November 2025

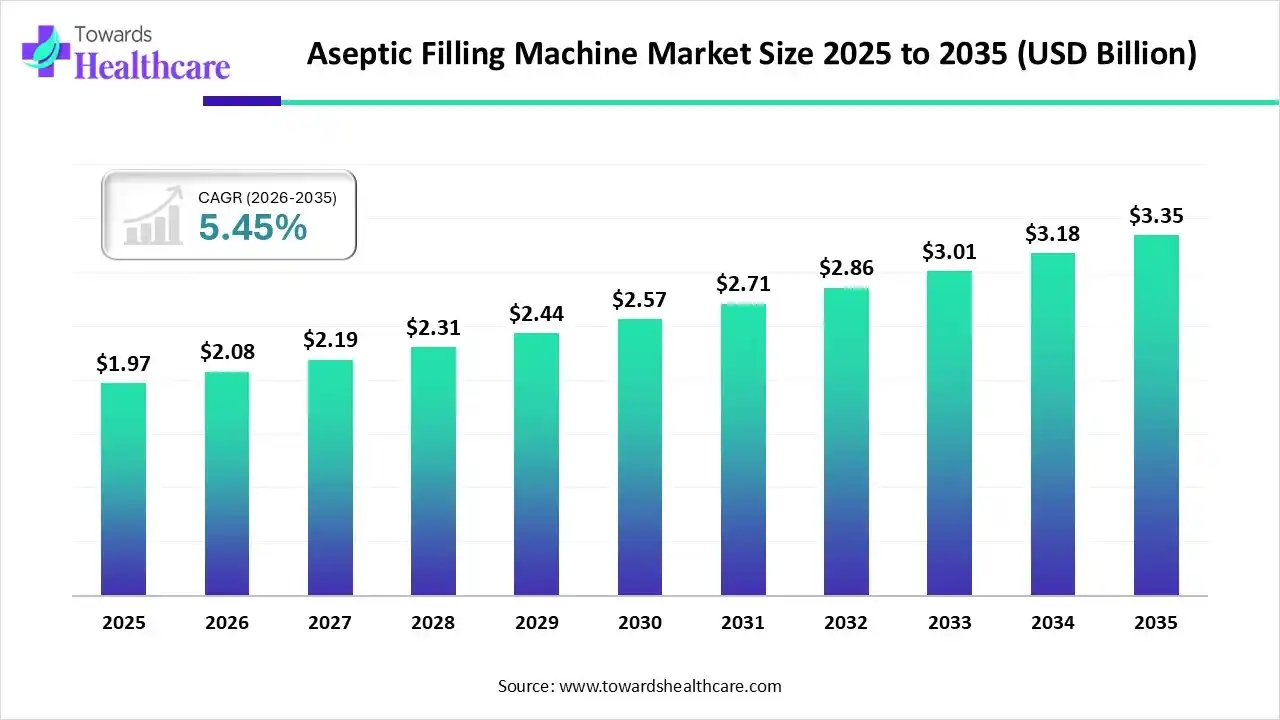

The global aseptic filling machine market size is calculated at USD 1.97 billion in 2025, grew to USD 2.08 billion in 2026, and is projected to reach around USD 3.35 billion by 2035. The market is expanding at a CAGR of 5.45% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 2.08 Billion |

| Projected Market Size in 2035 | USD 3.35 Billion |

| CAGR (2026 - 2035) | 5.45% |

| Leading Region | North America |

| Market Segmentation | By Type, By Mode of Operations, By End User, By Region |

| Top Key Players | ALFA LAVAL, GEA Aseptic Filling, Dara Pharma, Saini Industries, John Bean Technologies Corp, Groninger Holding Gmbh & Co. KG., Syntegon Technology Gmbh, Bauschstrbel SE Co. KG., Serac Group, Knones AG |

The aseptic filling machine market is growing rapidly due to these machines play a significant role in manufacturing sterile medications. These machines confirm that the drugs are free from contamination, ensuring their safety and efficacy. Aseptic filling machines are designed to maintain a sterile or aseptic environment throughout the filling process. This technology ensures that the liquid products, like pharmaceuticals, beverages, and cosmetics, are free from harmful microorganisms or bacteria that cause spoilage or pose health challenges to consumers.

In the beverage and food sector, aseptic filling machines are widely utilized to package products that need a longer shelf life without the requirement for preservatives or refrigeration. This technology allows producers to preserve the nutritional value, taste, and quality of the products, satisfying consumers with a safe and fresh experience. In the healthcare sector, aseptic filling machines are producing sterile medications.

AI integration in the aseptic filling machine is driving the growth of the market as applications of AI and machine learning in aseptic processing provide a wealth of opportunities, from improving process control and predictive maintenance to batch release automation and atmosphere monitoring. As manufacturing advances, these technologies play a significant role in ensuring safety, compliance, and efficiency. The pharmaceutical sector is growing, embracing Artificial Intelligence (AI) and Machine Learning (ML) to improve aseptic processing. These advanced technologies increase compliance and efficiency but also improve process reliability and product safety. AI-driven technology makes improvements in maintenance in sterile medicine manufacturing. Outdated processes are inefficient and disrupt production. AI-based technology predicts equipment challenges before they happen, leading to fewer disruptions, which drives the growth of the market.

Increasing Applications of Aseptic Filling

Aseptic filling equipment is highly adaptable and capable of handling various sterile liquids, such as aqueous solutions, oily solutions, and thick substances. It also meets specific needs like cold chain products and gas-protected solutions. These systems ensure that sterile products are protected from contamination during the filling process, which is vital for patient safety. They assist pharmaceutical companies in adhering to strict regulatory standards while preserving the integrity of their products. Additionally, aseptic filling machines utilize advanced technologies and follow rigorous aseptic processing protocols to ensure product sterility, which drives the growth of the aseptic filling machine market.

Challenges in Healthcare Cold Chain Logistics

Aseptic filling necessitates highly specialized tools and trained personnel, growing expenses. Its failure to maintain a sterile environment results in reputational damage and expensive recalls. Aseptic processing is challenging to scale up or down depending on the demand of the product, which limits the growth of the aseptic filling machine market.

Recent Technological Advancements

Recent advancements in aseptic filling machines highlight the integration of robotics. Robots significantly boost the speed and accuracy of the filling process, resulting in enhanced throughput and reduced error rates. Furthermore, they can be programmed to accommodate a diverse array of products, making them both versatile and responsive to evolving production needs. Another notable development in aseptic filling machines is the utilization of advanced sensors and monitoring systems. These technologies enable real-time detection and correction of issues, ensuring products are filled and packaged accurately. Additionally, they offer crucial data on production efficiency, empowering companies to optimize processes for peak performance. The incorporation of new technologies in aseptic filling machines also necessitates consideration of regulatory requirements and industry standards, presenting opportunities within the aseptic filling machine market.

Why the Standalone Filling Machine Segment Dominated the Market?

By type, the standalone filling machine segment dominated the aseptic filling machine market in 2024, as a stand-alone filling machine is designed for the bottling of a broad range of products. These machines are available with different accessories, like vacuum filling, hot filling, and inert atmosphere in the tank. Standalone systems are appropriate for those who want medium-level filling capacity in cylinder filling plants. It provides elastic capacity and the possibility to add different equipment.

Tabletop Filling Machine Segment

The tabletop filling machine segment is expected to be the fastest growing in the aseptic filling machine market because it is mainly applied where the operator places the two bottles on the machine physically. The bottle supporting system is attached to the machine. This system is adjustable, and the operator can easily adjust it as the diameter of the bottle differs. The tabletop filling machine provides advantages like accuracy with consumer-friendly simplicity.

Why is the Fully Automatic Segment Dominant in the Market?

By mode of operation, the fully automatic segment is dominant in the aseptic filling machine market as it permits a reliable, repeatable, and consistent fill cycle, whether the fill is based on a level of produce, the weight of produce, the volume of produce, or another such measurement. Automatic fillers eliminate inconsistencies and remove uncertainty from the filling process. The automation of the packaging process has provided many benefits for packaging organizations. There are various ways in which automation improves the packaging process.

Semi-Automatic Segment

The semi-automatic segment is expected to grow significantly during the forecast period because the control of the semi-automatic filling machine is easy, usually controlled by a foot switch or manual button to start the filling procedure, making it simple to operate and reducing the complexity for employees. Furthermore, it has a broad range of applications, appropriate for different types of liquids, and it is adjusted flexibly to meet the filling requirements of various types of packaging specifications. As compared to fully automatic filling machines, semi-automatic filling machines are affordable and effectively reduce equipment investment costs for the organization.

Why Food and Beverages Segment Dominant in the Market in 2024?

By end user, the food and beverages segment is dominant in the aseptic filling machine market, as it supports maintaining the freshness and quality of the food product, prolonging shelf life, and ensuring food safety by avoiding contamination. Aseptic filling also enables convenience in transportation and storage, making it an affordable and sustainable packaging option for food and beverage manufacturers. By investing in aseptic filling technology, various companies meet customer demands for high-quality products while lowering waste and reducing their carbon footprint.

Pharmaceutical Segment

The pharmaceutical segment is expected to be the fastest-growing in the market due to aseptic filling machines' ability to reduce the challenges of contamination of pharmaceuticals, leading to enhanced quality of product and offering a longer shelf life. By reducing the challenges of bacterial growth and spoilage, aseptic packaging helps manufacturers to maintain product integrity and deliver a superior end product to customers. By ensuring a sterile filling procedure, these machines avoid the growth of microorganisms, preserving the product's taste and quality for a longer duration. Furthermore, aseptic filling machines progress efficiency by allowing continuous production with negligible downtime for sterilization and cleaning.

Asia Pacific dominated the aseptic filling machines market as rapidly increasing populations and projected significant financial growth strengthen Asia Pacific's position as the major food producer globally, and increasing urbanization raises the demand for long-shelf-life and ready-to-eat beverages and food, which increases the demand for aseptic filling machines. The biopharmaceutical industry in the APAC is developing quickly, driven by strong government support, international cooperation, and regulatory reforms. Aseptic technology is important for injectables, vaccines, and sterile medicine, which contributes to the growth of the market.

China Aseptic Filling Machine Market Trends

Chinese biopharma companies are increasing substantial investment from domestic and international sources, supported by noteworthy government innovation-friendly and funding policies. This allows expanded research and development, leading to novel therapies and technologies, including aseptic filling lines. China majorly benefits from lower costs in multiple aspects of API production. Utilities such as electricity, water, steam, land use, and environmental compliance, which boost the sale of aseptic filling machines, contribute to the growth of the market.

India Aseptic Filling Machine Market

In India, food safety and quality complexes have become most frequent and have built up satisfactory safety stocks of food grains, which is pushing producers to invest in aseptic packaging solutions. The Indian healthcare device sector is experiencing robust growth, causing it to rise from $12 billion to $50 billion by 2030, and advanced technologies are being rapidly adopted globally in the medical device sector, making aseptic machines more affordable and accessible. An increasing government initiative raises demand for safe and wholesome food under the 'Eat Right India' movement. The Safe and Nutritious Food (SNF) initiative aims to promote safe and healthy diets, which encourages manufacturers to adopt aseptic systems, which contributes to the growth of the market.

The North America region is projected to experience the fastest growth in the aseptic filling machine market during the forecast period, because increasing demand for functional beverages and foods has significantly risen due to socioeconomic changes, specifically in health consciousness, to improve their functionality is fueling the need for aseptic filling. The biotechnology and pharmaceutical industries are undergoing an essential transformation, driven by scientific digitalization, advancements, and strategic collaborations, so aseptic filling is essential for maintaining sterility in these high-value products, which contributes to the growth of the market.

Canada Aseptic Filling Machine Market Trends

The growing urbanization and busy lifestyles of Canadians have led to a higher demand for ready-to-consume and convenient beverages, and also increasing consumer demand for healthier beverage options, the popularity of functional and flavored food, and the multicultural nature of the Canadian population, all of which require aseptic packaging for extended shelf life and natural preservation. Aseptic packaging is a technique designed to maintain the sterility of a product, ensuring it remains free from contaminants during its shelf life. This drives the growth of the market.

United States Aseptic Filling Machine Market Trends

The U.S. Food and Drug Administration (FDA) is the governmental authority responsible for overseeing the safety, quality, and effectiveness of vaccines used in the United States. This oversight necessitates sterile, preservative-free packaging, making aseptic filling essential. The introduction of new brand-name drugs has led to an increase in pharmaceutical use and spending; some of these drugs replace existing, less costly treatments, while others address conditions that previously lacked treatment options, thereby driving demand for aseptic filling machines.

Europe is expected to grow significantly in the aseptic Filling Machine Market during the forecast period, as the pharmaceutical industry is experiencing a rapid transformation, driven by advancements in technology and a growing demand for novel therapies, which is increasing the demand for aseptic filling machines. Major pharma companies are doubling down on investments in European manufacturing infrastructure to meet strong global demand, which contributes to the growth of the market.

Germany Aseptic Filling Machine Market Trends

Germany consistently holds top positions, specifically due to its substantial research and development investments. The German pharmaceutical industry is experiencing a real rush of investment. The German government's novel pharma strategy with numerous reforms to enhance the conditions for the pharmaceutical industry in Germany, which is driving the growth of the market.

South America is expected to grow significantly in the aseptic filling machine market during the forecast period, due to the expanding pharmaceutical manufacturing facilities. This is increasing the use of aspect-filling machines to comply with the GMP standards for the development of various sterile products, which is enhancing the market growth.

Brazil Aseptic Filling Machine Market Trends

The growing healthcare investments in Brazil are increasing the adoption of various technologies and equipment, such as aseptic filling machines. At the same time, the growing development of biologics and vaccines is also increasing the demand for these machines to maintain the sterility of the products.

MEA is expected to grow significantly in the aseptic filling machine market during the forecast period, due to expanding healthcare infrastructure, which is increasing the adoption of various advanced equipment. The stringent regulations are also encouraging their use for the development of various injectable and biologics, which is promoting the market growth.

Saudi Arabia Aseptic Filling Machine Market Trends

The growing government initiatives in Saudi Arabia are increasing the demand for advanced therapies and treatment options, which is promoting the adoption of aseptic filling machines. The growing vaccination programs and focus on GMP standards are also increasing their use and demand.

R&D

Clinical Trials and Regulatory Approvals

Formulation and Final Dosage Preparation

Packaging and Serialization

Distribution to Hospitals, Pharmacies

Support and Services

In May 2025, Chirag and Chintu Patel, Co-Chief Executive Officers of Amneal Pharmaceuticals, stated, “Partnership of Amneal and Apiject marks a significant step in expanding our U.S. manufacturing footprint with cutting-edge sterile pharmaceutical abilities.”

By Type

By Mode of Operations

By End User

By Region

November 2025

November 2025

November 2025

November 2025