February 2026

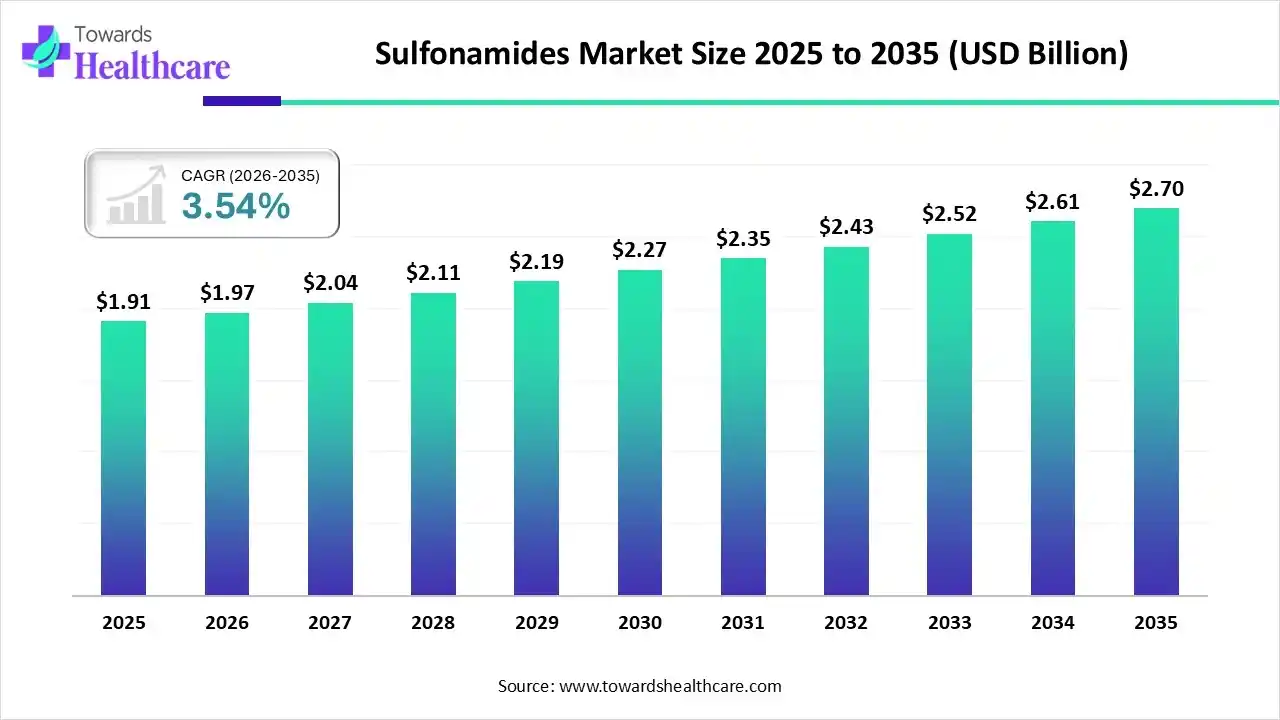

The global sulfonamides market size was estimated at USD 1.91 billion in 2025 and is predicted to increase from USD 1.97 billion in 2026 to approximately USD 2.7 billion by 2035, expanding at a CAGR of 3.54% from 2026 to 2035.

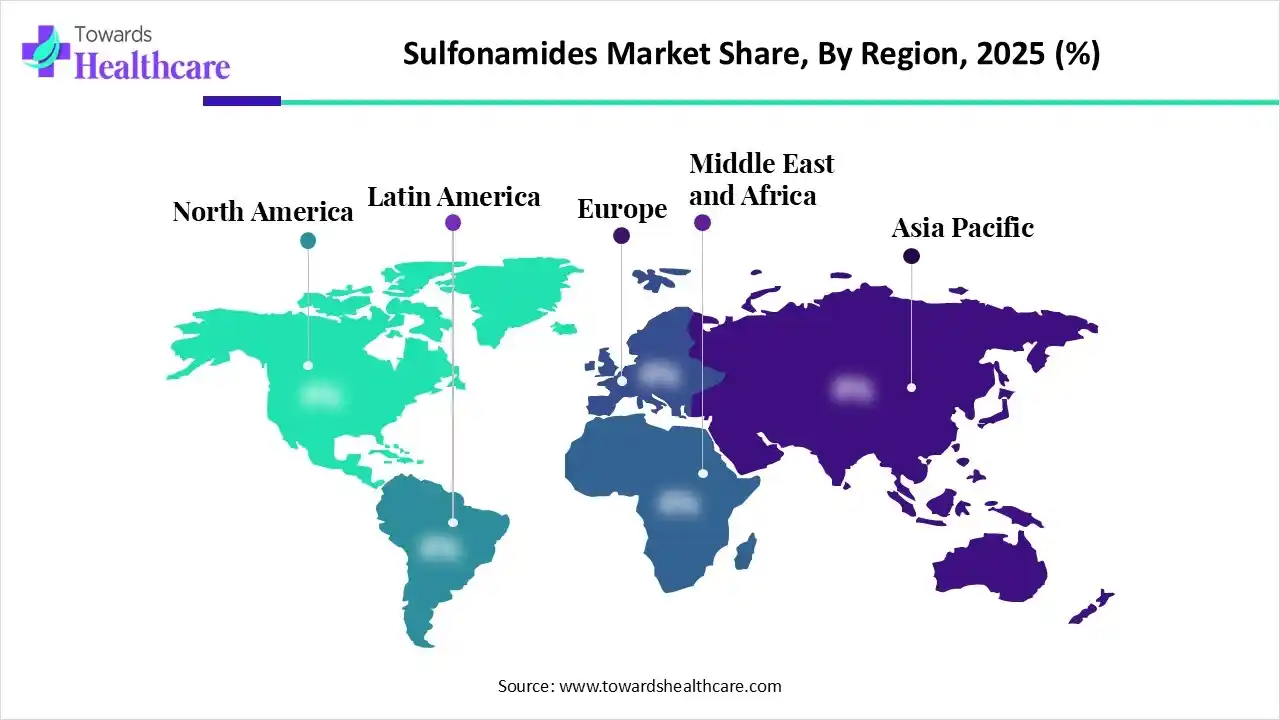

The sulfonamides market is driven by sustained demand for cost-effective antibacterial therapies across both human and veterinary healthcare. Asia-Pacific dominates due to high infectious disease prevalence, expanding pharmaceutical manufacturing, and strong generic drug production. Growing antibiotic resistance awareness, improved healthcare access, and continued use in combination therapies further support steady market adoption across emerging and developed regions.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.97 Billion |

| Projected Market Size in 2035 | USD 2.7 Billion |

| CAGR (2026 - 2035) | 3.54% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Product Type, By Application, By Route of Administration, By End User, By Region |

| Top Key Players | Pfizer Inc., GlaxoSmithKline (GSK plc), Sanofi S.A., Teva Pharmaceutical Industries Ltd., Cipla Ltd., Abbott Laboratories, F. HoffmannLa Roche Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Amneal Pharmaceuticals LLC |

The sulfonamides market covers a class of synthetic antimicrobial drugs widely used to treat bacterial infections in human and veterinary medicine. Market growth is driven by affordability, broad-spectrum activity, continued use in combination therapies, and strong demand from emerging economies with high infection burdens and expanding healthcare infrastructure.

AI integration can enhance the sulfonamides market by accelerating drug discovery, optimizing molecular design, and predicting antimicrobial resistance patterns. It improves clinical trial efficiency, supports precision prescribing, and streamlines manufacturing and supply chains. These capabilities extend product lifecycles, improve treatment outcomes, and strengthen competitiveness in cost-sensitive and emerging healthcare markets.

Sulfonamides are increasingly paired with other antibiotics to enhance efficacy and reduce resistance risks. This trend supports their continued clinical relevance, especially in treating complex and recurrent bacterial infections across both human and veterinary medicine.

Expanding livestock production and rising awareness of animal health are driving sulfonamide usage in veterinary care. Their cost-effectiveness and broad-spectrum action make them suitable for large-scale preventive and therapeutic use.

AI-driven research tools are improving compound optimization, resistance prediction, and manufacturing efficiency. These advancements help extend sulfonamide product lifecycles and support more targeted, effective antimicrobial development.

Asia-Pacific continues to expand generic drug manufacturing and active pharmaceutical ingredient production. Improved regulatory frameworks and export capabilities are positioning the region as a long-term supply hub for sulfonamide products.

Future growth will emphasize responsible usage, surveillance, and regulatory alignment. Improved stewardship programs aim to balance accessibility with resistance control, ensuring sustainable demand and continued acceptance in global healthcare systems.

Which Product Type Segment Dominated the Sulfonamides Market?

The sulfamethoxazole segment dominates the sulfonamides market with share of 31.1 % due to its widespread use in combination therapies, particularly with trimethoprim, offering broad-spectrum antibacterial effectiveness. Its proven clinical efficacy, affordability, strong prescribing familiarity, and extensive use in both human and veterinary applications further reinforce consistent demand across hospitals, clinics, and emerging healthcare markets.

Sulfadoxine

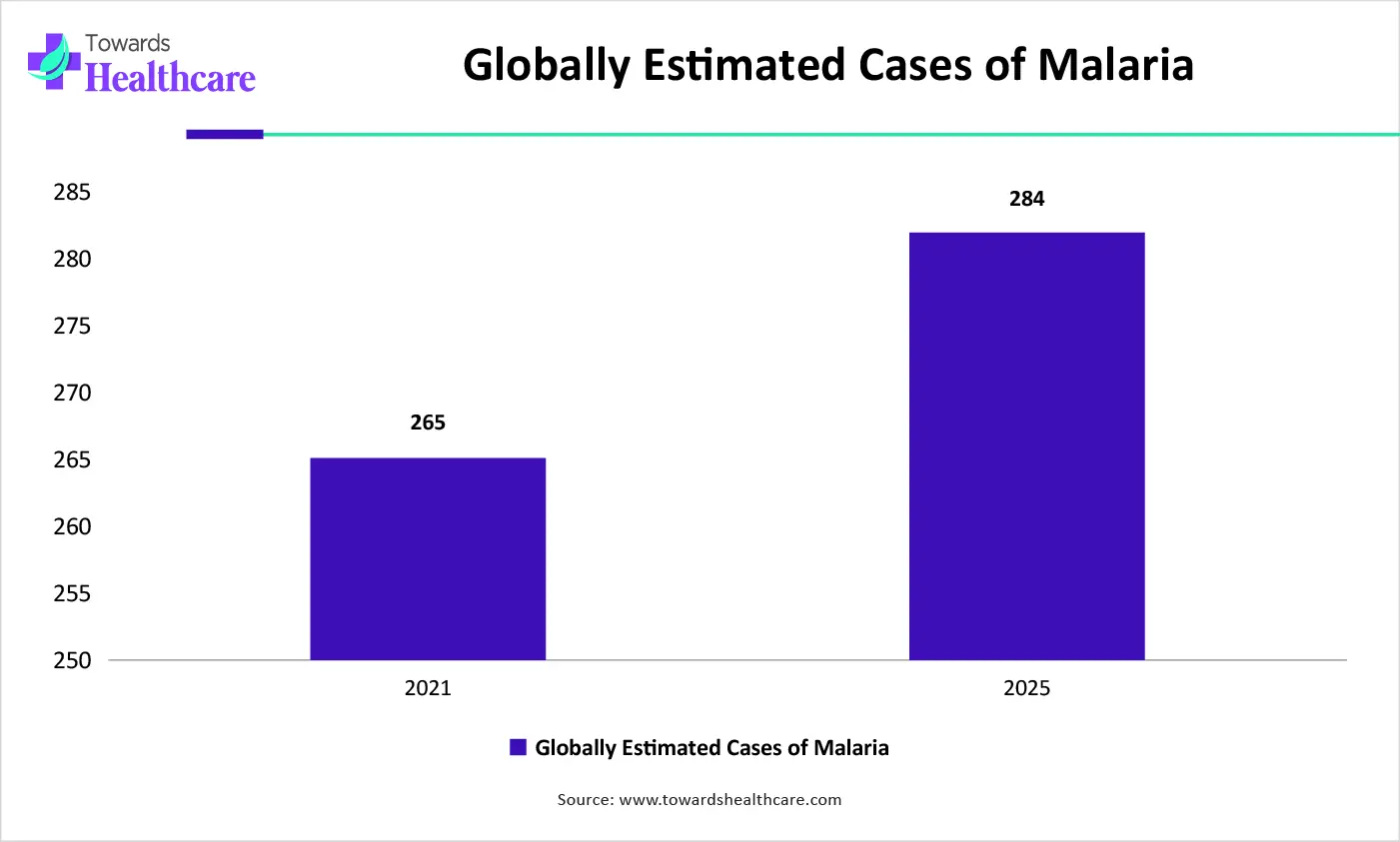

The sulfadoxine segment is anticipated to be the fastest-growing in the market with share of 4.6% due to its continued use in antimalarial combination therapies, especially in endemic regions. Strong public health programs, preventive treatment initiatives for vulnerable populations, and rising focus on infectious disease control in developing economies are accelerating demand and supporting sustained segment growth.

Why Did the for Urinary tract infections Segment Dominate the Sulfonamides Market?

The urinary tract infection segment dominates the market with share of 34.2% due to the high global incidence of UTIs and the continued use of sulfonamide-based combinations as first-line or alternative treatments. Their affordability, oral availability, and proven effectiveness in uncomplicated infections support widespread prescribing across outpatient and primary healthcare settings.

Malaria & protozoal infections

The malaria and protozoal infections segment is estimated to be the fastest growing in the market with share of 4.6% due to ongoing use of sulfonamide combinations in antimalarial prevention and treatment programs. Rising disease burden in endemic regions, expanded public health initiatives, and increased access to essential medicines are driving sustained growth in this segment.

Why Did Oral Dominant Segment in the Sulfonamides Market?

The oral segment dominates the market with share of 60.4% due to its ease of administration, high patient compliance, and suitability for outpatient treatment. Oral formulations enable cost-effective mass distribution, simplified dosing, and broad accessibility, making them preferred for managing common bacterial, urinary tract, and protozoal infections across diverse healthcare settings.

Topical

The topical segment is anticipated to be fastest-growing in the market with share of 5.0% due to rising use in dermatology, burn care, and wound management. Localized drug delivery reduces systemic side effects while improving infection control. Increasing surgical procedures, trauma cases, and demand for targeted antimicrobial therapies are further accelerating topical sulfonamide adoption.

Which Hospitals Segment Led the Sulfonamides Market?

The hospitals segment dominates the market with share of 42.5% due to high patient inflow for bacterial and protozoal infections requiring supervised treatment. Hospitals ensure accurate diagnosis, resistance monitoring, and controlled antibiotic use. Availability of combination therapies, inpatient care, and established procurement systems further supports consistent sulfonamide utilization in hospital settings.

Veterinary hospitals

The veterinary hospitals segment is estimated to be fastest-growing in the sulfonamides market with share of 4.9% due to rising pet ownership, increased livestock health monitoring, and greater awareness of animal infectious diseases. Expanding veterinary infrastructure, improved diagnostic capabilities, and cost-effective sulfonamide treatments are driving higher adoption across companion and food-producing animal care settings.

Asia Pacific dominated the sulfonamides market with share of 43.4% in 2025 due to a high burden of infectious diseases, large population base, and expanding healthcare access. Strong generic drug manufacturing, cost-efficient production of active pharmaceutical ingredients, and widespread availability of affordable antibiotics further support sustained demand across both human and veterinary healthcare sectors.

China dominates the Asia-Pacific market due to its large pharmaceutical manufacturing base, robust generic drug production, and well-established supply chains. High population-driven demand for antibacterial therapies, expanding healthcare infrastructure, and strong government support for infectious disease management further reinforce China’s leading position in both human and veterinary sulfonamides markets.

Middle East & Africa is estimated to host the fastest-growing market with share of 5.5% during the forecast period due to rising prevalence of infectious and parasitic diseases, expanding healthcare infrastructure, and increasing government initiatives for disease control. Greater awareness, improved access to affordable antibiotics, and growing veterinary and human healthcare demand are accelerating market growth.

The UAE is a notably growing country in the Middle East and Africa market due to advanced healthcare infrastructure, increasing government investment in infectious disease management, and rising adoption of modern veterinary and human healthcare practices. Strong regulatory support and expanding pharmaceutical distribution networks further drive market growth.

North America is expected to grow at a significant CAGR in the market during the forecast period due to increasing awareness of antibiotic resistance, steady demand for combination therapies, and well-established healthcare infrastructure. Strong research initiatives, advanced diagnostic capabilities, and continued use of sulfonamides in outpatient and hospital settings contribute to sustained market growth across the region.

The U.S. exhibits notable growth in the sulfonamides market due to rising awareness of antimicrobial resistance, consistent demand for proven antibacterial therapies, and strong healthcare infrastructure. Continued use in combination treatments, advanced diagnostic capabilities, and government-supported infectious disease programs further drive adoption, supporting steady growth in both hospital and outpatient settings.

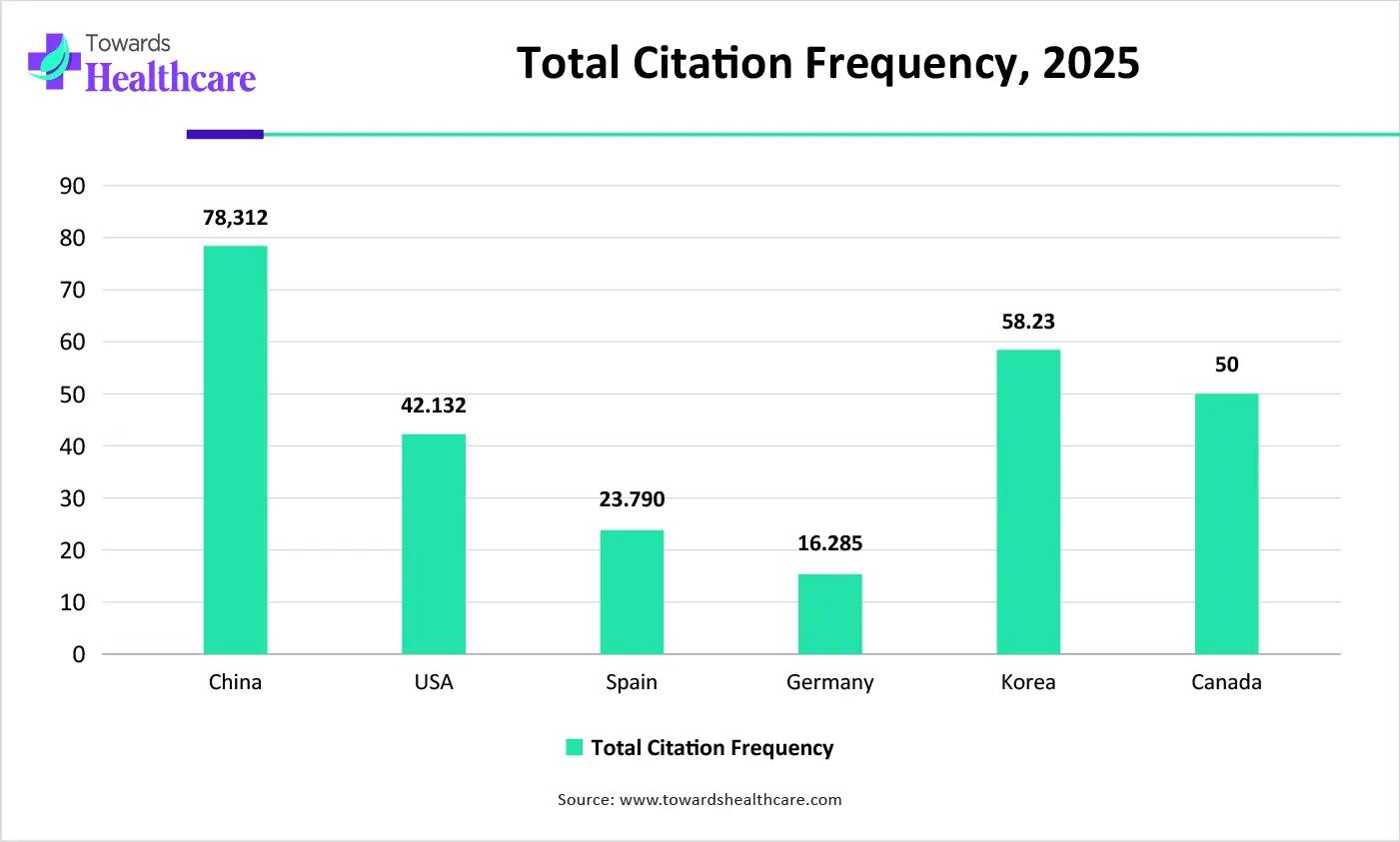

| Country | Total Citation Frequency |

| China | 78.312 |

| USA | 42.132 |

| Spain | 23.790 |

| Germany | 16.285 |

| Korea | 58.23 |

| Canada | 50 |

| Vendor | Offerings | Headquarters |

| Pfizer Inc. | Sulfonamide antibiotics and combination therapies | New York, USA |

| GlaxoSmithKline (GSK plc) | Antimicrobial agents including refined sulfonamide treatments | London, UK |

| Sanofi S.A. | Advanced sulfonamide-based formulations and combination antibiotics | Paris, France |

| Teva Pharmaceutical Industries Ltd. | Generic sulfonamide manufacturing | Petah Tikva, Israel |

| Cipla Ltd. | Affordable sulfonamide medications for emerging markets | Mumbai, India |

| Abbott Laboratories | Sulfonamide products as part of infectious disease portfolio | Abbott Park, Illinois, USA |

| F. HoffmannLa Roche Ltd. | Sulfonamide combinations like trimethoprim-sulfamethoxazole | Basel, Switzerland |

| Sun Pharmaceutical Industries Ltd. | Generic sulfonamide drugs and formulations | Mumbai, India |

| Dr. Reddy’s Laboratories Ltd. | Generic sulfonamide antibiotics and APIs | Hyderabad, India |

| Amneal Pharmaceuticals LLC | Generic sulfonamide antibiotics and related formulations | Bridgewater, New Jersey, USA |

By Product Type

By Application

By Route of Administration

By End User

By Region

February 2026

February 2026

February 2026

February 2026