March 2026

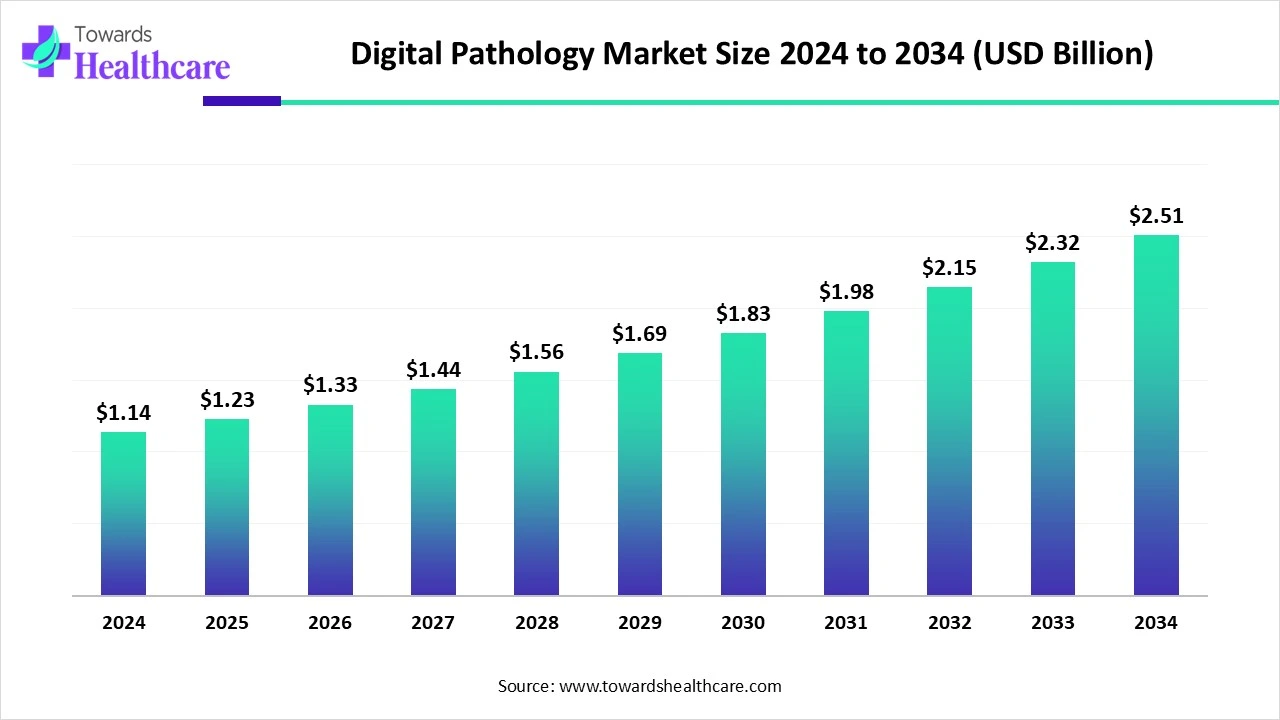

The global digital pathology market size is calculated at USD 1.14 in 2024, grew to USD 1.23 billion in 2025, and is projected to reach around USD 2.51 billion by 2034. The market is expanding at a CAGR of 8.24% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 1.23 Billion |

| Projected Market Size in 2034 | USD 2.51 Billion |

| CAGR (2025 - 2034) | 8.24% |

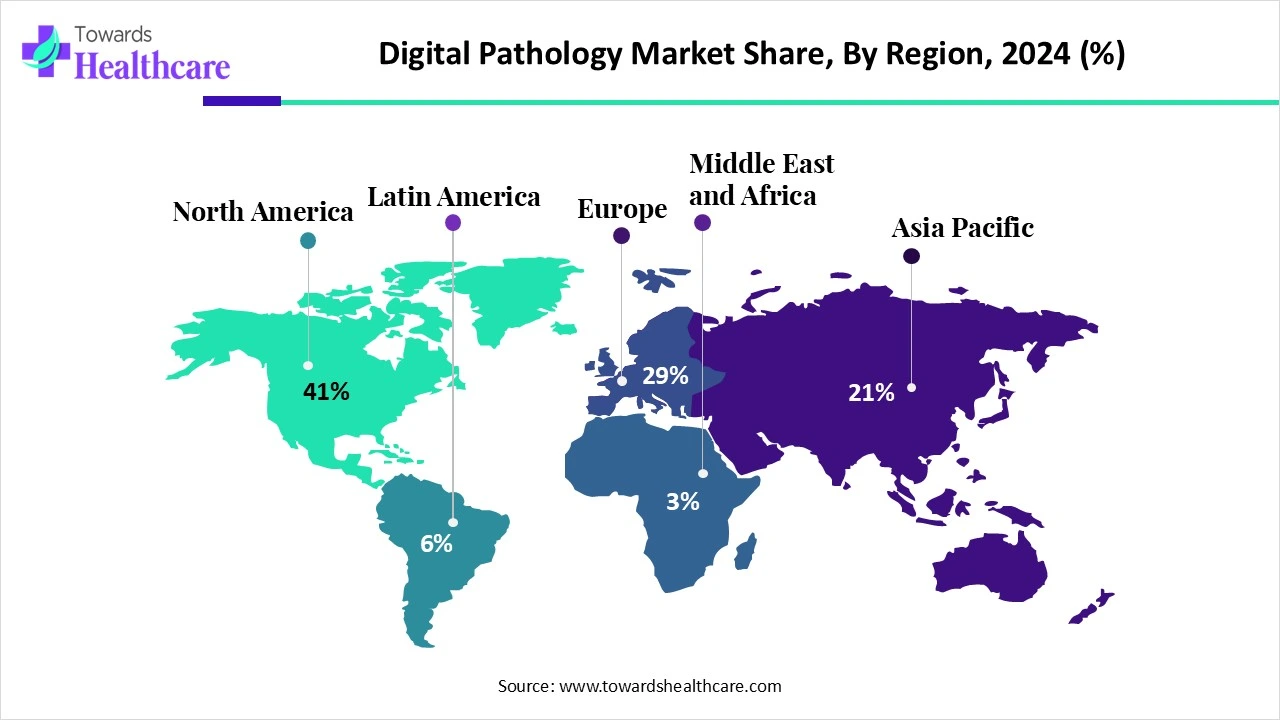

| Leading Region | North America share by 41% |

| Market Segmentation | By Product type, By Type, By Application type, By End Use type, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd., Koninklijke Philips N.V., Leica Biosystems Nussloch GmbH, 3DHISTECH Ltd., PathAI, Paige, Proscia, Danaher Corporation, Hamamatsu Photonics K.K. |

Digital pathology is described by, involves altering physical glass slides of tissue samples into high-resolution images for observing and examining on the computer monitor. Different computer-aided diagnostic (CAD) tools can be used in digital pathology, along with artificial intelligence (AI) and machine learning (ML), to encourage recognition and quantification of pathological characteristics. The market has been showing rising demand for these tools as there is an increasing prevalence of chronic diseases like cancer, and also enhancing the focus on optimizing workflow efficiency.

AI has the potential to increase the accuracy, efficiency, and completeness of the workflow of pathology, which results in improved patient care and certainly decreased costs. One of the developed technologies, called telepathology, AI-aided, permits pathologists to review slides from home, approach expert consultations, and deliver the diagnosis to patients from different geographical locations. By increased use of AI-based tools in medical care and an increase in capital investments, progress is contributing to a rise in demand for the technology in the digital pathology market.

Enhanced Investments and Utilization of Technology

As a rising chronic instances and cancer, which require rapid and highly accurate diagnostic approaches, are impelling the digital pathology as a significant tool. Moreover, nowadays, increasing investments in healthcare along with main leaders who regulate the focus on new launches in the market, rising utilization of telepathology, and raised aim on drug discovery, are influencing the market growth.

Barriers to Integration and Data Security

Integration of digital pathology with functional laboratory operations, electronic health records (EHRs), and laboratory information systems (LISs) can lead to complications. For this, modifications in processes, personnel training, and ensuring harmony with the working infrastructure are required. Besides this, digital pathology possesses sensitive patient information, which has raised increasing concerns about data security and privacy.

Raise Business Opportunities with AI-Aided Applications.

The digital pathology market is showing significant growth as it is impelled by advancements in AI, enhanced telepathology applications, and increasing healthcare expenses. Various business opportunities are generating like digital pathology solutions, hardware production, software development, and service providers. As the AI increases the accuracy and decreases the completion time for pathology reports, it can also make the tasks automated, such as slide scanning and sorting, liberating pathologists for more complicated analysis.

By product type, the device segment held the largest share of the digital pathology market in 2024. Slide management systems and scanners are involved in the device segment. In academic research activities, this segment has shown growth with raised resolution power. These slides can be used in the digitization of tissue analysis, as they are generating high-resolution tissue samples’ digital images, resulting in convenient reviewing and analyzing the reports at remote locations and more efficiently.

By product type, the software segment is predicted to grow at the fastest rate in the upcoming years. This segment is experiencing significant growth, as AI and ML are employed, which are assisting in pathology report analysis and raising the diagnostic accuracy level, as well as making the workflows more efficient. Some eminent examples include ImageJ/Fiji, QuPath, CellProfiler, Cytomine, and commercial platforms like Aperio and Proscia's Concentriq LS.

By type, the human pathology segment held the largest share of the digital pathology market in 2024. This segment dominated due to the rise in demand for accuracy and systematic diagnosis, specifically in chronic diseases such as cancer. However, the integration of digital pathology with AI and ML is contributing to the rapid pace, accuracy, and effectiveness of pathological analysis, which results in enhanced patient outcomes.

By type, the veterinary digital pathology segment is expected to grow significantly during the forecast period. The increasing number of animal associations and enhanced awareness about animal health are contributing to the demand for digital pathology in veterinary. With minimum restrictions in veterinary diagnoses using virtual scanned slides are promoting the implementation of digital pathology in the veterinary sector.

By application, the academic research segment led the market in 2024. Numerous academic research institutes are aligning with digital pathology providers to include the technology in research activities. For the conversion of glass slides into digital images for analysis, which assists the research in several domains like tumor morphology and disease response, digital pathology is widely applied. Applications with advanced technologies, AI-aided image analysis influencing the growth of the digital pathology market.

By application, the disease diagnosis segment is predicted to grow at the fastest rate in the upcoming years. The growth of this segment is greatly influenced by, rising prevalence of chronic diseases, and the rising target for the development of faster and new diagnostic techniques for the timely exchange of inter- and intra-departmental information by manufacturers. By the application of advanced technologies, it supports upgrading and increasing the efficiency of disease diagnosis and, thus, improves the therapeutics.

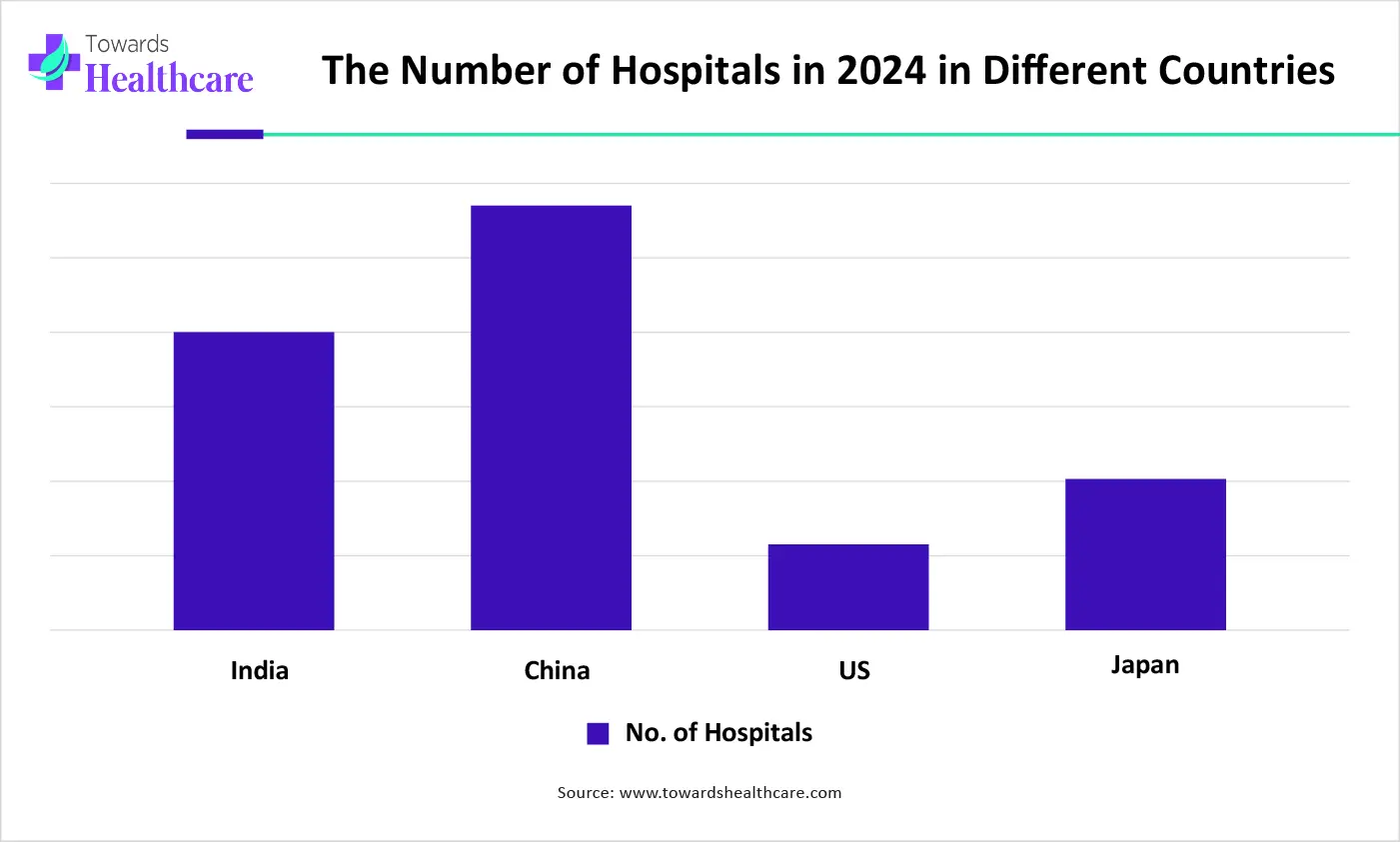

By end use, the hospital segment held the largest digital pathology market share in 2024. This segment dominated as hospitals with having higher number of patients are resulting in rising demand for more accurate and efficient pathology services. The growth of the market is propelled by enhanced diagnostic pace, which provides rapid patient care from hospitals by using digital pathology systems. Also, it gives simplified workflows, leads to enhanced productivity, and decreased processing time.

By end use, the diagnostic labs segment is seen to grow at the fastest rate during the forecast period. Globally, rising cancer instances and enhanced clinical trials of oncology are driving for growth of digital pathology in diagnostic labs. Technological advancements like whole-slide imaging and AI integration are playing a major role in the growth of this segment.

North America led the digital pathology market share by 41% in 2024. Primarily, the growth is impacted by the rise in cancer cases, advanced healthcare infrastructures, and technological advancements. As a government encouraging technological development for advanced pathologies, frequent R&D investments, enhanced digital imaging approaches, and the participation of market leaders of the region, aiming to provide exceptional solutions to the population.

Enhanced approaches of digital pathology are influenced by factors such as technological advancements, regulatory modifications, and the possible increased efficiency and inexpensive. Although, as a developing, less than 10% of US organizations are encouraging digital pathology for clinical purposes, which has been predicted to rise in the forecast period.

Canada is a vital core for the advancement and acquisition of digital pathology, fueled by the demand to overcome the geographical hurdles of providing various expert services across the country. Canada has an uncommon situation, such as scattered population centers and trouble in transportation of specimens and specialists, which forces digital pathology as a crucial tool in providing services with high-quality services.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, which is propelled by the rising acquisition of digital technologies, rising awareness of its advantages, and demand for enhanced diagnostic effectiveness and accuracy. Along with this, integrated AI and ML are allied with the progress of inexpensive solutions, which may lead to the expansion of the market in the upcoming period.

In China, boosting the patient population, unsatisfied medical necessities, and government initiatives are accelerating technological advancements. The market trend in China comprises teleconsultation, disease diagnosis, training and education, and most importantly, AI-based image analysis for increased accuracy and efficiency.

In Japan, the market is facing significant growth as it is fueled by factors such as a rising geriatric population and limitations of pathologists. Also, it has been employed in education, remote consultation, disease diagnosis, and research in the country. AI and ML-based technology are playing a vital role in the growth of the market.

The market of Europe is showing significant growth, which is fueled by the rise in prevalence of chronic diseases like cancer, cardiovascular conditions, and diabetes, as well as a larger number of emerging diagnostic imaging centers. This rising concerns demand highly precise and appropriate diagnostic tools; besides this, arising government investments in R&D in digital pathology are a major factor that assists in the growth of the market.

The UK market is experiencing rapid market growth, as it is impelled by enhanced needs for remote diagnostics, AI-based tools, and the necessity for a highly efficient digital pathology market. To maximize the specialized services and lessen the processing time, remote reviewing and consultation with a pathologist by using digital pathology slides are becoming widely employed in the market growth. Whereas, application of AI integration algorithms into digital pathology systems permits for automated analysis, predictive analytics, and more effective diagnoses.

In Germany, the market is facing significant growth, which is influenced by factors like increased acquisitions of technological advancements and advantages of remote alliance with AI-aided tools. Telepathology is playing a crucial role in the growth of the market, as it is feasible to review the slides and consultation from any location or remotely. Furthermore, digital pathology is more convenient than conventional methods and is cost-effective as well.

Latin America is expected to grow at a notable CAGR in the digital pathology market in the foreseeable future. The growing need for advanced technology in the healthcare sector promotes the adoption of digital pathology. The rapidly expanding medical tourism sector enables Latin American nations to digitize pathology, providing state-of-the-art diagnosis and care. Government organizaons are also supporting digitalization in the pathology sector.

The Scientific Laboratory Division of the New Mexico Department of Health performs more than 350,000 tests on nearly 80,000 samples. In May 2025, the 66th Mexican Pathology Congress was organized. Dr. Mario Murguía Pérez, head of the DIME laboratory, shared remote diagnosis and teaching workflows using KFBIO digital pathology scanners. (Source: KFBIO)

In February 2025, PathAI announced a strategic partnership with Rede D’OR to distribute its cutting-edge technology to Rede D’OR’s network of hospitals and diagnostic centers. Rede D’OR becomes the largest Brazilian integrated healthcare network to implement the AISight digital pathology image management system to enhance efficiency and advance clinical research. (Source: Path AI)

The Middle East & Africa are considered to be a significantly growing area in the digital pathology market, due to the rising adoption of advanced technologies and the growing demand for digitization. Government organizations launch initiatives to promote digitization among healthcare organizations, including pathology laboratories. The increasing need for telemedicine, as well as faster and more accurate results, propel the market. Key players provide innovative devices and software for pathology testing purposes.

The 13th Digital Pathology and AI UCG Congress conference will be held in September 2025, focusing on the intersection of pathology and digital technology. The conference is a platform for sharing knowledge, exploring innovations, and discussing trends in digital pathology. The UAE government’s National Platform for Radiology and Pathology potentiates the use of a deep convolutional network to collect different diseases.

South Africa is a leader in Africa’s digital economy due to its advanced digital infrastructure, vibrant startup ecosystem, and proactive government commitment to fostering digital growth. There are about 380 medical laboratories accredited to international standards in Sub-Saharan Africa.

By Product type

By Type

By Application type

By End Use type

By Region

March 2026

March 2026

March 2026

March 2026