February 2026

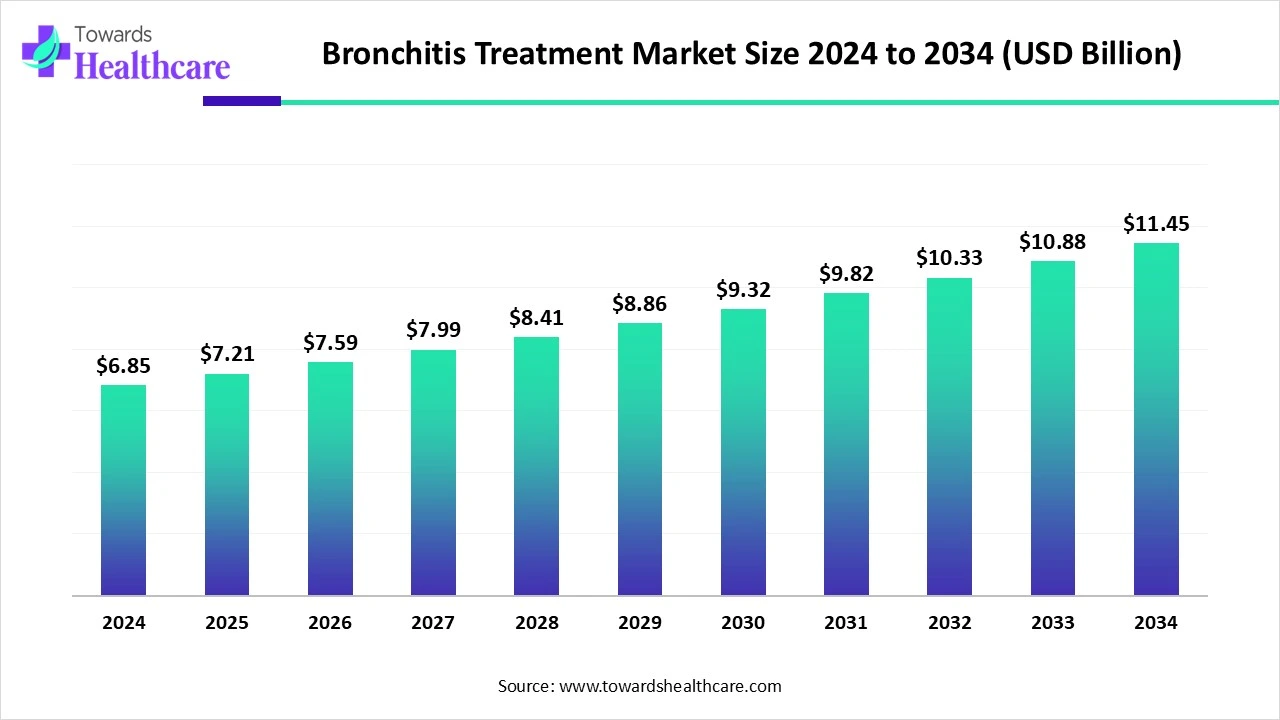

The global bronchitis treatment market size is calculated at US$ 6.85 in 2024, grew to US$ 7.21 billion in 2025, and is projected to reach around US$ 11.45 billion by 2034. The market is expanding at a CAGR of 5.28% between 2025 and 2034.

The global bronchitis treatment market has been expanding with the influence of several factors like both acute and chronic bronchitis prone to COPD cases, developing urbanization with raised smoking, industrial development with chemical emission, and leading to increased air pollution. These factors are widely in demand for bronchitis treatment, including long-acting bronchodilators, robust inhalers. Many opportunities are emerging for the future globe, such as advancements in targeted therapies, nebulizers, inhalers, and other drug formulations with an enhanced drug delivery approach.

| Metric | Details |

| Market Size in 2025 | USD 7.21 Billion |

| Projected Market Size in 2034 | USD 11.45 Billion |

| CAGR (2025 - 2034) | 5.28% |

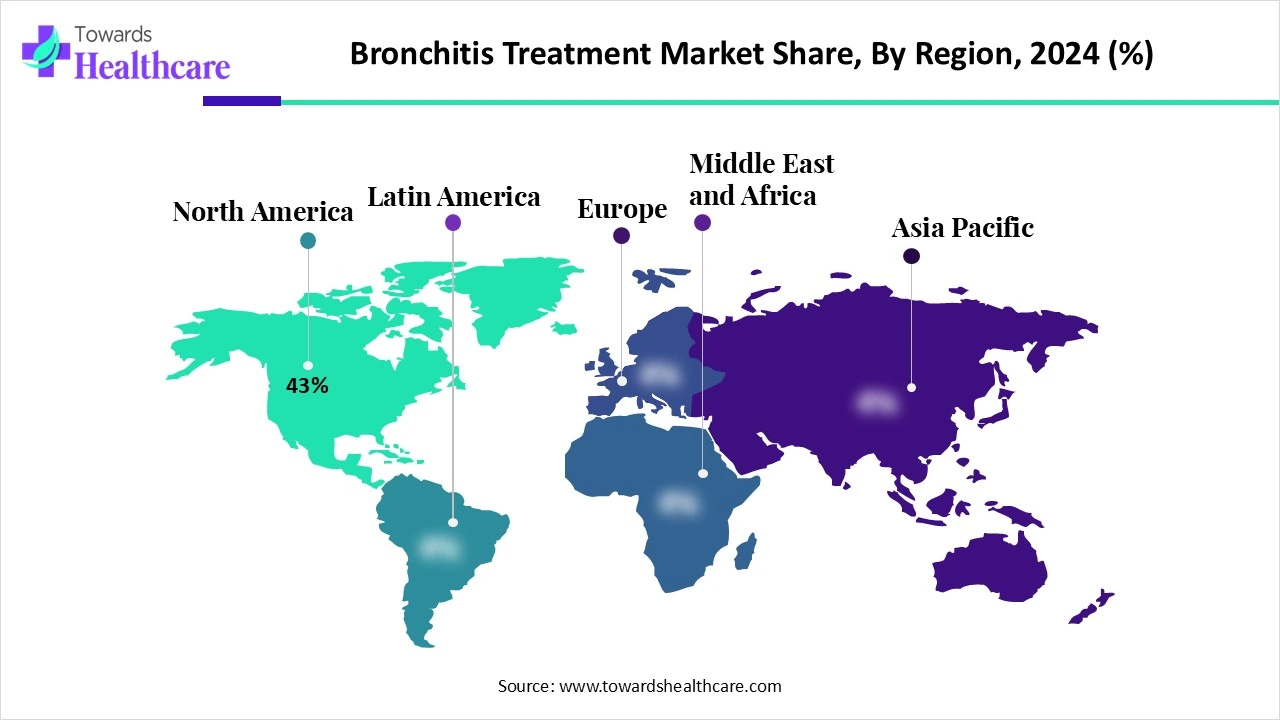

| Leading Region | North America share by 43% |

| Market Segmentation | By Disease Type, By Treatment Type, By Drug Class, By Distribution Channel, By End User, By Region |

| Top Key Players | GlaxoSmithKline plc, AstraZeneca plc, Boehringer Ingelheim GmbH, Teva Pharmaceutical Industries Ltd., Novartis AG, Pfizer Inc., Mylan N.V. (part of Viatris), Sanofi S.A., Cipla Ltd., Sun Pharmaceutical Industries Ltd., Chiesi Farmaceutici S.p.A., Dr. Reddy’s Laboratories, Zambon S.p.A., Merck & Co., Inc., Vertex Pharmaceuticals Inc., Lupin Pharmaceuticals, Glenmark Pharmaceuticals, Aurobindo Pharma Ltd., Otsuka Pharmaceutical Co., Ltd., Viatris Inc. |

The bronchitis treatment market comprises pharmaceutical, supportive care, and preventive therapies used to manage acute and chronic bronchitis, an inflammatory condition of the bronchial tubes that causes coughing, mucus production, and respiratory discomfort. Acute bronchitis is often viral and self-limiting, while chronic bronchitis, a key form of chronic obstructive pulmonary disease (COPD), requires long-term treatment. The market is driven by air pollution, smoking, respiratory infections, and the rising prevalence of chronic respiratory disorders, particularly among aging populations. Recently, this treatment has focused on an innovative minimally invasive procedure for chronic bronchitis called RejuvenAir® metered cryospray.

In 2025, AI algorithms are broadly employed in bronchitis conditions to analyze medical images (like chest X-rays) and patient data to optimize the precision and pace of the diagnosis with enabling differentiation from other respiratory conditions. Besides this, AI helps to represent predictive modeling by identifying high-risk individuals, allowing proactive interventions and public health responses. Moreover, for the development of personalized treatment, AI uses genetic information, medical history, and treatment responses to increase strategies for the most efficient treatment.

Growing COPD Cases and Public Awareness

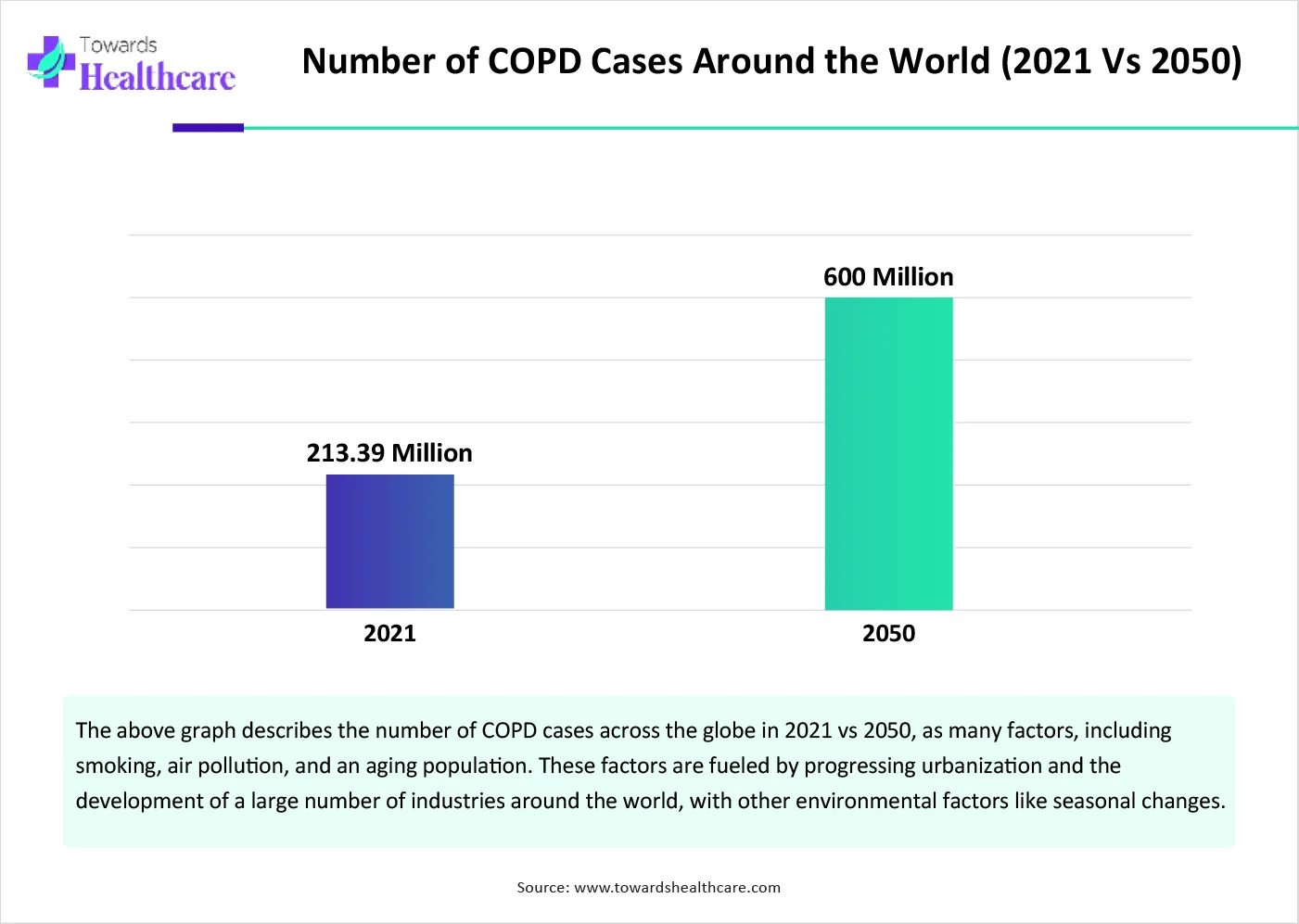

The major drivers in the bronchitis treatment market are increased incidences of both acute and chronic bronchitis, especially in COPD, fueled by factors like smoking, air pollution, and an aging population. Along with this, governments and healthcare organizations are emphasizing public awareness about bronchitis and its management with rising expenditure on healthcare, including respiratory illnesses such as bronchitis, which propels market growth.

Delayed Diagnosis and Antibiotic Resistance

As in bronchitis, early and accurate detection plays a crucial role; sometimes symptoms can lead to delayed diagnosis or misdiagnosis, ultimately affecting to results and probably raise an unessential use of drugs. Also, in some cases, overuse and misuse of antibiotics may generate antibiotic resistance, which develops challenges to treat bacterial infection linked with bronchitis.

Advancements in Novel Therapies and Accelerating Digitalization

In the bronchitis treatment market, numerous opportunities are rising, including the development and utilization of novel inhalation devices and drug formulations with a focus on target-specific pathways or mechanisms in bronchitis. Furthermore, in the upcoming generation, grasping digitalization approaches such as telehealth platforms for remote diagnosis, monitoring, and patient involvement, to escalate access to care and treatment adoption.

By disease type, the acute bronchitis segment led the bronchitis treatment market in 2024, due to contributing factors like rising air pollution, environmental factors including season changes, as well as increasing habituation of smoking in the growing population. Along with this, the increasing geriatric population is highly prone to the development of acute bronchitis conditions are fueling demand for effective bronchitis treatments.

However, the chronic bronchitis (COPD-related) segment is predicted to grow rapidly in the studied years. The segment is driven by accelerating tobacco consumption, rising occupational hazards like dust, fumes, and chemicals in certain industries, as well as other factors, including age, genetics, respiratory infections during childhood, and conditions like asthma and sleep apnea.

The drug therapy segment was dominant with 66% revenue share in 2024. Increasing prevalence of bronchitis, COPD, and smoking, particularly in urban areas, is majorly fueling demand for this segment. Also, these drug therapies enable symptom management such as cough, inflammation, and mucus production, by providing combined inhalers like bronchodilators and corticosteroids, and mucolytics, are support overall market growth.

By treatment type, the pulmonary rehabilitation segment is seen to grow fastest, due to its efficiency in enhancing exercise capacity, decreasing dyspnea, boosting psychological well-being, and lowering healthcare utilization. Moreover, their programs encompass exercise training, education, and self-management interventions, which are significant for managing chronic respiratory diseases and promoting long-term health-enhancing behaviors.

By drug class, the bronchodilators segment held a 34% in the global bronchitis treatment market in 2024. Specific bronchodilators such as short-acting beta-2 agonists, inhaled corticosteroids, and long-acting beta-2 agonists are widely employed in increasing incidences of acute and COPD bronchitis, with raised efficacy, safety, and reduced side effects, are ultimately impact the segment expansion.

And the anti-inflammatories segment is anticipated to show the fastest growth, due to the rising burden of both acute and chronic bronchitis with COPD, and enhanced morbidity and mortality rates. Whereas, this class of drug provides a combination therapy including bronchodilators and mucolytics, further boosting demand within the overall market.

By distribution channel, the retail pharmacies segment captured a major share of the market in 2024. The segment is fueled by its convenient access to a range of over-the-counter (OTC) drugs, such as cough suppressants (dextromethorphan), expectorants (guaifenesin), and pain relievers (ibuprofen, acetaminophen), which are highly used to treat bronchitis.

On the other hand, the online pharmacies segment is estimated to grow fastest with its major advantages like convenience, accessibility, and the raised adoption of digital healthcare, especially among younger demographics and COVID-era trends. As well as these pharmacies allow cost-effective shopping with protected privacy and confidentiality about sensitive cases is accelerating its adoption over the globe.

The hospitals & clinics segment dominated the market, due to the availability of advanced treatments, particularly personalized medicines and advanced therapies, which have assisted in accelerating bronchitis cases. Apart from this, hospitals and clinics possess developed diagnostic tools and approaches that are supporting to differentiating between acute and chronic bronchitis, guiding accurate treatment strategies within healthcare facilities.

Moreover, the homecare settings segment is estimated to expand rapidly during the forecast period. Widely beneficial for the geriatric population with major bronchitis conditions, with ease of operation in remote mode, along with technological innovations in respiratory devices, including nebulizers and pulse oximeters, are making it more accessible and effective to manage bronchitis symptoms at home.

North America dominated the global bronchitis treatment market share by 43% in 2024, due to driven by growing high COPD prevalence, advanced diagnostic capabilities, and widespread use of combination inhalers, with raised demand for effective treatment. As well as, this region’s governments and private sectors are actively encouraging major investments in healthcare, including bronchitis treatments is driving the market growth.

In the US, significantly contributing factors are a growing aging population with respiratory diseases like asthma and bronchitis, with an accelerating focus on the development of the healthcare systems.

For instance,

Canada’s government is stepping towards initiatives like public health campaigns and programs focused on accelerating awareness about respiratory health and promoting early diagnosis and treatment of bronchitis. As well as, adoption of digital healthcare, such as telemedicine, is propelling the market growth in this region.

For this market,

In the upcoming era, the Asia Pacific is estimated to grow at a rapid CAGR in the global bronchitis treatment market, due to developing countries like China and India are experiencing major urbanization, including the development of a large number of industries with generating huge air pollution by hazardous chemical emissions. Besides this, another concern is the growing population, which includes more geriatric people who are highly prone to the emergence of respiratory diseases like bronchitis are widely adopting or need effective bronchitis treatment is ultimately expanding the market.

Along with an aging population, air pollution and smoking, rising diagnoses, and awareness about bronchitis and its symptoms are boosting the market growth in India. Also, the environmental factors like seasonal changes are developing various respiratory concerns are raising demand for efficient treatment.

For this market,

China has been experiencing major growth due to a significant population of smokers who are facing risks of developing bronchitis and COPD (Chronic Obstructive Pulmonary Disease), resulting in an enormous demand for treatment. Although consumers are highly adopting OTC medications with enhanced awareness about respiratory health is accelerating the demand for cough and bronchitis treatment.

For instance,

Primarily, Europe is facing a significant growth in the market, with escalating cases of COPD derived from chronic bronchitis are immensely demanding for bronchitis treatment, resulting in market growth. Besides this, European governments and private firms are mainly investing in healthcare systems to boost the awareness and adoption of novel respiratory treatments among the people.

The UK, with advanced healthcare infrastructures possessing well-developed facilities like advanced diagnostic tools and medical devices, is boosting the market growth. Additionally, continuous R&D activities for novel and optimized respiratory therapies for bronchitis are also generating chances of market expansion.

For this market,

The French healthcare system is widely covering and focusing on respiratory disease management, as well as raising breakthroughs in drug formulations, such as cough remedies, combination therapies, and marketing strategies by pharmaceutical companies also play a crucial role in market expansion.

By Disease Type

By Treatment Type

By Drug Class

By Distribution Channel

By End User

By Region

February 2026

January 2026

January 2026

January 2026