March 2026

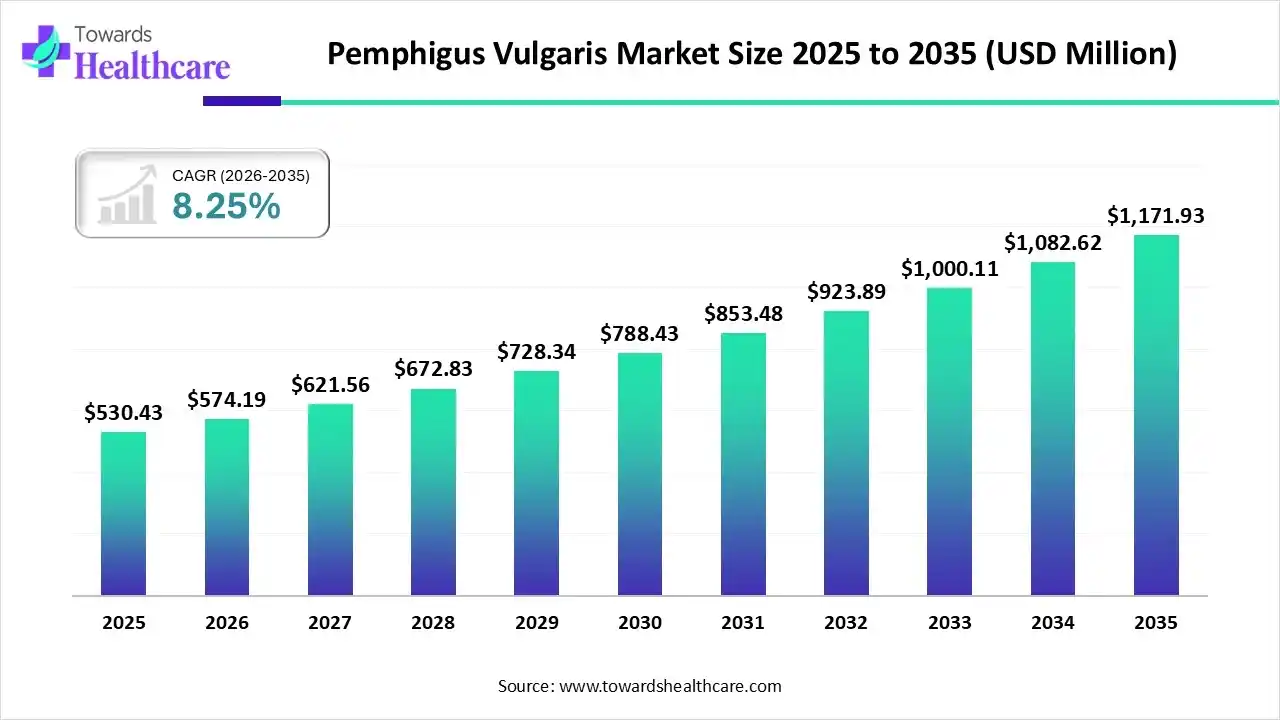

The global pemphigus vulgaris market size is calculated at US$ 530.43 million in 2025, grew to US$ 574.19 million in 2026, and is projected to reach around US$ 1171.93 million by 2035. The market is expanding at a CAGR of 8.25% between 2026 and 2035.

The pemphigus vulgaris market is mostly being driven by an increase in cases of immune system dysfunction, where antibodies target the proteins that hold skin cells together. The market is also expanding due to the increased use of different drugs, including penicillamine, angiotensin-converting enzyme inhibitors, and nonsteroidal anti-inflammatory drugs, which can cause the illness. A positive outlook for the market is also being created by the widespread use of immunosuppressive medications in conjunction with corticosteroids to regulate the immune system and stop the development of new blisters.

| Key Elements | Scope |

| Market Size in 2026 | USD 574.19 Million |

| Projected Market Size in 2035 | USD 1171.93 Million |

| CAGR (2025 - 2035) | 7.38% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Treatment Type, By Route of Administration, By Distribution Channel, By End-User, By Region |

| Top Key Players | Pfizer Inc., F. Hoffmann-La Roche Ltd., Sanofi, Amgen Inc., GlaxoSmithKline plc (GSK), Novartis AG, AstraZeneca, AbbVie Inc., Teva Pharmaceutical Industries Ltd., Argenx SE, Cabaletta Bio Inc., Daewoong Pharmaceutical Co. Ltd., HanAll Biopharma Co. Ltd., Merck & Co., Inc., GRIFOLS SA, Boehringer Ingelheim International GmbH, Regeneron Pharmaceuticals Inc., Johnson & Johnson Services, Inc., Zydus Group, Alexion Pharmaceuticals |

The global pemphigus vulgaris market includes pharmaceutical therapies, biologics, immunosuppressants, diagnostics, and supportive care solutions used for the treatment and management of pemphigus vulgaris, a rare autoimmune blistering disorder of the skin and mucous membranes.

The market covers corticosteroids, monoclonal antibodies, immunoglobulins, plasmapheresis, hospitalization services, and long-term disease management. Growth is driven by rising diagnosis rates, increasing awareness of rare autoimmune diseases, advancements in biologic therapies, improved access to specialty dermatology care, and expanding clinical research pipelines.

Artificial intelligence (AI) developments have the potential to improve immuno-correlated dermatological pathology diagnosis, treatment, and evaluation. AI algorithms may be able to provide more objective results by avoiding the biases present in human diagnoses through careful design and debugging. Machine learning (ML) and deep learning (DL) are two popular AI algorithms; DL performs better on big datasets and intricate features.

How Corticosteroids Dominated the Pemphigus Vulgaris Market in 2024?

The corticosteroids segment dominated the market in 2024. Pemphigus vulgaris is still best treated with systemic corticosteroids. Their use has reduced the mortality rate of an illness that was nearly always fatal to less than 10%. Prior to the availability of glucocorticosteroids in the 1950s, the death rate from pemphigus was between 60 and 90%.

Biologic Therapies

The biologic therapies segment is expected to grow at the fastest CAGR during the forecast period. Over the past ten years, rituximab, a chimeric anti-CD20 monoclonal antibody that targets B cells, has become a highly effective treatment for refractory pemphigus vulgaris. Numerous novel biologics have since been suggested or investigated for the treatment of autoimmune bullous disorders. Compared to traditional immunosuppressants, these may be more effective and cause fewer side effects.

Immunosuppressants

The immunosuppressants segment is expected to showcase lucrative growth during the forecast period. Patients with severe pemphigus vulgaris benefit from immunosuppressants (methotrexate, cyclophosphamide, and azathioprine) because they frequently lower the maintenance dose of prednisone needed following high-dosage prednisone treatment. Patients with pemphigus vulgaris in the early, stable stage benefit even more from immunosuppressants.

Why the First-Line Therapy Dominated the Pemphigus Vulgaris Market in 2024?

The first-line therapy segment dominated the market in 2024. Approved as a first-line treatment, rituximab successfully induces remission. Studies have shown that 90–95% of PV patients achieve disease control within ≤ 6 weeks of starting treatment, demonstrating the effectiveness of rituximab in inducing remission.

Combination Therapy

The combination therapy segment is expected to grow at the fastest CAGR during the forecast period. When treating pemphigus vulgaris, combination therapy typically combines an immunosuppressant such as rituximab, mycophenolate mofetil (MMF), cyclophosphamide, or methotrexate (MTX) with a corticosteroid such as prednisone. These combinations help reduce long-term side effects by enabling lower, more sustainable corticosteroid doses and accelerating remission.

Supportive & Symptomatic Therapy

The supportive & symptomatic therapy segment is expected to showcase lucrative growth during the forecast period. For Pemphigus vulgaris (PV), supportive and symptomatic therapy aims to control pain, encourage healing, and avoid complications like infections. The main benefits are enhancing the patient's immediate quality of life and making the primary systemic treatments more effective.

How did the Oral Segment Dominate the Pemphigus Vulgaris Market in 2024?

The oral segment dominated the market in 2024. The cornerstone of systemic therapy is oral medication, which is frequently used in conjunction with other oral immunosuppressants like mycophenolate mofetil or azathioprine to lessen long-term steroid side effects. Localized oral lesions can also be treated with topical steroids (pastes, mouthwashes).

Intravenous

The intravenous segment is expected to grow at the fastest CAGR during the forecast period. Fast-acting, immediate therapeutic effects can be achieved with intravenous drugs. For drugs that might not be absorbed by the GI tract, intravenous medications offer an alternative to the oral route. They are perfect for patients who have malabsorption or GI problems, as well as those who are unconscious or NPO (nothing by mouth).

Injectable

The injectable segment is expected to showcase lucrative growth during the forecast period. In a clinical setting, injections are preferred when oral administration would be ineffective, the medication must be administered quickly, or the dosage must be controlled. Injections are an essential tool in medical settings for administering drugs to the human body.

How did the Hospital Pharmacies Dominate the Pemphigus Vulgaris Market in 2024?

The hospital pharmacies segment dominated the market in 2024. One of a hospital pharmacy's most crucial duties is distributing medications. It guarantees that the appropriate medication is administered to the appropriate patient at the appropriate time and dose. Healthcare workers' workflow efficiency is increased, medication safety is promoted, errors are decreased, and patient outcomes are improved through effective drug distribution. Hospital pharmacies use systematic distribution models based on clinical needs, staff availability, size, and technology.

Online Pharmacies

The online pharmacies segment is expected to grow at the fastest CAGR during the forecast period. By offering over-the-counter medications for common ailments, chatbots for immediate first aid, reviews of local doctors, and help in locating doctors, recommendations for labs for tests, home delivery of medications, explanations of the medications, etc., online/E-pharmacies are progressively taking over the role that local chemists have historically played.

Retail Pharmacies

The retail pharmacies segment is expected to showcase lucrative growth during the forecast period. Drugstores, supermarkets, and standalone stores are common locations for retail pharmacies, also known as community pharmacies, which cater to the general public. These pharmacies are easily accessible and provide a large selection of pharmaceuticals and health-related items.

Why did the Hospitals Dominate the Pemphigus Vulgaris Market in 2024?

The hospitals segment dominated the market in 2024. When it comes to treating pemphigus vulgaris, hospitals, especially those with specialized dermatology or burn care units, offer several advantages. These include access to intensive therapy, a multidisciplinary approach, and cutting-edge treatment modalities that are challenging to administer in an outpatient setting.

Specialty Dermatology Clinics

The specialty dermatology clinics segment is expected to grow at the fastest CAGR during the forecast period. Because of their specialized knowledge, access to cutting-edge treatments, and all-encompassing, multidisciplinary approach to care, specialty dermatology clinics provide substantial benefits for the treatment of pemphigus vulgaris.

Research Institutes

The research institutes segment is expected to showcase lucrative growth during the forecast period. Pemphigus vulgaris is treated and studied by a number of prestigious international research institutes and medical facilities. These organizations frequently collaborate to explore new treatments and develop consensus guidelines.

North America dominated the pemphigus vulgaris market in 2024. supported by cutting-edge medical facilities, a high level of patient awareness, active research and development, a large supply of biologic treatments, and powerful government programs encouraging the treatment of uncommon diseases. Significant investments in healthcare, a robust pharmaceutical industry, and extensive insurance coverage all contribute to North America's dominance by ensuring patients have access to state-of-the-art treatments and diagnostics for pemphigus vulgaris.

Immunosuppressive treatments, such as corticosteroids and rituximab, are the mainstay of Pemphigus vulgaris management in the U.S. These treatments are frequently directed by the American Academy of Dermatology guidelines. Leading institutions like the National Institutes of Health (NIH) and several university medical centers are conducting cutting-edge research, including clinical trials of new biologics and immunotherapies. The International Pemphigus & Pemphigoid Foundation (IPPF), which provides patient resources and links people to research advancements, can provide support and additional information.

Asia Pacific is estimated to host the fastest-growing pemphigus vulgaris market during the forecast period due to the quickly expanding healthcare industry and the growing need for pemphigus vulgaris treatments. The region's biggest market is China. Growth in the Asia-Pacific area is being fueled by advancements in health technology and more financing for life sciences research. The Asia-Pacific region is the most lucrative due to more extensive government awareness campaigns and greater accessibility to generic drugs.

Improving pemphigus patient outcomes requires a clearly defined management protocol. Given this, the PUMCH Department of Dermatology has spearheaded the creation of China's first guidelines for the diagnosis and treatment of pemphigus. This guideline represents a major step forward in China's efforts to provide appropriate and more uniform pemphigus care. The Department of Dermatology at PUMCH provides comprehensive, high-quality outpatient care for bullous diseases, covering the full range of prevention, diagnosis, treatment, and follow-up. In order to give pemphigus patients more therapeutic options, the department is still dedicated to advancing research and encouraging consistent diagnosis and treatment.

Europe is expected to grow at a significant CAGR in the pemphigus vulgaris market during the forecast period. The demand for efficient PV treatments has increased due to the rising incidence and better diagnosis of autoimmune diseases. When compared to conventional corticosteroid-based treatments, biologic therapies offer more focused and efficient options.

Germany provides state-of-the-art treatment for pemphigus vulgaris by combining cutting-edge research, novel treatments like rituximab, and all-encompassing patient support. For professional care and hope, visit clinical trials and specialized treatment facilities.

South America is expected to grow significantly in the pemphigus vulgaris market during the forecast period. In South America, rising awareness of pemphigus vulgaris is driving improved diagnostic infrastructure and increasing adoption of biologic therapies. Urban dermatology centers in Brazil and Argentina are leading this shift, but access remains uneven across rural and under-resourced regions.

Argentina’s pemphigus vulgaris market is expanding with a stronger hospital-pharmacy network and growing preference for first-line treatments. Patients in metropolitan areas benefit from improved access, though outreach to more remote regions remains a key challenge for equitable care.

The Middle East and Africa are expected to grow at a lucrative CAGR in the pemphigus vulgaris market during the forecast period. In the Middle East and Africa, investment in dermatology care and rare-disease treatment is fueling market growth. Key countries are increasingly using targeted biologics, and healthcare systems are strengthening, though regulatory and infrastructure gaps still need bridging.

Within the GCC, nations such as Saudi Arabia and the UAE are advancing pemphigus vulgaris research through specialized clinics and the rollout of biologics. Public health strategies and telemedicine are improving access, but high therapy costs continue to challenge universal adoption.

Research and Development (R&D): Finding possible targets, creating novel medications, and carrying out preliminary research in labs are all part of this first phase. Driven by an understanding of autoimmune mechanisms, it focuses on novel treatments such as cell therapies, small molecules, and biologics.

Companies: Cabaletta Bio Inc, HanAll Biopharma Co Ltd, Argenx SE, BioXpress Therapeutics SA, Octagon Therapeutics Inc, ImmunoWork LLC, and Daewoong Pharmaceutical Co Ltd

Clinical Trials and Regulatory Approvals: After a medication is created, it goes through extensive clinical testing to evaluate its effectiveness and safety. After that, a request for regulatory approval from organizations like the FDA is made, necessitating a thorough evaluation before going on sale.

Companies: Cabaletta Bio, Argenx SE, Roche (F. Hoffmann-La Roche Ltd), Dr. Reddy's Laboratories, Principia Biopharma, Genentech, Inc., and Kemia, Inc

Distribution to Hospitals, Pharmacies: Distribution channels transfer the medication from producers to final consumers following approval. To guarantee patient access, this covers both hospital and retail pharmacies as well as internet pharmacies.

Companies: F. Hoffmann-La Roche Ltd, Pfizer Inc, AbbVie Inc, CSL Behring GmbH, Novartis AG, Teva Pharmaceutical Industries Ltd, and Johnson & Johnson Services, Inc.

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

A global healthcare company with two main divisions: Pharmaceuticals and Diagnostics.

Business Segments/Divisions:

Geographic Presence:

Global presence, with major operations in North America, Europe, Asia-Pacific, and emerging markets. North America is a significant revenue driver.

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Distribution Channel Strategy:

Primarily focused on Hospital Pharmacies and Specialty Pharmacies due to the nature of complex biologic infusions and the requirement for specialized handling and administration (e.g., intravenous Rituximab).

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates (2024-2025):

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

A global biopharmaceutical company dedicated to developing and commercializing advanced therapies across key therapeutic areas.

Business Segments/Divisions:

Geographic Presence:

Significant global footprint, with major revenues from the United States and strong presence across Europe, Asia-Pacific, and Latin America.

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Distribution Channel Strategy:

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates (2024-2025):

| Company | Key Product / Pipeline Offerings in PV | Status / Contribution | Advantages / Focus Area | Challenges / Trial Info |

| Pfizer Inc. | Ruxience (rituximab-pvvr) biosimilar to an anti-CD20 biologic. | Approved; competes with reference biologic. | Offers a cost-effective biosimilar alternative. | Needs to maintain supply reliability and manage competition. |

| Sanofi | Rilzabrutinib (PRN1008), an oral BTK inhibitor in Phase 3 for PV. | Trial (PEGASUS) did not meet the primary endpoint. | Small-molecule approach vs biologics; potential convenience benefits. | Setback due to failed Phase 3; development reassessment ongoing. |

| Amgen Inc. | Riabni (rituximab-arrx) biosimilar to the CD20 biologic used in PV indications. | Launched; competes in the biosimilar biologic market. | Leverages strong biologics-development and manufacturing expertise. | Faces general biosimilar competition and market dynamics. |

| GlaxoSmithKline plc (GSK) | Ofatumumab subcutaneous program for PV (via Stiefel, GSK company). | Initiated Phase III study for PV. | Targets CD20 with an alternate antibody, broadening therapeutic options. | Still investigational; not yet approved for PV broadly. |

| Novartis AG | Ianalumab (VAY736) BAFF-R inhibitor in Phase 3 trials for PV. | Pipeline stage; positive topline data reported. | Novel targeted mechanism potentially offering a new treatment paradigm. | Not yet approved; efficacy and regulatory outcomes pending. |

By Drug Class

By Treatment Type

By Route of Administration

By Distribution Channel

By End-User

By Region

March 2026

March 2026

March 2026

March 2026