February 2026

The global septicemia antibiotics market size is expected to be worth around USD 3.61 billion by 2035, from USD 2.7 billion in 2025, growing at a CAGR of 2.94% during the forecast period from 2026 to 2035.

The septicemia antibiotics market is experiencing robust growth, driven by advancements in diagnostics, the increasing risk of infection among vulnerable populations, and the rising number of hospital admissions. Antibiotics are widely prescribed during sepsis to reduce and prevent the spread of bacterial infections. The growing research and development activities have led to the development of more specific and targeted antibiotics for particular organisms.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.78 Billion |

| Projected Market Size in 2035 | USD 3.61 Billion |

| CAGR (2026 - 2035) | 2.94% |

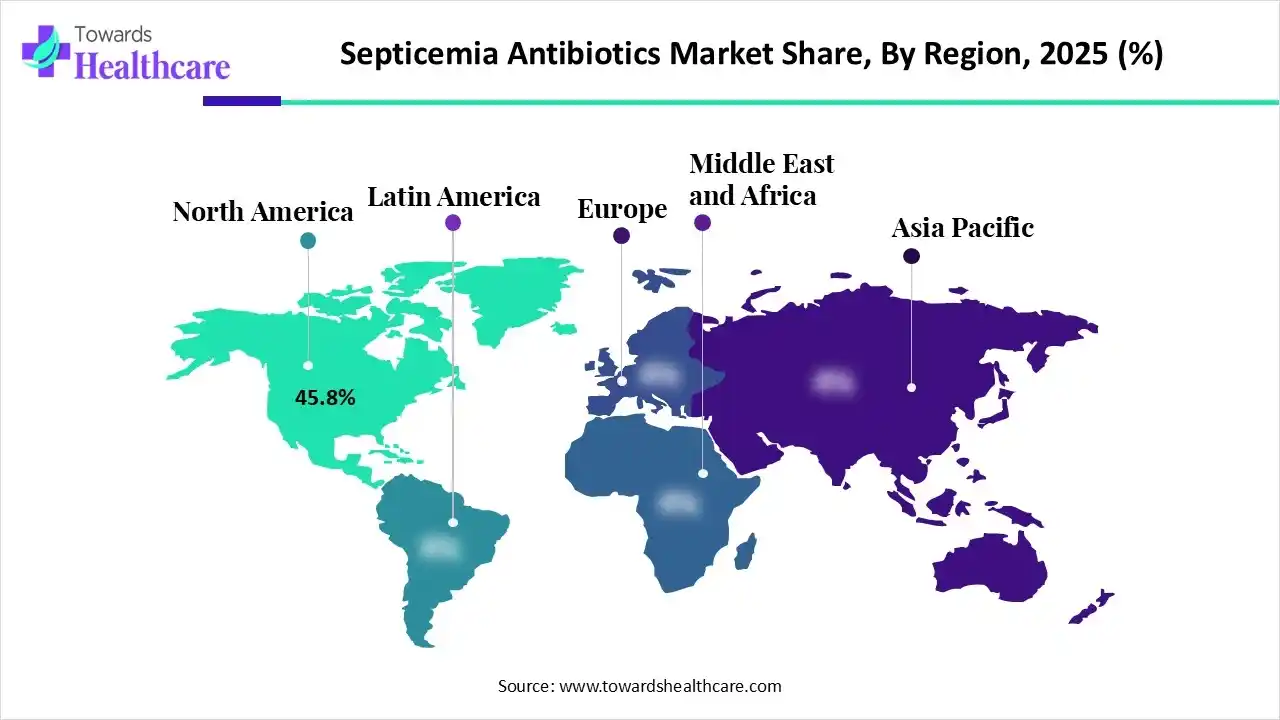

| Leading Region | North America by 45.8% |

| Market Segmentation | By Product/Drug Class, By Therapy Approach, By Administration Route, By Indication/Pathogen Focus, By End-User/Care Setting, By Treatment Line, By Distribution Channel, By Region |

| Top Key Players | Pfizer, Inc., Merck & Co., Glaxosmithkline plc, Johnson & Johnson, Novartis, Sanofi, Bayer AG, Teva Pharmaceuticals, Fresenius Kabi |

The septicemia antibiotics market comprises antimicrobial agents used to treat bloodstream infections (sepsis and septicemia), including empiric and targeted therapies against Gram-positive and Gram-negative pathogens. Products include broad-spectrum beta-lactams, carbapenems, glycopeptides, aminoglycosides, polymyxins, oxazolidinones, and novel beta-lactamase inhibitor combinations administered mainly via IV in hospital settings.

Artificial intelligence (AI) has emerged as a promising solution to bridge diagnostic and therapeutic gaps in sepsis care. AI and machine learning (ML) algorithms can analyze vast amounts of clinical, microbiological, and pharmacological data in real-time, enabling healthcare professionals to make effective clinical decisions. They can detect specific types of microbes, as well as detect sepsis onset 4 to 12 h before clinical recognition. AI and ML assist researchers in developing novel antibiotics with high specificity and reduced side effects.

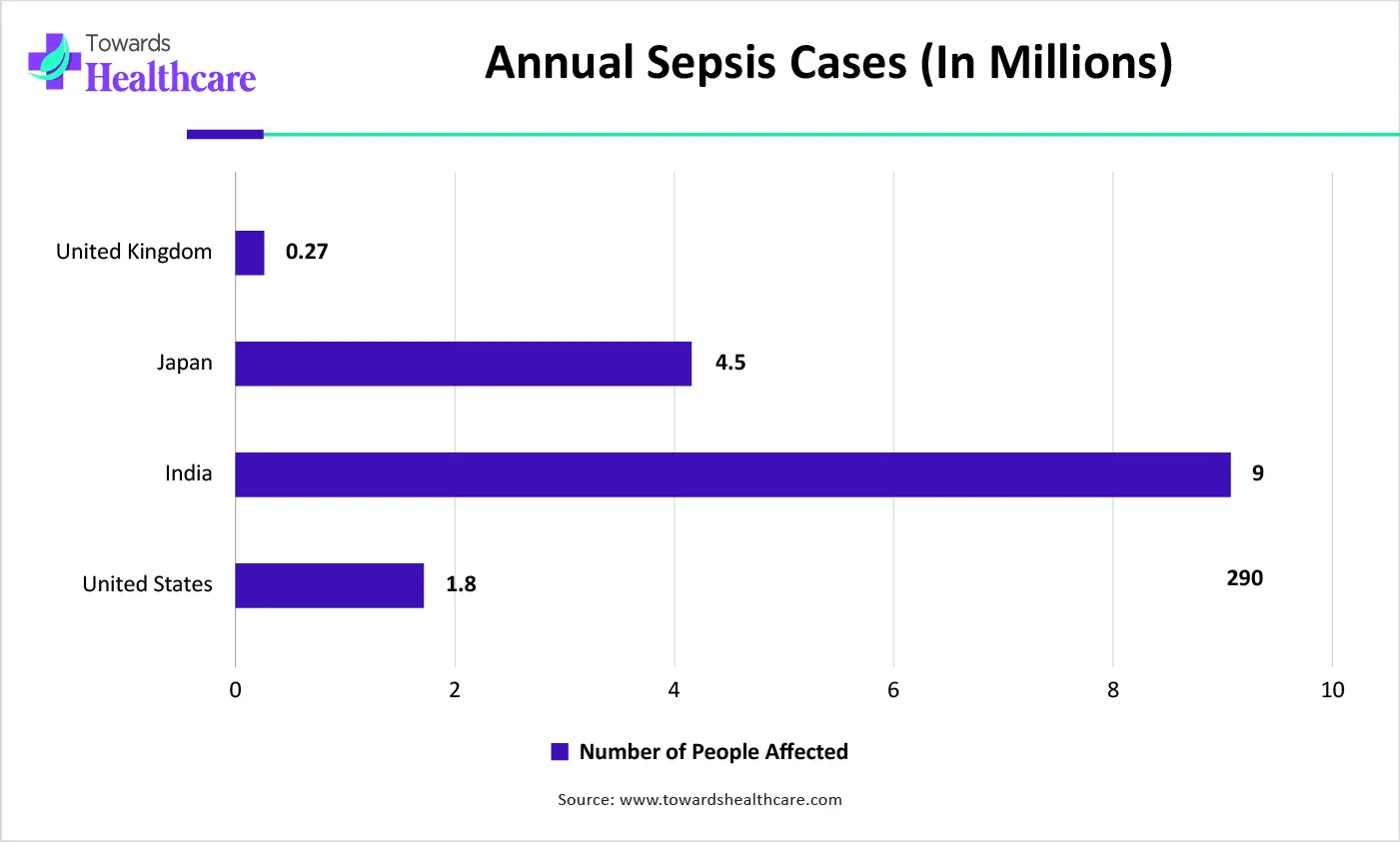

| Countries | Annual Sepsis Incidence (in millions) |

| United Kingdom | 0.27 |

| Japan | 4.5 |

| India | 9 |

| United States | 1.8 |

Which Product/Drug Class Segment Dominated the Septicemia Antibiotics Market?

The beta-lactams segment held a dominant position with a share of 31.4% in the market in 2025, due to the widespread availability of beta-lactams and their known therapeutic profiles. Beta-lactams are the oldest known antibiotics for treating a variety of bacterial infections. They are the first-line agents for antibiotic management of critically ill patients with sepsis or septic shock. It has been demonstrated that ICU patients with beta-lactam underexposure have a 1.5-fold higher risk of clinical failure.

Beta-Lactam/Beta-Lactamase Inhibitor Combinations

The beta-lactam/beta-lactamase inhibitor combinations segment is expected to grow at the fastest CAGR of 5.1% in the market during the forecast period. Beta-lactamase (BL) inhibitors, such as clavulanic acid, sulbactam, and tazobactam, are typically prescribed in combination with beta-lactams to prevent the development of antimicrobial resistance. They inhibit the enzyme serine beta-lactamase that inactivates the beta-lactam ring, decreasing the therapeutic potential of beta-lactams.

Why Did the Empiric Therapy Segment Dominate the Septicemia Antibiotics Market?

The empiric therapy segment held the largest revenue share of 72.4% in the market in 2025, due to the need for rapid intervention of sepsis patients. Broad-spectrum antibiotics are ideal for empiric therapy, as they provide coverage of multiple organisms. According to a recent cross-sectional study on 894,724 adults having suspected sepsis, 379,987 received empiric therapy. The most common empiric antibiotics were vancomycin (41.2%), ceftriaxone (37.8%), piperacillin-tazobactam (31.1%), and cefepime (24.8%).

Targeted/Culture-Directed Therapy

The targeted/culture-directed therapy segment is expected to grow with the highest CAGR of 5.0% in the market during the studied years. The availability of advanced and point-of-care diagnostics allows healthcare professionals to identify the type of microbes affecting the patient. This necessitates the use of targeted/culture-directed therapy. Targeted therapy reduces the risk of antimicrobial resistance among patients.

How the Intravenous (IV) Segment Dominated the Septicemia Antibiotics Market?

The intravenous (IV) segment contributed the biggest revenue share of 72.4% in the market in 2025, due to faster onset of action and maximum bioavailability. The IV route is predominantly preferred for patients with severe sepsis or septic shock. It eliminates the first-pass metabolism pathway and provides the benefit of drug administration even when the patient is unconscious. It delivers the drug directly into the bloodstream, thereby delivering it throughout the body.

Oral

The oral segment is expected to expand rapidly in the market with a CAGR of 5.4% in the coming years. The oral route is the most convenient and affordable, eliminating the need for skilled healthcare professionals for drug delivery. It is preferred by patients of all age groups. Antibiotics are delivered through the oral route in patients with early-stage sepsis.

What Made Community-acquired Sepsis the Dominant Segment in the Septicemia Antibiotics Market?

The community-acquired sepsis segment accounted for the highest revenue share of 56.7% in the market in 2025, due to the higher incidence of community-acquired (CA) sepsis compared to hospital-acquired (HA) sepsis. CA sepsis develops when patients come into close contact with other people who are suffering from infectious diseases. It starts within ≤72 h of hospital admission in an infected patient without recent exposure to healthcare risks.

MDR/XDR Pathogen-Targeted Therapy

The MDR/XDR pathogen-targeted therapy segment is expected to witness the fastest growth with a CAGR of 5.2% in the market over the forecast period. Sepsis caused by XDR pathogens is characterized by high mortality rates. Polyspecific intravenous immunoglobulin (IVIG) is used as an adjunctive therapy for a long time. It is estimated that the prevalence of XDR P. aeruginosa among nosocomial pathogens ranges between 9% and 11.2%.

Which End-User Segment Led the Septicemia Antibiotics Market?

The hospital (ICU) segment led the market with a share of 53.5% in 2025, due to the increasing number of hospital admissions and surgeries. This results from the rising prevalence of chronic disorders and the growing number of accidents. Immunocompromised patients are likely to get affected by hospital-acquired infections (HAIs), leading to sepsis. Hospitals have favorable infrastructure and skilled professionals to cure a patient from sepsis.

Ambulatory Infusion Centers/Outpatient Parenteral Therapy

The ambulatory infusion centers/outpatient parenteral therapy segment is expected to show the fastest growth with a CAGR of 5.3% over the forecast period. Patients with mild or moderate sepsis are not required to be admitted to the hospital. They prefer visiting ambulatory infusion centers or outpatient centers for advanced care. These centers have specialized equipment and the desired therapeutics to treat numerous patients.

How the First-Line Segment Dominated the Septicemia Antibiotics Market?

The first-line segment registered its dominance over the global market with a share of 72.4% in 2025. First-line agents are standard treatment given to the majority of patients with sepsis. The recommended first-line agent for septic shock is norepinephrine, preferably administered through a central catheter. First-line therapy prevents organ failure, stabilizes vital functions, and improves survival rates.

Second/Third-Line

The second/third-line segment is expected to account for the highest growth with a CAGR of 5.2% in the forthcoming years. The increasing cases of antimicrobial resistance necessitate healthcare professionals to provide advanced second/third-line therapy to patients. Second-line therapy is preferred when the first-line treatment fails to control the infection or restore organ function.

Why Did the Hospital Pharmacy/Institutional Procurement Segment Dominate the Septicemia Antibiotics Market?

The hospital pharmacy/institutional procurement segment held a major revenue share of 54.8% in the market in 2025, due to specialized infrastructure for the storage and distribution of antibiotics to patients. Hospital pharmacies comply with stringent regulations required for the Antimicrobial Stewardship Program and other guidelines, providing high-quality drugs to patients. Institutional procurement overcomes challenges related to the supply chain and local sourcing.

Specialty Pharmacy/Contract Manufacturers

The specialty pharmacy/contract manufacturers segment will grow at the fastest CAGR of 5.3% in the market over the studied period. Large companies and small- and medium-sized enterprises outsource their manufacturing activities to contract manufacturers. Contract manufacturers supply antibiotics to drug stores, hospitals, and patients. They leverage advanced facilities and GMP standards for both domestic and international standards.

North America dominated the global market in 2025. The availability of a robust healthcare infrastructure, favorable regulatory support, and state-of-the-art research and development facilities are the factors that govern market growth in North America. People are becoming aware of early diagnosis and intervention of sepsis, resulting in appropriate care. The increasing incidence of HAIs and hospital admissions foster market growth.

The U.S. witnessed over 34 million hospital admissions in 2023. This potentiates the risk of HAIs. The CDC reported that approximately 1 in 31 hospital patients and 1 in 43 home residents have an HAI. Of these, about half of hospital patients and 1 in 12 nursing home residents receive antimicrobial medication.

Asia-Pacific is expected to host the fastest-growing market in the coming years. Countries like China, India, and South Korea report the highest number of sepsis cases, mainly due to HAIs. Government organizations are at the forefront of establishing suitable guidelines about the appropriate use of antibiotics. The region has a specialized manufacturing infrastructure due to its favorable geographical location and affordable workforce, encouraging foreign companies to set up their manufacturing infrastructure.

The increasing sepsis cases result in higher healthcare expenditure. The total national healthcare expenditure in 2024 amounted to 9.09 trillion yuan ($1.27 trillion), representing 6.7% of China’s GDP. China has also witnessed a surge in the number of hospitals by 355, accounting for a total of 38,700 hospitals by 2024.

Europe is expected to grow at a notable CAGR in the foreseeable future. Favorable government support, the growing research activities, and the rising adoption of advanced technologies propel the market. The increasing burden of sepsis also necessitates stringent measures. The European Sepsis Alliance reports that over 3.4 million individuals develop sepsis annually, accounting for 700,000 deaths. Novel antibiotics are developed to address challenges related to conventional therapy.

The Medicines and Healthcare products Regulatory Agency (MHRA) recently approved gepotidacin (Blujepa), a novel oral antibiotic pill, for the treatment of uncomplicated urinary tract infections (UTIs), including sepsis or permanent kidney damage. In addition, a recent ecological study found that the sepsis-coded hospital admissions increased from 27.9 admissions per 100,000 in 1998 to 210.4 admissions in 2023, a 7.5-fold increase.

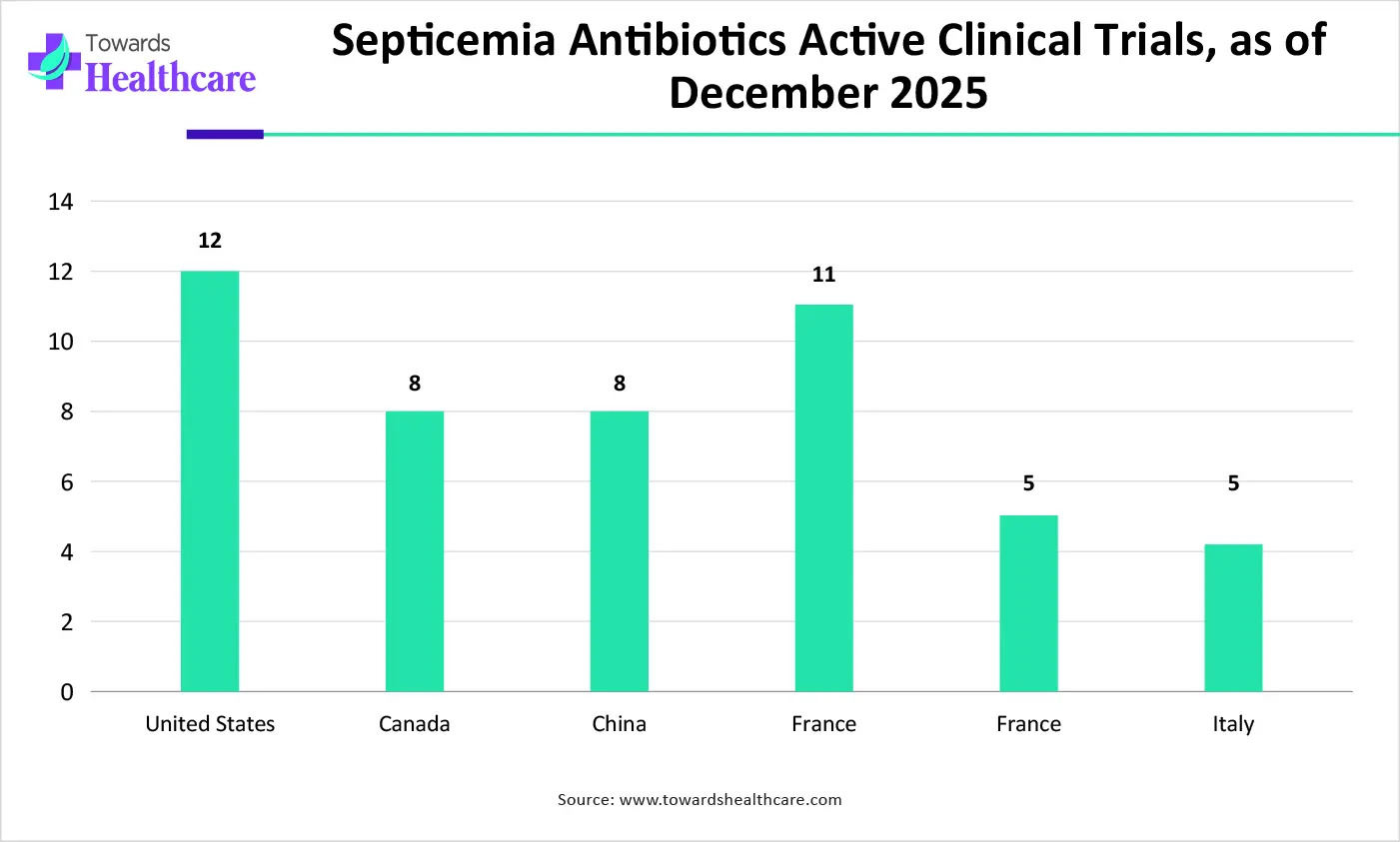

| Countries | Septicemia Antibiotics Active Clinical Trials (as of December 2025) |

| United States | 12 |

| Canada | 8 |

| China | 8 |

| France | 11 |

| Spain | 5 |

| Italy | 5 |

Patient support refers to guiding patients about antibiotic indications and manage antimicrobial resistance.

| Companies | Headquarters | Offerings |

| Pfizer, Inc. | New York, United States | It offers a diverse portfolio of anti-infectives from commonly-used beta-lactam/beta-lactamase inhibitors to high-end antibacterial therapeutics. |

| Merck & Co. | New Jersey, United States | The company has a strong legacy in antimicrobial R&D, with a broad portfolio that spans both human and animal health, and includes antibiotics and vaccines. |

| Glaxosmithkline plc | London, United Kingdom | Its infectious disease portfolio includes vaccines, antibiotics, antivirals, and antifungals. |

| Johnson & Johnson | New Jersey, United States | The company is working urgently to help protect society from the consequences of pathogenic E. coli, S. aureus, and P. aeruginosa. |

| Novartis | Basel, Switzerland | It is currently developing TIN-816 for the treatment of acute kidney injury and acute kidney injury-associated sepsis following cardiac surgery. |

| Sanofi | Paris, France | Sanofi commits to advancing healthcare through innovative medicines across various vaccines, specialty, and general medicine focus areas. |

| Bayer AG | Leverkusen, Germany | Bayer’s BAY-3389934, an investigational drug, is studied in patients with sepsis-induced coagulopathy. |

| Teva Pharmaceuticals | Tel Aviv-Yafo, Israel | It specializes in generic medicines, offering Erythromycin and Azithromycin tablets to treat a variety of bacterial infections. |

| Fresenius Kabi | Bad Homburg, Germany | The company’s portfolio includes anti-infective drugs, such as antibiotics and antibacterials, as well as antifungals and antivirals. |

By Product/Drug Class

By Therapy Approach

By Administration Route

By Indication/Pathogen Focus

By End-User/Care Setting

By Treatment Line

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026