Revenue, 2025

42.80 Billion

Forecast, 2035

88.45 Billion

Report Coverage

United States

U.S. Drug Utilization Management Market Size, Key Players with Shares and Trends

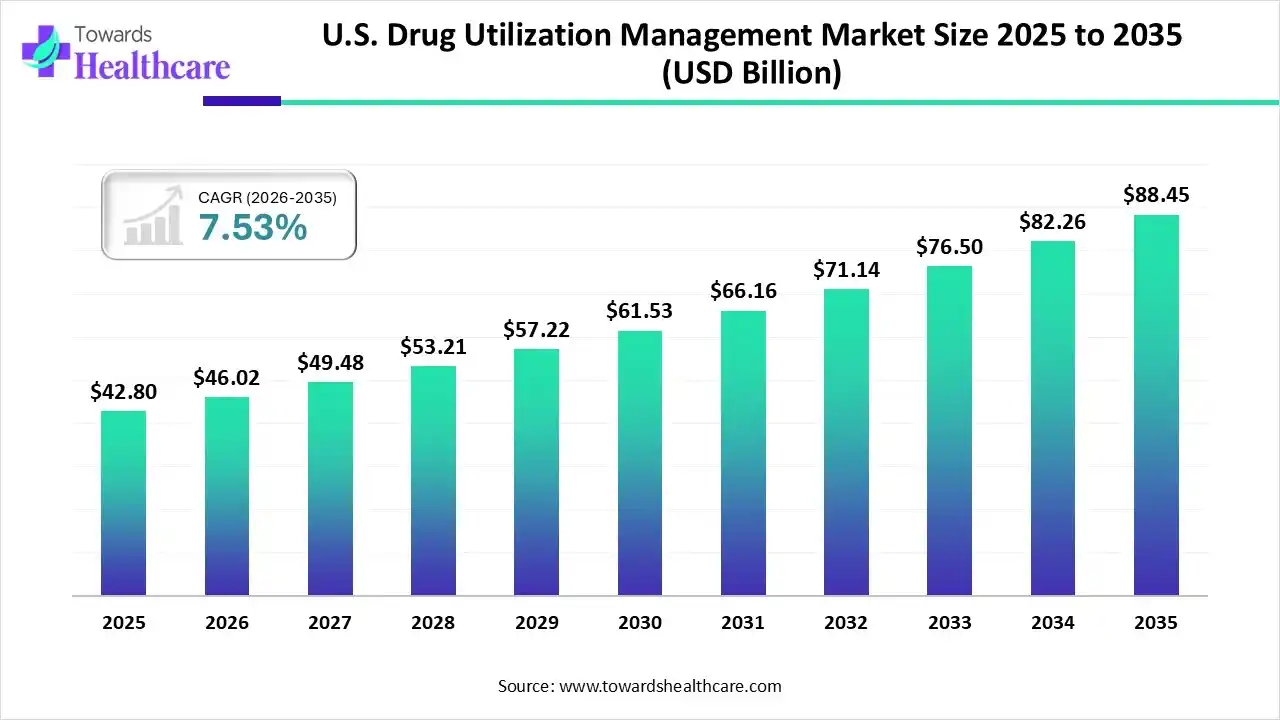

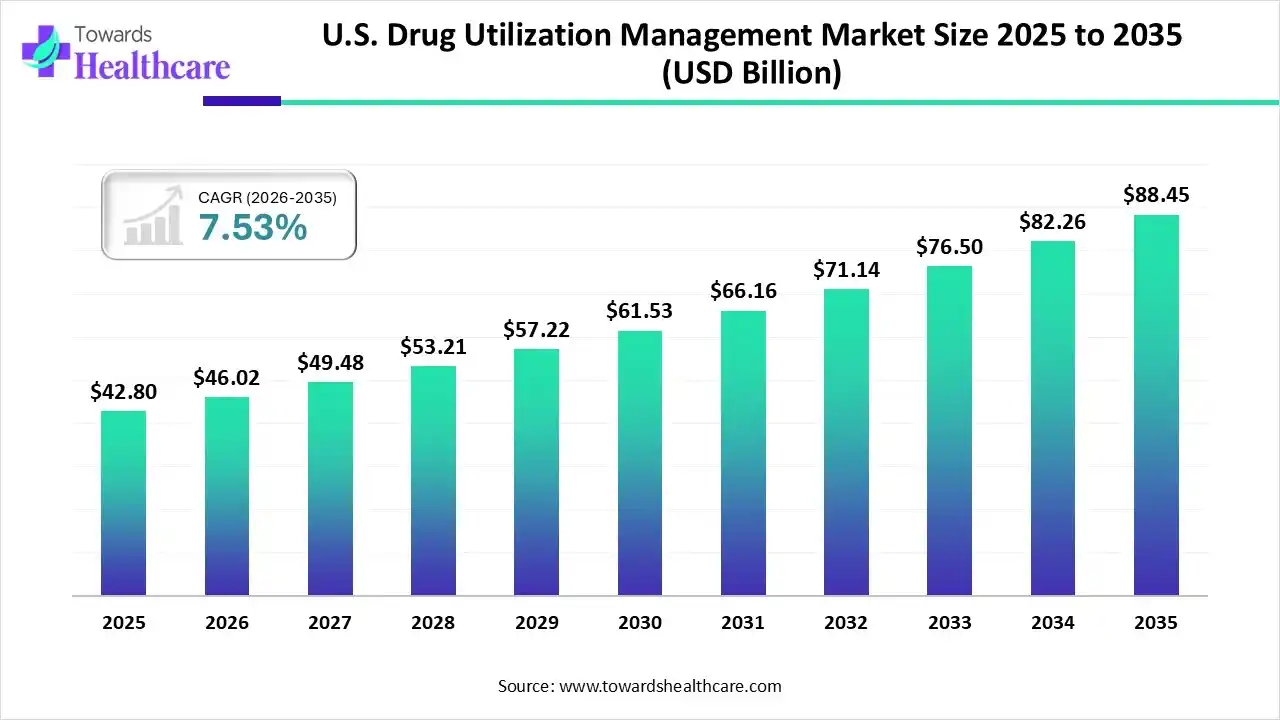

The U.S. drug utilization management market size is calculated at USD 42.80 billion in 2025, grew to USD 46.02 billion in 2026, and is projected to reach around USD 88.45 billion by 2035. The market is expanding at a CAGR of 7.53% between 2026 and 2035.

Key Takeaways

- U.S. drug utilization management sector pushed the market to USD 46.02 billion by 2026.

- Long-term projections show USD 88.45 billion valuation by 2035.

- Growth is expected at a steady CAGR of 7.53% in between 2026 to 2035.

- By program type, the in-house segment contributed the biggest revenue share of the market in 2024.

- By program type, the outsourced segment is expected to witness the fastest growth in the market over the forecast period.

- By end-use, the pharmacy benefit managers (PBMs) segment accounted for the highest revenue share of the market in 2024.

- By end-use, the health plan providers/payers segment is expected to grow with the highest CAGR in the market during the studied years.

Quick Facts Table

| Key Elements |

Scope |

| Market Size in 2026 |

USD 46.02 Billion |

| Projected Market Size in 2035 |

USD 88.45 Billion |

| CAGR (2026 - 2035) |

7.53% |

| Market Segmentation |

By Program Type, By End-Use |

| Top Key Players |

Peoples Health, MD Live, Rightway Healthcare, Medecision, Inc., NCQA, AllMed Healthcare Management, Optum Business, Genex, Agadia |

The U.S. drug utilization management market is primarily driven by the increasing healthcare expenditure and the growing demand for biologics. The rising number of hospitalizations potentiates the need for safer and cost-effective drugs. Government organizations also support drug utilization management (UM) in the U.S. Artificial intelligence (AI)-based methods may help optimize medication alerts and identify high-risk prescriptions, enhancing accuracy.

Drug Utilization Management: Redefining Drug Efficiency

The U.S. drug utilization management market is experiencing rapid growth, driven by the need to control high drug prices and the growing development of personalized medications. UM is a process that helps patients receive the right treatment at an affordable cost. This process leads to safer treatment as service providers ensure that patients administer the correct prescribed drugs. The different programs for UM include step therapy, prior authorization, and quantity limits.

U.S. Drug Utilization Management Market Outlook

- Industry Growth Overview: The market is expected to expand rapidly due to the increasing demand for treatment accessibility and favorable reimbursement policies. UM is widely adopted by both private payers and Medicaid plans to benefit a larger patient population.

- Major Investors: Private equity firms and venture capitalists provide funding to reduce the economic burden of UM on payers, manufacturers, physicians, and patients. Carlyle and Parthenon Capital are private equity healthcare investment companies for UM.

- Startup Ecosystem: The startup ecosystem is booming, with the integration of advanced technologies and the growing need for UM. Medecision, Inc., NCQA, and VativoRx are some startups that conduct drug UM programs in the U.S.

AI-Driven Utilization: Reshaping Prescription Pathways

AI and machine learning (ML) algorithms are embedded in UM programs to enhance accuracy and precision in personalized care. They analyze vast amounts of data by enabling dynamic learning from historical dispensing patterns, promoting proactive interventions by pharmacists. AI-based predictive analytics can predict drug-drug interactions and their associated adverse effects. AI and ML can also be integrated into electronic health records (EHRs) to access patient health data, ensuring personalized medication safety.

Segmental Insights

Program Type Insights

Which Program Type Segment Dominated the U.S. Drug Utilization Management Market?

The in-house segment held a dominant position in the market in 2024, due to the demand for complete control over health data and high affordability. In-house UM programs allow for a more hands-on approach, enabling healthcare professionals to make effective clinical decisions. They also allow professionals to tailor program needs based on requirements. In-house programs offer high flexibility by adapting to changing regulatory requirements and evolving patient needs. Moreover, in-house programs eliminate unnecessary costs related to outsourcing.

Outsourced

The outsourced segment is expected to grow at the fastest CAGR in the market during the forecast period. Outsourced UM programs are preferred by healthcare organizations that lack skilled professionals and specialized infrastructure. They streamline medication reviews by leveraging external expertise and advanced systems. They ensure compliance with regulatory standards and allow pharmacists to focus on their core competencies, like patient care. The growing need to reduce the workload on healthcare professionals and the demand for personalized care boost the segment’s growth.

End-Use Insights

Which End-Use Segment Led the U.S. Drug Utilization Management Market?

The pharmacy benefit managers (PBMs) segment led the market in 2024. This segment dominated because PBMs are mediators between pharmacies, drug insurers, and drug manufacturers. They help insurance companies control prescription drug spending and manage benefits by negotiating with pharmacies, insurance companies, and manufacturers. According to a recent report from the American Medical Association (AMA), 4 major companies, such as OptumRx, CVS Health, Express Scripts, and Prime Therapeutics, held a 67% share in the national PBM market in 2023.

Health Plan Providers/Payers

The health plan providers/payers segment is expected to expand rapidly in the market in the coming years. Health plan providers/payers increasingly prefer drug UM services and programs to control costs and ensure the safety of prescription drugs. Numerous payers launch new initiatives to increase patient care access and improve prior authorization. It is estimated that approximately 25% to 30% of total healthcare spending may be categorized as wasteful. Hence, insurers use cost containment systems to limit unnecessary spending.

Pharmacies

The pharmacies segment is expected to grow in the coming years. Pharmacists are in close contact with patients compared to insurers and PBMs, thereby guiding patients and providing personalized care. Drug UM programs help pharmacists improve the quality of patient care, enhance therapeutic outcomes, prevent adverse drug reactions, and reduce inappropriate pharmaceutical expenditures. Pharmacists can record inefficiencies in treatment and immediately report to patients.

Geographical Analysis

Which Factors Influence the U.S. Drug Utilization Management Market?

Numerous factors influence market growth, including the increasing number of hospitalizations, the growing development of cost-effective medications, and rising healthcare expenditure. These factors support the adoption of drug UM programs and services to enhance access to quality healthcare and improve patient well-being. Total prescription medicine use increased by 1.7% in the U.S., accounting for 215 billion days of therapy in 2024.

The U.S. is home to several government and private insurers, supporting patients financially. The increasing unfilled prescriptions by payers leads to payer rejections and abandonment by patients. The unfilled rates include 34% in Medicaid, 24% in Medicare, and 28% in commercial insurance. This further necessitates the use of drug UM programs. Additionally, the U.S. witnessed an 11.4% surge in net medicine spending in 2024, accounting for $487 billion.

Top Companies & Their Offerings in the U.S. Drug Utilization Management Market

| Companies |

Offerings |

| EXL Service Holdings, Inc. |

It offers end-to-end UM services that claim a 96% reduction in pre-certification case handling time and 15% improvement in document efficiency. |

| VativoRx |

It conducts the RetroDUR program to review, analyze, and interpret processed claims, as well as the Concurrent DUR program to provide timely information on potential conflicts. |

| Nexus |

It offers a suite of drug UM services to help payers, employers, and claims administrators navigate the complexities of pharmaceutical care. |

| Acentra Health |

It provides the UM program in eight states to promote quality and cost-effective healthcare and member well-being. |

| EK Health Services |

It specializes in clinical excellence through its superior technology in Utilization & Peer Review, resulting in a highly-refined process. |

Who Leads the DUM Market in 2024?

- Peoples Health

- MD Live

- Rightway Healthcare

- Medecision, Inc.

- NCQA

- AllMed Healthcare Management

- Optum Business

- Genex

- Agadia

Company Landscape

The Drug Utilization Management (DUM) market is primarily managed by the largest Pharmacy Benefit Managers (PBMs) in the U.S. As of the most recent data for 2024, the top two companies based on the volume of equivalent prescription claims processed, which directly relates to their DUM market influence, are:

- Express Scripts (Cigna/Evernorth)

- CVS Caremark (CVS Health)

2024 Market Share (by equivalent prescription claims processed):

- Express Scripts: Estimated at 30% (up from 23% in 2023)

- CVS Caremark: Estimated at 27% (down from 34% in 2023)

- Note: Express Scripts overtook CVS Caremark in 2024 largely due to the major Centene contract shift.

1. Express Scripts (An Evernorth Health Services Company, a subsidiary of The Cigna Group)

Company Overview

Company Overview: Express Scripts is one of the largest Pharmacy Benefit Managers (PBMs) in the U.S., managing drug benefits and utilization for health plans, employers, and government programs. It operates under Evernorth Health Services, the non-insurance segment of The Cigna Group, focused on integrated and connected care delivery.

Corporate Information:

- Headquarters: St. Louis, Missouri.

- Year Founded: 1986 (Express Scripts); Evernorth was launched in 2020.

- Ownership Type: Wholly-owned subsidiary (Ultimate parent is The Cigna Group, Publicly Traded).

History and Background:

- Achieved PBM giant status with the acquisition of Medco Health Solutions in 2012.

- Acquired by Cigna in 2018, leading to vertical integration.

- Rebranded key services under the Evernorth umbrella in 2020 to emphasize integrated medical and pharmacy solutions.

Key Milestones/Timeline:

- 2018: Acquired by Cigna.

- 2020: Becomes a key part of the new Evernorth division.

- Jan 2024: Begins managing pharmacy benefits for Centene Corporation (approx. 20 million lives), significantly boosting claims volume and making it the market leader by claims processed.

- Business Overview: Provides PBM services to control prescription drug costs and ensure appropriate utilization for more than 118 million lives (as of 2024).

Business Segments/Divisions (Under Evernorth):

- Express Scripts: Core PBM, claims processing, and utilization management.

- Accredo: Specialty Pharmacy services.

- EviCore by Evernorth: Medical Benefits Management (MBM), which provides prior authorization and utilization review for medical services, often integrating with pharmacy DUM.

- Geographic Presence: Primarily U.S.

Key Offerings (DUM-Related):

- Formulary Management: National Preferred Formulary (NPF) and tailored options with robust exclusion lists (600+ products in 2025).

- Prior Authorization (PA): Clinical review for high-cost or specialty drugs.

- Step Therapy: Requiring use of lower-cost, equally effective alternatives first.

- Utilization Management (UM) Programs: Quantity limits, dose optimization, and waste prevention.

- Specialty Guidance Management: High-touch patient support and utilization review for high-cost specialty drugs.

End-Use Industries Served:

- Commercial Employers and Health Plans.

- Managed Medicaid and Medicare Part D Plans.

- Federal Government Programs (e.g., TRICARE).

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Strategic past acquisitions (Medco, EviCore) are now foundational to the Evernorth integrated platform.

- Partnerships & Collaborations: Continues its long-standing network collaboration with Prime Therapeutics.

- Product Launches/Innovations: Express Scripts Pharmacy by Evernorth and efforts to integrate pharmacy PA into the EviCore portal for unified medical and pharmacy review (2024).

- Capacity Expansions/Investments: Continued investment in the Evernorth brand to expand integrated offerings beyond traditional PBM, focusing on data and behavioral health services.

- Regulatory Approvals: Maintains accreditations (e.g., URAC) for PBM and Mail Service Pharmacy services.

Distribution channel strategy:

- Retail Pharmacy Network: Massive nationwide contracted network.

- Mail-Order Pharmacy: Express Scripts Pharmacy by Evernorth.

- Specialty Pharmacy: Accredo.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Proprietary claims processing system and clinical edit software for real-time DUM enforcement. EviCore's technology for evidence-based medical necessity reviews.

- Research & Development Infrastructure: Evernorth invests heavily in data science and AI/predictive analytics to model drug trends and optimize utilization review logic.

- Innovation Focus Areas: Improving the speed and consistency of the PA process and better integrating pharmacy and medical data to manage total cost of care.

Competitive Positioning:

- Strengths & Differentiators: Largest claims volume in 2024. Strong vertical integration with medical benefits management (EviCore) and specialty pharmacy (Accredo). Powerful negotiating leverage.

- Market presence & ecosystem role: A market leader that sets industry standards for formulary exclusion strategies and provider reimbursement, particularly after its significant Centene contract win.

SWOT Analysis:

- S (Strengths): Market leadership by claims processed (2024), strong integration with Evernorth's clinical services, vast data assets.

- W (Weaknesses): Subject to intense regulatory scrutiny and PBM reform proposals. Dependence on large, volatile government contracts (Centene).

- O (Opportunities): Continued expansion of the EviCore/Evernorth platform into other areas like behavioral health and home-based care. Growth in biosimilar market management.

- T (Threats): Ongoing competition from Optum Rx and pressure from legislators to increase PBM transparency and pass rebates to consumers.

Recent News and Updates (2024-2025):

- Press Releases: Highlighted successful cost control, citing declining out-of-pocket costs for members in 2024 due to effective negotiations. Focused on the smooth transition of the Centene contract.

- Industry Recognitions/Awards: Focus on parent company Cigna/Evernorth's overall performance and value-based care initiatives.

2. CVS Caremark (A subsidiary of CVS Health Corporation)

Company Overview

Company Overview: CVS Caremark is the PBM arm of CVS Health Corporation, providing integrated pharmacy benefits, mail-order, and specialty pharmacy services. It is a key component of CVS Health’s goal to provide end-to-end healthcare services, leveraging its retail footprint and Aetna insurance arm.

Corporate Information:

- Headquarters: Woonsocket, Rhode Island.

- Year Founded: 1974 (CVS); Caremark PBM roots date to 1983.

- Ownership Type: Wholly-owned subsidiary (Ultimate parent is CVS Health Corporation, Publicly Traded).

History and Background:

- The CVS/Caremark Rx merger in 2007 created the first fully integrated PBM/Retail Pharmacy.

- The acquisition of health insurer Aetna in 2018 cemented its position as a vertically integrated healthcare behemoth.

- Launched Cordavis in 2023 to develop and commercialize biosimilars and other lower-cost drugs.

Key Milestones/Timeline:

- 2007: CVS and Caremark Rx merge.

- 2018: CVS Health acquires Aetna.

- 2023: Acquired Signify Health and Oak Street Health to expand primary care and home health. Launched Cordavis.

- Jan 2024: Loss of the Centene contract results in a significant volume drop (over 400 million claims).

- Business Overview: Provides DUM and PBM services for health plans, employers, and government programs, managing prescription costs and access for millions of members.

Business Segments/Divisions (Under CVS Health's Health Services Segment):

- CVS Caremark: Core PBM and DUM.

- CVS Specialty: Specialty pharmacy and complex care management.

- Cordavis: Private-label biosimilar and generic drug company.

- Zinc Health Services: PBM-affiliated Group Purchasing Organization (GPO).

- Geographic Presence: Primarily U.S., with a vast retail presence (CVS Pharmacy).

Key Offerings (DUM-Related):

- Formulary Management: Performance Drug List (PDL) and formulary exclusion lists (600+ products in 2025).

- Prior Authorization/Step Therapy: Implemented digitally and in real-time at the point of dispensing.

- Real-Time Drug Utilization Review (RTDUR): Enforcing DUM edits at the pharmacy level instantly.

End-Use Industries Served:

- Commercial Employers and Health Plans.

- Managed Medicaid and Medicare Part D Plans.

- Aetna members (Internal business).

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Focus on integrating Aetna, Signify Health, and Oak Street Health to manage medical and pharmacy spend holistically.

- Partnerships & Collaborations: Maintains its services agreement with CarelonRx (Elevance Health's PBM) through 2027. Key partnership with Sandoz for its Cordavis biosimilar product (Hyrimoz).

- Product Launches/Innovations: Launched Cordavis, promoting its own private-label biosimilars (like Hyrimoz, an adalimumab biosimilar) to accelerate cost savings via formulary preference.

- Capacity Expansions/Investments: Significant investment in integrated clinical programs across its PBM, retail, and provider segments to improve care coordination.

- Regulatory Approvals: Ongoing compliance with PBM regulations and managing formulary changes based on new FDA approvals, including biosimilars.

Distribution channel strategy:

- Retail Pharmacy Network: Extensive network, including over 9,000 CVS Pharmacy locations.

- Mail-Order Pharmacy: Dedicated mail-order services.

- Specialty Pharmacy: CVS Specialty (largest in the U.S.).

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Advanced AI/machine learning for predictive modeling of drug adherence and utilization patterns. Proprietary system for formulary and benefit administration.

- Research & Development Infrastructure: Focus on leveraging integrated data from Aetna and patient-facing services (e.g., MinuteClinic, Oak Street Health) to refine DUM protocols.

- Innovation Focus Areas: Driving biosimilar adoption through Cordavis; increasing transparency and simplifying the member experience; improving digital engagement for PA submissions.

Competitive Positioning:

- Strengths & Differentiators: Unmatched vertical integration (Payer, PBM, Retail Pharmacy, Primary Care). Largest specialty pharmacy footprint. Launch of Cordavis as a biosimilar/generic strategy.

- Market presence & ecosystem role: Sets formulary trends and, through its integration, aims to shift from being just a PBM to a total health solution provider.

SWOT Analysis:

- S (Strengths): Full vertical integration (Health Plan/PBM/Retail), leading position in Specialty Pharmacy, proactive biosimilar strategy (Cordavis).

- W (Weaknesses): Recent, significant loss of market share (Centene contract), high public and regulatory scrutiny of vertical PBM practices.

- O (Opportunities): Leveraging Aetna/Oak Street Health for comprehensive utilization and health outcomes management, expanding the Cordavis portfolio.

- T (Threats): Aggressive competition from Express Scripts and Optum Rx. Potential federal or state legislation targeting PBM transparency and vertical integration.

Recent News and Updates (2024-2025):

- Press Releases: Continued focus on the launch and success of Cordavis, which saw its partnered adalimumab biosimilar (Hyrimoz) gain significant market share rapidly after being preferred on the CVS Caremark formulary in 2024. Announced a focus on a more moderate formulary exclusion strategy for 2025.

- Industry Recognitions/Awards: Recognition for its broader CVS Health initiatives in community health and integrated care.

Recent Developments in the U.S. Drug Utilization Management Market

- In October 2025, the Centers for Medicare & Medicaid Services issued a memo to finalize the Medicare Advantage Utilization Management Annual Data Submission requirements through the Health Plan Management system. CMS may consider incorporating review of internal coverage criteria into future program audits.

- In May 2025, Quantum Health announced the expansion of its Premier Pharmacy platform to offer Vida Health’s new GLP-1 solution to self-insured employers. The platform focuses on drug UM patterns, optimizing prescribing patterns, clinical outcomes, and member support for weight loss.

Segments Covered in the Report

By Program Type

By End-Use

- Pharmacy Benefit Managers (PBMs)

- Health Plan Providers/Payers

- Pharmacies