February 2026

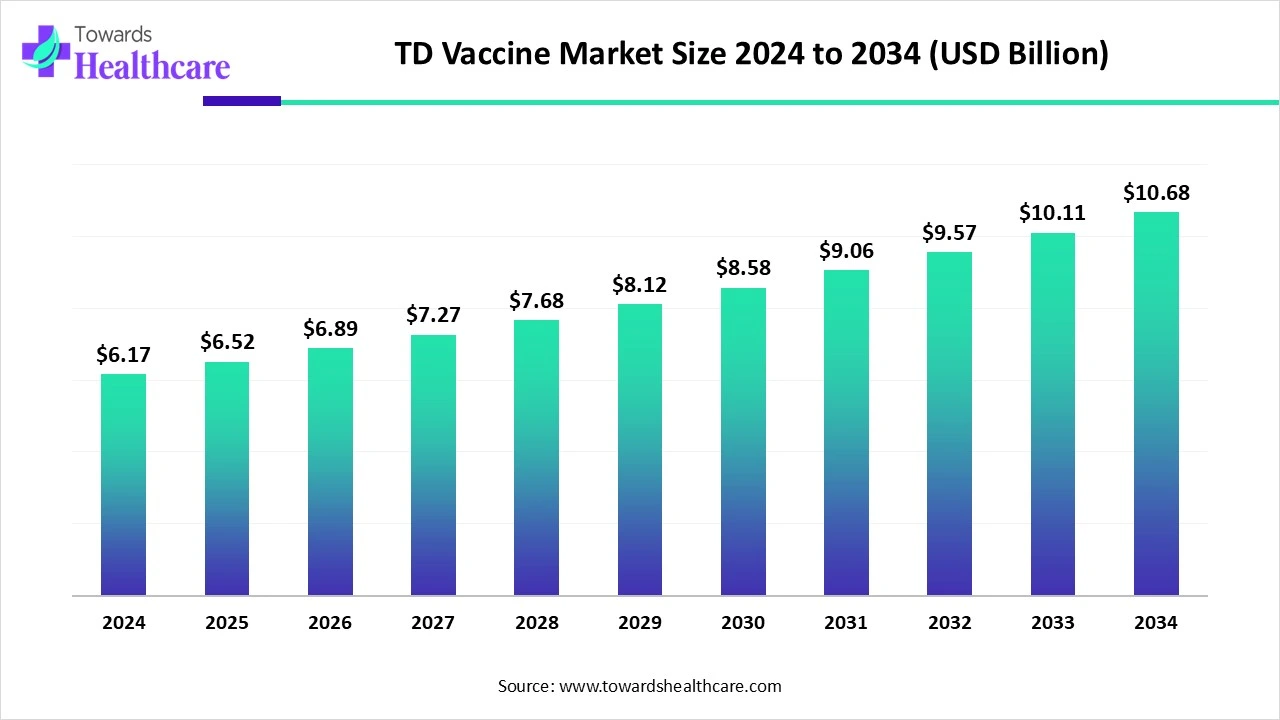

The global TD vaccine market size is calculated at US$ 6.17 in 2024, grew to US$ 6.52 billion in 2025, and is projected to reach around US$ 10.68 billion by 2034. The market is expanding at a CAGR of 5.64% between 2025 and 2034.

The global TD vaccine market is playing an immense role worldwide, as rising cases of tetanus and diphtheria, particularly in lower-income countries. Nowadays, regulatory bodies such as the WHO, UNICEF are stepping towards an increase in awareness regarding tetanus and diphtheria among pregnant women and infants, resulting in accelerated demand for the Td vaccine. Along with this, major developments in combination vaccines like Tdap, which protect against tetanus, diphtheria, and pertussis, streamline the vaccination process and boost patient compliance, especially among adolescents and adults. Also, developing countries are broadly investing in healthcare systems with enhanced easy access for vaccination among the public.

| Metric | Details |

| Market Size in 2025 | USD 6.52 Billion |

| Projected Market Size in 2034 | USD 10.68 Billion |

| CAGR (2025 - 2034) | 5.64% |

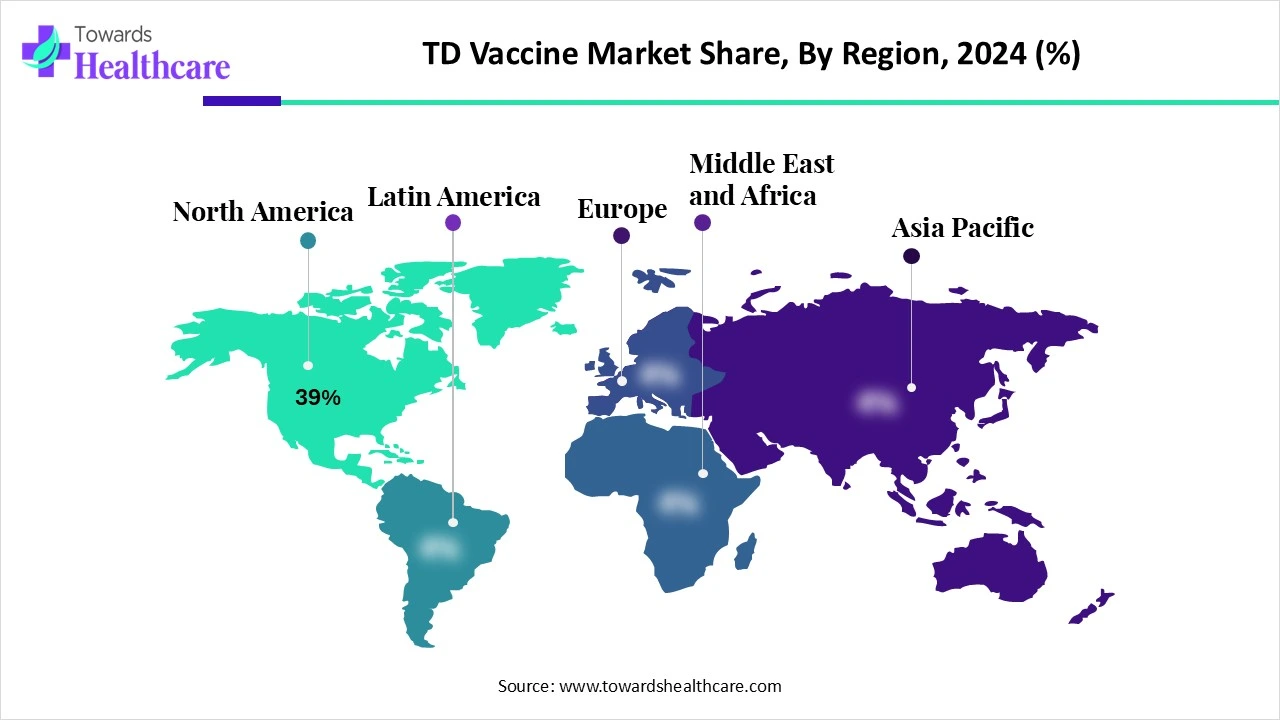

| Leading Region | Asia Pacific share by 39% |

| Market Segmentation | By Product Type, By Age Group, By Distribution Channel, By Formulation, By Region |

| Top Key Players | Sanofi Pasteur (Globally leading Td and Tdap manufacturer), GlaxoSmithKline (GSK), Serum Institute of India Pvt. Ltd., Biological E. Limited, Bharat Biotech International Ltd., Panacea Biotec Ltd., Pfizer Inc. (through Tdap product – Adacel), Merck & Co., Inc., Emergent BioSolutions Inc., Microgen (Russia), PT Bio Farma (Indonesia), Chengdu Institute of Biological Products, Sinovac Biotech Ltd., Haffkine Bio-Pharmaceutical Corporation Ltd., Vacsera (Egypt), LG Chem Ltd. (Korea), Novartis Vaccines (legacy – now part of GSK), Vabiotech (Vietnam), IMB Instituto Butantan (Brazil), WHO/UNICEF (as key procurement and policy stakeholders) |

The tetanus and diphtheria (TD) vaccine market consists of vaccines that provide dual immunization against tetanus and diphtheria, two serious but preventable bacterial diseases. TD vaccines are typically administered as booster doses for adolescents and adults after primary childhood immunization with DTaP. The market is driven by routine immunization programs, rising awareness of adult boosters, and global efforts to eliminate maternal and neonatal tetanus. Both monovalent (Td) and combination formulations (e.g., Tdap, Td-IPV) are used in public health and military settings. The market is characterized by unified self-procurement among countries, UNICEF procurement, and procurement through the PAHO revolving fund.

AI has a major role in the market, including analysis of large datasets by coupling with AI algorithms to detect possible vaccine candidates, estimate their efficacy, and improve their design for robust immunogenicity and stability. AI has been incorporated in manufacturing processes to raise efficiency, minimize expenses, and enhance quality control. This adoption of AI is fueled by the expansion of national immunization programs in developing countries, with support from international organizations like UNICEF, resulting in demand for TD vaccines.

Rise in global health initiatives and development of a combination vaccine

Worldwide, growing robust support from governments and international organizations like Gavi and the WHO has introduced the Expanded Program on Immunization, to accelerates access to TD vaccines through national immunization schedules and public health campaigns, is highly propelling the global TD vaccine market growth. As well as advancements in combination vaccines such as Tdap, which protect against tetanus, diphtheria, and pertussis, streamlines the vaccination process and boosts patient compliance, especially among adolescents and adults.

Misstatements in Campaigns and Supply Chain Issues

In the respective market, emerging challenges are raised by misstatements in campaigns, especially through social media, which develops fear and mistrust related to vaccines, leading to a step back among parents. Along with this, maintenance of the cold chain with proper storage and transportation conditions for these vaccines is critical, and inappropriate infrastructure in a few regions results in vaccine spoilage with decreased efficacy.

Accelerating Efforts Towards Self-Procurement by Countries and Rising Demand

Around the globe, many countries are putting efforts into self-procurement, in which India is a major purchaser. Whereas, the Low- and middle-income countries (LMICs) will enhance Td vaccine demand, on the other hand, high-income countries mainly fuel the demand for Tdap and Tdap-IPV vaccines. Majorly growing opportunities in the global TD vaccine market are due to the crucial role of organizations like UNICEF in procuring and distributing Td vaccines, especially in epidemic circumstances.

By product type, the monovalent TD vaccines segment registered dominance in the TD vaccine market in 2024. The segment is driven by rising awareness and increasing diphtheria prevalence among older age groups, and routine immunization programs for children and adults, due to the efficiency of these vaccines against both diphtheria and tetanus is more.

However, the combination vaccines segment will show rapid expansion, due to the accelerating need for booster doses in adolescents, adults, and pregnant women to protect their immunity against tetanus and diphtheria. Widespread combination vaccines, including DTaP and Tdap, provide significant advantages against numerous conditions with a single injection, optimize compliance, and decrease the number of clinic visits.

The adults & adolescents segment dominated the market, with a growing movement from TT (Tetanus Toxoid) to Td, as the WHO has recommended replacing TT with TD vaccines, which enable double protection against tetanus and diphtheria. Besides this, low-resource and low-income areas possessing a high number of unvaccinated individuals are widely raising demand for Tdap. In low-income regions, the increasing number of unvaccinated individuals is a factor in the growing demand for Tdap.

And the pregnant women segment is predicted to grow rapidly, due to Td or Tdap vaccination can protect both maternal and neonatal tetanus and diphtheria. Also, boosting awareness among pregnant women about the safety and advantages of Tdap vaccination, especially its capability in newborns to protect them from pertussis, is highly impacting the segment's growth.

In 2024, by end user, the public health agencies segment held a major share of ~58% in the TD vaccine market. Primarily, Gavi, the Vaccine Alliance, assists in the expansion of immunization programs in developing countries, resulting in a rise in the demand for Td vaccines. Moreover, the government, with favorable policies and funding for these programs, along with procurement and distribution of vaccines, greatly influences the segment and overall market growth.

The travel clinics & military use segment is anticipated to show the fastest growth, with specialized clinics focusing on travel health and occupational health. Besides this, in case of military use, these personnel are often deployed to different locations, sometimes regions may have greater disease risks, and are ultimately widely demanding vaccination to protect against potential tetanus and diphtheria.

By distribution channel, the government supply contracts/immunization programs segment has experienced major growth, due to various government-funded vaccination initiatives, including Td vaccines for children and adults. Through the many awareness campaigns and programs that address the role of vaccination during pregnancy and childhood are accelerating the segment is expanding.

Whereas, the private distribution segment will expand rapidly, by coupling with higher disposable incomes in developing economies allow individuals to access private healthcare services. As well as the development of private hospitals, clinics, and pharmacies is enabling more accessible points for the public looking for Td vaccinations.

The single-dose vials/prefilled syringes segment was dominant in the market in 2024. These vials/syringes offer benefits in speed, disposal, wastage, and patient safety. Having previously measured precise doses, which supports decreased dosing errors and risk of microbial contamination, is boosting the adoption of these formulations.

However, the liquid (ready-to-use) form segment is anticipated to grow at the fastest CAGR, due to its ease of use for healthcare providers and patients, eradicating the need for reconstitution and decreasing the risk of improper mixing or dosage errors. Also, these kinds of formulation are more stable and easier to store and transport, particularly in sectors with restricted cold chain infrastructure.

Asia Pacific led the vaccine market share by 39% in 2024 due to large birth cohorts, routine immunization programs in India, Bangladesh, Indonesia, and WHO-supported initiatives. As well as increasing healthcare expenses and optimizing access to healthcare services in urban areas, rising awareness in ASAP about the significance of vaccination and the severity of tetanus and diphtheria is fueling demand for Td vaccines.

India, with National immunization programs, like India's Universal Immunization Program (UIP), is boosting tetanus vaccination coverage and propelling demand for Td vaccines. Along with this, the Indian government, through initiatives like the National Health Mission, is promoting vaccination initiatives with a focus on pregnant women and children.

For instance,

China’s market is driven by well-established healthcare facilities and distribution resources that provide the accessibility and administration of Td vaccines. Besides this, in China, major technological advancements are adopted, such as enhancements in vaccine production techniques, like purification approaches are enormously contributing to the manufacturing processes with more effectiveness and safer vaccines.

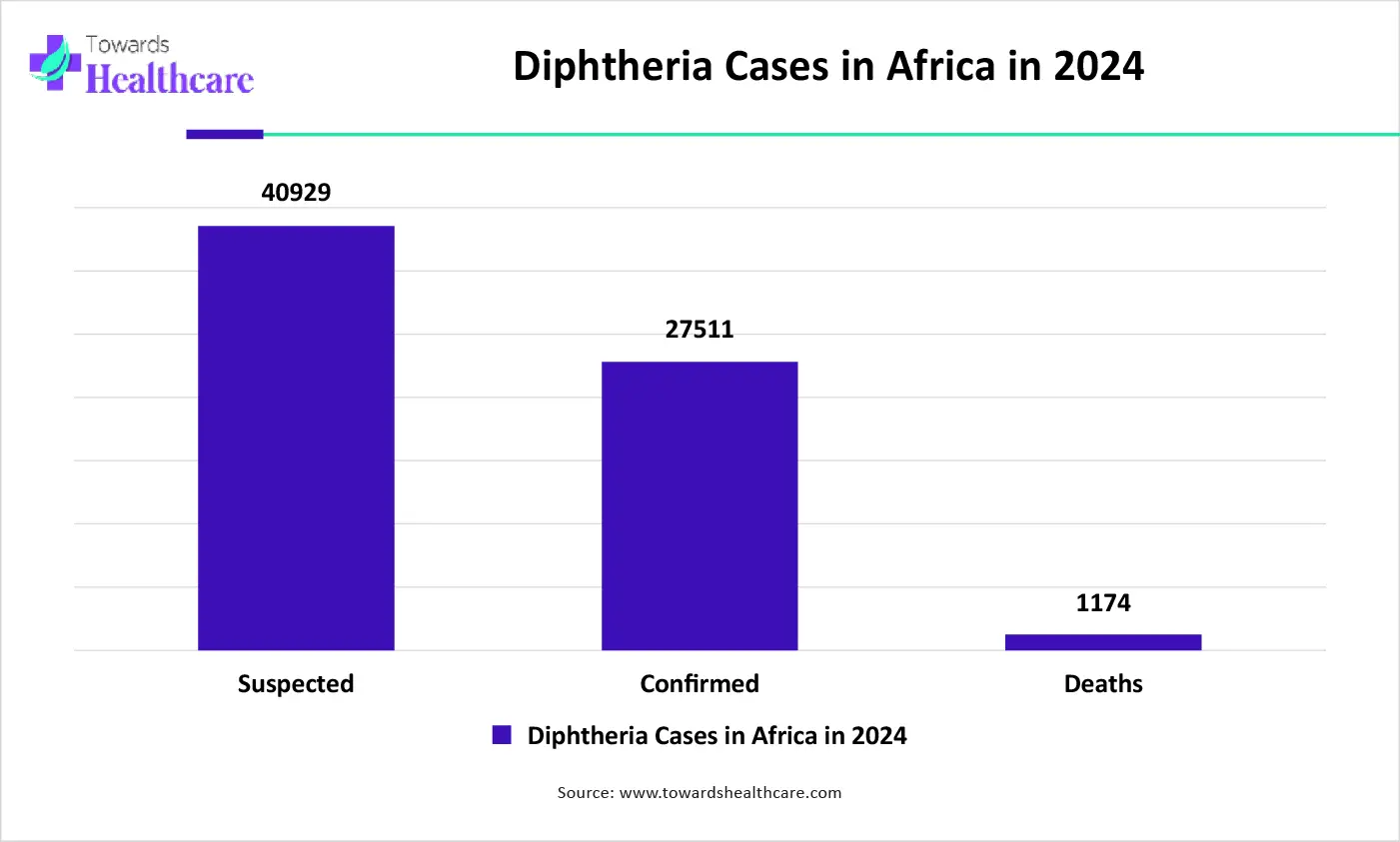

In the TD vaccine market, Africa is predicted to expand rapidly, driven by maternal tetanus elimination programs and expanded GAVI coverage by alliance with the WHO. Due to rising cases of tetanus and diphtheria are boosting awareness in Africa about vaccination and the risks of an unvaccinated approach. Furthermore, specific regions in Africa, like South Africa and Senegal, are putting efforts to develop domestic vaccine production facilities is playing a major role in the market expansion.

In South Africa, as mentioned above raised vaccine production capabilities, with mandatory immunization programs and public health campaigns, are accelerating the adoption of Td vaccine development. Also, nowadays, recommendations for booster doses every 10 years to maintain immunity against tetanus are fueling demand for these vaccines. Whereas, contribution in global vaccination efforts, such as he one for DTP (Diphtheria, Tetanus, and Pertussis), is driving the overall market growth.

Primarily, Nigeria is impacted by the recent outbreaks, vaccination coverage, and regional diversity in immunization practices. As well as this region encompasses a scheduled immunization routine including DTP vaccines for infants, pregnant women with varying rates and need for booster shots for adolescents and adults is assisting to raise demand for Td vaccines and ultimate market expansion.

In this era, Europe is registering significant market growth, due to fueling by strong European governments' support for vaccination programs via national immunization schedules, public health campaigns, and funding initiatives. Although raised vaccination rates of DTP vaccines, especially in children, are developing a robust foundation for the TD vaccine demand. Another important factor is the growing use of combination vaccines, including Tdap (tetanus, diphtheria, and acellular pertussis) are providing protection against many diseases.

Globally, emerging awareness about Td vaccination, including Germany, with advanced healthcare systems and infrastructure, is facilitating the effective distribution and administration of vaccines are further accelerating the market expansion. Also, strict regulatory considerations for tetanus vaccines in the EU ensure high-quality standards, develop trust, and encourage market development.

In the UK, increasing public awareness through NHS initiatives for the routine vaccination schedule, with its integrated advanced immunization strategies, enabling wide range availability through both physical and online modes, is driving vaccine uptake.

For this market,

North America is expected to grow at a notable CAGR in the TD vaccine market in the foreseeable future. The market is driven by special vaccination programs conducted by the government and private organizations. People are more aware of the immunization and vaccination of adults and adolescents. The TD vaccine is routinely used in the U.S., Canada, and Mexico as part of the guidelines.

There are around 11 vaccines available in the U.S. that protect against diphtheria and tetanus. 9 of these vaccines also protect against pertussis. The Centers for Disease Control and Prevention (CDC) encourages TD vaccine administration as a booster dose every 10 years. Since 2010, there have been fewer than 40 reported cases of tetanus in the U.S.

Latin America is expected to be a significantly growing area in the coming years, due to favorable government support and increasing investment. Regulatory authorities and government bodies are making constant efforts to improve immunization rates in the region. Increased awareness, improved diagnostic tests, and better reporting of tetanus and diphtheria in the region foster market growth.

A recent study reported that the vaccination of pregnant women with TD vaccine in Brazil was 83% effective in preventing tetanus and diphtheria in their infants less than 2 years old. The Brazilian government’s National Development Strategy for the Health Economic-Industrial Complex expands Brazil’s capacity to produce essential items for its Unified Health System (UHS).

The latest research on TD vaccine focuses on developing novel vaccines that can provide more effective responses in a single dose.

Key Players: Sanofi, Pfizer, and Biological E Ltd.

TD vaccines are manufactured by growing Clostridium tetani bacteria, purifying the toxin, inactivating the toxin to create a toxoid, and combining it with diphtheria toxoid.

Key Players: Bharat Biotech, GlaxoSmithKline, and Pfizer.

Patient support & services refer to guiding people about vaccine doses and vaccination schedules tailored to specific health situations.

By Product Type

By Age Group

By End User

By Distribution Channel

By Formulation

By Region

February 2026

December 2025

December 2025

December 2025