February 2026

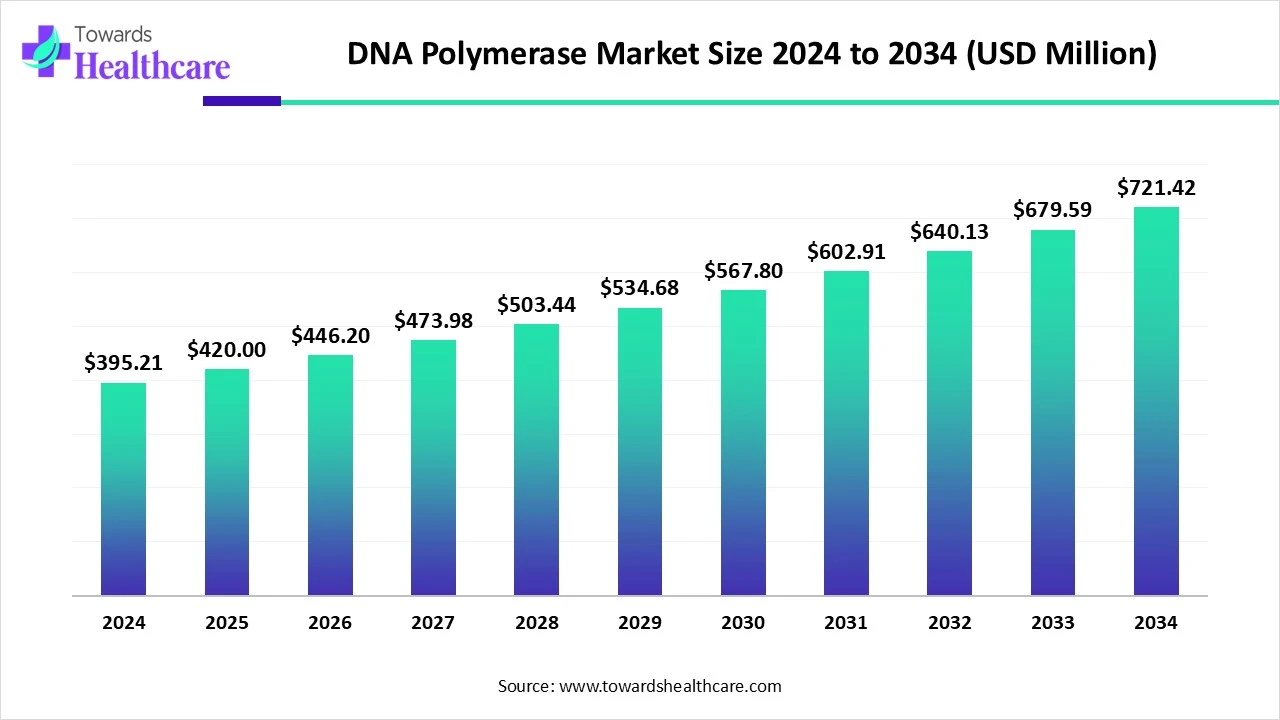

The global DNA polymerase market size is calculated at US$ 419.87 million in 2025, grew to US$ 446.07 million in 2026, and is projected to reach around US$ 769.12 million by 2035. The market is expanding at a CAGR of 6.24% between 2026 and 2035.

DNA polymerase is being widely used in clinical diagnostics, forensics, genetic engineering, and life sciences research. This, in turn, is increasing their use in industries as well as institutes, leading to new partnerships, launches, and projects. Moreover, to enhance its application, reduce errors, and develop new diagnostic platforms, the use of AI is also increasing. Thus, its use in various regions is increasing due to an advancing diagnostic ecosystem, industrial expansion, and research. Hence, all these factors are promoting the market growth.

| Metric | Details |

| Market Size in 2026 | USD 446.07 Million |

| Projected Market Size in 2035 | USD 769.12 Million |

| CAGR (2026 - 2035) | 6.24% |

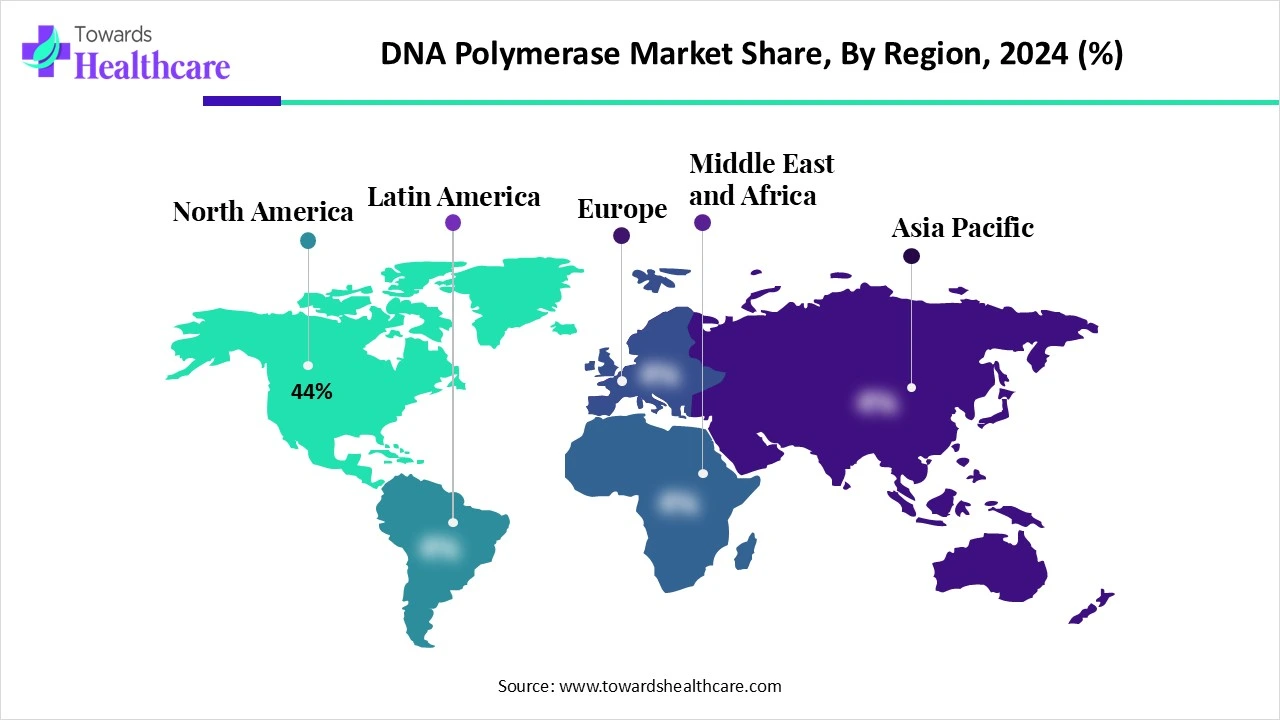

| Leading Region | North America share by 44% |

| Market Segmentation | By Type, By Application, By End User, By Format, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., New England Biolabs (NEB), QIAGEN N.V., F. Hoffmann-La Roche Ltd., Takara Bio Inc., Agilent Technologies, Inc., Promega Corporation, Merck KGaA (Sigma-Aldrich), Bioneer Corporation, Bio-Rad Laboratories, Inc., Lucigen Corporation (now part of LGC Biosearch Technologies), Enzymatics (acquired by QIAGEN), Zymo Research Corporation, Jena Bioscience GmbH, GenoVision Inc., Toyobo Co., Ltd., Vazyme Biotech Co., Ltd., ABclonal Technology, GenScript Biotech Corporation, Norgen Biotek Corp. |

The DNA polymerase market refers to the global demand and supply of DNA polymerase enzymes used in molecular biology for DNA replication, amplification (PCR), repair, and sequencing. DNA polymerases are crucial tools in clinical diagnostics, forensics, genetic engineering, and life sciences research. Thus, due to their innate ability of DNA strands with accuracy, their use is increasing in a wide range of biotechnological processes. The market is fueled by increasing adoption of PCR-based diagnostics, next-generation sequencing (NGS), genetic testing, and biotechnology R&D. Innovations in high-fidelity enzymes, hot-start polymerases, and proofreading variants are driving both research and commercial application growth.

The use of AI in the market is increasing for predicting the DNA polymerase structure and functional relationships. This, in turn, helps in enhancing the DNA sequencing. The accuracy as well as efficiency of PCR techniques is also being enhanced with the use of AI and machine learning algorithms. It also helps in providing insights for specific applications of DNA polymerases. Moreover, the optimization and monitoring of these processes can be improved with the use of AI. Furthermore, various platforms with improved accuracy, performance, and reduced errors are being developed.

Rising Demand for Diagnostic Applications

The growing diseases are increasing the demand for the use of diagnostic techniques, which in turn, is increasing the demand for DNA polymerase. With the use of DNA polymerase, the accuracy and sensitivity of diagnostic tests can be enhanced, resulting in early detection of diseases. At the same time, the growing use of molecular diagnostics and at-home testing is also contributing to the same due to their ease of handling and fast results. Thus, all these factors are driving the DNA polymerase market growth.

Complex Developmental Process

For the development of DNA polymerase, a deep knowledge of molecular biology, protein engineering, etc, is required. This increases the need for expertise, as well as sophisticated instruments. Moreover, they should meet the regulatory standard, which may make the developmental process more time-consuming and costly. This may reduce the use of DNA polymerase.

Advances in PCR Techniques

The use of PCR techniques is increasing for the early detection of various diseases. This, in turn, is increasing the innovations to enhance its applications, speed, as well as accuracy with the help of DNA polymerase. Moreover, next-generation DNA polymerases are being used to develop advanced PCR techniques for food safety testing and clinical diagnostics. Furthermore, the PCR techniques are being integrated with advanced technologies to enhance their performance, reduce errors, and make them portable. Thus, this promotes the DNA polymerase market growth.

For instance,

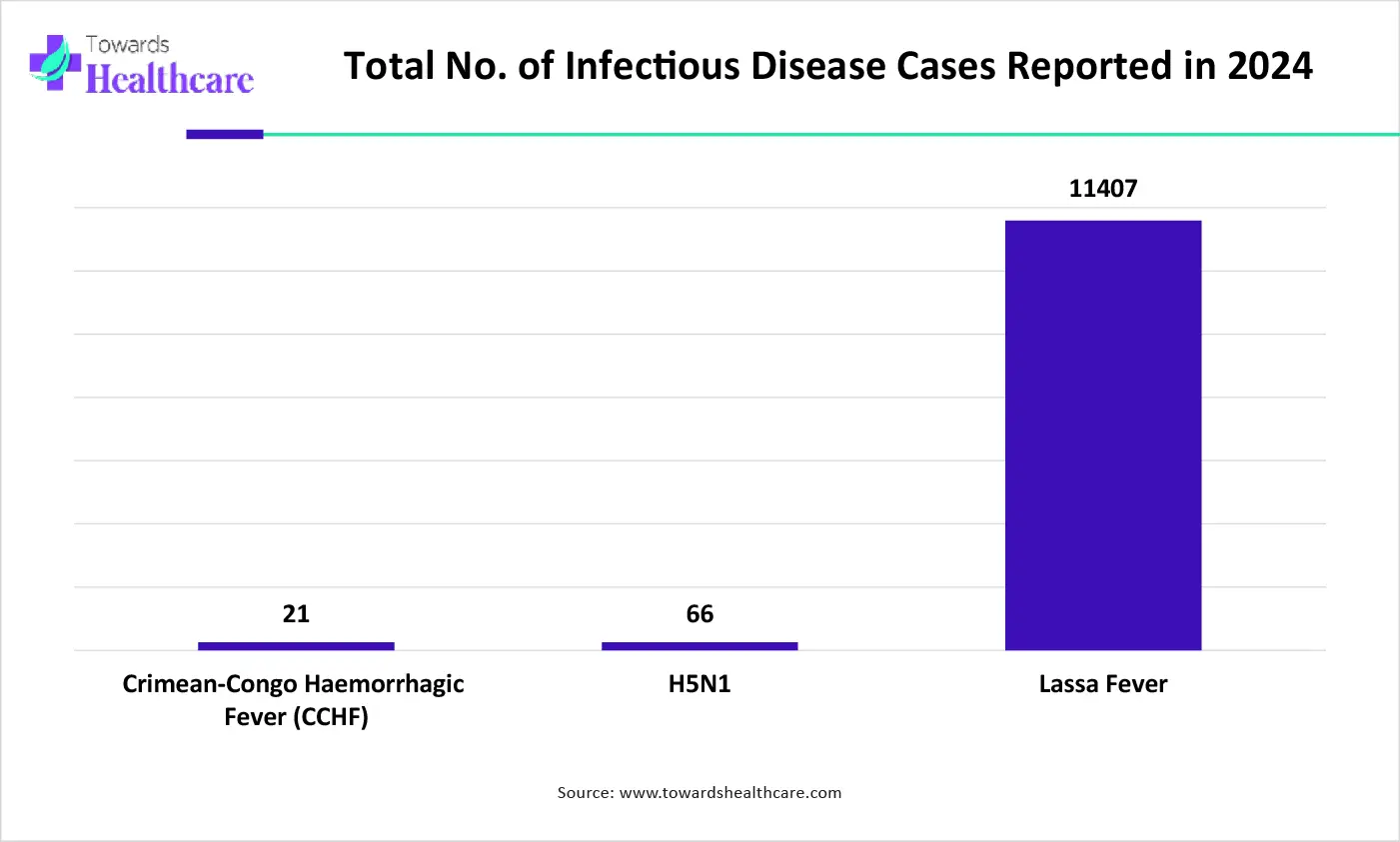

The graph represents the total number of infectious disease cases reported in year of 2024. It indicates that different types of infectious diseases are rising. Hence, it increases the demand for innovative PCR techniques for the early diagnosis and effective management of these diseases. Thus, this in turn will ultimately promote the market growth.

By type, the Taq DNA polymerase segment led the market with a 41% share in 2024. The Taq DNA polymerase was used in the development of PCR techniques. Moreover, it was affordable and showed faster amplification. Thus, this increased its use and contributed to the market growth.

By type, the high-fidelity DNA polymerase segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. The use of high-fidelity DNA polymerase is increasing in the development of NGS and gene editing. Additionally, it provided accurate results and is easily accessible.

By application type, the PCR (polymerase chain reaction) segment held the dominating share of the market with 55% in 2024. The DNA polymerase was a crucial component in the PCR technique. Moreover, it was used in the detection of various diseases as well as for food safety testing and forensic applications. Thus, this enhanced the market growth.

By application type, the DNA sequencing segment is expected to show the highest growth during the predicted time. DNA sequencing is increasing due to the growing use of NGS. At the same time, it is also being used in the detection of rare diseases and cancer. Additionally, various new developments are also being conducted to enhance its use.

By end user, the academic & research institutes segment held a held the largest share of 46% in the market in 2024. The use of DNA polymerase in academic & research institutes increased due to a rise in the research conducted. This increased its consumption. Moreover, this research was encouraged by the funding provided by the government.

By end user, the pharmaceutical & biotechnology companies segment is expected to show the fastest growth rate during the upcoming years. For the development of various diagnostic and treatment approaches, the use of DNA polymerase is increasing in pharmaceutical & biotechnology companies. Moreover, they are driven by regulatory bodies and advanced technologies to promote their safe and effective use with reduced errors.

By format type, the master mixes (ready-to-use kits) segment led the market with 52% share in 2024. The master mixes helped in minimizing the time as well as the errors during the production. Moreover, accurate and fast results were obtained, which increases their use in diagnostic applications. Thus, this promoted the market growth.

By format type, the lyophilized/stable formulations segment is expected to show the highest growth during the upcoming years. The use of lyophilized/stable formulations is increasing in POC applications. Furthermore, due to their improved stability, they are being widely used in the development of various portable diagnostic kits.

North America dominated the DNA polymerase market share by 44% in 2024. North America consisted of well-developed industries as well as institutes, which contributed to the development and use of innovative molecular diagnostics. At the same time, other testing techniques were also developed by using DNA polymerase. This contributed to the market growth.

The U.S. industries are increasing the use of DNA polymerase to develop various diagnostic applications. Moreover, they are mostly being used in the next-generation sequencing (NGS) techniques. The use of advanced technologies is further accelerating their development and production.

The growing genomic research and development in Canada is increasing the use of DNA polymerase. This, in turn, is increasing the collaborations among the industries as well as institutions. Furthermore, these are supported by the funding provided by the government, enhancing this research and promoting its adoption.

Asia Pacific is expected to host the fastest-growing DNA polymerase market during the forecast period. The industries in Asia Pacific are expanding along with the utilization of advanced technologies. Moreover, the growing research and development are also contributing to the same. Thus, this enhances the market growth.

The rising diseases in China are increasing the use of DNA polymerase to develop new diagnostic applications. At the same time, the growing research in health genomics is also increasing its use. Thus, to promote these advancements, investment and funding are being provided by the government.

The advancing industries in India are focusing on the development of various diagnostic approaches, which in turn increase the use of DNA polymerase. Moreover, the growing awareness is also contributing to the same. Furthermore, to make them affordable, the government is also providing its support.

Europe is expected to grow significantly in the DNA polymerase market during the forecast period. Europe is experiencing a rise in research and development to deal with the increasing incidence of diseases. Hence, the use of DNA polymerase is increasing to develop new diagnostic tools, which promotes the market growth.

The increasing cases of infectious disease and cancer are increasing the demand for the use of early diagnosis. This, in turn, is increasing the use of DNA polymerase to develop various PCR techniques, molecular diagnostics, etc. Therefore, it increases the investments by the private and government sectors to enhance their development.

The industries and institutes in the UK are using DNA polymerase for various applications. They are using it in next-generation sequencing, PCR techniques, etc. Moreover, the growing awareness is increasing the use of diagnostic tools. Thus, to ensure their safe and effective use, they are being developed in compliance with the regulatory standards.

For instance,

The Middle East & Africa are expected to grow at a considerable CAGR in the DNA polymerase market in the upcoming period. The growing demand for biologics, increasing research activities, and evolving regulatory landscapes propel market growth. Government and private organizations provide funding to academic researchers and biotech companies to foster their research activities. The rising prevalence of genetic and chronic disorders encourages researchers to fulfill the unmet needs of patients, promoting the development of novel diagnostics and therapeutics.

Meridian Bioscience, WatchMaker Genomics, and ArcticZymes are some companies that provide high-quality DNA polymerase to biotech companies. The Abu Dhabi Department of Health’s Healthcare Life Vision and Strategy aims to increase economic activity by $32 billion and support the launch of 290 biotech startups. The strategy also facilitates the establishment of 24 new life sciences manufacturing sites.

The National Biotechnology Strategy is poised to position Saudi Arabia as a regional and global biotech hub. It aims to advance Saudi Arabia’s self-sufficiency in vaccines, biomanufacturing, and genomics, thereby fostering innovation and improving the health and well-being of citizens. According to the 2024 Health Status Statistics Publication, 18.95% of adults aged 15 years and above have a chronic disease.

By Type

By Application

By End User

By Format

By Region

February 2026

December 2025

October 2025

November 2025