February 2026

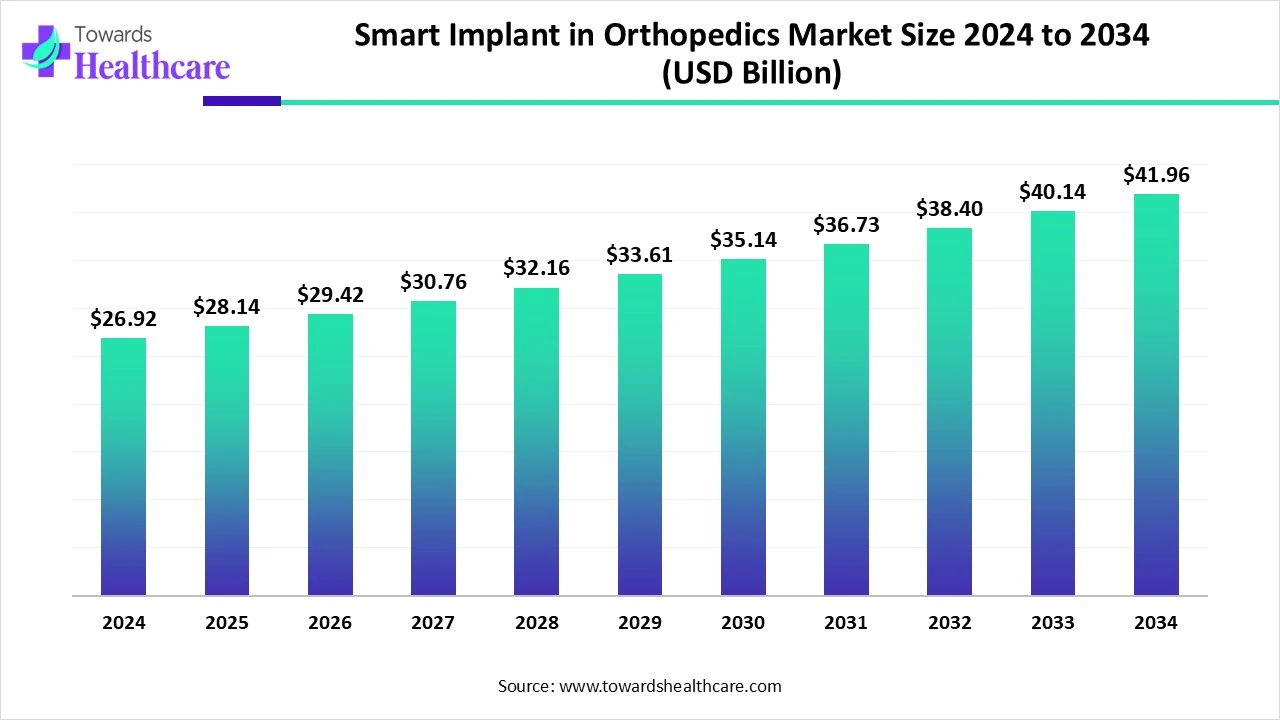

The global smart implant in orthopedics market size is calculated at USD 26.92 in 2024, grew to USD 28.14 billion in 2025, and is projected to reach around USD 41.96 billion by 2034. The market is expanding at a CAGR of 4.55% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 28.14 Billion |

| Projected Market Size in 2034 | USD 41.96 Billion |

| CAGR (2025 - 2034) | 4.55% |

| Leading Region | North America Share by 43% |

| Market Segmentation | By Application, By Component, By Procedure, By End-use, By Region |

| Top Key Players | Stryker, Zimmer Biomet, Abbott., Medtronic, CONMED Corporation., Nevro Corp., Exactech, Inc., Biotronik., Boston Scientific Corporation., Cochlear Ltd. |

The implantable devices that offer both therapeutic and diagnostic benefits are known as smart implants. Its application extends towards fracture fixation, knee arthroplasty, spine fusion, hip arthroplasty, etc. In most cases, these implants were used to measure physical parameters from inside the body, such as displacement, pressure, temperature, strain, etc. Thus, the data obtained by the smart implants enhance the surgical technique, strategies for postoperative care, implant design, and rehabilitation. Moreover, for the development of next-generation smart implants, sensors are being used to make them simple, inexpensive, small, and robust.

By integrating AI into smart orthopedic implants, the detection of infections, as well as the development of personalized treatment approaches, can be facilitated. With the aid of AI algorithms, infection rates, along with data on successful surgery outcomes, are also provided. Moreover, rehabilitation treatment plans after surgeries can also be made available using AI. At the same time, it monitors the healing process, as well as the performance and durability of the implants. Thus, with the help of AI, the failure rates during implant surgeries can be minimized.

Increasing Orthopedic Disorders

Due to the growing geriatric population and increasing number of accidents, various orthopedic disorders are on the rise. This, in turn, leads to a higher demand for orthopedic surgeries. At the same time, the use of traditional implants may lead to complications in patients. Thus, to deal with all these factors, the demand for the use of smart orthopedic implants increases for long-term management of such chronic conditions. Moreover, it helps in reducing the complications as well as increases patient satisfaction, improving patient outcomes. This, in turn, enhances the smart implant in the orthopedics market growth.

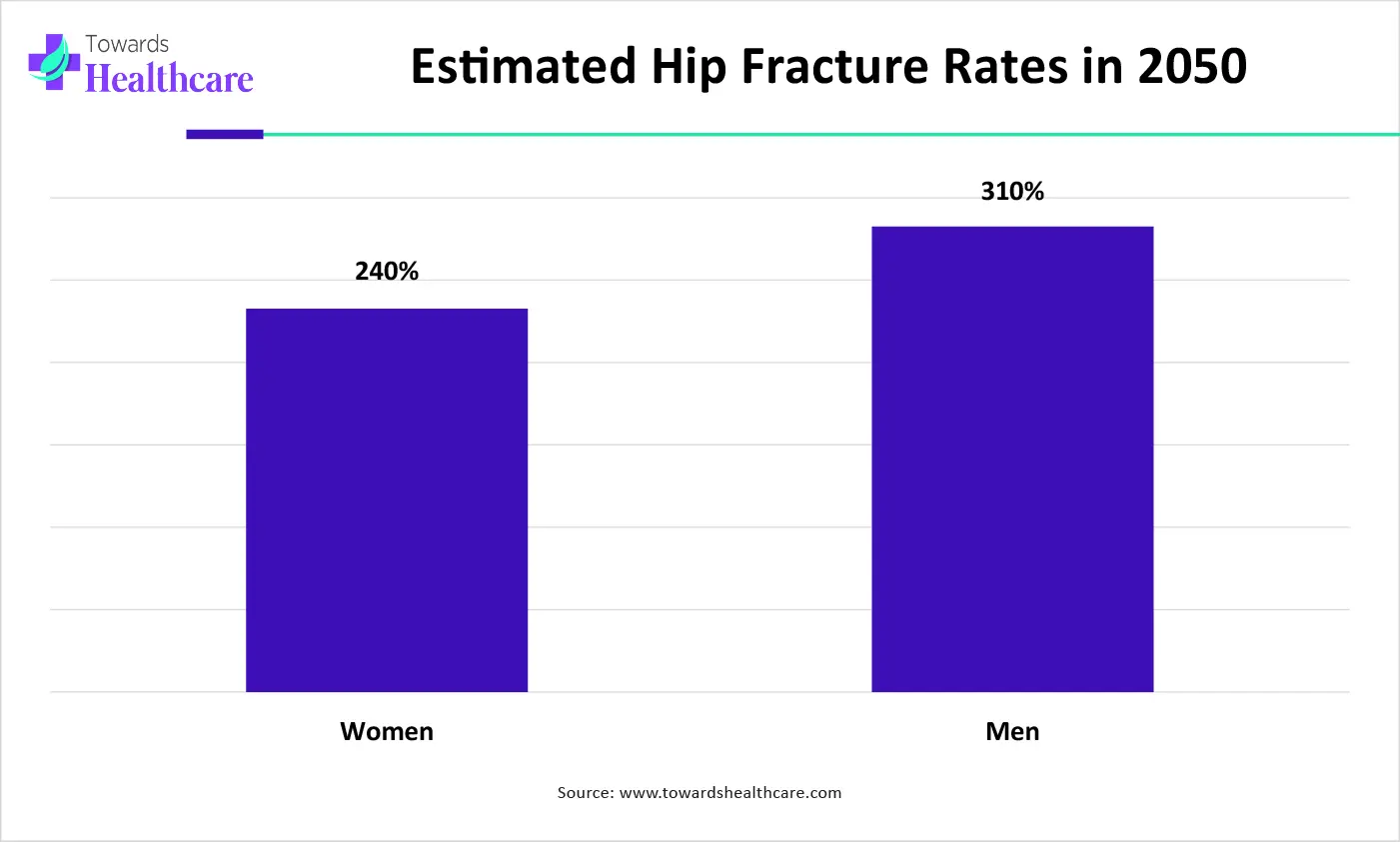

The graph represents the estimated hip fracture rates expected to be observed in 2050. It indicates that there will be a rise in the incidence of hip fractures, which in turn, increases the demand for smart orthopedic implants for their effective management. Thus, this in turn will ultimately promote the market growth. (Source - International Osteoporosis Foundation)

High Price

The development process of smart orthopedic implants is very high. At the same time, for compliance with regulatory guidelines, its manufacturing becomes complicated. Similarly, the cost of clinical trials also adds up. Thus, all these together make the smart orthopedic implants expensive. Hence, the patient prefers the use of traditional implants.

Rising use of Robotics

Due to the increasing demand for the use of smart orthopedic implants, there is a rise in various new approaches to making surgeries more precise. This increased the use of robots during the surgeries, which enhanced the accuracy of implantations. Furthermore, new platforms are also being introduced in these implants for various functions. Thus, this, in turn, helps in improving the precision, effectiveness, safety, as well as accuracy involved during the implantation process. At the same time, this enhances patient outcomes. Thus, the use of robotics helps in promoting the smart implant in orthopedics market growth.

For instance,

By application type, the knee segment dominated the market in 2024. Knee smart implants helped in detecting the healing as well as complications during the surgeries. The increasing number of knee replacement surgeries contributes to the segment’s growth. According to the 2024 American Joint Replacement Registry Annual Report, 4.3 million hip and knee arthroplasties were reported.

By application type, the hip segment is estimated to be the fastest growing at a notable CAGR during the forecast period. The increasing hip fractures, as well as an aging population, have increased the demand for the use of smart implants.

By component type, the implants segment dominated the market in 2024. The implants helped in monitoring the healing rates, temperature, pressure, etc in the body, which enhanced the patient outcomes. Implants provide structural support to damaged bones and joints, helping the body to heal by holding the broken bones. It is estimated that over 7 million Americans are currently living with implants.

By component type, the electronic segment is anticipated to be the fastest growing during the forecast period. The electronic component offers real-time monitoring as well as data collection, which enhances the smart orthopedic implant's performance.

By procedure type, the total replacement segment dominated the market in 2024. The use of smart implants in total replacement procedures provided accurate alignments as well as minimized the complications associated with it. Smart implants are believed to provide superior patient satisfaction rates and improved functional outcomes. About 790,000 total knee replacements and 544,000 hip replacements are performed annually in the U.S.

By procedure type, the partial replacement segment is estimated to be the fastest growing at a notable CAGR during the forecast period. The smart implants in partial replacement procedures reduce tissue damage, which enhances their use in the market.

By end user, the hospital segment dominated the global market in 2024. Hospitals offered smart orthopedic implant services to a wide range of the population. They have favorable infrastructure and skilled professionals to perform complex orthopedic procedures. Patients prefer hospitals as skilled professionals provide multidisciplinary expertise and the availability of reimbursement policies.

By end user, the ASCs segment is predicted to be the fastest growing during the forecast period. They consist of advanced technologies that improve the performance of smart implants as well as patient outcomes.

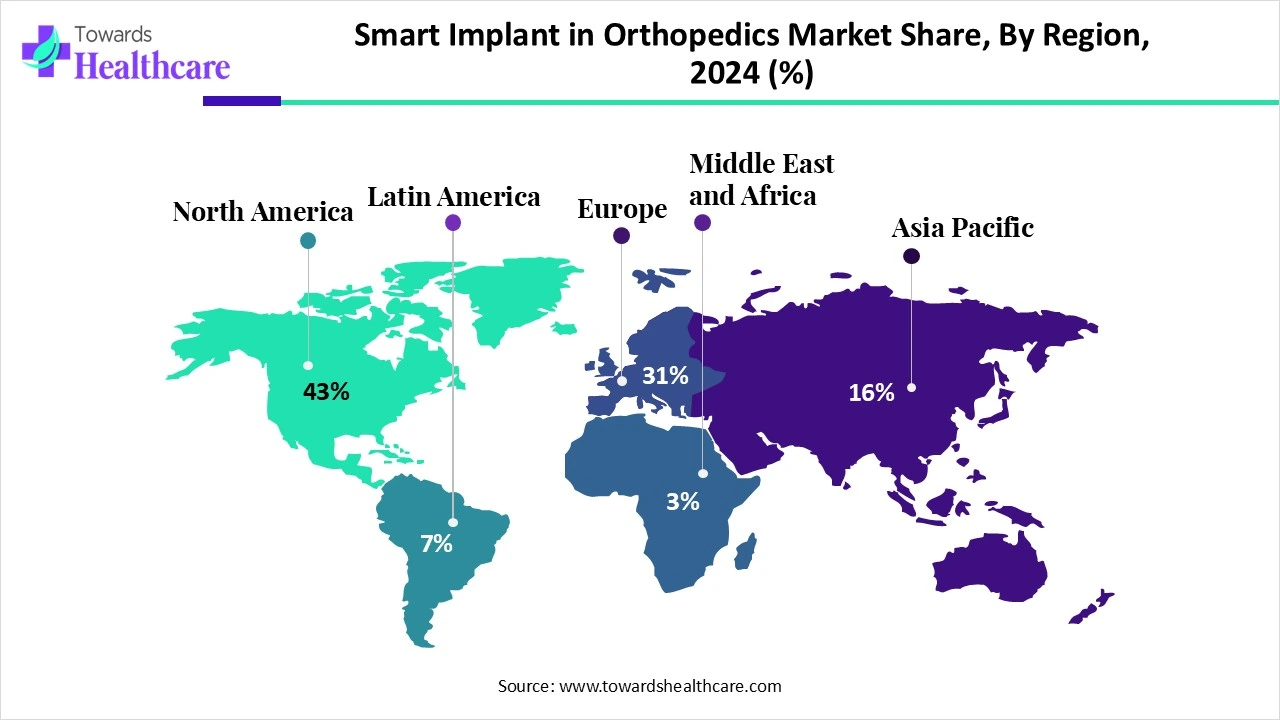

North America dominated the smart implant in orthopedics market share by 43% in 2024. North America consisted of a well-developed healthcare sector, along with the presence of advanced technologies as well as skilled personnel. This enhanced the production of smart implants, which contributed to the market growth.

The healthcare sector in the U.S is well established, due to which various new developments, as well as the production of smart orthopedic implants, are increasing. At the same time, with the help of advanced technologies, new features are also being added to these implants.

The hospitals in Canada are adopting smart orthopedic implants to enhance the accuracy and patient outcomes. Moreover, the industries are also developing various new AI-based smart orthopedic implants, which are increasing the collaborations between them.

Asia Pacific is estimated to host the fastest-growing smart implant in the orthopedics market during the forecast period. The healthcare sector in Asia Pacific is developing by utilizing various technological advancements and new developments. Along with these factors, the government also provides its support, enhancing the market growth.

Due to a large population, the healthcare systems in China are using smart implants to address rising orthopedic disorders. At the same time, to meet the rising demand for its use, they are also utilizing various technologies.

The healthcare sector in India is developing, due to which advanced treatment options are increasing, which increases the demand for smart orthopedic implants. Furthermore, to make these approaches affordable government is also providing its support.

Europe is expected to grow significantly in the smart implant in orthopedics market during the forecast period. The rising orthopedic disorders are increasing the demand for the use of smart orthopedic implants. This, in turn, promotes the market growth.

Due to increasing orthopedic disorders in Germany, the use, as well as the production of smart orthopedic implants, is rising. At the same time, the new developments are also driving their demand in the market.

The industries in the UK are focused on the research and development of various new smart implants with the use of AI for enhancing their performance and accuracy. This, in turn, is also increasing the number of collaborations

The latest research focuses on multifunctional platforms with synergistic interactions between different functions and the treatment of complex clinical issues. Smart bone implants provide better bone defect repair applications.

Key Players: Boston Scientific, Zimmer Biomet, and Medtronic

Clinical trials are conducted to assess the safety and efficacy of smart implants, which are then subsequently approved by regulatory agencies.

Key Players: Aesculap AG, Stryker Corporation, and MicroPort Orthopedics, Inc.

Patient support & services refer to providing personalized, proactive, and remote care. They also involve personalized rehabilitation and detecting complications.

By Application

By Component

By Procedure

By End-use

By Region

February 2026

February 2026

February 2026

February 2026