March 2026

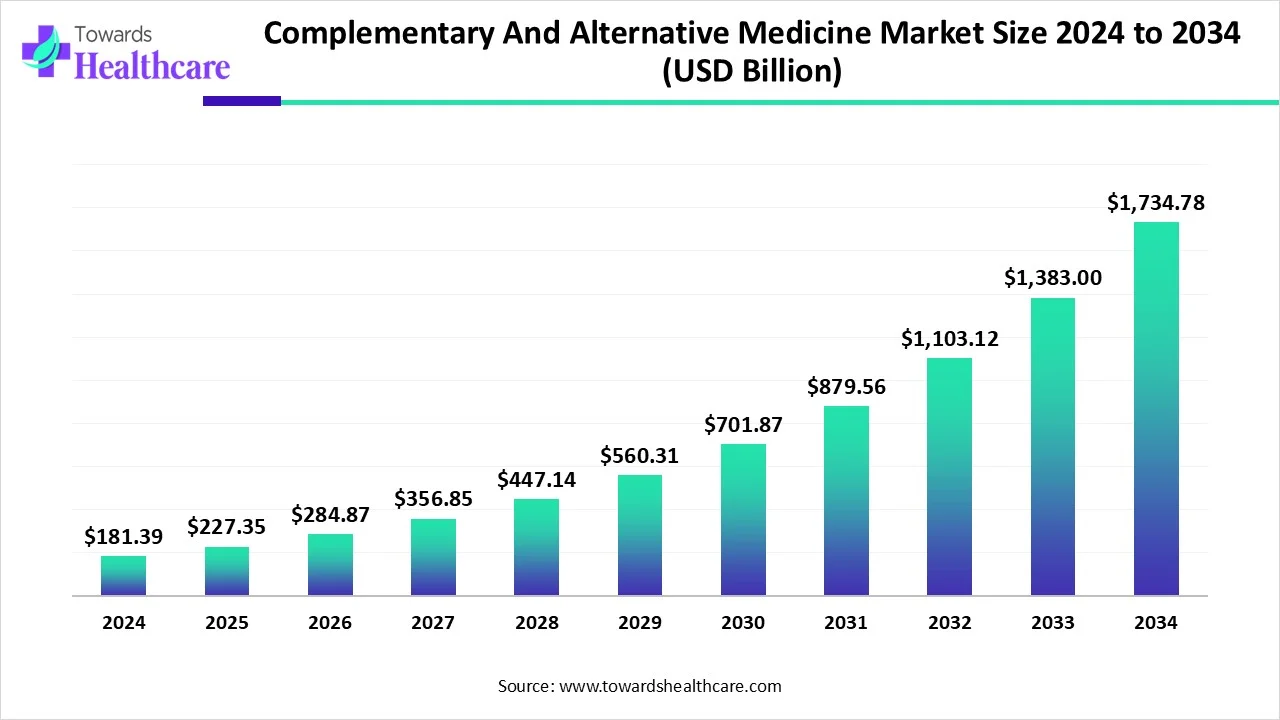

The global complementary and alternative medicine market size is calculated at USD 181.39 billion in 2024, grows to USD 227.35 billion in 2025, and is projected to reach around USD 1734.78 billion by 2034. The market is expanding at a CAGR of 25.34% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 227.35 Billion |

| Projected Market Size in 2034 | USD 1734.78 Billion |

| CAGR (2025 - 2034) | 25.34% |

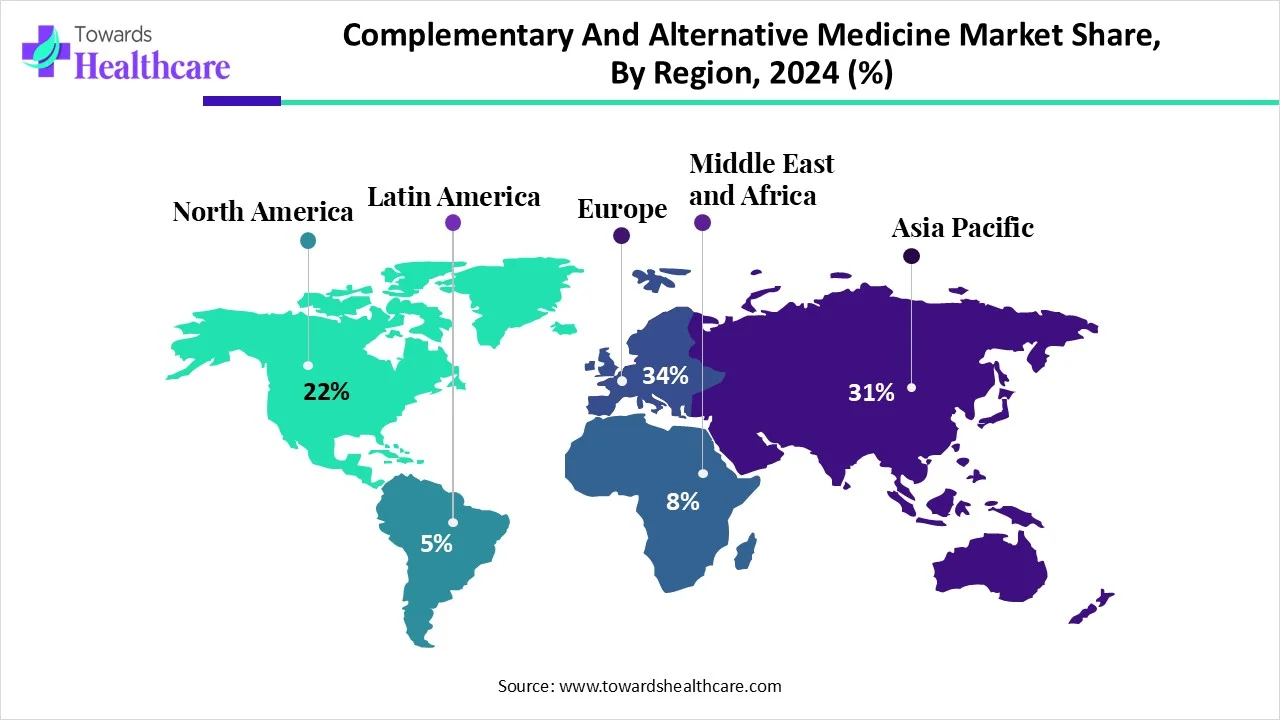

| Leading Region | Europe share by 34% |

| Market Segmentation | By Intervention, By Distribution Method, By Regions |

| Top Key Players | Columbia Nutritional, Nordic Nutraceuticals, Ramamani Iyengar Memorial Yoga Institute, The Healing Company Ltd., John Schumacher Unity Woods Yoga Centre, Sheng Chang Pharmaceutical Company, Pure encapsulations, LLC., Herb Pharm, AYUSH Ayurvedic Pte Ltd. |

Complementary and alternative medicine(CAM) includes diverse healthcare practices, such as herbal remedies, acupuncture, and meditation, used to support or replace standard medical treatments. CAM focuses on holistic care, emphasizing the body, mind, and spirit to improve overall health and prevent illness. Innovation is transforming the Complementary and alternative medicine market by introducing advanced technologies like telehealth, mobile apps, and evidence-based practices that are enhancing the credibility and effectiveness of CAM therapies. Additionally, innovations in herbal formulations and delivery systems are increasing safety and efficacy, driving wider acceptance and integration with conventional healthcare.

For Instance,

AI is enhancing the market by improving personalized treatment plans through data analysis of patient histories and responses. It helps in identifying effective therapies by analyzing large datasets and research findings. AI-powered tools also enable virtual consultations and remote monitoring, increasing accessibility and convenience for users. Additionally, AI aids in quality control and safety assessment of herbal and natural products, boosting confidence and adoption in the complementary and alternative medicine market.

Rising Consumer Demand for Natural and Holistic Health Solutions

The growing consumer preference for natural and holistic health solutions is a key driver of the complementary and alternative medicine market. As awareness about the side effects of conventional treatments increases, more people are turning to CAM therapies like herbal medicine, acupuncture, and yoga for safer, non-invasive care. These approaches focus on treating the whole person, mind, and body, aligning with the rising demand for personalized and preventive healthcare. This shift is significantly boosting the adoption and growth of CAM globally.

For Instance,

Lack of Standardization and Regulatory Challenges

Lack of standardization and regulatory challenges restrain the complementary and alternative medicine market because inconsistent quality, safety, and efficiency of products can reduce consumer trust. Without clear regulations, it becomes difficult. To validate claims or ensure uniform manufacturing practices. This creates barriers to market entry, limits international trade, and complicates integration with conventional healthcare systems. The absence of standardized guidelines also hinders clinical research and professional acceptance, slowing the overall growth and adoption of CAM therapies.

Advancement in Research and Development

Advancements in research and development present a major opportunity for the complementary and alternative medicine market by providing scientific validation for traditional therapies. As more clinical studies and evidence-based trials are conducted, the credibility and acceptance of CAM practices increase among healthcare professionals and patients. R&D also drives innovation in natural formulation, delivery methods, and personalized treatment approaches, improving effectiveness and safety. This fosters greater integration of CAM with conventional medicine, expanding market potential.

For Instance,

By intervention, the traditional alternative medicine segment was dominant in the market in 2024, due to its deep cultural roots, rising global acceptance, and effectiveness in managing chronic conditions. Systems Ayurveda and Traditional Chinese Medicine gained popularity for their holistic, natural approach. Government support, affordability, and accessibility further boosted their use. As more people sought preventive and wellness-focused care, the demand for traditional methods increased, making them the leading segment in the CAM industry.

For Instance,

By intervention, the mind healing segment is expected to grow at the fastest rate in the market during the forecast period, due to increasing awareness of mental health and rising cases of stress, anxiety, and depression. Practices like meditation, mindfulness, and therapy are gaining popularity as effective, non-invasive treatments. Scientific validation and the integration of mind-body approaches into mainstream healthcare have further boosted acceptance. Additionally, digital platforms and apps have made these services more accessible, driving rapid growth of the complementary and alternative medicine market.

By distribution method, the direct sales segment held the major market share in 2024 due to its personalized approaches, cost efficiency, and strong consumer trust. This method allows companies to engage directly with customers, offer tailored product recommendations, and eliminate intermediaries, reducing costs. It also enables better education about product use and benefits, increasing customer satisfaction. Additionally, in regions with limited retail infrastructure, direct sales provide a flexible and accessible distribution model, further boosting their complementary and alternative medicine market dominance.

By distribution method, the E-sales segment is projected to grow at the fastest CAGR in the market during the studied years, due to increasing digital adoption and the convenience of online platforms. Consumers prefer e-sales for easy access to a wide range of CAM products and virtual consultations. The rise of mobile apps, telehealth, and emerging technologies like virtual reality in wellness services further fuels growth. Additionally, growing awareness and demand for natural health solutions are driving more consumers toward digital purchasing channels.

Europe dominated the market share by 34% in 2024. This dominance stemmed from widespread cultural acceptance of natural therapies, robust regulatory frameworks, and integration of CAM into national healthcare systems. Countries like Germany and France have long-standing traditions in herbal medicine and homeopathy, bolstered by government support and insurance coverage. Additionally, Europe's aging population increasingly favors non-invasive, holistic treatments, further propelling the region's leadership in the CAM sector.

For Instance,

The UK's market is experiencing significant growth, driven by several key factors. A substantial portion of the population—over 40%—utilizes CAM therapies such as acupuncture, homeopathy, and herbal medicine. This trend is fueled by a growing preference for natural, holistic health solutions, especially among individuals managing chronic conditions like arthritis. The expansion of e-commerce and telehealth platforms has also enhanced accessibility to CAM products and services. Additionally, high-profile endorsements and increased public interest in wellness have further propelled the market's expansion.

Germany's market is expanding due to a strong cultural preference for natural therapies like homeopathy and herbal medicine. The integration of CAM into the national healthcare system, supported by insurance coverage, enhances accessibility. Germany hosts leading CAM product manufacturers, ensuring a robust supply chain. Additionally, the government's emphasis on preventive healthcare and wellness initiatives further propels market growth.

Asia-Pacific is anticipated to grow at a lucrative rate in the market during the forecast period. These include a rising prevalence of chronic diseases such as diabetes and cardiovascular conditions, leading to increased demand for CAM therapies. Additionally, growing health consciousness among the population and government initiatives promoting the integration of traditional practices like Ayurveda and Traditional Chinese Medicine into mainstream healthcare are propelling market expansion. The region's rich heritage in traditional medicine and increasing investments in CAM infrastructure further contribute to its lucrative growth prospects.

For Instance,

China's market is growing due to strong cultural roots in Traditional Chinese Medicine (TCM) and increasing public trust in natural healing methods. Government support and integration of TCM into the national healthcare system have boosted accessibility. Rising interest in holistic wellness, combined with greater availability through digital platforms, is also encouraging more people to adopt CAM practices across urban and rural areas.

India's market is expanding due to strong government support for traditional systems like Ayurveda, Yoga, Unani, Siddha, and Homeopathy (AYUSH). This includes initiatives such as the establishment of the WHO Global Centre for Traditional Medicine in India and the integration of AYUSH services into national healthcare programs. Additionally, a growing consumer preference for natural and holistic health solutions, along with increased accessibility through digital platforms, is driving the market's growth.

North America's complementary and alternative medicine (CAM) market is significantly expanding in 2025 due to several key factors. There's a growing consumer preference for natural and holistic health solutions, leading to increased adoption of therapies like yoga, meditation, and herbal remedies. The integration of CAM into conventional healthcare systems, supported by healthcare providers and insurance coverage, has enhanced accessibility and legitimacy. Additionally, the rise of digital platforms and telehealth services has made CAM therapies more accessible to a broader audience, further driving market growth.

The U.S. market is growing due to rising chronic diseases and a strong consumer shift toward holistic health approaches. Increased awareness and acceptance of CAM therapies among both the public and healthcare providers have boosted demand. Additionally, improvements in digital health platforms and better insurance coverage have made these therapies more accessible and affordable, driving the market’s steady expansion.

For Instance,

A growing preference for holistic and natural health solutions is evident, with Canadians increasingly seeking therapies like yoga, acupuncture, and herbal treatments. Additionally, the integration of CAM into mainstream healthcare, supported by favorable government policies and insurance coverage, has enhanced accessibility. The rise of digital platforms and e-commerce has further facilitated consumer access to CAM products and services, contributing to the market's expansion.

In May 2025, WHO introduced its first-ever Traditional, Complementary, and Integrative Medicine (TCIM) Dashboards. These interactive digital tools provide up-to-date global and country-specific data, replacing static survey reports. Based on insights from the Third WHO Global Survey (2023–2024), the dashboards allow continuous monitoring of TCIM policies, regulations, and integration. This innovation improves data access for policymakers and researchers, supporting evidence-based decisions and global cooperation in TCIM. (Source - World Health Organization)

By Intervention

By Distribution Method

By Regions

March 2026

February 2026

February 2026

February 2026