February 2026

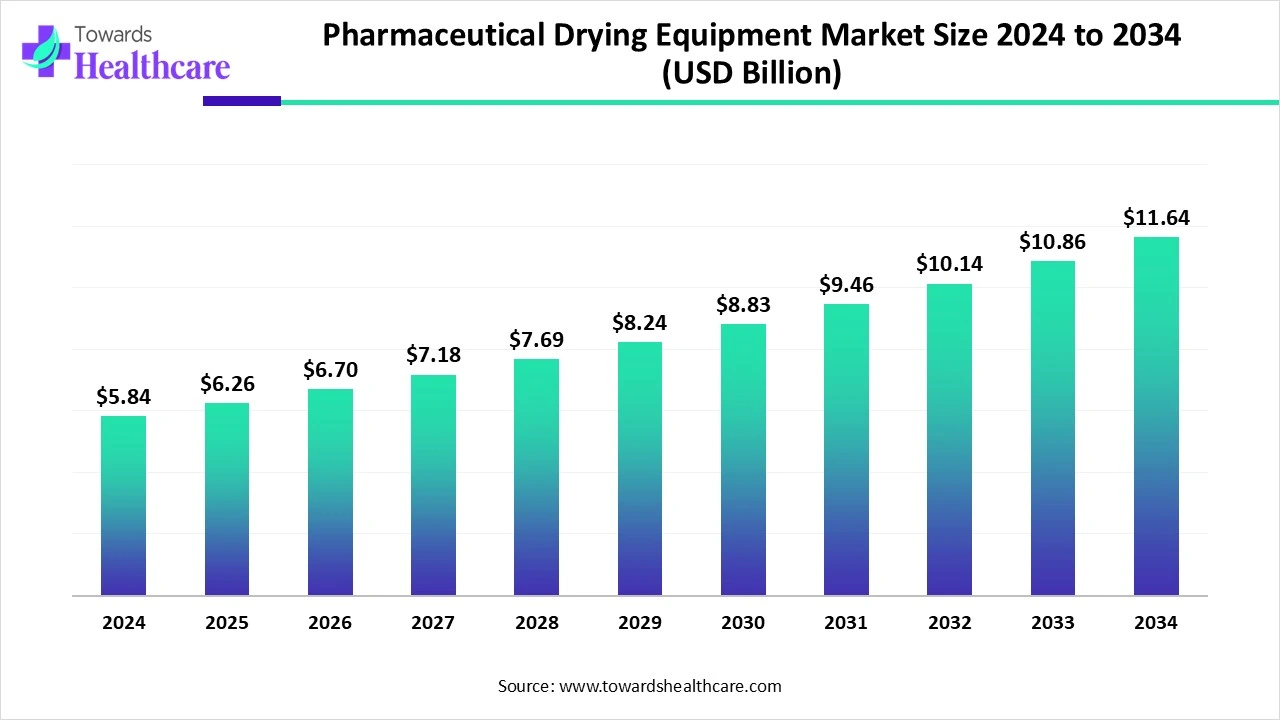

The global pharmaceutical drying equipment market size is calculated at USD 5.84 billion in 2024, grew to USD 6.26 billion in 2025, and is projected to reach around USD 11.64 billion by 2034. The market is expanding at a CAGR of 7.14% between 2025 and 2034.

The pharmaceutical drying equipment market is advancing with strong momentum, supported by innovations in automation, continuous drying, and eco-friendly technologies that enhance efficiency, product quality, and compliance with global regulatory standards. Freeze dryers are increasingly vital for biologics and vaccines due to their ability to process heat-sensitive formulations, while spray dryers remain widely used for producing consistent particle sizes. Industrial-scale equipment continues to dominate, though pilot-scale systems are gaining importance for research and small-batch production.

Sustainability has become a central focus, with manufacturers investing in energy-efficient dryers and advanced designs such as vibration-assisted systems to meet environmental goals. However, challenges persist, including rising demand for refurbished equipment, which pressures new sales, and the high operational costs and maintenance needs of advanced drying systems. Despite these barriers, opportunities are expanding, particularly with the growth of biosimilars, generics, and CDMO partnerships.

| Table | Scope |

| Market Size in 2025 | USD 6.26 Billion |

| Projected Market Size in 2034 | USD 11.64 Billion |

| CAGR (2025 - 2034) | 7.14% |

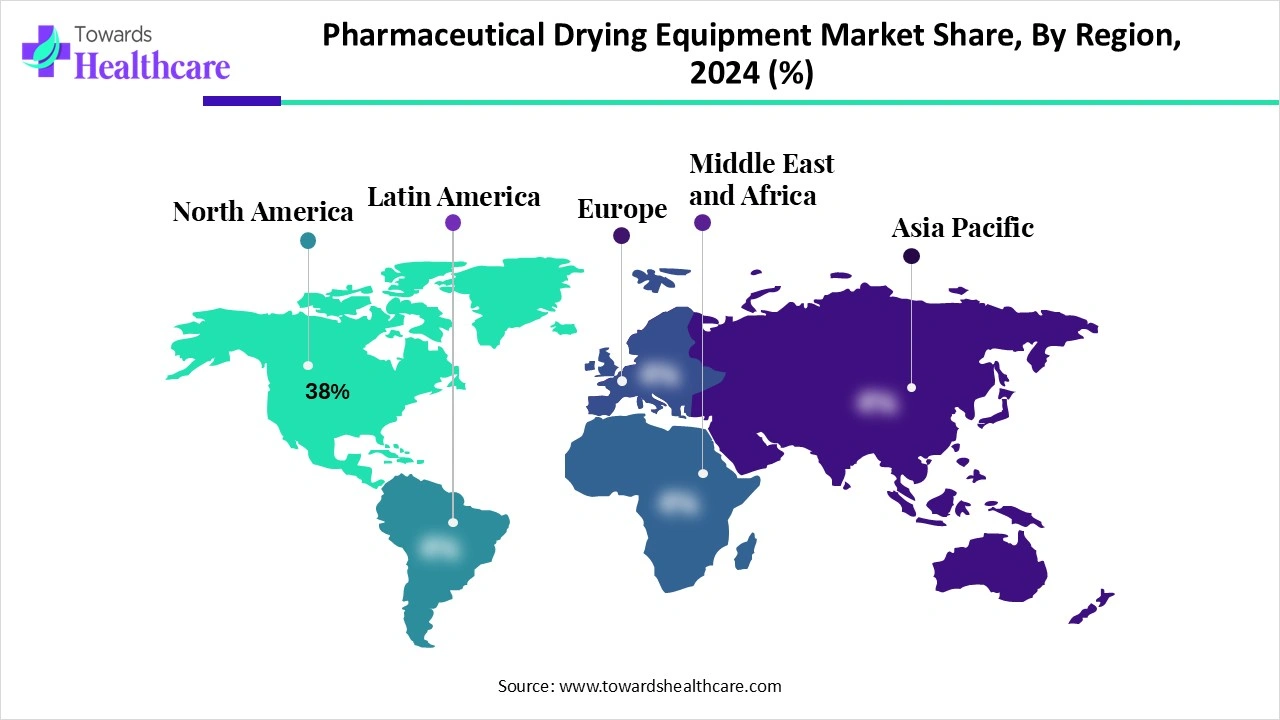

| Leading Region | North America Share 38 % |

| Market Segmentation | By Equipment / Technology Type, By Product Process / Application, By Scale / Offering, By Mode of Operation, By End User / Buyer, By Region |

| Top Key Players | GEA Group, Glatt GmbH, SPX FLOW (including former Niro / APV technologies), Syntegon Technology (formerly Bosch Packaging Technology / Bosch Pharma), IMA Life (IMA Group), Büchi Labortechnik AG, L.B. Bohle Maschinen + Verfahren GmbH, Telstar (AZ Group), Martin Christ Gefriertrocknungsanlagen (Christ), SP Scientific / SP Industries, Millrock Technology, Dedert Corporation (or equivalent industrial dryer specialists), Hosokawa Micron Group, Diosna (Pirovano Group), Harro Höfliger, HOF Sonderanlagenbau / HOF Engineering, Anhydro / SPX (Niro), Fitzpatrick (The Fitzpatrick Company), Yamato Scientific / Yamato (lab ovens & vacuum dryers at bench scale), Contract Engineering & Turnkey Integrators |

Pharmaceutical drying equipment refers to specialized machinery used in the pharmaceutical industry to remove moisture or solvents from raw materials, intermediates, and finished drug formulations while preserving their stability, safety, and efficacy. Moisture control is critical in pharmaceuticals as excess water can lead to microbial growth, reduced shelf life, and compromised drug quality. These systems use methods such as convection, conduction, radiation, or sublimation to achieve precise drying based on the sensitivity of the product. Common types include fluid bed dryers, tray dryers, spray dryers, and freeze dryers (lyophilizers). Pharmaceutical drying equipment is designed to meet stringent Good Manufacturing Practice (GMP) standards, ensuring uniformity, sterility, and regulatory compliance, making it essential for producing oral solid doses, biologics, and vaccines.

The Pharmaceutical Drying Equipment Market covers equipment and integrated solutions used to remove moisture from pharmaceutical materials and intermediates from lab-scale R&D units to large-scale GMP production plants. Drying is critical across API crystallization, granulation, pelletizing, aseptic fill/finish, sterile freeze-drying (lyophilization), spray-drying of biologics, and final finished-product drying. Key technology families include tray/bed dryers, fluid bed dryers, spray dryers, freeze-dryers (lyophilizers), vacuum/condenser dryers, and continuous drying platforms. Growth is driven by rising biologics manufacture (need for gentle drying), increasing oral solid-dose production, demand for continuous manufacturing, stricter quality/regulatory expectations, and outsourcing to CDMOs.

The market is shifting away from conventional belt and tray dryers toward fluidized beds, spouted beds, and advanced spray systems, which offer finer control over particle morphology and moisture distribution, especially crucial for drying biologics and complex formulations.

Innovations like infrared-assisted and microwave-assisted modules are being integrated into traditional heat-based systems to significantly boost energy efficiency and throughput.

Rise of Advanced Control & Automation

Fully automated systems are becoming the norm, equipped with advanced sensors, real-time data analytics, and predictive maintenance capabilities to streamline operations and ensure quality.

Sustainable, Green Engineering

There’s a strong push toward indirect heating methods and vibration-assisted techniques, driven by the twin goals of reducing emissions and improving reproducibility in drying processes.

Digitalization & Smart Systems

Open architecture platforms, IoT-enabled monitoring, and predictive analytics are reshaping the landscape, offering flexibility, faster validation, and better interoperability.

Modular Design for Flexibility

Modular, scalable systems are gaining traction, allowing manufacturers to quickly adapt to changing production volumes and regulatory demands.

Strategic Expansion & M&A Activity

Industry players continue to evolve through partnerships and acquisitions e.g., Syntegon's acquisition of Azbil Telstar and GEA’s substantial investment in a new freeze dryer technology center.

AI integration is rapidly transforming the pharmaceutical drying equipment industry by enhancing precision, efficiency, and reliability in manufacturing. Through advanced machine learning algorithms and real-time analytics, AI can optimize drying parameters such as temperature, airflow, and humidity, ensuring consistent product quality while reducing batch failures. Predictive maintenance powered by AI helps detect equipment anomalies early, minimizing downtime and extending equipment lifespan. Smart sensors combined with AI-driven monitoring systems allow continuous tracking of moisture levels and particle characteristics, which is especially valuable for heat-sensitive formulations like biologics and vaccines.

AI also supports adaptive process control, where systems can automatically adjust drying conditions based on product requirements, enabling greater flexibility for personalized medicine and complex drug formulations. Furthermore, AI-driven digital twins are being used to simulate drying processes, reducing development costs and accelerating scale-up. Collectively, these innovations make pharmaceutical drying more sustainable, cost-effective, and aligned with stringent regulatory compliance.

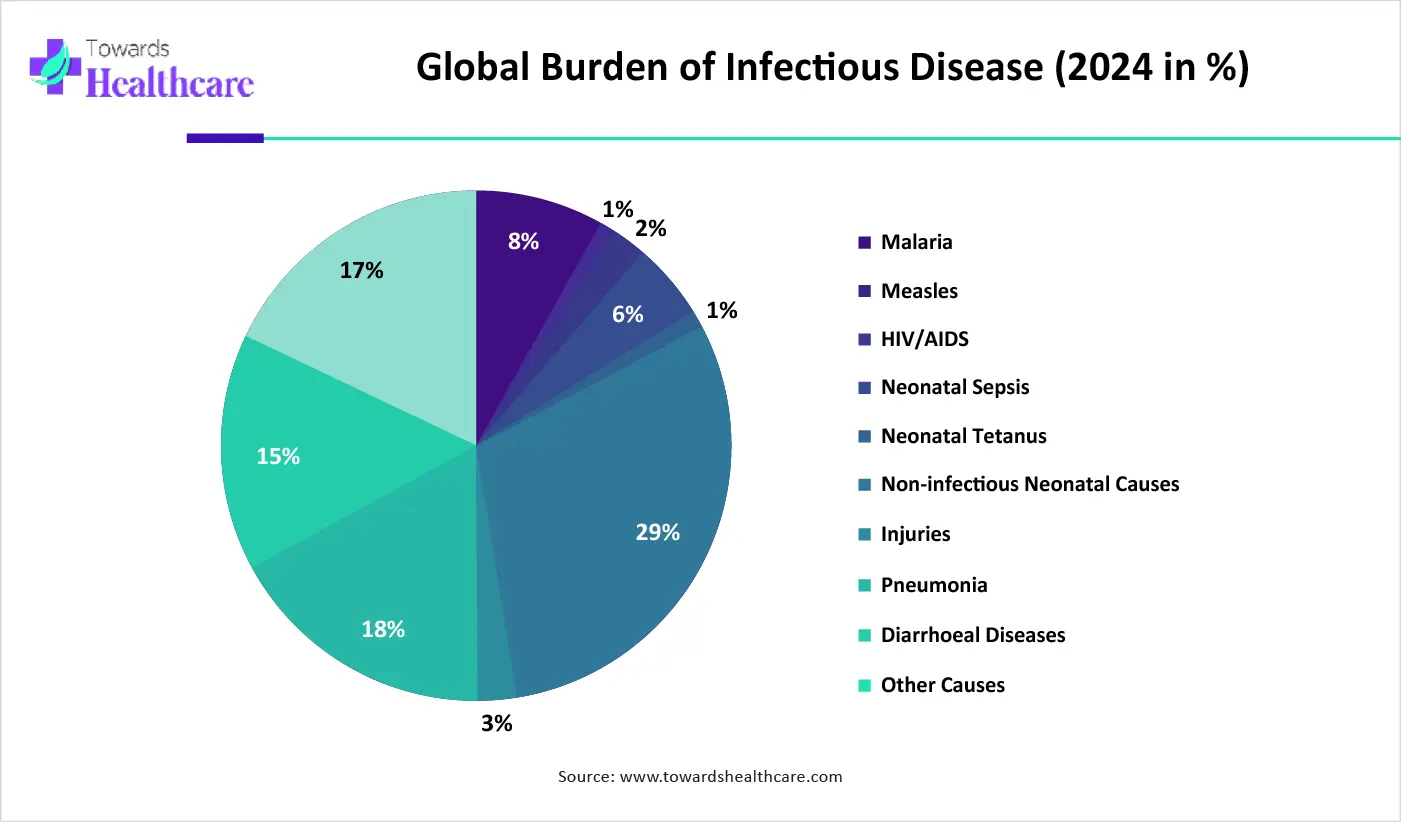

Growing Prevalence of Chronic and Infectious Diseases

Expands pharmaceutical production, boosting equipment demand. The prevalence of chronic and infectious diseases is a major driver of the pharmaceutical drying equipment market, as it fuels demand for large-scale and high-quality drug production. Chronic conditions such as diabetes, cardiovascular diseases, and cancer require continuous development of complex formulations, many of which involve sensitive biologics and specialty drugs that rely on advanced drying methods like lyophilization to maintain stability and efficacy.

Similarly, the rising threat of infectious diseases, highlighted by global pandemics and recurring outbreaks, has accelerated the production of vaccines and antibiotics that often require freeze-drying for long-term storage and distribution. This increasing demand for reliable and efficient pharmaceutical formulations directly boosts the adoption of modern drying equipment, encouraging innovation, automation, and investment in high-performance technologies across the industry.

For instance,

Preference for Refurbished Equipment & Complexity of Advanced Systems

The key players operating in the market are facing issues due to the complexity of advanced systems and the preference for refurbished equipment. Advanced drying systems such as freeze dryers and spray dryers require significant upfront costs, limiting adoption among smaller manufacturers. Frequent servicing and specialized expertise are needed to ensure smooth functioning, especially for complex equipment. Cost-conscious manufacturers often choose refurbished dryers over new installations, reducing demand for fresh equipment. Operating sophisticated drying equipment requires skilled technicians and extensive training, creating workforce challenges. Some drying technologies remain energy-intensive, leading to higher operational costs and sustainability concerns.

Technological Advancements & Sustainability Initiatives

Integration of AI, IoT, digital twins, and smart sensors enables more precise, efficient, and automated drying processes. Development of eco-friendly and energy-efficient dryers aligns with global environmental and regulatory goals. Technological advancements and sustainability initiatives are transforming the pharmaceutical drying equipment market by promoting energy-efficient, automated, and eco-friendly operations. Innovations such as real-time monitoring, Process Analytical Technology (PAT), and advanced control systems boost precision, process consistency, and throughput, while reducing product loss. Sustainable design elements like improved heat recovery, reduced power consumption, and solvent recycling align with global environmental goals.

For instance,

The fluid bed dryers segment dominated the pharmaceutical drying equipment market in 2024 due to their superior efficiency, versatility, and cost-effectiveness compared to other drying technologies. These systems provide uniform drying by suspending particles in a controlled hot air stream, ensuring consistent moisture removal and improved product quality. They are particularly valued for their ability to handle heat-sensitive materials without compromising drug stability, making them suitable for a wide range of pharmaceutical formulations. Additionally, fluid bed dryers offer faster processing times, scalability, and integration with granulation and coating systems, which streamline production. Their widespread adoption is further supported by regulatory compliance and growing demand for high-throughput drug manufacturing.

The freeze dryers/lyophilizers segment is estimated to emerge as the fastest-growing segment in the pharmaceutical drying equipment market during the forecast period. Freeze-dryers are booming in pharma due to soaring demand for biologics, vaccines, and heat-sensitive drugs that require long-term stability without refrigeration. Regulatory authorities increasingly approve freeze-dried formulations, and enhanced automation, real-time moisture tracking, and scalable systems are boosting efficiency and reliability across production environments.

For instance,

The granules & oral solid dose segment dominates the market due to its extensive use in global drug manufacturing and patient preference for solid dosage forms such as tablets and capsules. Oral solid doses are cost-effective, stable, easy to administer, and allow precise dosing, which makes them the most widely prescribed drug format worldwide. Drying equipment, especially fluid bed dryers and tray dryers, plays a critical role in ensuring uniform granulation, improved stability, and extended shelf life of these formulations. Additionally, the growing demand for generics and large-scale production of oral therapies further strengthens this segment’s dominance.

The biologics & vaccines segment is anticipated to be the fastest-growing application in the pharmaceutical drying equipment market, driven by the rising global demand for advanced therapies, monoclonal antibodies, and immunizations. These products are highly sensitive and require specialized drying techniques, particularly freeze-drying, to preserve stability, efficacy, and extend shelf life. The surge in vaccine development, fuelled by recent pandemics and ongoing efforts against infectious diseases, has further accelerated investments in advanced lyophilization systems. Additionally, increasing R&D in cell and gene therapies, along with the expansion of biologics manufacturing facilities, continues to boost the adoption of high-performance drying equipment tailored for these complex formulations.

The commercial/production-scale equipment (GMP) segment dominates the pharmaceutical drying equipment market due to its critical role in large-scale drug manufacturing that complies with stringent Good Manufacturing Practice (GMP) regulations. Pharmaceutical companies require robust, high-capacity drying systems to ensure consistent quality, safety, and efficiency in the mass production of drugs, especially oral solid doses and biologics. GMP-certified equipment offers validated processes, regulatory compliance, and scalability, making it essential for meeting global demand. Moreover, growing outsourcing to contract development and manufacturing organizations (CDMOs) and rising biologics production further drive the preference for production-scale equipment, cementing its dominance in the industry.

The pilot-scale & R&D equipment segment is experiencing rapid growth in the pharmaceutical drying equipment market as it plays a crucial role in early-stage drug development and process optimization. These systems allow manufacturers and researchers to test, validate, and refine formulations on a smaller scale before transitioning to full-scale production, reducing risks and costs. With the growing pipeline of biologics, vaccines, and novel therapies, the need for flexible and precise drying solutions has intensified. Additionally, the rise of personalized medicine, coupled with increased R&D investments by pharmaceutical companies and academic institutions, is further fueling this segment’s expansion.

The batch dryers segment dominates the mode of operation in the market due to its flexibility, reliability, and suitability for a wide range of drug formulations. Batch dryers are particularly favored in pharmaceutical manufacturing as they allow precise control over critical parameters such as temperature, pressure, and drying time, ensuring consistent product quality and compliance with regulatory standards. Their adaptability makes them ideal for processing small to medium production volumes, new drug formulations, and high-value biologics. Furthermore, their ability to handle heat-sensitive materials and support multiple applications strengthens their dominance as the preferred drying mode in the industry.

The continuous drying systems segment is estimated to be the fastest-growing mode of operation in the pharmaceutical drying equipment market due to rising demand for efficiency, scalability, and consistent product quality. Unlike batch systems, continuous dryers enable uninterrupted processing, reducing downtime and increasing overall productivity. They are particularly beneficial for high-volume drug manufacturing, where uniform drying and reduced cycle times are critical. Additionally, advancements in automation, real-time monitoring, and process control have enhanced their precision and reliability. With pharmaceutical companies focusing on cost optimization and meeting growing global drug demand, continuous drying systems are rapidly gaining adoption as the preferred next-generation drying solution.

The pharmaceutical & biotech manufacturers (in-house) segment dominates the end-user landscape of the pharmaceutical drying equipment market due to their direct involvement in large-scale drug production and formulation development. These manufacturers require advanced drying systems to ensure product stability, efficacy, and compliance with stringent regulatory standards. The growing demand for oral solid doses, biologics, and vaccines has further driven their reliance on high-performance drying equipment such as fluid bed dryers and lyophilizers. Additionally, increasing investments in manufacturing capacity, expansion of biologics pipelines, and the push for faster time-to-market strengthen their dominant position as the primary buyers of pharmaceutical drying technologies worldwide.

The contract development & manufacturing organizations (CDMOs) segment is anticipated to be the fastest-growing segment in the pharmaceutical drying equipment market due to the increasing trend of outsourcing drug development and manufacturing. Pharmaceutical companies are turning to CDMOs to reduce operational costs, accelerate product launches, and access advanced technologies without heavy capital investment. CDMOs are rapidly expanding their facilities with state-of-the-art drying equipment to handle complex formulations, biologics, and personalized medicines. Their expertise in regulatory compliance, scalability, and flexibility makes them preferred partners for both small biotech firms and large pharma companies. This growing reliance on outsourcing continues to drive the rapid expansion of CDMOs globally.

North America is the dominant region in the pharmaceutical drying equipment market share 38% in 2024, due to its strong pharmaceutical and biotechnology base, advanced research infrastructure, and early adoption of innovative technologies. The region hosts leading drug manufacturers and CDMOs, creating consistent demand for high-quality and scalable drying solutions. Strict regulatory frameworks from the FDA and Health Canada push companies to invest in advanced equipment that ensures product safety, efficiency, and compliance. The rising demand for biologics, vaccines, and personalized medicines further accelerates the adoption of freeze-dryers and spray-dryers, particularly for sensitive formulations. Moreover, the region’s focus on automation, sustainability, and digitalization, along with ongoing collaborations between pharma companies and technology providers, strengthens its global leadership in this market.

A surge in biologics, vaccines, and overall pharmaceutical output, fuelled by immunization campaigns and an aging population, boosts demand for advanced freeze-dryers in the U.S. Stringent cGMP standards enforced by the FDA drive the adoption of state-of-the-art filtration and drying equipment.

Growing pharmaceutical and adjacent sectors: Expansion in pharmaceuticals and food & beverage manufacturing supports demand for drying and filtration technologies. Though a smaller market than the U.S., Canada's needs parallel regional industrial activity and standards.

The Asia-Pacific region is outpacing others in pharmaceutical drying equipment growth, driven by rapid industrialization in countries like India, China, and South Korea, a surge in pharmaceutical and biopharmaceutical manufacturing, and rising adoption of advanced technologies such as freeze-drying and spray-drying. The expansion of CDMOs and stricter GMP compliance are also accelerating demand for precise, high-quality drying equipment.

In 2025, the Asia-Pacific pharmaceutical drying equipment market will continue to accelerate thanks to industrial innovation and smart automation. At CPHI Worldwide 2025, Changzhou Shinma Drying Engineering unveiled a suite of advanced equipment including vacuum belt dryers for preserving heat-sensitive biologics, efficient spray dryers, PLG plate dryers, and fluidized bed systems all showcased within integrated, full-process production lines, enhancing automation and hygiene. Looking ahead, the 12th Asia-Pacific Drying Conference, scheduled for October 2025 in Changzhou, will spotlight “green intelligence” innovations in drying technology, gathering academia and industry leaders to drive sustainable, next-generation process solutions.

The Europe region is witnessing notable growth in the pharmaceutical drying equipment market, supported by its strong pharmaceutical manufacturing base, high investment in R&D, and stringent regulatory standards that encourage the adoption of advanced technologies. The increasing demand for biologics, generics, and specialty medicines across the region is driving the use of efficient freeze dryers, vacuum dryers, and spray dryers. Additionally, sustainability initiatives in Europe are pushing manufacturers to adopt energy-efficient and eco-friendly equipment. Recent developments, such as collaborations between European pharma companies and equipment suppliers to integrate automation and digital monitoring systems, further strengthen the region’s growth trajectory and global competitiveness in this sector.

Pharmaceutical drying equipment R&D involves optimizing drying processes for various formulations, including APIs and excipients, using methods like spray drying, freeze drying, and fluid bed drying. Key R&D steps include understanding drying mechanisms, selecting appropriate equipment, optimizing process parameters, and scaling up production

Key Players Include: GEA, ATS Corporation, Hosokawa Micron, Freund Corporation, I.M.A. Industria Macchine Automatiche, Syntegon Technology, and BUCHI Labortechnik.

The distribution of pharmaceutical drying equipment involves a multi-step process that ensures the right equipment reaches the right pharmaceutical companies. This includes selecting suitable equipment, managing the supply chain, ensuring proper installation and validation, and providing ongoing support and maintenance.

Top Companies Include: GEA Group, ATS Corporation, Hosokawa Micron Group, and I.M.A. Industria Macchine Automatiche S.p.A.

Support and services for pharmaceutical drying equipment encompass a range of activities aimed at ensuring optimal performance and longevity of the equipment. These services typically include installation, maintenance, calibration, validation, and troubleshooting.

Top Companies Include: GEA Group and ATS Corporation

In July 2025, Florent Bordet, Chief Scientific Officer at Aenova, stated that Aenova is an end-to-end CDMO that helps clients at every stage of the drug product lifecycle, from pre-creation, development, and commercial production. One of the most important factors in the success of new pharmaceutical substances. The Aenova company’s new spray drying platform in Killorglin allows us to greatly increase the variety of solutions to speed up time-to-market and assist clients in overcoming bioavailability obstacles.

By Equipment / Technology Type

By Product Process / Application

By Scale / Offering

By Mode of Operation

By End User / Buyer

By Region

February 2026

February 2026

February 2026

February 2026