February 2026

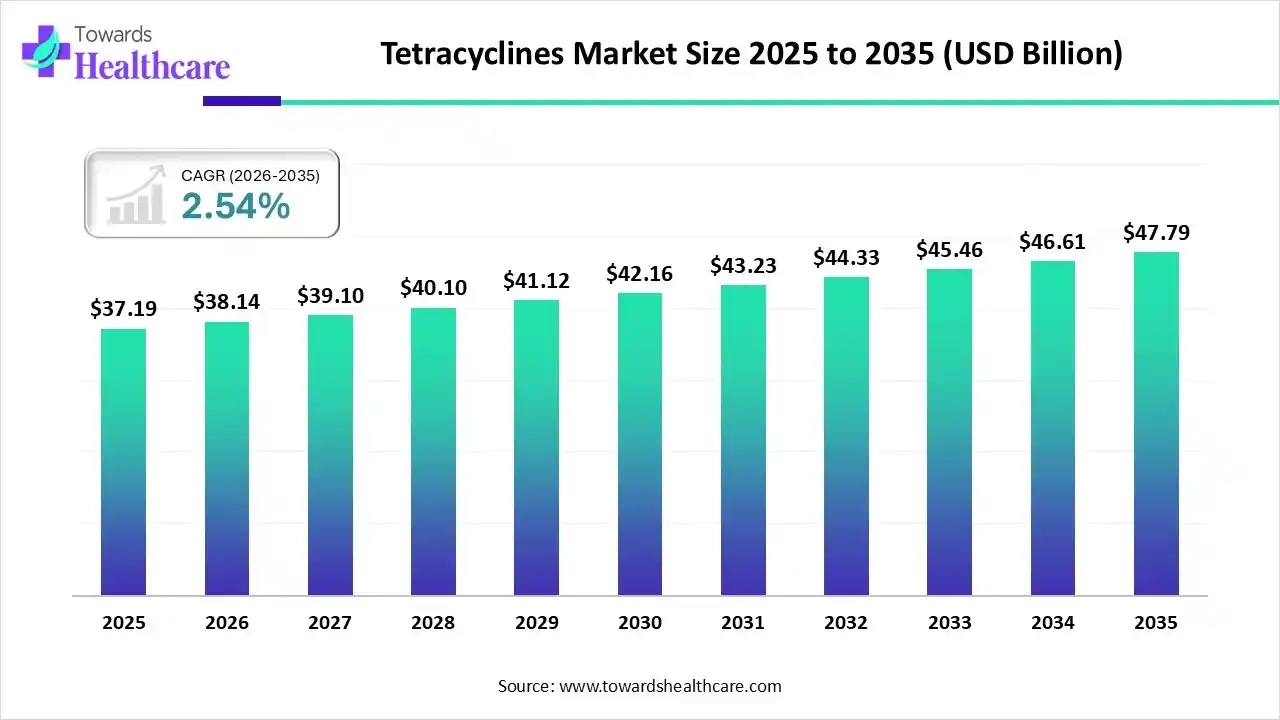

The global tetracyclines market size was estimated at USD 37.19 billion in 2025 and is predicted to increase from USD 38.14 billion in 2026 to approximately USD 47.79 billion by 2035, expanding at a CAGR of 2.54% from 2026 to 2035.

Day by day, many regions are facing a massive rise in different infectious diseases, mainly respiratory infections, UTIs, and STIs, which are encouraging the demand for tetracyclines and their derivatives. However, the global researchers are focusing on the development of novel candidates with the use of nanoparticles, and the progression of non-antibiotic applications. Numerous leading pharmaceutical companies and governments are initiating new programs for AMR and generics of existing tetracyclines.

| Key Elements | Scope |

| Market Size in 2026 | USD 38.14 Billion |

| Projected Market Size in 2035 | USD 47.79 Billion |

| CAGR (2026 - 2035) | 2.54% |

| Leading Region | North America |

| Market Segmentation | By Generation,By Application, By Route of Administration, By Distribution Channel, By Region |

| Top Key Players | Pfizer Inc., Abbott, Lupin, Dr. Reddy’s Laboratories Ltd., Everest Medicines, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Paratek Pharmaceuticals, Mylan N.V., Tetraphase Pharmaceuticals |

The tetracyclines market covers a class of broad-spectrum bacteriostatic antibiotics that inhibit bacterial protein synthesis by binding to the 30S ribosomal subunit. Also, they have a broader range of uses in bacterial infections, like respiratory, skin, and sexually transmitted infections, and specific non-infectious conditions. In the last few months, the researchers at the University of Oxford found existing non-antibiotic medicines, such as antipsychotics and antimalarials, in combination to inhibit the bacterial Tet(X) enzyme that degrades tetracyclines, for efficient protection of the antibiotics from resistance.

| World Health Organization (WHO) | In December 2025, the European Commission’s Health Emergency Preparedness Authority (HERA) signed a €3.5 million agreement to explore its partnership to combat antimicrobial resistance under the EU4Health programme. |

| Phare Bio | In December 2025, it partnered with Basilea to establish a next-generation broad-spectrum antibiotic using AI. |

| Amferia | In December 2025, a company secured €3.5M investment to boost advanced antimicrobial technology in human and animal health. |

| Japanese pharmaceutical companies | In July 2025, they invested in developing a domestic supply chain for antibiotics. |

In 2025, the globe is leveraging AI algorithms in the market with the substantial efforts from researchers in developing advanced solutions, such as a recent study that unveiled a multifunctional nanoparticle system. This mainly comprises the combination of detection, degradation, and bioimaging capabilities for tetracyclines, which uses graph neural networks (GNNs) in the analysis of fluorescence spectra and successfully distinguishes between highly similar tetracycline structures. AI also has an immersive application in faster screening of large chemical libraries and repurposing existing drugs to fight resistant bacteria.

Specifically, the market is stepping towards novel, semi-synthetic tetracyclines, like eravacycline, omadacycline, and sarecycline, as they have expanded ability to overcome common antibiotic resistance mechanisms and their broader spectrum of activity.

Alongside, researchers are executing the anti-inflammatory, immunomodulatory, and anti-cancer properties of tetracycline derivatives, like a few tetracyclines, which can stimulate the immune system in finding and attacking cancer cells by targeting specific proteins.

Researchers are putting efforts into enhancing efficiency, stability, and targeted delivery, with lowered systemic side effects and resistance development, including the development of nanoparticle-based delivery systems, like lipid, carbon, and polymeric nanoparticles for tetracyclines.

Moreover, the market is shifting towards new, narrow-spectrum agents, especially sarecycline, which are particularly evolved for treating inflammatory acne lesions with minimal impact on the gut microbiome.

Which Generation Led the Tetracyclines Market in 2025?

In 2025, the third-generation segment captured a major share of the market and will expand rapidly in the coming era. Mainly, this generation has wide activity against different multi-drug resistant (MDR) strains, such as Methicillin-resistant Staphylococcus aureus (MRSA), Vancomycin-resistant Enterococci (VRE), and Carbapenem-resistant Enterobacteriaceae and Acinetobacter baumannii. The latest example is Omadacycline, which is in Phase II clinical trials for the treatment of Nontuberculous Mycobacteria (NTM) pulmonary disease caused by Mycobacterium abscessus.

Why did the Skin Infections Segment Dominate the Market in 2025?

The skin infections segment held the biggest revenue share of the tetracyclines market in 2025. A vital driver is the rising number of acne, rosacea, and general skin infections, which are highly fostering demand for these advanced tetracyclines. Current transformations are focused on non-antibiotic properties of tetracyclines, like inhibition of matrix metalloproteinases, anti-apoptotic, and antioxidant effects for non-infectious dermatoses, such as autoimmune bullous disorders, vitiligo, and certain forms of alopecia.

Respiratory Infections

In the future, the respiratory infections segment is anticipated to expand fastest. According to UNICEF & ACCAI, in the U.S., pneumonia causes nearly 41,210 deaths annually, and sinusitis causes about 31 million people to have problems annually, respectively. Promising efforts are emphasising treating severe Mycoplasma pneumoniae pneumonia resistant to macrolides in children and as a robust substitute for nontuberculous mycobacterial (NTM) pulmonary disease in adults when used in multidrug regimens.

How did the Oral Segment Lead the Tetracyclines Market in 2025?

With a dominant share, the oral segment dominated the market in 2025. Oral drugs are easy to administer and affordable, especially for geriatric patients. Ongoing research activities for this ROA include extended-release tablets with polymer-based biomaterials to elevate the bioavailability and targeted delivery of oral tetracyclines. Also, they are widely using sodium alginate (SA) with metal-organic frameworks (MOFs) to explore extended release of tetracycline in the gastric and intestinal fluids over several days (up to 78 hours).

Parenteral

Moreover, the parenteral segment is predicted to witness rapid expansion. These solutions are highly useful in complicated intra-abdominal infections or community-acquired bacterial pneumonia, which need higher and more predictable drug concentrations for effective treatment. Persistent substantial developments comprise a research study that leveraged advanced drug delivery systems, particularly the use of solid lipid nanoparticles (SLN) for subcutaneous injection of tetracycline, with robust sustained drug release over a longer period in mice studies.

Which Distribution Channel Dominated the Tetracyclines Market in 2025?

In 2025, the retail pharmacy segment led with a major share of the market. Specifically, pharmacies, such as Apollo Pharmacy and local independent pharmacies, encompass generic tetracycline capsules/tablets. Besides this, pharmacists emphasise the significance of completing the full course of therapy for preventing antibiotic resistance and support to ensure the medication is used safely and effectively.

Online Pharmacy

The online pharmacy segment will expand rapidly during 2026-2035, due to its focus on convenience, privacy, and simplifying healthcare management. They usually facilitate rigorous information about the medication's uses, side effects, and proper administration, such as taking it on an empty stomach and avoiding dairy/antacids. Continuous advances offer automatic refill reminders and online portals to handle people's prescriptions and order history, making the process of obtaining repeat medications easy.

North America dominated the tetracyclines market in 2025, due to the rise in bacterial infection rates (respiratory, UTI), well-developed healthcare infrastructure, and favorable government incentives (QIDP) for new drugs. Day by day, the region is shifting towards raising the launch of generic versions of existing drugs, the implementation of new non-antibiotic applications, especially anti-cancer and anti-inflammatory uses.

Whereas, as per NIH, nearly 40% of women in the United States will develop a UTI during their lifetime, and approximately 10% of women experience a UTI annually. Alongside, a study has highlighted the possible impact of doxycycline post-exposure prophylaxis for STIs, and further research efforts into optimal usage to balance efficacy and resistance issues.

In May 2025, Avenacy, a specialty pharmaceutical company, unveiled Doxycycline for Injection, USP in the United States.

Specifically, the Asia Pacific will expand fastest in the tetracyclines market, due to the increasing infectious diseases, cost-effective generics (doxycycline, minocycline), government initiatives for AMR, and R&D into new uses like anti-cancer agents. In May 2025, nine Indian innovations were selected to eliminate AMR, mainly technologies to degrade antibiotic residues in wastewater from hospitals and aquaculture, and portable devices for detecting resistant bacteria in the field.

Whereas, Zai Lab is expanding the commercialisation of NUZYRA (omadacycline) in Greater China, a third-generation tetracycline-class antibacterial for treating community-acquired bacterial pneumonia (CABP) and acute bacterial skin and skin structure infections (ABSSSI).

A significant expansion of the tetracyclines market in Europe is encouraged by the ongoing EU initiatives (IMI's ND4BB), which bolsters antibiotic innovation, public health awareness, supports responsible use, and escalates healthcare spending. A recent effort is the Innovative Medicine Initiative (IMI) and its "New Drugs 4 Bad Bugs" (ND4BB) program, which offers an alliance among the EU and the pharmaceutical industry for an evolution of novel antibiotics, including tetracycline options.

Through the Federal Institute for Drugs and Medical Devices (BfArM) and the Robert Koch Institute (RKI), Germany pursues the tracking and implements plans against AMR. However, the country participates in the public-private partnership CARB-X, which funds preclinical research for innovative antibiotics and diagnostics.

| Company | Discription |

| Pfizer Inc. | This is a historical innovator in the discovery and development of tetracycline antibiotics and continues to facilitate specific products in this class, notably Vibramycin and Cynomycin. |

| Abbott | A company offers tetracyclines under the brand names Resteclin and Nicocycline. |

| Lupin | It mainly facilitates both second-generation antibiotics within the tetracycline class, specifically Doxycycline and Minocycline products. |

| Dr. Reddy’s Laboratories Ltd. | It primarily explores the tetracycline-class antibiotic doxycycline in diverse formulations, such as capsules, tablets (often in combination), and injections. |

| Everest Medicines | A significant company unveiled Xerava (eravacycline), a new, fully synthetic, broad-spectrum intravenous antibiotic. |

| Sun Pharmaceutical Industries Ltd. | This provides tetracycline-class antibiotics prominently through branded generic formulations containing minocycline. |

| Teva Pharmaceutical Industries Ltd. | It usually leverages a generic version of the first-generation tetracycline, available in strengths, including 250 mg. |

| Paratek Pharmaceuticals | A company introduced NUZYRA (omadacycline) and SEYSARA (sarecycline). |

| Mylan N.V. | This explores generic versions of the tetracycline-class antibiotics doxycycline and minocycline. |

| Tetraphase Pharmaceuticals | It mainly offers the FDA-approved product Xerava (eravacycline for injection). |

A major limitation is the need for greater expenses and long timelines for the development of antibiotics; also, integrated with low sales volumes and prices for the final product, makes the antibiotic market less attractive than other drug classes.

By Generation

By Application

By Route of Administration

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026