March 2026

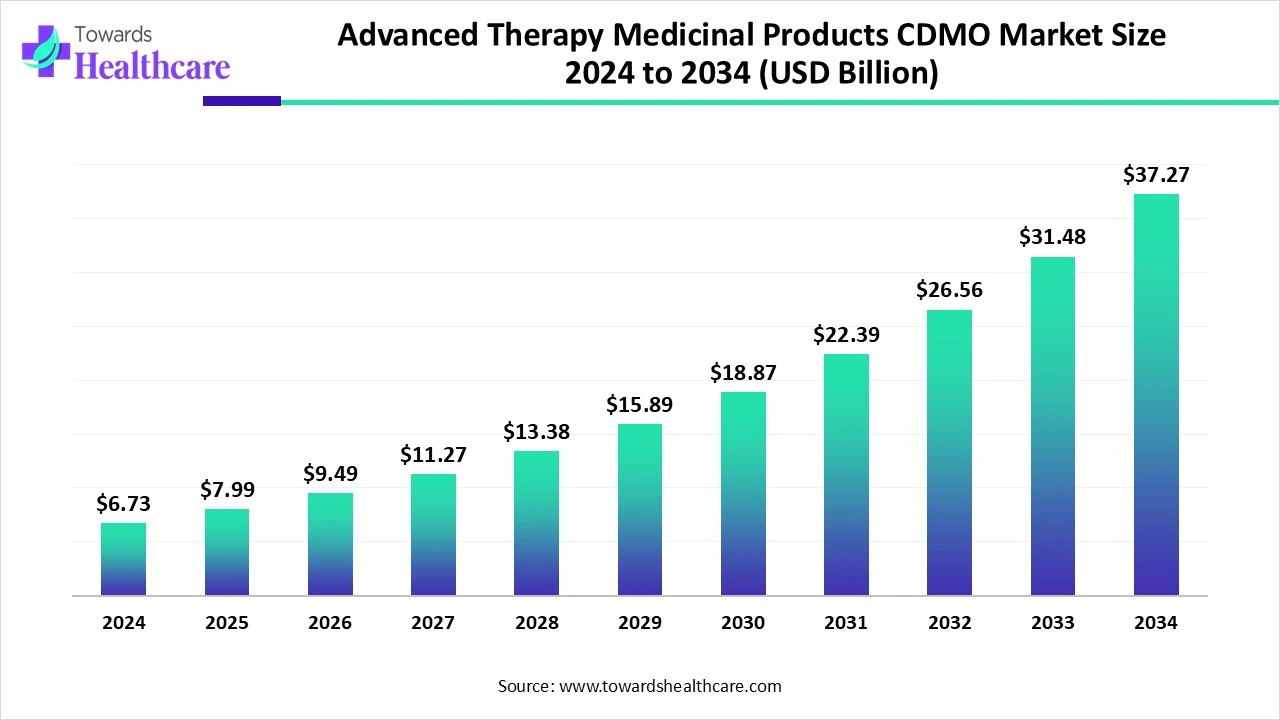

The global advanced therapy medicinal products CDMO market size is calculated at US$ 6.73 billion in 2024, grew to US$ 7.99 billion in 2025, and is projected to reach around US$ 37.27 billion by 2034. The market is expanding at a CAGR of 18.82% between 2025 and 2034.

The global advanced therapy medicinal products CDMO market is experiencing crucial growth, with the contribution of many factors, like cases of rare disorders, along with newly developing infectious diseases, generating a greater need for novel therapies. As well as a rising pipeline of ATMP in clinical trials, advancements in gene editing technologies like CRISPR, with escalating investments in pharmaceutical R&D in prospects, diverse opportunities will arise in the development of cell therapy and gene therapy, tissue-engineered products, along with innovative therapies employed in oncology. Along with this, increased investment in digital infrastructure, such as AI-driven analytics and digital twins, is expanding the market.

| Metric | Details |

| Market Size in 2025 | USD 7.99 Billion |

| Projected Market Size in 2034 | USD 37.27 Billion |

| CAGR (2025 - 2034) | 18.82% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Vector Type, By Workflow Stage, By End Use/Application, By Client Type, By Cell Type, By Region |

| Top Key Players | AGC Biologics, Aldevron (a Danaher company), Andelyn Biosciences, BlueReg (a PharmaLex company), Brammer Bio (Thermo Fisher Scientific), Catalent Cell & Gene Therapy, Center for Breakthrough Medicines, Charles River Laboratories, Cytiva (Danaher), Eurofins CDMO, Fujifilm Diosynth Biotechnologies, Lonza, Minaris Regenerative Medicine, Novasep, Oxford Biomedica, Porton Advanced, RoslinCT, Samsung Biologics (ATMP Division), Thermo Fisher Scientific, WuXi Advanced Therapies (WuXi AppTec) |

The advanced therapy medicinal products CDMO market comprises third-party providers offering development and manufacturing services for gene therapies, cell therapies, and tissue-engineered products. These therapies, which are often personalized, highly potent, and require stringent regulatory compliance, pose unique manufacturing challenges. CDMOs (Contract Development and Manufacturing Organizations) support pharmaceutical and biotech clients across early-stage development, viral vector production, cell processing, gene editing, fill-finish, and commercial-scale production under GMP conditions. Demand for outsourcing has grown due to high upfront infrastructure costs, limited internal capacity, complex regulatory requirements (especially from the EMA and FDA), and the surge in ATMP approvals and the expansion of the clinical pipeline.

The market possesses a major role of AI, due to growing technological breakthroughs in the integration of AI, automation, and digital technologies, which are revolutionizing the production methods, along with enhanced investment in digital infrastructure, such as AI-driven analytics and digital twins, are accelerating the market growth. Moreover, AI algorithms can boost product processes, anticipate possible concerns, and simplify workflows, resulting in rapid development and minimizing production timelines. As well as AI has significant advantages in quality control by detecting deviations from standards, and its automation allows CDMOs to meet diverse manufacturing demands and control complex, tailored therapies efficiently.

Advancements in Gene Therapies and Rising Clinical Trials

The global advanced therapy medicinal products CDMO market is fueled by the accelerating cases of rare disorders, along with newly emerging infectious diseases are generating a high need for novel therapies. Also, the acceleration in the pipeline of ATMP candidates in clinical trials necessary the growth of strong production facilities, which is propelling the requirement for specialized CDMO services. Whereas, immense advancements in gene editing technologies like CRISPR, with increasing investments in pharmaceutical R&D, especially in cell and gene therapies, are boosting market growth.

A Complicated Regulatory Landscape and Limited Expertise

The major challenges are that regulatory requirements for advanced therapy medicinal products are complex and time-consuming, with a strict need for safety, efficacy, and quality. Besides this, a shortage of skilled professionals with specialized expertise is required for the expansion and production of these developing therapies, resulting in a new challenge in the market.

Novel Demand for a Variety of Products and Strategic Collaborations

The advanced therapy medicinal products CDMO market will have various innovative opportunities in the coming era, including the development of a range of therapies, like gene therapy, cell therapy, and tissue-engineered products, along with innovative therapies employed in oncology. Furthermore, numerous companies are widely creating partnerships, collaborations, and alliances to raise their potential and global position within this market. Along with this, growing adoption of automation and digital analytics is boosting the focus of CDMOs on niche sectors and the development of customized solutions to differentiate themselves in a competitive market.

The cell therapy products segment held the largest share of the advanced therapy medicinal products CDMO market in 2024. The segment is impacted by the rising number of cell-based therapies in clinical trials and accelerating regulatory approvals, along with enhanced demand for sophisticated production services to assist their expansion and commercialization.

From these cell therapies, an autologous cell therapy led the segment due to its reduced risk of immunological rejection and major applications in several areas like regenerative medicine and treatment of diseases like cancer.

However, the gene therapy products segment will grow rapidly, due to the enormous financial backing and investments in gene therapy research and development, as well as its ability to cure inherited genetic issues, cancers, and other conditions. However, technological development in gene editing techniques, such as CRISPR, is also accelerating the overall segment growth.

By vector type, the adeno-associated virus (AAV) segment was dominant in the market. The emerging factors are the rising applications of AAV vectors in novel therapeutic areas, particularly in ophthalmology, hematology, cardiology, and various chronic conditions, increasing demand for tailored medicine, and accelerated investment in biotechnology research are assisting in expanding the ultimate market.

And, the lentivirus segment is predicted to grow rapidly, with escalating success rates of novel therapies in the treatment of earlier untreatable or difficult-to-treat diseases, such as specific cancers, genetic disorders, and autoimmune issues. Along with this, novel developments in vector design, with optimized safety properties and enhanced transduction efficiency, are making lentiviral vectors more useful for therapeutic uses.

The GMP manufacturing segment dominated the advanced therapy medicinal products CDMO market due to increasing demand for different cell and gene therapies, such as CAR-T, AAV-based gene therapies, and allogeneic stem cell treatments, resulting in a surge in demand for robust manufacturing facilities.

Whereas, the clinical-grade manufacturing held the biggest share of this segment with the inclusion of the expansion of regenerative medicine pipeline with many ATMP products in clinical trials, which requires advanced GMP support.

On the other hand, the fill-finish & cryopreservation segment is estimated to show rapid expansion, as the trend is moving towards personalized treatment solutions, which need flexible and compliant fill-finish approaches, can handle smaller batch sizes, and various formulations. Also, the segment will boost with the increased development of gene therapies, cell therapies, and tissue-engineered products, which require complex production conditions, including fill-finish & cryopreservation solutions.

The oncology segment led the market in 2024. The segment is propelled by the major global burden of cancer incidences, which are highly boosting significant research and development efforts in oncology, especially in advanced therapies. As well as this segment possesses a huge number of clinical trials across all phases, it is fueling the need for specialized CDMO services to expand the manufacturing of these therapies.

The genetic disorders segment is estimated to grow at the fastest CAGR in the upcoming years. With the contribution of many factors, including raised financial support for gene therapy R&D, billions of dollars in investments are driving the segment expansion. Also, rising awareness about the potential of gene therapy to address genetic disorders among researchers and the public is accelerating demand for specialized CDMO services.

By client type, the biotech startups segment held a major share of the advanced therapy medicinal products CDMO market. Due to the broad impact of the COVID-19 pandemic, which addresses the significance of cell-based therapies and vaccine development, as well as growing demand for personalized treatments with robust CDMO services in the manufacturing of cell and gene therapies, is impelling the complete segment expansion.

Whereas, the academic research & spinouts segment will show rapid growth, with an enhancement in research activities on gene and cell therapies, with emergence of genetically modified therapies, RNA therapies, and non-genetically modified cell therapies is fueling the ultimate growth of CDMO services. Also, these academic spinouts provide the delivery of cutting-edge technologies and intellectual property from academia to the commercial area, allowing the development of novel therapies.

In 2024, the T Cells segment was dominant in the market, with continuous research and development progress aimed at enhancing the efficiency, safety, and scalability of CAR-T and TCR-T cell therapies. Moreover, numerous innovations in domains, such as vector production, cell engineering, and analytical testing, are further boosting this segment's growth.

However, the iPSCs segment is predicted to grow fastest, due to its offering a customized approach to disease modeling and therapy development, enabling researchers to assess disease pathways, filter potential drug candidates, and evolve personalized treatments. Also, has widespread adoption in rising rare diseases is also accelerating the ultimate market growth.

In 2024, North America held a major share of the market due to the accelerating cases of major diseases like cancer, genetic conditions, and neurological diseases are fueling demand for targeted ATMPs with improved novel therapies as well. Besides this, this region widely encompasses increasing funding and investment in these therapies' R&D, which are influencing innovations and the development of novel treatment approaches. As well as, this region’s biopharmaceutical companies are widely dependent on CDMOs for specialized expertise and advanced manufacturing capabilities in ATMP development, with enhanced demand for CDMOs' services.

The US has shown major dominance in North America, with emerging innovations in ATMP manufacturing technologies, such as automation and closed systems with optimized efficacy and scalability properties. Besides this, this region’s market has been focusing on ATMPs clinical trials with a higher need for CDMOs' services to assist in the production and progression of novel therapies.

Canada comprises significant technological breakthroughs in cell processing, gene editing, and other areas are resulting in the development of highly efficient and tailored therapies. Along with this, this region secured recent approvals of many ATMPs R&D activities and generated new commercial choices for market leaders. However, rising collaborations between companies, research institutions, and CDMOs are also enhancing the adoption of novel manufacturing facilities.

As per the research process, Asia Pacific is estimated to grow at the fastest CAGR in the upcoming years, due to the incorporation of many factors, including growing cancer cases, genetic issues, and other diseases that require robust ATMPs. As well as many Asian countries, governments are broadly investing in research and development of ATMPs, including gene and cell therapies, which are driving the ASAP market growth.

China’s boosting burden of geriatric population with many severe health conditions is highly demanding for novel and more efficacious therapies with targeted properties is fueling demand for CDMOs' services. Moreover, China has adopted numerous clinical trials for the innovations in ATMPs, with sophisticated technologies like CRISPR and other gene editing techniques greatly driving the market expansion.

For this market,

Because of the COVID-19 pandemic, in India, ATMPs, including mesenchymal stem cells, vaccine developments have shown promising advantages, supporting the overall market growth. Along with this, the difficulties and specialized profile of ATMP production are resulting in pharmaceutical companies outsourcing development and manufacturing to CDMOs.

Europe is facing significant market growth, due to combined influential factors, like raised innovations in production approaches, including scalable and decentralized manufacturing models, as well as the growing outsourcing trend by many biopharma companies. Whereas European governments are supporting funding and favorable regulatory guidelines for ATMPs are also fueling this region’s market expansion.

Germany is increasingly adopting the development of personalized medicines, with novel candidates in cell and gene therapies, which are employed in accelerating cases of cancer, genetic disorders, and other issues.

For instance,

Different CDMOs in the UK are widely investing in the expansion of their facilities and capabilities to adapt to the increasing demand for ATMP manufacturing, such as specialized services like bioprocessing and cGMP production. Besides this, the UK is increasingly involved in novel creations in biomaterials, cellular therapies, and precision medicine are impacting advancements in several disease treatments, developing new opportunities for CDMOs.

By Product Type

By Vector Type (for Gene Therapy/CDMO Services)

By Workflow Stage

By End Use/Application

By Client Type

By Cell Type (for Cell/Tissue Therapy Manufacturing)

By Region

March 2026

February 2026

February 2026

February 2026