February 2026

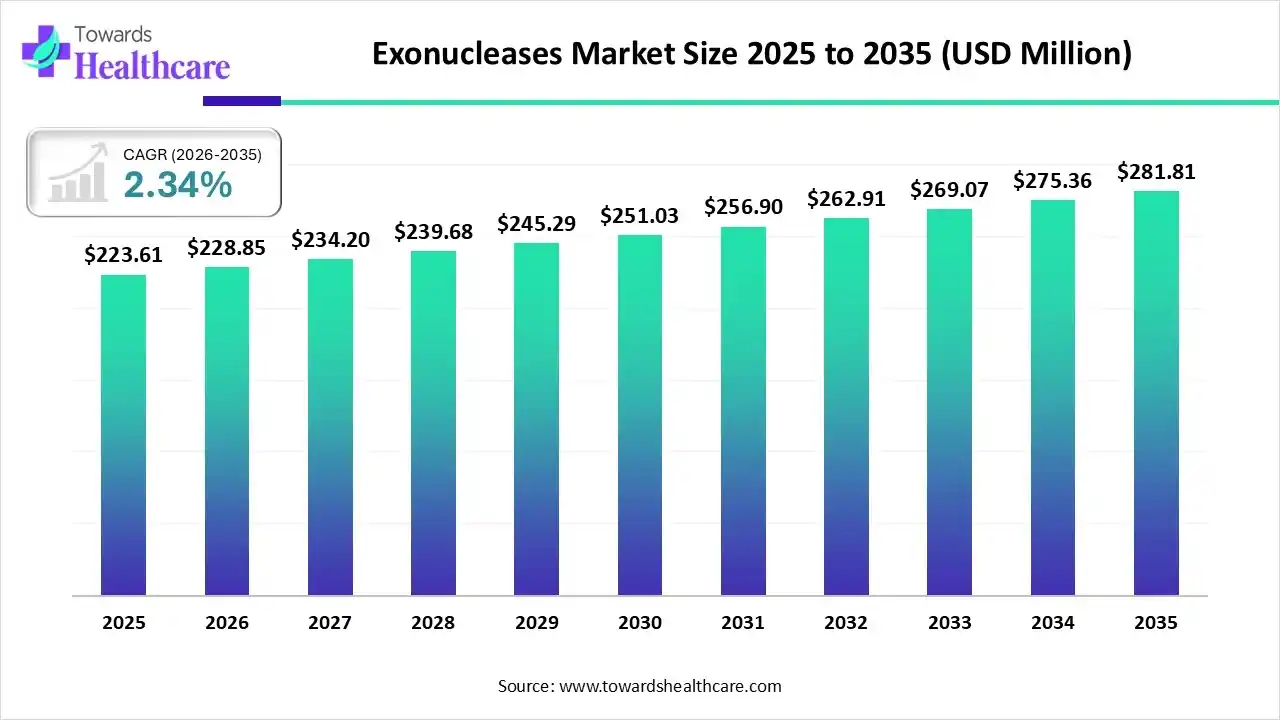

The global exonucleases market size is expected to be worth around USD 281.81 million by 2035, from USD 223.61 million in 2025, growing at a CAGR of 2.34% during the forecast period from 2026 to 2035.

The exonucleases market is experiencing robust growth, driven by the growing demand for personalized medicines, the increasing use of next-generation sequencing, and the expansion of clinical research programs worldwide. Exonucleases are commonly used in cellular metabolism, genome stability & aging, and DNA repair and replication. Government organizations of various countries support genomic research through initiatives and funding programs.

| Key Elements | Scope |

| Market Size in 2026 | USD 228.85 Million |

| Projected Market Size in 2035 | USD 281.81 Million |

| CAGR (2026 - 2035) | 2.34% |

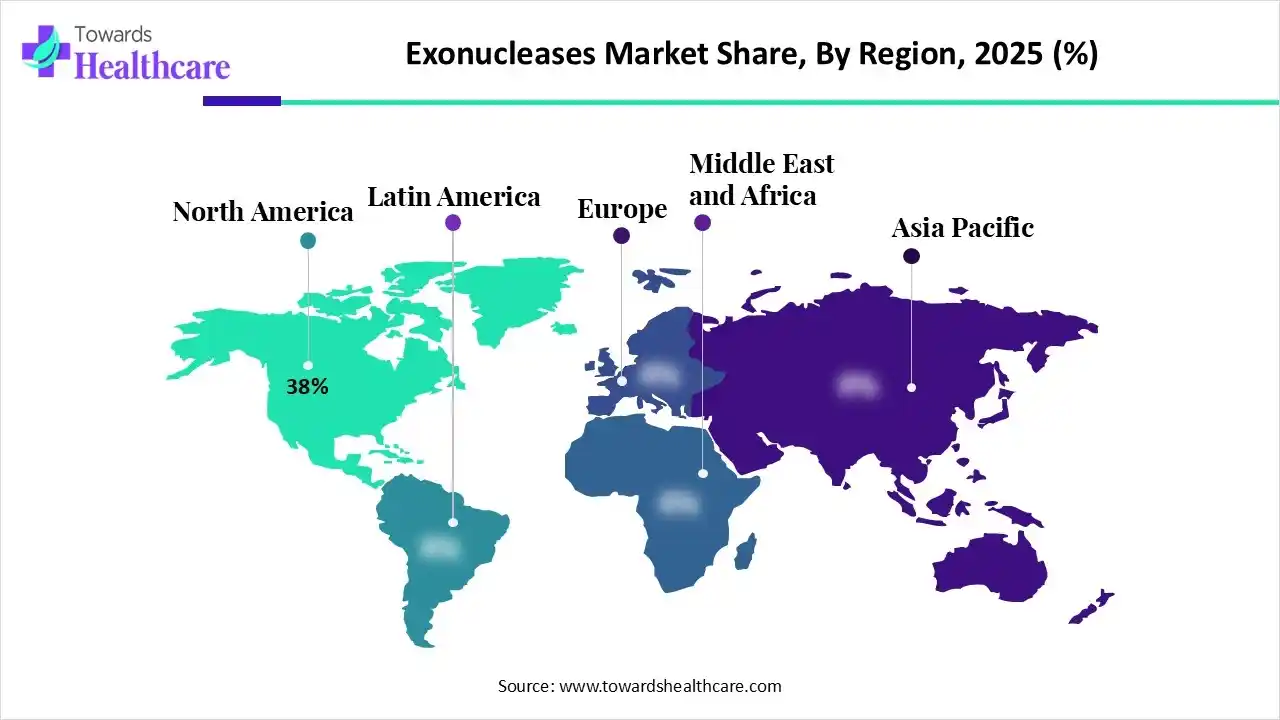

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Application, By Technology/Mode of Action, By End-User, By Usage, By Distribution Channel, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., New England Biolabs, Promega Corporation, Sigma-Aldrich, Takara Bio, Inc., Qiagen N.V., Roche Diagnostics, Toyobo Co. Ltd., GenScript Biotech Co., Ltd., Bio-Rad Laboratories |

The exonucleases market refers to the global market for enzymes that selectively remove nucleotides from the ends of DNA or RNA molecules. Exonucleases are widely used in molecular biology, genomics and biotechnology applications, including DNA sequencing, PCR clean-up, cloning, genome editing, and synthetic biology. These enzymes play a critical role in research, diagnostics, and therapeutic applications by enabling precise DNA/RNA manipulation, error correction, and sample preparation.

Artificial intelligence (AI) plays a pivotal role in transforming genomic research, enhancing efficiency and accuracy. It assists researchers in sample preparation and performing recombinant DNA procedures to derive the exonuclease enzyme with the desired properties, reducing manual errors. AI and machine learning (ML) algorithms can analyze vast amounts of data and help researchers interpret complex datasets. They guide exonucleases in identifying the correct site on DNA/RNA, driving precision. Thus, AI and ML have great potential in genetic engineering and gene therapy research.

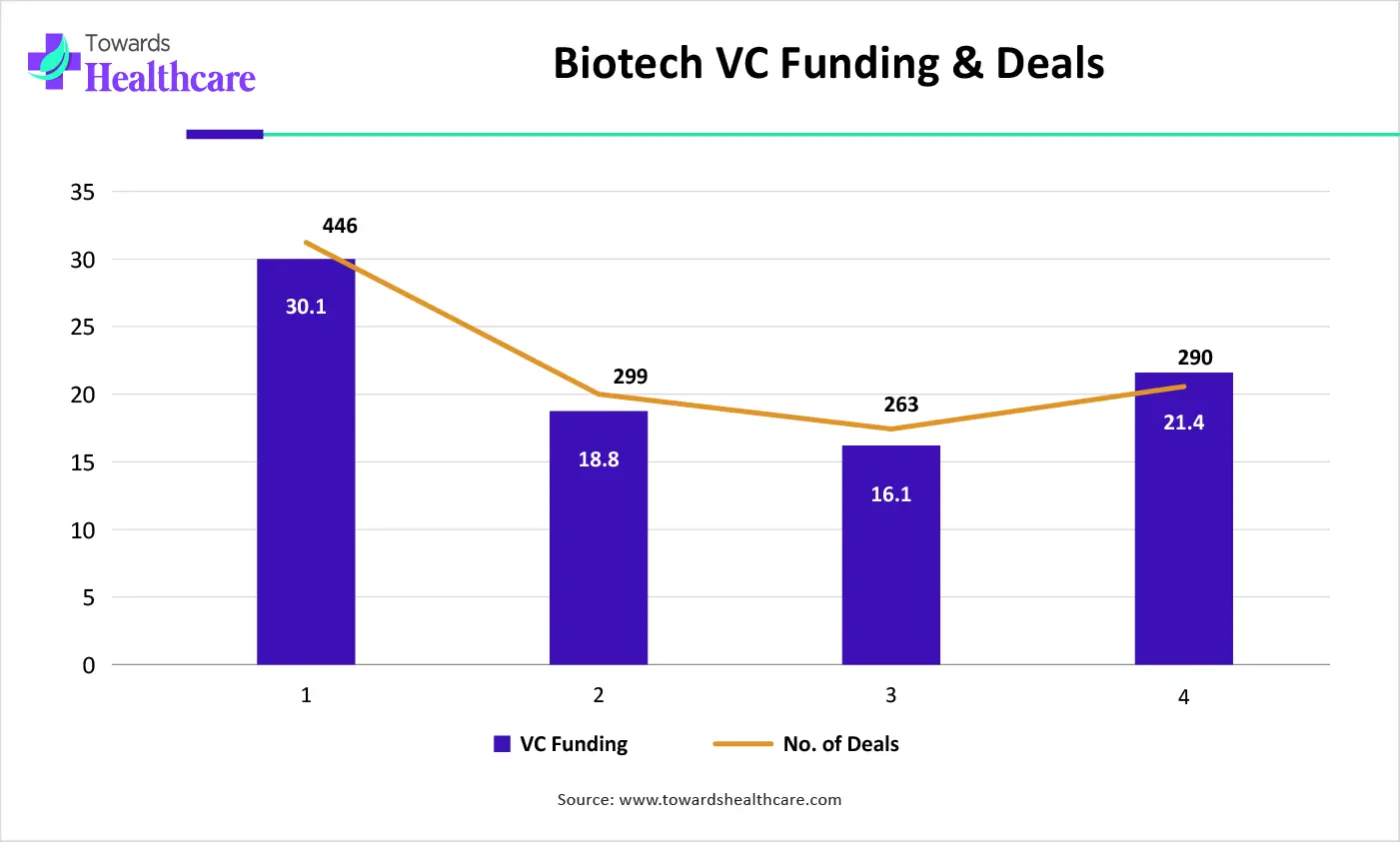

| Years | VC Funding ($ billion) | No. of Deals |

| 2021 | 30.1 | 446 |

| 2022 | 18.8 | 299 |

| 2023 | 16.1 | 263 |

| 2024 | 21.4 | 290 |

Several government bodies of different nations launch initiatives to support genomic research, bolstering the exonucleases market.

The U.S. government’s Materials Genome Initiative discovers, manufactures, and deploys advanced materials at a faster rate and at affordable prices. The initiative supports U.S. institutions in adopting methods to accelerate materials development.

The Australian government has launched “Genomics Australia” to harness cutting-edge genomic research and technologies to prevent, diagnose, and treat Australians with cancer and other diseases. The initiative will enable the effective implementation of research into clinical healthcare across the country.

The genomeDE – National Strategy for Genomic Medicine by the German government aims to set up care structures, network genomic medicine structures, establish standards in sequencing technologies, and the clinical use of genomic data. This enables wider clinical application of genome sequencing, thereby facilitating improved diagnosis and personalized treatment identification.

Why 5’ → 3’ Exonucleases Product Type Segment Dominated the Exonucleases Market?

The 5’ → 3’ exonucleases segment held a dominant position in the market with a share of 40% in 2025. 5’ → 3’ exonucleases are widely used to digest nucleotides in the 5’ to 3’ direction on a template ahead of polymerase activity. One of the common examples of 5’ → 3’ exonucleases is Taq polymerase, which catalyzes the cleavage of 5’ DNA flaps from a DNA duplex. The major advantages of these exonucleases are that they can remove mononucleotides or up to 10 nucleotides simultaneously.

3’ → 5’ Exonucleases

The 3’ → 5’ exonucleases segment is expected to grow at the fastest CAGR in the market during the forecast period. 3’ → 5’ exonuclease activity is known as proofreading activity that digests nucleotides with 3’ hydroxyl groups from the 3’ to 5’ direction. They correct mismatched base pairs and terminal 3’ digestion, as well as prevent mutations. They can remove one mononucleotide at a time, allowing researchers to focus on a single nucleotide precisely.

How the DNA Sequencing & NGS Workflows Segment Dominated the Exonucleases Market?

The DNA sequencing & NGS workflows segment held the largest revenue share of 35% in the market in 2025, due to the need for researchers to study disease progression and develop innovative diagnostics and therapeutics. Exonucleases facilitate the precise removal of nucleotides from DNA/RNA. DNA sequencing is an essential procedure to determine the order of DNA bases to read genetic instructions. The growing demand for point-of-care diagnostics boosts the segment’s growth.

PCR Clean-up & Sample Preparation

The PCR clean-up & sample preparation segment is expected to grow with the highest CAGR in the market during the studied years. PCR clean-up is used to purify DNA and remove remaining primers and dNTP left from a PCR reaction. Exonuclease-based real-time PCR uses Taq polymerase to measure PCR product accumulation. PCR clean-up is an essential step as it may interfere with the PCR results.

Why Did the Enzyme-based Digestion Systems Segment Dominate the Exonucleases Market?

The enzyme-based digestion systems segment contributed the biggest revenue share of 50% in the market in 2025, due to the need for precise sample preparation for various applications. Restriction enzyme-based methods use restriction enzymes to cleave genomic DNA in the initial step of library preparation. They are used in DNA sequencing procedures, either to generate long fragments or to reduce the length of the resulting fragments.

Recombinant Expression Platforms

The recombinant expression platforms segment is expected to expand rapidly in the market in the coming years. Exonucleases are considered essential parts of recombinant expression platforms for DNA manipulation. Recombinant technology is commonly used as a tool of gene therapy to prevent and treat acquired genetic disorders. It opens new opportunities for innovations to produce a wide range of therapeutic products.

How Pharmaceutical & Biotechnology Companies Segment Led the Exonucleases Market?

The pharmaceutical & biotechnology companies segment led the market with a share of 40% in 2025, due to favorable infrastructure and growing genomic research activities. Pharmaceutical & biotech companies have suitable capital investment to adopt advanced tools and techniques. The increasing competition among large and small companies necessitates them to develop advanced diagnostics and therapeutics, strengthening their market position.

Diagnostic Laboratories

The diagnostic laboratories segment is expected to witness the fastest growth in the market over the forecast period. Diagnostic laboratories possess specialized tools to diagnose a wide range of genetic and chronic disorders. Government initiatives encourage screening and early diagnosis of severe disorders to the general public. This enables healthcare professionals to provide early interventions. Diagnostic laboratories also operate on a referral basis from providers.

What Made Research-Grade Enzymes the Dominant Segment in the Exonucleases Market?

The research-grade enzymes segment accounted for the highest revenue share of 65% in the market in 2025, due to the need for novel biologics, such as cell and gene therapy and monoclonal antibodies. Research-grade enzymes are more affordable and are available in smaller quantities, enabling researchers to purchase the desired enzyme based on their research requirements. They are in high demand due to growing research activities related to genomics and proteomics.

Clinical-Grade/GMP-Ready Enzymes

The clinical-grade/GMP-ready enzymes segment is expected to show the fastest growth over the forecast period. Clinical-grade or GMP-grade exonucleases are available from specialized suppliers for use in therapeutic manufacturing. They are comparatively stable and are required in large quantities to fulfill unmet needs.

How the Direct Sales Segment Dominated the Exonucleases Market?

The direct sales segment held a major revenue share of 55% in the market in 2025, due to high affordability and limited stability. Direct sales enable developers to supply exonucleases directly to research laboratories and biotech firms. This saves the extra costs of wholesalers or suppliers, enhancing cost-effectiveness. They provide high-quality enzymes and offer after-sales services. Direct sales allow developers to guide researchers about the properties, applications, and advantages of their proprietary exonucleases.

Online/E-commerce Platforms

The online/e-commerce platforms segment is expected to account for the highest growth in the upcoming years. The increasing adoption of smartphones and advances in internet connectivity technologies augment the segment’s growth. Online platforms allow researchers to choose from a wide range of options, resulting in enhanced affordability. They also reduce geographical barriers, as researchers can purchase high-quality exonucleases from different countries.

North America dominated the global market with a share of 38% in 2025. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the factors that drive market growth in North America. The increasing R&D investments and collaborations among key players foster the market. North American countries also have a favorable clinical trial infrastructure, supporting the development of advanced genomic products.

There are over 5,000 pharmaceutical companies and over 3,000 biotechnology companies in the U.S. Key players, such as Thermo Fisher Scientific, Agilent Technologies, and Bio-Rad Laboratories, are major contributors to the market in the U.S. The National Institute of Health (NIH), a government-led institution, invested $27 million in first-year funding to establish a new program that supports the integration of genomics into learning health systems.

Asia-Pacific is expected to host the fastest-growing market in the coming years. Countries like China, India, Japan, and South Korea witness a surge in the number of biotech and pharmaceutical startups. The startups are supported by venture capital investments and technological advancements. Government and private institutions conduct seminars, workshops, and conferences to share the latest updates about biotech advancements. The increasing clinical testing due to the growing patient population contributes to market growth.

China is projected to become the first country in the world to build a nationwide genomic database covering its entire population by 2049. This is driven by the nation’s Human Genome Project (HGP) to accelerate the integration of genomics into national proactive health management. In addition, biotech innovations are also on the rise in China. It is estimated that China will account for 35% of all FDA approvals in the coming years.

Europe is considered to be a significantly growing area, due to the rising adoption of advanced technologies and evolving regulatory landscapes that support innovations in the biotech sector. Government organizations launch initiatives and provide funding to promote the development of novel diagnostics and therapeutics. The increasing prevalence of genetic and rare disorders and growing awareness of exonucleases and their applications propel the market.

The UK government recently announced an investment of £650 million by 2030 in genomic medicine in England. It aims to assess babies’ risk of hundreds of conditions, aligning with their focus on predictive and preventative healthcare. The Whole Genomic Sequencing (WGS) programme holds promise for speeding up the diagnosis of genetic, rare, and undiagnosed conditions.

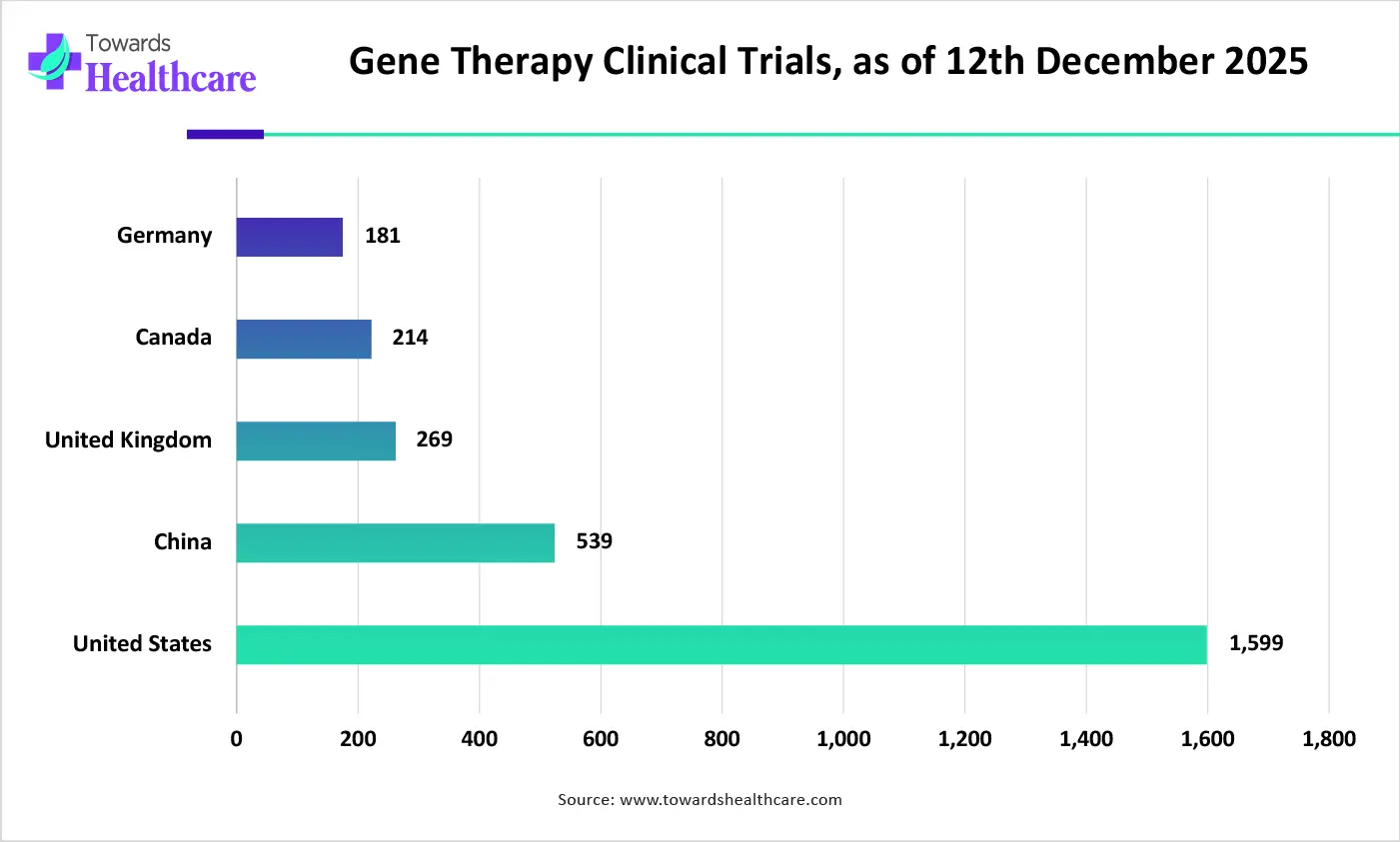

| Countries | Number of Clinical Trials, as of 12th December 2025 |

| United States | 1,599 |

| China | 539 |

| United Kingdom | 269 |

| Canada | 214 |

| Germany | 181 |

R&D:

R&D steps involve target identification, enzyme engineering, expression, purification, characterization of activity and specificity, optimization, and validation for specific applications and safety protocols.

Companies: F. Hoffmann-La Roche Ltd., Takara Bio Inc., Pacific Biosciences of California, Inc., New England Biolabs, Inc., Thermo Fisher Scientific, QIAGEN GmbH, Illumina, Inc., and ArcticZymes AS.

Clinical Trials & Regulatory Approvals:

Sterilization & Packaging:

| Companies | Headquarters | Offerings |

| Thermo Fisher Scientific, Inc. | Massachusetts, United States | It offers Exonuclease I (20 U/μL), Exonuclease III (200 U/μL), Lambda Exonuclease (10 U/μL), Exonuclease VII (1000 U), and T7 Gene 6 Exonuclease 10kU. |

| New England Biolabs | Massachusetts, United States | It provides a wide range of exonucleases derived from E.coli, such as Exonuclease I, Exonuclease T, and T7 Exonuclease. |

| Promega Corporation | Wisconsin, United States | It offers Exonuclease III, REXO1, and DNA Polymerase I Large Fragment Protocol. |

| Sigma-Aldrich | Missouri, United States | It offers Exonuclease I 10 U/μL and Exonuclease III. |

| Takara Bio, Inc. | Kusatsu, Japan | It offers a variety of endonucleases and exonucleases to cleave DNA and RNA, such as E.coli Exonuclease I & III. |

| Qiagen N.V. | Hilden, Germany | It provides Exonuclease I, III, and Lambda for assays and detection. |

| Roche Diagnostics | Indianapolis, United States | It provides AptaTaq exo DNA polymerase 5 U/μL and ActiTaq exo Genotyping Master. |

| Toyobo Co. Ltd. | Osaka, Japan | It offers KOD exo (-) DNA polymerase derived from Thermococcus kodakaraensis. |

| GenScript Biotech Co., Ltd. | New Jersey, United States | It offers multiple exonuclease products, supporting the company’s early drug discovery and development process. |

| Bio-Rad Laboratories | California, United States | It provides iProof High-Fidelity DNA polymerase to create a thermostable fusion polymerase that accurately amplifies long products from a variety of DNA templates. |

By Product Type

By Application

By Technology/Mode of Action

By End-User

By Usage

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026