February 2026

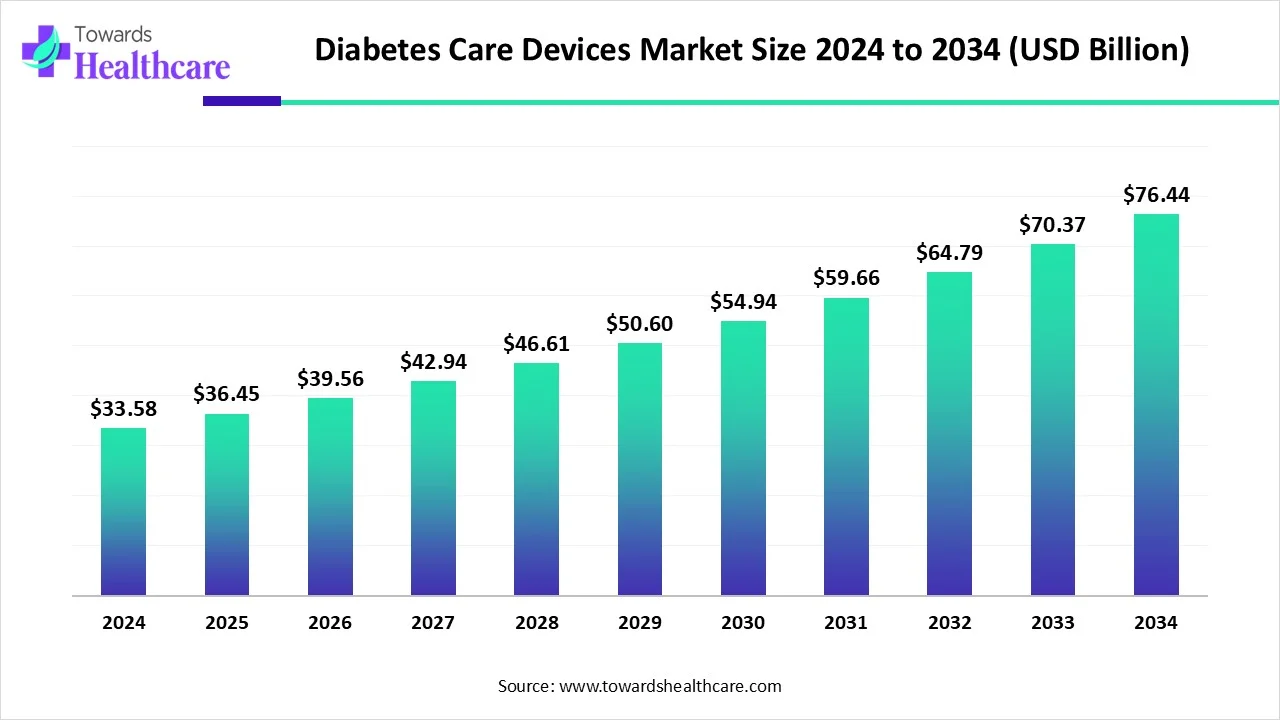

The global diabetes care devices market size is calculated at USD 33.58 billion in 2024, grow to USD 36.45 billion in 2025, and is projected to reach around USD 76.44 billion by 2034. The market is expanding at a CAGR of 8.54% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 33.58 Billion |

| Projected Market Size in 2034 | USD 76.44 billion |

| CAGR (2025 - 2034) | 8.54% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, End-use, By Region |

| Top Key Players | BOC Sciences, Thermo Fisher Scientific Inc., Merck KGaA, Glen Research, LGC Biosearch Technologies, Biosynth, BIONEER CORPORATION, QIAGEN, PolyOrg, Inc, Lumiprobe Corporation |

The diabetes care devices market includes medical devices used for monitoring blood glucose levels and managing insulin delivery in diabetic patients. It encompasses products like glucose meters, continuous glucose monitors, insulin pens, insulin pumps, and lancets. These devices help individuals with diabetes maintain blood sugar control and improve overall health outcomes. The market is expanding primarily due to the increasing global prevalence of diabetes, driven by sedentary lifestyles, unhealthy diets, and aging populations. Rising awareness about early diagnosis and effective disease management is also boosting demand.

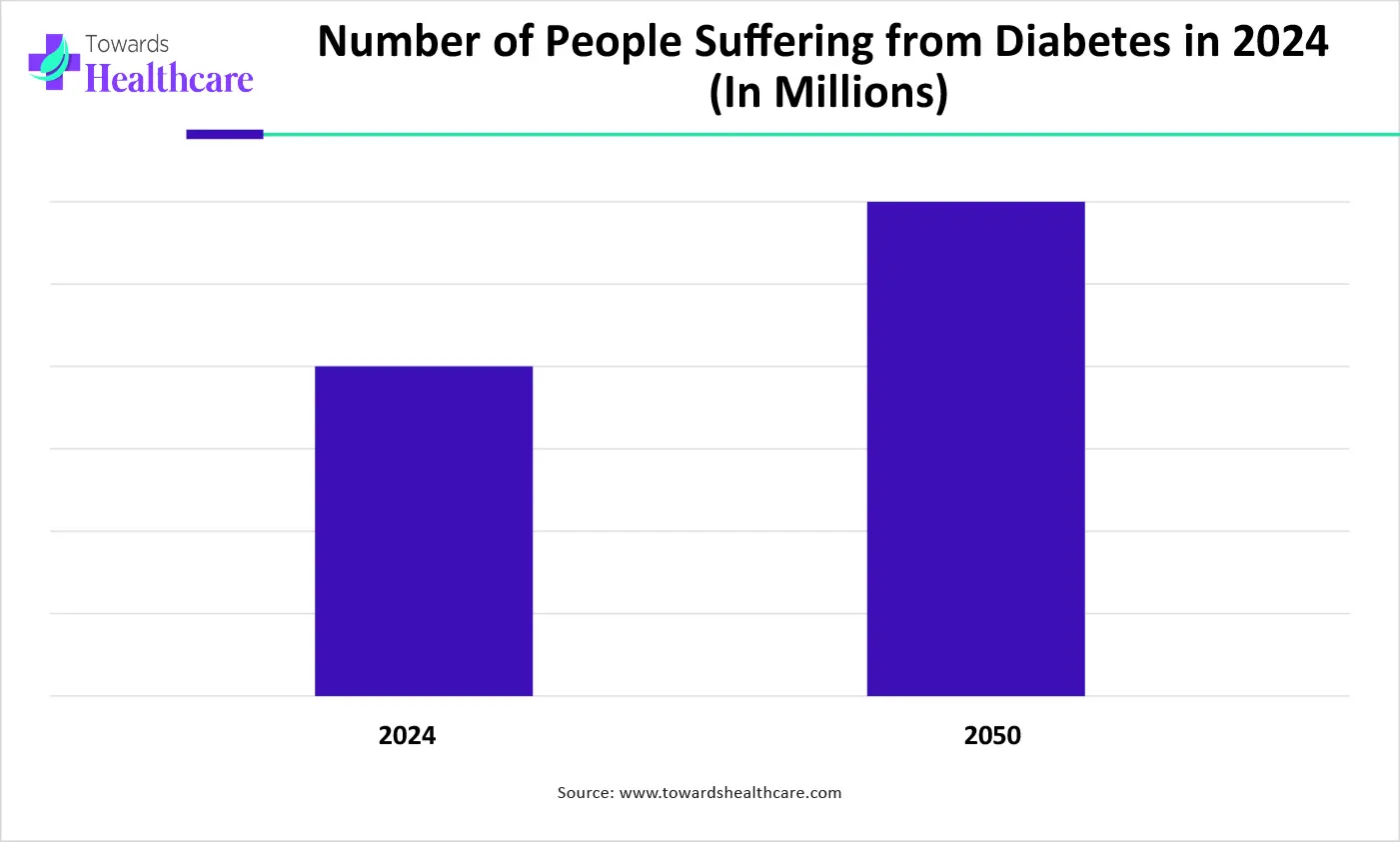

Technological advancements such as continuous glucose monitors and smart insulin delivery systems are making diabetes care more efficient and user-friendly. Additionally, government initiatives and improved healthcare infrastructure in emerging economies are enhancing access to diabetes care products, further driving market growth across both developed and developing regions.To determine the number of people suffering from diabetes worldwide in 2024, the International Diabetes Federation gives an estimate.

The various government initiatives for diabetes prevention, screening, diagnosis, and treatment are as follows:

Artificial Intelligence (AI) is playing a transformative role in the market by improving the efficiency and accuracy of disease management. AI-powered systems can analyze vast amounts of patient data to predict glucose level fluctuations, enabling timely interventions and better glycemic control. Smart insulin delivery devices use AI algorithms to automate and personalize insulin dosing, reducing the risk of hypo- or hyperglycemia. Additionally, AI enhances remote patient monitoring and supports clinical decision-making, making diabetes care more proactive and data-driven. As a result, AI is driving innovation and improving outcomes in diabetes management worldwide.

The Rising Prevalence of Diabetes

The rising prevalence of diabetes drives the diabetes care devices market because a growing number of individuals require continuous monitoring and effective management of their blood glucose levels. As more people are diagnosed with diabetes due to factors like poor diet, sedentary lifestyle, and aging populations, the demand for devices such as glucose monitors, insulin pumps, and continuous glucose monitoring systems increases. These tools are essential for daily disease management, reducing complications, and improving quality of life, thereby fueling consistent growth in the market.

For instance,

Lack of Awareness Regarding the use of Diabetes Devices

Many patients and healthcare providers remain uninformed about advanced tools like continuous glucose monitors and insulin pumps. This leads to low adoption, improper usage, and mistrust of technology. In underdeveloped regions, poor education and limited healthcare access further hinder device usage, slowing global market expansion despite rising diabetes prevalence.

Government Initiatives

Government initiatives provide a significant opportunity for the diabetes care devices market by increasing awareness, access, and affordability of diabetes management solutions. Through funding programs, public health campaigns, and the introduction of reimbursement policies, governments can promote the adoption of advanced diabetes care technologies. Additionally, initiatives aimed at early detection, prevention, and treatment of diabetes can drive demand for monitoring and management devices. These actions support the market by expanding coverage, improving healthcare infrastructure, and encouraging innovation in diabetes care solutions.

The latest R&D activities in diabetes care devices include the development of non-invasive devices with continuous monitoring. Innovative devices are integrated with AI and ML to enhance their efficiency and accuracy.

Key Players: Abbott Healthcare, Medtronic, and Dexcom

Diabetes care devices are assessed for their safety, efficacy, and precision through clinical trials, which are further approved by regulatory agencies of respective countries.

Key Players: DiaMon Tech AG, GlucoTrack, Inc., and Nemaura Medical

Diabetes care devices enable patients to get in touch with their physicians from the comfort of their home and away from hospitals. Companies also launch a patient support program (PSP) for diabetics.

Key Players: Roche Diagnostics, Ascensia Diabetes Care, and Novartis AG

By monitoring devices, the glucometer device segment held the largest share of the self-monitoring blood glucose devices market in 2024, due to the ease of operation. Glucometers offer quick, reliable, and accurate blood glucose measurements, making them a convenient and accessible option for daily diabetes management. Their cost-effectiveness and portability further enhance their appeal, particularly among individuals managing diabetes at home. With established adoption and continuous demand for effective monitoring tools, glucometers continue to dominate the diabetes care devices market within self-monitoring blood-glucose devices.

By monitoring devices, the continuous blood glucose monitoring segment is estimated to grow at the fastest CAGR during the predicted timeframe, due to its ability to provide real-time, continuous tracking of blood glucose levels. Unlike traditional methods, continuous blood glucose monitoring offers detailed insights into glucose trends, enabling better disease management and reducing the risk of complications. The increasing adoption of wearable health technologies, rising awareness among patients, and strong support from healthcare professionals are fueling this growth. Technological advancements, improved sensor accuracy, and user-friendly features are also making continuous blood glucose monitoring more accessible and attractive for long-term diabetes care.

By management devices, the disposable insulin pen segment held the largest share of the market in 2024. This pen comes prefilled with insulin, eliminating the need for manual preparation, which makes it highly suitable for both first-time users and those seeking a more practical alternative to traditional syringes. Their portability, accuracy, and ease of disposable also contribute to their popularity, especially among insulin-dependent patients. In addition, rising diabetes prevalence, increased patient awareness, and expanding access to healthcare in both developed and emerging markets have supported their widespread adoption. The combination of simplicity, safety, and growing global demand has positioned disposable insulin pens as a preferred choice in insulin therapy.

By management devices, the insulin pump segment is predicted to grow at the highest CAGR in the market due to its ability to deliver precise and continuous insulin doses, improving blood glucose control, and reducing the risk of complications. Insulin pumps offer greater flexibility and convenience compared to multiple daily injections, making them increasingly preferred by patients with Type 1 diabetes and some with Type 2. Technological advancements, such as integration with continuous glucose monitors and smart features, are further driving adoption. Growing awareness, improved healthcare access, and increasing demand for advanced diabetes management solutions are also contributing to the diabetes care devices market growth.

North America dominated the global diabetes care devices market in 2024, largely due to the high prevalence of diabetes, advanced healthcare infrastructure, and the presence of leading industry players. The region has shown strong adoption of innovative technologies such as insulin pumps, driven by high patient awareness and proactive disease management. Additionally, supportive government policies, significant funding for diabetes research, and favorable reimbursement frameworks have encouraged the use of modern diabetes care solutions. These combined factors have contributed to North America's leading position in the global market during the forecast period.

The U.S. market is growing steadily due to rising diabetes prevalence, driven by lifestyle changes and an aging population. Technological advancements such as continuous glucose monitors, insulin pumps, and smart pens have made diabetes management more accurate and convenient. Regulatory support, including FDA approvals, and accessibility. Additionally, the integration of digital health tools and AI enhances personalized care. These factors together are fueling the sustained growth of the market.

In November 2023, according to a CDC report, about 136 million U.S. adults were affected by either diabetes or prediabetes. This reflects the increasing burden of the condition and underscores the need for effective monitoring and management tools.

The market is expanding due to the rising number of diabetes and prediabetic cases, with over 5.7 million diagnosed and nearly 6 million more at risk. Technological advancements like continuing glucose monitors and smart insulin pens are improving disease management and treatment adherence. Government initiatives, including subsidies and support programs like the Pharmacare Act, are ensuring access to these devices. Additionally, an aging population, especially in provinces like Ontario, is contributing to increased demand, further driving market growth.

Europe is anticipated to grow at the fastest rate in the market during the forecast period. Europe is anticipated to grow rapidly in the diabetes care devices market due to increasing awareness of diabetes management and advancements in healthcare technology. Rising healthcare investments, coupled with the adoption of innovative devices such as smart insulin pens and wearable glucose monitoring systems, are contributing to this growth. The focus on improving healthcare systems, particularly in countries like Germany and France, along with the growing demand for better patient outcomes, is expected to drive the market forward. Additionally, the increasing prevalence of chronic diseases in Europe further supports this trend.

In October 2023, Medtronic received approval for its new continuous glucose monitor (CGM) called Simplera in Europe. This approval marks a significant step in expanding access to advanced diabetes management technology within the region, offering patients a more efficient way to monitor their glucose levels continuously.

The UK market is growing due to government support through initiatives like the National Health Service (NHS) adoption of advanced technologies, such as hybrid closed-loop systems. Technological innovations, including continuous glucose monitors (CGMs) and insulin pumps, are improving patient management and increasing adoption rates. Additionally, the aging population in the UK is contributing to a higher incidence of diabetes, further driving demand for effective diabetes care solutions. These factors combined are fostering market growth and enhanced patient outcomes.

Germany's market is expanding due to rising diabetes prevalence, with an estimated 8.5 million people affected, expected to rise to 12 million by 2040. Technological advancements, including continuous glucose monitors (CGMs), insulin pumps, and smart insulin pens, are improving patient management and treatment adherence. Additionally, government initiatives promoting diabetes awareness and prevention, along with investments in telemedicine and mobile health applications, are accelerating the adoption of digital health solutions. Germany's strong healthcare infrastructure and advanced diabetes care facilities further support market growth.

Asia-Pacific is anticipated to grow at a significant rate in the diabetes care devices market during the forecast period due to expanding healthcare infrastructure and increasing investments in medical technology. Rising awareness about diabetes management, along with improvements in diagnostic and monitoring devices, is driving market demand. Additionally, the adoption of innovative solutions like digital health platforms and mobile applications for diabetes care is increasing. Rapid economic growth in the region is also improving access to diabetes care devices, while government policies are fostering healthcare development, further boosting market expansion during the forecast period.

China's market is expanding due to the high prevalence of diabetes, with China now having the largest number of cases globally. Urbanization, changing diets, and sedentary lifestyles contribute to the rise in diabetes cases. Additionally, the aging population is increasing the demand for diabetes care solutions. The Chinese government has introduced initiatives to reduce medical costs for diabetic patients and promote National Metabolic Management Centers, which focus on improving care. Technological advancements in self-monitoring devices, insulin pumps, and continuous glucose monitors are further driving the market's growth.

India's market is expanding due to the increasing number of diabetic patients requiring better management solutions. Rising healthcare awareness, especially in tier 2 and tier 3 cities, is driving demand for effective diabetes management tools. Additionally, the growing presence of global and local diabetes device manufacturers in India is making advanced products more accessible. Furthermore, the government's push for digitization in healthcare and the rising adoption of telemedicine are also playing a key role in the growth of diabetes care devices in the country.

The Middle East & Africa are expected to grow at a notable CAGR in the diabetes care devices market in the foreseeable future. The rising prevalence of diabetes and the burgeoning medical device sector bolster market growth. The growing research and development activities and the increasing use of advanced technologies facilitate the use of innovative diabetes care devices. People are becoming aware of diagnosing and treating diabetes at an early stage. The increasing investments by government and private organizations and collaborations among key players contribute to market growth.

In 2024, approximately 7.7 million people were affected by diabetes in the UAE, representing 20.7% of the total adult population. Companies like Diabetes Arabia, GluCare.Health, and Medworld Trade manufactures and distributes diabetes care devices in the UAE. The Ministry of Health and Prevention conducted more than 12,000 tests for the early detection of diabetes as part of its Government Accelerators Program Initiative.

The International Diabetes Federation (IDF) reported that approximately 38 million people had diabetes in 2024, accounting for 7.2% of the total adult population. The South African government has launched the “Diabetes Prevention Programme” to inform community-specific diabetes education strategies.

In March 2025, Tandem Diabetes Care, Inc. announced the U.S. launch of its Control-IQ+ technology, the latest version of its hybrid closed-loop algorithm. This new technology, compatible with the t: slim X2 insulin pump and Tandem Mobi System, is available for individuals with type 1 diabetes aged 2 and older, as well as adults with type 2 diabetes. New customers will receive pumps pre-loaded with the updated software, and existing eligible customers will get the upgrade through a free remote software update. John Sheridan, the company’s CEO, highlighted that the new features offer greater personalization, flexibility, and ease of use, benefiting a broad range of users.

By the Monitoring Device

By Management Device

By Region

February 2026

February 2026

January 2026

January 2026