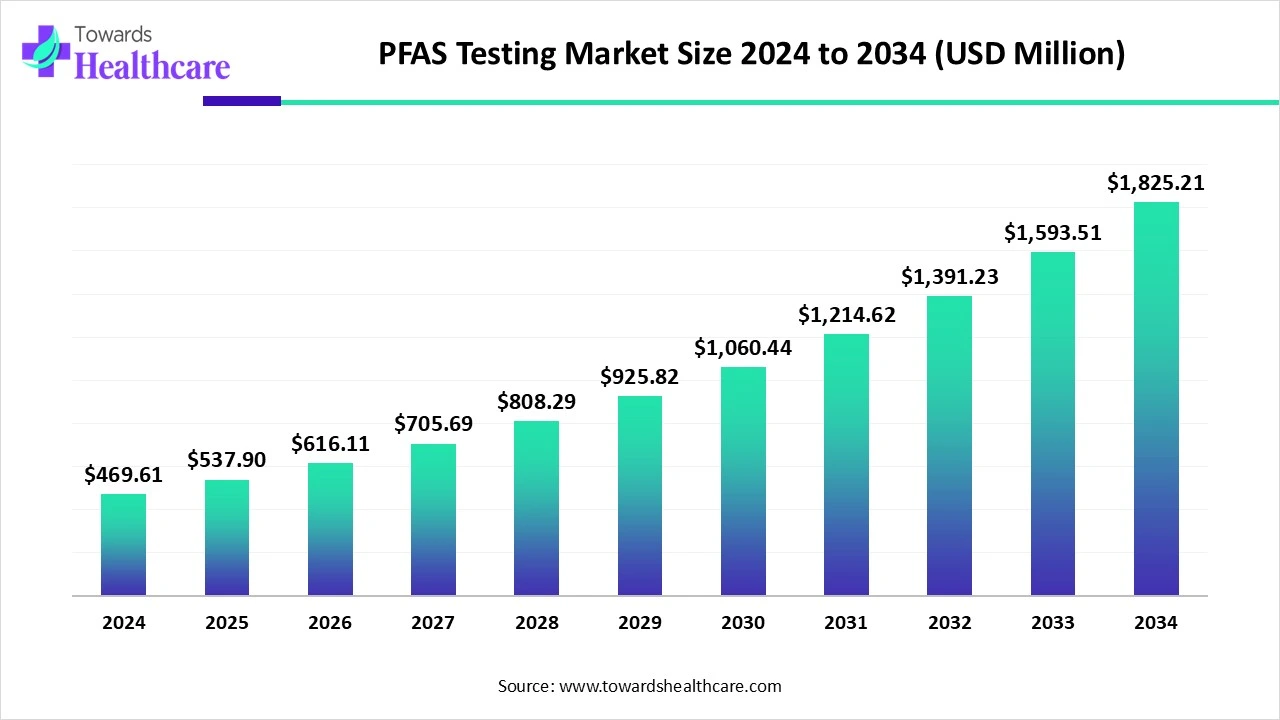

The global PFAS testing market size is calculated at US$ 537.89 million in 2025, grew to US$ 616.1 million in 2026, and is projected to reach around US$ 2090.58 million by 2035. The market is expanding at a CAGR of 14.54% between 2026 and 2035.

Around the world, accelerating environmental complexities, including PFAS contamination of water sources and ecosystems, with enhanced challenges of PFAS contaminants that are linked with health concerns, are driving the global PFAS testing market growth. Furthermore, the involvement of the U.S. EPA, EU REACH, and OECD is propelling demand for precise PFAS detection using methods such as LC-MS/MS, GC-MS, and TOF-MS. As well as in various countries, rising awareness about PFAS’s probable health effects is also assisting in the adoption of these tests. Along with this, innovation in analytical techniques is boosting efficiency, safety, and accuracy of testing in different areas of samples, like soil. Wastewater treatment, air, and industrial water.

| Metric | Details |

| Market Size in 2026 | USD 616.1 Million |

| Projected Market Size in 2035 | USD 2090.58 Million |

| CAGR (2025 - 2034) | 14.54% |

| Leading Region | North America |

| Market Segmentation | By Matrix Type, By Testing Method, By Service Provider, By Region |

| Top Key Players | Eurofins Scientific, SGS SA, ALS Limited, Pace Analytical Services, Intertek Group plc, Test America, Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Shimadzu Corporation, Axys Analytical |

The PFAS testing market encompasses analytical testing services, equipment, and consumables used to detect, quantify, and monitor PFAS compounds in water, soil, air, food, biological samples, and industrial products. PFAS, dubbed “forever chemicals,” are persistent environmental pollutants linked to adverse health outcomes such as cancer, endocrine disruption, and immune system effects. Global regulatory mandates, including from the U.S. EPA, EU REACH, and OECD, are driving demand for accurate PFAS detection using methods such as LC-MS/MS, GC-MS, and TOF-MS. Currently, the market is seeking an expansion in mobile and on-site testing measures for faster screening of PFAS contamination, especially in water samples.

Primarily, a significant role of AI, machine learning is in transforming PFAS (per- and polyfluoroalkyl substances) testing by accelerating efficiency, accuracy, and affordability. Whereas, the contribution of ongoing breakthroughs in AI and other analytical techniques, with raised need for safer substitutes to PFAS chemicals, is propelling research and development in PFAS testing and remediation, further supporting market growth. Generally, AI algorithms help in the analysis of huge datasets, detecting contamination profiles, and improving remediation approaches, coupled with the estimation of PFAS concentrations in groundwater.

Widespread Awareness of Health Concerns and Advanced Testing Approaches

The PFAS testing market is driven by rising awareness of PFAS's potential health effects, such as associated with different health issues, mainly acting as a driver for testing. Furthermore, developing environmental complications, including PFAS contamination of water sources and ecosystems, are also prone to the broad adoption of these testing procedures. Besides this, immense advancements in analytical technologies, like high-resolution mass spectrometry and automated testing equipment, are expanding the application of PFAS detection and quantification.

Restricted Authenticated Test Methods and Difficulties in Environmental Sampling

Limited authorized and universally accepted laboratory test methods, particularly PFAS analysis in matrices like soil, wastewater, and food packaging materials, are a crucial obstacle in the PFAS testing market expansion. Along with this, the collection of representative samples from different environmental matrices, including soil, sediment, and wastewater, may pose challenges and require skilled professionals to avoid contamination and boost precise results.

Development of New Application Areas and Advancing Techniques

Widen applications of PFAS testing solutions in various areas, such as testing of soil, air, food, and numerous industrial products, like scrutiny of cosmetic products, textile testing. In addition, the growing use of this testing is assisting in the emergence of novel advances in analytical techniques, such as mass spectrometry and chromatography, with increasingly high-throughput and inexpensive properties. As well as integrated technologies, including IoT sensors, cloud-based analytics, and automated platforms with escalated real-time monitoring and data analysis, are also developing new opportunities in the respective market.

By matrix type, the water testing segment captured the largest share of the market, due to numerous advantages of PFAS testing in drinking water, wastewater water and other water sources like surface water, groundwater, and industrial process water. Besides this, different regions’ governments and environmental bodies are creating stringent limits for FAS levels in drinking water and wastewater, which require more often and accurate testing. Along with this, strong awareness among the public about possible health risks connected with PFAS exposure is impelling demand for testing to confirm the safety of drinking water and other water sources

In 2024, the liquid chromatography-mass spectrometry (LC-MS/MS) segment dominated the PFAS testing market. The emergence of its high sensitivity and potential to discrete and identify several PFAS compounds is boosting the adoption of this technique in testing. Also, this segment has versatility in drinking water, wastewater, soil, and biological samples, and its progressive adoption is driving the overall segment and market growth.

However, the immunoassay-based rapid tests segment is predicted to show significant expansion in the projected period. The segment has many benefits over the above testing approach, such as its rapid development results, with decreased turnaround time, as well as being affordable tests, especially for large-scale or frequent testing needs. Moreover, a growing need for faster, on-site PFAS detection in different settings (e.g., water sources, industrial sites) is fueling the adoption of portable immunoassay-based rapid tests. As well as this test is basically user-friendly, which necessary minimal skilled professional training, possessing enhanced accessibility for many users.

The third-party testing laboratories segment led with the biggest share of the global PFAS testing market in 2024. Incorporation of EPA-validated testing methodologies, like EPA 537, EPA 533, and EPA 8327, is becoming the industry standard due to their sensitivity and capability of the analysis of several PFAS compounds in diverse matrices. Besides this, third-party testing laboratories enable independent verification of PFAS levels, offering an unbiased assessment of contamination and building reliability among stakeholders.

Whereas, the academic & research laboratories segment will register the fastest growth during 2025-2034. Eventually, the segment will widely adopt the major validation and standardization of novel testing, with the possession of specialized knowledge and expertise for PFAS analysis accelerating the ultimate segment expansion. Although vital collaborations among academic institutions, industry stakeholders, and regulatory bodies are fostering novel developments and assisting in ensuring testing methods meet recent scientific advancements.

As per research, North America was dominant in the market in 2024, driven by U.S. EPA regulations and legal settlements. Also, the contribution of Environment Canada, such as maximum contaminant levels (MCLs) and mandatory monitoring of PFAS in drinking water, soil, and industrial effluents, has fueled the overall regional market expansion. As well as highlighted, public awareness and scrutiny of PFAS contamination in North America resulted in the enforcement of highly strict testing requirements.

As mentioned above, the U.S. EPA regulations, with rising research activities in the health impacts of PFAS and breakthroughs in analytical techniques like mass spectrometry and chromatography, are driving the adoption of these tests with their escalated effectiveness and accuracy level in the US market.

For instance,

Mainly, contributing factors, like Canadian environmental regulations, with raised expenditure on environmental studies, remediation efforts, and enforcement activities, are widely impacting Canada’s market growth. Also, this region is focusing on investments in wastewater treatment and water management technologies are also supporting the adoption and demand for PFAS testing.

For this market,

During 2025-2034, Asia Pacific will expand rapidly, due to faster industrial growth and urbanization in this region are resulting in optimized application of PFAS in different industrial processes and consumer products, leading to widespread potential for PFAS contamination. Furthermore, governments in South Korea, Japan, and India are executing highly strict environmental rules for monitoring and controlling PFAS discharge in water and other media.

In Japan, growing innovations in analytical techniques, like as liquid chromatography-mass spectrometry (LC-MS/MS), have enhanced the speed, accuracy, and efficiency of PFAS testing, which is further assisting the market expansion. Also, Japan has been increasingly putting efforts into a variety of industries, like the chemical, manufacturing, and firefighting sectors are greatly investing in these tests to meet compliance with regulations and mitigate environmental risks.

For instance,

South Korea’s market is driven by its accelerating focus on improvements in water quality and broad investments in wastewater treatment infrastructure. Furthermore, the South Korean government is actively encouraging environmental protection and enforcing policies to control PFAS pollution. Besides this, public health agencies and private vendors are partnering on pilot projects and technology trials to highlight PFAS contamination risks.

Primarily, Europe is experiencing a significant expansion of the PFAS testing market, with the involvement of industries, particularly manufacturing, oil & gas, and municipal water treatment are further investing in the PFAS testing to achieve industrial compliance with regulations and reduce environmental effects. As well as major emphasis on circular economy principles and sustainable laboratory practices, with adoption of green chemistry reagents and energy-efficient instrumentation is also fueling Europe’s overall market growth.

General rise in Germany’s robust industrial sector, especially in chemicals, pharmaceuticals, and food & beverage, is a crucial contributor to PFAS contamination and ultimately supports a requirement for testing and monitoring. Additionally, Germany’s growing awareness among people about probable environmental challenges linked with this PFAS is fostering higher transparency and accountability in industrial and environmental practices.

UK, with a notable expansion of the market, is experiencing a raised adoption of modular platforms and flexible consumable sourcing strategies to manage the expanding demand for PFAS analysis in various laboratories. However, different industries in the UK, like automotive and chemical manufacturing, are investing in in-house PFAS testing capabilities, while research institutions are focusing on method innovation and validation.

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The PFAS testing is primarily offered by international testing, inspection, and certification (TIC) companies in the MEA region. Stringent regulatory policies and the rising adoption of advanced technologies boost the market. The growing awareness of monitoring and treating PFAS in environmental media augments market growth. Government organizations make constant efforts to build the necessary infrastructure for PFAS testing.

Key players, such as QIMA, SGS SA, and Gulf Bio Analytical, provide PFAS testing services in the UAE. SGS SA offers testing for 31 different types of PFAS to identify potential contamination hotspots in supply chains. The UAE government has launched the UAE Water Security Strategy 2036 to ensure sustainability and continuous access to water during normal and extreme emergency conditions.

By Matrix Type

By Testing Method

By Service Provider

By Region

January 2026

January 2026

January 2026

January 2026