February 2026

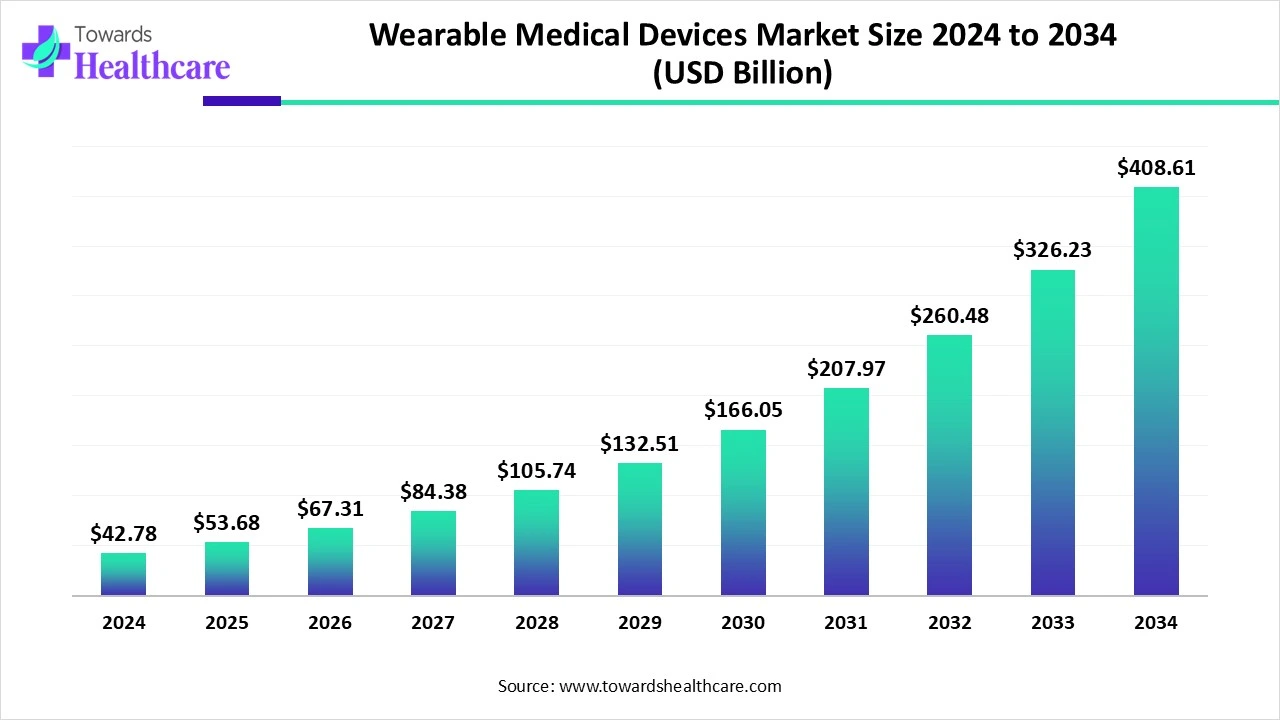

The global wearable medical devices market size is calculated at USD 53.72 billions in 2025, grew to USD 67.45 billion in 2026, and is projected to reach around USD 523.58 billion by 2035. The market is expanding at a CAGR of 25.57% between 2026 and 2035.

| Metric | Details |

| Market Size in 2026 | USD 67.45 Billion |

| Projected Market Size in 2035 | USD 523.58 Billion |

| CAGR (2026 - 2035) | 25.57% |

| Leading Region | North America |

| Market Segmentation | By Product, By Site, By Application, By Grade Type, By Distribution Channel, By Region |

| Top Key Players | Medtronic, Google, Abbott, OMRON Healthcare, Inc., Koninklijke Philips N.V., Garmin Ltd, GE HealthCare, Fresenius Medical Care AG, Insulet Corporation, Dexcom, Inc., Tandem Diabetes Care, Inc., VivaLNK, Inc., AliveCor, Inc., Cognita Labs, EMAY, Qardio, Inc, Ypsomed AG, CAIRE Inc, Wellue, LOOKEETech, iRhythm Technologies, Inc, Withings, OxyGo HQ Florida, LLC., LivaNova PLC, Boston Scientific Corporation, VitalConnect, Nexstim, tVNS Technologies GmbH, Nevro Corporation, Neuropace Inc., electroCore, Inc., Sotera, Inc., Laborie, Polar Electro, Axonics, Inc |

Monitoring of the health status at a medical level, which will provide data to clinicians for early diagnosis and treatment, is increasing within the population due to wearable medical devices. This also helps in the analysis of vital signs and health status even outside the clinical environment. Therefore, it ensures improved and quick recovery in patients with injury or medical intervention. Furthermore, these devices can be used to develop a collaboration between various scientific fields, which may include microtechnology, nanotechnologies, biomedical technologies, information and communication technologies, materials engineering, and electronic engineering.

The efficiency and accuracy of wearable medical devices are transforming with the help of AI integration, as it aids in the identification and correction of errors in the collected data. It can also analyze a large amount of data using AI algorithms, which can allow healthcare providers to predict health outcomes, recognize patterns, and make decisions for patient care. Furthermore, AI pattern identification models are also being used during cross-sensitivity and multimodal sensing issues, in which the presence of other signals influences the measurement of one signal to identify specific patterns.

Rising Iincidences of Diseases

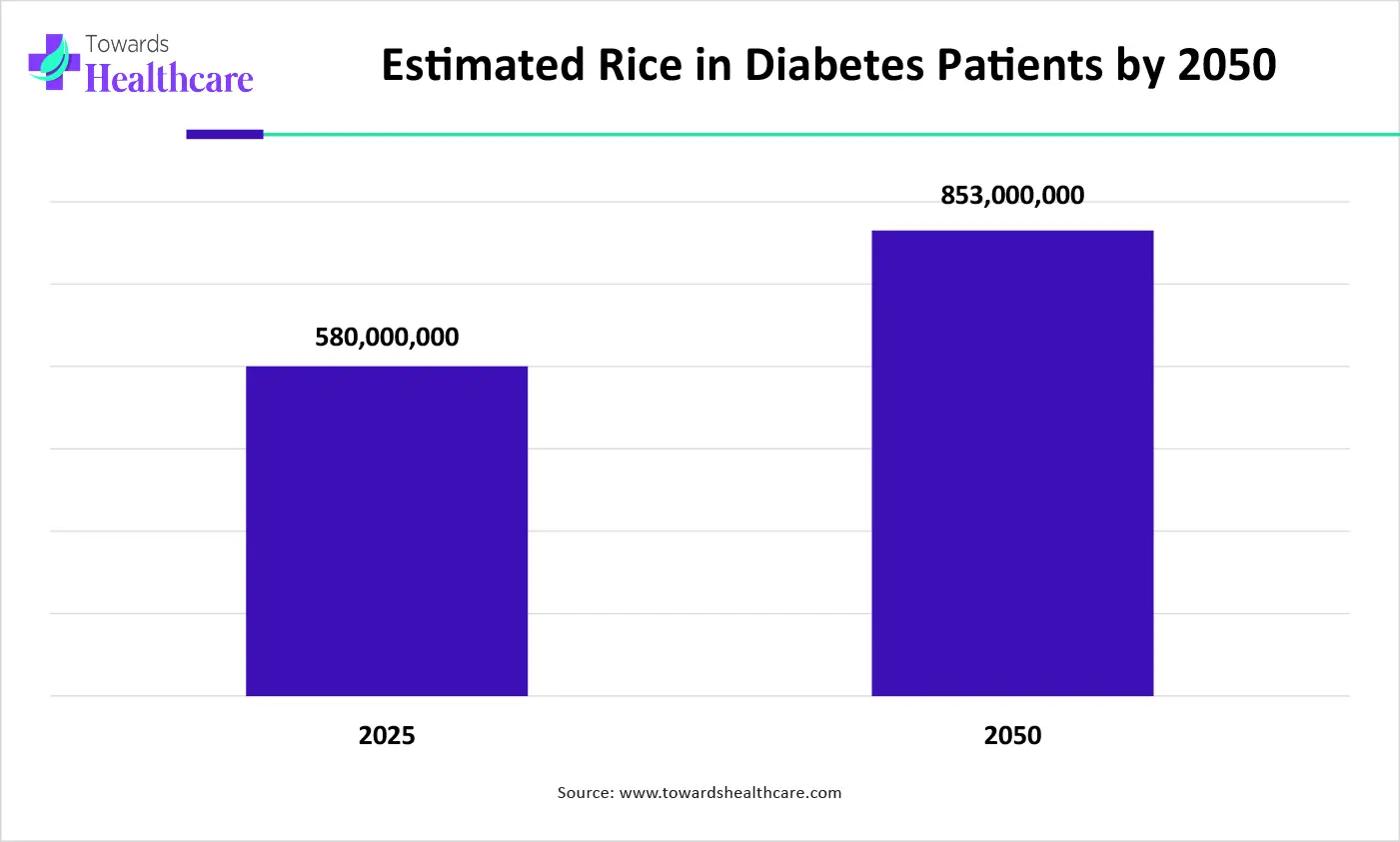

The occurrences of various diseases, such as cardiovascular diseases, asthma, diabetes, etc, are increasing. This, in turn, raises the demand for early diagnosis and effective treatment options. Hence, the use of wearable medical devices increases. They help in the regular monitoring of such conditions, reducing the risk of complications. Furthermore, it also helps in the early diagnosis of disease. At the same time, it can be used by the patient themselves, decreasing the hospital visits. Thus, all these factors drive the wearable medical devices market growth.

The graph represents the estimated rise in the patients by 2050. It indicates that there will be a rise in diabetes, which will increase the demand for early diagnosis and treatment options, as well as increase the use of wearable medical devices. Thus, this in turn will ultimately promote the market growth.

High Costs

The wearable medical devices are expensive. This causes limited access by patients who cannot afford it. Similarly, the hospital with limited resources cannot use it for patient monitoring, which further affects the patient outcomes. Moreover, the advanced wearable medical devices can also add to their development costs, making it more expensive. Thus, this restricts the effective use of the devices.

Non-Invasive Devices

There is a rise in the development of various non-invasive wearable medical devices, as they provide comfort and safety to the patient. These innovations also reduce the risk associated with the infection, which in turn enhances patient compliance. Thus, these devices can be used for patients of all age groups. Moreover, the presence of specialized staff or hospital visits can also be reduced with the help of these devices. Thus, this promotes the wearable medical devices market growth.

For instance,

Why Did the Diagnostic Devices Segment Dominate in the Wearable Medical Devices Market?

By product type, the diagnostic devices segment dominated the market in 2024. The diagnostic devices helped in the early diagnosis of the diseases. Furthermore, they also provided accurate data, which increased their demand, contributing to the market growth.

Therapeutic Device Segment: Fastest Growing

By product type, the therapeutic device segment is estimated to be the fastest growing at a notable CAGR during the forecast period. The use of therapeutic devices is increasing due to the rising chronic diseases. They provide better management of these diseases, enhancing patient outcomes.

How Strap/Clip/Bracelet Segment Dominated the Wearable Medical Devices Market?

By site type, the strap/clip/bracelet segment dominated the market in 2024 and is estimated to be the fastest growing at a notable CAGR during the forecast period. It provided comfort to the patients as they were easy to wear. At the same time, being non-invasive, they caused increased use in the market.

Shoe Sensors Segment: Significantly Growing

By site type, the shoe sensors segment is anticipated to grow significantly during the forecast period. The shoe sensors help to monitor mobility. Thus, their use in musculoskeletal disorders is rising.

Which Application Type Segment Held the Dominating Share of the Wearable Medical Devices Market?

By application type, the home healthcare segment dominated the global market in 2024. The home healthcare application provided patients with comfort and convenience. Thus, the geriatric population with chronic disease contributed to their increased use, promoting the market growth.

Remote Patient Monitoring Segment: Fastest Growing

By application type, the remote patient monitoring segment is predicted to be the fastest growing during the forecast period. Remote patient monitoring is improving patient care and adherence to treatments as it provides monitoring of patients anywhere, reducing hospital visits.

What Made Consumer-Grade Wearable Medical Devices the Dominant Segment in the Wearable Medical Devices Market?

By grade type, the consumer-grade wearable medical devices segment dominated the global wearable medical devices market in 2024. The consumer-grade wearable medical devices enhanced the market growth due to their user-friendly advantage as well as affordability, along with their accurate monitoring.

Clinical Grade Wearable Medical Devices Segment: Fastest Growing

By grade type, the clinical grade wearable medical devices segment is expected to be the fastest growing during the forecast period. The accuracy, which helps in the diagnosis and management of diseases as well as helps to reduce the complications, is increasing the use of clinical-grade wearable medical devices in the market.

Why Did the Pharmacies Segment Dominate in the Wearable Medical Devices Market?

By distribution channel type, the pharmacy segment dominated the global market in 2024. The pharmacies provided guidance to the patient about the devices, which increased patient compliance. At the same time, the availability of devices in pharmacies also increased the market growth.

Online Channel Segment: Fastest Growing

By distribution channel type, the online channel segment is anticipated to be the fastest growing during the forecast period. The online channel is offering information about the devices along with the home deliveries. They also provide a variety of products so that the patients can select the one suitable for them, depending on the information and their diseases.

North America dominated the wearable medical devices market in 2024. North America consists of well-developed healthcare sectors along with technological advancements. This increased the use of wearable medical devices to monitor health conditions, which in turn enhanced the market growth.

The U.S. Wearable Medical Devices Market Trends

The healthcare systems in the U.S. are using wearable medical devices for the diagnosis of various diseases as well as for therapeutic purposes. This, in turn, increases the demand for the same for effective management of health.

The Canada Wearable Medical Devices Market Trends

As the healthcare sectors are well established, they are focusing on the development of new wearable devices that can be used in the diagnosis as well as treatment of diseases. Furthermore, this is increasing the collaboration between companies.

Asia Pacific is estimated to host the fastest-growing wearable medical devices market during the forecast period. Asia Pacific is experiencing growth in the healthcare sector. They are adopting various technologies as well as approaches for the diagnosis and treatment of rising diseases. Thus, the demand for wearable medical devices is also rising, contributing to the market growth.

The China Wearable Medical Devices Market Trends

Due to a large population, China is utilizing the use of wearable medical devices for patients with different diseases. At the same time, new innovations are also being developed using advanced technologies, which in turn increases the use of devices.

The India Wearable Medical Devices Market Trends

The healthcare systems in India are developing, due to which the use of medical devices in regular practice is also increasing. Moreover, the government is also supporting for making of these devices affordable.

Europe is expected to grow significantly in the wearable medical devices market during the forecast period. Due to rising diseases, the investments in healthcare sectors by the government as well as the private sector are increasing in Europe. This, in turn, enhances the manufacturing process as well as the market growth.

The Germany Wearable Medical Devices Market Trends

The industries as well as the institutes in Germany are developing new wearable medical devices. Furthermore, the support provided by the government and regulatory agencies promotes the development and approval process, respectively.

The UK Wearable Medical Devices Market Trends

As the number of diseases is increasing, the demand for wearable medical devices is also increasing in the UK. Thus, this increases the production process, which is supported by the investment of the government and private sectors.

South America is expected to grow significantly in the wearable medical devices market during the forecast period, due to growing demand for remote patient monitoring solutions. The growing smartphone penetration and expanding healthcare are also leading to the development of new digital healthcare technologies to tackle the growing chronic diseases, which is enhancing the market growth.

Brazil Wearable Medical Devices Market Trends

The presence of a well-developed healthcare sector in Brazil is increasing the use of wearable medical devices. The growing focus on telemedicine and digital health solutions is also increasing their development. Moreover, growing chronic diseases are also increasing their adoption rates.

MEA is expected to grow significantly in the wearable medical devices market during the forecast period, due to growing chronic diseases. The growing shift toward home-based care is also increasing the use of wearable medical devices for remote patient monitoring. The growing health awareness and growing geriatric population are also increasing their use, promoting the market growth.

Saudi Arabia Wearable Medical Devices Market Trends

The growing adoption of telemedicine platforms backed by government initiatives is increasing the use of various wearable medical devices. The growing chronic disease, expanding healthcare, and increasing use of smartphones are also encouraging their use. Additionally, the rising healthcare investments are also increasing their innovations.

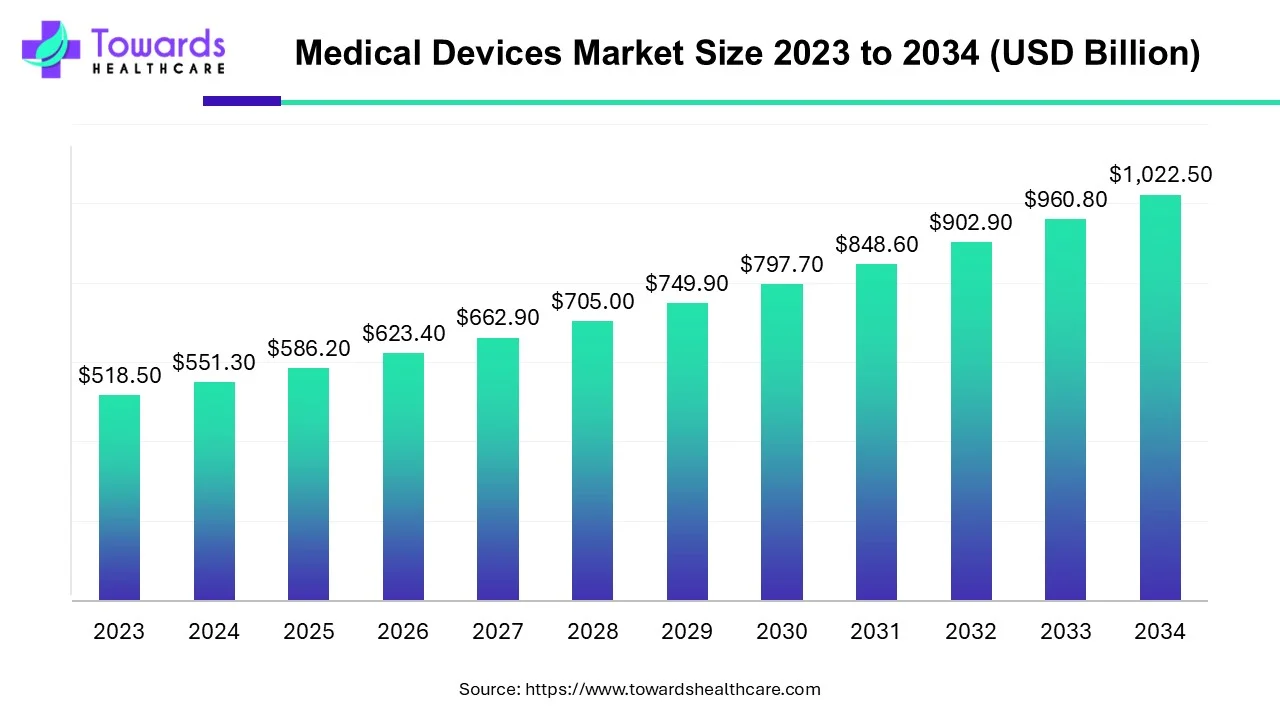

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

R&D

Clinical Trials and Regulatory Approvals

Formulation and Final Dosage Preparation

Packaging and Serialization

Patient Support and Services

By Product

By Site

By Application

By Grade Type

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026