Psoriatic Arthritis Treatment Market Size, Key Players with Shares and Forecast

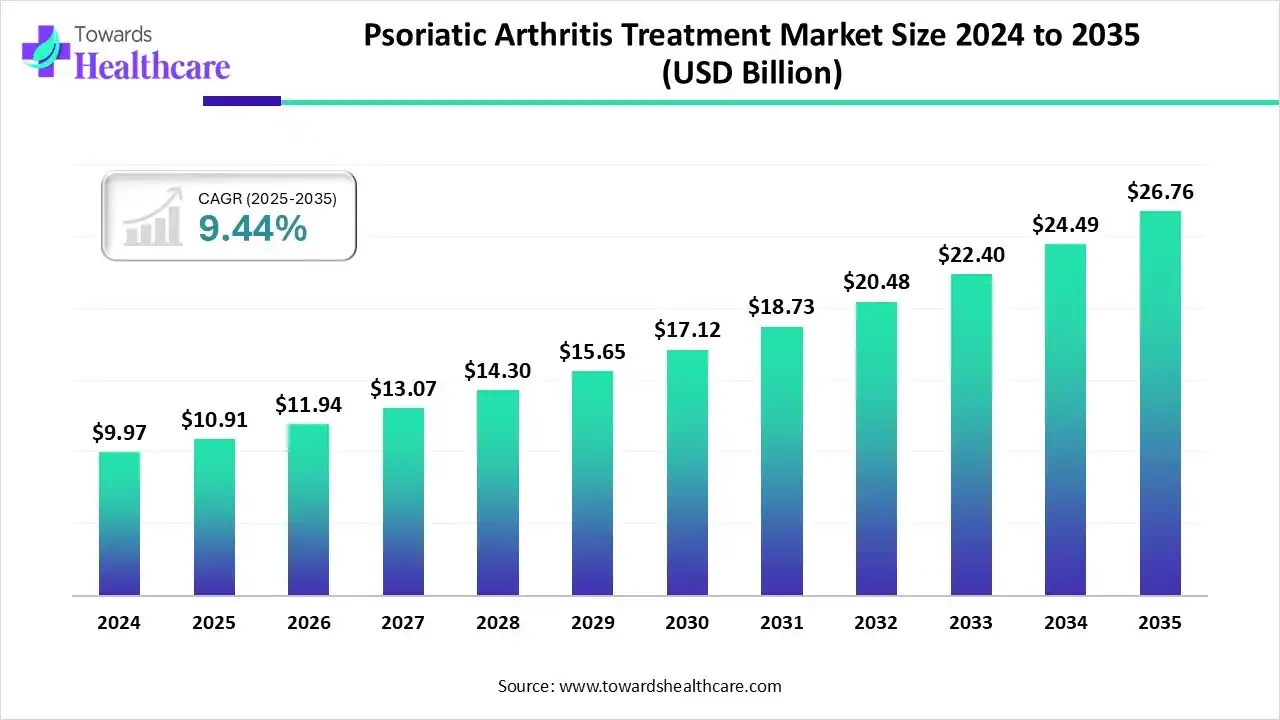

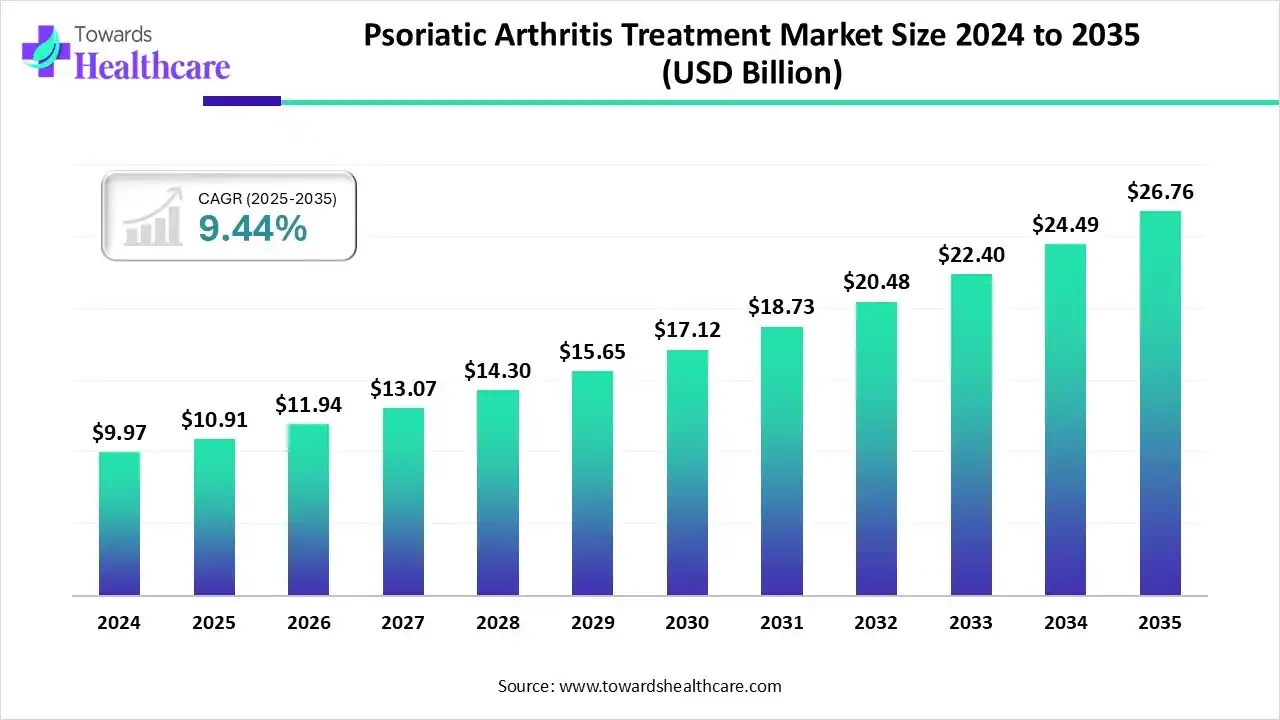

The global psoriatic arthritis treatment market size is calculated at USD 10.91 billion in 2025, grew to USD 11.94 billion in 2026, and is projected to reach around USD 26.76 billion by 2035. The market is expanding at a CAGR of 9.44% between 2026 and 2035.

The psoriatic arthritis treatment market is primarily driven by the increasing prevalence of psoriasis and the growing development of immunotherapy drugs. As patients are more aware of early diagnosis, healthcare professionals are encouraged to provide early intervention. Favorable reimbursement policies and increasing healthcare expenditure contribute to market growth. Artificial intelligence (AI) revolutionizes the diagnosis and treatment of psoriatic arthritis (PsA).

Key Takeaways

- Psoriatic arthritis treatment market to crossed USD 10.91 billion by 2025.

- Market projected at USD 26.76 billion by 2035.

- CAGR of 9.44% expected in between 2026 to 2035.

- North America held a major revenue share of approximately 40-43% of the market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the psoriatic arthritis treatment market in the upcoming years.

- By drug class, the biologic DMARDs segment dominated the market with a revenue of approximately 50-52% in 2024.

- By drug class, the targeted synthetic DMARDs segment is expected to witness the fastest growth in the market over the forecast period.

- By clinical manifestation, the peripheral arthritis segment contributed the biggest revenue share of approximately 48-52% of the market in 2024.

- By clinical manifestation, the axial psoriatic disease/spondylitis segment is expected to expand rapidly in the market in the coming years.

- By route of administration & delivery, the parenteral segment held a dominant revenue share of approximately 68-72% of the market in 2024.

- By route of administration & delivery, the oral segment is expected to grow at the fastest CAGR in the psoriatic arthritis treatment market during the forecast period.

- By patient setting/end-user, the specialist rheumatology clinics & hospitals segment accounted for the highest revenue share of approximately 60% of the market in 2024.

- By patient setting/end-user, the outpatient infusion centers/specialty pharmacies segment is expected to grow with the highest CAGR in the market during the studied years.

Executive Summary Table

| Table |

Scope |

| Market Size in 2025 |

USD 10.91 Billion |

| Projected Market Size in 2035 |

USD 26.76 Billion |

| CAGR (2026 - 2035) |

9.44% |

| Leading Region |

North America |

| Market Segmentation |

By Drug Class, By Clinical Manifestation, By Route of Administration & Delivery, By Patient Setting/End-User, By Region |

| Top Key Players |

Eli Lilly and Company, UCB, Amgen, Inc., Bristol Myers Squibb, Roche/Genentech, Sun Pharmaceuticals Ltd., Biocon, Gilead Life Sciences, Alvotech |

Psoriatic Arthritis Treatment: Breaking the Pain Barrier

The psoriatic arthritis treatment market is experiencing robust growth, driven by the rising prevalence of psoriasis, the shifting trend toward personalized medicines, and technological innovations. It covers approved and late-stage therapies used to prevent and control musculoskeletal and cutaneous manifestations of PsA, including pain, joint swelling/erosion, enthesitis, dactylitis, axial disease, and skin psoriasis.

The market includes conventional therapies (NSAIDs, corticosteroids), conventional synthetic DMARDs, biologic DMARDs (TNF, IL-17, IL-23, etc.), targeted synthetic DMARDs (JAK / TYK inhibitors), combination regimens, delivery formats (injectable, infusion, oral), and related services (diagnostics, specialty pharmacy, monitoring).

Psoriatic Arthritis Treatment Market Outlook

- Industry Growth Overview: The market will expand rapidly, due to the availability of biosimilars and the growing demand for early use of biologics or advanced orals to prevent joint damage and improve long-term outcomes. Biosimilars enhance patient affordability and convenience.

- Major Investors: Private equity firms and venture capitalists provide funding to budding startups, enabling them to develop novel therapeutics based on patients’ conditions. Funding also allows companies to conduct clinical trials and manufacture drugs on a large scale.

- Global Expansion: Key players collaborate to expand their geographical presence and deliver their proprietary products to a larger patient population. Companies receive regulatory approval from different countries to serve patients from those respective countries.

Smart Healing: AI in Psoriatic Arthritis Treatment Market

AI can play a crucial role in managing PsA by predicting treatment outcomes and guiding more informed therapeutic decision-making. This helps healthcare professionals to provide personalized treatment. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest appropriate treatment based on patients’ symptoms. They can also determine different stages of diseases with high accuracy and precision.

For instance,

- In October 2025, some German researchers developed ML models to help rheumatologists tailor treatment decisions for patients with PsA. AI tools were used to predict outcomes and interpret how individual factors influenced the results.

Segmental Insights

Drug Class Insights

| Sub-Segment |

Market Share (%) |

| Biologic DMARDs |

51% |

| Targeted Synthetic DMARDs (tsDMARDs/JAK/TYK inhibitors) |

20% |

| Conventional Synthetic DMARDs |

15% |

| Adjunctive/Symptomatic Therapies (NSAIDs, corticosteroids, analgesics) |

14% |

Explanation:

- Biologic DMARDs (51%) dominate due to proven efficacy in controlling inflammation and preventing joint damage.

- Targeted Synthetic DMARDs (20%) are rapidly gaining traction due to convenient oral administration and precision targeting.

- Conventional Synthetic DMARDs (15%) hold a stable share as baseline therapies in early or mild PsA cases.

- Adjunctive/Symptomatic Therapies (14%) are widely used for symptom management but are not disease-modifying, hence smaller share.

Which Drug Class Segment Dominated the Psoriatic Arthritis Treatment Market?

The biologic DMARDs segment held a dominant presence in the market in 2024, with an approximately 50-52% share due to the growing need for targeted treatment and reduced side effects. Biologic disease-modifying anti-rheumatic drugs (DMARDs) are highly specific and target a particular pathway of the immune system. They offer superior benefits compared to conventional DMARDs, including a faster onset of action and improved symptoms. These drugs directly target the immune system, reducing inflammation, pain, and joint damage.

Targeted Synthetic DMARDs

The targeted synthetic DMARDs segment is expected to grow at the fastest CAGR in the market during the forecast period. JAK inhibitors and tyrosine kinase inhibitors are some examples of targeted synthetic DMARDs. These drugs are widely preferred because they can be administered orally. Newer drugs are developed to selectively target IL-17, IL-23, and other receptors. They are comparatively cost-effective, enhancing patient convenience.

Adjunctive/Symptomatic Therapies

The adjunctive/symptomatic therapies segment is expected to grow in the coming years, due to the need for relieving symptoms and improving the quality of life of individuals. Adjuvant therapies for PsA include NSAIDs, corticosteroids, and non-pharmacological treatment. They complement PsA therapeutics and provide synergistic effects.

Clinical Manifestation Insights

| Sub-Segment |

Market Share (%) |

| Peripheral arthritis |

50% |

| Axial psoriatic disease/spondylitis |

20% |

| Enthesitis |

12% |

| Dactylitis |

10% |

Explanation:

- Peripheral arthritis (50%) leads as it represents the most common and clinically recognized PsA manifestation.

- Axial psoriatic disease/spondylitis (20%) is expanding rapidly with increased diagnosis using imaging techniques.

- Enthesitis (12%) contributes notably as biologics targeting IL-17/IL-23 show strong efficacy in these cases.

- Dactylitis (10%) represents severe forms but a smaller patient base limits its share.

- Skin-dominant PsA (8%) remains lower due to overlap treatment with dermatological therapies rather than rheumatologic.

Why Did the Peripheral Arthritis Segment Dominate the Psoriatic Arthritis Treatment Market?

The peripheral arthritis segment held the largest revenue share of approximately 48-52% of the market in 2024. This segment dominated because peripheral arthritis is one of the major clinical features and can exist in various patterns. Peripheral arthritis refers to the inflammation of the joints in the hands, wrists, feet, ankles, and knees. It is a potentially debilitating feature of PsA, necessitating its early treatment. Treatment focuses on reducing symptoms and preventing damage progression.

Axial Psoriatic Disease/Spondylitis

The axial psoriatic disease/spondylitis segment is expected to grow with the highest CAGR in the market during the studied years. Axial psoriatic disease occurs in 25% to 70% of patients with PsA. It results in worse arthritis and psoriasis as measured by several clinical variables compared with nonaxial patients. Treatment plans for this condition are based on evidence from patients with axial spondyloarthritis, including biologics.

Enthesitis

The enthesitis segment is expected to grow at a notable CAGR. Enthesitis is the inflammation of the sites where tendons, ligaments, and joint capsules attach to bones. Symptoms include pain and stiffness, especially when the body part is moved. Enthesitis is also considered a root cause of some common orthopedic problems, such as tennis elbow. It is estimated that over 40% of PsA patients suffer from enthesitis.

Route of Administration & Delivery Insights

| Sub-Segment |

Market Share (%) |

| Parenteral (subcutaneous injectables, IV infusions) |

70% |

| Oral (small-molecule JAK/TYK inhibitors) |

25% |

| Topical (adjunctive for skin symptoms) |

5% |

Explanation:

- Parenteral (70%) dominates as biologic DMARDs are largely administered via injections or infusions for better bioavailability.

- Oral (25%) shows strong growth due to patient convenience and the success of targeted small molecules.

- Topical (5%) remains limited to mild or adjunctive cases addressing skin symptoms.

What Made Parenteral the Dominant Segment in the Psoriatic Arthritis Treatment Market?

The parenteral segment accounted for the highest revenue share of approximately 68-72% of the market in 2024, due to faster onset of action, higher bioavailability, and reduced systemic side effects. Biologics are delivered through the parenteral route, such as subcutaneous and i.v. Infusions. They completely bypass the digestive system, thereby delivering drugs into body fluids. Drugs are absorbed more quickly and provide the desired action at the target site.

Oral

The oral segment is expected to expand rapidly in the market in the coming years. The oral route is more convenient and affordable than injectable medicines. Oral drugs can be administered to patients of all age groups. Tablets are available in various forms, including sustained release and immediate release. The oral route is generally safe, simple, convenient, and non-invasive. Patients do not need skilled professionals for drug administration.

Topical

The topical segment is expected to show lucrative growth due to the growing demand for targeted treatment and patient convenience. Drugs are available in creams, gels, and ointments that are applied to the skin. They are delivered into the body fluids through the skin layers. As PsA is an inflammatory disorder, topical drugs can help relieve inflammatory symptoms and swelling.

Patient Setting/End-User Insights

| Sub-Segment |

Market Share (%) |

| Specialist rheumatology clinics & hospitals |

60% |

| Dermatology clinics (skin-dominant cases) |

15% |

| Outpatient infusion centres/specialty pharmacies |

15% |

| Primary care (diagnosis, early management, referrals) |

10% |

Explanation:

- Specialist rheumatology clinics & hospitals (60%) lead as they handle complex PsA cases requiring biologic therapies.

- Dermatology clinics (15%) manage patients with overlapping psoriasis symptoms needing co-treatment.

- Outpatient infusion centers/specialty pharmacies (15%) are rising due to the shift toward ambulatory biologic infusions.

- Primary care (10%) contributes modestly as they are mostly involved in early-stage screening and referrals.

Which Patient Setting/End-User Segment Led the Psoriatic Arthritis Treatment Market?

The specialist rheumatology clinics & hospitals segment led the market in 2024, with a share of approximately 60% due to favorable infrastructure and the availability of specialized equipment. Clinics and hospitals have skilled professionals who provide personalized treatment to patients. Favorable reimbursement policies also encourage patients to visit rheumatology clinics and hospitals. Hospitals and clinics are also part of clinical trials, benefiting patients by receiving novel therapeutics before market approval.

Outpatient Infusion Centers/Specialty Pharmacies

The outpatient infusion centers/specialty pharmacies segment is expected to witness the fastest growth in the market over the forecast period. Outpatient centers save a lot of costs for patients as they do not need to stay overnight. Specialty pharmacies possess the required facilities to store and manage innovative PsA therapeutics. Pharmacists guide patients about the dose and drug delivery of biologics.

Primary Care

The primary care segment is expected to grow significantly, due to the increasing awareness of screening and early diagnosis of PsA. Healthcare professionals manage PsA at an initial stage through NSAIDs and other over-the-counter (OTC) medications to manage mild symptoms. They also suggest lifestyle changes and screen for joint involvement. They can refer to specialized professionals for advanced treatment.

Regional Analysis

| Region |

Market Share (%) |

| North America |

42% |

| Europe |

30% |

| Asia-Pacific |

18% |

| Latin America |

6% |

| Middle East & Africa |

4% |

Explanation:

- North America (42%) held the leading share due to advanced healthcare infrastructure, high prevalence of psoriatic arthritis, widespread adoption of biologics, and strong reimbursement systems.

- Europe (30%) accounted for a major portion owing to increased awareness, strong clinical research activity, and availability of biosimilars in major markets like Germany and the U.K.

- Asia-Pacific (18%) is expected to record the fastest CAGR driven by improving diagnosis rates, rising healthcare expenditure, and expanding access to biologic and targeted synthetic therapies.

- Latin America (6%) maintains a modest share due to limited access to advanced biologic treatments but growing awareness and patient diagnosis are fueling gradual uptake.

- Middle East & Africa (4%) represent smaller shares, largely constrained by limited specialist availability and high treatment costs, though emerging private healthcare investments are improving access.

Which Factors Govern the Psoriatic Arthritis Treatment Market in North America?

North America dominated the global market in 2024, with a revenue of approximately 40-43%. The availability of a robust healthcare infrastructure, the rising prevalence of autoimmune disorders, and the presence of key players are the factors that govern market growth in North America. Favorable regulatory policies and the rising adoption of advanced technologies propel the market. Government and private organizations provide funding for conducting advanced research activities.

Increasing Prevalence Fuels the U.S. Growth

Key players, such as Pfizer, Johnson & Johnson, and AbbVie, are the major contributors to the market in the U.S. About 8 million people live with psoriasis, of which approximately 3.3 million people in the U.S. live with PsA. In September 2025, the U.S. FDA approved Tremfya (guselkumab) for the treatment of children six years or older with PsA.This FDA approval will benefit 14,000 American children who are impacted by PsA.

How is Asia-Pacific Growing in the Psoriatic Arthritis Treatment Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The market is driven by increasing R&D investments and growing research and development activities. Companies in China and India primarily focus on manufacturing biosimilars for PsA treatment to cater to a wide range of the population, providing affordable medications. The rapidly expanding clinical trial infrastructure is attracting foreign companies to conduct clinical trials in the region.

India - The Global Destination for Medical Tourism

The prevalence rate of PsA in India ranges from 0.44% to 8.7% in patients with psoriasis. The burgeoning medical tourism sector attracts foreign patients for affordable and advanced treatment in India. India has expertise in complementary therapies, such as acupuncture, massage therapy, dietary supplements, and herbal remedies. Approximately 2 million patients visit India every year for medical treatment.

Will Europe Grow in the Psoriatic Arthritis Treatment Market?

Europe is expected to grow at a considerable CAGR in the upcoming period. Government organizations launch initiatives to screen for and diagnose autoimmune disorders. The Horizon Europe’s iPROLEPSIS project aims to transform the early detection, diagnosis, and treatment of PsA by using AI and different types of biological data. The European Medicines Agency (EMA) regulates the approval of PsA therapeutics in Europe. The increasing prevalence of PsA and technological innovations boost the market.

Biosimilar Boom Contributes to the UK’s Growth

A recent comprehensive analysis and modelling study found that the incidence of PsA in patients with psoriasis varied from 2.31 per 1000 person-years in the UK. The shifting trend toward biosimilars fosters market growth. The NHS England estimated that the broader adoption of biosimilars, including those for ustekinumab, could generate up to £1 billion in savings by 2028.

South America Market Surge

South America's psoriatic arthritis treatment sector is witnessing a strong expansion. Improved healthcare access and growing patient awareness drive the demand for advanced therapies like biologics. Expanding insurance coverage is making expensive, effective treatments more readily available to a larger patient population.

Brazil: Biologics Lead the Charge

The Brazilian market is experiencing notable momentum, primarily fueled by the increasing adoption of advanced biologic drugs. A rising prevalence of the disease, combined with enhanced diagnostic capabilities, contributes significantly to the market growth in this key Latin American nation.

MEA Embraces Modern Therapy

The Middle East and Africa region demonstrates a robust growth trajectory. Improved healthcare infrastructure and increasing patient education are key factors. The market sees a rising demand for targeted therapies, including novel small molecules, reflecting a push toward more effective and specialized treatment options.

GCC Nations Drive Upscale Demand

The Gulf Cooperation Council countries are a high-value, growing segment. Elevated healthcare spending and the swift regulatory approval of cutting-edge therapies ensure patients receive the newest treatments. The availability of high-cost biologics is a major component of this sophisticated market's latest expansion.

Company Landscape

AbbVie Inc.

Company Overview: A global, research-based biopharmaceutical company focused on developing and commercializing advanced therapies, with Immunology as its largest and most strategic revenue-driving franchise. It is actively and successfully navigating the loss of exclusivity for Humira by aggressively growing its next-generation PsA treatments.

Corporate Information:

- Headquarters: North Chicago, Illinois, USA

- Year Founded: 2013 (Spun off from Abbott Laboratories)

- Ownership Type: Public (NYSE: ABBV)

History and Background: Established as an independent entity focused on specialty pharmaceuticals. Its history is defined by the massive success of Humira (adalimumab) in the PsA and autoimmune space. The current phase is marked by a focus on diversifying and driving market adoption of its successor products, Skyrizi and Rinvoq.

Key Milestones/Timeline:

- 2020: Acquired Allergan, significantly diversifying its therapeutic and aesthetic portfolio.

- 2023-2025: Successfully executed the commercial strategy to offset Humira biosimilar entry by achieving explosive sales growth for its next-generation immunology assets.

- June 2024: RINVOQ approved for pediatric PsA patients (2 years and older) in the U.S.

- April 2025: RINVOQ received U.S. FDA approval for Giant Cell Arteritis (GCA).

- Business Overview: Focuses on delivering innovative treatments for complex and serious diseases. The company reported global net revenues of $15.776 billion for Q3 2025, with the Immunology portfolio generating $7.885 billion, an increase of 11.9% year-over-year.

- Business Segments/Divisions: Immunology (Core to PsA market), Oncology, Neuroscience, and Aesthetics.

- Geographic Presence: Maintains a significant operational presence across more than 175 countries, with the largest market shares in North America and key European countries.

Key Offerings:

- Biologics: Skyrizi (risankizumab, an IL-23 inhibitor); Humira (adalimumab, a TNF inhibitor, declining due to biosimilar competition).

- Oral Small Molecule: Rinvoq (upadacitinib, a JAK inhibitor).

- End-Use Industries Served: Specialty Clinics (Rheumatology, Dermatology), Hospitals, and Specialty Pharmacies.

Key Developments and Strategic Initiatives:

- Aggressively pushing the commercial transition to Skyrizi (Q3 2025 sales: $4.708 billion) and Rinvoq (Q3 2025 sales: $2.184 billion) to drive the new growth platform.

- Successfully raised its full-year 2025 Adjusted Diluted EPS Guidance to $10.61 - $10.65 based on strong demand for its immunology treatments.

Mergers & Acquisitions:

- Aug 2025: Completed the acquisition of Capstan Therapeutics, further strengthening the Immunology and Oncology pipeline with in vivo cell therapy capabilities.

- Jan 2025: Completed the acquisition of Nimble Therapeutics to enhance its drug discovery efforts.

Partnerships & Collaborations:

Feb 2024: Collaboration with Tentarix to develop conditionally-active, multi-specific biologics for both Oncology and Immunology.

Product Launches/Innovations:

- June 2024: RINVOQ launched for pediatric Polyarticular Juvenile Idiopathic Arthritis and Psoriatic Arthritis patients in the U.S.

- Ongoing clinical trials for pipeline assets like Lutikizumab for Hidradenitis Suppurativa, showing positive Phase 2 results (Jan 2024).

Capacity Expansions/Investments:

Announced plans for a $195 million investment in a new U.S. manufacturing facility, part of a $10 billion decade-long strategy to expand U.S. biopharmaceutical manufacturing capabilities.

Regulatory Approvals:

- April 2025: RINVOQ received U.S. FDA approval for Giant Cell Arteritis (GCA).

- June 2024: SKYRIZI received U.S. FDA approval for Ulcerative Colitis.

- Distribution channel strategy: Relies on a managed distribution model primarily utilizing Specialty Pharmacies to handle the high cost, specialized patient management, and administration of its biologic and JAK inhibitor drugs.

Technological Capabilities/R&D Focus:

- Focus: Next-generation targeted therapies, specifically highly selective IL-23 inhibition (Skyrizi) and JAK1 inhibition (Rinvoq) to offer differentiated efficacy and patient convenience.

- Core Technologies/Patents: Monoclonal antibody technology and proprietary Janus Kinase (JAK) selective inhibition technology.

- Research & Development Infrastructure: Maintains an extensive global R&D network, with adjusted R&D expense standing at 14.3% of net revenues in Q3 2025.

- Innovation Focus Areas: Advancing oral small molecules and targeted biologics that offer superior efficacy and durability to address unmet needs in autoimmune diseases.

- Competitive Positioning: Holds a dominant position in the PsA market through a successful portfolio transition, positioning its newest drugs as the preferred options following the failure of older TNF inhibitors.

Strengths & Differentiators:

- Robust Portfolio: Offers multiple, high-efficacy mechanisms (IL-23, JAK) for tailored treatment.

- Strong Financial Growth: High sales of successor drugs successfully absorbing the impact of biosimilar competition.

- Market presence & ecosystem role: A dominant industry player, setting market standards for commercial strategy and patient support programs in the autoimmune field.

SWOT Analysis:

- Strengths: Leading Immunology Franchise (Skyrizi/Rinvoq); High R&D investment.

- Weaknesses: Continued decline of Humira revenue; Safety warnings associated with JAK inhibitors (Rinvoq).

- Opportunities: Global expansion of Skyrizi/Rinvoq; Pipeline drugs for other immune conditions (e.g., Alopecia Areata, Vitiligo).

- Threats: Increasing competition from rival IL-23/TYK2 inhibitors; Pricing pressure on biologics.

Recent News and Updates:

- Oct 31, 2025: Reported strong Q3 2025 financial results, raising full-year profit forecast due to Skyrizi and Rinvoq outperformance.

- Oct 29, 2025: Announced positive topline results from Phase 3 studies evaluating RINVOQ in adults and adolescents with Vitiligo.

Press Releases:

- Oct 31, 2025: AbbVie Reports Third-Quarter 2025 Financial Results, highlighting Global Skyrizi net revenues of $4.708 billion and Global Rinvoq net revenues of $2.184 billion in the quarter.

- Industry Recognitions/Awards: Consistently recognized as a global leader in biopharma innovation, particularly for advancements in immunology.

Johnson & Johnson Services, Inc. (Janssen Pharmaceutical Companies)

Company Overview: A focused global healthcare company specializing in Innovative Medicine (Janssen) and MedTech. The Janssen division is a major force in the PsA market, focused on immunology, oncology, and neuroscience.

Corporate Information:

- Headquarters: New Brunswick, New Jersey, USA

- Year Founded: 1886

- Ownership Type: Public (NYSE: JNJ)

History and Background: Long history as a diversified healthcare giant. Janssen's immunology success was pioneered with Remicade and solidified with the launch of Stelara and the next-generation Tremfya, maintaining a key competitive edge in autoimmune diseases. The company fully separated its Consumer Health business (Kenvue) in 2023 to sharpen its focus on Innovative Medicine and MedTech.

Key Milestones/Timeline:

- 2017: TREMFYA (guselkumab) received initial US FDA approval.

- 2023: Completed the separation of the Consumer Health business (Kenvue).

- July 2025: Submitted a New Drug Application (NDA) to the U.S. FDA for its oral targeted peptide icotrokinra (JNJ-2113) for plaque psoriasis, which is also in Phase 3 for PsA.

- Business Overview: The Innovative Medicine segment drives the company's growth, with reported revenues of $88.82 billion in 2024. Immunology, driven by its PsA treatments, is a top-performing franchise.

- Business Segments/Divisions: Innovative Medicine (Janssen - Includes PsA treatments), MedTech.

- Geographic Presence: Operates and serves patients worldwide, with a powerful presence across North America, Europe, and the Asia Pacific.

Key Offerings:

- Biologics: STELARA (ustekinumab, an IL-12/23 inhibitor); TREMFYA (guselkumab, an IL-23 inhibitor).

- Pipeline Oral Peptide: icotrokinra (JNJ-2113, a targeted oral IL-23 receptor antagonist) currently in Phase 3 trials for PsA.

- End-Use Industries Served: Hospitals, Specialty Clinics, Rheumatology and Dermatology Practices, Specialty Pharmacies.

Key Developments and Strategic Initiatives:

- Aggressive late-stage development of the oral targeted peptide icotrokinra, a potential first-in-class, non-injectable, selective IL-23 blocker intended to capture the large market segment seeking oral convenience.

- Focusing on label expansions and real-world data to demonstrate the durable efficacy of TREMFYA across multiple immune-mediated diseases.

- Mergers & Acquisitions: Has historically focused on targeted acquisitions, such as the initial agreement with Protagonist Therapeutics (2017) that led to the development of icotrokinra.

Partnerships & Collaborations:

- Feb 2024: Announced a settlement and licensing agreement with Biocon Biologics to manage the commercialization of a Stelara biosimilar in the US.

- Ongoing co-development and licensing agreement with Protagonist Therapeutics for icotrokinra.

Product Launches/Innovations:

- July 2025: Submitted NDA for the oral peptide icotrokinra for plaque psoriasis, with PsA filings expected soon after based on the ongoing ICONIC-PSA 1 and 2 Phase 3 studies.

- Capacity Expansions/Investments: Maintained consistently high R&D investment, prioritizing advanced immunology platforms like the oral targeted peptide technology.

Regulatory Approvals:

- Oct 2025: Presented new 96-week data at ACG 2025 showing TREMFYA achieves durable remission in Crohn's disease, reinforcing its broad utility across immune conditions, including PsA.

- July 2025: NDA submitted for icotrokinra in plaque psoriasis.

- Distribution channel strategy: Utilizes a sophisticated global distribution network focused on Specialty Pharmacies and hospital/infusion centers for its injectable biologics, complemented by comprehensive patient support and adherence programs.

Technological Capabilities/R&D Focus:

- Focus: Highly selective IL-23 inhibition (Tremfya) and the development of the first-in-class oral targeted peptide (icotrokinra) to precisely block the IL-23 receptor.

- Core Technologies/Patents: Monoclonal antibody technology targeting interleukins (IL-23) and patented oral peptide technology for targeted immune modulation.

- Research & Development Infrastructure: Extensive global infrastructure under Janssen, with the ICONIC program (for icotrokinra) representing a massive investment across multiple immune indications, including PsA.

- Innovation Focus Areas: Leading the push toward oral targeted biologics (icotrokinra) and maximizing the clinical differentiation of TREMFYA, which is noted for its ability to inhibit joint structural damage in PsA.

- Competitive Positioning: A strong, entrenched market competitor that successfully transitioned from the TNF era to the IL-23 inhibitor class. The potential launch of the oral peptide icotrokinra could be a major competitive disruptor.

Strengths & Differentiators:

- Highly Effective Biologic: TREMFYA offers a quarterly subcutaneous injection schedule and strong efficacy across all PsA domains.

- Pipeline Innovation: Leading the development of a potential first-in-class oral IL-23 receptor antagonist (icotrokinra).

- Market presence & ecosystem role: A historic leader in autoimmune disease treatment, heavily influencing clinical guidelines and standard of care for PsA and psoriasis.

SWOT Analysis:

- Strengths: Established, high-performing IL-23 inhibitor (Tremfya); Highly promising late-stage oral pipeline asset (icotrokinra).

- Weaknesses: Facing biosimilar erosion for the older anchor drug Stelara.

- Opportunities: Launch of icotrokinra to capture the oral therapy market; Further clinical data demonstrating Tremfya's long-term durability.

- Threats: High-efficacy competition from AbbVie's Skyrizi/Rinvoq and newer TYK2 inhibitors.

Recent News and Updates:

- Oct 27, 2025: Presented new 96-week data on TREMFYA showing durable remission in Crohn's disease, confirming its long-term efficacy across related immune conditions.

- Oct 27, 2025: Announced that icotrokinra maintains a strong therapeutic benefit and favorable safety profile in ulcerative colitis through 28 weeks, reinforcing its high potential for PsA.

Press Releases:

- July 2025: Submitted NDA for icotrokinra to the U.S. FDA.

- Industry Recognitions/Awards: Recognized among the top pharmaceutical companies for R&D spending and innovation.

Value Chain Analysis - Psoriatic Arthritis Treatment Market

R&D

Researchers are focusing on better understanding the pathophysiology of PsA to develop targeted treatments. Novel biomarkers are identified to derive biologics for personalized treatments.

Key Players: Bristol Myers Squibb, Amgen, Inc., and UCB.

Clinical Trials & Regulatory Approval

Clinical trials are conducted to assess the safety and efficacy of PsA therapeutics. These therapeutics are then subsequently approved by several regulatory agencies.

Key Players: MoonLake Immunotherapeutics AG, Novartis Pharmaceuticals, Hansoh BioMedical R&D Company, and ACELYRIN Inc.

Patient Support & Services

Patient support & services refer to regular monitoring and lifestyle changes like exercise and stress management. It also includes reimbursement for treatment regimens.

Top Companies & Their Offerings in the Psoriatic Arthritis Treatment Market

| Companies |

Headquarters |

Offerings |

Sales (USD) |

| AbbVie, Inc. |

Illinois, United States |

Skyrizi |

$4.7 billion (Q3 2025) |

| Novartis AG |

Basel, Switzerland |

Consentyx |

$6.14 billion (FY2024) |

| Johnson & Johnson |

New Jersey, United States |

Tremfya |

$1.2 billion (Q2 2025) |

| Pfizer, Inc. |

New York, United States |

Xeljanz |

$1.7 billion (FY2023) |

| Sanofi |

Paris, France |

Arava |

- |

Other Companies

Recent Developments in the Psoriatic Arthritis Treatment Market

- In June 2025, Bristol Myers Squibb reported positive results from its Phase 3 POETYK PsA-1 trial that assesses Sotyktu (deucravacitinib) to improve symptoms in adults with active PsA compared to placebo. Approximately 54.2% of patients receiving Sotyktu achieved a 20% improvement in signs and symptoms in PsA.

- In May 2025, Biocon Biologics Ltd. announced that its commercial partner, Yoshindo, Inc., launched Ustekinumab BS Subcutaneous Injection, a biosimilar to Stelara. The drug is approved for the treatment of psoriasis vulgaris and PsA. It was launched in the U.S. and European markets in February 2025.

Segments Covered in the Report

By Drug Class

- Biologic DMARDs

- TNF inhibitors (anti-TNF)

- IL-17 inhibitors

- IL-23/IL-12-13 inhibitors

- Targeted Synthetic DMARDs (tsDMARDs/JAK/TYK inhibitors)

- Conventional Synthetic DMARDs

- Adjunctive/Symptomatic Therapies (NSAIDs, corticosteroids, analgesics)

By Clinical Manifestation

- Peripheral arthritis

- Axial psoriatic disease/spondylitis

- Enthesitis

- Dactylitis

- Skin-dominant PsA/psoriasis comorbidity

By Route of Administration & Delivery

- Parenteral (subcutaneous injectables, IV infusions)

- Oral (small-molecule JAK/TYK inhibitors)

- Topical (adjunctive for skin symptoms)

By Patient Setting/End-User

- Specialist rheumatology clinics & hospitals

- Dermatology clinics (skin-dominant cases)

- Outpatient infusion centres/specialty pharmacies

- Primary care (diagnosis, early management, referrals)

By Region

- North America

- US

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Turkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific (APAC)

- China

- Taiwan

- India

- Japan

- Australia & New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- Middle East and Africa (MEA)

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA