January 2026

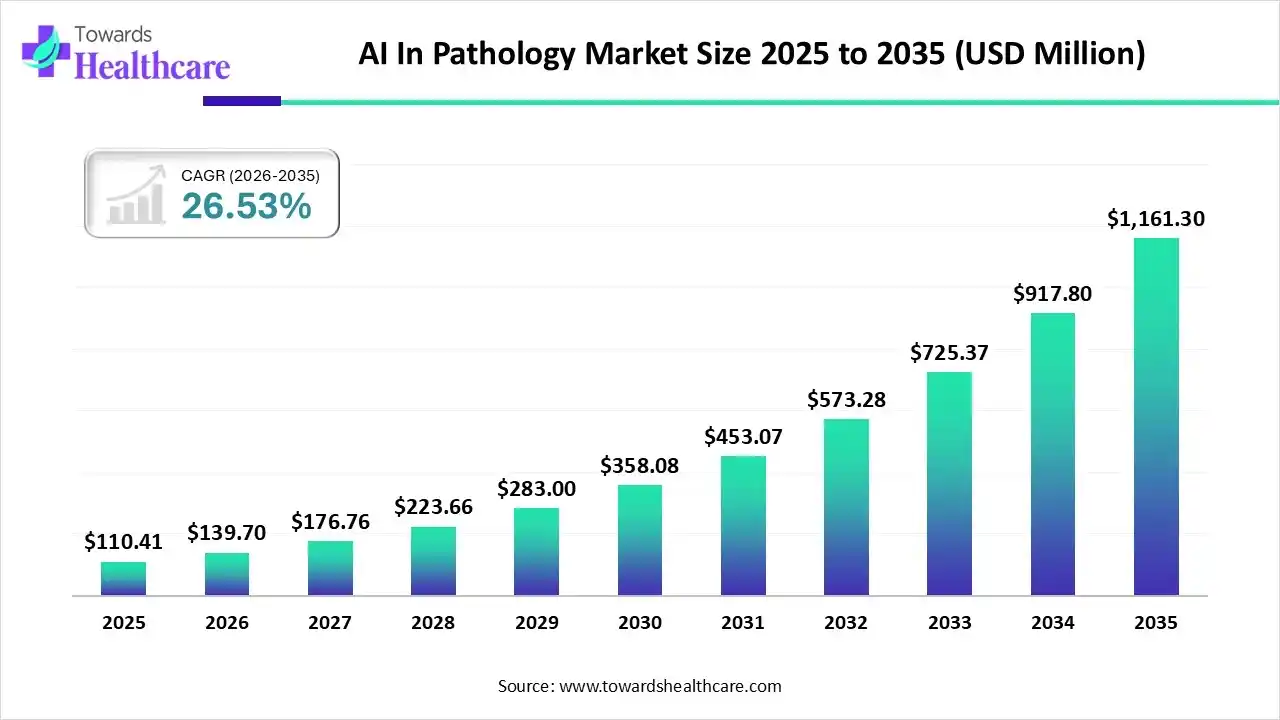

The global AI in pathology market size was estimated at USD 110.41 million in 2025 and is predicted to increase from USD 139.7 million in 2026 to approximately USD 1161.3 million by 2035, expanding at a CAGR of 26.53% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 139.7 Million |

| Projected Market Size in 2035 | USD 1161.3 Million |

| CAGR (2026 - 2035) | 26.53% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Application, By Technology / Mode of Action, By Distribution Channel, By Region |

| Top Key Players | Roche Diagnostics, Philips Healthcare, Leica Biosystems, 3D HISTECH, Hamamatsu Photonic, Proscia, PathAI, Paige, Ibex Medical Analytics |

AI strengthens pathology by automating image interpretation, reducing diagnostic errors, accelerating slide review, and identifying subtle disease patterns. These capabilities enhance accuracy, streamline workflows, and support pathologists with faster, more informed decisions.

AI accelerates biomarker identification, analyzes large datasets, and supports high-throughput pathology research. Its advanced modeling speeds drug discovery, improves study precision, and enables deeper insights into disease mechanisms across diverse therapeutic areas.

AI integrates pathology images with molecular and clinical data, enabling personalized treatment strategies, improved risk stratification, and early disease detection. This predictive power supports tailored therapies, better outcomes, and more efficient clinical decision-making.

AI will increasingly support routine diagnostics, offering faster image analysis, higher accuracy, and standardized results. Hospitals will adopt integrated platforms combining digital pathology, automation, and advanced algorithms for improved patient care.

Future systems will merge pathology images with genomics, radiology, and clinical records. This unified data approach will enable deeper insights, stronger prediction models, and highly personalized treatment decisions across disease areas.

Cloud-enabled digital workflows will connect labs worldwide, supporting remote consultations, shared AI tools, real-time collaboration, and large-scale data analytics. This will expand access to expert pathology and accelerate global research innovation.

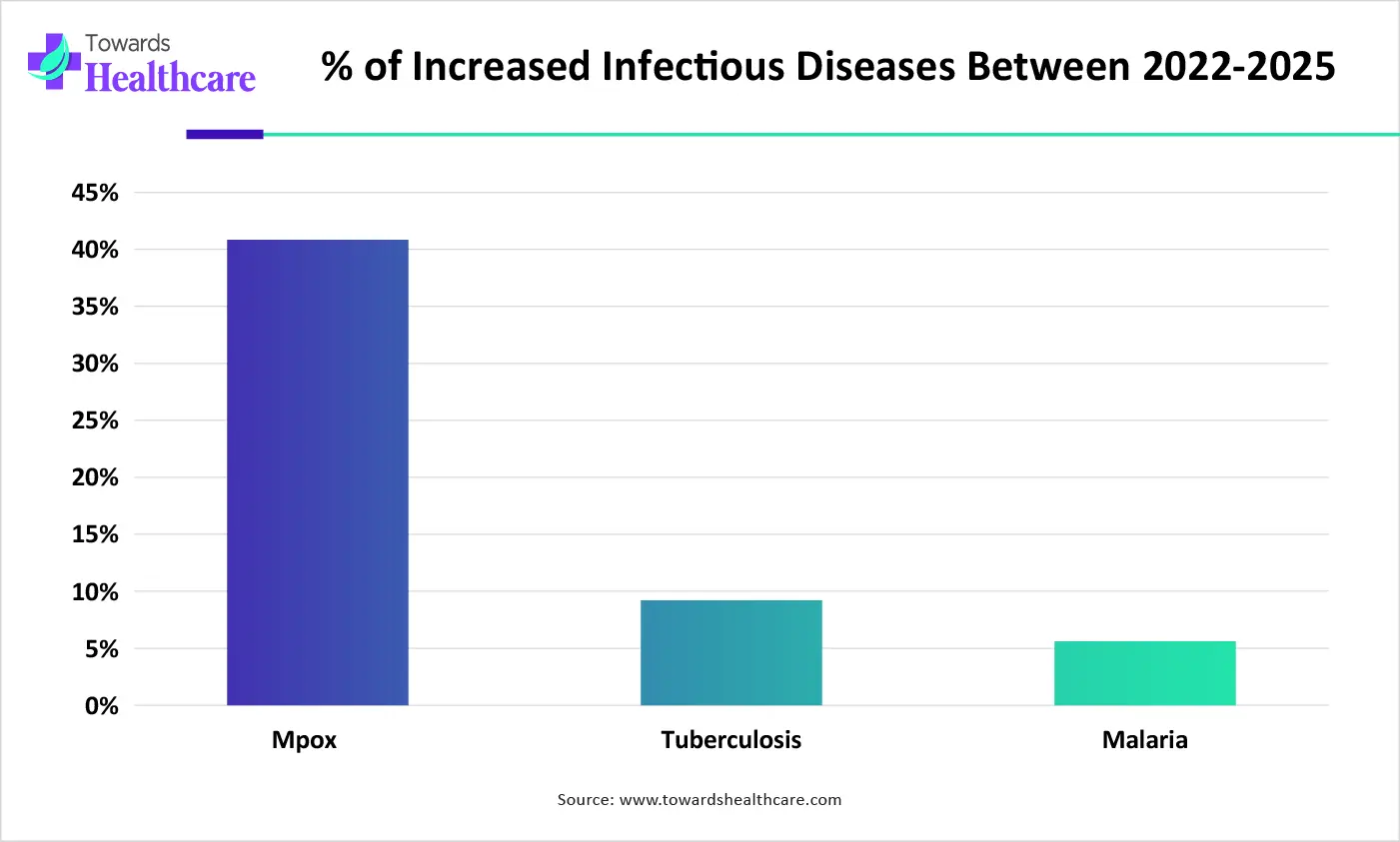

| Diseases | % of Increased Infectious Diseases | In Year |

| Mpox | 41% | 2022-2025 |

| Tuberculosis | 9.3% | 2022-2025 |

| Malaria | 5.6% | 2022-2025 |

How Does the Whole Slide Imaging (WSI) Systems Segment Dominate the Market in 2025?

The whole slide imaging (WSI) system segment dominates the AI in pathology market, accounting for 35% of revenue, because it serves as the foundation for digital and AI-driven diagnostics. WSI enables high-resolution slide digitizations, seamless image sharing, and efficient integration with AI algorithms for automated analysis. Its ability to enhance workflow efficiency, support remote pathology, and improve diagnostic accuracy has made WSI the most widely adopted product type in the market.

Image Analysis Software

The image analysis software segment is expected to grow at the fastest CAGR because AI-driven tools are increasingly essential for automating slide interpretation, improving diagnostic precision, and reducing pathologists' workloads. Growing adoption of digital pathology platforms, rising cancer cases, and demand for real-time analytics are accelerating software uptake. Continuous advancements in machine learning models and integration with cloud-based systems further support the rapid expansion of this segment during the forecast period.

What Made the Cancer Diagnostics / Oncology Segment Dominant in the Market in 2025?

The cancer diagnostics/oncology segment dominates the AI in pathology market in 2025, with a revenue of 45% because oncology generates the highest volume of pathology samples, driving strong demand for AI-enhanced analysis. Rising global cancer cases, the need for faster and more accurate tumor identification, and widespread adoption of digital pathology for precision medicine strengthened its lead. AI tools in oncology also support biomarker detection and treatment planning, further boosting this segment's revenue share.

Research & Drug Discovery

The research & drug discovery segment is expected to grow at the fastest CAGR because pharmaceutical companies and research institutions are increasingly adopting AI-powered pathology tools to accelerate biomarker discovery, streamline clinical trials, and enhance predictive modelling. AI enables rapid analysis of complex tissue data, improving R&D productivity and reducing development timelines. Rising investment in precision medicine and collaborations between AI firms and biopharma further fuel rapid growth in this segment.

How do the Machine Learning Algorithms Segment dominate the Market in 2025?

The machine learning algorithms segment dominated the AI in pathology market in 2025, with a revenue of 40% because these models form the core of most AI pathology systems, enabling reliable pattern recognition, image classification, and quantitative analysis of tissue samples. Their proven accuracy, faster training cycles, and ability to handle large datasets made them the preferred choice for diagnostic applications. Widespread adoption in cancer detection, workflow automation, and clinical decision support further strengthened this segment’s leadership.

Deep Learning / Neural Networks

The deep learning/neural networks segment is expected to grow at the fastest CAGR because these models deliver superior accuracy in complex image interpretation, enabling precise detection of subtle tissue abnormalities. Their ability to process massive datasets, learn intricate patterns, and support advanced applications like mutation prediction and multi-class classification drives rapid adoption. Growing investments in high-performance computing and increasing validation of deep learning tools in clinical workflows further fuel this segment’s expansion.

Why Did the Direct Sales (to Hospitals/Labs) Segment Dominate the Market in 2025?

The direct sales (to hospitals/labs) segment dominated the AI in pathology market, with a revenue of 50% because hospitals and pathology labs prefer purchasing AI and digital pathology systems directly from manufacturers for better customization, technical support, and seamless integration into existing workflows. Direct sales also allow vendors to provide installation, training, and maintenance services, ensuring higher reliability. Growing demand for on-site AI tools and long-term service partnerships further strengthened the dominance of this segment.

Online / Digital Platforms

The online/digital platforms segment is expected to grow at the fastest CAGR because healthcare providers increasingly prefer cloud-based marketplaces and digital portals for easy access to AI pathology software, upgrades, and analytics tools. These platforms offer faster deployment, lower upfront costs, and seamless scalability. Additionally, rising adoption of subscription models, remote workflows, and integration-friendly digital ecosystems is accelerating the shift towards online purchasing and deployment of AI pathology solutions.

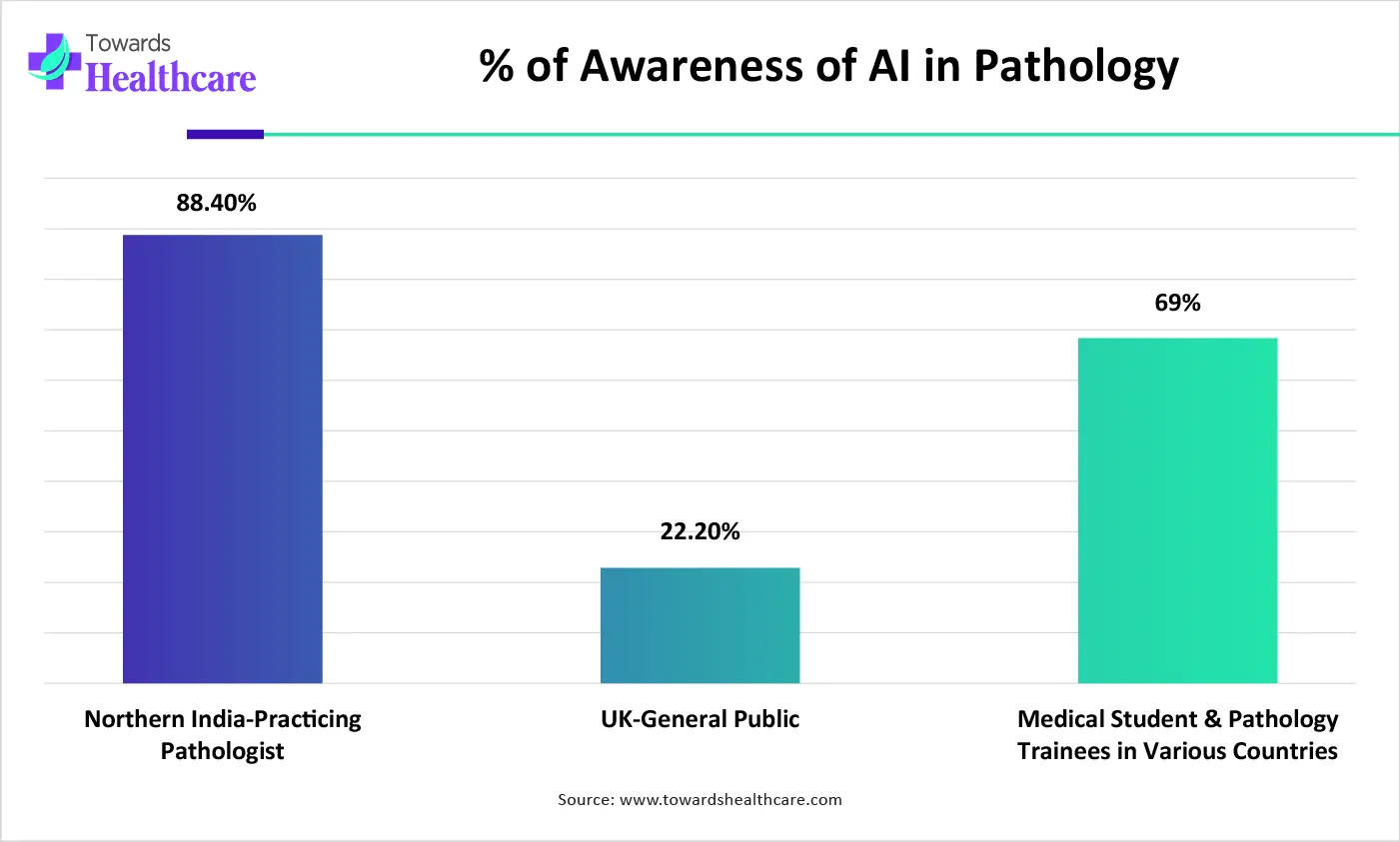

| Region/Population | % of Awareness of AI in Pathology |

| Northern India-Practicing Pathologist | 88.4% |

| UK-General Public | 23.2% |

| Medical Student &Pathology Trainees in Various Countries | 69% |

North America leads the market with a revenue of 35% due to advanced healthcare infrastructure, extensive digital pathology adoption, and strong R&D investment. Supportive regulations, high cancer prevalence, and skilled pathologists enable faster integration of AI tools, enhancing diagnostic accuracy and efficiency. These factors collectively position the region at the forefront of AI-powered pathology solutions.

The AI in pathology market in the Asia Pacific is expected to grow at the fastest CAGR due to rising healthcare investments, increasing cancer prevalence, and expanding digital pathology adoption. Growing awareness of AI benefits, supportive government initiatives, and improving healthcare infrastructure across countries like China, Japan, and India are driving rapid market expansion during the forecast period.

China’s AI in pathology market is growing due to increasing cancer incidence, rising adoption of digital pathology, of significant government support for AI healthcare technologies. Investments in advanced medical infrastructure, expansion of research and diagnostics centers, and growing awareness among hospitals and pathologists are driving rapid integration of AI solutions, boosting market growth in the country.

Europe held a notable share in the AI in pathology market in 2025 and is expected to grow significantly due to advanced healthcare infrastructure, widespread digital pathology adoption, and strong R&D activities. Supportive regulatory frameworks, increasing cancer prevalence, and investments in AI-driven diagnostic tools are driving the region’s steady market expansion.

The UK market is increasing due to rising adoption of digital pathology, growing cancer prevalence, and government support for AI-driven healthcare initiatives. Investments in advanced diagnostic tools, research collaborations, and integration of AI in clinical workflows are enhancing efficiency and accuracy, driving steady market growth across hospitals and pathology laboratories in the country.

| Company | Headquaters | Offerings |

| Roche Diagnostics | Basel, Switzerland | Through its tissuediagnostics arm, Roche provides AI-powered digital pathology systems and integrates third-party AI algorithms for cancer diagnostics, companion diagnostics, and workflow automation. |

| Philips Healthcare | Amsterdam/Netherlands | Offers wholeslide scanners, Image Management System (IMS), digital pathology openplatform, and supports integration with AI tools to enable remote, cloud-based pathology workflows. |

| Leica Biosystems | Nuuloch, Germany | Provides digitalpathology scanners and imagemanagement/analysis systems, enabling labs to digitize slides, a foundation for AI-based pathology workflows. |

| 3D HISTECH | Budapest, Hungary | Offers wholeslide scanners (PANNORAMIC series), digital microscopy, workflow management software imageanalysis solutions supporting both research and diagnostic digital pathology. |

| Hamamatsu Photonic | Japan | Supplies high-resolution imaging/slidescanner hardware and imaging systems; their scanners are used in digitalpathology workflows, enabling slide digitization as a prerequisite for AI/image analysis. |

| Inspirata | Tampa, Florida | Offers digital pathology workflow and management solutions, facilitating AI-enabled image analysis and pathology lab interoperability (as part of the wider market’s AI ecosystem). |

| Proscia | Philadelphia, USA | Provides the Concentriq® platform a cloud-native digital pathology platform with AI-powered image analysis, slide management, and support for labs, research, and pharma, enabling scalable AI pathology workflows. |

| PathAI | Boston, USA | Develops AI-powered diagnostic algorithms (tumor detection, grading, biomarker analysis), and offers AISight® image management system for labs and biopharma; collaborates with major diagnostics players to integrate AI into pathology workflows. |

| Paige | New York, USA | Provides AI pathology software (e.g., for cancer detection, biopsy triage) tools, including Constellation™ and Page.AI, helping pathologists flag suspicious regions and quantify tumor features. |

| Ibex Medical Analytics | Tel Aviv, Israel | Offers AI-driven diagnostic tools for cancer and histopathology; these tools are used in clinical labs and integrate with scanners/platforms. |

By Product Type

By Application

By Technology / Mode of Action

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026