December 2025

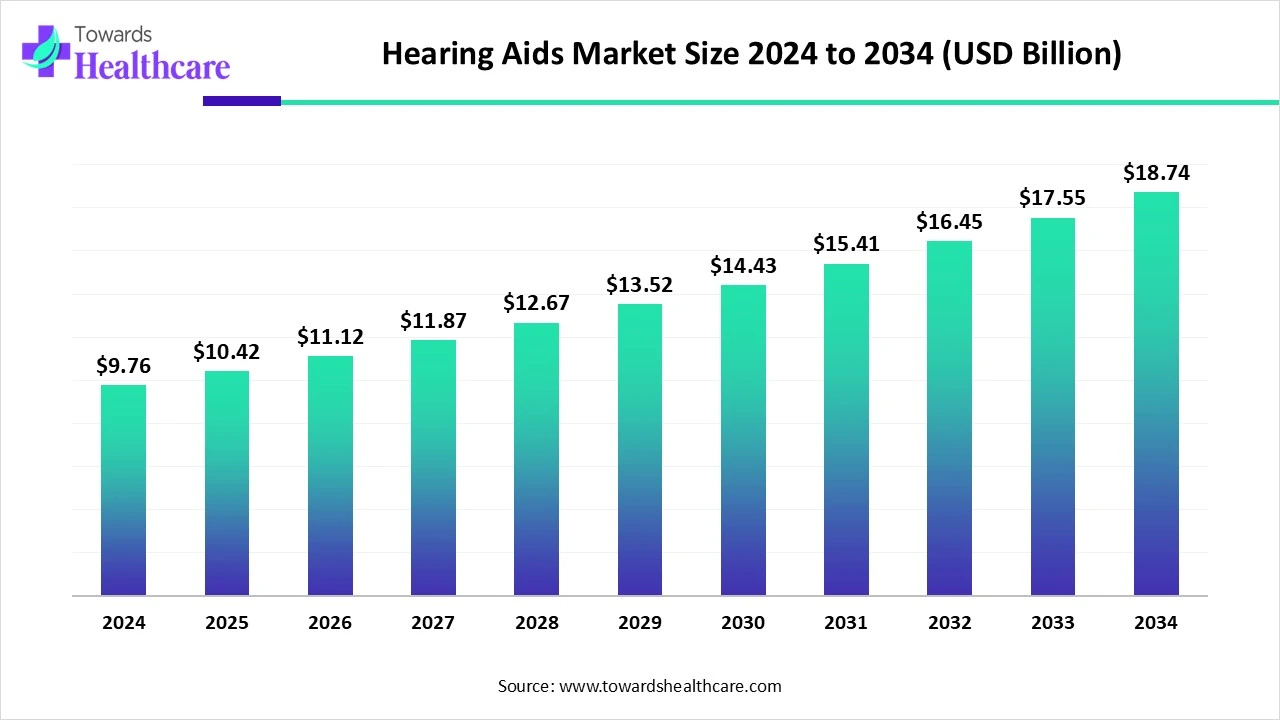

The global hearing aids market size is calculated at USD 10.42 billion in 2025, grew to USD 11.12 billion in 2026, and is projected to reach around USD 20 billion by 2035. The market is expanding at a CAGR of 6.74% between 2026 and 2035.

The hearing aids market in Europe is experiencing strong growth driven by a rapidly aging population, rising prevalence of hearing loss, and increased awareness of early detection. Technological advancements such as AI integration, Bluetooth connectivity, rechargeable batteries, and teleaudiology services are enhancing device performance and accessibility.

Supportive healthcare infrastructure, including reimbursement policies in countries like Germany, France, and the UK, is improving affordability. Expanding audiology clinics, online sales platforms, and reduced stigma are further boosting adoption. Additionally, high R&D investments from leading European manufacturers and growing demand for discreet, lifestyle-oriented devices are contributing to the market’s sustained expansion across the region.

| Table | Scope |

| Market Size in 2026 | USD 11.12 Billion |

| Projected Market Size in 2035 | USD 20 Billion |

| CAGR (2026 - 2035) | 6.74% |

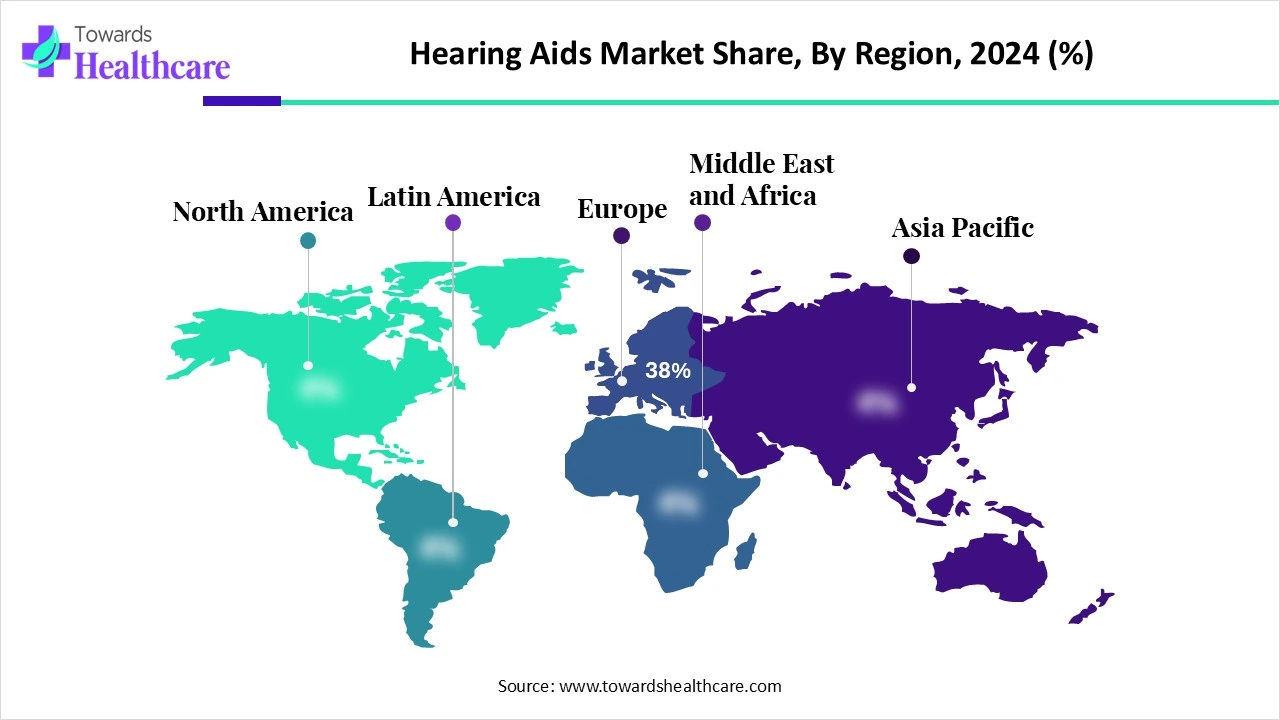

| Leading Region | Europe Share 38% |

| Market Segmentation | By Product Type, By Technology, By Distribution Channel, By End User, By Region |

| Top Key Players | Sonova Holding AG (Phonak, Unitron), WS Audiology (Widex, Signia), Demant A/S (Oticon, Bernafon), Starkey Hearing Technologies, GN Store Nord (ReSound), Cochlear Limited, MED-EL, Amplifon S.p.A., Eargo, Inc., Audicus, Audina Hearing Instruments, Beltone (GN Group), Horentek Hearing Aids, Rion Co., Ltd., Zounds Hearing, Audifon GmbH Microson, Vibe Hearing, iHEAR Medical, Lively Hearing (now Jabra Enhance) |

The hearing aids market includes medical devices designed to improve hearing in individuals with hearing loss by amplifying sound and transmitting it to the ear. It covers behind-the-ear (BTE), receiver-in-canal (RIC), in-the-ear (ITE), in-the-canal (ITC), completely-in-canal (CIC), and bone-anchored hearing aids (BAHA), as well as emerging cochlear implants, implantable hearing systems, and smart/AI-powered hearing devices. Growth is driven by the rising prevalence of age-related and noise-induced hearing loss, increasing awareness, technological advances (Bluetooth streaming, rechargeable batteries, AI-based noise reduction), and expansion of access through online and retail channels.

AI integration is revolutionizing the hearing aid market by making devices smarter, more adaptive, and highly personalized. Modern AI-powered hearing aids can analyze sound environments in real time, automatically adjusting settings to optimize clarity in various situations, from noisy restaurants to quiet rooms. Advanced noise reduction and speech enhancement algorithms separate speech from background noise with remarkable accuracy, improving conversation quality without losing environmental awareness. These devices learn from user preferences to create personalized hearing profiles, integrate seamlessly with smartphones and smart home systems, and provide features like real-time translation or alerts. AI also enables predictive maintenance, supports teleaudiology for remote fine-tuning, and incorporates health monitoring capabilities such as fall detection and activity tracking, transforming hearing aids into multifunctional wellness tools that enhance both accessibility and quality of life.

Expanding Aging Population Worldwide

As the global elderly population grows, the prevalence of age-related hearing loss is set to rise sharply. Older adults are more likely to require long-term hearing assistance, creating a sustained demand for advanced, comfortable, and user-friendly devices.

Technical Limitations & Regulatory Hurdles

The key players operating in the market are facing issues due to regulatory hurdles and technical limitations, which are estimated to restrict the growth of the market. High cost of devices and limited affordability in low- and middle-income countries. Low awareness about hearing loss and late diagnosis in many populations. Social stigma and aesthetic concerns discourage use. Shortage of trained audiologists and limited hearing care infrastructure. Technical limitations such as short battery life, device discomfort, and maintenance requirements.

Supportive Government Programs and Awareness Campaigns

Increased investment by governments and NGOs in hearing health through screening programs, subsidies, and awareness initiatives will expand early detection and encourage the timely adoption of hearing aids.

Health & Wellness Feature Integration

Incorporating sensors for activity tracking, fall detection, and even cognitive health monitoring transforms hearing aids into multifunctional wellness devices. This added value can appeal to health-conscious consumers beyond traditional hearing-impaired users.

Untapped Emerging Markets

Regions such as Asia-Pacific, Latin America, and parts of Africa have large populations with untreated hearing loss. As healthcare infrastructure improves and disposable incomes rise, these markets present significant growth potential.

The Behind-the-Ear (BTE) hearing aids segment dominated the market due to their versatility, durability, and suitability for a wide range of hearing loss, from mild to profound. They are preferred for their ability to house larger batteries, providing longer usage time and better amplification, especially for severe hearing impairments. BTE devices also support advanced features such as Bluetooth connectivity, telecoil integration, and directional microphones, enhancing the user experience. Their design allows for easy cleaning and maintenance, making them ideal for both pediatric and elderly patients. Additionally, recent advancements in miniaturization and ergonomic designs have made BTE aids more discreet and comfortable, further driving their adoption.

The Receiver-in-Canal (RIC)/Receiver-in-the-Ear (RITE) segment is currently expected to be the fastest-growing segment in the hearing aids market, combining comfort, discretion, and high performance. Unlike traditional BTE models, RITE devices place the speaker directly in the ear canal, resulting in clearer, more natural sound and reduced occlusion, key benefits for users with mild to moderate hearing loss. Technological advancements are further driving their growth. Rechargeable variants now hold a 60% market share of RITE devices, thanks to innovations in battery technology and consumer preference for convenience and sustainability. Companies are also rolling out new models. For instance, GN Store Nord's ReSound Nexia line introduced both rechargeable Micro RIE and standard RIE models in late 2023. RITE hearing aids already command about 35% of the overall hearing aid market, outpacing other styles.

The digital hearing aids segment dominates the hearing aid market thanks to their superior customization, adaptability, and integration with modern technologies. Unlike analog models, digital aids employ programmable digital signal processing, enabling selective amplification, effective feedback reduction, multi-channel compression, and automatic adaptation to various environments. They are further enhanced with wireless features like Bluetooth streaming, telecoils, and smartphone connectivity, improving user convenience and lifestyle integration. A wave of innovation is accelerating this dominance: Phonak’s Infinio platform offers neural-accelerated AI sound processing with under-10 ms latency, GN’s ReSound Vivia predicts and filters wind noise, and Oticon’s Intent leverages head-motion sensors for context-aware audio adjustments. These advanced capabilities clearly distinguish digital devices as the market’s leading segment.

The analog hearing aids segment is expected to experience notable growth in the hearing aids market, particularly in regions where cost is a critical factor. These devices are relatively inexpensive and simpler to use compared to their digital counterparts, making them a practical option for budget-conscious consumers or those in developing markets. Analog hearing aids are experiencing notable growth in the hearing aids market, particularly in regions where affordability plays a major role in consumer decisions. These devices are simpler to operate and provide reliable sound amplification without the need for advanced digital processing, making them appealing to elderly users or those unfamiliar with complex technology. Their lower cost compared to digital models makes them especially popular in developing markets, where access to affordable healthcare solutions is crucial. Countries like India are witnessing increased adoption of analog hearing aids due to their practicality, ease of maintenance, and ability to meet essential hearing needs without the higher expense of digital alternatives.

The audiology & ENT clinics segment dominated the hearing aids market in 2024 due to their ability to offer comprehensive, specialized hearing care services, including precise diagnosis, personalized fitting, and follow-up adjustments. These clinics employ trained audiologists and ENT specialists who can accurately assess hearing loss and recommend tailored solutions, ensuring optimal device performance and user comfort. They also have access to advanced diagnostic equipment, enabling early detection and effective intervention. In addition, clinics often collaborate directly with leading hearing aid manufacturers, giving patients access to the latest technologies and models. The trust, professional expertise, and ongoing support provided by these clinics make them the preferred choice for many patients, especially in developed markets.

The online/e-commerce platforms segment is estimated to be the fastest-growing distribution channel in the hearing aids market, driven by key benefits that resonate deeply with today’s consumers. First and foremost, they offer convenience and affordability, allowing buyers to browse, compare, and purchase hearing aids from home, often at significantly lower prices due to the absence of clinic premiums. These platforms empower users through ample product information, user reviews, and tools for self-assessment, enabling informed and confident decision-making. The rise of digital literacy and telehealth integration, including remote fittings and virtual consultations, further reinforces this trend, particularly among tech-savvy and younger consumers. With the FDA's approval of over-the-counter hearing aids fostering direct-to-consumer access, the online channel is redefining how people discover and adopt hearing solutions.

For instance,

The adult/geriatric population segment dominates the hearing aids market primarily due to the high prevalence of age-related hearing loss, known as presbycusis, which typically affects individuals over 60 years of age. Growing global life expectancy and the rapid expansion of the elderly population are significantly increasing the demand for hearing solutions. This demographic often experiences chronic conditions such as diabetes or cardiovascular diseases that further contribute to hearing impairment. Additionally, improved awareness, accessibility to advanced hearing aid technologies, and government or insurance support programs are encouraging higher adoption rates among older adults, solidifying this segment’s market dominance.

The pediatric population segment is the fastest-growing segment in the hearing aids market due to increasing early diagnosis of hearing impairments through newborn and school-based screening programs. Growing awareness among parents and healthcare providers about the critical importance of early intervention for speech and cognitive development drives demand. Advances in pediatric-specific hearing aid designs, such as smaller, more comfortable, and durable devices with child-friendly features, also contribute to growth. Additionally, government initiatives and subsidies supporting children with hearing loss, along with improved access to audiology services, are enabling wider adoption. These factors collectively fuel rapid expansion in the pediatric hearing aid segment globally.

Europe holds a dominant position in the market share by 38% in 2024, due to its rapidly aging population, with a high prevalence of age-related hearing loss driving consistent demand. Europe’s rapidly growing elderly population is a major driver of demand. For example, there are about 95 million people aged 65+ in 2024, a figure expected to increase significantly in the coming years. Hearing loss prevalence is also rising, with over 60 million Europeans currently affected by moderate to severe hearing impairment, projected to swell to 75 million by 2030. The region benefits from well-established healthcare infrastructure, widespread access to audiology services, and favorable reimbursement policies in countries such as France, Germany, and the UK. Technological innovation is strong, with leading global manufacturers like Sonova, Demant, and GN Store Nord headquartered in Europe, actively investing in AI-powered, Bluetooth-enabled, and rechargeable devices. Recent developments include the adoption of teleaudiology services, the growing availability of over-the-counter hearing aids, the integration of wellness features, expanding accessibility, and enhancing user experience.

Europe has seen a surge in advanced hearing aids featuring AI, machine learning, Bluetooth, rechargeable batteries, and smarter noise management for improved user experience. Notably, Sonova rolled out the Sphere Infinio hearing aid with real-time AI for better speech clarity in noisy settings. Europe leads in delivering highly personalized hearing solutions and integrating mobile health technology and virtual reality for device fitting and training. Universal health systems and reimbursement schemes have made hearing aids more affordable in many countries. For instance, France offers a 100% reimbursement for certain hearing aid designs. The UK’s NHS and Germany’s statutory insurance also support adoption through coverage of audiological services. European hearing aid companies (like Sonova, Demant, GN Store Nord) continue to invest heavily in R&D to bring next-gen features to the hearing aids market.

Germany is one of the largest hearing aid markets in Europe, supported by a strong healthcare system and statutory insurance that covers a significant portion of hearing aid costs. The country has a well-developed network of audiologists and hearing care centers, ensuring accessibility. German consumers also have a high adoption rate of advanced hearing aid technologies, such as AI-enabled and Bluetooth-connected devices. Manufacturers are focusing on premium and discreet designs to cater to style-conscious users.

France has seen rapid market growth due to its “100% Health” reform, which allows full reimbursement for basic hearing aids under public health insurance. This has significantly boosted adoption rates, especially among older adults. The market is also shifting towards rechargeable and invisible devices. Awareness campaigns and hearing screening programs have further encouraged early diagnosis and device adoption.

The UK’s National Health Service (NHS) provides free hearing aids to eligible patients, which ensures widespread access. While NHS devices are often basic models, the private market is growing due to demand for advanced features like AI sound processing, smartphone connectivity, and sleek designs. Teleaudiology services have expanded significantly post-pandemic, enabling remote fitting and follow-up care.

Italy’s market is expanding as awareness of hearing health increases, supported by government subsidies for certain devices. Demand is rising for custom-fit, rechargeable hearing aids, and there is growing interest in devices with integrated wellness features. Distribution channels are expanding through retail hearing centers and online sales platforms.

The Asia-Pacific hearing aid market is expanding rapidly, driven by a demographic surge in age-related hearing loss, especially in China, Japan, and India, and increasing urban noise exposure due to rapid urbanization. Rising disposable incomes and growing awareness of hearing health are boosting affordability and adoption. Government-led awareness campaigns, subsidies, and public-private partnerships are improving access, while teleaudiology and digital solutions are making remote fitting and monitoring feasible for users in remote regions.

Market momentum is further fueled by strategic moves such as Sony’s self-fitting OTC launches, Tencent’s AI-powered hearing aid innovations, and retail expansion through acquisitions like Demant’s takeover of ShengWang. Additionally, manufacturers are tailoring cost-effective yet advanced devices and exploring untapped Southeast Asian and pediatric markets, all contributing to Asia-Pacific’s dominant growth trajectory.

China is the largest hearing aid market in Asia-Pacific, fueled by a rapidly aging population and increasing cases of age-related hearing loss. Government healthcare reforms and awareness campaigns have improved screening and diagnosis rates. Local manufacturers like NewSound and Vivtone are producing cost-effective digital hearing aids, while global players such as Demant and WS Audiology are expanding retail networks. Recent moves include Demant’s acquisition of Chinese hearing aid retailer ShengWang and partnerships with e-commerce platforms for online sales.

Japan has one of the world’s oldest populations, creating a high demand for advanced hearing solutions. Japanese consumers favor discreet, high-tech devices, and companies like Sony and Panasonic are leading innovations, including self-fitting over-the-counter (OTC) hearing aids and AI-powered sound processing. Government subsidies and healthcare support further enhance accessibility, and teleaudiology adoption is increasing to serve rural and aging communities.

India’s market is growing quickly due to rising awareness of hearing health, expanding middle-class incomes, and the availability of affordable digital hearing aids. Government programs such as ADIP (Assistance to Disabled Persons) provide free or subsidized devices to low-income groups. International companies are partnering with local clinics to improve distribution, while online platforms are emerging as key sales channels. Pediatric hearing aid adoption is also on the rise due to school-based screening initiatives.

South Korea’s market is expanding due to increased awareness and early diagnosis rates, aided by government health screenings. The country is at the forefront of integrating hearing aids with smart devices and IoT systems. Domestic brands are innovating in rechargeable and invisible hearing aids, while multinational companies are increasing retail footprints.

North America is experiencing notable growth in the hearing aids market due to a combination of demographic, technological, and policy-driven factors. The region has a rapidly aging population, with a high prevalence of age-related hearing loss, driving consistent demand.

Strong insurance coverage and government programs, such as Medicare Advantage and the U.S. Veterans Affairs hearing aid benefits, make devices more accessible. Technological advancements, including AI-powered sound processing, Bluetooth connectivity, and rechargeable batteries, are attracting tech-savvy users. The recent U.S. FDA approval for over-the-counter (OTC) hearing aids in 2022 has expanded consumer access, fostering competition and innovation from both traditional manufacturers and new entrants. High awareness levels, robust distribution networks, and active R&D investments further strengthen the region’s market expansion

The U.S. leads the North American hearing aids market, driven by a significant aging population with millions experiencing hearing loss. Growth is fueled by technological innovations such as over-the-counter (OTC) hearing aids and integration with consumer electronics like Apple’s AirPods Pro 2, making hearing solutions more accessible and appealing. Retailers like Costco have contributed by offering affordable hearing aids with strong customer service, capturing a substantial share of the market.

Manufacturers such as Audien (ATOM ONE under USD $100) and Eargo (self-fitting Eargo SE) are leveraging this with cost-effective, rechargeable canal-style devices. Retail expansions by Amplifon and Costco are enhancing physical accessibility, with Costco capturing over 16 % of the U.S. market by offering affordable pricing and consumer-centric service. Meanwhile, Apple and Nuance have embedded hearing-aid functionalities into everyday devices like AirPods Pro and glasses, making assistive hearing features more discreet, mainstream, and consumer-friendly.

Canada’s hearing aids market is expanding due to an increasing geriatric population and advancements in hearing aid technology. The prevalence of sensorineural hearing loss is significant, and government initiatives, along with healthcare policies, aimed at improving access to hearing care further propel market growth.

In October 2024, Andi Vonlanthen, Sonova’s Global Head of Research and Development for Hearing Instruments, stated that during Sonova’s 77-year history, the company has always been focused on addressing the most pressing challenges of people with hearing loss. With the development of their new real-time AI technology, Sonova has made a huge step forward even in terms of technological ingenuity. To achieve these significant results, the user must implement a powerful Deep Neural Network (DNN) in a hearing aid. This required the company to develop a chip – DEEPSONIC, their DNN unit, as well as a specific training and testing environment, so that the company could optimize the chip’s performance. The entire process took a long time and a significant investment in technology development.

By Product Type

By Technology

By Distribution Channel

By End User

By Region

December 2025

November 2025

November 2025

February 2026