February 2026

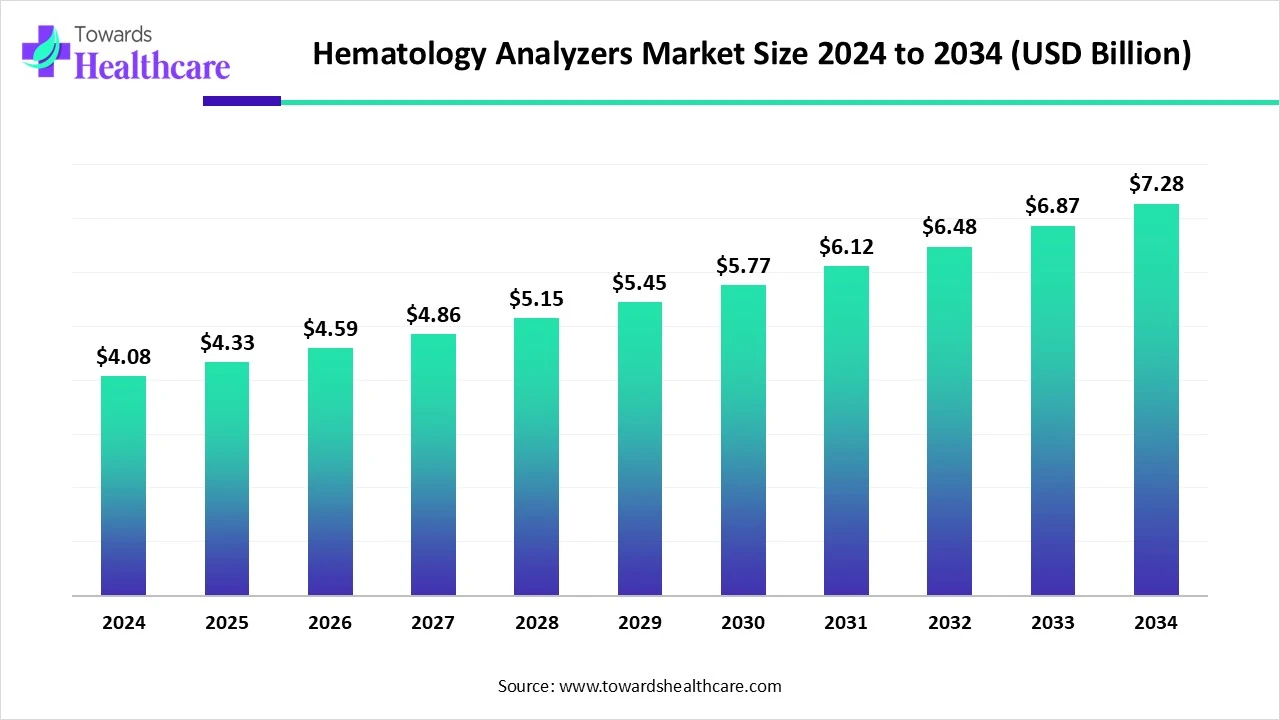

The global hematology analyzers market size is calculated at US$ 4.08 in 2024, grew to US$ 4.33 billion in 2025, and is projected to reach around US$ 7.28 billion by 2034. The market is expanding at a CAGR of 5.97% between 2025 and 2034.

Accelerating the growth of the global hematology analyzers market is fueled by increasing cases of blood conditions, including majorly anemia, blood cancers, coagulation disorders, and stem cell issues, along with the increased adoption of advanced diagnostic tools in hospitals and laboratories. These analyzers will provide information related to complete blood count, WBC, and RBC results. Moreover, around the world, the growing adoption of automated high-throughput analyzers, integration with AI/ML, and point-of-care testing (POCT), as well as oncology diagnostics, and preventive health screenings, are boosting the market growth.

| Metric | Details |

| Market Size in 2025 | USD 4.33 Billion |

| Projected Market Size in 2034 | USD 7.28 Billion |

| CAGR (2025 - 2034) | 5.97% |

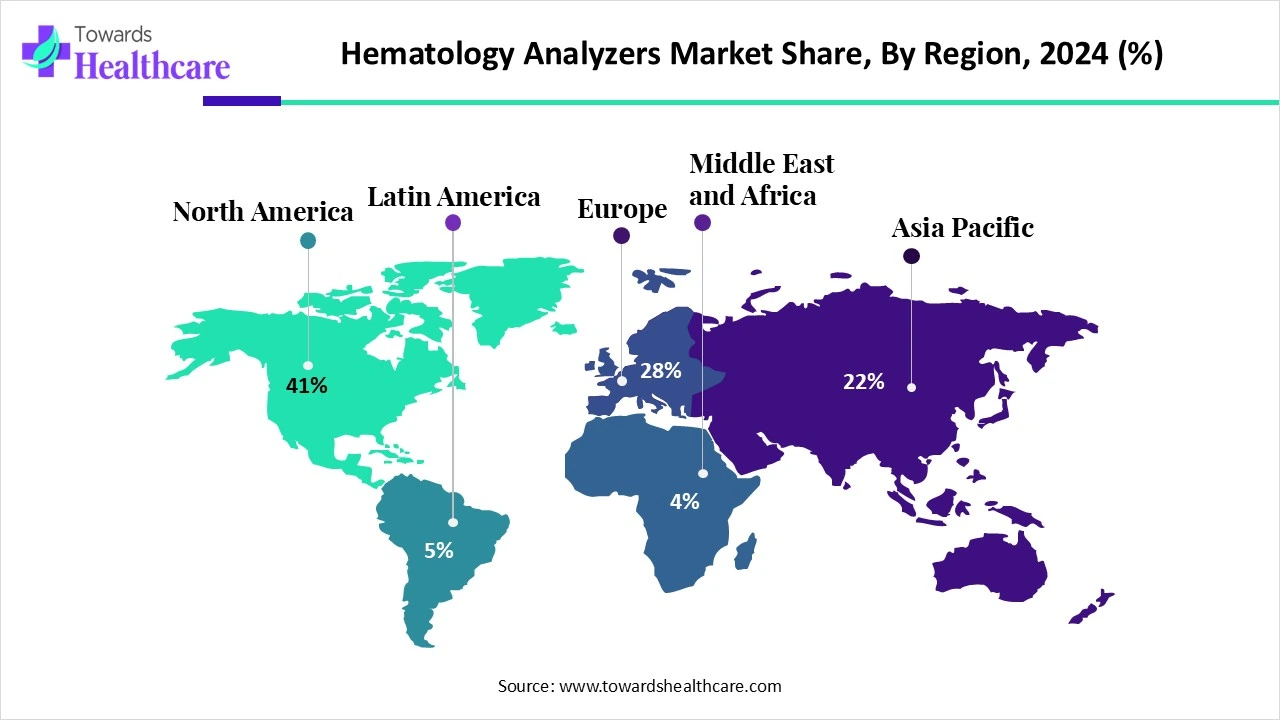

| Leading Region | North America share by 41% |

| Market Segmentation | By Product Type, By Technology, By Application, By End User, By Modality, By Region |

| Top Key Players | Sysmex Corporation, Beckman Coulter (Danaher Corporation), Abbott Laboratories, Siemens Healthineers, Horiba Ltd., Mindray Medical International Limited, Bio-Rad Laboratories, Inc., Roche Diagnostics, Boule Diagnostics AB, Diatron MI Zrt. (Stratec Biomedical), Nihon Kohden Corporation, Ortho Clinical Diagnostics, Drucker Diagnostics, PixCell Medical Technologies, Dymind Biotechnology Co., Ltd., Heska Corporation (veterinary segment), Agappe Diagnostics, Dirui Industrial Co., Ltd., Erba Mannheim (Transasia Bio-Medicals Ltd.), Thermo Fisher Scientific (hematology reagents & kits) |

The hematology analyzers market includes diagnostic equipment used to analyze blood samples and generate complete blood counts (CBC) and other hematological parameters. These devices are essential in clinical laboratories, hospitals, and research settings for diagnosing conditions such as anemia, infections, blood cancers, and coagulation disorders. Technological advancements, including automated high-throughput analyzers, integration with AI/ML, and point-of-care testing (POCT), are driving market growth. The increasing demand from aging populations, oncology diagnostics, and preventive health screenings also contributes to the market’s expansion.

In 2025, raised adoption of technological advancements, including AI, ML, and cloud connectivity, with enhanced automation in hematology analyzers and rising movement towards point-of-care testing, is boosting the throughput, minimizing manual intervention, and reducing human error with an increased accuracy level. As a growing cases of blood disorders require major diagnostic accuracy, streamlining workflows, and enabling personalized medicine by coupling with AI-driven tools.

Rising Blood Disorders and the Adoption of Innovations

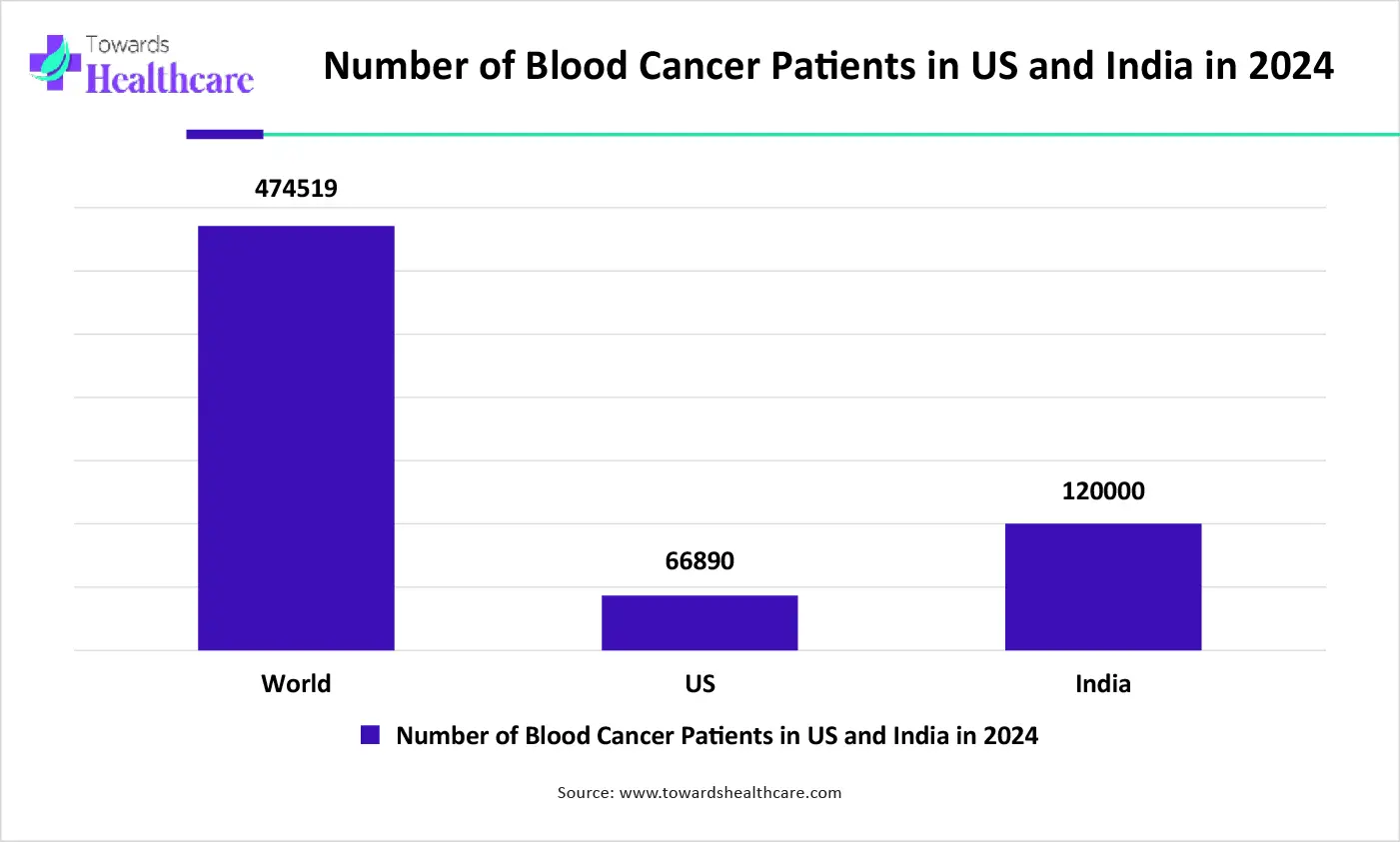

Blood disorders like anemia, leukemia, and coagulation disorders are fueling growth in the number of cases, with accelerating demand for hematology analyzers across the world. As well as increased research and development activities in sectors such as pharmacogenomics, genetic therapies, and stem cell research, along with significant technological breakthroughs with raised diagnostic accuracy and the development of personalized medicine, are driving the expansion of the hematology analyzers market.

High Expenses and a Shortage of Skilled Personnel

The market is facing emerging challenges, including higher initial spending, especially for advanced models in resource-constrained settings and developing countries. Besides this, along with delayed regulatory approvals for new technologies, limited trained and skilled laboratory personnel to operate and maintain these complex instruments are creating a barrier for effective use and adoption in the market.

Escalating Innovations and the Emergence of Home Healthcare

The hematology analyzers market will have enormous opportunities in the upcoming years, such as innovations in microfluidics, lab-on-a-chip technology, and the integration of AI with accelerated sensitivity, accuracy, and automation properties of these analyzers. Whereas, majorly impacting adoption and utilization of telemedicine and remote patient monitoring are raising development in home healthcare. Also, increasing demand for POC hematology analyzers, especially in emergency departments and clinics, is developing new avenues for market growth.

By product type, the 5-part differential hematology analyzers segment led the global hematology analyzers market, due to growing cases of blood conditions and greater demand for highly accurate and detailed blood cell analysis. Primarily, these analyzers provide detailed information on neutrophils, lymphocytes, monocytes, eosinophils, and basophils for diagnosing and managing different diseases.

However, the 6-part and above/high-end analyzers segment is predicted to grow rapidly, with raised demand for more sophisticated analyzers, which enable rapid, more precise, and automated analysis in the modernized globe. Also, expansion of new hospitals and diagnostic labs, particularly in emerging markets, is in high demand for this testing equipment for oncology and specialized testing.

The flow cytometry-based analyzers segment held a ~46% share in the market in 2024. The segment possesses advantages like detailed analysis of individual cells, with more specific data about cell types, and other multiple parameters, such as cell size, granularity, and fluorescence intensity, are propelling the overall market and segment expansion.

Shape, PictureBy technology, the artificial intelligence & machine learning integration segment is estimated to show the fastest growth, due to its major benefits, which include increased diagnostic accuracy, automating data analysis, and improving the efficiency of blood analysis. This will result in minimal human intervention with rapid turnaround times and more accurate disease classification.

By application, the complete blood count (CBC) segment dominated nearly 58% share of the global hematology analyzers market in 2024. Increasing geriatric population with major disorders demanding more frequent blood testing, including CBCs, for early detection and management. Along with this, CBC tests are the basis of routine checkups and pre-surgical assessments.

Mainly, the coagulation & platelet studies segment will show rapid growth is driven by cancer and cardiovascular care, in rising cases of cancer and heart conditions. Besides this, across the globe, growing demand for biological drugs and self-administration is supporting pharmaceutical companies to invest in developing advanced drug delivery systems such as dual-chamber prefilled syringes, which need coagulation testing.

The hospitals segment was dominant in the market, with a major role of hematology analysis in diagnosing various conditions like infections, anemia, and malignancies, allied with the more cases and the requirement for quick, reliable results within hospitals.

The ambulatory surgical centers & physician offices segment will expand at the fastest CAGR during 2025-2034. The major contributing factors are raised POCT, rising adoption in arthroscopy and joint repair in which hematology testing is necessary, with its inexpensive property for numerous procedures, as compared to hospitals, are appealing to patients and healthcare professionals as the best choice.

Shape, PictureBy modality, the standalone hematology analyzers segment dominated the global hematology analyzers market in 2024. The segment is fueled by the growing prevalence of blood disorders, with significant adoption in hospitals and reference labs for their ability to manage a large volume of tests with accuracy and efficiency.

On the other hand, the integrated systems with immunoassay/chemistry platforms segment will grow fastest due to its comprehensive diagnostic will allow a more holistic view of a patient's health, with more precise diagnoses and treatment plans. As well as the increasing demand for automation and efficiency in clinical laboratories will assist in the expansion of the ultimate segment and market growth.

North America is dominated hematology analyzers market share by 41% in 2024 by fueling factors, such as high diagnostic volumes, chronic disease screening, and centralized lab chains. Furthermore, the region has been broadly investing in healthcare infrastructure development, especially in clinical laboratories and research institutes, which is driving the demand for advanced hematology testing solutions.

In the US, the major expansion of the market is driven by continuous advancements in hematology analyzers, such as the development of highly precise and robust instruments and the integration of AI-based systems, along with research and development activities, including areas like pharmacogenomics, genetic therapies, and stem cell research.

For this market,

In Canada, the market is fueled by raised awareness amo ng healthcare professionals about the benefits of using hematology analyzers for prior diagnosis and monitoring of many conditions, contributing to their adoption. Although, Canadian government is encouraging healthcare approachability and infrastructure development is playing a major role in the market growth.

In the upcoming years (2025-2034), Asia Pacific is predicted to grow at the fastest CAGR, as developing countries like India, China, and Southeast Asia are widely investing in healthcare infrastructure. These developed infrastructures will demand an advanced healthcare system with sophisticated equipment, including hematology analyzers. However, developing incidences of anemia, thalassemia, and blood cancers in ASAP are an important driver for the respective market growth.

India is experiencing rapid growth due to boosting cases of anemia, thalassemia, and blood cancers highly particularly in rural areas are demanding advanced technologies like analyzers to accelerate the diagnosis. Whereas, government initiatives like Ayushman Bharat are enhancing awareness about blood diseases and raising demand for diagnostic tools.

For instance,

The market in China is propelled by growing susceptibility to hematological diseases due to a growing geriatric population, along with increased expenditure on the healthcare system and government programs promoting regular blood testing and improved healthcare access.

For instance,

Europe in the hematology analyzers market is facing significant growth, influenced by growing healthcare investments with innovations in technologies, such as the integration of flow cytometry, artificial intelligence, and automation, and increasing preference for point-of-care (POC) testing in outpatient settings, remote areas, and emergencies are boosting demand for easily accessible and consumer-friendly hematology analyzers.

For this market,

The UK’s market is experiencing growth with combined influential factors like raised adoption of early diagnosis, technological developments with automation, and majorly growing awareness about rising blood conditions like anemia, leukemia, and thalassemia.

For instance,

In July 2025, Manchester researcher awarded £300k as Blood Cancer UK launched £70 million strategy. (Source - Bloodcancer)

In Germany, innovations in instruments and systems, like electronic morphology systems, ESR analyzers, and slide-makers with advanced features, are achieving traction, with emphasis on translational research, personalized medicine, and drug development is fueling investments in advanced hematology analyzers within the research community.

For this market,

The latest research on hematology analyzers refers to developing analyzers with enhanced diagnostic accuracy and introducing automation.

Key Players: Abbott Laboratories, Siemens Healthineers, and Sysmex Corporation.

Clinical trials are conducted for novel, innovative, and point-of-care hematology analyzers to assess their safety and efficacy. Regulatory agencies like the FDA, EMA, and NMPA regulate the approval of hematology analyzers.

Key Players: Sight Diagnostics, Essenlix Corporation, RizLab Health, Inc., and Entia Ltd.

Patient support & services include providing high-quality hematology data and training individuals about the usage of analyzers.

By Product Type

By Technology

By Application

By End User

By Modality

By Region

February 2026

February 2026

February 2026

February 2026