February 2026

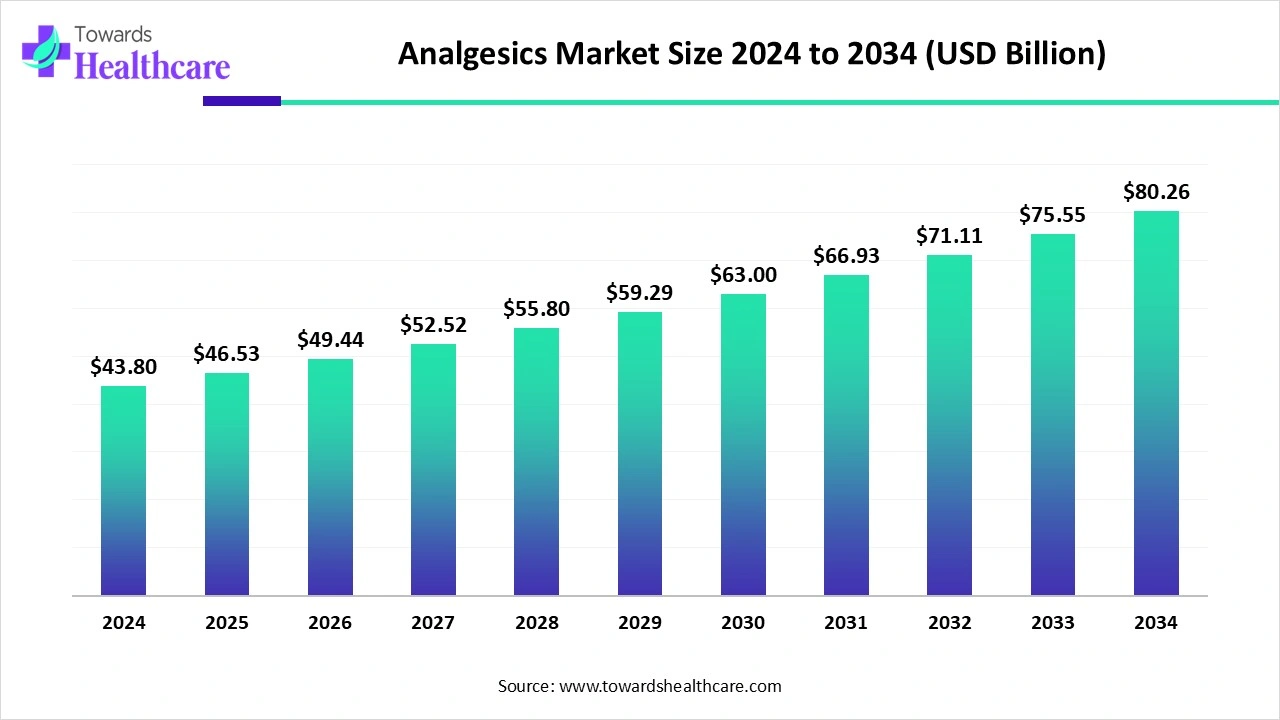

The global analgesics market size is calculated at USD 43.8 billion in 2024, grew to USD 46.53 billion in 2025, and is projected to reach around USD 80.26 billion by 2034. The market is expanding at a CAGR of 6.24% between 2025 and 2034.

The analgesics market is primarily driven by the increasing prevalence of chronic pain, cancer, and musculoskeletal disorders. Researchers develop custom combination drugs to relieve pain based on patients’ conditions. The rising investments by government and private organizations facilitate research on analgesics. Artificial intelligence (AI) enables researchers to develop more efficacious drugs with reduced side effects. The growing research and development activities present future opportunities for the market.

| Table | Scope |

| Market Size in 2025 | USD 46.53 Billion |

| Projected Market Size in 2034 | USD 80.26 Billion |

| CAGR (2025 - 2034) | 6.24% |

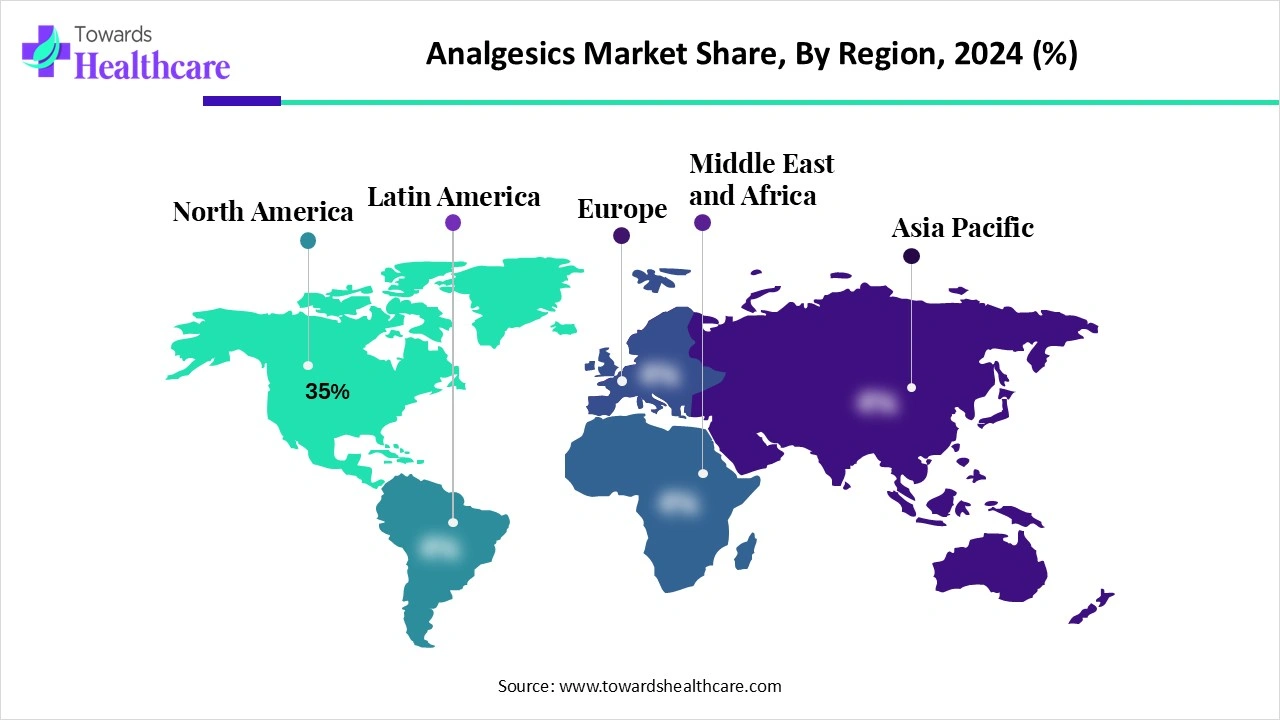

| Leading Region | North America by 35% |

| Market Segmentation | By Drug Type, By Route of Administration, By Distribution Channel, By End-User, By Therapeutic Application, By Region |

| Top Key Players | Johnson & Johnson, Pfizer Inc., Novartis AG, GlaxoSmithKline plc (GSK), Teva Pharmaceutical Industries Ltd., Mylan N.V., Bayer AG, Eli Lilly and Company, Bristol-Myers Squibb, Sanofi S.A., Endo International plc, Mundipharma International Limited, Grunenthal GmbH, AbbVie Inc., Amgen Inc., Hikma Pharmaceuticals, Aurobindo Pharma Limited, Alembic Pharmaceuticals, Cadila Healthcare Ltd., Sun Pharmaceutical Industries Ltd. |

The analgesics market refers to pharmaceutical drugs used to relieve pain of varying intensities, including acute, chronic, and neuropathic pain. Analgesics are broadly classified into opioid, non-opioid, and adjuvant therapies, and they are available in oral, injectable, topical, and transdermal formulations. Growth is driven by the rising prevalence of chronic pain, musculoskeletal disorders, cancer, postoperative pain, and an aging population, alongside innovations in non-opioid pain management and combination therapies. Regulatory policies, prescription guidelines, and the rise of over-the-counter (OTC) pain medications also shape market dynamics.

Evolving Regulatory Landscape: Regulatory agencies implement various regulations to expedite the approval of analgesics.

FDA Approval: Regulatory agencies, like the FDA, EMA, and NMPA, approve a drug for its marketing authorization, increasing the accessibility of drugs in their respective nations.

AI and machine learning (ML) algorithms enable researchers to develop novel, personalized analgesics tailored to patients' specific conditions. They assist researchers in target identification, lead optimization, and drug synthesis. They can predict the pharmacokinetic and pharmacodynamic properties of a drug candidate. AI and ML can help reduce the exorbitant costs of drug development and save time. They can analyze vast amounts of data and suggest an appropriate analgesic to a patient. Moreover, AI can streamline the manufacturing and supply chain processes of analgesics.

OTC Medications

The major growth factor for the analgesics market is the growing demand for OTC medications. Patients can purchase OTC analgesics without a prescription. Analgesics that can be purchased without a prescription are paracetamol and non-steroidal anti-inflammatory drugs (NSAIDs), such as aspirin, ibuprofen, and ketorolac. People mostly prefer self-medication to get rid of pain. This reduces additional healthcare costs and saves travel time as they do not need to visit a healthcare professional.

Side Effects

Analgesics tend to cause potential side effects, ranging from mild to severe. This is a major concern among patients and healthcare professionals, especially while taking them for a longer period. Analgesics may cause heartburn, vomiting, skin rash, chest pain, stomach ulcers, and liver damage. These side effects limit their use for a long period, restricting market growth.

What is the Future of the Analgesics Market?

The market future is promising, driven by the growing research and development activities. Ongoing efforts to identify novel targets involved in pain sensation that are supported by advancements in proteomics and molecular screening techniques. Synthesized opioid derivatives, such as oliceridine, YZJ-4729, and tegileridine, are developed to reduce potential side effects and enhance efficacy. Moreover, the demand for non-opioid analgesics is increasing as they can be designed based on target requirements. There is also interest in new drug delivery methods to facilitate targeted delivery.

By drug type, the non-opioid analgesics segment held a dominant presence in the market in 2024. This is due to the cost-effectiveness of non-opioid analgesics and their lower adverse effects. Non-opioid analgesics are easily available and traditionally used pain killers for a wide range of pain disorders. Studies have proven that adjunctive use of non-opioid analgesics can significantly reduce the opioid requirement and opioid-related adverse effects. For certain applications like dental pain, NSAIDs are more effective than opioid analgesics.

By drug type, the adjuvant analgesics segment is expected to grow at the fastest CAGR in the market during the forecast period. Adjuvant analgesics include the use of anticonvulsants, antidepressants, and corticosteroids used in combination therapy. They facilitate better pain control with a reduction in analgesic consumption and reduced complications. They enable healthcare professionals to reduce the dose of conventional analgesics while increasing analgesic efficacy. Researchers are focusing on repurposing medications for pain management.

By route of administration, the oral segment held the largest revenue share of the market in 2024. The segmental growth is attributed to the ease of administration of oral analgesics and their easy availability. The oral route is more convenient and effective. Analgesics through the oral route can be taken by patients of all age groups and are comparatively cost-effective. They eliminate the need for a trained professional to deliver a medication. The growing demand for non-invasive drug delivery also boosts the segment’s growth.

By route of administration, the transdermal patches segment is expected to grow with the highest CAGR in the market during the studied years. Transdermal patches enable extended release of pain medications for the treatment of chronic pain. They provide targeted drug delivery directly at the site. They reduce the frequency of oral analgesic dosing, enhancing patient compliance. Drugs delivered through transdermal patches directly reach the systemic circulation, avoiding first-pass metabolism.

By distribution channel, the hospital pharmacies segment contributed the biggest revenue share of the market in 2024. This segment dominated because hospital pharmacies have a favorable infrastructure and skilled professionals. The increasing number of hospital admissions potentiates the demand for analgesics for cancer and surgical pain. Hospital pharmacies have suitable capital investment to purchase innovative drugs for advanced patient care.

By distribution channel, the online pharmacies segment is expected to expand rapidly in the market in the coming years. Online pharmacies enable patients to purchase analgesics from a wide range of options and at affordable rates. The increasing e-pharmacy adoption and the burgeoning e-commerce sector augment the segment’s growth. Online pharmacies offer free home delivery and virtual consultations.

By end-user, the hospitals & clinics segment led the market in 2024. This is due to the increasing number of surgeries and the presence of skilled professionals. Hospitals and clinics have professionals from multiple fields, providing multidisciplinary expertise to patients. They provide personalized care and treatment to patients. Patients also prefer treatment from hospitals & clinics due to favorable reimbursement policies.

By end-user, the patients/direct-to-consumer segment is expected to witness the fastest growth in the market over the forecast period. The growing demand for OTC medications due to self-medication propels the segment’s growth. The ability to purchase analgesics through online pharmacies facilitates the segment’s growth. Patients mostly self-medicate with OTC drugs for everyday ailments, such as headaches and fever.

By therapeutic application, the musculoskeletal disorders segment accounted for the highest revenue share of the market in 2024. This is due to the rising prevalence of musculoskeletal disorders caused by sedentary lifestyles. The World Health Organization (WHO) reported that more than 530 million people are living with osteoarthritis, of whom 73% are older than 55 years. Other examples of common musculoskeletal disorders include rheumatoid arthritis, osteoporosis, fibromyalgia, and herniated discs.

By therapeutic application, the neuropathic pain segment is expected to show the fastest growth over the forecast period. Neuropathic pain is caused by a lesion of the somatosensory nervous system. It affects approximately 7% to 10% of the total global population. It is a major public health concern due to its complex pathophysiology and the disability it can cause. It lacks suitable treatment options; however, analgesics can help provide symptomatic relief.

North America dominated the global market share 35% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable regulatory policies are the major factors that govern market growth in North America. North America has a strong hospital and OTC market and an advanced healthcare infrastructure. Government organizations support the development of novel analgesics and innovative drug delivery systems through funding.

Key players, such as Johnson & Johnson, Pfizer, Inc., and Eli Lilly and Company, are the major contributors to the market in the U.S. The Centers for Disease Control and Prevention (CDC) reported that 24.3% of adults experienced chronic pain in the U.S., and around 8.5% of adults experienced high-impact chronic pain in 2023.

In Canada, approximately 8 million people live with chronic pain, affecting their lifestyle and well-being. The Canadian Pain Task Force provides evidence and best practices for the prevention and management of chronic pain. Canada’s Drug Agency regulates the use and approval of analgesics.

Asia-Pacific is expected to grow at the fastest CAGR in the analgesics market during the forecast period. The rising prevalence of chronic disorders and the growing geriatric population boost the market. People are becoming aware of different types of analgesics and their benefits, potentiating their demand. The expansion of retail and hospital pharmacies in countries like India, China, Japan, and South Korea contributes to market growth. The increasing investments and collaborations for conducting research activities foster the market.

In Japan, about 22.5% of the adult population reported having chronic pain, accounting for 23.15 million people. Chronic pain causes economic losses of approximately 2 trillion annually. The Health and Global Policy Institute (HGPI) Project for Chronic Pain Measures presented policy recommendations, “Achieving Equity in Multidisciplinary Pain Treatment and Support Systems for Pain Management”.

A cross-sectional study found that 47% of individuals aged 45 years and above had joint pain, 31% had back pain, and 20% had ankle or foot pain. The Indian government’s research institute, Council of Scientific and Industrial Research (CSIR), developed indigenous technology to produce paracetamol. This aims to make India self-reliant in paracetamol manufacturing.

The R&D activities for analgesics involve developing novel medications for pain relief and repurposing licensed drugs for pain relief.

Key Players: Bayer AG, Sanofi, Endo Pharmaceuticals, and Premier Research

Clinical trials are conducted to assess the safety and efficacy of analgesics, which are then approved by several regulatory agencies.

Key Players: Sofpromed, Concentric Analgesics, Ltd., and Tris Pharma

Patient support & services refer to providing personalized care through analgesics and training individuals about the use and benefits of different analgesics.

Joy Chatterjee, Vice President, Sales and Marketing Head, Consumer Business Unit, Mankind Pharma Ltd., commented that the company’s entry into the topical analgesic market with Nimulid Strong marks a pivotal moment for Mankind Pharma’s consumer business. By focusing on neck pain, the company aims to empower millions of Indians to live and communicate more freely.

By Drug Type

By Route of Administration

By Distribution Channel

By End-User

By Therapeutic Application

By Region

February 2026

February 2026

February 2026

February 2026