February 2026

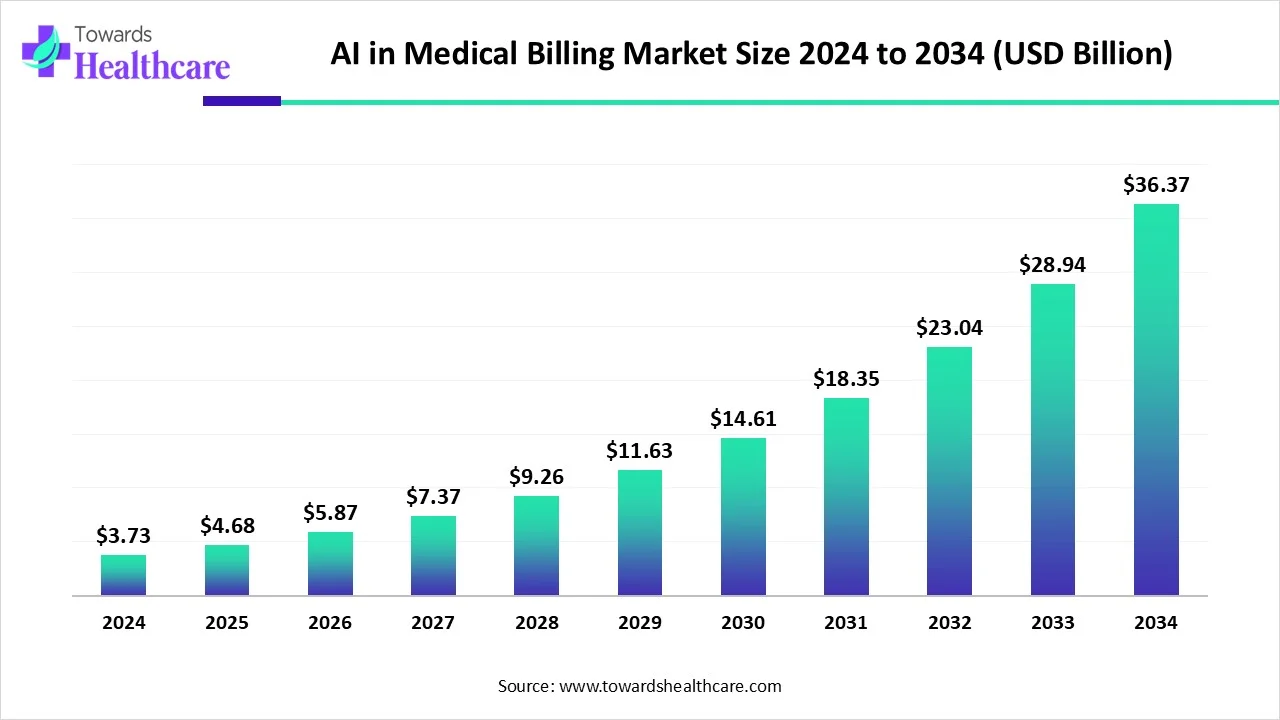

The global AI in medical billing market size is calculated at USD 3.73 billion in 2024, grew to USD 4.68 billion in 2025, and is projected to reach around USD 36.37 billion by 2034. The market is expanding at a CAGR of 25.4% between 2025 and 2034.

The integration of artificial intelligence (AI) in the healthcare sector is a primary driver of growth in the AI in medical billing market. Numerous healthcare professionals are aware of the benefits of AI in medical billing, enhancing the efficiency and speed of insurance claims. The increasing number of hospital admissions and growing demand for advanced patient services augment the market. The future of the market is primarily driven by the integration of AI in electronic health records (EHRs) and the increasing need for automated administrative tasks.

| Metric | Details |

| Market Size in 2025 | USD 4.68 Billion |

| Projected Market Size in 2034 | USD 36.37 Billion |

| CAGR (2025 - 2034) | 25.4% |

| Leading Region | North America |

| Market Segmentation | By Deployment Mode, By Application, By End-User, By Region |

| Top Key Players | Amperos Health, Cedar, Claimocity, CollaborateMD, Enable Healthcare, Inc., Enter.Health, ImagineSoftware, Jorie AI, Matellio, Maverick Medical AI, PracticeSuite, ReferralMD |

AI is revolutionizing every workflow in healthcare organizations, from diagnosing medical conditions to personalizing treatment plans and claims approval. AI in medical billing can reduce manual errors, accelerate claims processing, and improve revenue cycle management. It can automate the submission and tracking of insurance claims, identify and solve billing errors, and assist with compliance and regulatory updates. This helps healthcare organizations improve and scale their operations, ensuring proper reimbursement.

The increasing number of hospital admissions encourages healthcare professionals to provide personalized services to patients. Technological advancements lead to the development of innovative AI-based tools for medical billing. Government organizations support the development and deployment of AI in medical billing through initiatives and funding. The burgeoning healthcare sector and favorable reimbursement policies globally also drive the market.

Increasing Hospital Admissions

The major growth factor of the AI in medical billing market is the increasing number of hospital admissions. Hospital admissions are increasing owing to the rising prevalence of acute and chronic disorders, the growing number of surgeries, and increasing road accidents. It is estimated that more than 313 million surgeries are performed annually in the world. The growing geriatric population is also a significant concern that contributes to declining health among people. The United Nations anticipates that the global population aged 65 and older will reach 2.2 billion by late 2070. (Source - UN Org) This encourages healthcare organizations to use AI in medical billing for streamlined claims processing.

Data Privacy Issues

AI in medical billing poses significant privacy issues. There are chances of data leakage of patients’ confidential medical data. This limits healthcare organizations from adopting AI-based tools for medical billing, restricting market growth.

What is the Future of the AI in Medical Billing Market?

The future of the market is promising, driven by the integration of AI in electronic health records (EHRs). EHRs provide hospitals with a centralized platform that allows real-time access to patient data and helps streamline the documentation process. They maintain patient records, enabling healthcare professionals to access patients’ medical data. Integrating billing software with EHRs automates several aspects of the billing workflow, including accuracy in data entry and a better submission process. EHRs can verify patients’ insurance eligibility, leading to faster claims processing and achieving higher patient satisfaction levels.

By deployment mode, the cloud-based segment held a dominant presence in the market in 2024. This segment dominated because of the ability to operate from remote locations and effectively manage patient data. Cloud-based solutions can store and manage large amounts of patient data. The data can be accessed from anywhere and at any time by healthcare professionals as well as patients. Cloud-based solutions eliminate the need for appropriate infrastructure to install hardware. They lead to enhanced interoperability and real-time collaboration.

By deployment mode, the on-premises segment is expected to grow at the fastest CAGR in the market during the forecast period. On-premises medical billing is installed and run on local servers. It enables healthcare professionals to have complete control over the system and patient data. There are negligible chances of data leakage, keeping data confidential. This system offers greater control and customization options for patient data. It can be operated even during internet outages.

By application, the revenue cycle management segment led the global market in 2024. This is due to the increasing market competitiveness and the demand for streamlined healthcare workflows. The increasing number of healthcare startups encourages healthcare professionals to use AI in medical billing to stay competitive in the market. AI-based solutions enable faster claims processing and personalize payment plans based on patients’ financial situations. According to a recent survey by AKASA, 74% of healthcare organizations actively automate some portion of their revenue cycle operations. About 46% of organizations use some form of AI. (Source - Akasa)

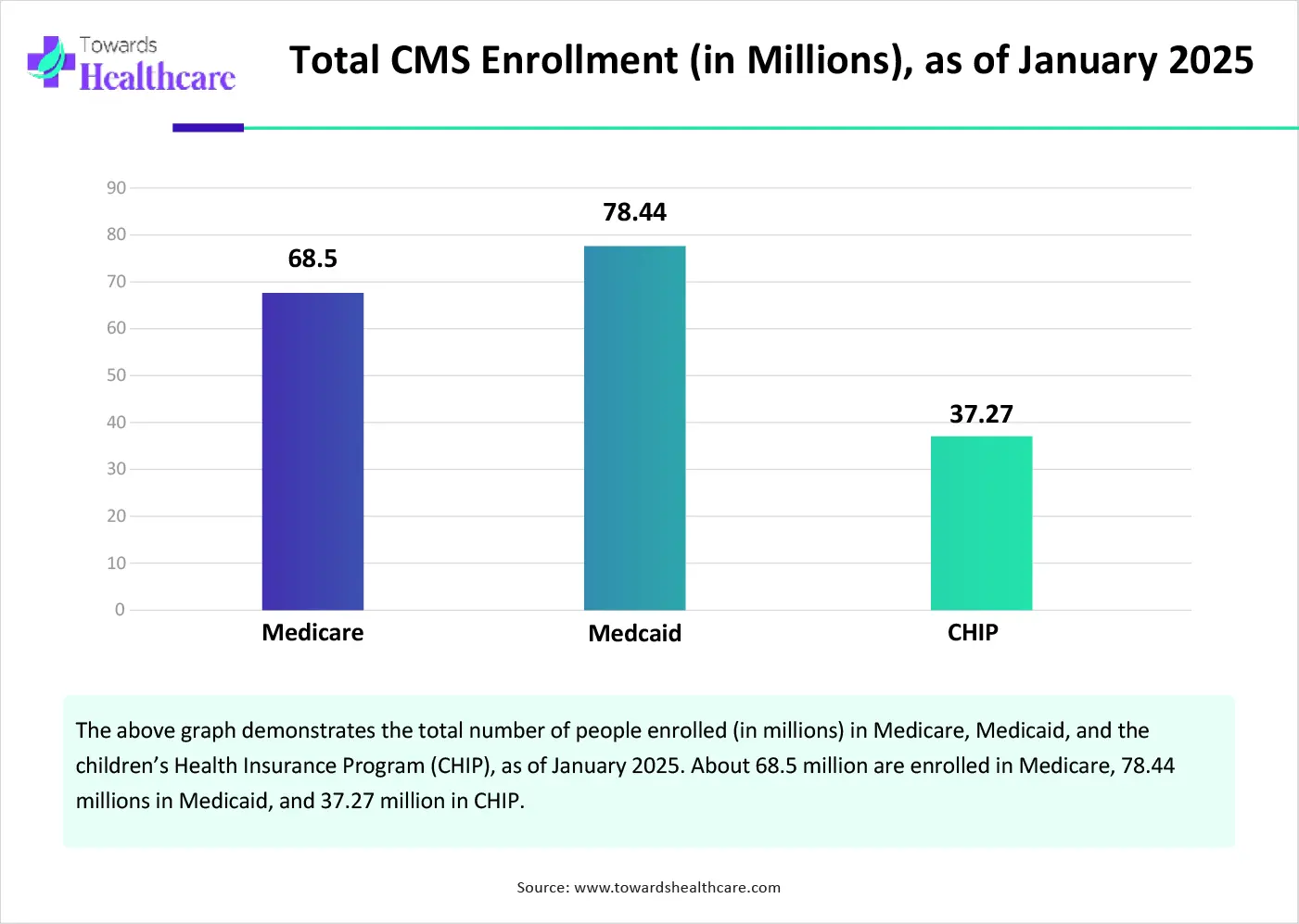

By application, the fraud detection segment is expected to grow with the highest CAGR in the market during the studied years. AI has been used to help detect fraud in healthcare claims by analyzing large volumes of data. It plays a vital role in pattern recognition and anomaly detection. AI-based predictive analytics can detect potential fraud, helping insurers and regulators prevent losses before they occur. The Centers for Medicare & Medicaid Services (CMS) reports that fraud accounts for approximately $60 billion in Medicare & Medicaid fraud annually. (Source - CMS.gov)

By end-user, the hospitals & clinics segment held the largest revenue share of the market in 2024. The increasing number of hospital admissions and the rising number of clinics boost the segment’s growth. The medical billing process is an essential task of administrative staff. Healthcare professionals or administrative staff create and submit healthcare claims to insurance companies. Manual claims processing increases the risk of claim denials. The burden of denied claims costs around $260 billion annually. This promotes the use of AI in medical billing.

By end-user, the healthcare payers segment is expected to expand rapidly in the market in the coming years. Numerous government and private insurance companies invest heavily in adopting AI tools to perform various tasks, from evaluating patients’ insurance data to approving reimbursements. The growing demand for faster claims processing and reduced manual errors encourages insurance companies to use AI. AI improves patient experience and helps with fraud detection.

North America dominated the global market in 2024. The presence of key players, technological advancements, and favorable reimbursement policies are the major growth factors of the market in North America. The presence of a robust healthcare infrastructure also leads to the adoption of advanced technologies in healthcare organizations. The increasing investments by government and private organizations govern the market. The rising number of hospital admissions also contributes to market growth.

The 2023 American Hospital Association survey reported that there were more than 34 million hospital admissions in the U.S. in 2023. (Source - AHA.org) The Centers for Medicare & Medicaid Services (CMS) is a government agency that provides health coverage in the U.S. to more than 100 million people. Key players, such as Amperos Health, CollaborateMD, and PracticeSuite, contribute to market growth in the U.S.

Approximately 30 million Canadians are covered by insurance policies, of which 27 million have health coverage. In 2023, insurers paid roughly $48 billion in health insurance and $17 billion in life insurance in Canada. The total reimbursement accounted for $128 billion in 2023, increasing by 13% from 2022. Prescription drug costs held the largest share of the health benefits, accounting for $15 billion.

Asia-Pacific is expected to grow at the fastest CAGR in the AI in medical billing market during the forecast period. The increasing awareness of purchasing health insurance claims and the rising adoption of advanced technologies drive the market. Government and private organizations provide funding to adopt digitization in healthcare organizations. The burgeoning healthcare sector and increasing collaboration among key players augment market growth. The rising number of new policies issued promotes the market.

The total number of digital healthcare users in China was reported to be 363 million as of June 2023. In 2024, the total health insurance premiums in China were CNY 977.4 billion ($134 billion), an increase of 8.2% from 2023. The data was released by the National Financial Regulatory Administration. Out of the total premium, life insurers generated CNY 773.1 billion. (Source - Asiainsurancereview)

In 2023, 34.92 lakh hospital admissions were reported in India, worth Rs 6,537 crore. (Source - Sansad) About 287.7 lakh new policies were issued in FY2023, worth 3.7 lakh crore. According to the India Brand Equity Foundation (IBEF), India’s insurance premium penetration accounted for 3.7% of the GDP in FY24. (Source - IBEF)

Europe is expected to grow at a notable CAGR in the AI in medical billing market in the upcoming period. The availability of favorable reimbursement policies by the government and private organizations favors market growth. Several government bodies launch initiatives to adopt advanced technological solutions. The increasing adoption of EHRs contributes to market growth. Government and private institutions conduct seminars, workshops, and conferences to create awareness about innovative tools in medical billing.

The French government supports digital health through initiatives, like Digital Health Scale-Up 2025. The initiative aims to link all public and private sectors to promote the spread of digital health in Europe. About 96% of the French population holds a Comprehensive Health Insurance (CHI) to cover co-payments.

The UK government announced an investment of £10 billion in NHS technology and digital transformation by 2028-29. (Source - Digital Health) Roughly 8 million people in the UK have active health insurance policies, accounting for 13% of the British population.

Yossi Shahak, CEO of Maverick Medical AI, commented that the company’s collaboration with NewVue and RADPAIR allows to expand boundaries of real-time, AI-driven coding, and RCM optimization in radiology. Healthcare providers are continually looking to improve revenue cycle optimization and efficiency, and reduce billing errors. The integrated solution enables radiologists to optimize billing instantly, minimizing addendum requirements and operational delays. (Source - Businesswire)

By Deployment Mode

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026