March 2026

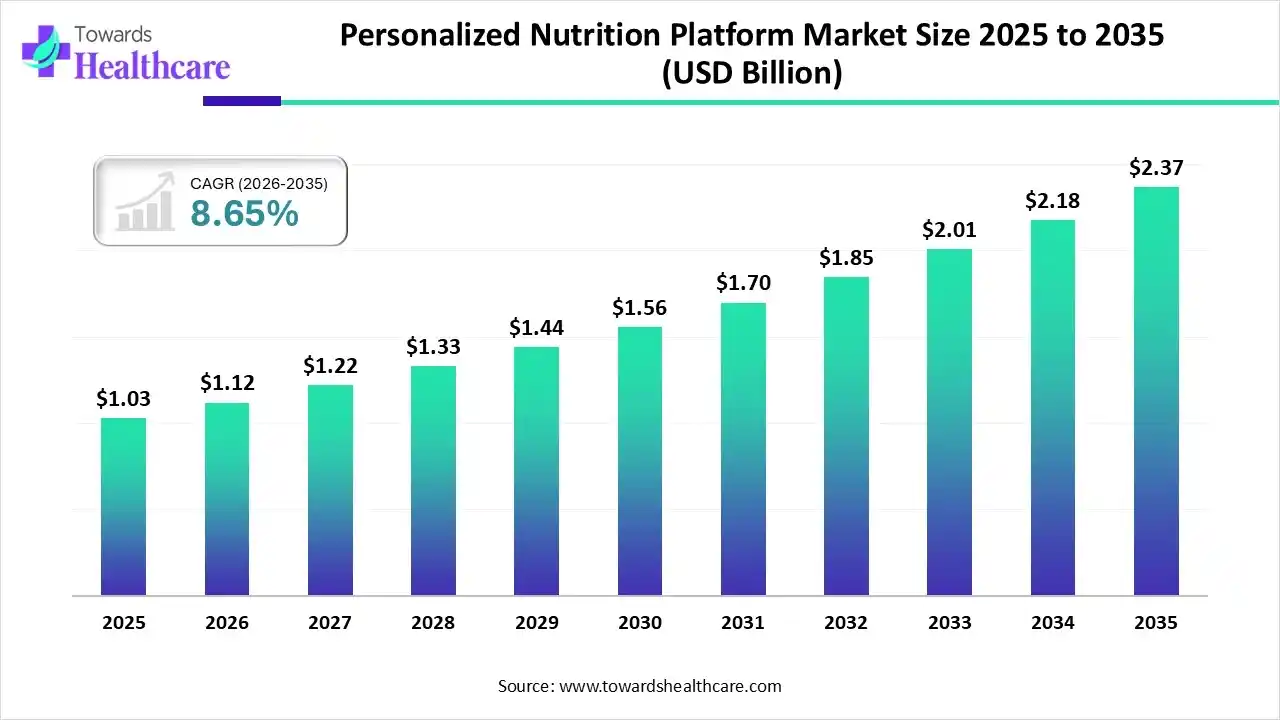

The global personalized nutrition platform market size was estimated at USD 1.03 billion in 2025 and is predicted to increase from USD 1.12 billion in 2026 to approximately USD 2.37 billion by 2035, expanding at a CAGR of 8.65% from 2026 to 2035.

The global personalized nutrition platform market is driven by the integration of digital health technologies with personalized nutrition provides a transformative strategy for managing diabetes and obesity. This emerging paradigm extends beyond generic dietary recommendations by tailoring interventions based on genetic, epigenetic, microbiome, and real‐time metabolic data. Personalized nutrition is an increasing industry that has spun out of advances in personalized medicine and a growing end-user demand for personalization in the industry.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.12 Billion |

| Projected Market Size in 2035 | USD 2.37 Billion |

| CAGR (2026 - 2035) | 8.65% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Dosage / Form, By Therapeutic / Health Focus, By Mechanism / Approach, By End-User, By Distribution Channel |

| Top Key Players | MyFitnessPal, Herbalife Ltd., Vitamin Shoppe, NationsBenefits, Eden, Walmart |

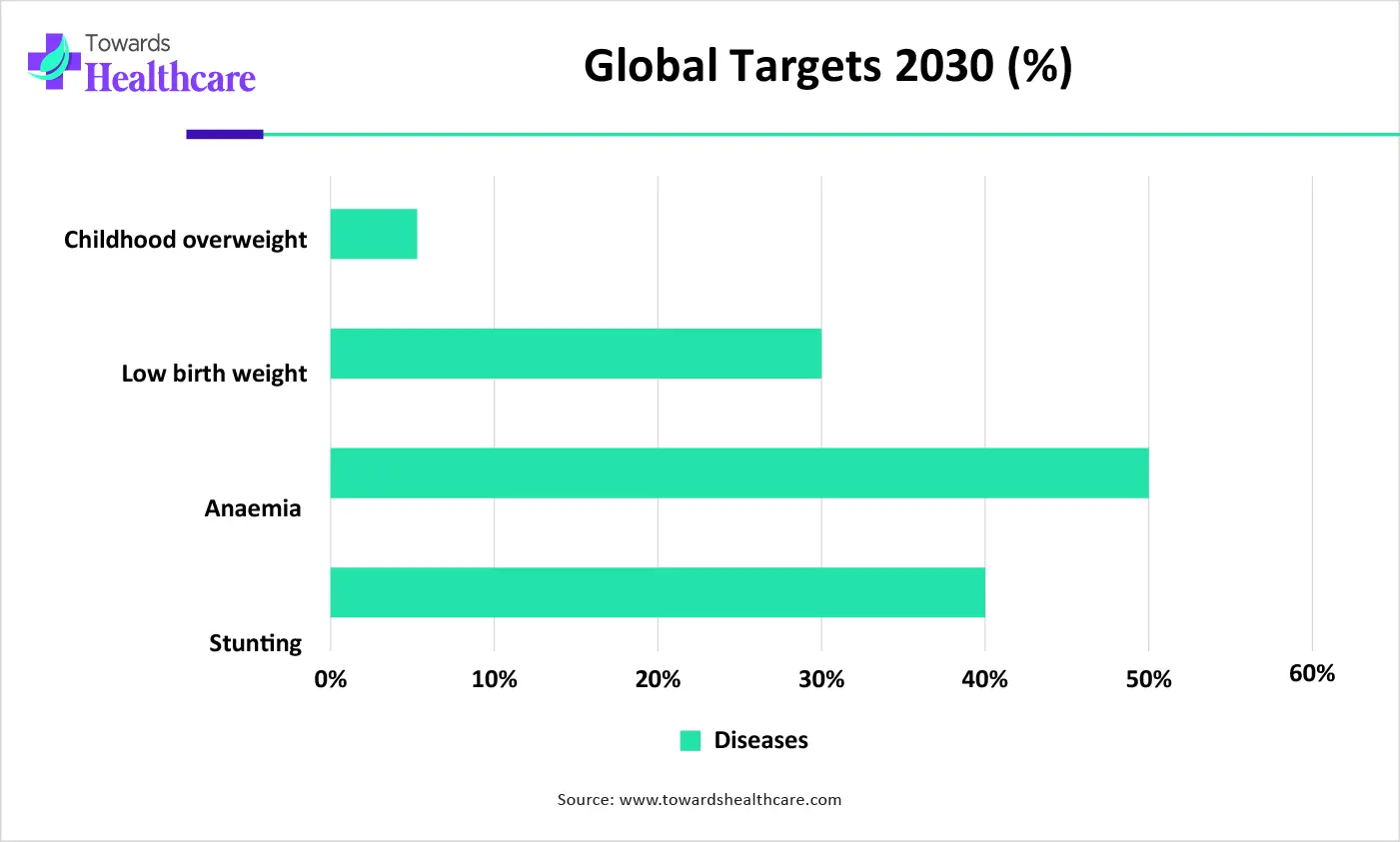

At the 78th World Health Assembly in 2025, WHO Member States accepted a resolution to extend the Global Nutrition Targets for enhancing infant, maternal, and young child nutrition from 2025 to 2030.

The incorporation of AI-driven health technologies with personalized nutrition provides a transformative approach for managing obesity and diabetes. AI-based technology has proven to be efficient in generating adaptive nutrition plans, improving self-management, and supporting decision-making in clinical and community settings. AI-driven systems are progressively used to monitor physiological data and personalize care. Tools such as AI-driven telemedicine platforms and electrochemical breathomics sensors enable continuous monitoring of patient metrics.

| Target | Explanation |

| Target 1 | 40% reduction in the number of children under five years of age who are stunted |

| Target 2 | 50% reduction in anaemia in women of reproductive age. |

| Target 3 | 30% reduction in low birth weight |

| Target 4 | Reduce and maintain wasting in children under five years of age to less than 5%. |

Which Product Type Led the Personalized Nutrition Platform Market in 2024?

In 2024, the nutrigenomics & DNA-based nutrition segment held the dominating share of 35% of the market, as it provides a ground-breaking strategy to health, one where diet plans are built around a genetic blueprint. Nutrigenomics supports identifying an individual's nutritional needs based on specific genetic makeup, and it is related to chronic diseases.

Whereas, the personalized supplements segment is the fastest growing in the market as personalized nutrition increases energy and protein levels, and enhances functional activities and quality of life. This type of nutrition is becoming a differentiator in vitamins and supplements, which is one category in consumer wellness and health.

Why did the Oral Solids Segment Dominate the Market in 2024?

The oral solids segment captured the biggest revenue share of 50% of the personalized nutrition platform market in 2024, as they have an extended shelf life compared to liquid medications, confirming their efficiency for a longer period of time. They are comparatively simple to manufacture, package, and transport, provide good chemical and physical stability, and drive simple and accurate dosing.

Whereas, the beverages/liquid supplements segment is the fastest growing in the market, as beverages are an improved vehicle for the consumption of healthy supplement-driven additives than foods. It is simple for an individual to select to drink a healthier beverage over a food. Energy beverages include stimulants such as caffeine, guarana, taurine, and yerba mate. Fortification of energy drinks with B vitamins, ginseng, creatine, ginkgo biloba, and flavonoids is becoming popular.

Why Weight Management & Metabolic Health Segment Dominant in the Market?

In 2024, the weight management & metabolic health segment held the dominating share of 30% of the personalized nutrition platform market, as personalized nutrition, particularly formulated to deliver a wide range of nutrients containing carbs, protein, vitamins, and minerals. This nutrition offers meal replacement shakes and dietary supplements to help people slim down.

Whereas, sports/performance nutrition segment is the fastest growing in the market as personalized nutrition improves sporting performance. A nutritious diet meets most of an athlete’s vitamin and mineral requirements and offers enough protein to promote muscle repair and growth. Sports nutrition plans should be tailored to the individual athlete and consider their exact sport, goals, food preferences, and practical issues.

What Made the Individual Consumers/Direct-to-Consumer Segment Dominant in the Personalized Nutrition Platform Market in 2024?

In 2024, the individual consumers/direct-to-consumer segment captured the largest revenue share of 70% of the market as personalized nutrition focuses on a person's behavior, biological history, preferences, and objectives in achieving adapted nutrition. Nutrition is essential to human health, and the dramatic response to its results from genetics, microbiota, biochemistry, and metabolism.

Whereas, fitness and wellness centers segment is fastest growing in the market as segment is fastest growing in the market as this center provides personalized nutrition coaching, for clients to achieve their results faster. To break it down, the workout makes the stimulus for change, but nutrition offers the building blocks that allow that change to arise. Nutrition coaching drives this retention because it becomes crucial to their daily routine, not their workout schedule.

What Made the Online Direct-to-Consumer Platforms Segment Dominant in the Personalized Nutrition Platform Market in 2024?

In 2024, the online direct-to-consumer platforms segment captured the largest revenue share of 45% of the market, as online nutrition counselling goal to support patients in eating healthier, developing a meal plan, or managing health situations such as high blood pressure or diabetes. Instead of holding an in-person appointment, an online nutrition counsellor or dietitian performs the session online by video or phone call with their patient.

Whereas the retail & specialty nutrition stores segment is the fastest-growing in the market, as retailers offer compelling benefits to meet shoppers' needs, retain current consumers, and attract new customers. Specialty nutrition stores often help as community hubs, offering educational resources, in-store events, or working with local health doctors to help community wellness.

In 2024, North America dominated the personalized nutrition platform market by capturing a share of 35%, driven by advanced technological infrastructure, such as extensive adoption of digital health platforms, mobile applications, and integration with wearable health devices. The application of artificial intelligence (AI) and machine learning for data analysis enables platforms to deliver highly precise and tailored dietary advice based on individuals’ genetics, microbiome, and lifestyle.

The U.S. boasts a tech-savvy population and advanced digital infrastructure, enabling quick uptake of digital health solutions, mobile apps, and wearable tech essential for personalized nutrition. It hosts numerous innovative startups and major corporations such as Viome, Nutrigenomix, and Nestlé Health Science's Habit and Persona Nutrition brands, all utilizing technology to provide direct-to-consumer (DTC) services and products.

Asia Pacific is poised for rapid growth in the personalized nutrition platform market, supported by the deep cultural roots of traditional medicine systems such as Ayurveda in India and Traditional Chinese Medicine (TCM). These systems lay a foundation for integrating holistic and personalized health approaches, aligning well with contemporary nutritional trends. Furthermore, the expansion of e-commerce and direct-to-consumer (D2C) channels greatly increases access to personalized nutrition products and services, reaching a broad audience, including previously underserved rural regions.

China's large population includes a rapidly growing middle class with substantial disposable income. This group is prepared to pay more for high-quality, personalized health products and services, viewing them as a status symbol and a trustworthy choice given past food safety issues.

For Instance,

Europe is significantly growing in the personalized nutrition platform market as the European populations are increasingly shifting from reactive healthcare to a proactive wellness strategy, accepting targeted nutrition to prevent long-term diseases and manage overall well-being. Major countries such as Germany, France, and the UK have a health-conscious customer base with high disposable spending, enabling premium investment, customized medical services, including genetic and blood testing solutions for tailored advice.

Whereas, UK is a hub of prominent worldwide personalized nutrition organizations such as ZOE, which uses progressive microbiome and blood-based insights to provide individualized recommendations, enticing significant spending and fostering innovation. The UK has high mobile phone integration (98% of adults) and a tech-savvy population, easing the extensive acceptance and incorporation of health apps and wearable devices.

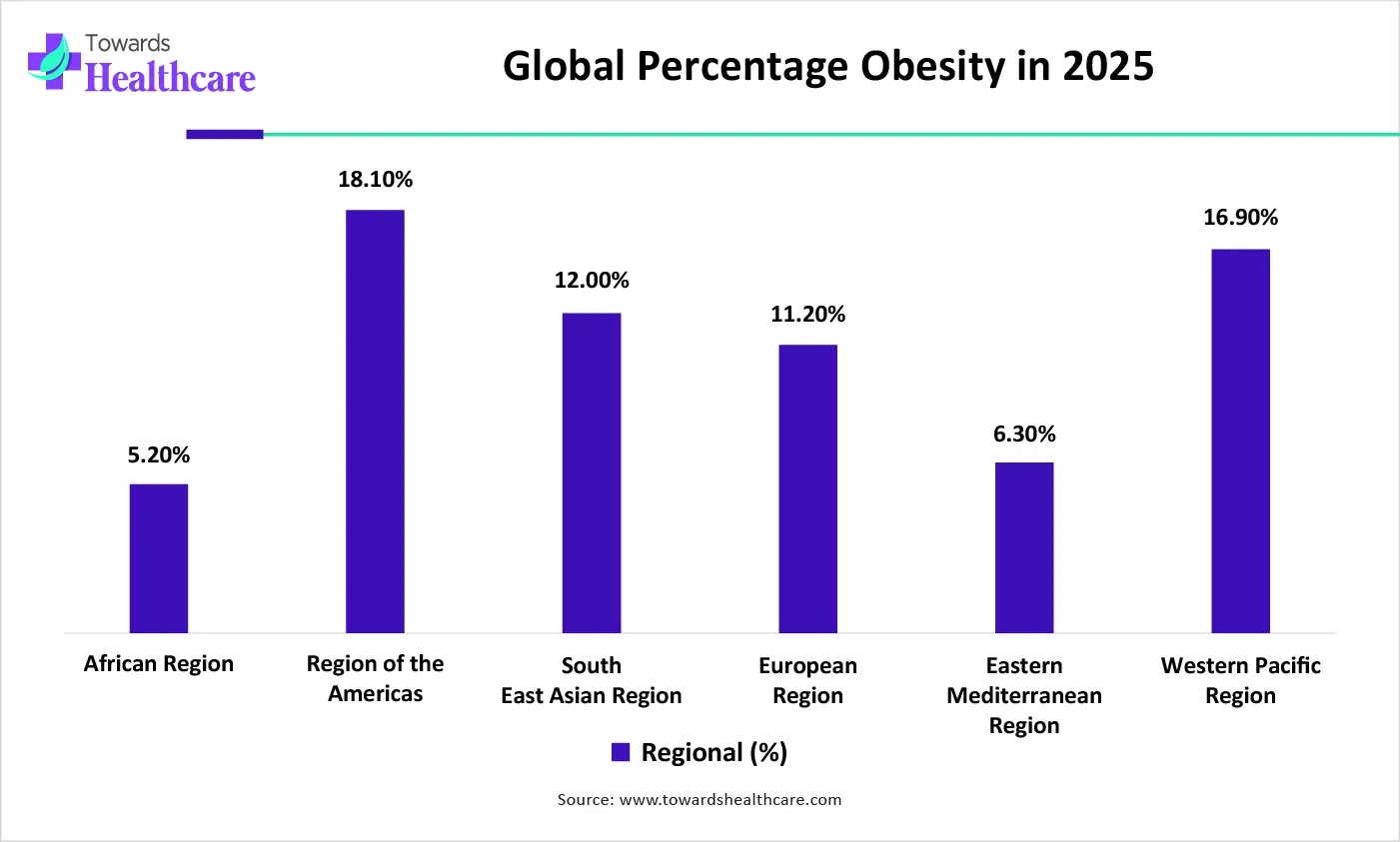

| Region | Estimated Percentage in 2025 |

Estimated Numbers in 2025 |

| Global | 10.5% | 205.5m |

| African Region | 5.2% | 23.5m |

| Region of the Americas | 18.1% | 42.0m |

| South-East Asian Region | 12.0% | 26.4m |

| European Region | 11.2% | 18.4m |

| Eastern Mediterranean Region | 6.3% | 32.0m |

| Western Pacific Region | 16.9% | 61.8m |

| Company | Headquarters | Latest Update |

| MyFitnessPal | Austin | MyFitnessPal's strategic acquisition of Intent marks a significant milestone in MyFitnessPal's mission to empower its community of over 270 million members to live healthier lives through better food choices. |

| Herbalife Ltd. | California | Herbalife Ltd., a premier health and wellness company, community, and platform, announced it has entered into a binding memorandum of understanding to acquire 100% of the assets of Pro2col Health LLC (Pro2col) and Pruvit Ventures, Inc. (Pruvit), as well as a 51% controlling ownership interest in Link BioSciences Inc. |

| Vitamin Shoppe | New Jersey, U.S. | The Vitamin Shoppe, a global wellness and health retailer, offers an At-Home DNA Collection Kit from nutrigenomics company GenoPalate. Announced in a the partnership is intended to expand consumer access to personalized nutrition and wellness. |

| NationsBenefits | United States | NationsBenefits, the leading fintech, benefits, and outcomes platform for healthcare, announced the acquisition of Good Measures, the leading platform for Food as Medicine supporting health plans and their members. |

| Eden | New York | Eden, the health platform that connects members with independent, licensed providers for personalized health care, announced a partnership with Gainful, the leader in clean, personalized performance nutrition. |

| Walmart | Arkansas | Walmart, the world’s leading omnichannel retailer, and Soda Health, a health technology company focused on smarter health benefits administration, announced a collaboration to launch the Walmart Everyday Health Signals™ program to select Medicare Advantage and Medicaid members. |

The R&D process for a personalized nutrition platform is a many-step process, a science-driven cycle that integrates specific data, advanced technology, product advancement, and continuous user feedback to offer tailored dietary advice.

Key Players: Spark Therapeutics, Intellia Therapeutics, Bluebird Bio, etc.

The process of a clinical trial for a personalized nutrition platform includes many key stages, from study design and participant recruitment to data gathering, analysis, and interpretation of results.

Key Players: IRCCS San Raffaele, Donald B. Kohn, M.D., David Williams, etc.

Patient support and services in a personalized nutrition platform spread beyond meal plans to include a combination of professional coaching, technological equipment for monitoring, educational resources, and community engagement.

Key Players: Cencora, Claritas Rx, Allucent, etc.

By Product Type

By Dosage / Form

By Therapeutic / Health Focus

By Mechanism / Approach

By End-User

By Distribution Channel

By Region

March 2026

February 2026

January 2026

January 2026