February 2026

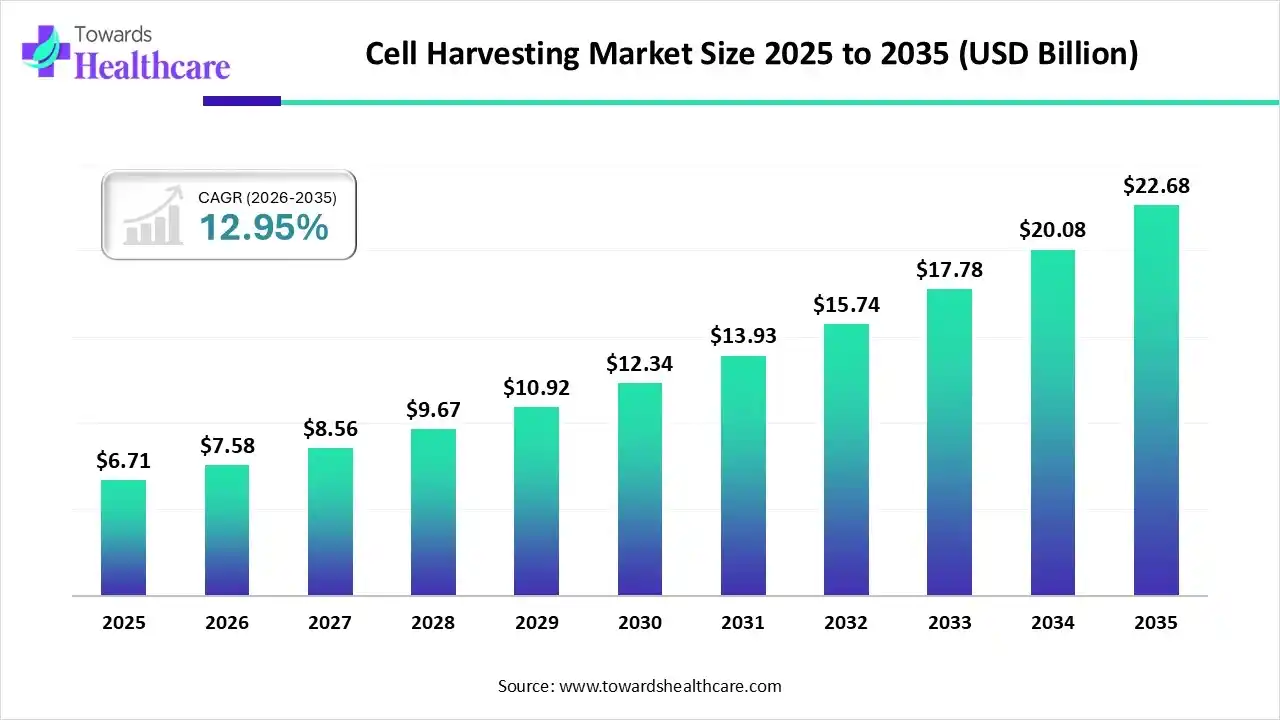

The global cell harvesting market size is calculated at US$ 6.71 billion in 2025, grew to US$ 7.58 billion in 2026, and is projected to reach around US$ 22.68 billion by 2035. The market is expanding at a CAGR of 12.95% between 2026 and 2035.

The use of cell harvesting is increasing in the healthcare sector for the development of various treatment approaches. It is also being used in the development of personalized treatment options. To improve their production and minimize contamination and error, the use of AI is also increasing. Moreover, new partnerships or agreements are driving their development and launches. Additionally, their demand in various regions is growing due to advanced healthcare facilities and research conducted. Thus, all these advancements are promoting the market growth.

| Metric | Details |

| Market Size in 2026 | USD 7.58 Billion |

| Projected Market Size in 2035 | USD 22.68 Billion |

| CAGR (2025 - 2034) | 12.95% |

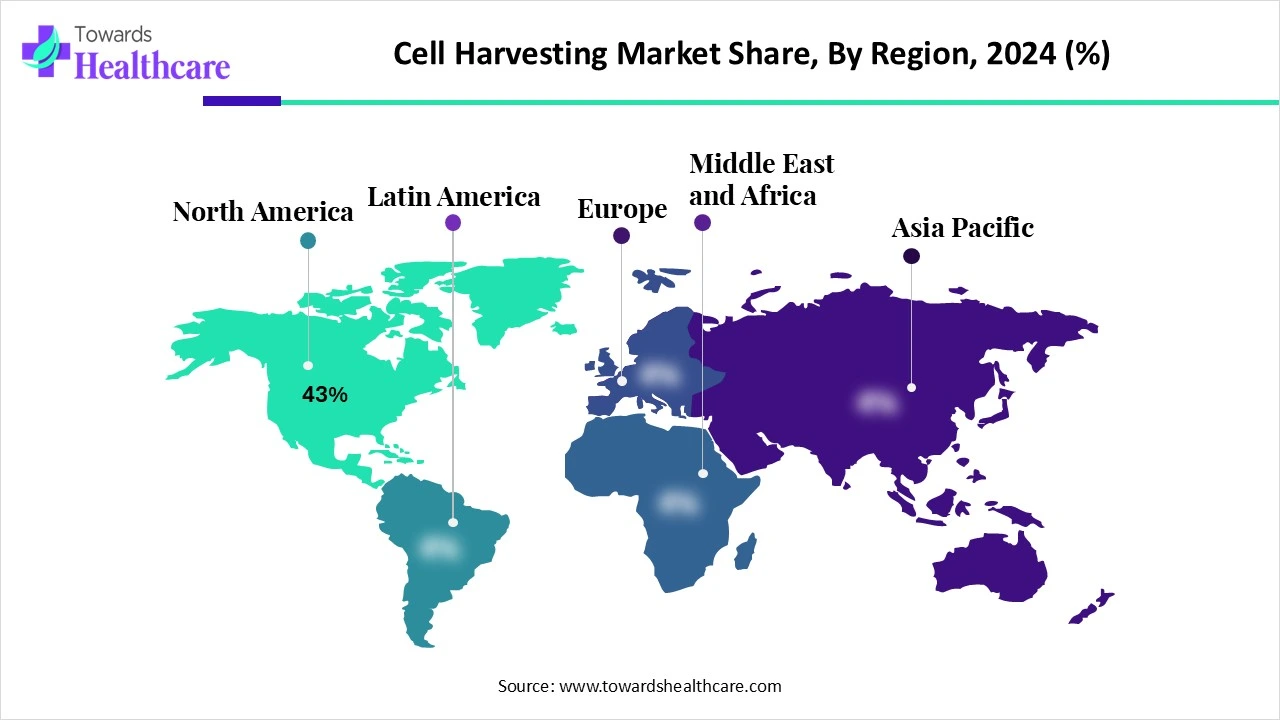

| Leading Region | North America share by 43% |

| Market Segmentation | By Product Type, By Cell Type, By Application, By Technique, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), GE HealthCare (Cytiva), Sartorius AG, Eppendorf SE, BD Biosciences, Terumo BCT, Inc., Beckman Coulter Life Sciences (Danaher), Miltenyi Biotec GmbH, Fresenius Kabi (CompoFlex & LOVO systems), Corning Incorporated, Lonza Group AG, Repligen Corporation, Asahi Kasei Medical Co., Ltd., Stemcell Technologies Inc., PerkinElmer Inc. (Revvity), Bio-Rad Laboratories, Inc., PBS Biotech, Inc., Terumo Corporation, Applikon Biotechnology (a Getinge company) |

The cell harvesting market includes technologies, devices, and solutions used for the collection, separation, and concentration of cells from cultures or tissues. This process is essential in biopharmaceutical manufacturing, regenerative medicine, cell & gene therapy, cancer research, and diagnostic applications. Cell harvesting ensures the viability, purity, and yield of the desired cell population and is critical for downstream processing. The market is rapidly growing due to the expansion of cell-based therapies, stem cell research, and the increasing demand for personalized medicine and biologics manufacturing.

AI plays an important role in the cell harvesting market as it helps in the optimization of its process. It shows automated control and adjustment of the reagent concentration and speed of the process depending on the data gathered. At the same time, it helps in identifying defective or damaged cells, preventing failures. It can also differentiate the types of cells used, promoting cell sorting and reducing the risk of cross-contamination. Moreover, various platforms for the development of personalized treatment options are also being developed.

Increasing Demand for Cell and Gene Therapies

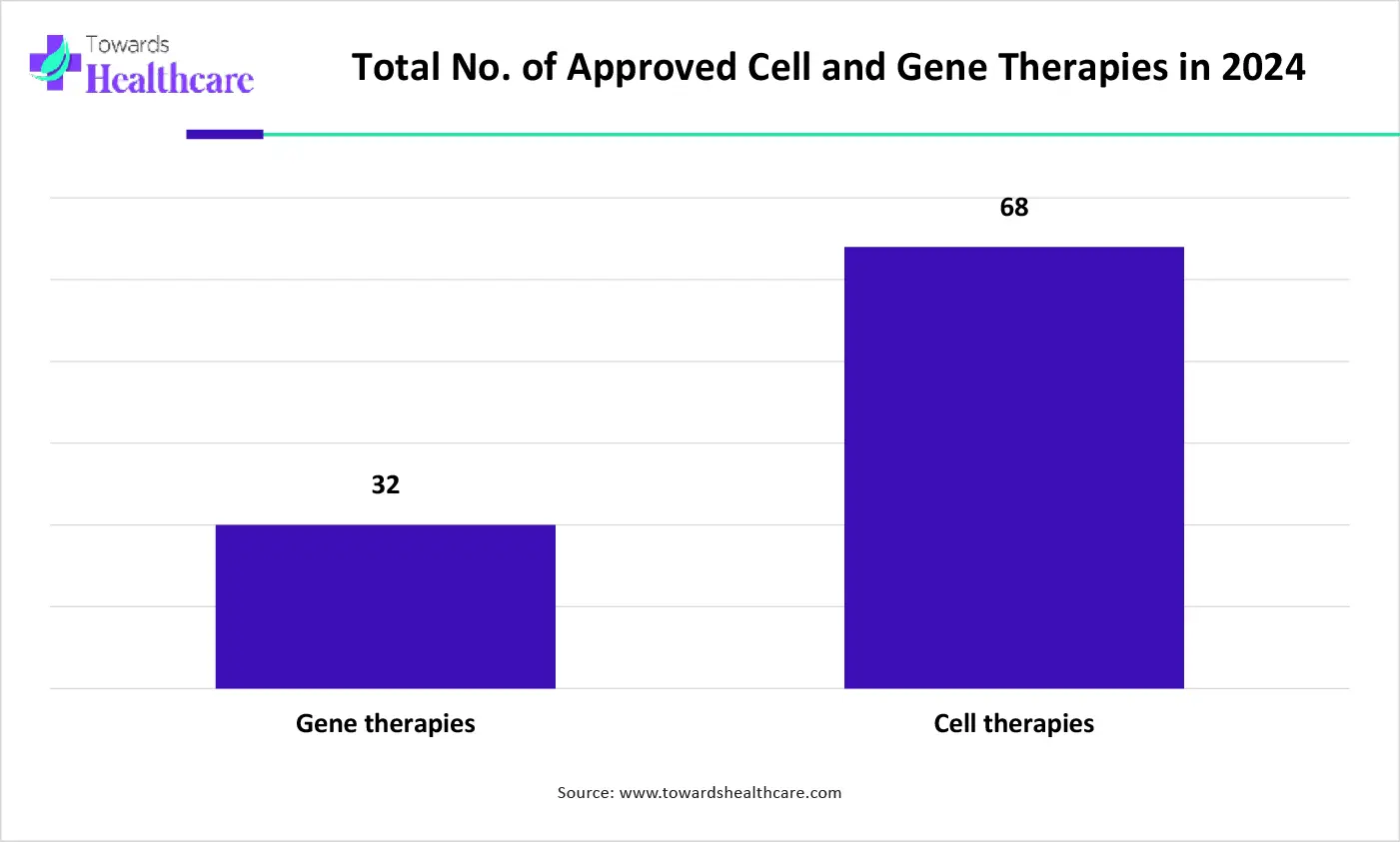

The growing incidence of chronic diseases is increasing the demand for the use of cell and gene therapies. This, in turn, increases the cell harvesting procedures. At the same time, the growing use of personalized therapies also increases the cell harvesting depending on the patient's genetic profile. Moreover, to develop high-quality, pure, stable, and effective cell and gene therapies, the cell harvesting is conducted in sterile and controlled facilities. Thus, all these factors are promoting the cell harvesting market growth.

The graph represents the total number of approved gene and non-genetically modified cell therapies in 2024. It indicates that there is a rise in the demand for cell harvesting for the development of cell and gene therapies. Thus, this in turn will ultimately promote the market growth.

High Price

For the cell harvesting, sophisticated equipment and facilities are required. This equipment is costly, which makes its utilization in start-ups or small industries difficult. Moreover, the reagents used may be required in large quantities or repeatedly, making their development process lengthy. Additionally, the need for expertise and regulatory hurdles also contributes to this increased cost, making the cell harvesting costly.

Increasing Use of Stem Cell-Based Treatment Approaches

The use of stem cells for the development of innovative therapeutic solutions is increasing, as it is responsible for the replacement or repair of defective organs or tissues. Hence, its uses in various chronic diseases such as cancer, neurological diseases, etc., are growing. Moreover, it is mostly being used in the development of regenerative medications. At the same time, personalized treatment options are also being developed with the use of stem cells. Thus, this is promoting the cell harvesting market growth.

For instance,

By product type, the devices & instruments segment dominated the market with ~61% share in 2024. The devices & instruments were the crucial products required for cell harvesting. They were essential for the research and development of any treatment approaches and were used in large-scale production in industries and institutes. Thus, this contributed to the market growth.

By product type, the consumables segment is expected to show the fastest growth rate at a notable CAGR during the forecast period. The consumables are required continuously during cell harvesting as well as during the development of new therapies. Moreover, they are affordable and easily accessible.

By cell type, the mammalian cells segment held the largest share of ~53% in the market in 2024. The mammalian cells were used in the development of various biologics. Moreover, it was also used for formulating vaccines, recombinant proteins, cell therapies, etc. Thus, this increased the cell harvesting.

By cell type, the stem cells segment is expected to show the highest growth during the forecast period. The use of stem cells is increasing in the development of regenerative medicines, or personalized therapies. Additionally, the growing research in cancer, rare diseases, neurological diseases, etc., is advancing its development and applications.

By application type, the biopharmaceutical production segment held a dominating share of ~48% in the market in 2024. There was a rise in the demand for cell, gene therapies, vaccines, etc., which increased the biopharmaceutical production. This, in turn, enhanced the cell harvesting. Thus, all these factors enhanced the market growth.

By application type, the cell & gene therapy manufacturing segment is expected to show the fastest growth rate during the forecast period. Due to the growing awareness about the advantages of cell & gene therapy, their demand is increasing, enhancing cell harvesting. Moreover, the growing research, clinical trials, and funding are also contributing to the same.

By technique type, the centrifugation-based harvesting segment led the market with ~45% share in 2024. The centrifugation-based harvesting was widely used due to its ability to separate the different types of cells quickly, along with improved recovery rates. Hence was used in both small as well as large-scale production practices.

By technique type, the automated & closed system harvesting segment is expected to show the highest growth during the forecast period. The automated & closed system harvesting maintains the sterile conditions of the medium, reducing the risk of contamination. Additionally, it helps in monitoring the process, enhancing its quality.

By end user, the biopharmaceutical & biotechnology companies segment dominated the market with ~54% share in 2024. The increased diseases and the use of vaccines, advanced therapies, etc., have increased the cell harvesting and their production by the biopharmaceutical & biotechnology companies. Moreover, new such candidates were launched, which promoted the market growth.

By end user, the cell therapy companies & CDMOs segment is expected to show the fastest growth rate during the forecast period. The cell therapy companies & CDMOs are contributing to the growing development in cell therapies. At the same time, growing innovation is increasing clinical trials, increasing the demand for CDMO services.

North America dominated the cell harvesting market share by 43% in 2024. North America consisted of well-developed industries that consisted of advanced technologies, equipment, etc. Moreover, the growing developments in cell therapies have enhanced the use of cell harvesting. Thus, this contributed to the market growth.

The biopharma industries in the U.S. consist of robust infrastructure that helps in accelerating the cell harvesting procedures for various applications. At the same time, the growing development in cell and gene therapies is also increasing their use. This, in turn, leads to new collaborations among the industries as well.

To develop new treatment approaches, various research and development are being conducted in the industries and institutes in Canada. This is driving the cell harvesting demand. Additionally, these projects are being supported by NIH funding as well as government initiatives.

Asia Pacific is expected to host the fastest-growing cell harvesting market during the forecast period. Asia Pacific is experiencing an expansion in the healthcare sector. This, in turn, increases the research and use of stem cells and gene therapies. Thus, this enhances the market growth.

The growing diseases in China are increasing the demand for and research of cell and gene therapies. This, in turn, increases the cell harvesting procedures as well. Moreover, the utilization of advanced technologies optimizing their development reduces errors and contamination, as well as providing safe and high-quality harvesting.

The industries in India are expanding, which in turn is increasing the research for the development of various stem, gene, and cell therapies. At the same time, their manufacturing and development are also driven by growing investments. Furthermore, to make them affordable government is also providing its support.

Europe is expected to grow significantly in the cell harvesting market during the forecast period. The industries in Europe are advanced, which consist of advanced equipment that, in turn, enhances the cell harvesting. The research is also contributing to the same. Hence, this promotes the market growth.

The increasing incidence of chronic diseases in Germany is increasing the demand for advanced therapies. This, in turn, is promoting the cell harvesting process. Moreover, the growing use of immunotherapies and regenerative medicines is also contributing to the same. This development is supported by the regulatory bodies.

The industries as well as institutes in the UK are developing various personalized therapies to deal with growing diseases. Thus, the cell harvesting procedures are being amplified with the use of advanced technologies without affecting their safety and purity. Moreover, this is leading to new collaborations to enhance the development.

The Middle East & Africa are considered to be a significantly growing area, due to advancements in cell culture technologies and growing research and development activities. The growing demand for personalized medicines encourages foreign companies to set up their manufacturing infrastructure in the region. Favorable government support and increasing R&D investments also contribute to market growth.

The UAE University launched the Stem Cells Research Center to advance healthcare and innovation in regenerative medicine, thereby aligning with national efforts to enhance the UAE’s leadership in advanced medical sciences. Abu Dhabi aims to become a regional hub in organ failure treatment and stem cell therapy.

Latin America is expected to grow at a considerable CAGR in the upcoming period. The presence of key players, growing awareness of cell culture technologies, and the rapidly expanding genomics sector are the major factors that influence market growth. The rising adoption of advanced technologies and favorable government support propel the market growth.

Key players, such as Thermo Fisher Scientific, Cytiva Life Sciences, and Akadeum Life Sciences, are major providers of cell harvesting solutions in Brazil. As of November 2025, a total of 71 clinical trials were registered in Brazil related to stem cell therapy. In addition, 9 gene therapy products are approved by ANVISA for commercialization.

By Product Type

By Cell Type

By Application

By Technique

By End User

By Region

February 2026

February 2026

February 2026

February 2026