January 2026

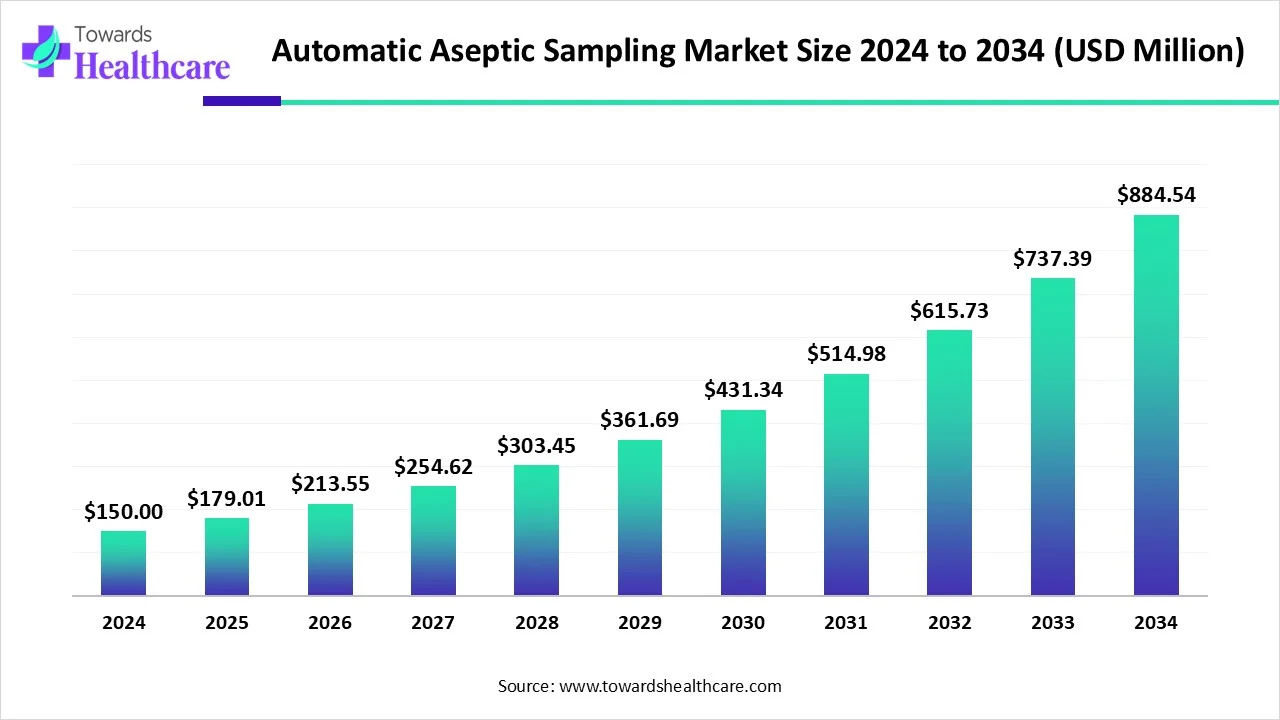

The global automatic aseptic sampling market size is calculated at USD 150 million in 2024, grew to USD 179.01 million in 2025, and is projected to reach around USD 884.54 million by 2034. The market is expanding at a CAGR of 19.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 179.01 Million |

| Projected Market Size in 2034 | USD 884.54 Million |

| CAGR (2025 - 2034) | 19.34% |

| Leading Region | North America |

| Market Segmentation | By Monitoring Method Type, By Working Volume, By Scalability, By Region |

| Top Key Players | Agilent Technologies, Alfa Wassermann Separation Technologies, Biomatics Technology, Eli Lilly & Company, Merck Millipore, Mettler Toledo, MGI Tech, Pfizer, Sartorius AG, Sigma Aldrich |

Automatic aseptic sampling (AAS) is a process analytical technology (PAT) technique that involves the use of an automated system to transport a sample from its source to analysis or storage. This helps maintain a closed, sterile sampling environment. AAS is beneficial for both upstream and downstream processing, as well as microbial fermentation. It is modality-agnostic and modular by design, offering flexible and customizable solutions during implementation. It offers numerous benefits, including reduced contamination risk, intensified turnaround times, and decreased number of experiments.

Several factors influence market growth, including the growing demand for biopharmaceuticals and the increasing production of biologics. Technological advancements lead to the latest innovations in biomanufacturing of biopharmaceuticals. The increasing investments and collaborations boost the market. The burgeoning biotech sector and the growing number of startups also contribute to market growth. The pharma and biotech companies need to follow stringent regulatory policies for producing biologics and injectables in an aseptic environment.

Artificial intelligence (AI) plays a vital role in automatic aseptic sampling by streamlining the manufacturing process. It enables real-time monitoring of the production process, enabling manufacturers to get real-time insights into the processing data and take necessary actions. AI and machine learning (ML) algorithms enhance the efficiency and accuracy of the manufacturing process. ML-analyzed data provides the evidence for validation of the change by demonstrating more control over the process, along with a decrease in process risks. The advent of robotics enables the ability to perform different types of operations and handle multiple formats, such as transporting samples from one place to another, thereby reducing manual errors.

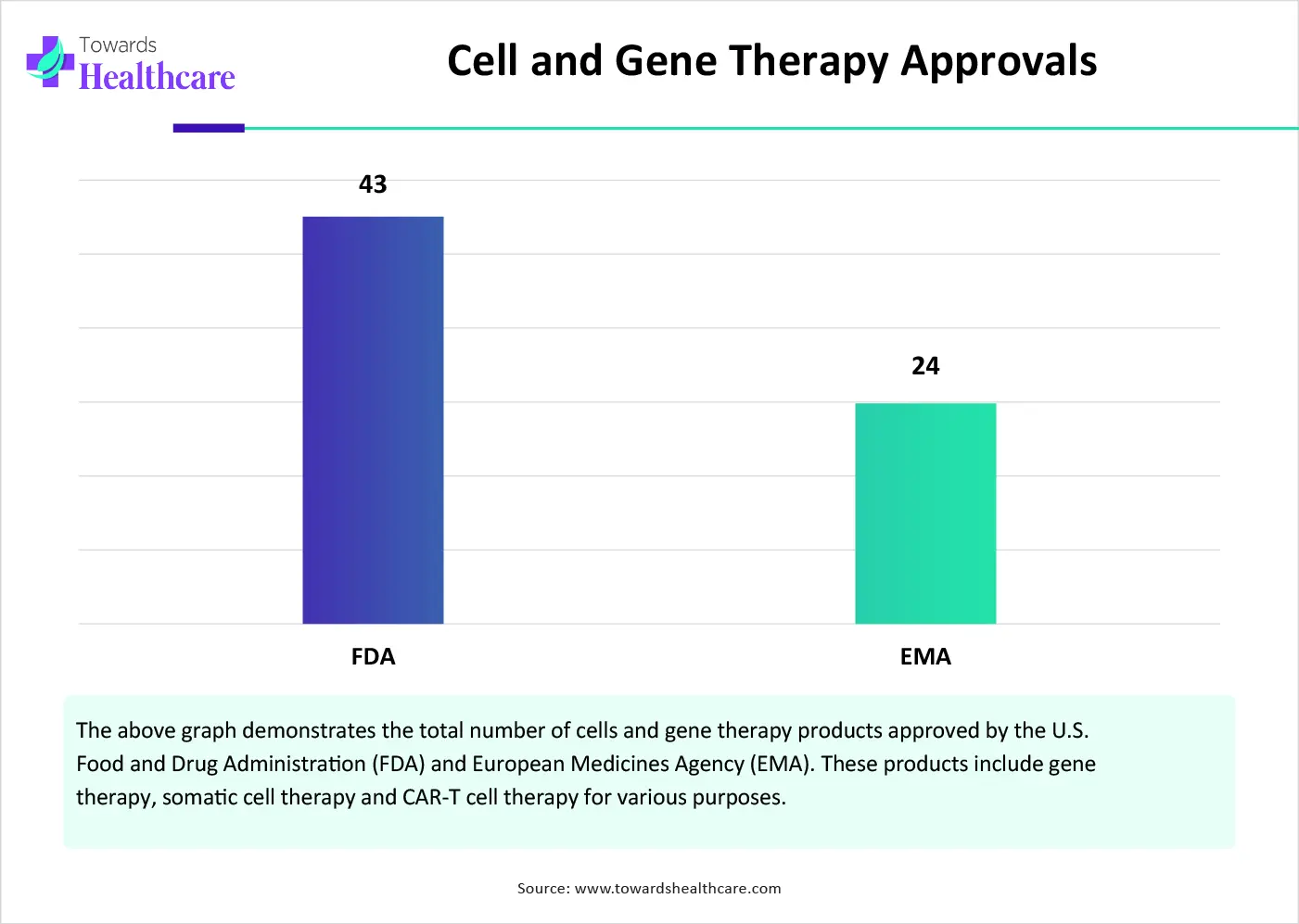

Cell and Gene Therapy

The growing demand for cell and gene therapy is the major growth factor of the market. Researchers are currently developing novel cell and gene therapy products for the treatment of chronic and genetic disorders. The demand for these products is increasing due to their ability to provide targeted action and reduce systemic side effects. They treat a disease by addressing the underlying cause at the genetic level. Hence, they can cure untreated diseases and reduce the chance of relapse. The production of these products requires specialized infrastructure and aseptic conditions to avoid contamination.

Lack of Skilled Professionals

The major challenge of the automatic aseptic sampling market is the lack of skilled professionals with proper training to operate advanced aseptic processing. Some professionals from underdeveloped and developing countries also have a lack of comprehensive understanding of the techniques, restricting the market growth.

Integration with Raman Spectroscopy

The future of the market is promising, driven by the integration of automatic aseptic sampling techniques with other PAT techniques, such as Raman spectroscopy. Raman spectroscopy is an essential process for maintaining the process performance of a bioreactor and ensuring that the final product meets the prespecified quality requirements. Integrating AAS with Raman spectroscopy facilitates real-time monitoring of the process, improving process understanding. It enables the efficient and reliable analysis of samples in bioprocessing and other sterile environments. The integration also results in improved calibration and validation of data-driven models.

By monitoring method type, the online segment held a dominant presence in the automatic aseptic sampling market in 2024. Online monitoring involves real-time analysis of critical process parameters, such as temperature, pressure, and chemical concentrations, within the manufacturing equipment. Automatic systems in online help pharma & biotech companies achieve high-end product quality and satisfy regulatory demands. Manufacturers can get real-time insights into sampling procedures. Online analysis can be run continuously or on a predetermined schedule.

By monitoring method type, the at-line segment is expected to grow at the fastest CAGR in the market during the forecast period. At-line process involves automatically extracting a sample from the process line and transporting it to a nearby particle size analyzer. The need for automatic aseptic sampling for at-line monitoring increases as it offers flexibility and can be used to monitor multiple process lines sequentially. This accelerates the speed of analysis, resulting in a faster production process.

By working volume, the 10-50 ml segment held the largest share of the automatic aseptic sampling market in 2024. Optimal volume, i.e., 10-50 ml, is essential for quality control as it can provide relevant information about the sample. Too little volume can be insufficient for testing, while too large a volume may result in sample wastage. 10-50 ml of sample can be used to perform various tests. This volume can also reduce the chance of accidental results and confirm the validity of outcomes.

By working volume, the 51-100 ml segment is expected to grow with the highest CAGR in the market during the studied years. 51-100 ml quality is sufficient for sampling of bulk materials and assessing the quality of finished products. Automated systems can accurately and precisely draw a sufficient volume of samples, reducing manual errors. They can avoid the spillage of large volumes of sample, eliminating wastage.

By scalability, the lab scale segment led the global automatic aseptic sampling market in 2024. The growing research and development activities and the need for lab testing of raw materials, intermediates, and finished products boost the segment’s growth. An automatic aseptic sampling system is required to ensure product quality, safety, and efficiency by minimizing contamination risks. The system improves sampling frequency and eliminates the need for professionals to draw samples at short intervals.

By scalability, the pilot scale segment is expected to expand rapidly in the market in the coming years. Pilot scale is an essential phase in pharmaceutical manufacturing to validate lab-scale procedures and protocols for large-scale production. Hence, continuous monitoring of the entire process is necessary. This requires frequent sampling from the manufacturing process. Automatic aseptic sampling can draw samples from various procedures to assess the scaling up of the lab scale to the pilot scale.

North America dominated the global market in 2024. The presence of key players and stringent regulations by various regulatory agencies are the major growth factors of the market in North America. State-of-the-art research and development facilities and the rising adoption of advanced technologies potentiate the demand for automatic aseptic sampling. Favorable government policies and increasing investments contribute to market growth.

The increasing number of pharma and biotech companies potentiate the need for aseptic sampling techniques. There are around 2,435 biotech companies in the U.S. as of 2024, an increase of 3% from 2025. Key players, such as Agilent Technologies and Eli Lilly & Company, are the major contributors to the market.

Canada is home to more than 1,000 biotech companies. The Canadian biotech sector raised an investment of $1.2 billion for venture and private equity activity in 2023, across 57 deals. While the mergers and acquisitions investment activities were $10.8 billion across 8 deals in 2023. This makes the total investment $12.0 billion. (Source - Biotech)

Asia-Pacific is anticipated to grow at the fastest CAGR in the automatic aseptic sampling market during the forecast period. The growing demand for biologics and the need for advanced technologies in pharmaceutical manufacturing augment the market. The availability of a suitable manufacturing infrastructure encourages foreign players to set up their manufacturing facilities in the Asia-Pacific countries. This is due to affordable facilities and the ability to hire trained professionals at affordable salaries. The increasing venture capital investments in startups facilitate the use of automatic aseptic sampling.

The Japanese government has launched the “Japanese Bioeconomy Strategy” to achieve a world’s most advanced bioeconomy society in Japan, creating a sustainable and innovation-driven ecosystem by 2030. Advancements in biomanufacturing are one of the aims of the strategy. The nation also aims to generate a bioeconomy valued at 100 trillion yen by 2030. (Source - Biosector)

According to a report by Bain and Company, India emerged as the largest private equity buyout in the healthcare sector in the Asia-Pacific region in 2024, with 26% of the deal volume. The growth was due to a combination of buoyant capital markets, strong economic fundamentals, and a burgeoning investor confidence. (Source - Health world)

Europe is expected to grow at a notable CAGR in the automatic aseptic sampling market in the foreseeable future. The increasing number of pharma and biotech startups and the burgeoning pharma and biotech sectors foster the market. The growing demand for biopharmaceuticals and favorable regulatory policies lead to new product launches. The European Medicines Agency regulates the approval of biologics in Europe. Favorable government policies and growing research and development activities favor the market.

Major players like GEMU Group and Sartorius AG provide advanced automatic aseptic sampling technologies to other companies. Sartorius Group generated sales of 3.38 billion euros in 2024. The European region, which accounts for 41% of the Group’s business, recorded a 5.5% increase in sales revenue. The underlying net profit amounted to 280 million euros in 2024. (Source - Sartorius)

The Denmark government announced an investment of DKK 60 million (EUR 8.05 million) to expand test, development, and demonstration facilities, strengthening Denmark’s biosolutions infrastructure. The initiative also aims to enhance the country’s ability to support companies in scaling their technologies, ensuring that both start-ups and established players have access to world-class capabilities. (Source - Invest in Denmark)

Vanessa Vega Saenz, Director of Invest in Denmark, commented that Denmark stands as a global leader in biosolutions. The country offers an unparalleled ecosystem for companies that want to scale their biosolutions in Denmark, fostering collaboration, accelerating commercialization, and driving global impact. (Source - Invest in Denmark)

By Monitoring Method Type

By Working Volume

By Scalability

By Region

January 2026

November 2025

November 2025

January 2026