December 2025

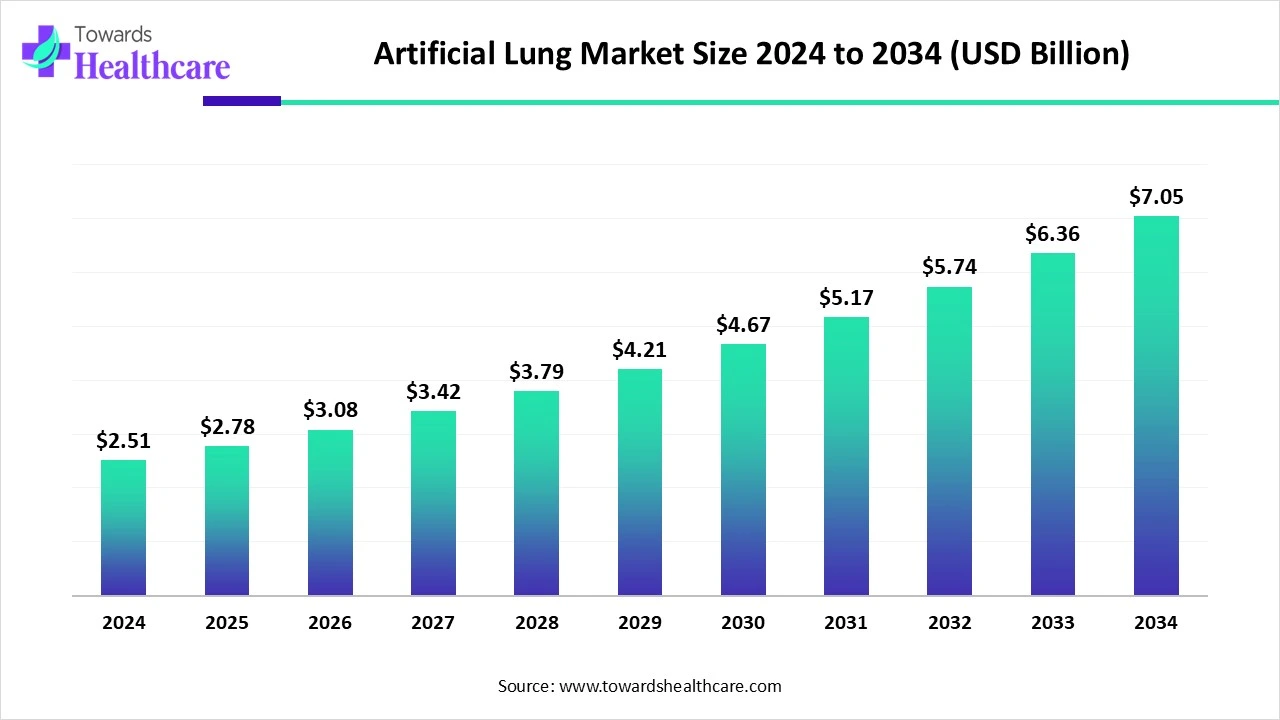

The global artificial lung market size is calculated at US$ 2.51 in 2024, grew to US$ 2.78 billion in 2025, and is projected to reach around US$ 7.05 billion by 2034. The market is expanding at a CAGR of 10.84% between 2025 and 2034.

The growing number of patients with chronic respiratory conditions, such as pulmonary fibrosis and chronic obstructive pulmonary disease, as well as their associated operations that require lung support, are the primary drivers of the expanding artificial lung market. Additionally, recent developments in lung devices are enhancing the assisted lungs' functions to better meet patients' needs. The need for more sophisticated lung disease care arises from the fact that the population is aging and becoming increasingly afflicted with illnesses. These are all aided by advancements.

| Metric | Details |

| Market Size in 2025 | USD 2.78 Billion |

| Projected Market Size in 2034 | USD 7.05 Billion |

| CAGR (2025 - 2034) | 10.84% |

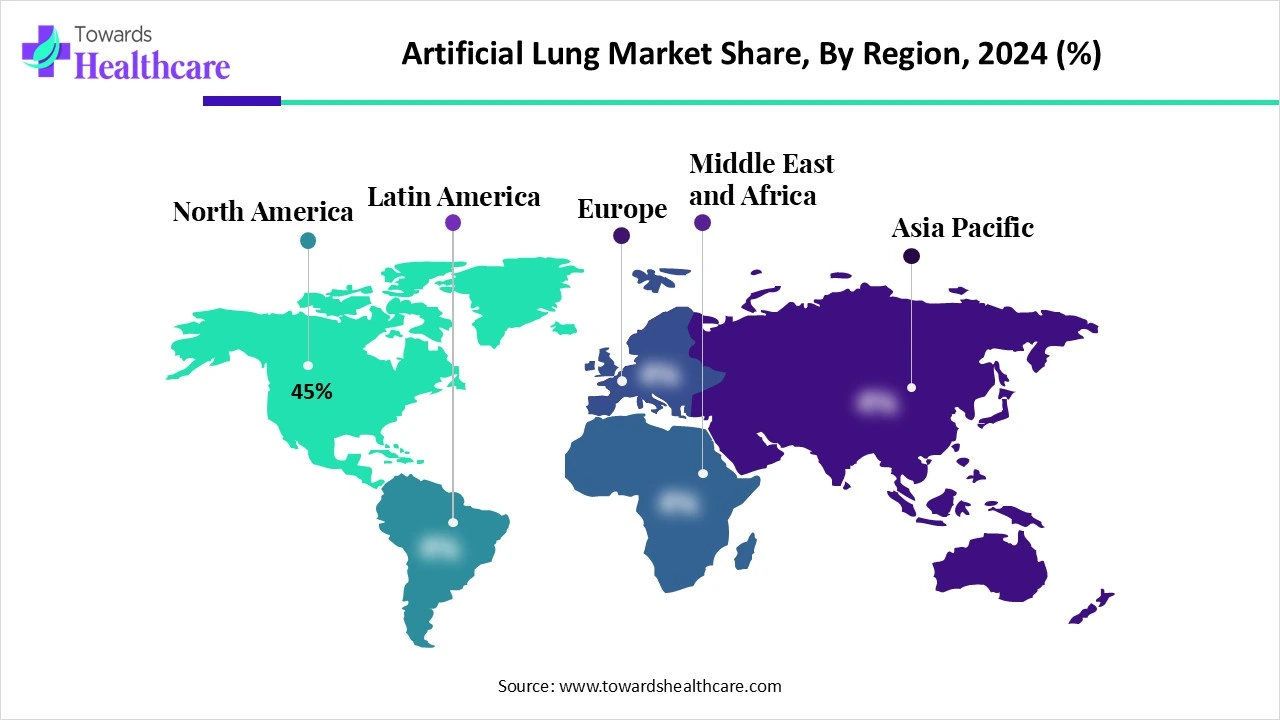

| Leading Region | North America share by 45% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Patient Type, By Region |

| Top Key Players | Medtronic plc, Getinge AB, Abbott Laboratories (Thoratec/HeartMate for hybrid devices), Xenios AG (a Fresenius Medical Care company), ALung Technologies, Inc., MicroPort Scientific Corporation, Abiomed (a Johnson & Johnson company), Eurosets S.r.l., Terumo Corporation, Nipro Corporation, CytoSorbents Corporation, Tianjin Medical, Hemovent GmbH, LivaNova PLC, NovaLung (Xenios), Breethe, Inc. (Acquired by Abiomed),Phantom Lung LLC (early-stage developer), Sankyo Seiki Mfg. Co., Harvard Apparatus Regenerative Technology, NIH/NHLBI & University of Pittsburgh |

The artificial lung market comprises medical devices and technologies designed to replicate or support the function of human lungs in oxygenating blood and removing carbon dioxide in patients with respiratory failure. These devices are used as bridges to lung transplantation, alternatives to mechanical ventilation, or temporary life-support systems during acute respiratory distress. This market is driven by the rising incidence of chronic obstructive pulmonary disease (COPD), ARDS, pulmonary fibrosis, and COVID-19-related complications, as well as the increasing adoption of extracorporeal life support systems (ECLS/ECMO) in critical care.

Artificial intelligence (AI) is revolutionizing the market as it can be used in various aspects of artificial lung development. AI enables precision modelling and evaluation of artificial lungs. AI is also useful in developing smarter and safer artificial lungs, as AI can analyse data from blood flow, gas exchange, and pressure. AI can also automate the settings, which can provide optimal performance. Overall, AI has become an essential part of artificial lungs due to its advantages in developing more accurate, efficient, and advanced artificial lungs.

Rising Cases of COPD

The direct and indirect costs of COPD to society are substantial and continue to rise. The number of people with COPD who are 25 years of age or older will rise by 23% worldwide between 2020 and 2050, reaching 600 million patients by that time. It was predicted that the burden of COPD will increase more among women and in areas with lower and moderate incomes. COPD accounts for 56% (€38.6 billion) of the total cost of respiratory disorders in the European Union, which is expected to represent 6% of the total annual healthcare budget. Costs associated with COPD are expected to rise in the United States over the next 20 years, reaching $40 billion annually and $800 billion in total.

Cannot Provide Long-Term Support

Technical difficulties now prevent long-term use of lung replacement systems, such as implantable artificial lungs, while short-term usage of extracorporeal lung support is already feasible. Nowadays, this is hindered by several problems, including biocompatibility issues that lead to the formation of clots within the system, particularly in areas with abnormal flow conditions. The deposition of proteins, cells, and fibrin on the membranes, which reduces the effectiveness of gas exchange, further limits long-term use.

What are the Opportunities in the Artificial Lung Market?

The market for artificial lungs offers stakeholders a number of profitable options. There are great opportunities for the future due to the continuous study and development in regenerative medicine, especially the investigation of bioengineered lungs. Medical professionals are looking for alternatives to standard lung transplantation, and the creation of artificial lungs that can work with patients' biological systems might completely change the range of available treatments. The expansion of artificial lung technology is also made possible by rising investments in healthcare infrastructure, especially in developing nations.

By product type, the extracorporeal membrane oxygenation (ECMO) systems segment dominated the artificial lung market in 2024. ECMO, an invasive form of life support, is used in critical care units to treat newborns, children, and adults with severe respiratory and/or cardiac failure. Two examples of technological developments that have increased the effectiveness and portability of ECMO are miniaturization and better oxygenators. ECMO has applications all across the world, such as helping underdeveloped countries and managing illnesses.

By product type, the portable/implantable artificial lungs segment is anticipated to grow at the fastest rate during the upcoming period. Currently, artificial lungs are present externally to support patients in oxygenation. They are hefty and cannot be moved. Researchers are taking efforts to develop portable and implantable artificial lungs, which could be implanted externally or internally in patients. This advancement will provide several advantages, including prolonged survival, improved quality of life, and may serve as a long-term alternative for lung transplantations.

By application, the acute respiratory distress syndrome (ARDS) segment led the artificial lung market in 2024. Acute respiratory distress syndrome (ARDS) has been progressively becoming more common in recent years. ARDS continues to be a major source of morbidity and death in critically sick patients, even with advancements in supportive treatment. ARDS patients have substantial death rates, with a total in-hospital mortality rate of 40.0% and a 28-day mortality rate of 34.8%.

By application, the lung transplantation support segment is estimated to grow at the highest rate during 2025-2034. The use of ECMO in lung transplants has increased dramatically during the last three decades. It has become increasingly important in a growing number of specialized facilities as a bridge to transplantation, as well as in the intraoperative and/or postoperative environment. ECMO is an extremely versatile tool in the field of lung transplantation, as it can be used and adjusted in various ways, with multiple potential cannulation sites depending on the recipient's specific needs.

By end-user, the hospitals & intensive care units (ICUs) segment held the dominant share of the artificial lung market in 2024. Intensive care units, or ICUs, are critical care units that are essential to hospitals because they offer patients with life-threatening diseases specialized treatment. These facilities are manned by highly skilled medical personnel and furnished with the newest medical technology to deliver the best possible treatment.

By end-user, the research institutions & transplant centers segment is expected to grow at the highest growth rate during the predicted period. The artificial lung is highly important in the care of lung transplantation patients & respiratory disease patients. However, artificial lungs as several limitations, which is why research institutions and transplantation centers are taking efforts to overcome these limitations and conducting clinical trials to improve the quality of artificial lungs. In the future, portable, implantable, and long-term use artificial implants can be seen due to the growing research.

By technology, the membrane-based oxygenation segment held the largest share of the artificial lung market in 2024. Membrane-based oxygenation, which utilizes artificial lungs, is crucial in many medical applications, particularly for treating severe lung and heart conditions. Among these applications is extracorporeal membrane oxygenation (ECMO), which offers both immediate and long-term support in cases of severe respiratory and/or cardiac failure. Furthermore, they are essential in supporting patients during and following open-heart surgery.

By technology, the wearable artificial lung devices segment is anticipated to grow at the fastest CAGR during 2025-2034. The need for a new technology that can replace the human lung while preserving a patient's mobility is increasing, and the portable artificial lung system might completely change the way that patients with severe pulmonary illness are treated. Hospital-bound patients may be able to leave the hospital and return to more of their regular activities with the aid of wearable artificial lung devices.

By patient type, the adult patients segment captured the major share of the artificial lung market in 2024. COPD majorly occurs in adults and worsens with time; due to this, artificial lungs are highly essential devices in adults. ECMO can help adults with heart failure who are unable to wean themselves off a cardiac bypass or who cannot be treated with a ventricular assist device. Several programs have been developed to address the increasing demand for ECMO in adults. For instance, the only Adult ECMO program in the state, offered by WVU Medicine, is a nationally acclaimed Center of Excellence that provides the greatest treatment and outcomes.

By patient type, the neonatal & pediatric patients segment is expected to grow at the highest CAGR during the upcoming period. Pulmonary hypertension and right heart failure are common in children with lung diseases. The development of a pediatric artificial lung (PAL) would create new therapeutic options for acute and chronic diseases by offering a bridge to recovery in the former and transplantation in the latter.

North America dominated the artificial lung market share by 45% in 2024. The rise in chronic diseases like diabetes and obesity, which require cardiopulmonary bypass surgery and, as a result, raise demand for artificial lungs, and the increased prevalence of various acute respiratory conditions globally, such as acute respiratory distress syndrome (ARDS), are the main drivers of the growth. The prevalence of lung diseases caused by excessive smoking and increased air pollution is another important element driving market growth.

About 16 million people in the U.S. suffer from COPD, and many more are not even aware that they have it. In 2023, COPD was the sixth leading cause of death in the U.S., accounting for 141,733 deaths. Every year, COPD causes over $24 billion in medical costs for those aged 45 and above.

The Lung Health Foundation ("LHF") estimates that chronic obstructive pulmonary disease (COPD) will cost Canada $10 billion in healthcare by 2030 and has the potential to completely destroy the country's healthcare system. LHF initiates a historic set of three virtual policy forums called "Breathe Change" in response to this situation.

Asia Pacific is estimated to host the fastest-growing artificial lung market during the forecast period. Asia Pacific markets expanded as a result of China, Japan, and India increasing their investments in biotechnology research and essential health infrastructure. The market's continuous expansion is facilitated by both recently founded medical device companies in the industry and government initiatives that support healthcare access. Local companies and global industry partners work together strategically to improve product accessibility in the market.

China Pulmonary Health (CPH) survey data show that the prevalence of COPD is 8.6% in those aged 20 and older and 13.7% in those aged 40 and older. China is home to more than 100 million people with chronic obstructive pulmonary disease (COPD), accounting for over 25% of all COPD cases globally. China has made strategic investments in primary healthcare institutions to provide access to COPD treatment services.

One of the highest rates of chronic respiratory illnesses is seen in India. India is the country where COPD causes the second-highest number of fatalities worldwide. With the highest number of asthma-related fatalities worldwide, India also leads the globe in this regard. The Indian government is making efforts to in order to provide COPD treatment in rural and remote areas.

Europe is expected to grow significantly in the artificial lung market during the forecast period. Technological advancements, including increased durability, reduced size, and enhanced biocompatibility, are advantageous to the European market. The aging population, an increase in the prevalence of chronic diseases, and continued research and development into artificial lungs are major motivators. Regulatory clearances and collaborations between healthcare carriers and medical device companies are also speeding up industry growth.

Smoking, air pollution, and an aging population are all factors in the increased incidence of COPD in Germany. In 2020, 21.5% of the population was 65 and older; by 2050, that number is expected to increase to 28.3%, according to the German Federal Statistical Office. Germany is at the forefront of healthcare innovation, with a particular focus on research and development. Further developments in artificial lung technology may be sparked by government funding for healthcare research and innovation through organizations such as the Federal Ministry of Education and Research (BMBF).

In England, the prevalence of asthma in people aged 6 and over was 6.5% in 2023–2024, which remained constant from 2022–2023. At all ages, the prevalence of chronic obstructive pulmonary disease (COPD) was 1.9% (it was 1.8% in 2022–2023). The NHS spends £1.9 billion annually on COPD, which is the second leading cause of emergency hospital admissions in the UK.

In May 2024, with our completely new approach to pump drive, which will handle blood flow and guarantee the safety, simplicity, and compactness of the entire ECMO system, MOBYBOX® will be able to serve both traditional in-hospital settings and mobile medical scenarios, Hemovent CEO and CMO Dr. Jürgen O. Böhm emphasized. It will be crucial in scenarios such as outside rescue, intra-hospital transport, and more. We are working diligently to expand our market access in other countries, enabling more patients to benefit from this technology, and we are proud of our progress to date.

By Product Type

By Application

By End User

By Technology

By Patient Type

By Region

December 2025

October 2025

November 2025

November 2025