February 2026

The computer-aided drug design (CADD) market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

The growing research and development activities and the rising funding by government and private institutions support the creation of new drugs. Prominent players collaborate to access advanced technologies and develop more effective drugs. The future looks promising, with advancements in genomics and proteomics, as well as progress in computer technology.

Computer-aided drug design (CADD) refers to the use of computational techniques and software tools to discover, design, and optimize new drug candidates. CADD integrates bioinformatics, cheminformatics, molecular modeling, and simulation to accelerate drug discovery processes, reduce costs, and improve the success rates of new therapeutics. It involves structure-based and ligand-based drug design approaches to predict the binding affinity, pharmacokinetics, and toxicity profiles of potential drug molecules before synthesis and clinical testing.

The major growth factors of the market are the growing research and development activities and the increasing demand for faster drug discovery. Numerous government organizations support the use of CADD through funding and initiatives. The rising collaborations among key players and academic researchers foster market growth. Technological advancements drive the latest innovations in CADD tools and software.

Artificial intelligence (AI) plays a crucial role in CADD by automating the process of drug design. AI and machine learning (ML) algorithms can analyze vast amounts of data and screen a large number of compounds. They enable researchers to identify the most active and effective drug compounds from a large dataset. AI and ML can also predict properties of novel compounds, allowing researchers to develop drugs with higher efficacy and fewer side effects. They can also predict the binding of drugs in the active site of proteins and determine their stability with the proteins after administering the drug.

New Drug Discovery Research

The major growth factor of the computer-aided drug design (CADD) market is the growing new drug discovery research. The conventional drug discovery process takes 12-15 years to develop a novel drug and costs about $2.6 billion. Additionally, the probability of success for a drug candidate entering clinical trials is only around 10%. CADD enables researchers to expedite the drug discovery and development process, thereby saving time and costs for researchers. It can also predict the pharmacokinetic and pharmacodynamic properties of compounds, allowing researchers to anticipate and address potential issues related to novel drug compounds, thereby increasing the chance of a drug entering a clinical trial.

High Cost

CADD software and tools are very expensive and require an annual subscription. This limits the affordability of several small- and medium-sized enterprises, as well as research institutions, especially in underdeveloped and developing countries.

What is the Future of the Computer-Aided Drug Design (CADD) Market?

The future of the market is promising, driven by the increasing market competitiveness among key players. The rising number of pharma & biotech startups potentiates competition to develop more novel drugs with greater efficacy. Major players invest heavily in R&D every year to facilitate new drug discovery and development. Merck and Johnson & Johnson contribute 27% and 24% of their revenue to R&D investment, respectively. The increasing collaborations and mergers & acquisitions help key players expand their services. Thus, increasing investment and collaboration strengthen their market position.

By type, the structure-based drug design (SBDD) segment held a dominant market share of approximately 55% in 2024. This segment dominated due to the availability of protein structure and the burgeoning proteomics sector. Ongoing efforts are made to determine the complex structure of proteins or enzymes, and drugs are designed based on their structure. This helps researchers to develop drugs with greater specificity and selectivity. SBDD also enables researchers to optimize the binding pattern of drug molecules to the target.

By type, the ligand-based drug design (LBDD) segment is expected to grow at the fastest CAGR in the market during the forecast period. The availability of large ligand databases facilitates the use of the LBDD approach. LBDD eliminates the need for the protein structure. Novel drugs are designed based on the chemical properties of existing drugs, allowing researchers to create drugs with desired characteristics. LBDD is comparatively cost-effective as it does not require complex software to determine protein structure.

By technology, the molecular docking segment contributed the biggest revenue share of approximately 40% of the market in 2024, due to its ability to assess the binding efficacy of drug compounds with the target. Molecular docking is a primary step in drug screening. The molecular docking procedure is comparatively easier to perform and does not need complex computational requirements, enabling researchers to save costs. It plays a vital role in making drug discovery faster, cheaper, and more effective.

By technology, the AI/ML-based drug design segment is expected to grow with the highest CAGR in the market during the studied years. The increasing use of AI and ML due to their advancements boosts the segment’s growth. AI and ML can screen vast amounts of data and identify essential features required for biological activity. They can also detect chemical features that can cause adverse effects in humans. Thus, AI/ML-based drug design can enhance data analysis and prediction, leading to faster and more effective treatments.

By application, the cancer research segment held the largest revenue share of approximately 35% of the market in 2024. The segmental growth is attributed to the rising prevalence of cancer and the growing demand for developing novel and more effective cancer drugs. According to the World Health Organization (WHO), about 1 in 5 people develop cancer in their lifetime, and approximately 1 in 9 men and 1 in 12 women die from the disease. (Source - WHO) Numerous government organizations launch initiatives to prevent, detect, diagnose, treat, and cure different types of cancer.

By application, the infectious diseases segment is expected to expand rapidly in the market in the coming years. The increasing prevalence of infectious diseases and the need for rapid antiviral drug discovery augment the segment’s growth. Infectious diseases are caused by pathogens like bacteria and viruses. These pathogens tend to mutate immediately in response to a drug or environmental conditions. Hence, there is an increasing need to develop novel drugs to combat antimicrobial resistance.

By end-user, the pharmaceutical and biotech companies segment led the global market with a share of approximately 60% in 2024. This segment dominated due to the presence of favorable infrastructure and suitable capital investment. Pharmaceutical & biotech companies prefer the CADD approach to design novel drugs, reducing the drug development timeline. They also focus on developing more effective treatments with reduced side effects. They can expand their drug pipeline and strengthen their position in the market.

By end-user, the academic & research institutes segment is expected to witness the fastest growth in the market over the forecast period. Academic and research institutes have skilled professionals to operate complex software for drug design. The increasing academic-industry collaboration also facilitates the development of novel drugs. They receive funding for their research work from the government and private organizations, propelling market growth.

By deployment mode, the on-premise segment held a major revenue share of approximately 65% of the market in 2024. This segment dominated because on-premise tools enable complete control over the system. On-premise tools can be operated without any internet connection, thereby maintaining the privacy of confidential data. There is no risk of cyberattacks. Researchers can tailor their research data and reduce long-term costs for large, established teams.

By deployment mode, the cloud-based segment is expected to show the fastest growth over the forecast period. The segmental growth is attributed to the rapid advancements in connectivity technology and remote access benefits. Cloud-based platforms enable researchers to access data from anywhere in the world and at any time. They eliminate the need for any suitable infrastructure to install complex equipment. They do not require any maintenance, thereby saving lots of cost.

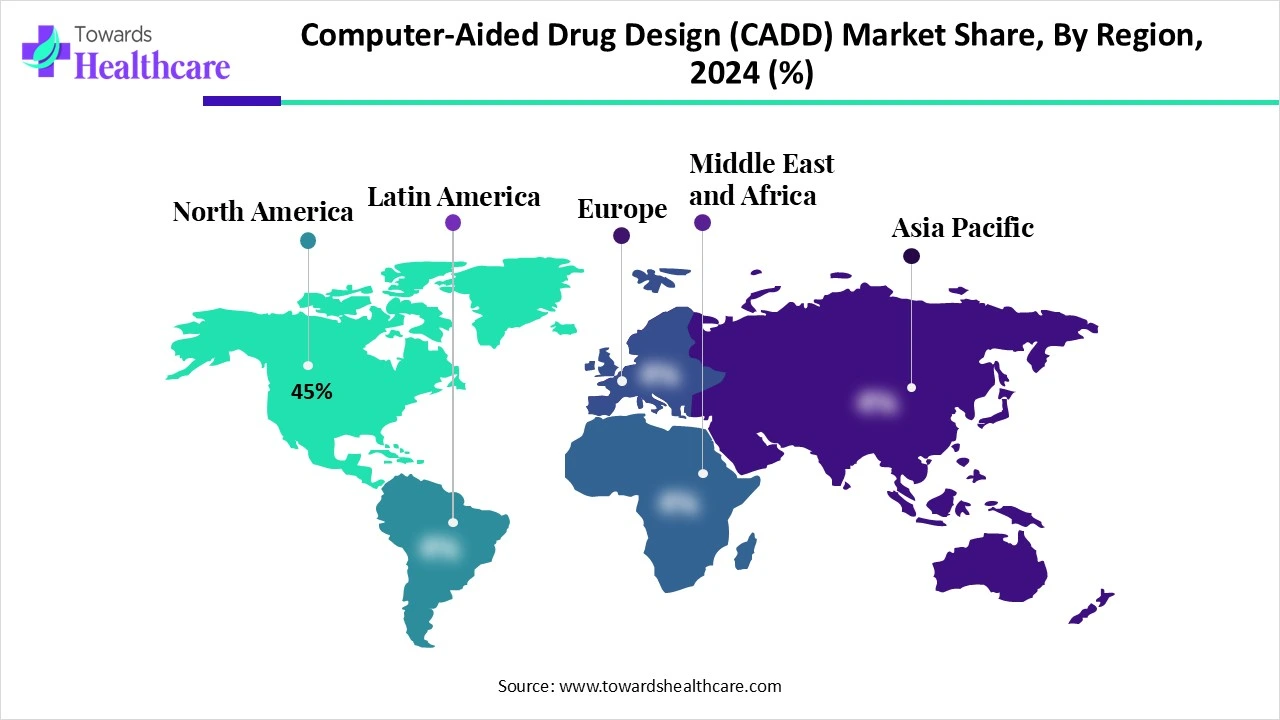

North America dominated the global market with a share of approximately 45% in 2024. The presence of key players, technological advancements, and increasing investments are the major growth factors of the market in North America. The availability of state-of-the-art research and development infrastructure also promotes market growth. Favorable government initiatives and increasing collaboration are fostering market growth.

Key players, such as Schrödinger, Inc., BIOVIA, and Molsoft LLC, are the major contributors to the market in the U.S. The U.S. Food and Drug Administration (FDA) approved 50 new drugs in 2024, including pharmaceuticals and biologics. (Source - US Food Drug & Delivery) The National Institute of Health (NIH) is a major government body that provides funding for many types of grants, contracts, and research programs involving new drug discovery research.

The Ontario Institute for Cancer Research (OICR) announced funding of $300,000 over two years for Ontario researchers to help advance promising drug discovery research to develop novel cancer drugs. (Source - OICR) The Government of Canada also actively supports the adoption of cutting-edge technologies and approaches to accelerate drug discovery. (Source - Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the computer-aided drug design (CADD) market during the forecast period. The increasing R&D investments by government and private organizations, and the burgeoning pharmaceutical sector, boost the market. Numerous institutions conduct seminars, conferences, and workshops to train individuals and increase awareness about the latest updates in the field of CADD. The increasing venture capital investments enable companies to develop novel tools and software to transform drug discovery and development.

The National Medical Products Administration (NMPA) approves the highest number of new drugs in the world. The NMPA approved a total of 228 new drug applications in 2024, including 123 drugs, 93 biologics, and 12 traditional Chinese medicines. (Source - Nature) According to a recent report by Stifel, large pharma companies in-licensed about 31% of their external molecules from China in 2024. China also contributed 29% of new global clinical trials in 2023.

India hosts a total of 3,000 drug companies and is ranked third in pharmaceutical production by volume. The CSIR-CDIR, Lucknow, recently organized an “International Symposium on Current Trends in Drug Discovery Research”. The Indian government allocated Rs. 5000 crores, including Rs 700 crores, to establish Centers of Excellence (COEs) at 7 NIPER institutes and Rs. 4250 crores to accelerate investments in the R&D ecosystem within the sector. (Source - Department of Pharmaceutical)

Europe is expected to grow at a considerable CAGR in the computer-aided drug design (CADD) market in the upcoming period. Favorable government support and growing research and development activities potentiate market growth. The increasing number of pharma and biotech startups also contributes to market growth. The rising adoption of advanced technologies and the growing demand to strengthen Europe’s position in the pharmaceuticals market favor the use of CADD. Major players, such as Chemaxon, Accenture, and BioSolve IT, are the key contributors to market growth in Europe.

The German government’s Medical Research Act (MFG) is a major legislative reform to strengthen Germany’s position as an attractive environment for medical innovation and pharmaceutical development. (Source - B farm) In 2024, 43 novel drugs were launched in Germany, representing the fourth-highest in the past two decades.

In May 2025, Sorbonne University and Qubit Pharmaceuticals announced the launch of FeNNix-Biol, the world’s most powerful AI model, for molecular simulation in pharmaceutical chemistry. The model can simulate molecular behavior with precision and speed. (Source - Siliconre public) The French government organized an “Artificial Intelligence Action Summit: France, land of AI” in February 2025 to discover the latest advances in the field. (Source - Business France)

Martin Rose, CEO of Tetra Pharm Technologies, commented on collaborating with Kvantify that the collaboration will help to accelerate their drug development process and significantly expand their pipeline of promising drug candidates. Moreover, the collaboration is also expected to transform the landscape of ECS-targeted drug discovery, potentially leading to significant advancements in therapeutic options for patients. (Source - Quantum zeitgeist)

By Type

By Technology

By Application

By End Use

By Deployment Mode

By Region

February 2026

February 2026

February 2026

February 2026