February 2026

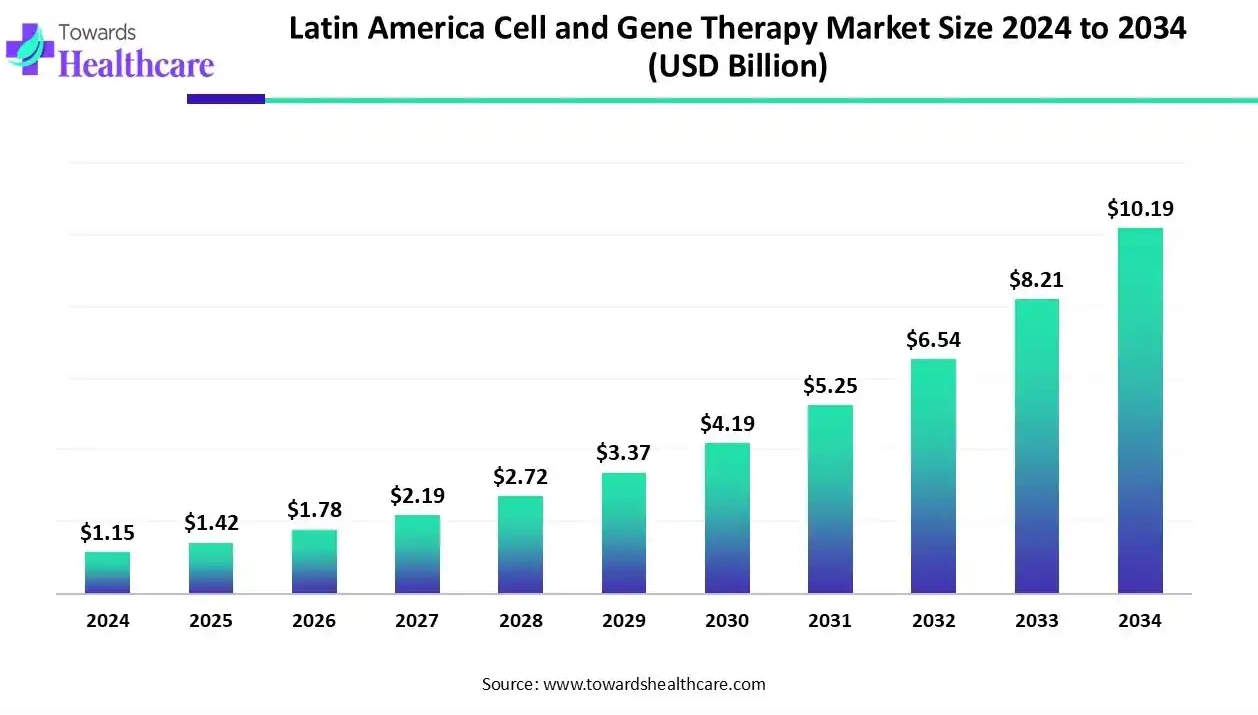

The Latin America cell and gene therapy market size recorded US$ 1.15 billion in 2024, set to grow to US$ 1.42 billion in 2025 and projected to hit nearly US$ 10.19 billion by 2034, with a CAGR of 24.40% throughout the forecast timeline.

The Latin America cell and gene therapy market is witnessing robust growth, driven by the increasing prevalence of chronic and genetic diseases, including cancer, rare disorders, and immunological conditions. Advances in biotechnology, gene-editing technologies, and regenerative medicine are accelerating the development of innovative therapies. Expanding clinical trial activity in countries like Brazil and Mexico, coupled with government support, investments, and strategic collaborations between pharmaceutical companies and research institutions, is fostering a favorable environment. Rising awareness and adoption of personalized medicine further enhance market potential across the region.

| Table | Scope |

| Market Size in 2025 | USD 1.42 Billion |

| Projected Market Size in 2034 | USD 10.19 Billion |

| CAGR (2025 - 2034) | 24.40% |

| Market Segmentation | By Therapy Type, By Therapeutic Area, By Vector / Delivery Type (for Gene Therapy), By Cell Source (for Cell Therapy), By Manufacturing Scale & Service, By End User, By Country |

| Top Key Players | Novartis, Roche / Spark Therapeutics (Roche group), Gilead Sciences (Kite Pharma), Pfizer Inc., AstraZeneca, Sanofi, Janssen (Johnson & Johnson), Takeda Pharmaceutical Company, Merck & Co. (MSD), Moderna, Inc., Bluebird Bio, Lonza Group (CMO/CDMO), Catalent, Inc. (CDMO), Thermo Fisher Scientific (manufacturing & analytics), Samsung Biologics, Charles River Laboratories (CRO services), IQVIA / Parexel / ICON (regional CRO presence), Biomm S.A. (Brazil — regional biotech/manufacturing), Instituto Butantan (Brazil — vaccine & biologics manufacturing/research), Grupo Biotoscana / Regional Biotech & Hospital Networks |

The Latin America cell and gene therapy market is driving growth through rising prevalence of chronic and genetic diseases, expanding clinical trials, and increasing investments in biotechnology infrastructure. Cell and gene therapy refers to innovative medical treatments that modify or manipulate cells and genes to treat or cure diseases at their source. Cell therapy involves introducing live cells into a patient to repair or replace damaged tissues, while gene therapy targets defective genes to correct or regulate their function. These therapies are used in cancer, rare genetic disorders, and immunological conditions, offering personalized, long-term solutions and transforming conventional treatment paradigms.

AI integration is revolutionizing cell and gene therapy by streamlining discovery, optimizing manufacturing, and enhancing clinical trial outcomes. Through predictive analytics, AI helps identify effective gene targets, improve viral vector design, and accelerate biomarker discovery for personalized treatments. In manufacturing, AI-powered automation reduces errors, increases scalability, and ensures quality control. Clinical trials benefit from AI-driven patient stratification and real-time monitoring, improving success rates and reducing costs. Companies like Novartis and Insilico Medicine are actively applying AI in developing advanced therapies, while Owkin leverages AI in precision oncology, demonstrating its transformative potential in making cell and gene therapies safer and more accessible.

| Country | Month / Year | Initiative / Development | Notes & source |

| Brazil | April 2024 | Local CAR-T manufacturing push | Brazilian institutions moved to produce CAR-T therapies domestically to cut costs and expand access (national manufacturing initiatives and public funding) |

| Mexico | April 2025 | Regulatory landscape updates & stronger oversight | Regulatory reviews and watchdog analyses highlighted progress (and remaining gaps) in Mexico’s cell-therapy regulation, improving trial clarity |

| Chile | Initiative in 2024 (ongoing) | IMPACT CGT meetings & clinical trial capacity building | IMPACT Center events and clinic-based programs promoted CAR-T and cell-therapy manufacturing know-how, advancing regional clinical capacity. |

| Argentina | 2024–2025 | Regulatory & public-private models for rare diseases | Argentina advanced regulatory frameworks for gene therapies and explored shared-risk models to improve access for orphan diseases. |

| Colombia | 2024–2025 | Growing clinical research partnerships | Academic–clinical collaborations (e.g., university clinics) increased CAR-T and cell-therapy trial activity and regional expertise. |

| Peru & Others | 2024–2025 | Early-stage infrastructure and interest | Several smaller markets showed rising interest—investments in site readiness, training, and logistics for future trials. Regional reports note nascent activity. |

| Regional / Cross-Country | 2024–2025 | More CDMO, 3PL, and clinical-trial activity | Expansion of CDMO capacity, third-party logistics, and rising Phase I trial starts across LATAM improved access and scaling potential. |

The cell therapy segment dominates the market with a share of 58% due to rising demand for advanced treatments in oncology, regenerative medicine, and rare disorders. Strong clinical trial activity, especially in Brazil and Mexico, supports innovation, while increasing government initiatives and hospital partnerships enhance adoption. Additionally, growing regional expertise in CAR-T therapy and stem cell research strengthens its leadership in the market.

The gene therapy segment is estimated to be the fastest-growing segment in the Latin American cell and gene therapy market, with the gene editing sub-segment expanding rapidly due to breakthroughs in technologies such as CRISPR and adeno-associated viral vectors. These innovations enable precise genetic modifications, offering long-term solutions for rare diseases and cancers. Supportive regulations, growing clinical trials in Brazil and Mexico, and rising collaborations with global biotech firms are fueling momentum. Increasing investment in personalized medicine and heightened awareness of advanced therapies further position gene editing and gene therapy as the fastest-growing segment in the region’s healthcare innovation landscape.

The oncology segment dominates the market with a share of 45% due to the high prevalence of cancers and the urgent need for advanced treatments. Increasing adoption of CAR-T therapies, strong clinical trial activity in countries like Brazil and Mexico, and growing collaborations between hospitals, research institutions, and biotech companies support innovation. This focus on cancer therapies drives the segment’s leadership in the region.

The rare genetic disorders segment is estimated to be the fastest-growing segment in the Latin America cell and gene therapy market due to rising awareness of inherited diseases and the urgent need for targeted, personalized treatments. Advances in gene-editing technologies, such as CRISPR and viral vectors, enable precise interventions for these conditions. Increasing clinical trials, supportive regulatory frameworks in Brazil and Mexico, and strategic collaborations between biotech companies and research institutions are accelerating therapy development.

The viral vectors segment dominates the market with a share of 65% due to their proven efficacy and versatility in delivering therapeutic genes. These vectors are widely used in CAR-T therapies, gene replacement, and immunotherapies, offering high safety and transduction efficiency. Strong clinical trial activity in Brazil, Mexico, and Chile, along with growing investments from biotech firms and research institutions, supports vector development, manufacturing, and adoption, solidifying AAV and lentivirus as the preferred platforms in the region’s advanced therapy landscape.

The non-viral delivery segment is anticipated to be the fastest-growing segment in the market due to its safety, scalability, and flexibility in delivering genetic material. These methods reduce immunogenicity and manufacturing complexity compared to viral vectors. Increasing research collaborations, rising clinical trials in Brazil and Mexico, and growing adoption of mRNA-based therapies and ex vivo gene editing are driving rapid expansion across the region.

The autologous segment dominates the market with a share of 62% due to its personalized approach, using a patient’s own cells to minimize immune rejection and enhance treatment safety. Widespread adoption in CAR-T therapies and regenerative medicine, strong clinical trial activity in Brazil and Mexico, and collaborations between hospitals, research institutions, and biotech companies further drive its preference. The segment’s reliability and effectiveness make it the leading cell source in the region.

The Allogeneic segment is estimated to be the fastest-growing segment in the market due to its “off-the-shelf” approach, enabling scalable production and quicker treatment delivery. Advances in immune-matching technologies, expanding clinical trials, and increasing adoption by biotech firms and hospitals are accelerating its use across oncology and regenerative therapies in the region.

The clinical-scale manufacturing segment dominates the market with a share of 60% due to the increasing number of early- and late-phase clinical trials requiring reliable, high-quality production. Investments in advanced bioprocessing facilities, automation, and quality control systems in countries like Brazil and Mexico support consistent output. Additionally, collaborations between biotech firms, hospitals, and contract development organizations enhance capacity, ensuring a timely supply of cell and gene therapies and strengthening the segment’s leadership in the region.

The contract manufacturing & CDMO services segment is anticipated to be the fastest-growing in the market due to rising demand for scalable, outsourced manufacturing solutions. These services enable biotech companies to accelerate commercialization, reduce costs, and ensure regulatory compliance. Investments in automated facilities, cold-chain logistics, and regional partnerships in Brazil, Mexico, and Chile are expanding capacity, supporting broader therapy adoption, and driving rapid growth in this segment.

The biopharma & biotechnology companies segment dominates the market with a share of 40% due to their strong focus on research, development, and commercialization of advanced therapies. These companies lead in clinical trials, innovation in gene-editing and cell-processing technologies, and collaborations with hospitals and research institutions. Supportive regulatory frameworks in Brazil and Mexico, along with increasing investment in personalized medicine, further strengthen their ability to drive therapy development and maintain a dominant position in the regional market.

The hospitals & specialty clinics segment is estimated to be the fastest-growing segment in the Latin America cell and gene therapy market due to increasing adoption of advanced therapies for personalized and regenerative treatments. Their direct access to patients enables rapid clinical trial recruitment and real-world therapy application. Investments in specialized infrastructure, trained personnel, and partnerships with biotech companies enhance treatment delivery, while growing patient awareness and demand for innovative therapies accelerate market growth across Brazil, Mexico, and other key regional markets.

Brazil dominates the Latin America cell and gene therapy market due to its advanced healthcare infrastructure, strong biotechnology research ecosystem, and high clinical trial activity. Supportive government policies, public funding for innovative therapies, and a growing network of hospitals and specialty clinics facilitate adoption. The country also attracts collaborations and investments from international biopharma companies, particularly in CAR-T and gene therapies.

Mexico is the fastest-growing country in the market due to favorable regulatory reforms that facilitate clinical trials and therapy approvals. Expanding healthcare infrastructure, growing public and private investment, and rising collaborations between local biotech companies and international pharmaceutical firms accelerate research and commercialization. Additionally, increasing awareness of advanced therapies, adoption of personalized medicine, and development of specialized hospitals and clinics for cell and gene therapies further drive market expansion, positioning Mexico as a key hub for innovative treatments in the region.

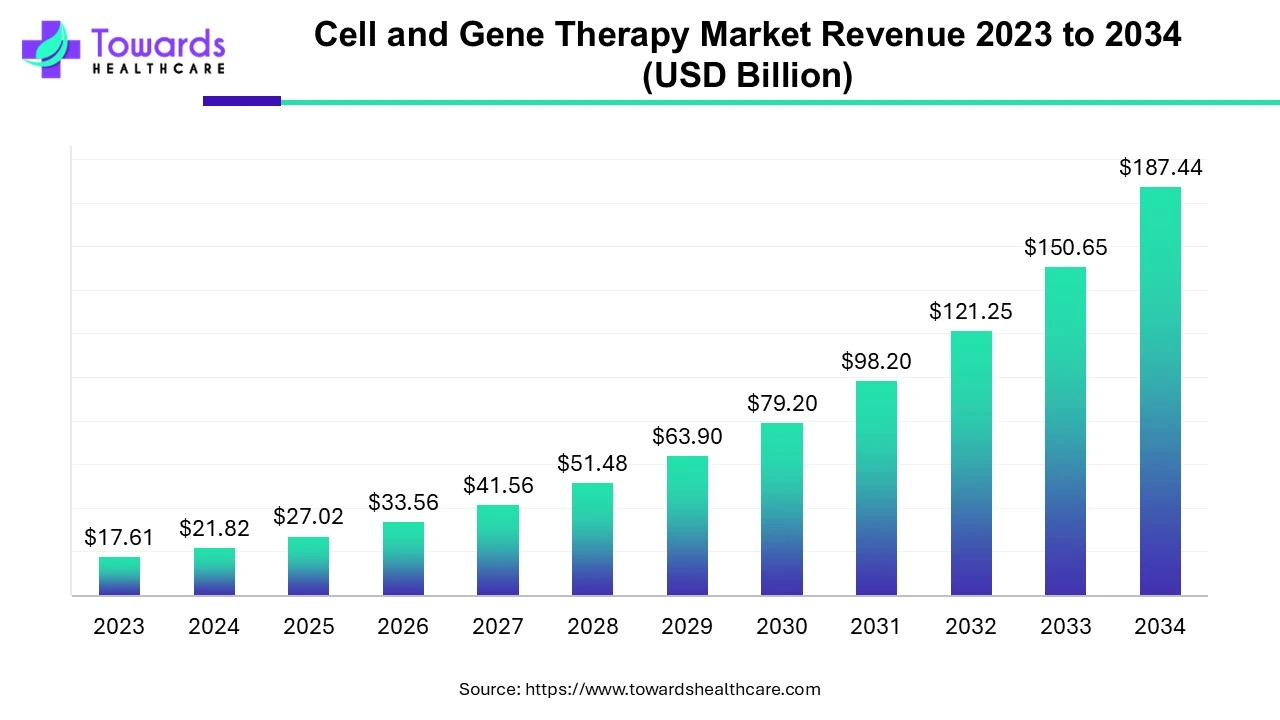

The global cell and gene therapy market is valued at USD 21.82 billion in 2024 and is projected to reach USD 187.44 billion by 2034, growing at a CAGR of 24% over the forecast period, driven by an increase in clinical trials and a rising number of product approvals.

Target discovery, preclinical studies, vector design, cell processing, and formulation of therapy candidates.

Key Organizations:

Phase I–III clinical trials, safety and efficacy testing, protocol approval, submission to regulatory agencies, and post-trial reporting.

Key Organizations / Regulators:

Steps: Therapy administration, follow-up monitoring, patient education, logistics for therapy delivery (cold-chain management), and post-treatment care.

Key Organizations:

Instituto Butantan (Brazil)

Fiocruz (Brazil)

Cellus Medicina Regenerativa (Chile)

Instituto Nacional de Medicina Genómica (INMEGEN) (México)

Laboratório Pasteur (Brazil)

Laboratorio Elea (Argentina)

Biosonda Biotechnology (Chile)

By Therapy Type

By Therapeutic Area

By Vector / Delivery Type (for Gene Therapy)

By Cell Source (for Cell Therapy)

By Manufacturing Scale & Service

By End User

By Country (Latin America)

February 2026

February 2026

February 2026

February 2026