February 2026

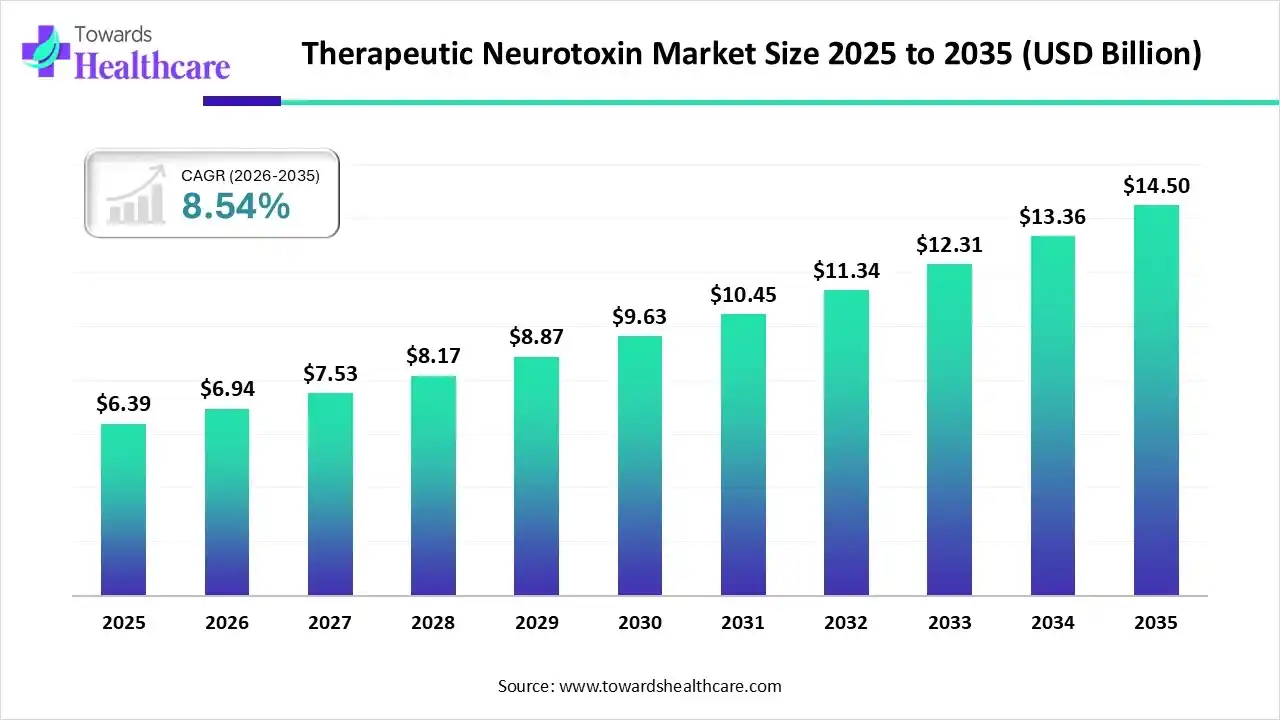

The global therapeutic neurotoxin market size was estimated at USD 6.39 billion in 2025 and is predicted to increase from USD 6.94 billion in 2026 to approximately USD 14.5 billion by 2035, expanding at a CAGR of 8.54% from 2026 to 2035.

The growing neurological disease burden globally is increasing the demand for therapeutic neurotoxins, where AI is being used to accelerate their innovations. Government initiatives are also supporting their innovations, where their growing approvals, expanding healthcare, and growing migraine cases are also increasing the demand across various regions. At the same time, the companies are also developing and launching new products, promoting market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.94 Billion |

| Projected Market Size in 2035 | USD 14.5 Billion |

| CAGR (2026 - 2035) | 8.54% |

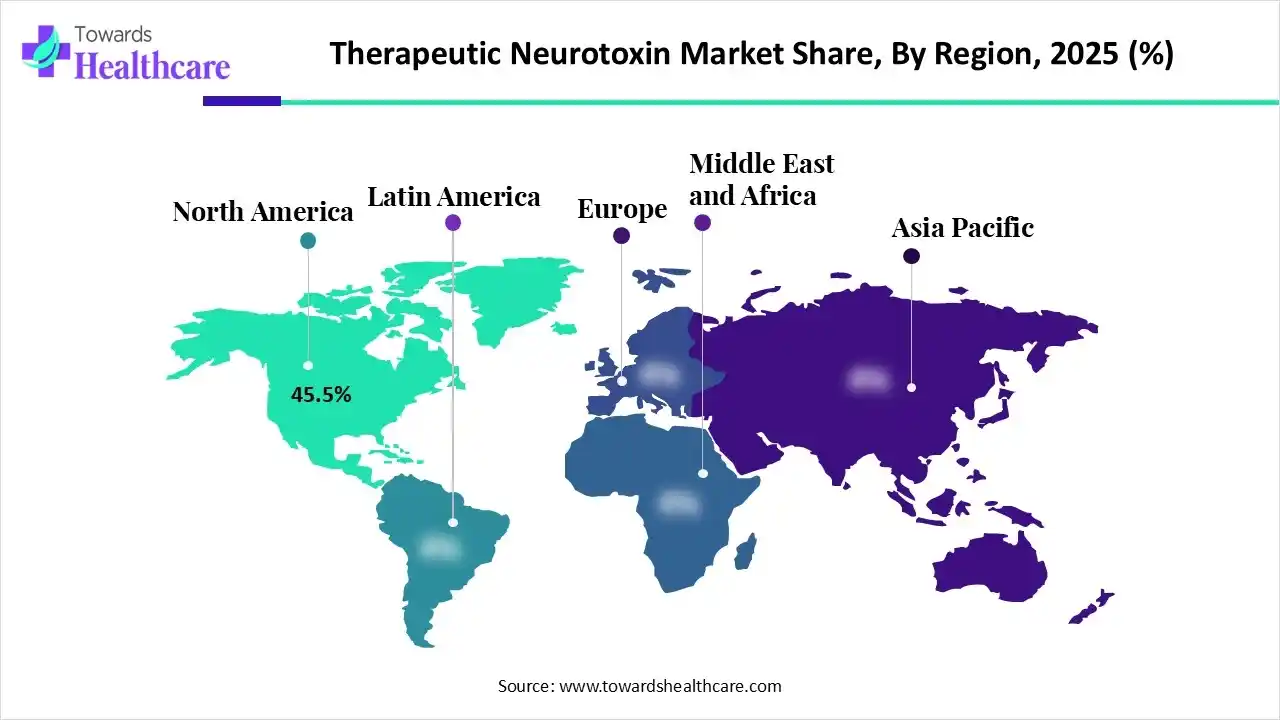

| Leading Region | North America 45.5% |

| Market Segmentation | By Neurotoxin Type, By End User, By Route of Administration, By Region |

| Top Key Players | AbbVie/Allergan, Ipsen, Merz Therapeutics, Revance Therapeutics, Galderma S.A., Hugel, Daewoong Pharmaceutical, Medytox, Evolus, Lanzhou Institute of Biological Products, US WorldMeds, Eisai, Supernus Pharmaceuticals |

The therapeutic neurotoxin market is driven by the diversification of medical applications beyond aesthetics, into neurology, psychiatry, and urology. The therapeutic neurotoxin market comprises prescription injectable neurotoxins, primarily botulinum toxin types, used for medical indications such as neuromuscular disorders, chronic migraine, spasticity, dystonia, hyperhidrosis, and bladder dysfunction. These biologics temporarily inhibit nerve signal transmission to targeted muscles or glands.

AI is being used to optimize and formulate new therapeutic neurotoxins, which accelerates the drug development and their clinical trials where it is also being used to predict the patient response to the treatments. It also helps in providing personalized therapies as well as monitoring the side effects. AI is also being used in the telehealth platforms for patient scheduling, consultations, and product inventory management.

The companies are focusing on developing various precision dosing systems, next-generation, and ready-to-use therapeutic neurotoxin formulations, with affordable pricing.

The increasing demand for personalized treatments is driving the development of customized treatment options depending on the patient profile, to offer target-specific action and reduced side effects.

There is a growth in the development of digital tools for monitoring, treatment planning, and consultation, which is increasing the early diagnosis of neurological conditions and access to the therapeutic neurotoxins.

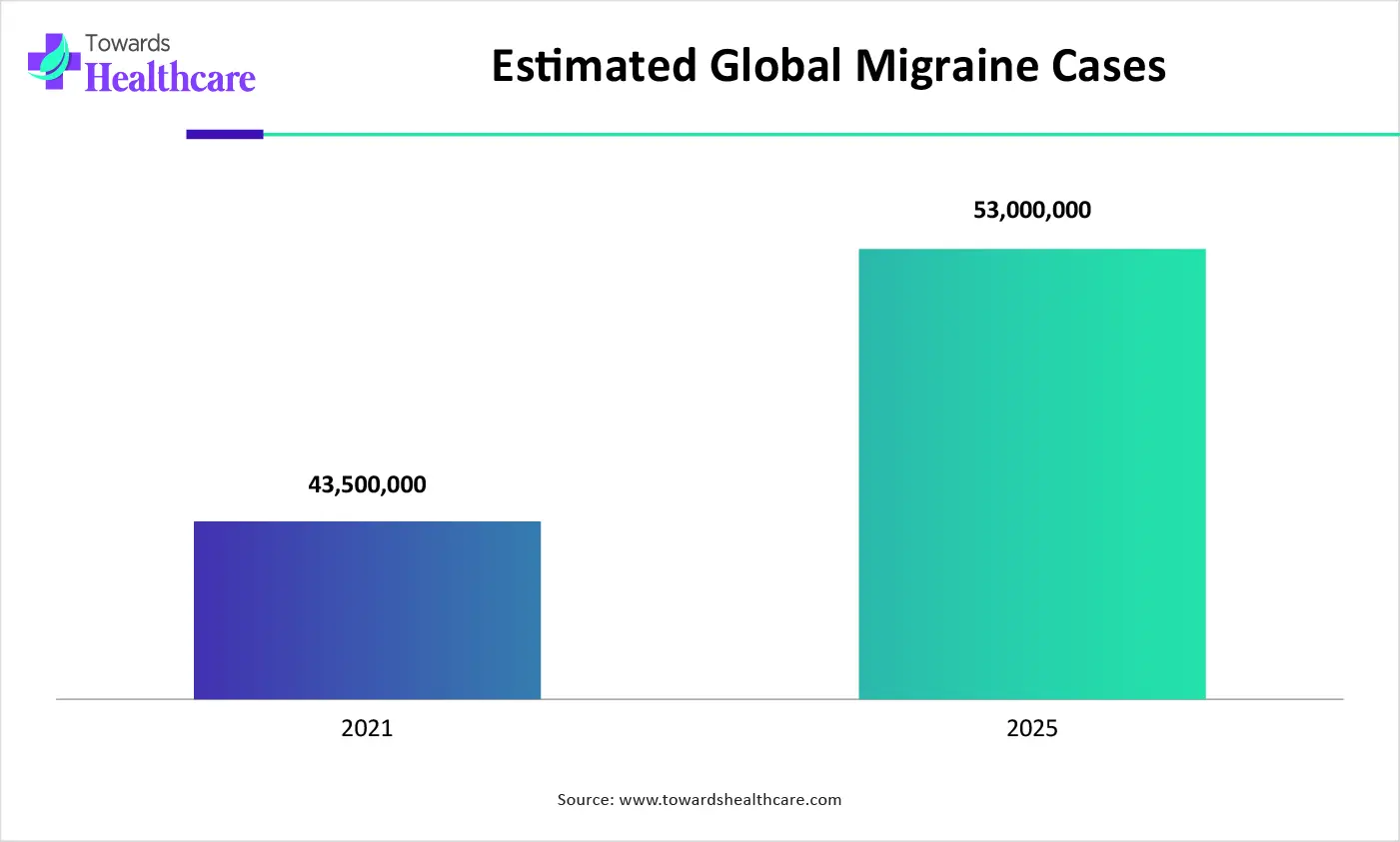

| Years | Global Number of Years Lived with Disability (YLDs) Attributable to Migraine |

| 2021 | 43,500,000 |

| 2050 | 53,000,000 |

Why Botulinum Toxin Type A Segment Dominated the Therapeutic Neurotoxin Market?

The botulinum toxin type A segment led the market with 74.3% share in 2025 and is expected to show the highest growth with a CAGR of 9.3% during the predicted time, due to its proven efficacy. Moreover, they also provided a longer duration of action with enhanced safety, which increased their use. Additionally, growing innovation also contributed to their increased adoption.

What Made Hospitals the Dominant Segment in the Therapeutic Neurotoxin Market in 2025?

The hospitals segment held the dominating share of 58.5% in the market in 2025, due to the presence of advanced treatment options. This increased the use of therapeutic neurotoxins for the treatment of various severe cases. At the same time, they also offered specialty care and reimbursement policies, which attracted the patients and enhanced the use of therapeutic neurotoxins.

Specialty Neurology Clinics

The specialty neurology clinics segment is expected to show rapid growth with a CAGR of 9.1% during the predicted time, due to growing neurological disorders. Moreover, growing neurologists and outpatients are also increasing the use of therapeutic neurotoxins. Additionally, their short wait time and affordable treatment options are also attracting patients.

Which Route of Administration Type Segment Held the Dominating Share of the Therapeutic Neurotoxin Market in 2025?

The intramuscular segment held the largest share of 56.8% in the market in 2025, because it is considered the primary route to administration and due to its enhanced effectiveness. This, in turn, increased their use in the treatment of a wide range of disorders, which promoted their use across hospitals, clinics, and rehabilitation centres.

Intradermal

The intradermal segment is expected to show the highest growth with a CAGR of 8.9% during the upcoming years, driven by its small dose requirement. This is increasing their use for the management of pain and muscle weakness as well as aesthetic therapeutic applications. Furthermore, their growing innovations are also driving new opportunities.

North America dominated the therapeutic neurotoxin market with 45.5% in 2025, due to growth in the regulatory approvals of various therapeutic neurotoxins. At the same time, the growth in the disease also increased their use, where the presence of robust healthcare infrastructures also increased their adoption rates. The companies also contributed to new innovations, where the investment supported their growth, and reimbursement policies enhanced their accessibility, which promoted the market growth.

The U.S. consists of a well-developed healthcare sector, which is increasing the use of therapeutic neurotoxins for the treatment of neurological diseases and pain management. Moreover, the growing cases of migraines are also increasing their demand. This, in turn, is driving their innovation, clinical trials, and approvals.

Asia Pacific is expected to host the fastest-growing therapeutic neurotoxin market with a 10.0% CAGR during the forecast period, due to growing patient volume and expanding healthcare. This, in turn, is increasing the demand and adoption of therapeutic neurotoxins, where the growing investments and awareness are also increasing their innovations. At the same time, the booming medical tourism is also increasing its demand, which is enhancing the market growth.

Due to the presence of a large population in China, the risk of neurological disease is increasing, which is driving the demand for therapeutic neurotoxins. The expanding healthcare infrastructure and investment are increasing their R&D and launches, increasing their adoption rates. Additionally, increasing health awareness is also promoting their use.

Europe is expected to grow significantly in the therapeutic neurotoxin market during the forecast period, due to rising neurological disorders. At the same time, the presence of a robust healthcare sector is increasing the demand for therapeutic neurotoxins for various applications, where they are backed by reimbursement policies. Additionally, the industries are also developing various advanced therapeutic neurotoxins, which are contributing to the market growth.

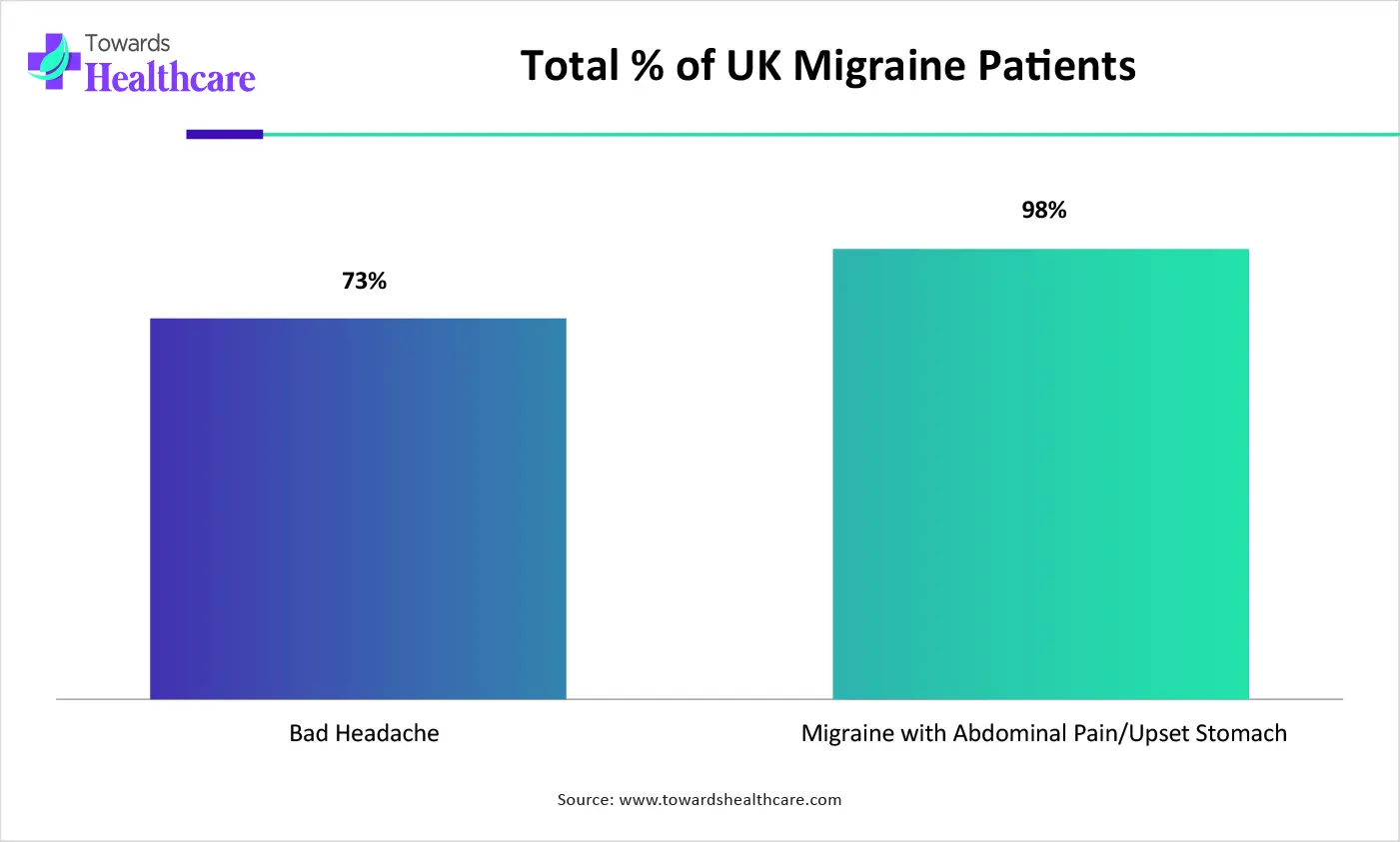

The UK consists of a robust healthcare system that is enhancing access to the therapeutic neurotoxin. The increasing neurological diseases, migraine cases, and clinical expertise are also increasing their demand. Moreover, robust regulations, reimbursement policies, and growing R&D are also driving their innovations.

| UK Migraine Experiences | % |

| Bad headache | 73% |

| Migraine with abdominal pain/upset stomach | 98% |

| Companies | Headquarters | Solutions |

| AbbVie/Allergan | North Chicago, IL, U.S. | Botox |

| Ipsen | Paris, France | Dysport |

| Merz Therapeutics | Frankfurt, Germany | Xeomin/Bocouture |

| Revance Therapeutics | Nashville, TN | Daxxify |

| Galderma S.A. | Lausanne, Switzerland | Alluzience/Relfydess |

| Hugel | Seoul, South Korea | Letybo/Botulax |

| Daewoong Pharmaceutical | Seoul, South Korea | Nabota/Jeuveau |

| Medytox | Seoul, South Korea | Meditoxin/Coretox/Innotox |

| Evolus | Newport Beach, CA, U.S. | Jeuveau |

| Lanzhou Institute of Biological Products | Lanzhou, China | BTXA |

| US WorldMeds | Louisville, KY, U.S. | Myobloc |

| Eisai | Tokyo, Japan | NerBloc and NeuroBloc |

| Supernus Pharmaceuticals | Rockville, MD, U.S. | Myobloc |

By Neurotoxin Type

By End User

By Route of Administration

By Region

February 2026

February 2026

February 2026

February 2026