March 2026

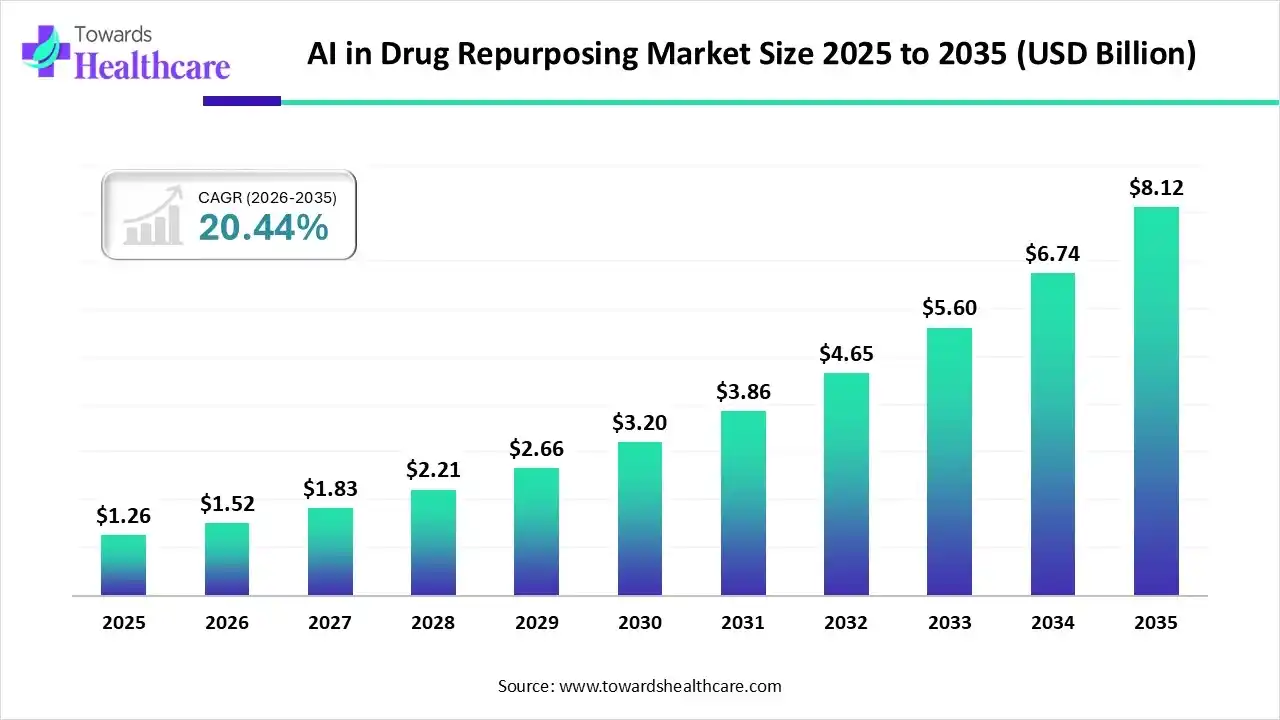

The global AI in drug repurposing market size is calculated at US$ 1.26 billion in 2025, grew to US$ 1.52 billion in 2026, and is projected to reach around US$ 8.12 billion by 2035. The market is expanding at a CAGR of 20.44% between 2026 and 2035.

The integration of artificial intelligence (AI) with pharmaceutical research, the pressing need to expedite drug-discovery timelines, and the growing focus on developing cost-effective therapeutics are driving the AI in drug repurposing market. Pharmaceutical and biotechnology companies' approach to drug development is being completely transformed by the rapid adoption of AI-driven platforms for medication repurposing, enabling the rapid and precise identification of new indications for existing therapies.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.52 Billion |

| Projected Market Size in 2035 | USD 8.12 Billion |

| CAGR (2026 - 2035) | 20.44% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Technology, By Application, By Therapeutic Area, By Deployment Model, By End User, By Region |

| Top Key Players | Insilico Medicine, BenevolentAI, Recursion Pharmaceuticals, Atomwise, Exscientia, Healx, Euretos, Berg Health, Cyclica, Valo Health |

| Region | Affected Population (Estimated Range) |

| European Union (EU) | 27–36 million individuals |

| United States | 25–30 million individuals |

| Australia | ~2 million individuals |

| China | 49–82 million individuals |

| Africa | ~50 million individuals |

| Latin America | 40–50 million individuals |

| Middle East | ~25 million individuals |

With their unparalleled capacity for knowledge extraction and experimental automation, LLMs are becoming revolutionary tools in synthetic biology and biomanufacturing. By using modern approaches such as retrieval-augmented generation (RAG) and knowledge graph creation, these AI systems can effectively handle huge amounts of scientific literature and biological sequence data, substantially expediting the design-build-test-learn (DBTL) cycle.

Leading firms are embracing AI to transform medication repurposing and discovery, accelerating progress in rare-disease therapies and innovative drug development.

The financial losses per failed clinical trial might vary from $800 million to $1.4 billion, including not just the trial expenditures but also the losses in preclinical development. Applying AI technology to critical processes in clinical trial design has the potential to improve patient stratification, boost recruitment efficiency, and ultimately increase the likelihood of trial success.

The integration of pharmacophore ideas with AI techniques is still expanding, with future research likely to focus on using pharmacophore characteristics as molecular descriptors for AI models or on applying AI methods to generate pharmacophores from large datasets.

SBVS, sometimes referred to as target-based VS (TBVS), is a strong and promising CADD approach. In the near future, SBVS, powered by AI and DL, is expected to emerge as one of the most promising methods in drug development.

Future directions incorporate precision medicine, AI, and global collaboration. A promising future for medication repurposing is enabled by interdisciplinary collaboration and technological advances, which may lead to better patient care and public health outcomes.

Which Product Type Dominated the Market in 2024?

The AI platforms & software suites segment dominated the AI in drug repurposing market, accounting for 46% of revenue in 2024. Traditional experimental approaches are generally time‐consuming and costly, making artificial intelligence (AI) an attractive option due to its lower cost, computational benefits, and ability to identify hidden patterns.

Cloud-Based Discovery Workbenches

The cloud-based discovery workbenches segment is expected to be the fastest-growing during the forecast period. Cloud-based discovery workbenches are integrated, scalable systems that employ high-performance cloud computing and AI/ML to speed medication repurposing. They enable access to large biological and chemical data sets, complex modeling tools, and collaboration spaces without requiring expensive in-house equipment.

How did Machine Learning (ML) dominate the Market in 2024?

The machine learning (ML) segment dominated the AI in drug repurposing market, accounting for 38% of revenue in 2024. ML is revolutionizing medication repurposing, delivering a more efficient, cost-effective method to drug development by uncovering novel therapeutic applications for existing pharmaceuticals. Large, intricate biological datasets are processed by machine learning algorithms, which also anticipate potential adverse effects and uncover hidden patterns revealing unanticipated connections between medications and illnesses.

Network Biology & Graph-Based AI

The network biology & graph-based AI segment is expected to be the fastest-growing during the forecast period. By representing complicated biological systems as networks with nodes representing things (drugs, genes, proteins, illnesses) and edges representing their interactions, network biology, in conjunction with graph-based AI, offers a potent method for drug repurposing.

Which Application Dominated the Market in 2024?

The target identification & validation segment dominated the AI in drug repurposing market with a revenue of 32% in 2024. AI has transformed the way researchers find prospective drug targets by integrating and analyzing enormous and diverse datasets that span genomes, proteomics, transcriptomics, and clinical information. The target identification step has made use of a number of AI approaches.

Clinical Outcome Modeling & Real-world Evidence

The clinical outcome modelling & real-world evidence segment is expected to be the fastest-growing during the forecast period. By facilitating the smooth synthesis and interpretation of diverse datasets, AI and ML are playing a critical role in bridging the gap between controlled clinical trials and real-world clinical practice. By helping to match clinical evidence to actual treatment patterns and outcomes, these tools increase the data's applicability and impact for regulatory documentation.

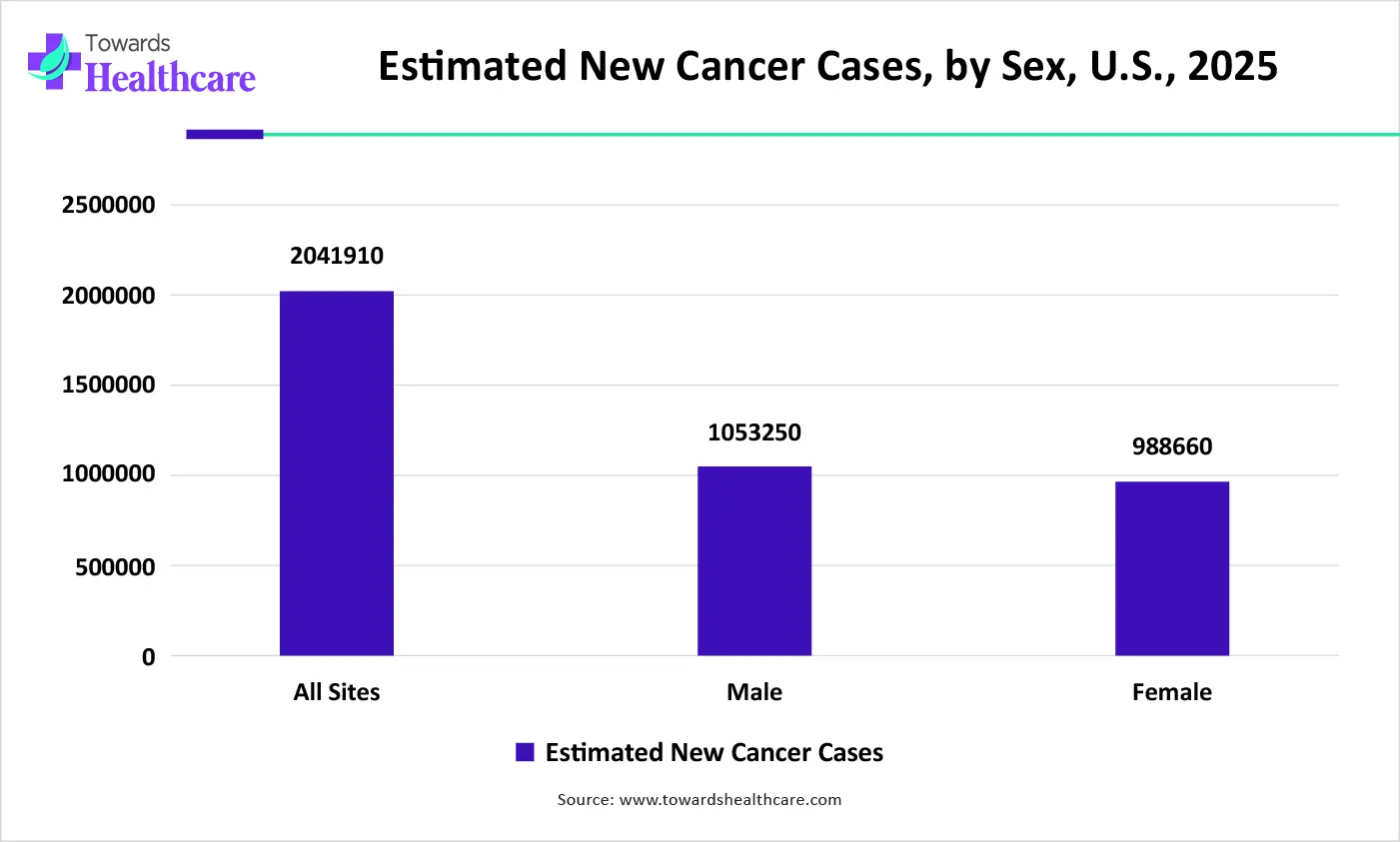

How the Oncology Segment Dominated the Market in 2024?

The oncology segment dominated the AI in drug repurposing market with a revenue of 28% in 2024. Drug repurposing, or finding new uses for currently available, clinically authorized medications, is one potential tactic that has drawn a lot of attention recently. Therapeutic repurposing offers numerous intrinsic benefits in cancer therapy, as repurposed medications are often cost-effective, proven safe, and can considerably accelerate therapeutic development due to their established safety profiles.

Rare Diseases/Orphan Indications

The rare diseases/orphan indications segment is expected to be the fastest-growing during the forecast period. Almost 8,000 uncommon illnesses occur worldwide, affecting approximately 350 million people. However, only 5% of patients obtain a particular licensed or approved therapy. Drug repurposing may enable novel treatments for uncommon and orphan illnesses.

How Cloud-Based AI Platforms Became Dominant in 2024?

The cloud-based AI platforms segment dominated the AI in drug repurposing market, accounting for 55% of revenue in 2024. Cloud-based medication repurposing is a significant step towards digital transformation in the pharmaceutical business. Through effective data storage and workflow automation, the infrastructure helps pharmaceutical businesses expedite increasingly complicated medication repurposing and development research.

Hybrid Deployment

The hybrid deployment segment is expected to be the fastest-growing during the forecast period. By mixing on-premise and cloud resources, hybrid cloud solutions provide enterprises with the flexibility and scalability of both worlds. Organizations may further strengthen their hybrid cloud approach with AI and ML.

Which End-User Dominated the Market in 2024?

The pharmaceutical & biotech companies segment dominated the AI in drug repurposing market, accounting for 48% of revenue in 2024. Pharmaceutical and biotech businesses are rapidly realizing the potential of repurposing as a strategy to broaden their pipelines and meet important medical needs. As additional success stories emerge, the pharmaceutical and biotech sectors are likely to commit larger resources to systematic medication repurposing activities, assuring speedier and more cost-effective treatment choices for a wide spectrum of ailments.

AI-Focused Drug Discovery Startups

The AI-focused drug discovery startups segment is expected to be the fastest-growing during the forecast period. Some major AI-focused drug development businesses are Insilico Medicine, Exscientia, and Atomwise, which employ AI to design novel compounds and speed the drug discovery process. Other significant businesses include BenevolentAI, which identifies new uses for existing pharmaceuticals; Cradle, which creates proteins; and Iktos, which merges AI with robotics.

North America dominated the AI in drug repurposing market in 2024, with a revenue share of 36%. The industry is driven by large R&D spending from pharmaceutical and biotechnology companies, coupled with robust venture capital funding for AI-driven drug-discovery startups. In addition, the availability of modern healthcare IT infrastructure enables effective integration of large-scale genetic and clinical datasets. Repurposing research into clinical applications is more quickly when academics, pharmaceutical companies, and AI companies work together strategically.

In the U.S. pharmaceutical sector, medication repurposing, also known as drug repositioning, has become increasingly popular as businesses seek quicker and more affordable ways to develop therapies for a variety of illnesses. The future of medication repurposing in the U.S. looks promising, driven by further AI breakthroughs, regulatory backing, and collaboration among pharmaceutical companies, biotech firms, and academic institutions.

Asia Pacific is estimated to host the fastest-growing AI in drug repurposing market during the forecast period. This is due to the growing number of clinical data warehouses and healthcare databases, which enhance the validity of AI-driven drug development models. Additionally, collaborations between global pharmaceutical firms and regional AI start-ups are accelerating the identification of potential repurposing candidates. Government programs encouraging innovation in digital health are driving industry expansion.

The Chinese government has developed numerous regulations to encourage drug repurposing in the country. These strategies include expediting the regulatory clearance process for repurposed medications, offering financial incentives for enterprises to conduct research and development in this field, and fostering collaborations between industry and academia to enable knowledge exchange and cooperation.

Europe is expected to grow at a significant CAGR in the AI in drug repurposing market during the forecast period. Europe follows as a serious rival, with large expenditures in AI research and an emphasis on healthcare innovation. Germany ranks out in Europe, powered by its powerful R&D environment and strategic alliances. The market's development is further bolstered by growing collaboration between AI startups and pharmaceutical companies, as they strive to tap the full potential of AI in medication repurposing.

Germany’s Medical Research Act (Medizinforschungsgesetz or MFG), which came into effect on October 30, 2024, is a major legislative change aiming at boosting Germany’s position as a favorable setting for medical innovation and pharmaceutical research. The act offers incentives for regional clinical trials, streamlined clinical trial approvals, confidential negotiated medication prices, and standardized ethics committee procedures.

| Company Name | Headquarters Location | Latest Update/Status |

| Insilico Medicine | Cambridge, Massachusetts, U.S. | Moved its primary U.S. headquarters from New York to Cambridge, MA, in April 2024. Maintains other global offices in Hong Kong, Montreal, Suzhou, and more. |

| BenevolentAI | London, England, UK | The company is headquartered in London and continues to operate in the UK and the U.S., applying AI to develop new medicines. |

| Recursion Pharmaceuticals | Salt Lake City, Utah, US | Remains headquartered in Salt Lake City. The company acquired Cyclica in May 2023 and completed the acquisition of Exscientia in November 2024. |

| Atomwise | San Francisco, California, U.S. | Headquartered in San Francisco, utilizing its AtomNet deep learning technology for drug discovery in partnership with other entities. |

| Exscientia | Oxford, England, UK (previously) | Acquired by Recursion Pharmaceuticals in a definitive agreement completed in November 2024. Exscientia is now a wholly owned subsidiary of Recursion. |

| Healx | Cambridge, England, UK | Continues to be headquartered in Cambridge, focused on using AI to find treatments for rare diseases. |

| Euretos | Leiden, Netherlands | Based in the Netherlands, it provides an AI platform for in-silico target and biomarker discovery and validation. |

| Berg Health | Framingham, Massachusetts, U.S. (previously) | Acquired by BPGbio in February 2023, its assets were integrated into BPGbio's pipeline. It is no longer an independent operating entity under the Berg name. |

| Cyclica | Toronto, Ontario, Canada (previously) | Acquired by Recursion Pharmaceuticals in May 2023. |

| Valo Health | Boston/Lexington, Massachusetts, U.S. | The company maintains offices in both Boston and Lexington, MA, leveraging its Opal Computational Platform for drug discovery. |

By Product Type

By Technology

By Application

By Therapeutic Area

By Deployment Model

By End User

By Region

March 2026

March 2026

March 2026

March 2026