February 2026

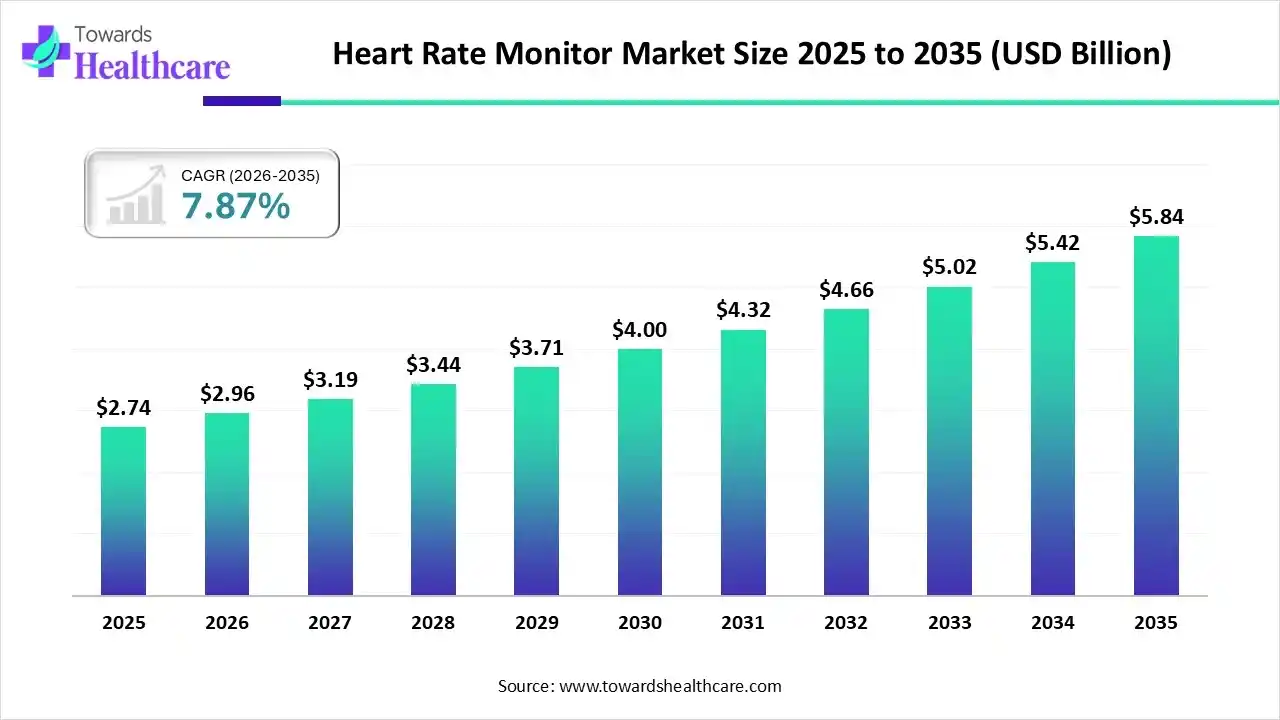

The heart rate monitor market size stood at US$ 2.74 billion in 2025, grew to US$ 2.96 billion in 2026, and is forecast to reach US$ 5.84 billion by 2035, expanding at a CAGR of 7.87% from 2026 to 2035.

The heart rate monitor market is witnessing steady growth, driven by rising health awareness, increasing fitness adoption, and expanding clinical monitoring applications. North America dominated the market due to advanced healthcare infrastructure, high wearable device penetration, strong consumer spending on fitness technologies, and early adoption of connected health solutions across both consumer and medical segments.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.96 Billion |

| Projected Market Size in 2035 | USD 5.84 Billion |

| CAGR (2026 - 2035) | 10.14% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By Technology / Mode of Action, By End-User, By Treatment Line / Usage, By Distribution Channel, By Region |

| Top Key Players | Apple, Samsung, Garmin, Fitbit (Google), Polar, Masimo, Philips, Nihon Kohden, Omron, Wahoo / Other specialty (e.g., Whoop, Suunto, Coros) |

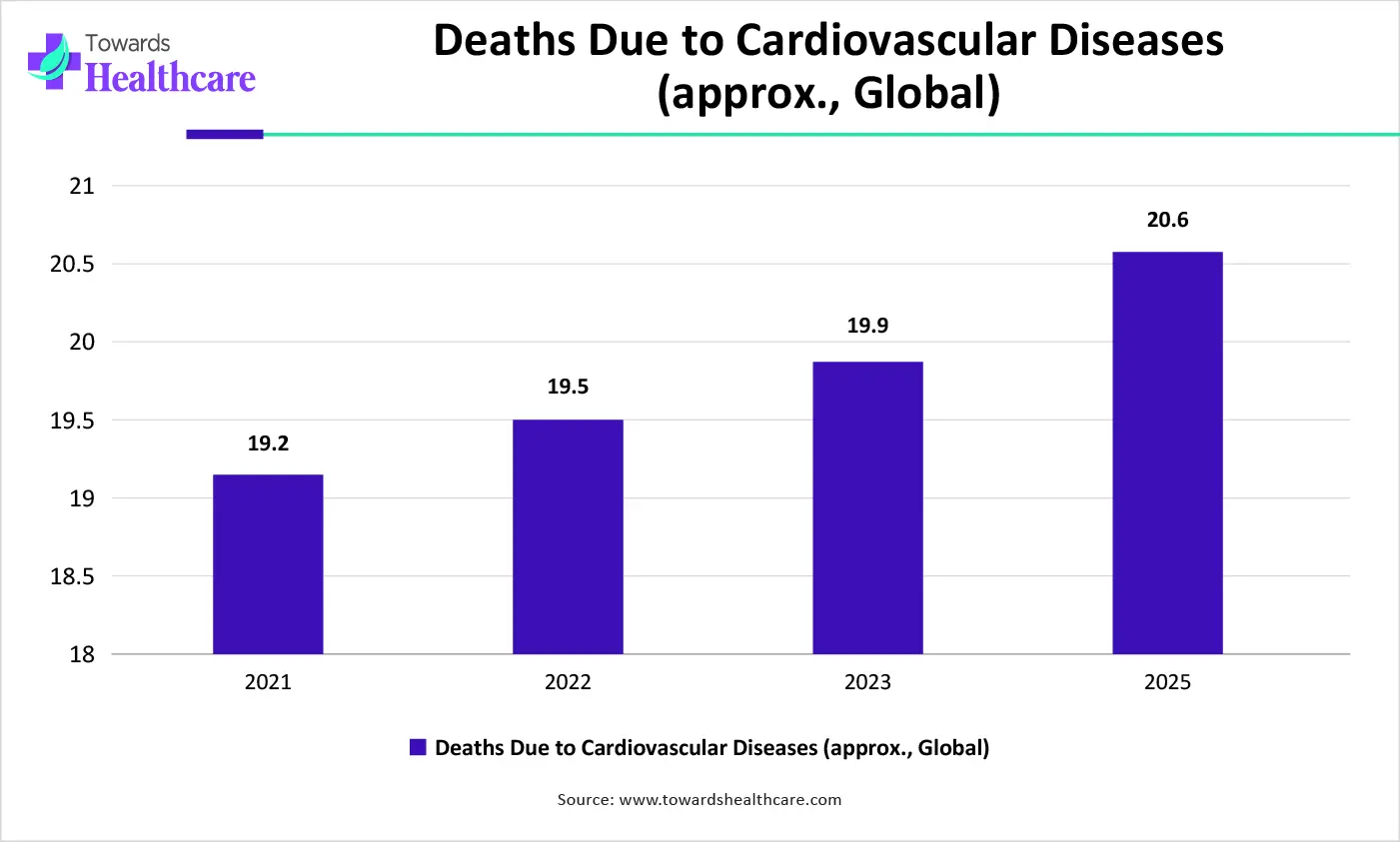

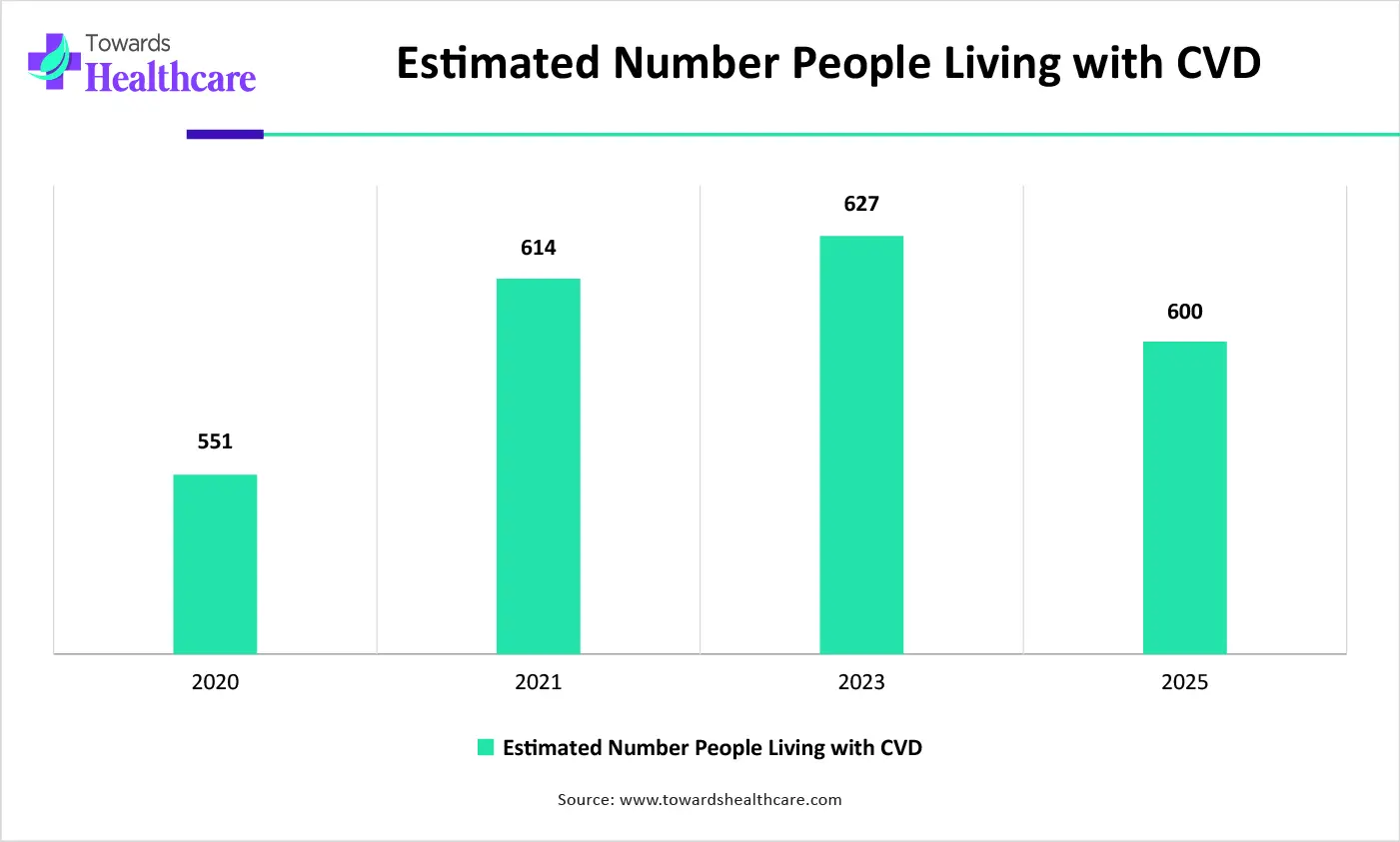

Driven by growing health awareness, rising fitness participation, increasing prevalence of cardiovascular disorders, and expanding use of wearable health technologies, the heart rate monitor market is experiencing sustained global growth across consumer, fitness, and clinical settings. A heart rate monitor is an electronic device used to measure and continuously track the heart’s beating rate in real time. It helps individuals and healthcare professionals assess cardiovascular health, monitor physical activity intensity, detect abnormal heart rhythms, and support preventive care, fitness optimization, and medical diagnosis across home, sports, and hospital environments.

AI integration enhances heart rate monitors by improving signal accuracy, filtering motion noise, and enabling real-time anomaly detection. Advanced algorithms support personalized insights, predictive alerts for irregular rhythms, adaptive training guidance, and continuous learning from user data, making monitoring more reliable, proactive, and clinically relevant across fitness and healthcare applications.

Consumers increasingly prefer smartwatches, fitness bands, and chest straps with built‑in heart rate monitoring, driven by convenience, real‑time tracking, and integration with daily fitness routines and health awareness.

Heart rate monitors are paired with additional sensors for SpO₂, sleep analysis, and stress tracking, giving users a more holistic view of their health beyond just heart rate figures.

Users are linking heart rate monitors directly with smartphone apps to view detailed trends, historical data, and personalized dashboards, making it easier to track progress and share information with healthcare providers.

The market sees a surge in budget‑friendly heart rate monitors with essential features, expanding adoption among price‑sensitive consumers who seek health tracking without premium costs.

Manufacturers are designing lighter, more ergonomic devices soft chest straps and sleek wrist wearables improving user comfort for prolonged wear during daily activities and exercise.

Use of heart rate monitors will expand beyond fitness enthusiasts into clinical settings, remote patient monitoring, and chronic disease management, driven by growing health awareness and demand for continuous physiological tracking.

Which Product Type Segment Dominated the Heart Rate Monitor Market?

The wearable heart rate monitors segment dominates the global market 50% due to its convenience, real-time continuous monitoring, and integration with smartphones and fitness apps. Its widespread use in fitness tracking, preventive healthcare, and remote patient monitoring, combined with technological advancements in sensors, miniaturization, and user-friendly designs, drives strong adoption among consumers and healthcare providers worldwide.

Chest Strap Heart Rate Monitors

The chest strap heart rate monitors segment is estimated to be fastest-growing with market share of 20% due to its high accuracy in capturing real-time heart rate data during intense physical activities. Preferred by professional athletes and fitness enthusiasts, it offers reliable performance for training, sports monitoring, and clinical assessments. Integration with wearable devices and mobile apps further enhances its adoption globally.

Why Did the for On-Person / Wearable Segment Dominate the Heart Rate Monitor Market?

The on-person / wearable segment dominates the market with share of 60% due to its convenience, continuous real-time monitoring, and ease of integration with smartphones and fitness apps. High consumer preference for smartwatches, fitness bands, and wearable medical devices, along with advancements in lightweight, non-invasive sensors, drives widespread adoption across fitness, wellness, and healthcare applications globally.

Cloud-Based / App-Integrated

The cloud-based / app-integrated segment is anticipated to be fastest-growing in the heart rate monitor market with share of 25% due to increasing demand for real-time data access, remote health tracking, and personalized insights. Integration with smartphones, fitness apps, and telehealth platforms enables seamless monitoring, data analysis, and sharing with healthcare providers, driving rapid adoption among consumers and medical professionals.

Why Did Fitness & Sports Tracking Dominant Segment in the Heart Rate Monitor Market?

The fitness & sports tracking segment dominates the market with share of 45% due to the growing popularity of wearable devices for exercise, running, and athletic performance monitoring. Rising health consciousness, increasing adoption of fitness apps, and demand for real-time heart rate feedback during workouts drive widespread use. Integration with smartwatches and connected platforms further strengthens this segment’s market leadership.

Research & Health Studies

The research & health studies segment is the fastest-growing in the market with share 15% due to rising demand for accurate physiological data in clinical trials and academic research. Advanced wearable devices provide continuous, precise monitoring, supporting studies on cardiovascular health, fitness, and preventive care, driving rapid adoption among researchers and healthcare institutions.

Which Technology / Mode of Action Segment Led the Heart Rate Monitor Market?

The optical sensors / PPG technology segment dominates the market with share of 40% due to its non-invasive, continuous monitoring capability. Its integration into wearable devices like smartwatches and fitness bands, ease of use, and ability to provide accurate real-time heart rate data for both fitness and healthcare applications drive widespread adoption.

Electrocardiogram (ECG)-Based Monitoring

The electrocardiogram (ECG)-based monitoring segment is the fastest-growing in the market with share of 30% due to its high accuracy in detecting heart rhythms and identifying cardiovascular abnormalities. Preferred for clinical and professional applications, ECG-based monitors provide detailed insights for preventive care and remote patient monitoring, driving rapid adoption in healthcare, research, and advanced fitness settings.

Why Did Consumers / Fitness Enthusiasts Dominant Segment in the Heart Rate Monitor Market?

The consumer / fitness enthusiasts segment dominates the market with share of 55% due to growing health and fitness awareness, rising adoption of wearable devices, and increasing interest in tracking workout intensity, calories, and cardiovascular performance. Easy integration with smartphones and fitness apps, along with the desire for personalized health insights, further drives widespread usage in this segment.

Research Institutes & Universities

The research institutes & universities segment is estimated to be the fastest-growing in the heart rate monitor market with share of 15% due to increasing demand for accurate physiological data in clinical studies, academic research, and health experiments. Advanced heart rate monitors provide precise, continuous monitoring, supporting cardiovascular research, sports science, and preventive healthcare studies, driving rapid adoption among educational and research institutions globally.

Which Treatment Line / Usage Segment Led the Heart Rate Monitor Market?

The routine fitness & health tracking segment dominates the market with share of 60% due to the growing focus on daily wellness, preventive healthcare, and maintaining an active lifestyle. Consumers increasingly use wearable devices to monitor heart rate, track physical activity, and manage overall health, while seamless integration with apps and fitness platforms further drives widespread adoption in this segment.

Research & Clinical Trials

The research & clinical trial segment is estimated to be fastest-growing in the market with share of 15% due to the rising demand for precise, continuous physiological data in medical studies and trials. Advanced heart rate monitoring devices enable accurate assessment of cardiovascular health, drug effects, and treatment outcomes, supporting evidence-based research and enhancing the quality and efficiency of clinical and academic investigations globally.

Why Did Above Direct Sales (Online & Offline) Dominant Segment in the Heart Rate Monitor Market?

The direct sales segment dominates the market with share of 50 % due to its ability to provide personalized service, product demonstrations, and direct customer engagement. Manufacturers can build stronger relationships, offer customized solutions, and ensure better after-sales support. High consumer trust, brand loyalty, and the preference for direct interactions contribute to the widespread adoption of this distribution channel.

E-commerce / Online Platforms

The e-commerce/online platforms segment is anticipated to be fastest-growing in the market with share of 25% due to the convenience of online shopping, wider product selection, and easy price comparison. Consumers can access detailed reviews, make quick purchases, and benefit from home delivery. Growing internet penetration, digital payment adoption, and the rise of global online marketplaces further drive rapid growth in this segment.

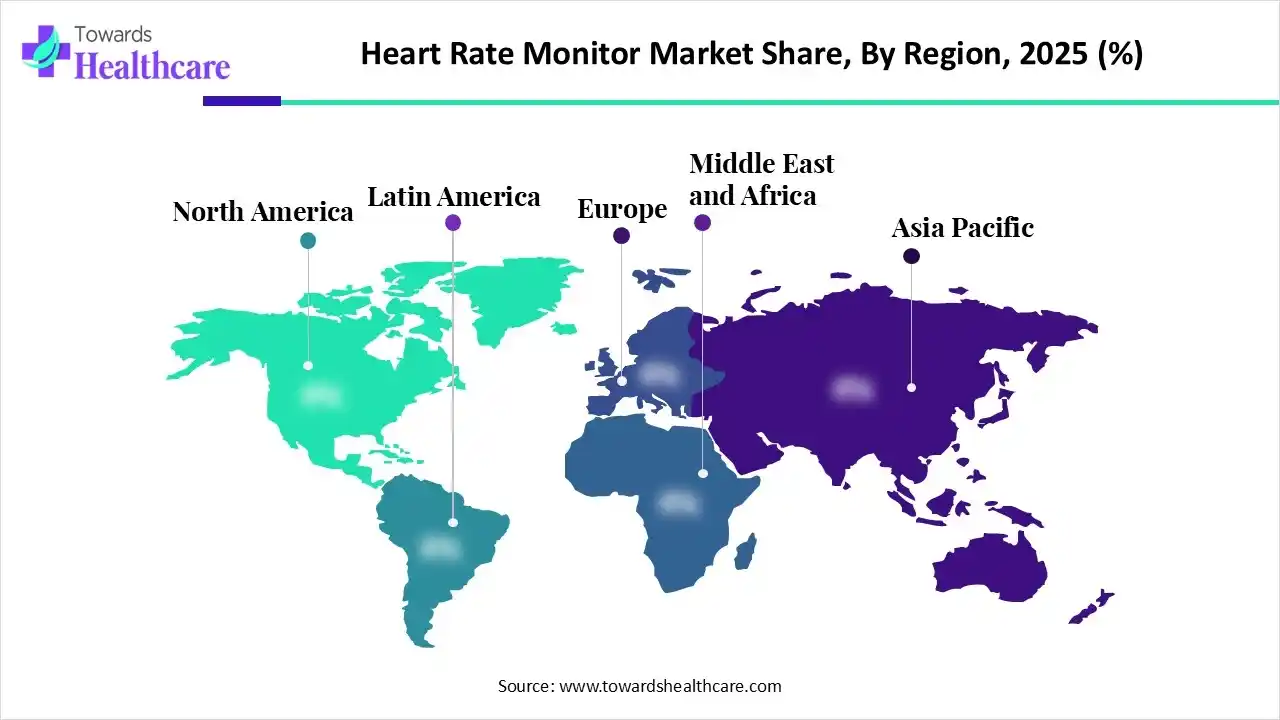

North America dominates the market with share of 35% due to advanced healthcare infrastructure, high adoption of wearable technologies, strong consumer focus on preventive health and fitness, and widespread use of remote patient monitoring. Favorable reimbursement policies, early technology adoption, presence of leading device manufacturers, and robust investment in digital health further strengthen regional market leadership.

What are New Trends in the U.S. Market?

The U.S. leads the North America heart rate monitor market due to strong consumer adoption of wearable devices, advanced healthcare and digital health infrastructure, and widespread use of remote patient monitoring. Supportive regulatory frameworks, higher healthcare spending, growing fitness awareness, and the presence of major technology and medical device companies further reinforce the country’s market dominance.

The Asia-Pacific region is growing rapidly in the market with share of 30% due to rising health awareness, expanding middle-class population, and increasing adoption of affordable wearable devices. Improving healthcare infrastructure, growth of fitness culture, government initiatives promoting digital health, and higher smartphone penetration further accelerate demand across both consumer and clinical segments.

What are the Current Trends in China Market?

The China dominates the Asia-Pacific market due to its large population base, rising health awareness, and rapid adoption of wearable technologies. Strong domestic manufacturing capabilities, widespread smartphone usage, government support for digital healthcare, expanding fitness culture, and increasing use of remote health monitoring solutions further strengthen the country’s leadership in the regional market.

Europe is witnessing notable growth in the market with share of 25% due to increasing prevalence of cardiovascular conditions, strong emphasis on preventive healthcare, and rising adoption of wearable fitness devices. Supportive regulatory frameworks, growing remote patient monitoring programs, aging population, and expanding digital health initiatives across public healthcare systems further drive regional market expansion.

What are the Current Market Trends in UK?

The UK dominates the European market due to advanced digital healthcare infrastructure, strong adoption of wearable health technologies, and growing focus on preventive and remote patient monitoring. Supportive government initiatives, widespread smartphone usage, high health awareness, and collaboration between healthcare providers and technology companies further reinforce the country’s leading position in the region.

| Sr. No. | Vendors | Core heart-rate monitor offerings (short) |

| 1 | Apple | Apple Watch line (real-time HR, ECG, HRV metrics, clinical features such as irregular rhythm/ECG in supported regions). |

| 2 | Samsung | Galaxy Watch family (PPG HR, ECG feature, blood-pressure/health apps via Samsung Health Monitor). |

| 3 | Garmin | GPS sports watches and chest-strap/optical HR sensors for fitness and clinical-grade sports metrics (Forerunner/Fenix/Vivosmart). |

| 4 | Fitbit (Google) | Consumer fitness trackers and smartwatches with continuous HR, resting HR, HR zones, and wearable ECG on select models. |

| 5 | Polar | Sports/athlete HR devices, chest straps (e.g., H10), wrist watches and HRV analytics for training |

| 6 | Masimo | Medical-grade patient monitoring (pulse oximetry, continuous HR) plus consumer wearables/remote patient monitoring platforms |

| 7 | Philips | Clinical ambulatory ECG/HR monitors, Holter/MCOT solutions and inpatient/outpatient cardiac monitoring systems. |

| 8 | Nihon Kohden | Hospital/clinical cardiac monitors, ECG/telemetry and continuous HR monitoring systems for acute care. |

| 9 | Omron | Home/clinical monitors and a small range of wearable sensors (BP + some cardiac monitoring devices used with apps). |

| 10 | Wahoo / Other specialty (e.g., Whoop, Suunto, Coros) | Chest-strap HR sensors and athlete-focused wearables offering high-accuracy HR data for training (Wahoo TICKR; Whoop band - subscription analytics). |

By Product Type

By Deployment Type

By Application

By Technology / Mode of Action

By End-User

By Treatment Line / Usage

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026