February 2026

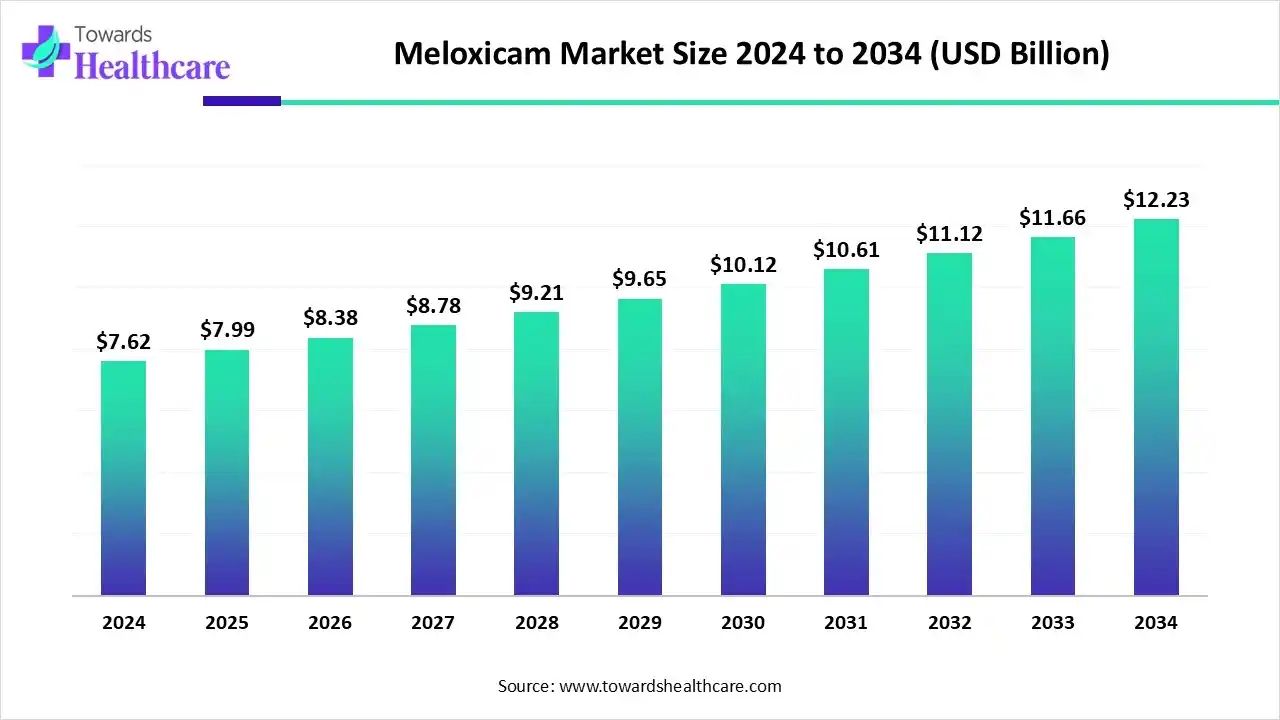

The global meloxicam market size began at US$ 7.62 billion in 2024 and is forecast to rise to US$ 7.99 billion by 2025. By the end of 2034, it is expected to surpass US$ 12.23 billion, growing steadily at a CAGR of 4.84%.

The meloxicam market is witnessing growth globally as the demand for anti-inflammatory and analgesic therapies rises, particularly for treating rheumatoid arthritis and osteoarthritis. Increasing geriatric populations and the prevalence of chronic pain conditions are driving consumption. North America remains the largest market due to well-established healthcare systems, widespread availability of prescription drugs, and strong patient awareness, while regions like the Asia Pacific are experiencing faster growth from expanding healthcare access and rising awareness of pain management options.

| Table | Scope |

| Market Size in 2025 | USD 7.99 Billion |

| Projected Market Size in 2034 | USD 12.23 Billion |

| CAGR (2025 - 2034) | 4.84% |

| Leading Region | North America |

| Market Segmentation | By Dosage Form, By Strength / Dosage, By Application / Indication, By Distribution Channel, By End-User, By Region |

| Top Key Players | Sun Pharmaceutical Industries Ltd., Cipla Ltd., Dr. Reddy’s Laboratories Ltd., Zydus Lifesciences Ltd., Lupin Ltd. , Aurobindo Pharma Ltd., Torrent Pharmaceuticals Ltd., Amneal Pharmaceuticals, Hikma Pharmaceuticals Plc, Glenmark Pharmaceuticals Ltd. |

The meloxicam market is growing due to rising cases of chronic pain and inflammatory disorders worldwide. The market refers to the global trade and utilization of meloxicam-based pharmaceutical products, a nonsteroidal anti-inflammatory drug (NSAID) primarily used for the treatment of pain and inflammation associated with osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and postoperative pain. It works by inhibiting cyclooxygenase (COX-2), reducing prostaglandin synthesis, and alleviating inflammation.

The meloxicam market is driven by the rising prevalence of arthritis and musculoskeletal disorders, increasing geriatric population, expansion of generic drug availability, and growing demand for cost-effective pain management therapies. The market is expanding as healthcare providers increasingly prefer selective NSAIDs for treating joint and musculoskeletal disorders. Growing emphasis on improving chronic pain and wider availability of oral and injectable formulations are boosting demand globally, driving steady market growth.

AI can influence the meloxicam market by streamlining clinical trials, accelerating the development of safer and more effective formulations, and improving regulatory compliance through predictive modeling. It also enables data-driven insights into patient demographics and treatment patterns, helping pharmaceutical companies optimize production and distribution. Furthermore, AI-powered diagnostic tools can guide physicians in selecting meloxicam for targeted pain and inflammation management, enhancing precision therapy and boosting market adoption across both developed and emerging regions.

| Year | Drug Name | Formulation | Indication |

| 2024 | Mobic | Oral Tablet | Relief of the signs and symptoms of osteoarthritis, rheumatoid arthritis in patients who weigh more than 60kg. |

| 2025 | Xifyrm | Intravenous Injection | Manage the moderate to severe pain in adults. |

| 2025 | Symbravo | Oral Tablet | Acute treatment of migraine with or without aura in adults. |

| 2025 | Meloxicam Oral Suspension | Oral Suspension | Control of pain and inflammation associated with osteoarthritis in dogs |

The tablets segment dominated the market in 2024 due to its accessible and widespread availability in pharmacies and hospitals. Tablets are preferred for long-term therapy, offering consistent drug release and ease of storage and transport. Their versatility for both acute and chronic conditions, combined with strong physician familiarity and patient preference for oral administration, has led to higher prescription rates, securing the segment’s largest market share compared to injectables or other dosage forms.

The injectables segment is projected to grow rapidly as healthcare providers increasingly prefer it for controlled and consistent drug delivery in acute pain management. Its use in perioperative care and for patients unable to take oral medications boosts demand. Additionally, rising adoption in veterinary medicine, hospitals, and specialty clinics, along with advancements in prefilled and ready-to-use injectable formulations, enhances convenience and safety, driving faster market growth compared to other dosage forms during the forecast period.

The 15mg segment dominates the market in 2024 as it meets the therapeutic needs for most adult patients, providing effective pain and inflammation control with minimal risk of side effects. Its versatility for various conditions, including arthritis and post-operative pain, makes it the preferred choice for physicians. High demand in both hospital and outpatient settings, coupled with strong patient adherence due to convenient dosing, contributed to the market achieving the largest revenue shares.

In 2024, the osteoarthritis segment led the market because the condition significantly impacts mobility and quality of life, driving consistent treatment needs. Rising obesity rates and sedentary lifestyles have increased osteoarthritis cases, fueling demand for effective therapies. Meloxicam’s established role in reducing stiffness and improving joint function makes it a preferred choice among healthcare providers. The large patient base, along with the necessity for continuous management, ensured osteoarthritis remained the top application segment in the market.

The postoperative & acute pain management segment is projected to grow fastest as healthcare systems prioritize enhanced recovery protocols and shorter hospital stays. Meloxicam is being increasingly integrated into perioperative care due to its ability to control inflammation while minimizing sedation and dependency risks. Expanding use in outpatient and minimally invasive surgeries, alongside rising awareness of non-opioid analgesics, further accelerates adoption. These trends collectively position this segment for the highest CAGR during the forecast period.

The retail pharmacies segment led the market in 2024 due to the growing trend of self-managed care and increasing over-the-counter accessibility in some regions. These outlets often maintain a consistent stock of pain and anti-inflammatory drugs, ensuring quick fulfillment of prescriptions. Partnerships between pharmaceutical companies and pharmacy chains, along with loyalty programs and doorstep delivery services, have further boosted sales. Such convenience and trust built with patients positioned retail pharmacies as the dominant distribution channel in the market.

The online pharmacies segment is projected to grow at the fastest CAGR as patients increasingly seek privacy and discretion in purchasing pain and anti-inflammatory medications like Meloxicam. Improved digital payment security, quick delivery logistics, and integration of telemedicine consultations on e-pharmacy platforms are boosting adoption. Growing preference among busy urban populations and elderly patients for hassle-free ordering without repeated pharmacy visits is also fueling momentum, positioning online pharmacies as the fastest-expanding distribution channel in the forecast period.

In 2024, the clinics segment dominated the market as they increasingly adopted evidence-based pain management protocols and were often the first to prescribe NSAIDs for inflammation and joint disorders. Clinics also benefit from strong patient trust, shorter waiting times, and affordability compared to larger hospitals. Their role in both routine checkups and specialized care, coupled with rising patient visits for musculoskeletal complaints, positioned clinics as the leading end-user segment in the Meloxicam market.

The homecare/self-administration segment is projected to grow fastest as aging populations and patients with chronic conditions increasingly rely on at-home treatment options. Availability of oral and easy-to-administer Meloxicam formulations, coupled with rising telehealth services and home nursing support, enables effective pain management without frequent clinic visits. Convenience, cost savings, and reduced hospital dependency are encouraging adoption, making homecare the fastest-growing end-user segment in the Meloxicam market during the forecast period.

In 2024, North America led the market because of advanced healthcare facilities, strong regulatory support, and high adoption of innovative pain management therapies. Rising geriatric populations and increasing demand for outpatient and home-based care further boosted Meloxicam prescriptions. Additionally, well-established pharmaceutical distribution networks and greater physician preference for selective NSAIDs for chronic and post-operative pain management reinforced North America’s position as the largest revenue-generating region in the global market.

In June 2025, the FDA approved Meloxicam injection (Xifyrm; Azurity Pharmaceuticals) for adults to manage moderate-to-severe pain, either alone or with other NSAIDs. This IV formulation provides a nonopioid alternative, supporting multimodal pain management strategies aimed at reducing opioid reliance. Administered as a rapid once-daily 30 mg/mL IV bolus, it offers workflow efficiency in hospitals and surgical settings. Its COX-2 selectivity may lower gastrointestinal risks, though caution is advised in patients with cardiovascular, renal, or GI concerns

In October 2024, the Pharmacare Act, now in effect, ensures all Canadians can access essential medications without financial barriers. It provides free contraception for nine million women and gender-diverse individuals and diabetes medications for 3.7 million people. The Act also establishes a national drug formulary, bulk purchasing, and an expert committee to guide universal, single-payer pharmacare, improving affordability, access, and long-term healthcare outcomes.

Asia Pacific is expected to grow at the fastest CAGR in the market due to rising awareness of pain management, increasing prevalence of arthritis and musculoskeletal disorders, and expanding healthcare infrastructure. Rapid urbanization, growing geriatric populations, and rising disposable incomes are driving demand for effective and convenient NSAID therapies. Additionally, improving access to pharmacies, hospitals, and homecare services, along with the entry of global pharmaceutical companies offering affordable Meloxicam formulations, is accelerating market adoption across the region during the forecast period.

By Dosage Form

By Strength / Dosage

By Application / Indication

By Distribution Channel

By End-User

By Region

February 2026

February 2026

February 2026

February 2026