February 2026

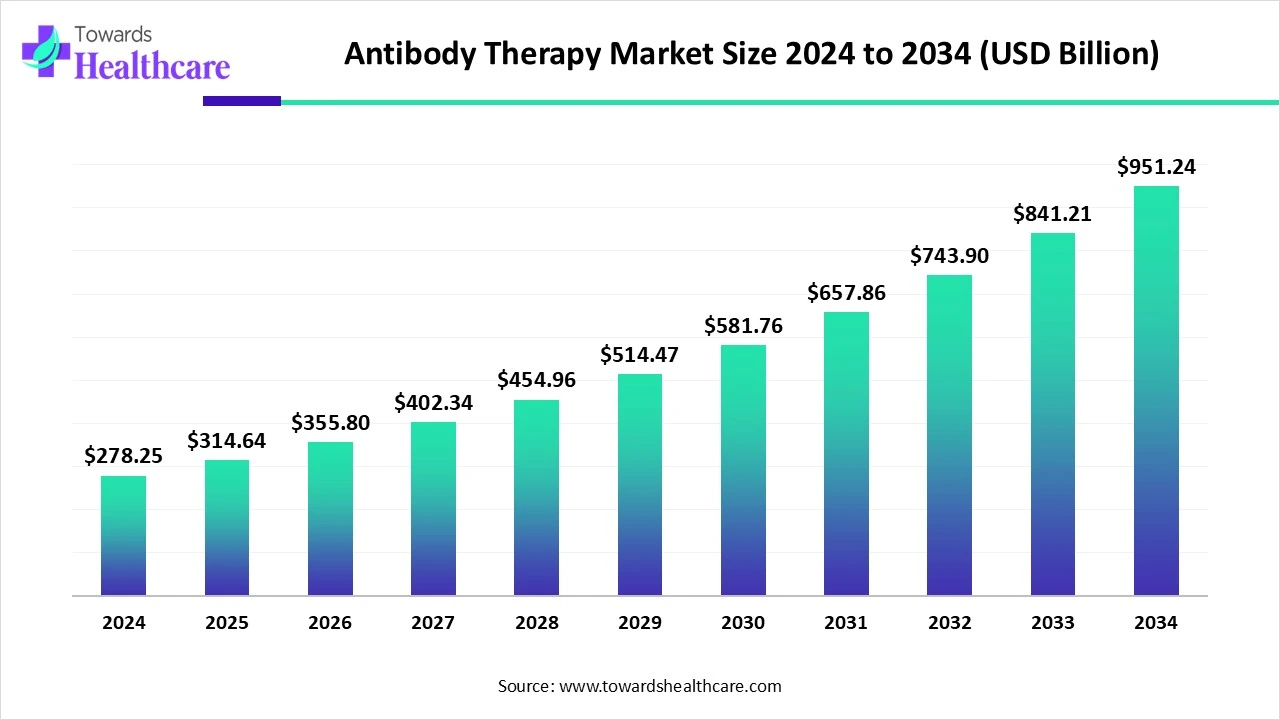

The global antibody therapy market size is calculated at US$ 278.25 in 2024, grew to US$ 314.64 billion in 2025, and is projected to reach around US$ 951.24 billion by 2034. The market is expanding at a CAGR of 13.08% between 2025 and 2034.

The use of antibody therapies is increasing in the treatment of various diseases. The growing research and development to identify, design, and optimize are also enhancing their advancements, clinical trials, and launches. Additionally, new platforms are being developed with the use of AI to improve the antibody and its target discovery. This, in turn, is leading to new collaboration among the industries and institutes. Hence, their acceptance rate in various regions is increasing. Thus, all these factors are promoting the market growth.

| Metric | Details |

| Market Size in 2025 | USD 314.64 Billion |

| Projected Market Size in 2034 | USD 951.24 Billion |

| CAGR (2025 - 2034) | 13.08% |

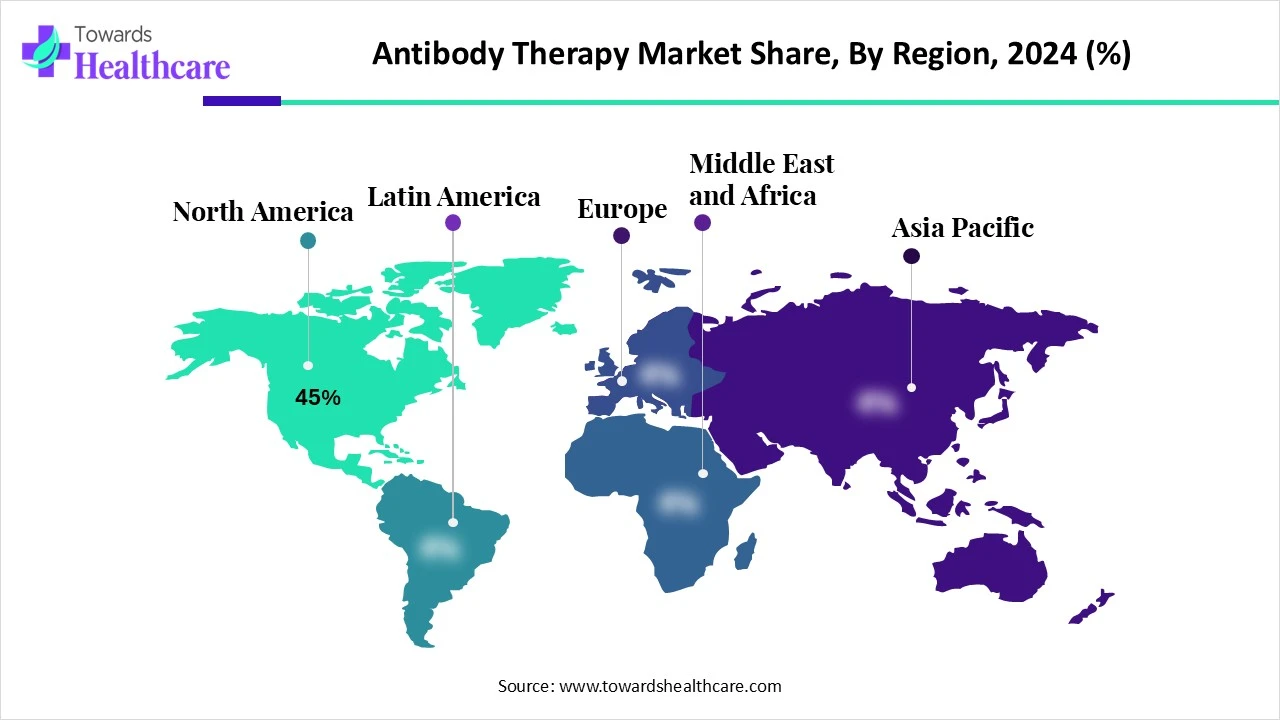

| Leading Region | North America share by 45% |

| Market Segmentation | By Type of Antibody, By Therapy Area, By Mechanism of Action, By Route of Administration, By End-User, By Region |

| Top Key Players | Takeda Pharmaceuticals, Bristol-Myers Squibb, Eli Lilly and Company, GlaxoSmithKline plc, Novartis AG, Merck & Co, Inc., Regeneron Pharmaceuticals, Merck & Co, IncSeagen, Seagen, Johnson & Johnson, F. Hoffmann-La Roche Ltd. |

The antibody therapy market encompasses the development, production, and application of monoclonal antibodies (mAbs) and other antibody formats used to treat a wide range of diseases, including cancer, autoimmune disorders, infectious diseases, and inflammatory conditions. These therapies target specific antigens to neutralize disease mechanisms, offering precision treatment with fewer side effects than traditional drugs. Key modalities include monoclonal antibodies, bispecific antibodies, antibody-drug conjugates (ADCs), and immune checkpoint inhibitors. At the same time, the new antibody targets and antibody discovery advancements can enhance the design and development of antibody therapies.

AI plays a crucial role in the design and discovery of antibodies for antibody therapies. It also helps in the optimization and development of the therapies. Moreover, AI and machine learning (ML) can be used in the computational prediction of antibody structure and antigen interface or interaction. Additionally, various models are being developed to predict the antibody non-specific binding and affinity with the use of antibody datasets. Thus, the use of AI for the design, development, and optimization of potent antibody therapies is increasing.

Increasing Chronic Diseases

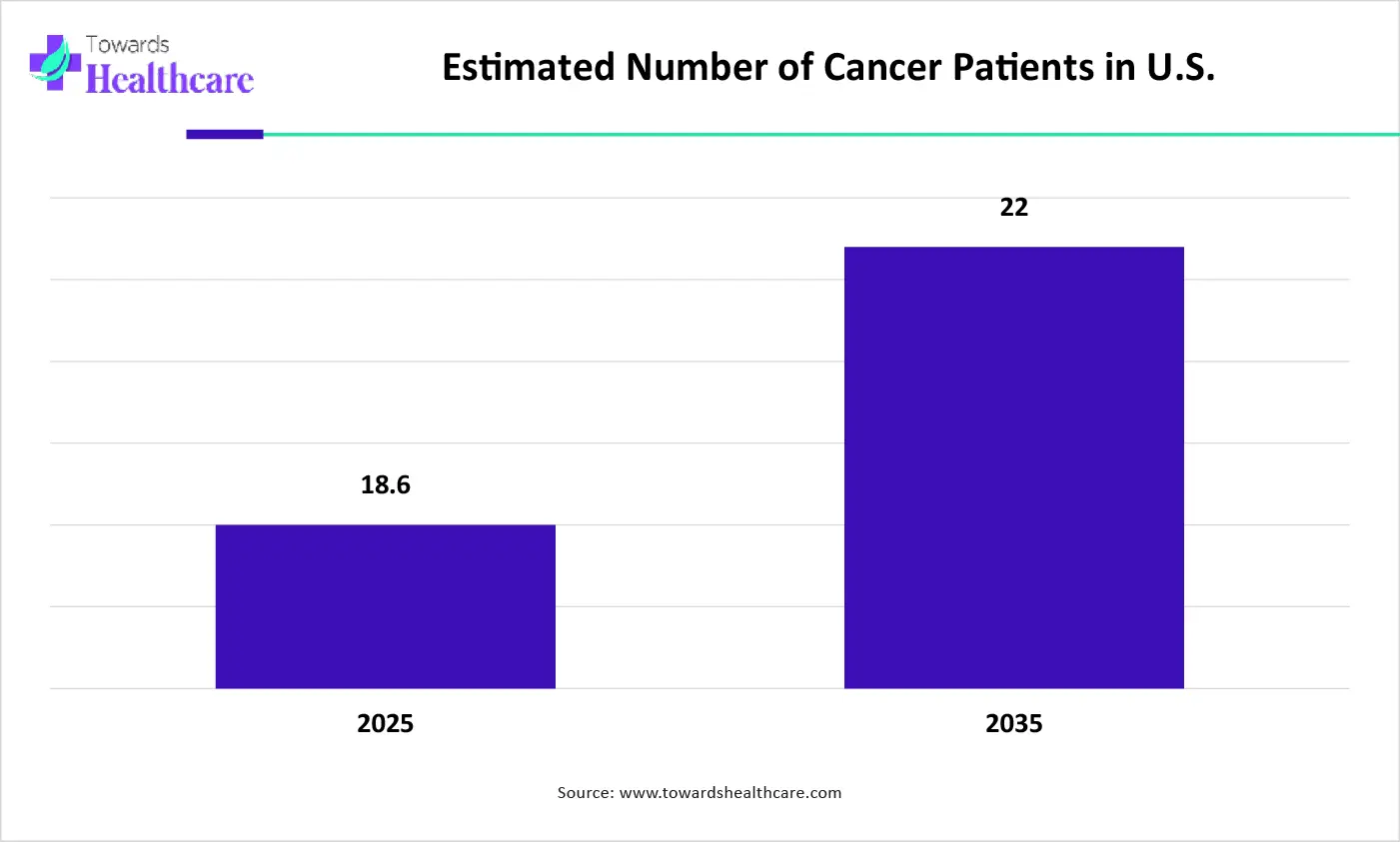

The growing incidence of chronic diseases such as cancer, asthma, diabetes, etc., is increasing the demand for the use of antibody therapies. The antibody therapies provide target-specific action, minimizing the side effects associated with them. They are also being used in the treatment of recurring diseases or as an alternative for resistant treatment options. Thus, they reduce the chances of disease relapses and surgeries in many cases, which in turn, enhances the patient outcomes. Thus, all these factors are driving the antibody therapy market growth.

The graph represents a comparison between the cancer patients in the U.S. in the year of 2025 and 2035. It indicates that there will be a rise in cases of cancer. Hence, it increases the demand for the use of antibody therapies for its effective management. Thus, this in turn will ultimately promote the market growth.

Complex Manufacturing

The manufacturing of antibody therapies requires advanced equipment and consists of a multistep procedure. Variation in these steps affects its safety, efficacy, and potency. Moreover, there is a high chance of contamination, increasing the need for quality control procedures. Additionally, the regulatory hurdles also delay their manufacturing.

Increasing Advances in Antibody Discovery

There is a rise in the discovery of antibodies to develop effective and safe antibody therapies for the management of various diseases. At the same time, various platforms are being developed to accelerate their discoveries, enhance their efficacy, and minimize their toxicity. These antibodies are further used for the development of bispecific antibodies, antibody drug conjugates, etc., which are being used in the treatment of various infectious or rare diseases. Thus, all these developments are promoting the antibody therapy market growth.

For instance,

By antibody type, the monoclonal antibodies (mAbs) segment held a dominating share of ~64% in the market in 2024. The mAbs showed target-specific action, which in turn increased their use in various diseases. Thus, various next-generation mAbs were used as treatment options. This contributed to the market growth.

By antibody type, the bispecific antibodies segment is expected to show the highest growth at a notable CAGR during the upcoming years. The bispecific antibodies are being used in the treatment of cancer and autoimmune diseases due to their dual targeting mechanism. Moreover, new candidates are also being developed and evaluated.

By therapy area type, the oncology segment led the market with ~48% in 2024. The growth in the incidence of cancer has increased the use of antibody therapies for its treatment. Moreover, their targeted action and personalized therapies enhanced their use.

By therapy area type, the neurology segment is expected to show the fastest growth rate during the predicted time. The increasing neurological diseases is increasing the use as well as development of various antibody therapies. This, in turn, is increasing the clinical trials and is supported by the government investments.

By mechanism of action type, the targeted cell killing segment held the largest share of ~40% in the market in 2024. The targeted cell killing helped in reducing the cytotoxicity and other side effects. Hence, they were used in cancer treatment. Thus, this enhanced the market growth.

By mechanism of action type, the immune modulation segment is expected to show the highest growth during the forthcoming years. The immune modulation helps in stimulating or enhancing the immune system's responses against diseases. Hence, its use in autoimmune diseases is increasing.

By route of administration type, the intravenous (IV) segment led the market with ~70% in 2024. The intravenous route of administration showed a rapid onset of action along with enhanced bioavailability of the antibodies. Thus, this route was the preferred option for various large-sized antibodies.

By route of administration type, the subcutaneous (SC) segment is expected to show the fastest growth rate during the upcoming years. The patients are now shifting to the use of the subcutaneous route as it provides convenience to them. Moreover, the self-administration through this route is also increasing, which enhances the patient's adherence to the treatment.

By end user, the hospitals & clinics segment held the largest share of the market in 2024. A large volume of patients with different diseases were treated in the hospitals & clinics by using antibody therapies. Moreover, the presence of skilled professionals enhanced patient compliance and outcomes

By end user, the contract research & manufacturing organizations (CROs/CMOs) segment is expected to show the highest growth during the predicted time. The growing research and development of antibody therapies is increasing the use of CROs/CMOs services. Furthermore, growing clinical trials are also contributing to the same.

North America dominated the antibody therapy market share by 45% in 2024. North America consisted of a well-developed healthcare sector, along with the presence of advanced technologies and skilled personnel. This enhanced the production and development of antibody therapies. Thus, this contributed to the market growth.

The industries in the U.S. are well developed and are contributing to the accelerated production of antibody therapies to treat various diseases. At the same time, the use of advanced technologies is helping in their optimization and discoveries. The fundings are also enhancing their development and trials.

The growing use of bispecific antibodies and antibody drug conjugates is resulting in the increased use of antibody therapies in Canada. Moreover, the growing rates of cancer or autoimmune diseases are increasing their early adoption. Thus, their development and approvals are supported by various investments.

Asia Pacific is expected to host the fastest-growing antibody therapy market during the forecast period. The increasing incidence of various diseases in the Asia Pacific is increasing the demand for the use of antibody therapy. Their development is also supported by the investments. Thus, this enhances the market growth.

The growing investments in the healthcare sector of China are enhancing the development and production of antibody discoveries as well as antibody therapies. Moreover, new therapies are being discovered and evaluated by leveraging advanced technologies. At the same time, the aging population is increasing its use.

The increasing diseases in India is increasing the use of antibody therapies. This, in turn, is promoting their development as well as research. Therefore, there is a rise in the clinical trials as well. Furthermore, investments are also provided by the government to make them affordable and accessible.

Europe is expected to grow significantly in the antibody therapy market during the forecast period. The industries and institutes in Europe are focused on developing and discovering new antibody targets and therapies. This, in turn, is increasing the candidates for clinical trials. Thus, this promotes the market growth.

The use of various antibody therapies in Germany is increasing to deal with the growing diseases. This, in turn, is leading to new research and development, promoting innovative therapies. Moreover, funding is provided to encourage these advancements by the government.

The R&D sector of the industries and the institutions present in the UK are increasing the development as well as innovations in the antibody therapies. This, in turn, is increasing the number of clinical trials conducted. Additionally, new collaborations are promoting these developments. Furthermore, the use of advanced technologies is improving their design and discoveries.

By Type of Antibody

By Therapy Area

By Mechanism of Action

By Route of Administration

By End-User

By Region

February 2026

February 2026

February 2026

February 2026