March 2026

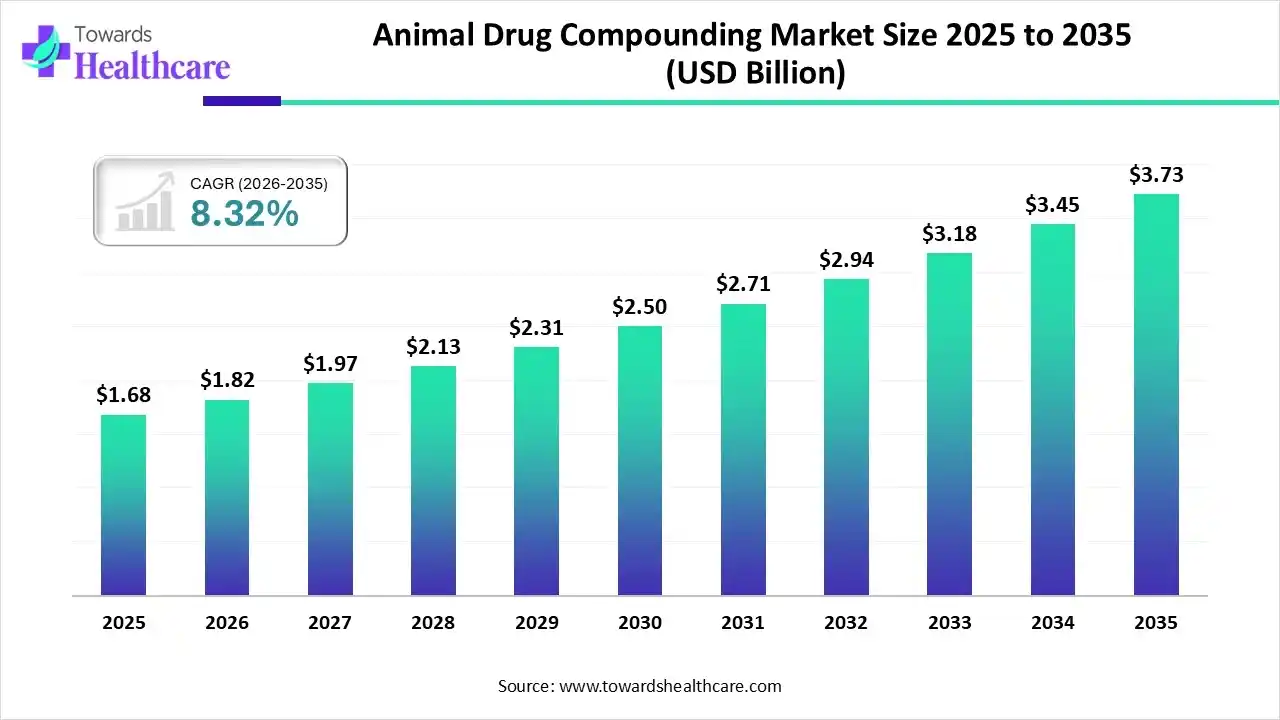

The global animal drug compounding market size was estimated at USD 1.68 billion in 2025 and is predicted to increase from USD 1.82 billion in 2026 to approximately USD 3.73 billion by 2035, expanding at a CAGR of 8.32% from 2026 to 2035.

The current era is facing a huge rise in several infectious conditions among animals, which bolsters demand for innovative, customized medications. Also, regions are emphasizing revolutions in animal wellness through the adoption of advanced telemedicine and online pharmacy solutions.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.82 Billion |

| Projected Market Size in 2035 | USD 3.73 Billion |

| CAGR (2026 - 2035) | 8.32% |

| Leading Region | North America |

| Market Segmentation | By Product, By Animal Type, By Route of Administration, By Dosage Form, By Region |

| Top Key Players | WEDGEWOOD PHARMACY, Vimian, Pharmaca, Akina Animal Health, Triangle Compounding |

The global animal drug compounding market refers to the adoption of tailored therapeutics for animals, which are developed by mixing, altering, or combining ingredients, and should meet extensive compliance guidelines. Moreover, the global market is fueled by a rise in the number of pets & raised pet humanization, which results in demand for human-like care. However, ongoing progression includes the expansion of Mixlab's physical footprint through novel lab acquisitions, providing rapid shipping and more reliable nationwide access to compounded drugs.

Revolutionary efforts in the market are exploring new projects, such as the Virtual Second Species project and other machine-learning-aided multi-scale modeling landscapes (MLMMF), which have designed virtual dog models to estimate toxicological endpoints and examine drug safety without live animals. Alongside, various AI models have been employed to develop personalized drug formulations for over 224 species, especially companion animals, horses, and exotics.

The market is emphasizing "feline-friendly" and "canine-friendly" alternatives, like flavored transdermal gels and chewable treats, which enhance owner compliance and lower animal stress.

Firms are executing advanced online veterinary pharmacies and telehealth platforms, which are further united with compounding labs to offer direct-to-home shipping of customized medications, mainly for remote or underserved areas.

Researchers will step towards the exploration of new, advanced quality control protocols and extensive documentation to ensure the safety, potency, and consistency of compounded products, which highlights issues raised by regulatory bodies, especially the FDA.

Which Product Dominated the Animal Drug Compounding Market in 2025?

In 2025, the CNS agents segment captured the biggest share of the market. Expanding awareness regarding neurological/behavioral conditions, such as anxiety, epilepsy, pain, and diversity of these agents, including anticonvulsants, anxiolytics, analgesics, sedatives, and antidepressants are propelling the segmental growth. The market is focusing on developing flavored oral oil suspensions, chewable tablets, and transdermal gels/patches for CNS agents, which makes easy administration for pet owners and reduces stress on animals.

Hormones & Substitutes

Whereas, the hormones & substitutes segment is anticipated to expand rapidly. These products are acquiring attention among veterinary practitioners for their distinguished potency and effectiveness in hormonal replacement therapy. Also, they have a vital role in treating endocrine disorders, like hyperthyroidism in cats & for reproductive management. The year had widened compounded altrenogest for estrus suppression and pregnancy support in horses, coupled with diverse vitamin-hormone supplements for livestock reproductive health.

How did the Companion Animal Segment Lead the Market in 2025?

The companion animal segment was dominant in the animal drug compounding market in 2025 & will expand fastest. The raised adoption of compounding facilitates customized doses, flavors, such as fish for cats, beef for dogs, and forms, like gels, liquids for easier administration, with optimized compliance. The globe is putting efforts into the rising use of semi-solid extrusion (SSE) 3D printing to design chewable, precisely-dosed tablets for veterinary clinic preparation.

Why did the Oral Segment Dominate the Market in 2025?

In 2025, the oral segment held the largest revenue share of the market. More specifically, this route provides ease, non-invasiveness, and greater compliance for both pets and livestock. The latest solutions comprise oral transmucosal gels, which are an option for animals that resist swallowing drugs, with enhanced absorption for specific drugs, particularly compounded buprenorphine. Day by day, pharmacies are widely using automated mixing systems and cloud-based prescription platforms to accelerate the precision and accuracy of dosing in oral therapeutics.

Topical

In the future, the topical segment is predicted to witness the fastest expansion. Owners and practitioners are highly using creams, gels, and sprays to treat localized conditions, specifically infections, wounds, parasites, like fleas, ticks, mites, and dermatitis. However, transdermal gels/patches are broadly adopted as pain relievers or anti-anxiety meds. Nowadays, the market is implementing advanced nanotechnology, particularly nanogels and liposomes, to boost topical delivery by raising drug penetration, offering controlled release, and also enabling targeted action.

How did the Suspensions Segment Lead the Market in 2025?

In 2025, the suspensions segment registered dominance in the animal drug compounding market. This dosage form is highly suitable for pediatric, geriatric, and exotic animals, as they offer accurate dosing and can mask unpleasant tastes, with crucially improved compliance in pets compared to solid forms. Researchers are working on long-acting injectable suspensions, often using oil-based vehicles or depot systems, which emphasize maintaining therapeutic levels over extended periods.

Solutions

The solutions segment is estimated to expand rapidly. They have prominent benefits over the other forms, such as quicker absorption, ease of administration, accurate dosing, and expanded stability. A recent development covers the launch of a patented injectable omeprazole solution for equine gastric ulcers developed by Epicur Pharma and Bova as an innovative administration route for horses. Recently, FDA-approved Otiserene, a single-dose, long-acting otic suspension that acts as a liquid for application but remains in the ear for sustained therapy.

North America registered dominance in the animal drug compounding market in 2025, due to the increasing pet ownership, wider emphasis on animal wellness, and robust veterinary infrastructure. As of late 2025, Health Canada is guiding on "Agile Licensing" regulations, which enable terms and conditions (T&Cs) for all drugs, comprising veterinary products, to highlight extensive evidence for debilitating concerns.

U.S. Market Trends

The U.S. dominated the market with a major share in 2025. This is led by the ongoing FDA upgradation to its "List of Bulk Drug Substances for Compounding Office Stock Drugs" under Guidance for Industry (GFI) #256, which allows application discretion for specific drugs required for urgent care.

Asia Pacific is anticipated to show the fastest growth in the market, as the region is spurring specialized veterinary clinics and compounding pharmacies in countries, mainly in China and India. Alongside, the region is fostering AI-assisted dose-form personalization, which lowers formulation cycle times. Recently, My Compounding, a Brisbane-based pharmacy, broadened its operations nationwide to offer bespoke veterinary compounding, like transdermal gels and allergy-friendly formulas across substantial Australian cities to find hard-to-treat cases in domestic pets and livestock.

China Market Trends

In China, the animal drug compounding market is predicted to expand rapidly, as recently the Ministry of Agriculture and Rural Affairs (MARA) executed stringent veterinary drug registration guidelines that demand comprehensive, accurate data for novel products. This also further encompasses on-site inspections for non-compliant applications to ensure data authenticity and raised manufacturing standards.

Europe is experiencing a notable growth in the market, as the region is shifting towards combating antimicrobial resistance (AMR) by enforcing new regulations and stricter restrictions on the preventative use of antimicrobials. Recently, all antiparasitics in Ireland need a veterinary prescription, moving them from over-the-counter status.

UK Market Trends

Recently, in the UK, a novel UK-wide licensing regime for human medicines was developed, but a two-tier system for veterinary medicinal products remains. Whereas the VMD facilitated rigorous guidance for the supply of veterinary medicines to Northern Ireland to ensure continued access.

| Company | Description |

| WEDGEWOOD PHARMACY | It specifically offers diverse animal drug compounding, which develops flavored suspensions, chewable treats, tiny tablets, and transdermal gels. |

| Vimian | A firm specializes in medications, such as flavors, injections, capsules, transdermals, from pure powders or discontinued drugs for particular animal needs |

| Pharmaca. | This facilitates tailored medications for different animals in collaboration with veterinarians. |

| Akina Animal Health | It focuses on providing solutions, suspensions, transdermal gels, like creams for skin application, and more |

| Triangle Compounding | This involves implementing variations in flavors, forms, and dosages to meet specific pet needs, mainly for dogs, cats, birds, and other animals. |

By Product

By Animal Type

By Route of Administration

By Dosage Form

By Region

March 2026

February 2026

February 2026

February 2026