February 2026

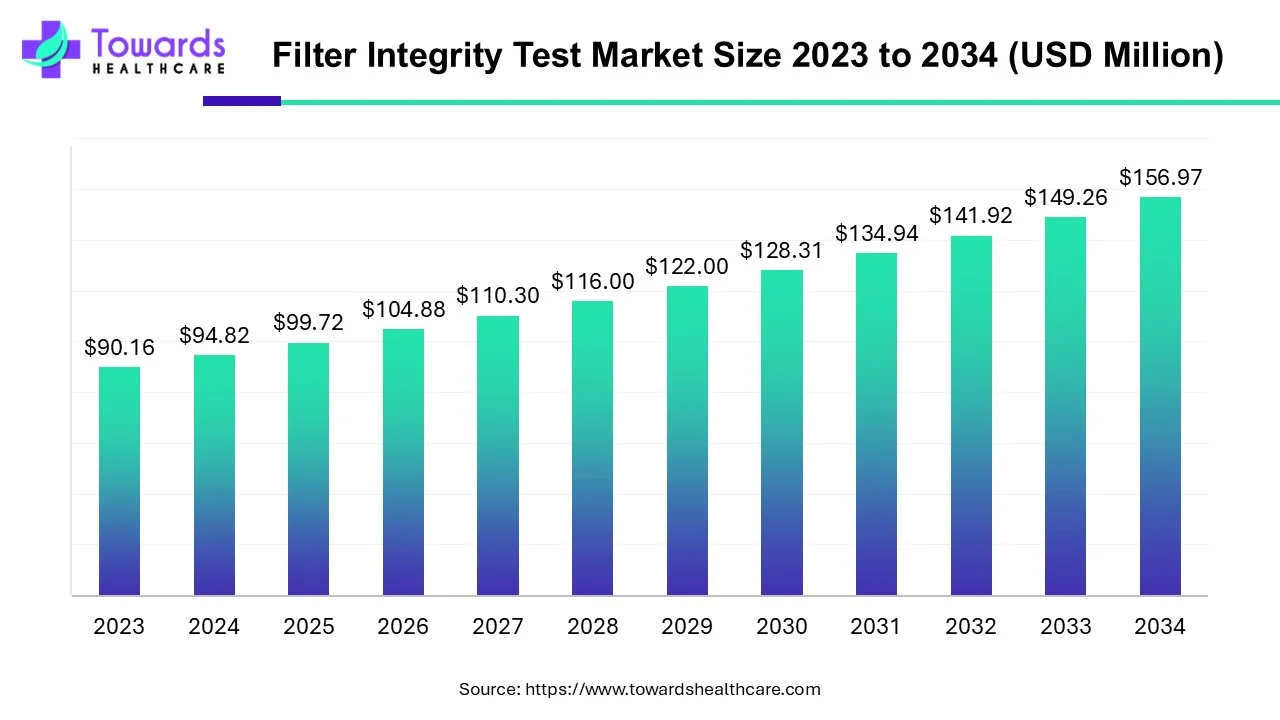

The filter integrity test market size is forecast to grow from USD 99.72 million in 2025 to USD 156.97 million by 2034, driven by a CAGR of 5.17% from 2025 to 2034.

The filter integrity test market encompasses tests done to guarantee a filter is free of contamination. This involves checking the integrity of the cartridges/capsules, disk filters, and filter membranes. A filter integrity machine is the name of the device that carries out this function. Specifically, this test equipment can generate reports and handle data thanks to an integrated data description management unit.

A process's use of a filter may result in a number of damaging phenomena. The filter integrity test is a technique for monitoring these filter element attributes as the process progresses. Suppliers offering absolute-rated membrane cartridge filters for the microbiological reduction or elimination of yeast and mold are required to conduct integrity testing.

A certificate attesting to the filter's quality is supplied with every product, and test results are verified for the removal of certain species. For crucial process filtering applications in the pharmaceutical sector, integrity testing sterilizing filters is a basic necessity. Industry rules in the bioprocessing and pharmaceutical industries require Integrity Testing at certain stages of a process. The food and beverage sector is becoming more involved with the filter integrity test market as a result of the strategic decision to use integrity testing, even when it is not required, to guarantee product safety and quality.

In industrial and clinical settings, HEPA filtration devices are commonly utilized. HEPA systems are used in clinics, medical institutions, veterinary hospitals, nursing homes, and pharmaceutical production plants. There are many different types of industrial workplace settings where HEPA filtration is utilized. The other is precision optics for the military and commercial markets. Particles of tiny dust produced during the manufacture of precision components are reduced and eliminated using HEPA systems. To guarantee quality and safety while packing and processing food-grade items, HEPA systems are employed to maintain a clean room environment. For both alcoholic and non-alcoholic beverage bottling, these systems are very crucial. Last but not least, automakers use HEPA filtering systems in their paint and coatings R&D centers.

For instance,

The filter integrity test market faces challenges due to the high costs of tests. Preciseness and rigorous adherence to standards necessitate a substantial financial commitment. The cost components mostly include purchasing and maintaining specialist testing apparatus, such as diffusive flow, bubble point, and water intrusion testers. The intricate nature of these instruments needs regular calibration and maintenance to provide accurate outcomes, hence augmenting operational expenses.

Consumables like integrity test filters and sterilized solutions that are used during the testing procedure also have an impact on continuous costs. The cost of labor is further increased by the highly skilled individuals who perform these exams. The technicians must train in the special filter integrity testing techniques, which calls for ongoing education and certification. Consequently, high operating costs hinder the filter integrity test market expansion.

The accuracy and dependability of these evaluations are consistently improved by technological and methodological advancements, which propels market expansion. The filter integrity test market is growing as a result of advances in membrane integrity testing methodologies, such as quicker and more accurate procedures. These developments enable producers to maintain strict quality control guidelines, guaranteeing the efficacy and safety of their goods.

Technological developments in integrity test equipment are enhancing industries' capacity to carry out accurate and effective testing, guaranteeing the integrity of their filtering systems. The need for advanced filter integrity testing is anticipated to increase as long as companies maintain their emphasis on quality and safety. Businesses in this industry are spending money on R&D to improve and reinvent their product offerings and make sure they satisfy the changing demands of their clientele.

By type, the liquid filter integrity test segment dominated the filter integrity test market in 2023. The rise in this segment is due to the use of filters designed for liquid sterilization in different industries. The filters designed for liquid materials are highly essential due to their demand in pharmaceuticals, healthcare, and food and beverages. The filters are essential for liquids that are sensitive to heat, such as serums, antibodies, and active ingredients in medicines. With time, the use of filters has increased due to quality improvement, continuous demand from the pharma and healthcare industry, and utilization of filters for liquid filtration. Two of the very common methods used for liquid filter integrity tests are the forward flow (Diffusion) test and the bubble hold test.

By mode insights, the automated segment dominated the filter integrity market in 2023. A further advancement is the automation of integrity testing. Although the bulk of laboratory filtration products are still validated using the manual bubble-point method, there is a trend toward speedier, more automated techniques that reduce human error and boost productivity. Thanks to automated technology, filter integrity testing may now be done quickly, precisely, repeatedly, traceably and auditably. It is one of the most important tools for producing biopharmaceutical components for medications efficiently.

By test method, the bubble point test segment dominated the filter integrity test market in 2023. The test is the most widely used for integrating filters. Hydrophobic filters, which are frequently used in pharmaceutical applications, provide several benefits for evaluating the integrity and performance of filters when using the bubble point test. Finding the biggest holes in the filter matrix with accuracy is one of its main advantages. The test displays the pore size distribution of the filter and its capacity to hold particles of certain sizes by watching the development of a continuous stream of bubbles at the bubble point pressure. The bubble point test method is also a helpful way for regular quality control evaluations since it is extremely simple to do and can be completed quickly. It also provides a non-destructive method of assessing filter performance, enabling tests on filters without sacrificing their structural integrity.

By end-use, the biopharmaceutical & pharmaceutical industry segment dominated the filter integrity test market in 2023. The biopharmaceutical & pharmaceutical industry needs filter integration the most due to the continuous use of filters for sterilizing medicines and air in laboratories. Apart from this, filters are used in various steps during the upstream and downstream processes. The medicines go through strict regulatory standards as they should be safe for medical use. Therefore, continuous integrity tests are done in the pharma industries, which promotes the growth of the filter integrity test market.

By region, North America dominated the filter integrity test market in 2023. Robust filter integrity testing processes are necessary due to several factors, including the pharmaceutical, biotechnology, and food and beverage sectors, which have strict regulatory requirements and quality standards. In order to guarantee product safety and efficacy, the region's sophisticated pharmaceutical production skills and healthcare infrastructure fuel the need for high-quality filter integrity testing. Furthermore, filtration technology advances and technical advancements drive market expansion in North America.

The U.S. is the largest manufacturer of injectables with 45% of production volume. As of 2023, there were 1,580 biopharmaceutical manufacturing facilities across the U.S. The Food and Drug Administration (FDA) is responsible for guidelines around sterile manufacturing.

There are around 10,500 manufacturing facilities in Canada. Canada is the 8th largest market in the pharmaceutical sector, with sales of 2.2% of the global share. HEPA filters are used in research labs, operating rooms, intensive care units (ICUs), and cleanrooms. There are around 404 hospitals with ICUs in Canada.

During the projected time frame, increased demand for the market is anticipated due to the expanding need for high-purity, high-quality goods from the biotechnology and pharmaceutical sectors, as well as rising production volumes. In particular, the rising demand for various pharmaceuticals, medications, and other food and beverage goods, together with the growing number of ailments and growing concern for purity, have driven the market's burgeoning expansion in North America.

Europe is considered to be a significantly growing area, due to the rising demand for biopharmaceuticals and burgeoning manufacturing infrastructure. Europe accounts for over 19% of the production volume of injectables, necessitating the use of sterile filters. The presence of key players and favorable regulatory policies promotes the market. The increasing investments, collaborations, and mergers & acquisitions also contribute to market growth. As of 2023, the European Medicines Agency (EMA) has approved 74 biosimilars, including antibody-drug conjugates (ADCs), bispecific proteins, and cell and gene therapies. This necessitates the large-scale manufacturing of biologics, facilitating the use of sterile manufacturing techniques.

| Company Name | ATI |

| Headquarters | Maryland, U.S. |

| Recent Development | In March 2024, the new photometer product from Air Techniques International (ATI), a leading global authority in the development and production of specialist testing apparatus for HEPA filters and protective masks, became available. The new device's name is the iProbe Plus scanning probe. The most sophisticated filter scanning probe on the market, the iProbe Plus is "plug and play" compatible with both new and old model 2i Aerosol Photometers and comes with a number of additional capabilities and advantages over the original iProbe. |

| Company Name | Donaldson Company Inc. |

| Headquarters | Minneapolis, U.S. |

| Recent Development | In March 2023, the Alpha-Web® filtering medium was released by Donaldson Company, Inc., a prominent global provider of cutting-edge filtration technologies. With the use of this revolutionary hydraulic filtering technology, hydraulic fluid purity may be greatly increased, resulting in longer-lasting hydraulic components, less downtime, and cheaper equipment ownership. |

Type

Mode

Test Method

End-use

Region

February 2026

February 2026

January 2026

January 2026