January 2026

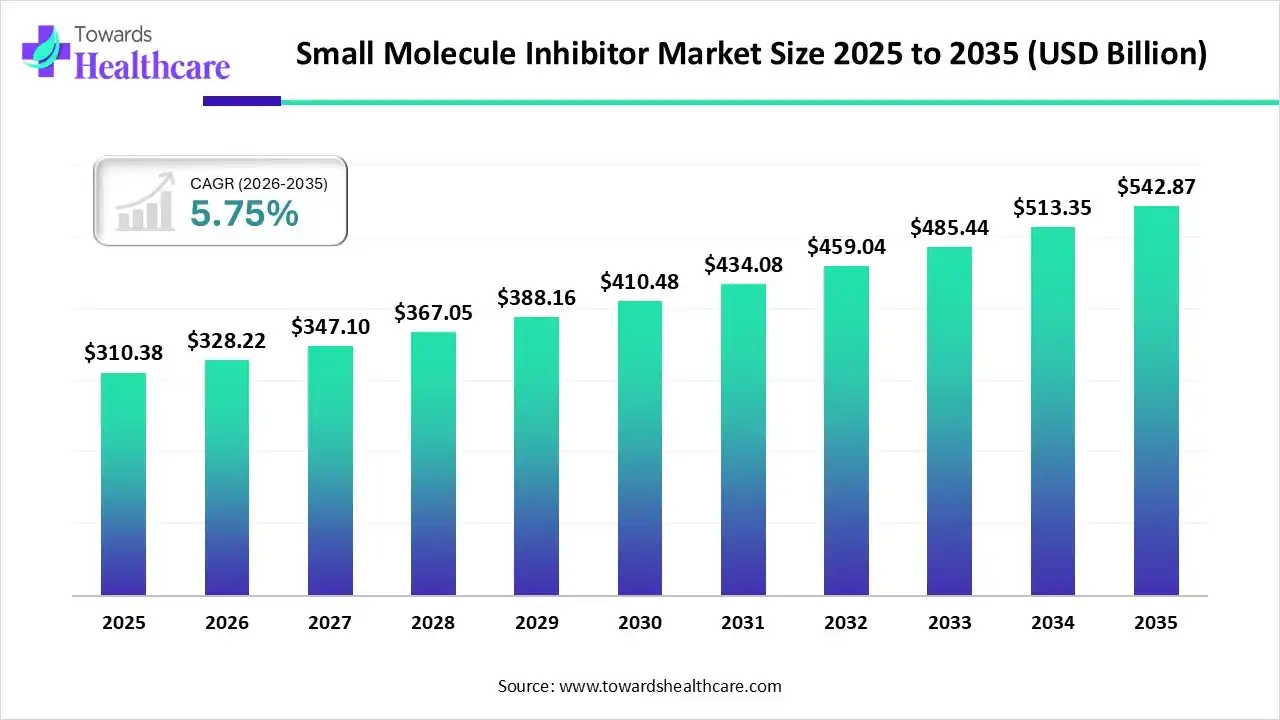

The global small molecule inhibitor market size is expected to be worth around USD 542.87 billion by 2035, from USD 310.38 billion in 2025, growing at a CAGR of 5.75% during the forecast period from 2026 to 2035.

The growing disease burden globally is increasing the demand for small-molecule inhibitors. AI technologies, advanced healthcare, R&D investment, and government support are also driving their demand, where the industries are also investing and collaborating to develop new products, promoting market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 328.22 Billion |

| Projected Market Size in 2035 | USD 542.87 Billion |

| CAGR (2026 - 2035) | 5.75% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Therapeutic Area, By Sales Channel, By Molecule, By Region |

| Top Key Players | Pfizer Inc., Gilead Sciences, Inc., Takeda Pharmaceutical Co, Takeda Pharmaceutical Co, Roche Holding AG, AstraZeneca plc, Bristol-Myers Squibb, Amgen Inc.,Merck & Co., Inc. |

The small molecule inhibitor market is driven by increasing chronic diseases, the advantages of oral drug delivery, and technological advancements. The small molecule inhibitor refers to a compound with low molecular weight, which is used to control or block any biological process by binding to a specific protein or enzyme. These products are being used in the treatment of various diseases such as cancer, rare, autoimmune, infectious, and metabolic diseases.

What is the Impact of AI in the Small Molecule Inhibitor Market?

Different types of AI models are being utilized in the development of small molecule inhibitors, as they help in detecting targets, promote screening of drug candidates and help in reducing workload. AI is also used for molecule modification, which reduces their toxicity and optimizes their safety, potency, and bioavailability. Moreover, they are also being used in the development of personalized solutions and the prediction of their ADME properties.

Why Did the Immunomodulatory Small Molecules Segment Dominate in the Small Molecule Inhibitor Market in 2025?

The immunomodulatory small molecules segment led the market in 2025, due to a wide range of applications. It also provided enhanced oral bioavailability, which increased their use. They were also used in combination with other therapies to offer targeted action, which enhanced their production rates.

BCL-2 inhibitors

The BCL-2 inhibitors segment is expected to show the highest growth during the predicted time, due to their growing use in cancer treatment. They offer target-specific action, which is increasing their use in leukaemia and lymphoma. Additionally, their high efficacy is driving the development of new combinations.

How Oncology Segment Dominated the Small Molecule Inhibitor Market in 2025?

The oncology segment led the market in 2025, due to its growing incidence rates. Moreover, the growth in the unmet medical need has also increased the use of small-molecule inhibitors. At the same time, high treatment costs also enhanced the use of these inhibitors, where their innovations also promoted their adoption rates.

Rare Diseases

The rare diseases segment is expected to show the fastest growth rate during the predicted time, due to growing government incentives. Furthermore, the growing advances in genetics are also increasing the development of novel small molecules to offer targeted therapies, where the startups are also driving their innovations.

Which Sales Channel Type Segment Held the Dominating Share of the Small Molecule Inhibitor Market in 2025?

The hospitals segment held the dominating share in the market in 2025, as they offered a wide range of expensive therapies. Furthermore, the presence of large patient volume also increased the demand for small-molecule inhibitors. They also provided diagnostic services along with supervision, which enhanced the patients' trust.

Cancer Research Institutes

The cancer research institutes segment is expected to show the highest growth during the upcoming years, due to growing cancer incidences. This, in turn, is driving the development of various advanced therapies, which are backed by government funding and investments.

What Made Small Organic Molecules the Dominant Segment in the Small Molecule Inhibitor Market in 2025?

The small organic molecules segment held the largest share in the market in 2025, due to increased oral bioavailability. At the same time, they were easy to manufacture and offered improved stability. Moreover, their affordability and growth in their R&D also increased their use for various applications.

Peptidomimetics

The peptidomimetics segment is expected to show the fastest growth rate during the upcoming years, due to their high target specificity. At the same time, they also offered improved stability and bioavailability. Moreover, their growing applications are driving their R&D, increasing their innovations.

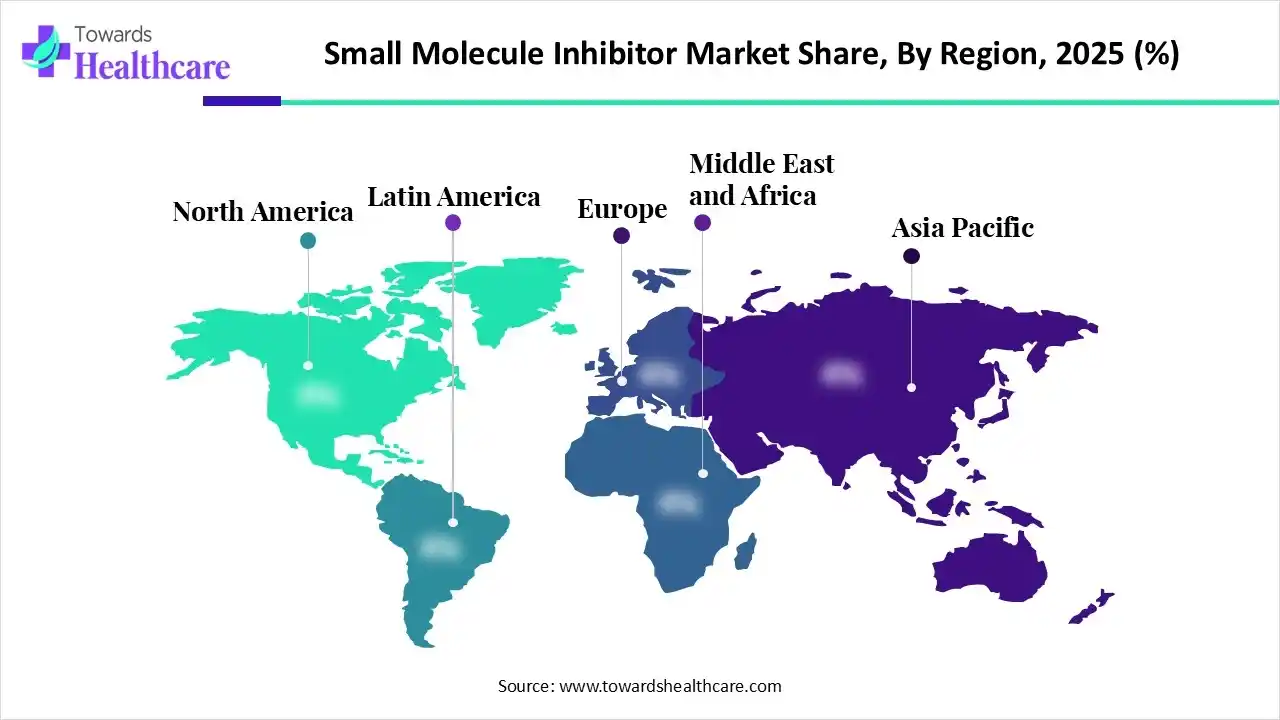

North America dominated the small molecule inhibitor market in 2025, due to the presence of robust industries. At the same time, the growth in healthcare investments also promoted their development and affordability. Additionally, the growth in health awareness and advanced infrastructure also increased their use, which contributed to the market growth.

Due to the presence of high healthcare expenditure, the adoption of small molecules in the U.S. is increasing. Additionally, the presence of large industries is also developing and innovating various treatment options for a variety of diseases. Moreover, growing R&D investments are also increasing their innovations.

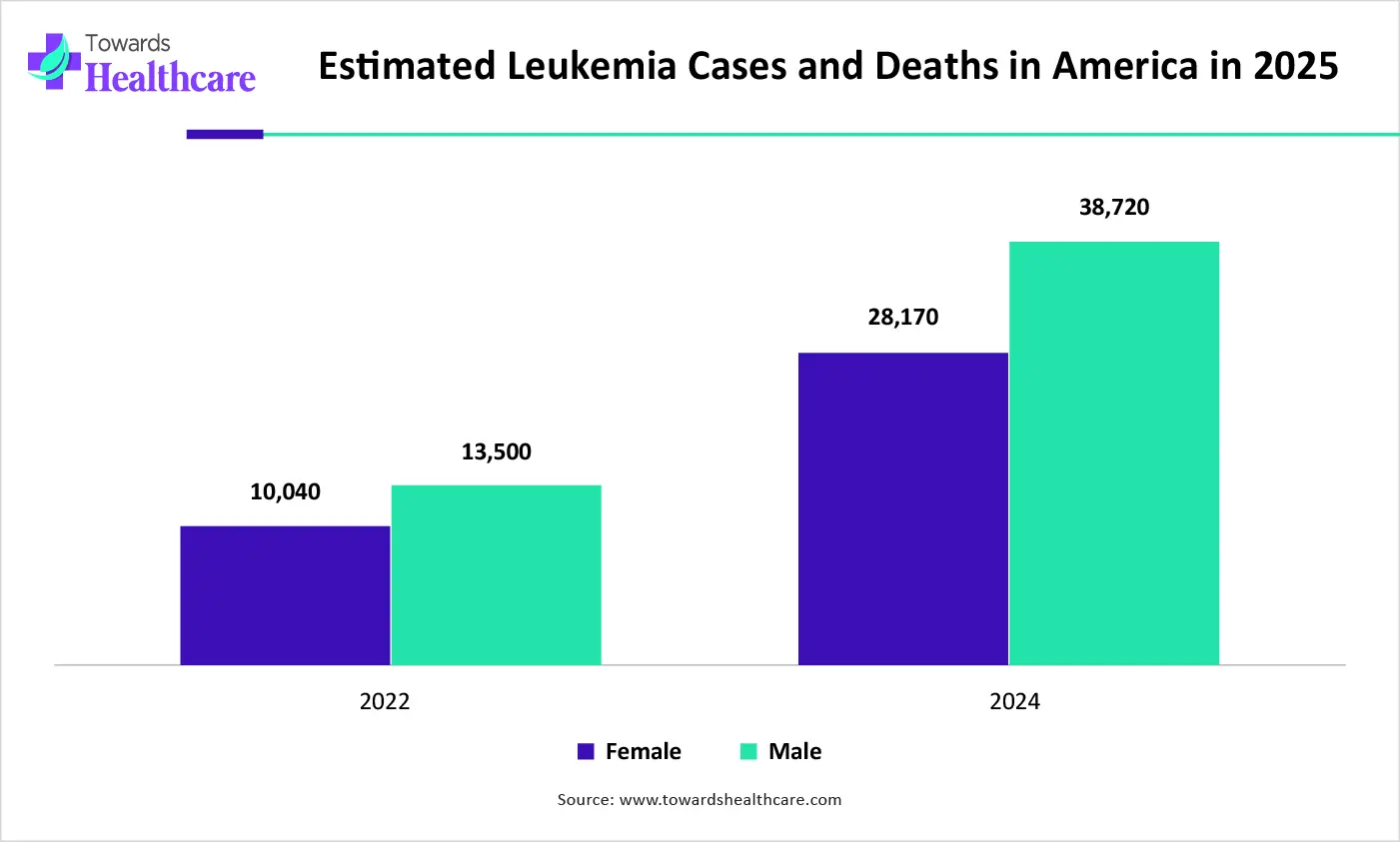

| Leukemia | Deaths | New Cases |

| Female | 10,040 | 28,170 |

| Male | 13,500 | 38,720 |

Asia Pacific is expected to host the fastest-growing small molecule inhibitor market during the forecast period, due to growing chronic diseases. The expanding healthcare is also increasing the adoption of various small-molecule inhibitor treatment options, where the industries are also focusing on their innovations. All these factors, along with government support, are enhancing the market growth.

Due to the presence of a large population, the incidence of chronic diseases is increasing in India, which is driving the demand for small-molecule inhibitors. The presence of pharmaceutical industries is also driving the development of generic products, where the expanding healthcare is also encouraging the adoption of advanced treatment options.

Europe is expected to grow significantly in the small molecule inhibitor market during the forecast period, due to the presence of well-developed healthcare systems. This is increasing the use of small molecules for the treatment of cancer and rare diseases, which are supported by the reimbursement policies. Increasing diseases and their awareness are also increasing their innovations, promoting market growth.

The growth in healthcare awareness is increasing the demand for small-molecule inhibitors for target-specific action. Moreover, the presence of advanced healthcare systems and industries is increasing their use and innovations, respectively. Additionally, growing investments are also supporting their R&D, promoting new collaborations among the companies.

| Companies | Headquarters | Small Molecule Inhibitor Products |

| Novartis AG | Basel, Switzerland | Gleevec and Kisqali |

| Pfizer Inc | New York, U.S. | Paxlovid and Ibrance |

| Gilead Sciences, Inc. | California, U.S. | Biktarvy, Veklury, Livdelzi, Epclusa, and Harvoni |

| Takeda Pharmaceutical Co | Tokyo, Japan | Dexilant, Iclusig, Exkivity, and Fruzaqla |

| Eli Lilly and Company | Indiana, U.S. | Verzenio and Orforglipron |

| Roche Holding AG | Basel, Switzerland | Alecensa |

| AstraZeneca plc | Cambridge, UK | Tagrisso and Lynparza |

| Bristol-Myers Squibb | New Jersey, U.S. | Sotykto and Imbruvica |

| Amgen Inc. | California, U.S. | Otezla |

| Merck & Co., Inc. | New Jersey, U.S. | Lagevrio and Orserdu |

| Companies | Headquarters | Small Molecule Inhibitor Products |

| Novartis AG | Basel, Switzerland | Gleevec and Kisqali |

| Pfizer Inc | New York, U.S. | Paxlovid and Ibrance |

| Gilead Sciences, Inc. | California, U.S. | Biktarvy, Veklury, Livdelzi, Epclusa, and Harvoni |

| Takeda Pharmaceutical Co | Tokyo, Japan | Dexilant, Iclusig, Exkivity, and Fruzaqla |

| Eli Lilly and Company | Indiana, U.S. | Verzenio and Orforglipron |

| Roche Holding AG | Basel, Switzerland | Alecensa |

| AstraZeneca plc | Cambridge, UK | Tagrisso and Lynparza |

| Bristol-Myers Squibb | New Jersey, U.S. | Sotykto and Imbruvica |

| Amgen Inc. | California, U.S. | Otezla |

| Merck & Co., Inc. | New Jersey, U.S. | Lagevrio and Orserdu |

By Drug Class

By Therapeutic Area

By Sales Channel

By Molecule

By Region

January 2026

December 2025

November 2025

October 2025