January 2026

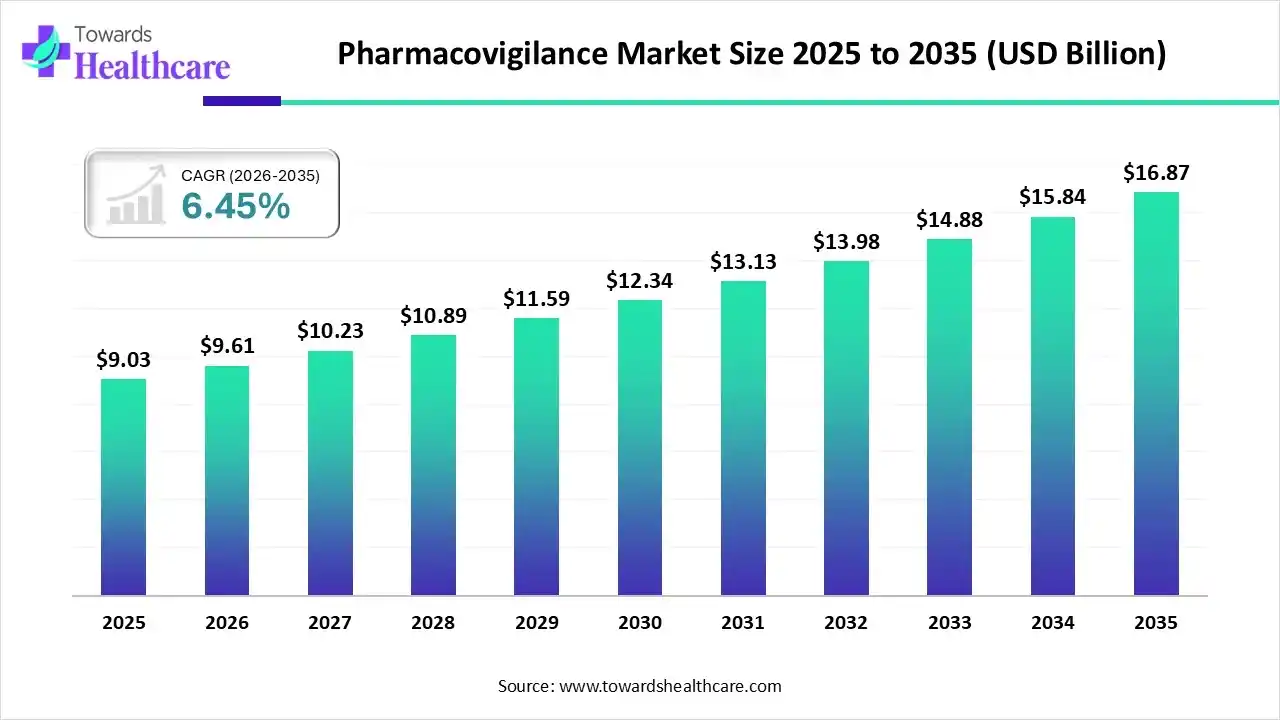

The global pharmacovigilance market size was estimated at USD 9.03 billion in 2025 and is predicted to increase from USD 9.61 billion in 2026 to approximately USD 16.87 billion by 2035, expanding at a CAGR of 6.45% from 2026 to 2035.

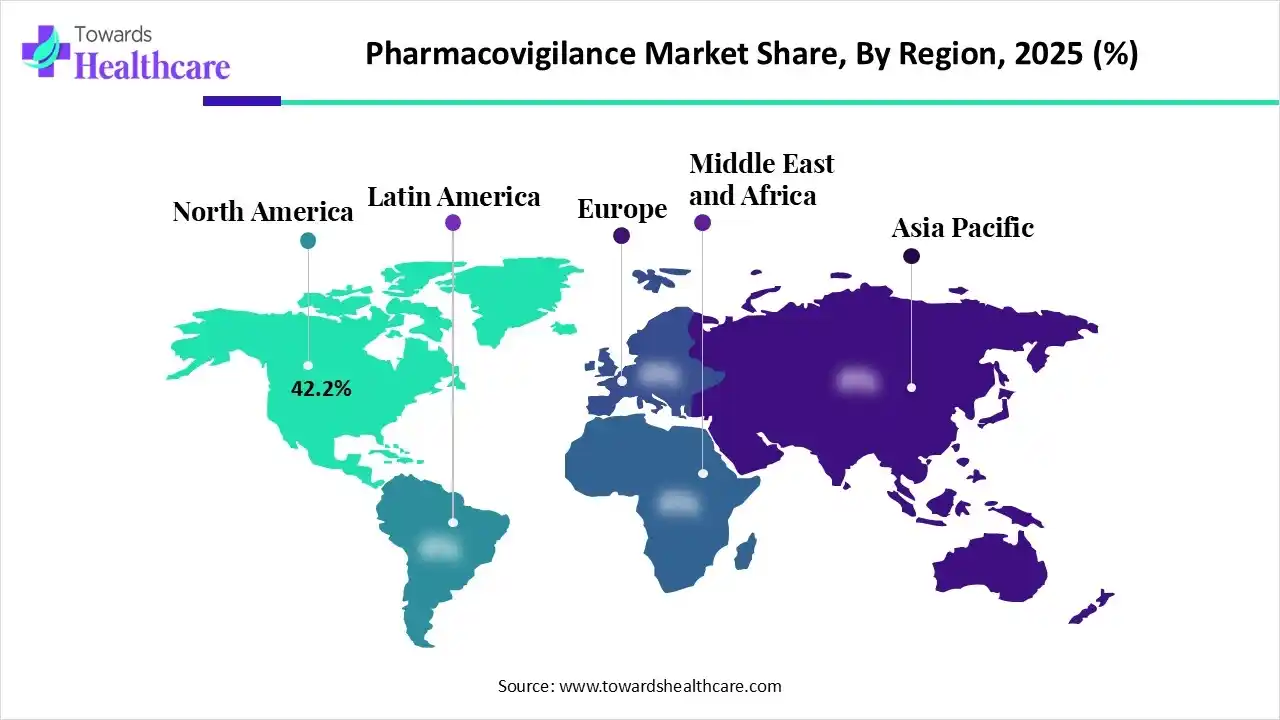

The global pharmacovigilance market is expanding due to rising adverse drug reaction cases, stricter regulatory frameworks, and increased drug development activities. Growing adoption of advanced safety analytics further accelerates progress. North America dominates the market, supported by strong regulatory enforcement, a mature healthcare infrastructure, and high investments in drug safety monitoring.

| Key Elements | Scope |

| Market Size in 2026 | USD 9.61 Billion |

| Projected Market Size in 2035 | USD 16.87 Billion |

| CAGR (2026 - 2035) | 6.45% |

| Leading Region | North America 42.5% |

| Market Segmentation | By Service Type, By Type, By Process Flow, By End User, By Region |

| Top Key Players | IQVIA Holdings Inc., Parexel International Corporation, Accenture PLC, ICON plc, Cognizant Technology Solutions, ArisGlobal LLC, Thermo Fisher Scientific (PPD division), Genpact Limited, Capgemini Services SAS |

Pharmacovigilance refers to the science and activities involved in detecting, assessing, understanding, and preventing adverse effects or any drug-related problems. The pharmacovigilance market is driven by increasing adverse drug reactions, stringent regulatory requirements, rising clinical trials, and the growing need for real-time drug safety monitoring systems. It ensures continuous evaluation of medicines to safeguard patient health, improve therapeutic outcomes, and maintain regulatory compliance. By collecting and analyzing safety data from healthcare professionals, patients, and pharmaceutical companies, pharmacovigilance supports early identification of risks, promotes safer medication use, and enhances public confidence in healthcare systems.

AI integration significantly enhances pharmacovigilance by automating the detection, analysis, and reporting of adverse drug events with greater accuracy and speed. It enables real-time data processing from diverse sources such as electronic health records, social media, and clinical reports, improving signal detection and risk assessment. AI-powered natural language processing helps extract meaningful insights from unstructured data, while machine learning models predict potential safety issues earlier in the drug lifecycle. This reduces manual workload, minimizes errors, and supports faster regulatory decision-making.

| Metric/Category | Number in 2024 |

| Total “novel” drugs approved by the FDA in 2024 | 50 |

| Among them: Smallmolecule / New Chemical Entities (NCEs / small molecules + TIDES) | 34 (≈ 68%) |

| Biologics (new biological therapeutics / NBEs) | 16 (≈ 32%) |

| TIDES (peptides/oligonucleotides) included in NCEs | 4 (of the NCEs) |

| Total innovator + biosimilar drug approvals in 2024 (per one datasource) | 127 |

The rise in drug approvals directly drives the pharmacovigilance market because each new drug increases the volume and complexity of safety monitoring, regulatory reporting, and post-marketing surveillance activities.

Which Case Processing Segment Dominated the Pharmacovigilance Market?

The case processing segment dominates the pharmacovigilance market with a share of 31.3% because it forms the core of drug safety operations, involving systematic collection, assessment, and documentation of adverse event reports. Rising drug usage, expanding clinical trials, and strict regulatory expectations for timely and accurate case submissions strengthen its importance. Growing adoption of automated and AI-enabled platforms further accelerates efficiency, solidifying its leading position.

Signal Detection

The signal detection segment is the fastest-growing, with a 6.6% CAGR, driven by an increasing emphasis on early identification of potential safety risks using large datasets and real-world evidence. Advances in AI and data analytics allow faster, more accurate detection of safety patterns. As regulators push for proactive surveillance beyond spontaneous reporting, pharmaceutical companies invest heavily in automated signal detection tools, accelerating this segment’s rapid growth.

Why Did the Outsourced Segment Dominate the Pharmacovigilance Market?

The outsourced segment dominates the pharmacovigilance market with a share of 72.4% and is expected to grow at the fastest CAGR of 6.5% during the forecast period due to cost efficiency, access to specialized expertise, and flexible resource management. Pharmaceutical companies increasingly rely on Contract Research Organizations (CROs) and third-party service providers to handle adverse event reporting, case processing, and regulatory compliance. Outsourcing also enables faster turnaround times, scalability, and adoption of advanced AI-powered pharmacovigilance tools, strengthening overall drug safety management.

In-House

The in-house segment is expected to grow at a significant CAGR in the market due to pharmaceutical companies’ desire for greater control over data privacy, regulatory compliance, and decision-making processes. Maintaining internal PV teams allows real-time monitoring of adverse drug reactions, faster signal detection, and seamless integration with internal R&D and clinical operations. Increasing investments in AI and automated safety systems further drive in-house pharmacovigilance adoption.

Which Process Flow Segment Led the Pharmacovigilance Market?

The post-marketing surveillance (phase IV) segment dominates the market with a share of 34.5% because it ensures continuous monitoring of drugs after approval, helping identify rare or long-term adverse effects. Regulatory authorities mandate robust post-marketing safety reporting, and pharmaceutical companies rely on this segment to maintain compliance, protect patient safety, and enhance drug efficacy. Advanced data analytics and real-world evidence further strengthen its critical role.

Phase III

The phase III segment is the fastest-growing in the market, with a CAGR of 6.7% due to the large-scale patient involvement and extensive data generated during late-stage clinical trials. This phase requires intensive monitoring of adverse drug reactions to ensure safety and regulatory compliance. Increasing global clinical trials and adoption of AI-powered safety analytics further accelerate the growth of Phase III pharmacovigilance activities.

Which End User Segment Dominated the Pharmacovigilance Market?

The pharmaceutical companies segment dominates the market with a share of 40.4% as they are directly responsible for ensuring drug safety, regulatory compliance, and post-marketing surveillance. They invest heavily in adverse event monitoring, case processing, and signal detection to protect patient health and maintain market approval. Integration of AI tools and in-house PV teams further strengthens their control over comprehensive safety management.

Biotechnology Companies

The biotechnology companies segment is the fastest-growing in the pharmacovigilance market, with a 6.7% CAGR, driven by the rapid expansion of biotech R&D and the increasing approvals of biologics, vaccines, and advanced therapies. These companies require specialized safety monitoring for complex molecules and immunotherapies, driving adoption of advanced PV tools. Growing regulatory scrutiny, real-world evidence integration, and rising patient awareness further accelerate investment in robust pharmacovigilance systems.

North America dominates the pharmacovigilance market with a share of 42.5 % due to its strong regulatory framework, led by the FDA, which enforces strict drug safety and reporting standards. The region also benefits from advanced healthcare infrastructure, high adoption of AI-enabled safety systems, significant R&D activity, and a large volume of clinical trials. Additionally, strong industry investment and widespread ADR reporting systems further strengthen its leadership in drug safety monitoring.

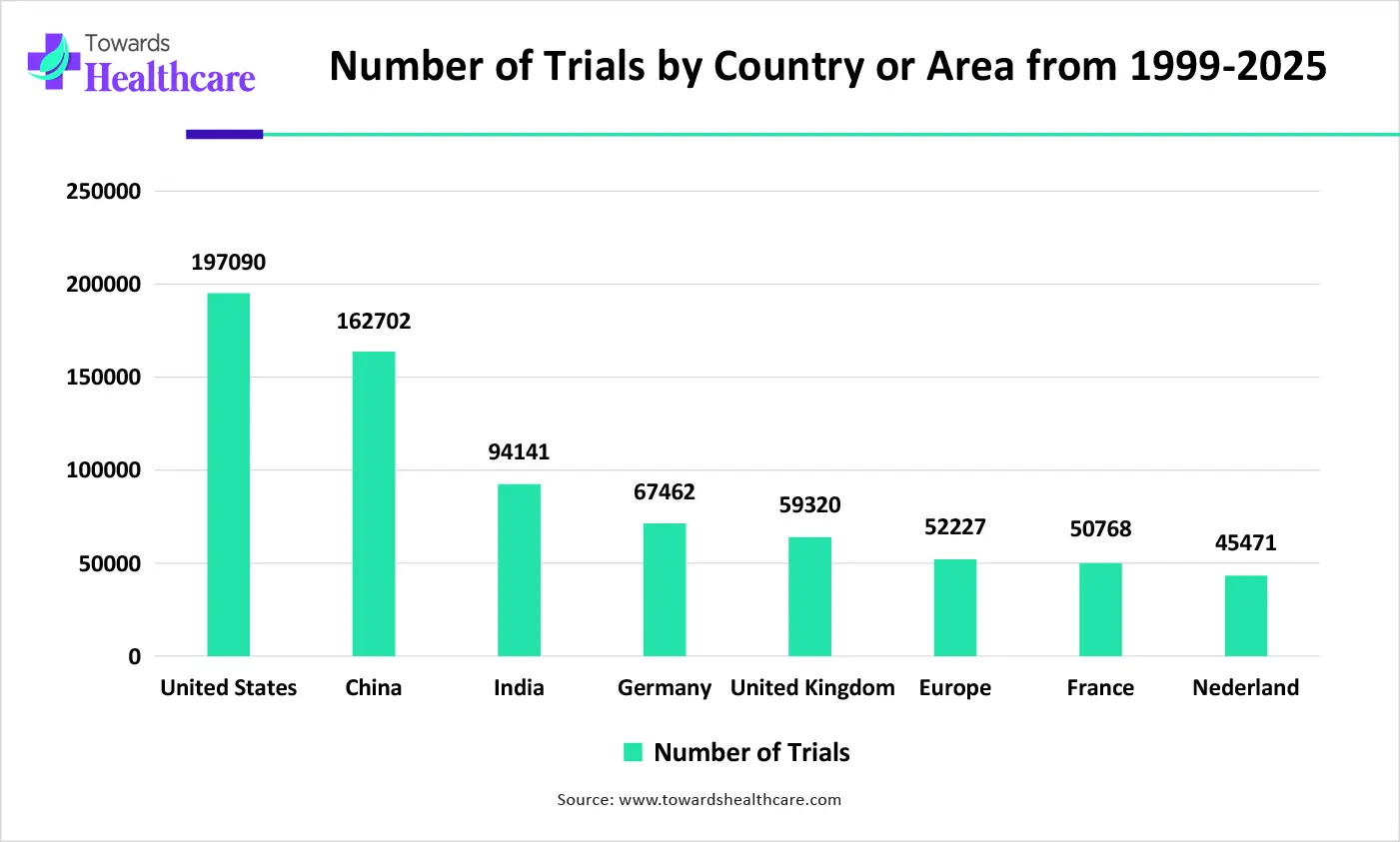

The U.S. leads the North America market due to its stringent FDA regulations, high drug consumption, and large volume of clinical trials generating extensive safety data. Strong investment in AI-driven drug safety systems, well-established reporting platforms, and active participation from pharmaceutical companies further reinforce its dominance. Advanced healthcare infrastructure and rapid adoption of digital monitoring tools also enhance the country’s leadership in pharmacovigilance.

Asia-Pacific is the fastest-growing region in the pharmacovigilance market with a CAGR of 7.8% because of expanding pharmaceutical manufacturing, rising clinical trial activities, and increasing regulatory reforms focused on drug safety. Growing healthcare digitalization, outsourcing of pharmacovigilance services to countries like India and China, and heightened awareness of adverse drug reactions also accelerate regional growth. The region’s cost-effective workforce further strengthens its rapid market expansion.

China dominates the Asia-Pacific market because of its rapidly expanding pharmaceutical industry, strong government regulations under the National Medical Products Administration (NMPA), and large-scale clinical trial activity. The country is heavily investing in digital drug safety systems, AI-driven adverse event detection, and real-world data platforms. Its massive population and growing medication use create a high volume of safety data, strengthening monitoring needs. Increasing innovation and global drug approvals further reinforce China’s leadership.

Europe shows notable growth due to stringent EMA regulations, strong collaboration among member states, and well-established drug safety networks. Increasing adoption of digital reporting tools, expansion of real-world evidence programs, and rising cross-border clinical studies reinforce progress. Additionally, growing investment in AI-based pharmacovigilance and strong emphasis on patient protection drive the region’s sustained momentum in drug-safety innovation.

The U.K. leads Europe’s pharmacovigilance market due to its highly systematic MHRA-driven safety framework and strong focus on digital ADR reporting platforms such as the Yellow Card scheme. Extensive clinical research activities, rapid adoption of AI-enabled drug-safety technologies, and strong collaboration between healthcare providers and regulators enhance its leadership in ensuring efficient and proactive drug-safety monitoring.

| Company Name | Headquarters | Pharmacovigilance / Key Offerings |

| IQVIA Holdings Inc. | Durham, North Carolina, USA | Full-suite PV & drug-safety services: adverse event reporting, signal detection, safety analytics, regulatory compliance, global PV outsourcing, real-world data integration. |

| Parexel International Corporation | Raleigh, North Carolina, USA | End-to-end PV & safety services: case management, post-marketing surveillance, regulatory consulting, risk management, global compliance support. |

| Accenture PLC | Dublin, Ireland | PV outsourcing & consulting: automation of case processing, safety monitoring, regulatory safety operations, intelligent workflows, cloud/digital transformation. |

| ICON plc | Dublin, Ireland | Comprehensive PV & clinical research services: safety case handling, post-marketing surveillance, regulatory reporting, integration with clinical trial data. |

| Cognizant Technology Solutions | Teaneck, New Jersey, USA | Outsourced PV services & BPO: case intake & processing, literature monitoring, regulatory reporting, safety database management, automation-driven PV operations. |

| ArisGlobal LLC | Waltham, Massachusetts, USA | PV software solutions (LifeSphere): safety case management, adverse-event tracking, regulatory submissions, signal detection, compliance support for pharma & biotech. |

| LabCorp / Covance | Burlington, North Carolina, USA | PV services: risk management, adverse event monitoring, regulatory reporting, safety support as part of lab/clinical-development services. |

| Thermo Fisher Scientific (PPD division) | Waltham, Massachusetts, USA | PV services: case intake/processing, medical review, safety database hosting, signal detection, regulatory safety reporting, supporting biotechs & pharma. |

| Genpact Limited | New York, New York, USA | Data-driven PV outsourcing: safety case processing, literature monitoring, regulatory reporting, leveraging AI/automation & global delivery capabilities. |

| Capgemini Services SAS | Paris, France | Digital PV solutions: automation/AI, safety case management, regulatory compliance, scalable global delivery for pharmaceutical clients. |

By Service Type

By Type

By Process Flow

By End User

By Region

January 2026

January 2026

January 2026

January 2026