February 2026

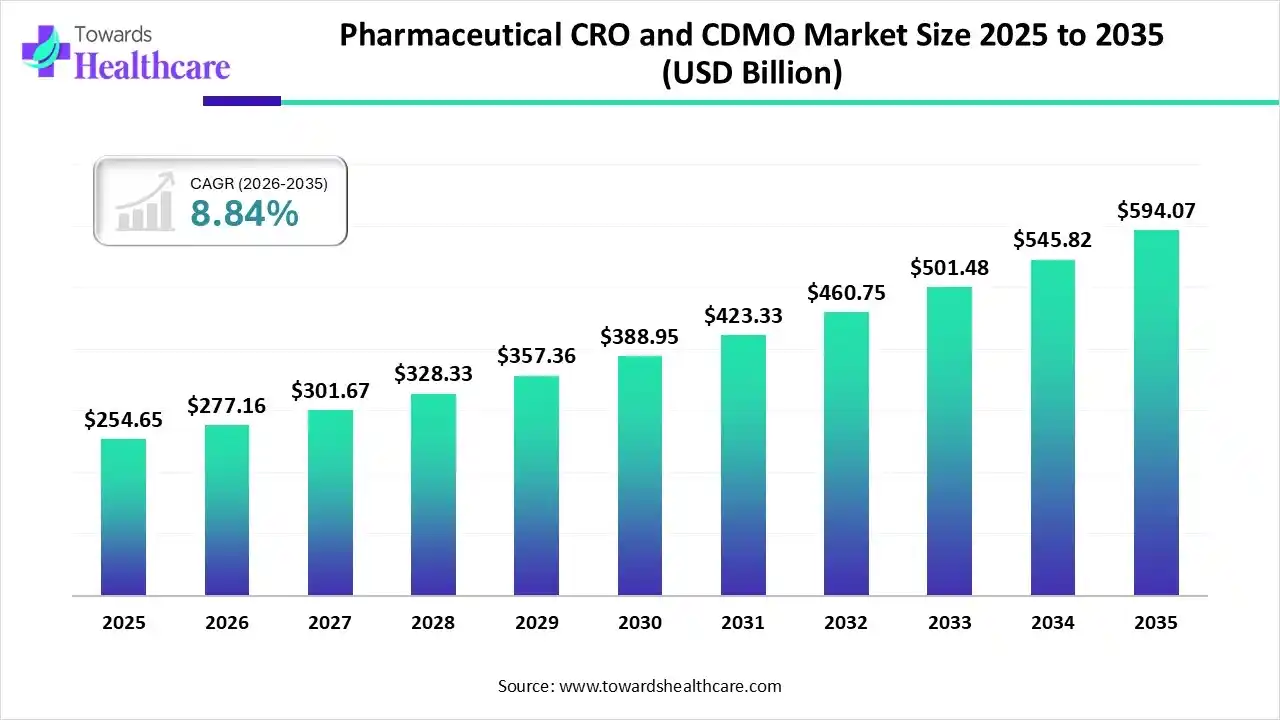

The global pharmaceutical CRO and CDMO market size was estimated at USD 254.65 billion in 2025 and is predicted to increase from USD 277.16 billion in 2026 to approximately USD 594.07 billion by 2035, expanding at a CAGR of 8.84% from 2026 to 2035.

The growing development of various advanced treatment options is increasing the demand for pharmaceutical CRO and CDMO services, leading to their collaborations. Furthermore, their growing expansion and adoption of advanced technologies are also promoting the market growth.

The pharmaceutical CRO and CDMO market is driven by the growing shift towards asset light business model to manage the increasing R&D cost and technical complexities. The pharmaceutical CRO and CDMO encompasses the companies providing outsourced research, drug development, and manufacturing services. They offer various drug development, drug testing, and clinical trial services.

AI offers a wide range of applications, which are increasing its use in the pharmaceutical CRO and CDMO market, where it is being utilized to enhance drug development, clinical trials, patient recruitment, and their optimization. It helps in data management, quality control, and inventory management. It is also used in the identification of drug safety profiles, accelerating their development with reduced errors and failures.

There is a rise in the outsourcing trends, which is increasing the partnerships with the pharmaceutical CRO and CDMO, for affordable and specialised services, and reducing the clinical trials and product development timelines.

To deal with the growing chronic and complex diseases, the companies are focusing on the development of various complex therapeutics, promoting collaboration with the pharmaceutical CRO and CDMOs.

The growing digitalization is increasing the use of various remote monitoring and telemedicine platforms, which is increasing the adoption of decentralized clinical trials and hybrid trials.

| Key Elements | Scope |

| Market Size in 2026 | USD 277.16 Billion |

| Projected Market Size in 2035 | USD 594.07 Billion |

| CAGR (2026 - 2035) | 8.84% |

| Leading Region | North America |

| Market Segmentation | By CRO, By CDMO, By Therapy Area, By Region |

| Top Key Players | IQVIA, ICON plc, Parexel, Charles River Laboratories, Medpace, Lonza Group, Samsung Biologics, Catalent, Boehringer Ingelheim, Thermo Fisher Scientific |

Why Did the Clinical Research Services (CRO) Segment Dominate in the Market in 2025?

The clinical research services (CRO) segment held the largest share in the pharmaceutical CRO and CDMO market in 2025, due to growth in the outsourcing trends. Moreover, the complex, stringent, and lengthy clinical trials also increase their demand. Additionally, growth in the development of advanced technologies also increased their use.

Clinical Data Management (CRO)

The clinical data management (CRO) segment is expected to show the highest growth during the upcoming years, due to growing clinical trials. Furthermore, the growing decentralized and hybrid trials are also increasing their demand for maintaining data integrity and traceability by integrating advanced technologies.

How API Development and Manufacturing (CDMO) Segment Dominated the Market in 2025?

The API development and manufacturing (CDMO) segment led the pharmaceutical CRO and CDMO market in 2025, as they are essential for the development of various products. The growth in the development of small molecule-based products also increased their demand. Moreover, to reduce the regulatory burden also increased their use.

Drug Product Manufacturing (CDMO)

The drug product manufacturing (CDMO) segment is expected to show the fastest growth during the predicted time, due to the growing use of biologics. This is driving their development, increasing the collaboration with CDMO for these services. Additionally, their improved high-quality facilities are also encouraging their use.

Which Therapy Area Type Segment Held the Dominating Share of the Market in 2025?

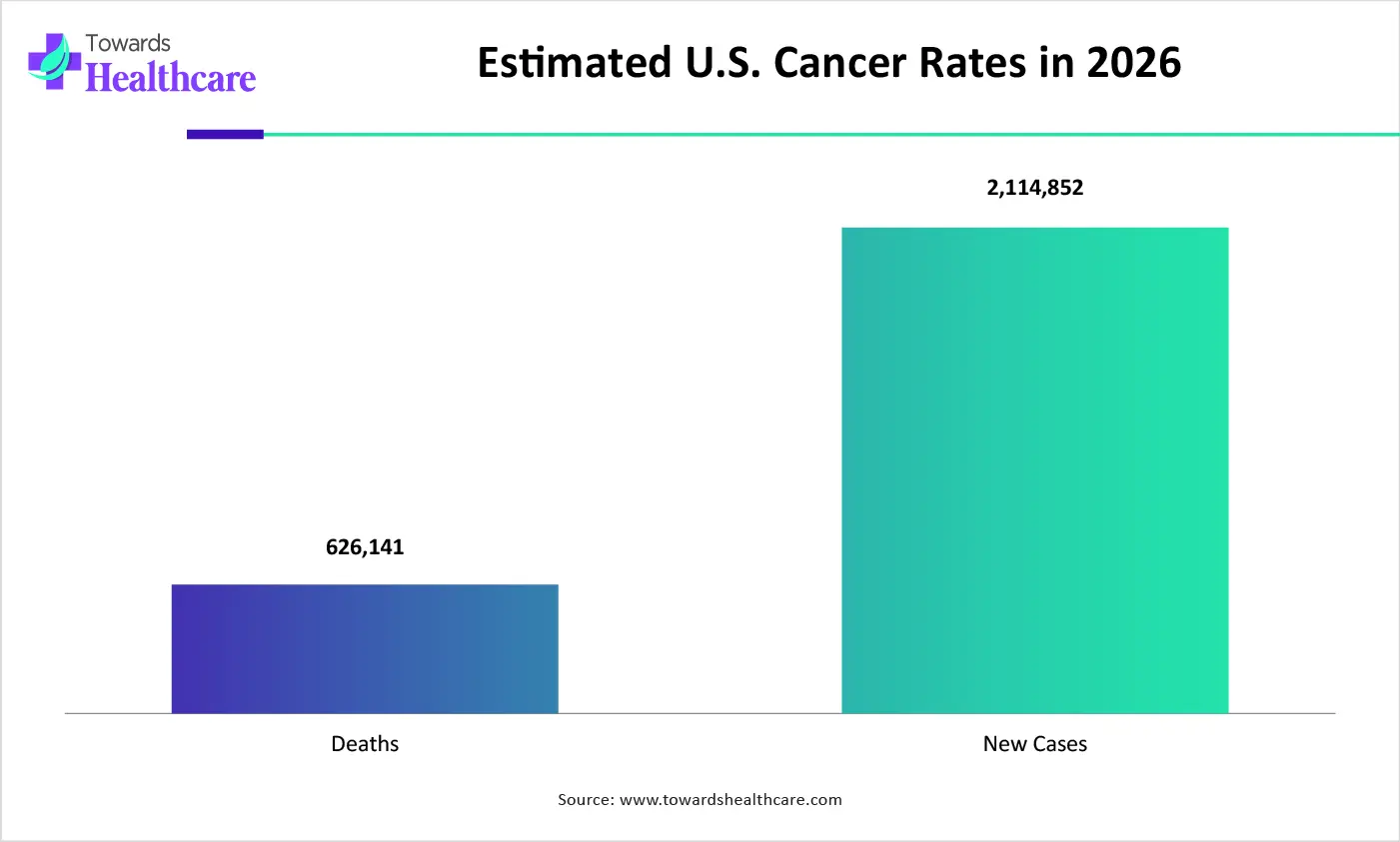

The oncology segment held the dominating share in the pharmaceutical CRO and CDMO market in 2025, due to growth in drug development. The lengthy trials and their complexities also increased the partnerships with pharmaceutical CRO and CDMOs. Furthermore, the growing outsourcing trends have also increased their demand.

Infectious Diseases

The infectious diseases segment is expected to show the highest growth during the predicted time, due to growing incidences of infectious diseases. The growing government support and increasing immunization campaigns are also increasing the development of various treatment option driving the demand for pharmaceutical CRO and CDMO services.

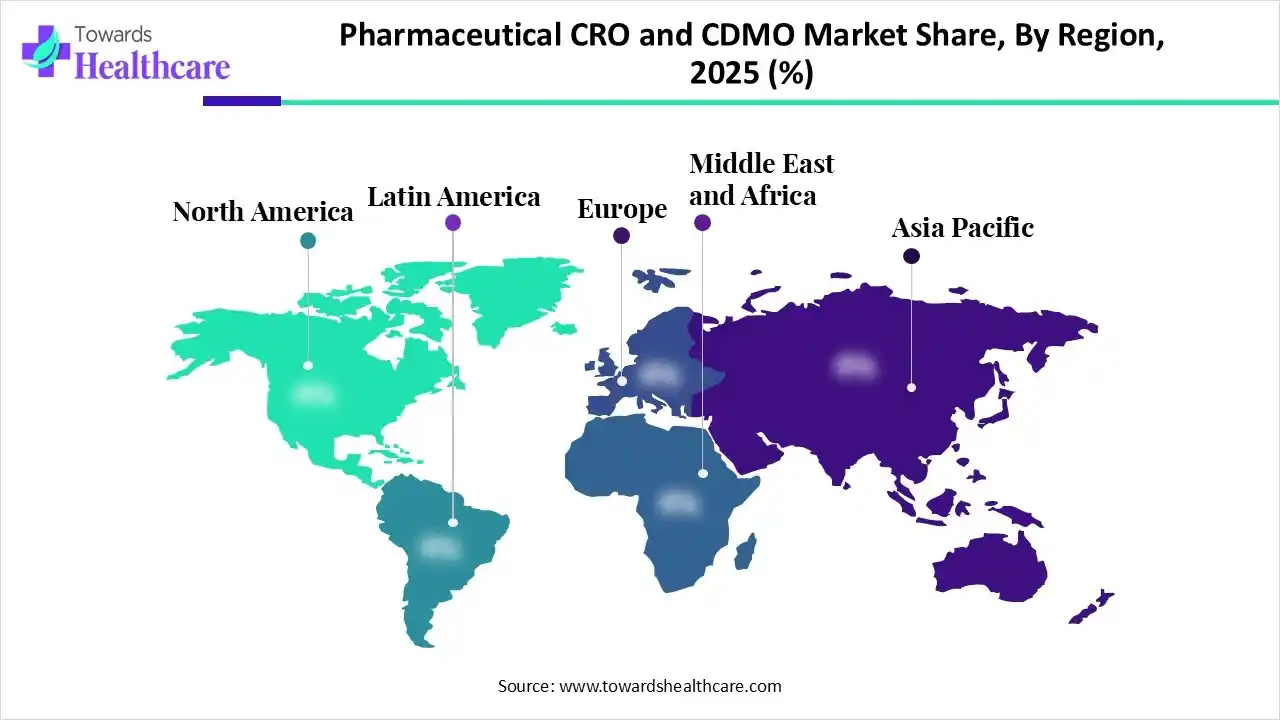

North America dominated the pharmaceutical CRO and CDMO market in 2025, due to the presence of advanced industries and enhanced R&D investments. The presence of stringent regulations and skilled personnel also increased the dependence on the pharmaceutical CRO and CDMOs for product development and clinical trials, which contributed to the market growth.

U.S. Market Trends

The growing R&D investments in the U.S. are increasing the outsourcing trends, leading to an increasing use of pharmaceutical CRO and CDMO services. The advanced clinical trial infrastructure, regulatory expertise, and skilled personnel are also increasing their use to accelerate drug development, clinical trials, and product approvals.

Asia Pacific is expected to host the fastest-growing pharmaceutical CRO and CDMO market during the forecast period, due to the diverse patient population. The expanding industries are also leading to the launch of new pharmaceutical CRO and CDMOs. Furthermore, the growing government support, stringent regulations, and investments are also enhancing the market growth.

China Market Trends

The expanding industries in China are increasing the development of biologics, cell & gene therapies, vaccines, etc, which is growing the demand for pharmaceutical CRO and CDMO services. The growing diseases and manufacturing services are also increasing their use, where the increasing government initiatives are also promoting their collaborations.

Europe is expected to grow significantly in the pharmaceutical CRO and CDMO market during the forecast period, due to the presence of a stringent regulatory framework. The presence of advanced industries is also increasing the development of various products, leading to new collaborations with the pharmaceutical CRO and CDMOs. The growing R&D activities are also promoting the market growth.

UK Market Trends

The UK consists of well-developed industries, which are collaborating with the pharmaceutical CRO and CDMO to enhance the development and clinical trials of their next-generation products. Their advanced infrastructure and regulatory expertise are also encouraging new strategic partnerships, which are also being supported by government investments.

| Pharmaceutical CRO and CDMO | Headquarters | Services |

| IQVIA | North Carolina, U.S. | Phase 1-4 clinical trials and advanced technologies |

| ICON plc | Dublin, Ireland | Full-service clinical development, biosimilar research, and adaptive trial designs |

| Parexel | Massachusetts, U.S. | Phase 1-4 clinical development, AI-driven trial simulation, and post-market surveillance |

| Charles River Laboratories | Massachusetts, U.S. | Preclinical discovery, laboratory models, efficacy testing ad safety assessment |

| Medpace | Ohio, U.S. | Integrated full-service clinic trials and central laboratory services |

| Lonza Group | Basel, Switzerland | Biologic manufacturing, API synthesis, and cell and gene therapy development. |

| Samsung Biologics | Incheon, South Korea | Large-scale biologics manufacturing, small molecule substances, drug product filling, and monoclonal antibodies production |

| Catalent | New Jersey, U.S. | Oral, respiratory drug delivery technologies, cell and gene therapy manufacturing |

| Boehringer Ingelheim | Ingelheim, Germany | Contract manufacturing for biologics, small molecule chemical innovation, and process development |

| Thermo Fisher Scientific | Massachusetts, U.S. | End-to-end solutions, API manufacturing, sterile fill-finish, and clinical trials logistics |

By CRO

By CDMO

By Therapy Area

By Region

February 2026

February 2026

February 2026

February 2026