January 2026

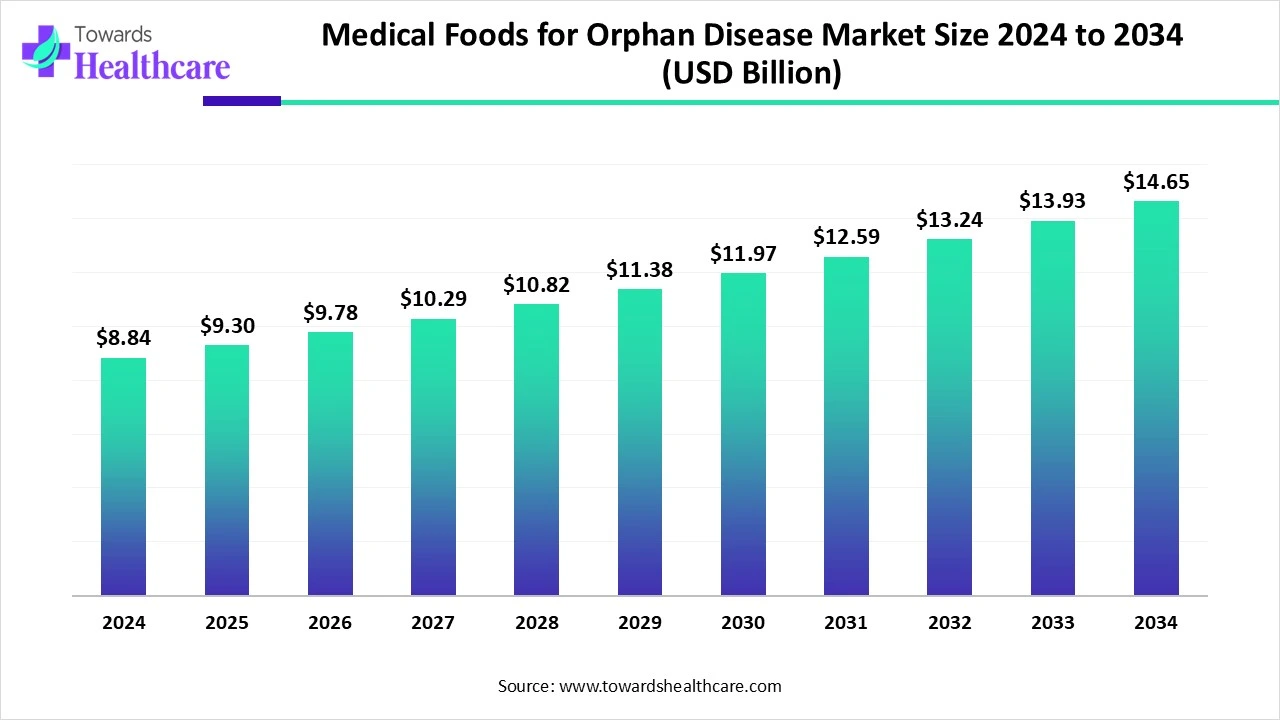

The global medical foods for orphan disease market size is calculated at USD 8.84 billion in 2024, grow to USD 9.3 billion in 2025, and is projected to reach around USD 14.65 billion by 2034. The market is expanding at a CAGR of 5.2% between 2025 and 2034.

The medical foods for orphan disease market is growing due to the increasing recognition of specialized dietary needs in managing rare metabolic and genetic disorders. These products offer essential nutritional support where standard diets are insufficient. Rising awareness, improved diagnostic tools, and advancements in personalized nutrition are driving demand. However, access remains limited due to high costs and a lack of widespread insurance coverage, presenting ongoing challenges despite growing clinical acceptance and need.

| Metric | Details |

| Market Size in 2025 | USD 9.3 Billion |

| Projected Market Size in 2034 | USD 14.65 Billion |

| CAGR (2025 - 2034) | 5.2% |

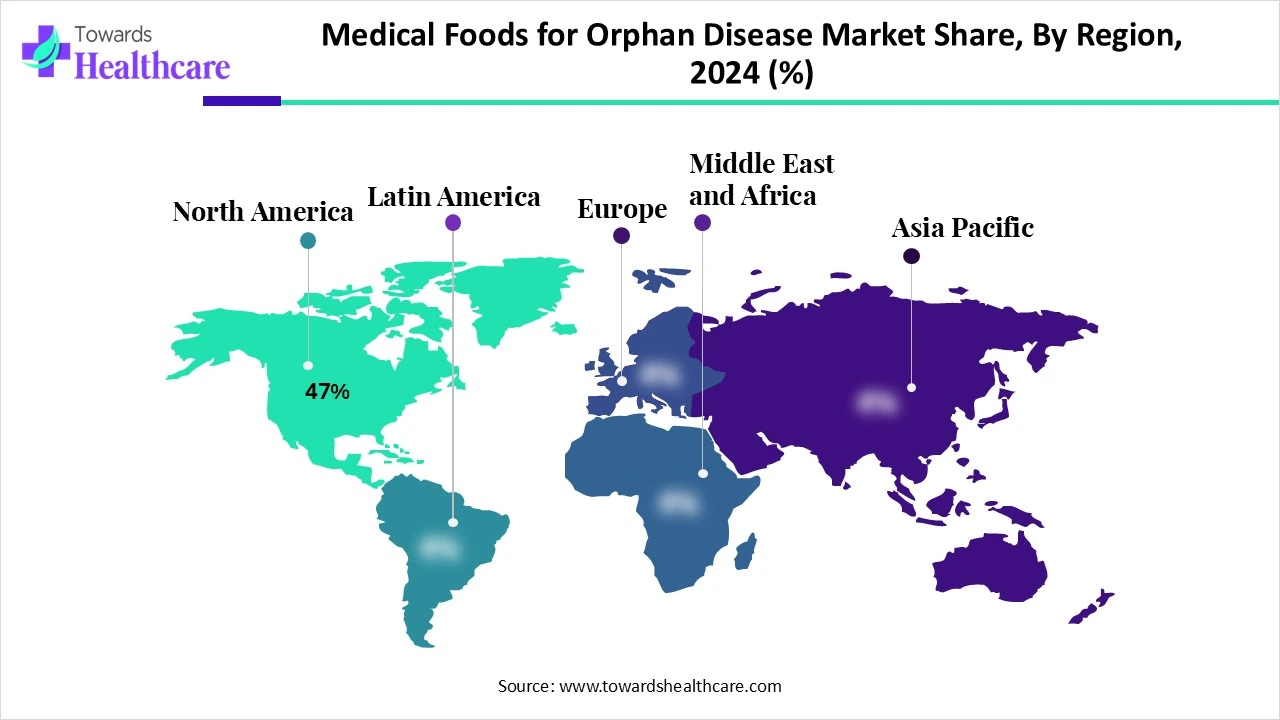

| Leading Region | North America share by 47% |

| Market Segmentation | By Disease Type, By Product Type, By Route of Administration, By Age Group, By Distribution Channel |

| Top Key Players | Nestlé Health Science, Abbott Laboratories, Danone Nutricia, Mead Johnson Nutrition, Cambrooke Therapeutics, Vitaflo International Ltd, BioMarin Pharmaceutical Inc., MedDay Pharmaceuticals, Relmada Therapeutics, B. Braun Melsungen AG, Ajinomoto Cambrooke Inc., Targeted Medical Pharma, Inc., Mevalia, Nutricia Metabolics, Cymbiotika, Metagenics Inc., KetoCal (Nutricia), Vitafriends (distributor & service provider), Solace Nutrition, Nutricia North America |

The Medical Foods for Orphan Disease Market refers to a specialized segment of therapeutic nutrition developed to manage rare (orphan) diseases through dietary regulation of metabolic and genetic imbalances. Medical foods are formulated to be consumed or administered under physician supervision, providing specific nutritional profiles not achievable through a normal diet. These are distinct from dietary supplements and drugs, and are used in conditions like phenylketonuria (PKU), maple syrup urine disease (MSUD), homocystinuria, mitochondrial disorders, and more.

The market is growing rapidly due to increased orphan drug legislation, newborn screening programs, and a focus on non-pharmacological disease management. Innovation is enhancing the medical foods market for orphan diseases by enabling the development of tailored nutritional therapies, improving ingredient formulation, and advancing delivery systems, leading to better disease management, patient compliance, and expanded treatment options.

An increasing number of individuals are being diagnosed with rare genetic and metabolic diseases such as phenylketonuria (PKU) and maple syrup urine disease (MSUD), which require strict dietary management through specialized medical foods.

Patients, caregivers, and healthcare providers are becoming more aware of the importance of condition-specific diets, leading to higher demand for medical foods as part of long-term disease management.

Improvements in genetic testing and newborn screening programs are allowing for earlier detection of rare diseases, enabling timely dietary interventions using medical foods.

Innovations in nutrition science are allowing for the development of targeted medical foods tailored to individual metabolic profiles, improving treatment outcomes and patient compliance.

Government policies and incentives for orphan disease treatment have encouraged research and commercialization of medical foods as part of a broader strategy to address unmet medical needs.

Ongoing clinical trials and scientific studies are supporting the efficacy of medical foods in managing specific conditions, encouraging investment and innovation in the sector.

AI can significantly impact the medical foods market for orphan diseases by enabling the development of personalized nutrition plans based on genetic, metabolic, and clinical data. It helps identify precise dietary needs, improve product formulations, and predict patient responses. AI-driven tools can also streamline research, enhance the diagnosis of rare diseases, and optimize supply chains. These innovations lead to more effective, targeted medical foods, ultimately improving disease management and expanding access for patients with rare conditions.

Rising Prevalence of Rare Diseases

The rising prevalence of rare diseases is a driver in the medical foods for orphan disease market because it increases the number of patients who require specialized dietary management. Many rare condition, especially inherited metabolic disorders, cannot be effectively treated with conventional therapies diagnoses become more common through improved screening and awareness, the demand for condition-specific medical foods grows, making them an essential-specific medical foods grows, making them an essential part of long-term care and boosting market expansion.

High Cost and Limited Reimbursement Coverage

The high cost and lack of consistent reimbursement for medical foods pose a major barrier in the orphan disease market. These products, designed for very specific conditions, often require complex ingredients and manufacturing, leading to elevated pricing. Without strong insurance support, many patients struggle to afford them, especially over long treatment periods. This financial strain limits patient access, reduces treatment adherence, and discourages broader use, slowing overall market growth despite the medical need.

Increased R&D Investment

Higher R&D investment opens new doors in the medical foods for orphan disease market by enabling the development of more effective and specialized formulations. It allows scientists to better understand the nutritional needs linked to rare disorders and create innovative solutions that support patient care. This also accelerates the discovery of novel ingredients and delivery methods, making medical foods more precise and accessible. As a result, the market is poised for growth through continuous advancements and product diversification.

The dominance of the inborn errors of metabolism (IEM) segment is largely driven by the necessity for precise nutritional control in managing these rare conditions. Since many of these disorders disrupt normal nutrient processing, patients' medical foods are affected. Limited alternative treatments make nutritional therapy essential. Additionally, increased newborn screening programs have improved early detection, prompting timely intervention with medical foods, thereby boosting demand and solidifying this market’s strong position.

The neurological & neurodevelopmental disorders segment is projected to witness the fastest growth due to a rising number of diagnosed cases and growing emphasis on supportive care. These conditions often require specialized dietary interventions to manage symptoms and improve short. Increasing clinical focus on brain health, advancements in tailored nutritional solutions, and great caregiver awareness are further driving the adoption of medical foods in managing rare neurological conditions.

The amino acid-based formulas segment dominated the market due to its effectiveness in providing safe, complete nutrition for patients who cannot tolerate intact proteins. These formulations are essential for managing various rare metabolic and digestive conditions, where precise nutrient control is vital. Their easy absorption, minimal allergenic potential, and ability to prevent nutritional deficiencies have made them a preferred choice among healthcare providers. Additionally, their established clinical use and growing demand contribute to their leading market position.

The ketogenic medical foods segment is anticipated to grow at the fastest rate in the medical foods for orphan disease market due to its proven efficacy in managing refractory epilepsy and other neurological conditions. Ketogenic diet, being high-fat and low-carbohydrate, induces ketosis, which has been shown to reduce seizure frequency in patients unresponsive to conventional treatments. The growing recognition of dietary interventions in neurological disorders, coupled with advancements in specialized ketogenic formulations, is driving increased adoption and market growth.

The oral segment captured the largest revenue share in the market due to its high patient compliance and ease of administration across all age groups. Unlike invasive methods, oral intake allows for flexible dosing and home-based management, reducing hospital dependency. Its compatibility with various formulations, like liquid tablets and powders, also enhances accessibility. These advantages make it the most practical and widely adopted route in long-term nutritional therapy.

The enteral segment is expected to witness the fastest CAGR owing to its increasing use in patients with rare conditions that impair normal swallowing or digestion. This method ensures precise nutrient delivery directly into the gastrointestinal tract, which is vital for individuals with severe metabolic or neurological disorders. Rising adoption its clinical settings, growing availability of disease-specific formulas, and technological improvement in feeding systems are collectively fueling the market's rapid growth.

The pediatric patients segment leads the medical foods for the orphan disease market, as most rare diseases manifest early in childhood, requiring immediate nutritional management. Children with inherited metabolic disorders often depend on specialized diets for survival and development. Growing awareness, early interventions through neonatal screening, and the availability of age-appropriate, easy-to-consume formulations have increased adoption. Additionally, long-term reliance on medical foods from infancy contributes to sustained demand within this age group, boosting the market growth.

The adult segment is expected to grow at a faster CAGR due to the increasing number of late-diagnosed rare diseases and improved healthcare access among adults. Many individuals previously undiagnosed in childhood are now being identified and require tailored nutritional support. Growing health consciousness, coupled with a rise in adult-focused medical food formulation, supports this trend. Additionally, better disease management has allowed more pediatric patients to transition into adulthood, expanding the long-term demand within this group.

The hospitals & specialty clinics segment secured the highest market share as these facilities are primary centers for diagnosing and managing rare diseases. Patients with orphan conditions often require close medical supervision, and these institutions offer structured care plans, including nutritional therapy. The presence of multidisciplinary teams and the availability of medical foods within clinical settings ensure quick access and appropriate usage. This trusted environment makes hospitals and clinics the preferred channel for initiating and managing specialized dietary treatments.

The home delivery & online pharmacies segment is witnessing rapid growth as it offers a flexible and patient-friendly approach to accessing medical foods for rare diseases. Many individuals prefer the ease of ordering from home, especially those requiring continuous nutritional support. Improved digital infrastructure, personalized subscription models, and expanding e-pharmacy services are making specialized products more accessible. This shift is also supported by growing comfort with remote healthcare and rising awareness of managing orphan diseases at home.

North America holds the leading position in the market share by 47% due to a well-established system for managing rare conditions and a growing population diagnosed through advanced screening programs. The region shows strong demand for tailored nutrition, supported by high healthcare spending and a proactive approach to patient care. Furthermore, collaboration between research institutions and manufacturers, along with easier access to innovative medical food products, has contributed to its dominant market share.

The U.S. market is growing due to early diagnosis through advanced screening, rising awareness of rare diseases, and strong regulatory support. Increased R&D investment, favorable healthcare policies like the Orphan Drug Act, and higher patient access to specialized care also drive demand. These factors collectively support market expansion across the country.

Canada's market is expanding due to the increasing prevalence of rare diseases that necessitate specialized nutritional interventions, driving demand for medical foods. Advancements in diagnostic technologies have improved early detection, enabling timely dietary management. Additionally, Canada's robust healthcare infrastructure and supportive regulatory environment facilitate the development and distribution of medical foods. The growing awareness among healthcare professionals and patients about the benefits of medical nutrition therapy further propels market growth.

Europe is projected to experience the fastest CAGR in the market due to several key factors. The region's commitment to personalized medicine, increased investment in rare disease treatments, and cross-border healthcare initiatives are enhancing access to specialized nutritional therapies. Public-private partnerships are accelerating research and drug approval processes, while the establishment of specialized treatment centers and advancements in health technology are improving patient care. These elements collectively position Europe as a significant growth driver in the orphan disease medical foods sector.

The UK market is expanding due to several key factors. Enhanced newborn screening programs have improved early detection of rare conditions, necessitating specialized nutritional interventions. Supportive policies like the Orphan Drug Act encourage development in this sector. Additionally, increased healthcare spending and growing awareness of rare diseases contribute to the rising demand for tailored medical foods.

The country boasts a robust healthcare system with wide insurance coverage, facilitating access to specialized nutritional therapies. Government incentives, including tax benefits and research grants, support the development of orphan drugs and medical foods. Additionally, advancements in diagnostic technologies have improved early detection of rare diseases, increasing the demand for tailored nutritional interventions. These elements collectively contribute to the market's growth.

Asia-Pacific is driving growth in the market through expanding healthcare access, improved rare disease recognition, and government efforts to strengthen nutritional care. Countries like China, India, and Japan are investing in diagnostics and patient support programs. Additionally, increasing collaborations between local firms and global players are enhancing product availability, while growing patient awareness is fueling the demand for condition-specific nutritional therapies across the region.

China's market is expanding due to rising cases of rare disorders, improved diagnostic capabilities, and growing government focus on rare disease management. Increasing awareness among healthcare providers and patients, along with broader access to specialized nutrition products, is driving demand. Supportive regulatory initiatives are also encouraging product development and availability.

The rising prevalence of rare diseases, coupled with improved diagnostic capabilities, has increased the demand for specialized nutritional therapies. Government initiatives, such as the National Policy for Rare Diseases, provide regulatory support and incentives for product development. Additionally, growing awareness among healthcare professionals and patients about the benefits of medical nutrition therapy further propels market growth.

In September 2024, Dutch Medical Food B.V. partnered with Pristine Pearl Pharma to launch medical nutrition products in India, targeting conditions like cancer, COPD, pediatric malnutrition, and drug-resistant epilepsy. Highlighting the mission, Dr. Guru Ramanathan and Dr. Rolf Smeets said, “This initiative is far more than a business venture; it's a mission to positively impact lives.” Pristine Pearl’s MD, Mr. S.M. Ayoob, added, “We aim to deliver cutting-edge nutritional solutions that meet critical patient needs.” (Source - Hindustan times)

By Disease Type

By Product Type

By Route of Administration

By Age Group

By Distribution Channel

January 2026

January 2026

January 2026

January 2026