February 2026

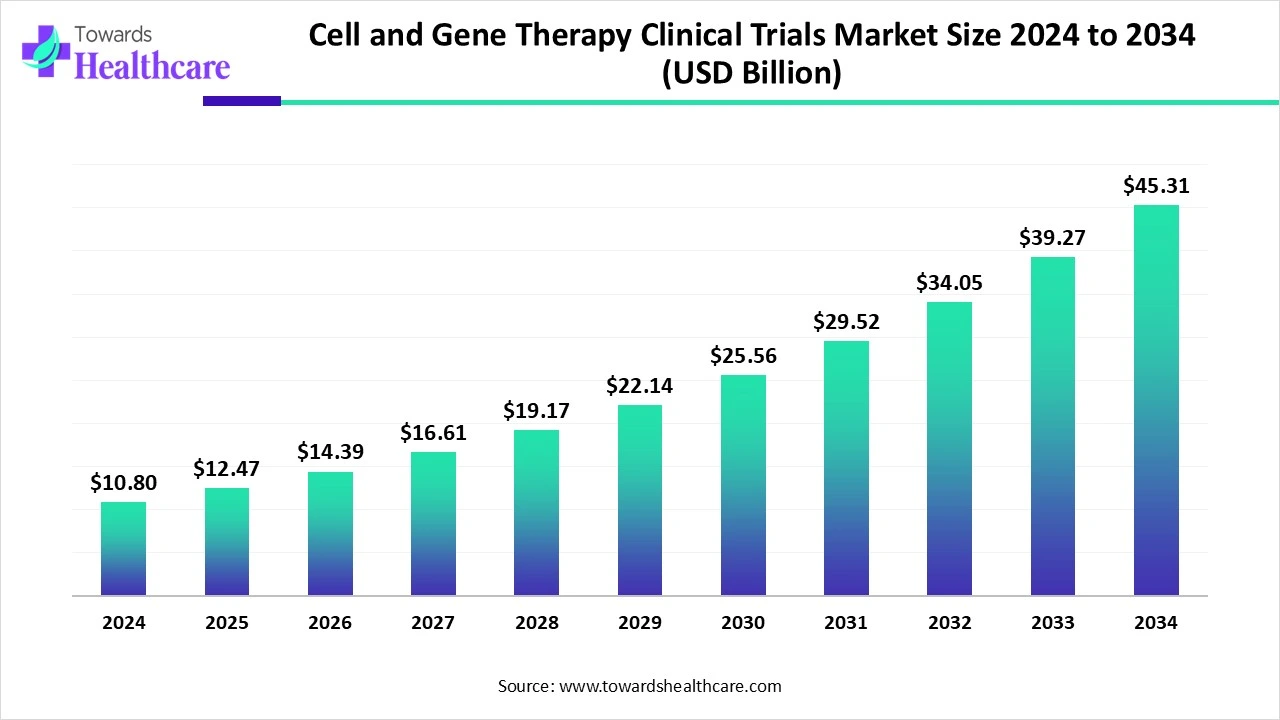

The global cell and gene therapy clinical trials market size reached USD 10.8 billion in 2024, grew to USD 12.47 billion in 2025, and is projected to hit around USD 45.31 billion by 2034, expanding at a CAGR of 15.43% during the forecast period from 2025 to 2034.

The cell and gene therapy clinical trials are revolutionary approaches in clinical research and development. The extensive research focuses on targeting affected cells or genes and treating them with novel medical strategies. The American Society of Gene and Cell Therapy stands out as the principal membership organization for healthcare professionals and scientific enthusiasts to advance gene and cell therapy. Gene and cell therapies are transforming modern medicine by delivering advanced treatments for hematological malignancies, rare genetic disorders, and cancer.

| Metric | Details |

| Market Size in 2025 | USD 12.47 Billion |

| Projected Market Size in 2034 | USD 45.31 Billion |

| CAGR (2025 - 2034) | 15.43% |

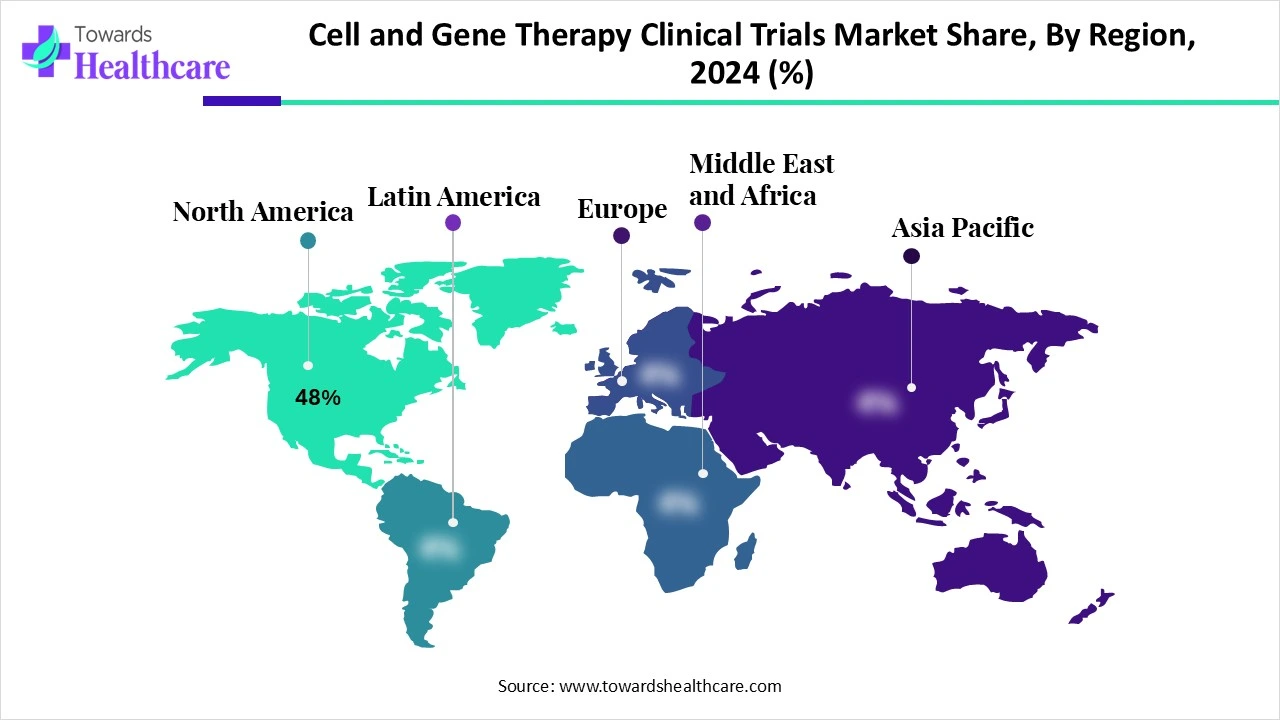

| Leading Region | North America Share 48% |

| Market Segmentation | By Therapy Type, By Phase of Trial, By Indication, By Vector Type, By Sponsor Type, By Region |

| Top Key Players | Novartis AG, Gilead Sciences, Bristol Myers Squibb, Bluebird Bio/2seventy bio, Sarepta Therapeutics, Sana Biotechnology, CRISPR Therapeutics, Intellia Therapeutics, Editas Medicine, REGENXBIO Inc., Orchard Therapeutics, Beam Therapeutics, Verve Therapeutics, Allogene Therapeutics, Poseida Therapeutics, Rocket Pharmaceuticals, Astellas Gene Therapies, Passage Bio, MeiraGTx |

The cell and gene therapy clinical trials market encompasses all clinical research and development activities involved in evaluating cell-based and gene-based therapies for various indication, including oncology, rare diseases, ophthalmology, neurology, and hematologic disorders. These trials test engineered cells or gene-modified constructs for safety, efficacy, and long-term durability. The market is growing rapidly due to surging R&D investments, regulatory incentives, and increased collaboration between biotech firms and CROs to manage the complexity of CGT trials.

Artificial intelligence, predictive analytics, real-time analytics, machine learning, and deep learning are the strong assets of modern healthcare research and development. AI algorithms contribute to analyzing many clinical trial datasets and deliver improved outcomes. Clinical researchers are enabled to conduct multiple clinical trials with vast datasets due to AI, with enhanced operational efficiency and accuracy in test results.

Predictive analytics play a major role in predicting unexpected scenarios in clinical trials and allow us to overcome them in real-time. Personalized medicine approaches have introduced precision in medical treatments through real-time analysis of patients’ health and their responses. AI facilitates research and innovation based on individual genetic makeup and patients' adaptability to medical treatments.

What are the Modern Strategies in Medical Treatments?

China is the leading country in introducing novel medical treatment approaches like CAR-T therapy. This cell therapy proved to be effective in modifying T-cells, killing cancer cells, and treating blood cancers. They are significant in treating leukemia and lymphoma through dual/multi-specific CAR T-cells and armored CAR-T cells. Allogenic CAR-T and CAR-NK have also gained traction due to a broad range of treatment access. Dual/multi-specific CAR T-cells can directly target several cancer markers, while armored CAR-T cells can overcome the defense mechanism of the tumor. Research is on the rise to combine CAR-T therapy with chemotherapy or radiotherapy to elicit strong effectiveness for cancer treatments.

Which Challenges arise in Patient Recruitment to Conduct Clinical Trials?

Clinical researchers have concerns about collecting patient data and assembling patients to conduct clinical trials of gene and cell therapies. These concerns arise due to regional and country-level disparities, beliefs, and positive responses towards clinical trials. It is challenging to ensure the effectiveness of novel medical therapies and adapt to new technological advancements for both researchers and patients. Some other factors, like good hospital infrastructure, efficient healthcare management, and the prevalence of a diseased population, also impact the journey of clinical trials regarding novel cell and gene therapies.

What is the Immense Growth Potential across Diverse Areas of Clinical Research?

The opportunistic rise of clinical research and development belongs to venture funding and substantial investments in biotechnology and pharmaceutical companies. Most of these leading and early-stage companies have shifted their focus towards investing in advanced technologies like CRISPR-Cas9, gene editing, CAR-T cell therapy, CAR-NK therapy, and allogenic therapies that offer a wide array of treatment solutions. The collaborations and strategic partnerships between biopharmaceutical firms and CROs, CMOs, or CDMOs are driven by the exclusive potential of the newest medical treatments in addressing the unmet medical needs of patients.

The gene therapy trials segment dominated the cell and gene therapy clinical trials market in 2024, owing to increased access to cutting-edge gene therapies and their long-term effects. The clinical trials of gene therapies are allowing researchers to advance their knowledge by improving the quality of patients’ lives. These cell and gene therapies and medicines are becoming beneficial to access for people living with rare genetic conditions, cancer, and limited treatment solutions.

Gene therapies and other advancing technologies like molecular biology and recombinant DNA technology hold the potential to address the root cause of diseases by correcting or replacing the faulty genes with new healthy ones. Some of the gene therapies offer ease of administration, which reduces the frequent need for medications or treatments while eliciting long-term relief. The collection of patients’ healthcare data and results of clinical trials helps researchers to develop safe and more effective gene therapies in the future.

The combined cell + gene therapy segment is expected to grow at the fastest CAGR in the cell and gene therapy clinical trials market during the forecast period due to targeted and long-lasting treatments. The use of stem cells in cell therapies delivers genetically modified cells and allows the consistent production of therapeutic gene products within the human body. The ex vivo production of genetically modified stem cells or other cells allows better control over gene delivery and cell selection for the expression of an efficient therapeutic gene. These stem cells and related therapies contribute to tissue repair and regeneration in addition to treating degenerative diseases.

The phase I segment dominated the cell and gene therapy clinical trials market by number of trials in 2024, owing to the major role of phase I clinical trials in the safety assessment of medical treatments. These trials enable researchers to determine the correct doses of medications and identify patient responses to these medicines. The phase I clinical trials give deep insights into pharmacokinetics, which help in process optimization. The regulatory bodies help with decision-making in drug development based on data provided by phase I trials. Patients and volunteers of clinical trials contribute to medical advancement by being involved in research conduct. The phase I trials help scientists to assess the toxicity and potential side effects of treatments in healthy individuals, which allows them to conduct extensive research in healthcare.

The phase III segment is expected to grow at the fastest CAGR by funding volume in the cell and gene therapy clinical trials market during the forecast period due to the increased need for generating effective dosage and administration of gene therapy medications. Phase III clinical trials provide promising data for the regulatory approvals of gene and cell therapies that will improve the quality of patient life. Healthcare professionals receive information about drug labels, package inserts, and other important factors to make informed decisions. These trials result in advanced medical knowledge, expanded treatment options, and improved patient care.

The oncology segment dominated the cell and gene therapy clinical trials market in 2024, owing to the targeted precision and reduced side effects of gene and cell therapies. They offer personalized treatments for cancer patients based on their genetic profile and specific mutations. These novel medical approaches are addressing the root causes of defective genes and delivering long-lasting effects on the disease. These therapies can address various cancer types, including lung cancer, brain cancer, pancreatic cancer, and solid tumors. The expanded treatment options are revolutionizing cancer care by delivering improved outcomes for patients. It is possible to explore combination therapies with other treatment modalities like radiation and chemotherapy to enhance their effectiveness.

The rare genetic disorders segment is expected to grow at the fastest CAGR in the cell and gene therapy clinical trials market during the forecast period due to the effectiveness of gene and cell therapy approaches in treating monogenic disorders caused by mutations in a single gene. They introduce a reduced burden in terms of resources and costs needed for ongoing medical care. The approvals by the U.S. FDA and the EMA for novel therapies to treat rare health conditions like Beta thalassemia, Duchenne muscular dystrophy, Metachromatic leukodystrophy, and many others have expanded treatment options. A single dose of therapy or medication can cure a long-term burden of chronic conditions beyond rare diseases.

The AAV (Adeno-Associated Virus) segment dominated the cell and gene therapy clinical trials market in 2024, owing to its high efficiency of gene delivery and tissue tropism. They elicit long-term and stable gene expression. They are potentially suitable for targeted and localized treatment. Recombinant AAV (rAAV) vectors offer reduced immunogenicity and an enhanced safety profile. AAV vectors allow durable transgene expression and a long-term therapeutic intervention. AAV-based therapies show a successful profile in clinical trials.

The CRISPR/Cas9 & Other Gene Editing Platforms segment is expected to grow at the fastest CAGR in the cell and gene therapy clinical trials market during the forecast period due to their potential in treating previously untreatable diseases. They facilitate cellular rejuvenation, regeneration, and immunomodulation. They became popular due to advancements in CRISPR technology, which include base editing, prime editing, and improved delivery systems. They allow correction of gene mutations by replacing defective or mutated genes.

The biotechnology companies segment dominated the cell and gene therapy clinical trials market in 2024, owing to the rapid expansion of venture capitalists, government bodies, and biopharmaceutical companies. R&D in gene therapies is also driven by significant investments, strategic partnerships, and acquisitions. The biotechnology firms are presenting gene editing breakthroughs and advancements in cell engineering. They are introducing the evolution of viral vectors and non-viral delivery systems. R&D and manufacturing in diverse sectors boost the economic potential. They offer precision, targeting, and tailored treatments.

The contract research organizations (CROs) segment is expected to grow at the fastest CAGR as facilitators in the cell and gene therapy clinical trials market during the forecast period due to integrated solutions and end-to-end services. They can address complexities in regulatory and manufacturing areas. They result in enhanced trial efficiency and improved success rates. They allow expanded market reach with the increased demand for services.

North America dominated the cell and gene therapy clinical trials market share by 48% in 2024, owing to the substantial R&D investments from government organizations, pharmaceutical and biotechnology companies, venture capital, and the overall public and private sectors. The American Society of Gene and Cell Therapy stated that two new RNA therapies will be approved in the U.S. in the second quarter of 2024. These include Rytelo for myelodysplastic syndrome and mRESVIA, the mRNA vaccine for respiratory syncytial virus prophylaxis.

There is a rising number of phase I clinical trial candidates, and the remarkable development of 1,023 gene therapies for rare genetic diseases. About 76 gene therapy trials were initiated, while 10 major therapies were oncological. The ASGCT also reported that 31 gene therapies, including genetically modified cell therapies, 30 RNA therapies, and 68 non-genetically modified cell therapies, have been approved in the U.S.

| Name of the Product | Category | Generic Name | Disease | Locations Approved | Name of the Originator Company |

| Beqvez | Gene Therapy | Fidanacogene elaparvovec | Hemophilia B | Canada, U.S. | Pfizer |

| Rytelo | RNA Therapy | Imetelstat | Myelodysplastic syndrome | U.S. | Geron |

| mRESVIA | RNA Therapy | Respiratory syncytial virus vaccine, Moderna Therapeutics | Respiratory syncytial virus prophylaxis | U.S. | Moderna Therapeutics |

The National Heart, Lung, and Blood Institute (NHLBI) led the Cure Sickle Cell Initiative, which is a collaborative research effort to accelerate the development of gene therapies to cure sickle cell disease. The National Center for Advancing Translational Sciences reported on the Accelerating Medicines Partnership (AMP) Program that covers the Bespoke Gene Therapy Consortium (BGTC). It is a public-private partnership between the NIH, the U.S. FDA, non-profit organizations, and several pharmaceutical and life science companies.

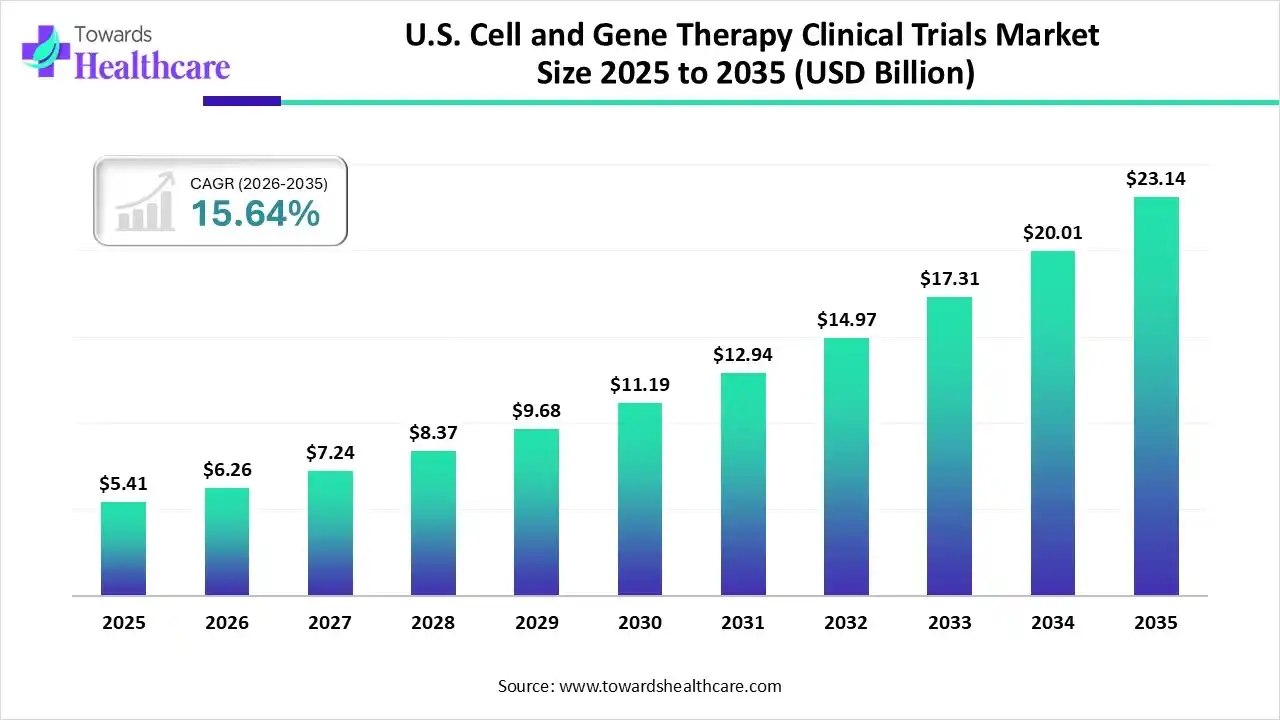

The U.S. cell and gene therapy clinical trials market size was estimated at USD 5.41 billion in 2025 and is predicted to increase from USD 6.26 billion in 2026 to approximately USD 23.14 billion by 2035, expanding at a CAGR of 15.64% from 2026 to 2035.

Asia Pacific is expected to grow at the fastest CAGR in the cell and gene therapy clinical trials market during the forecast period due to the increasing regulatory support for the establishment of streamlined approval processes. The International Society for Stem Cell Research and the Alliance for Regenerative Medicine are committed to developing and enabling global access to all cell and gene therapies. After North America, Asia Pacific holds the second position in uniting cell and gene therapy developers, clinical trials, and investments. The APAC region represents itself through innovative development, regulatory framework, and commercialization strategies.

The presence of major developers of CAR-T drugs, including JW Therapeutics, Fosun Kite, IASO Biotherapeutics, and Juventas, drove CAR-T innovation in China. Prominent Chinese cities such as Tianjin, Shenzhen, Shanghai, Beijing, and Haikou were involved in formulating the local incentive plans for novel cell therapy drugs. Chinese firms are focusing on importing consumables and instruments related to retro-viral gene transfer, cell cryopreservation technologies, and iPSC differentiation to expand product commercialization.

By Therapy Type

By Phase of Trial

By Indication

By Vector Type

By Sponsor Type

By Region

February 2026

February 2026

February 2026

February 2026