February 2026

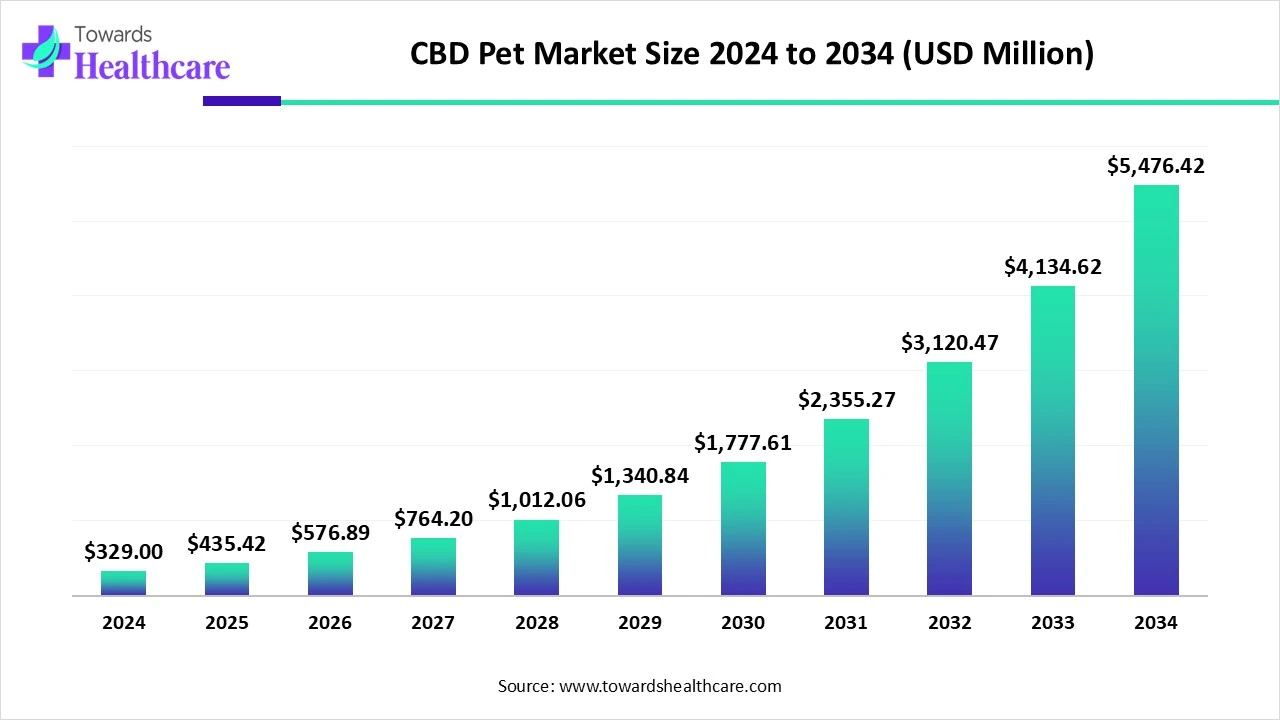

The global CBD pet market size is calculated at USD 329 million in 2024, grows to USD 435.42 million in 2025, and is projected to reach around USD 5476.42 million by 2034. The market is expanding at a CAGR of 32.5% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 435.42 Million |

| Projected Market Size in 2034 | USD 5476.42 Million |

| CAGR (2025 - 2034) | 32.5% |

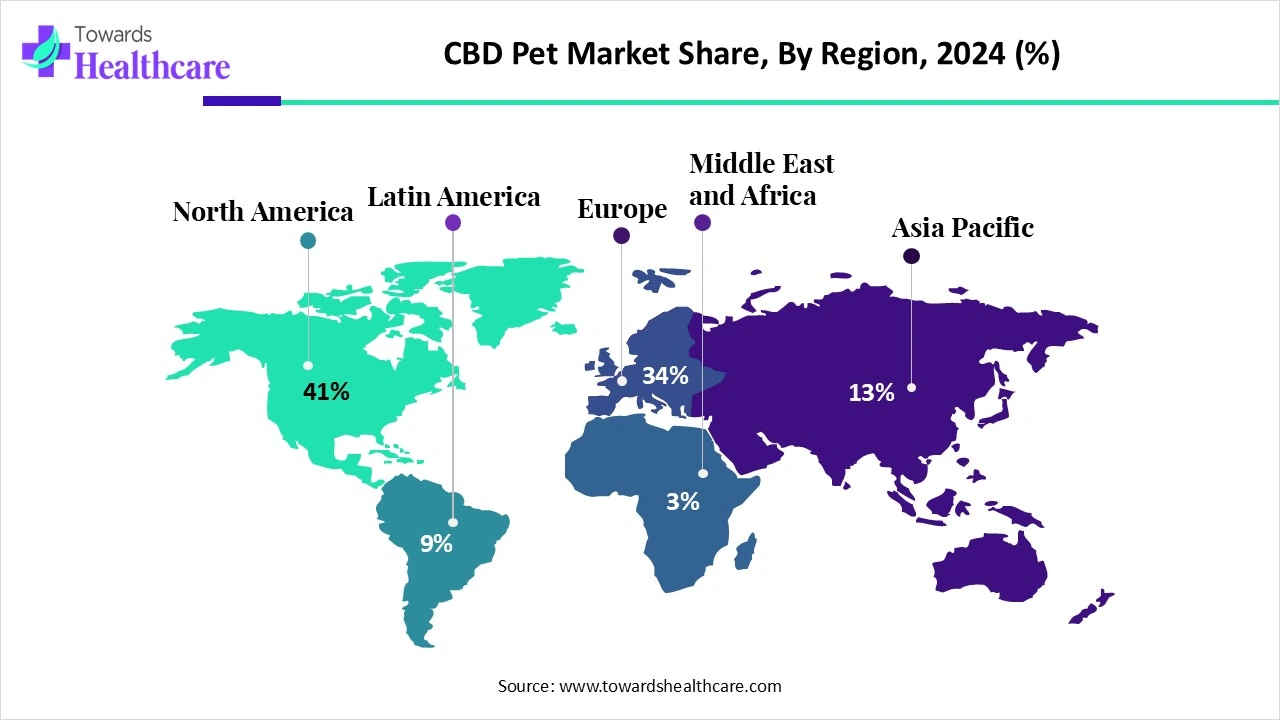

| Leading Region | North America (41% Shares in 2024) |

| Market Segmentation | By Animal Type, By Indication, By Distribution, By Regions |

| Top Key Players | Honest Paws LLC, Canna-Pet LLC, Laboratoire Francodex, Pet Releaf, HolistaPet, Joy Organics, Wet Noses Natural Dog Treat Co., CBD Living, PETstock, Garmon Corp., Charlotte’s Web, Inc., Green Roads, HempMy Pet, FOMO Bones |

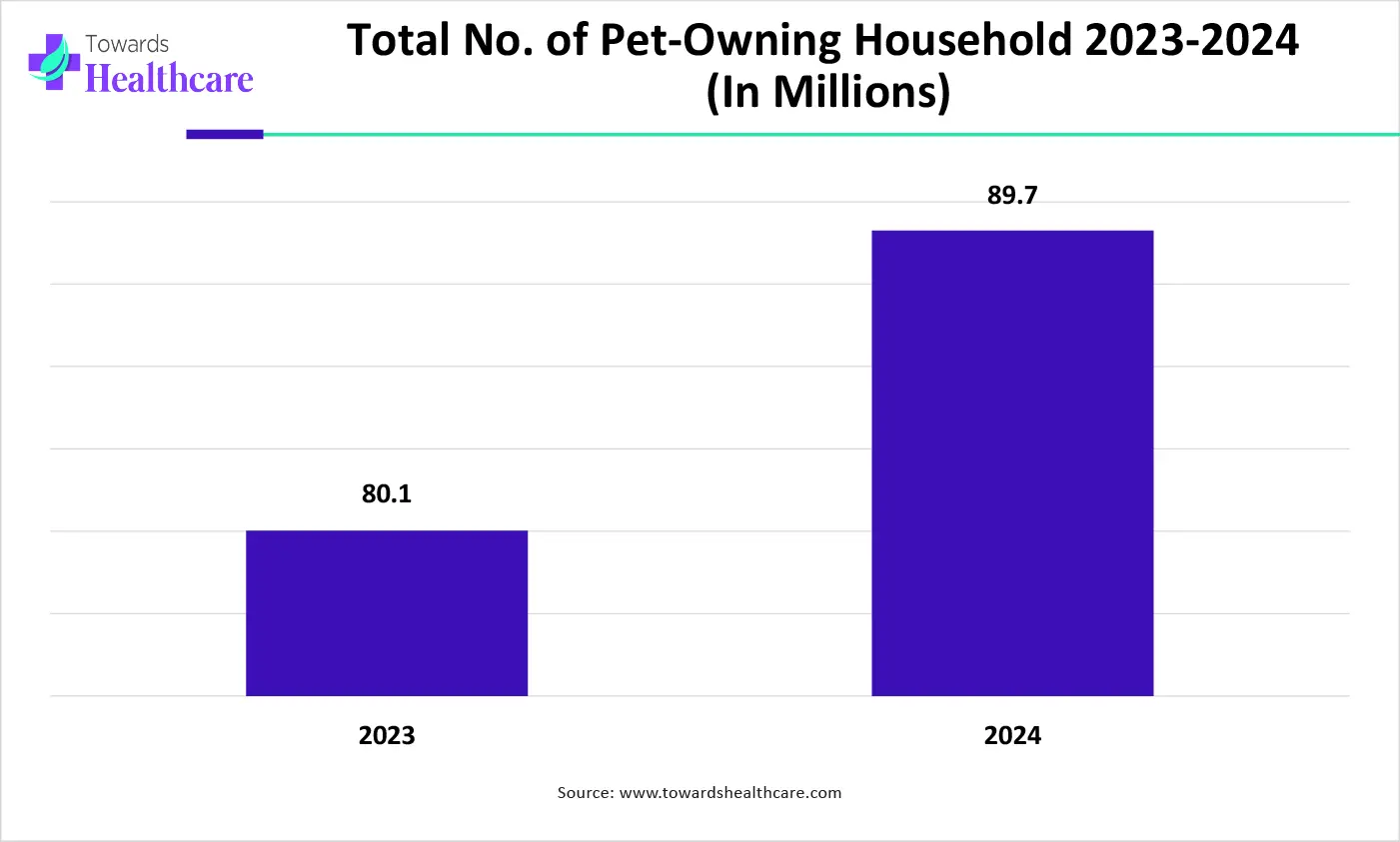

A CBD pet is an animal, typically a dog or cat, that is given cannabidiol (CBD), a non-psychoactive compound derived from hemp, to help manage issues like anxiety, pain, or inflammation. The market is growing rapidly due to rising pet humanization, with owner seeking natural alternatives to manage anxiety, pain, and stress in their animal. Increased awareness of CBD’s benefits, coupled with fewer side effects than traditional medications, is boosting demand. Easing regulations around hemp-derived products and greater availability through online and retail channels further fuels this trend, making CBD a popular choice in pet wellness routines.

For Instance,

AI can significantly impact the market by analyzing consumer behavior, predicting trends, and personalizing product recommendations. It can enhance product development by identifying effective formulations through data analysis. AI-powered tools also improve supply chain efficiency and optimize marketing strategies. Additionally, AI chatbots can provide instant customer support and education about CBD products for pets, helping businesses build trust and improve customer engagement in this growing niche market.

Changing Consumer Preference Towards Organic Healthcare Pet Products

As more pet owners seek natural, plant-based alternatives to traditional treatments, CBD is seen as a safe and effective option for addressing issues like anxiety, pain, and inflammation. Its association with wellness, minimal processing, and sustainable appeals to those who prioritize organic care. Furthermore, consumers drawn to organic products are often willing to pay premium prices, which supports the growth of high-quality CBD offerings tailored for pets and reinforces their place in the evolving pet wellness industry.

For instance,

Regulatory Uncertainty

Regulatory uncertainty is a major restraint because inconsistent laws and unclear guidelines hinder product development, distribution, and consumer trust. In many regions, including the U.S., the FDA has not approved CBD for veterinary use, leaving manufacturers unsure of compliance requirements. This ambiguity discourages investment, limits veterinary recommendations, and creates confusion for pet owners. Without clear regulations, quality control, and safety standards, increasing an increased risk of ineffective or unsafe products entering the market.

Expanding e-Commerce Channels, Enhancing CBD Pet Product Accessibility

The proliferation of e-commerce platforms presents a significant opportunity for the CBD pet market. Online retailers offer pet owners convenient access to a diverse range of CBD-infused products, including treats, oils, and supplements. This ease of access allows consumers to compare products, read reviews, and make informed decisions from the comfort of their homes. The growing preference for online shopping, coupled with the availability of detailed product information, is driving increased adoption of CBD products for pets, thereby fueling market growth.

By animal type, the dogs segment accounted largest share in the CBD pet market in 2024, due to higher global dog ownership and increased spending on canine wellness. Dogs frequently suffer from issues like anxiety, joint pain, and inflammation, for which CBD is commonly used. The market also offers a wider variety of CBD products for dogs, such as treats and oils, enhancing accessibility. Moreover, greater awareness and acceptance of CBD benefits among dog owners has further fueled demand and market dominance in his segment.

By animal type, the cats segment is expected to grow at the fastest rate in the market during the forecast period due to the growing demand for antecedent remedies for feline health issues. Unlike dogs, cats often experience stress-related problems from environmental changes, making CBD a popular option. Additionally, limited existing treatment options for chronic feline conditions are pushing owners to explore CBD alternatives. The market is also expanding as more pet brands focus on cat-specific formulations, encouraging owners to try new, safe, and non-invasive solutions to improve their pets' overall well-being.

For instance,

By distribution, the e-commerce segment held a dominant presence in the CBD pet market in 2024 due to its convenience, wider product selection, and discreet purchasing options. Online Platforms enabled consumers to access detailed product information, reviews, and competitive pricing, boosting confidence in trying CBD products for pets. The rise in pet wellness awareness, coupled with digital marketing and subscription models, further propelled online sales. Additionally, restrictions in physical retail distribution and growing smartphone usage made e-commerce the preferred channel for purchasing CBD pet products, further drives CBD pet market growth.

By distribution, the pet specialty stores segment is anticipated to grow at a significant rate in the market during the studied years because of increasing consumer preference for personalized guidance and product assurance. These stores offer expert advice, allowing pet owners to make informed decisions about CBD products. The growing collaboration between manufacturing and availability in these outlets. Additionally, the tactile experience of in-store shopping and the trust associated with specialty retailers contribute to their expanding role in CBD pet product distribution.

By indication, the joint pain segment held the highest share of the CBD pet market in 2024 due to the high prevalence of arthritis and mobility issues among aging pets, especially dogs. Pet owners increasingly turned to CBD products for their anti-inflammatory and pain-relieving properties, seeking natural alternatives to traditional medications. The rising awareness of CBD therapeutic benefits, combined with a growing focus on pet wellness, significantly boosted demand in this segment, solidifying its leading position in the market.

By indication, the anxiety/stress segment is projected to grow at the highest CAGR in the CBD pet market during the studied years due to rising awareness of pet mental health and increasing cases of anxiety-related behaviors in pets. Urban lifestyles, frequent travel, and loud environments contribute to pet stress, prompting owners to seek natural, non-pharmaceutical solutions. CBD’s calming effects make it a preferred choice. Additionally, product innovations and growing endorsements from veterinarians are boosting consumers' confidence, driving rapid expansion in this segment.

North America dominated the CBD pet market share by 41% in 2024. High pet ownership rates, especially in the U.S., fueled demand for natural wellness solutions like CBD. The 2018 Farm Bill legalized hemp-derived CBD, encouraging product innovation and market expansion. Pet ownership increasingly seek CBD products to address issues such as anxiety and joint pain in these animals. Major companies like Honest Paws and Pet Releaf invested in research and expanded distribution channels, including e-commerce, enhancing accessibility and consumer trust. These combined elements solidified North America's leading position in the global CBD pet market.

Increasing pet ownership and the humanization of pets have led owners to seek high-quality, natural wellness solutions. CBD is gaining popularity for its potential to alleviate anxiety, pain, inflammation, and age-related issues in animals. Additionally, growing awareness, positive anecdotal experiences, and supportive preliminary research have boosted consumer confidence. Evolving regulations and wider product availability, both online and in retail stores, are fueling market growth. As more pet owners prioritize holistic care, demand for CBD-infused pet products continues to rise across the country.

The market in Canada is steadily expenditure due to rising awareness among pet owners about natural wellness options. Many Canadians are turning to CBD products to help manage their pets' anxiety, pain, and inflammation, especially in aging animals. This growing interest is also supported by positive anecdotal results and a shifting attitude towards holistic pet care. While regulatory clarity is still developing, pet-specific CBD oils, treats, and supplements are becoming more widely available through both online and retail channels.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period, due to increasing pet adoption, rising disposable incomes, and growing awareness of pet health and wellness. As attitudes toward pet care shift, demand for natural and therapeutic products like CBD is rising. Evolving regulatory frameworks and expanding e-commerce platforms also make CBD products more accessible. Additionally, increasing veterinary recommendations and interest in alternative treatments for pet anxiety, pain, and inflammation contribute to the market's rapid growth in the region.

China's market is expanding rapidly due to a combination of demographic shifts and evolving consumer behaviors. The aging pet population, with millions of cats and dogs entering senior years, has heightened demand for health-focused products like CBD for pain and anxiety relief. Younger, urban pet owners, especially millennials and Gen Z, are treating pets as family members, driving increased spending on premium wellness products. Additionally, the growth of e-commerce platforms has made CBD products more accessible, further fueling market expansion.

India's market is expanding due to rising pet ownership, increased awareness of natural remedies, and growing demand for holistic pet wellness solutions. Pet owners are increasingly turning to CBD products to address issues like anxiety, pain, and inflammation in their animals. The availability of CBD-infused pet care products through e-commerce platforms has made these solutions more accessible. Additionally, the market is projected to grow significantly, reaching $28.8 million by 2032, driven by the anxiety/stress segment.

Europe is expected to see significant growth in the CBD pet market during the forecast period, due to increasing pet humanization, rising demand for natural and alternative treatments, and growing awareness of CBD’s potential benefits for pets. Supportive regulations in several European countries are also encouraging product development and market entry. In addition, expanding distribution channels, including online platforms and specialized pet stores, are making CBD products more accessible. These factors combined are driving greater adoption and anticipated market expansion across the region during the forecast period.

The UK's market is experiencing significant growth due to increasing pet ownership, heightened awareness of natural wellness products, and a favorable regulatory environment. Approximately 53% of UK households owned pets in 2023, with 29% being dogs. The approval of medical cannabis in 2018 and the availability of CBD products without a prescription have made CBD more accessible to pet owners. Additionally, the rise of e-commerce platforms has facilitated easier access to CBD pet products, contributing to the market's expansion.

France's market is expanding due to the country's status as Europe's leading hemp producer, providing a robust supply chain for CBD products. The legality of THC-free CBD oil for pets supports its use as a natural supplement for issues like anxiety and joint discomfort. French pet owners are increasingly seeking holistic, plant-based remedies, aligning with broader wellness trends. Additionally, the growing pet population and heightened awareness of alternative therapies contribute to the market's rapid growth.

In March 2025, Fusion CBD Products launched Wiggles and Paws Dog Treats and Pet Drops to support aging pets with issues like arthritis and anxiety. The treats use natural ingredients, and the drops are flavorless. With longer pet lifespans, age-related health problems are increasing. Dr. Silver noted that low-dose CBD and CBDA blends have shown promise in treating drug-resistant epilepsy in dogs. Owners should consult vets before use. (Source - cannabis)

By Indication

By Distribution

By Regions

February 2026

November 2025

November 2025

November 2025