March 2026

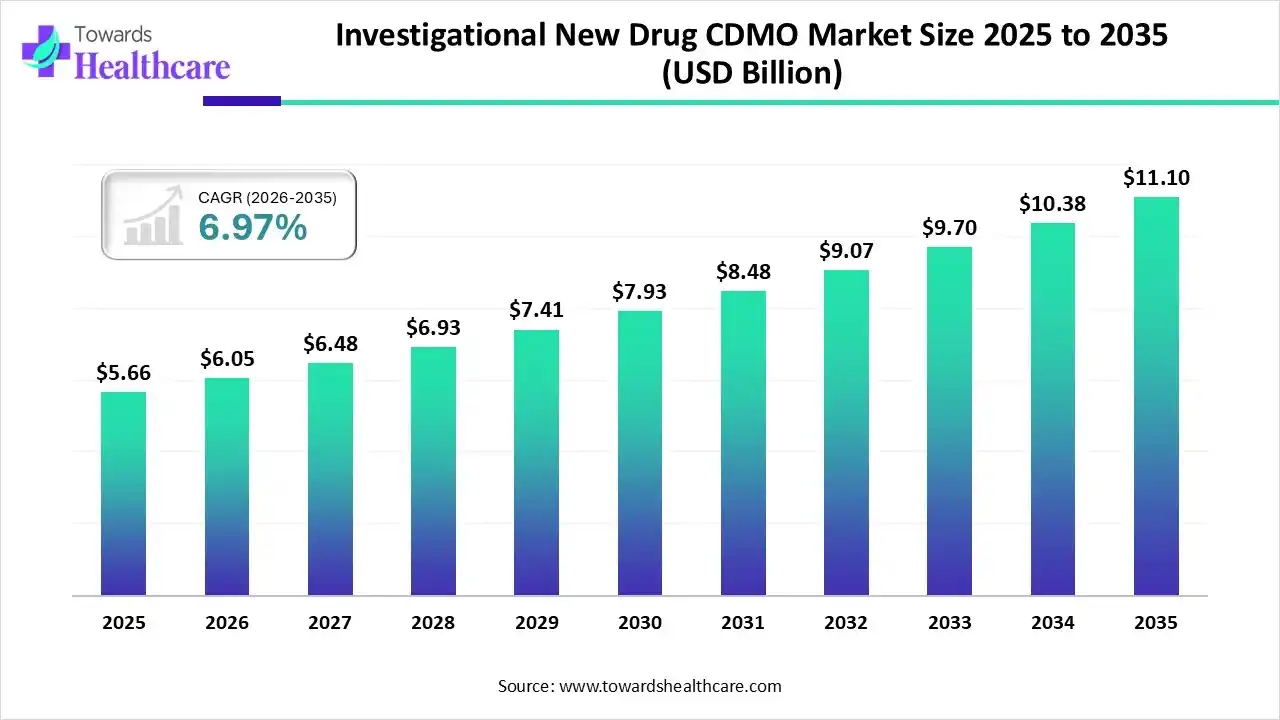

The global investigational new drug CDMO market size is calculated at US$ 5.66 billion in 2025, grew to US$ 6.05 billion in 2026, and is projected to reach around US$ 11.10 billion by 2035. The market is expanding at a CAGR of 6.97% between 2026 and 2035.

The growing drug development and manufacturing is increasing the demand as well as the use of investigational new drug (IND) CDMO services. This, in turn, is leading to new collaboration between the companies. At the same time, various platforms integrated with AI are also being developed and launched to enhance their services. Therefore, their demand in different regions is increasing, which is further being supported by the investments of private, as well as government, sectors. Thus, all these developments are promoting the market growth.

| Metric | Details |

| Market Size in 2026 | USD 6.05 Billion |

| Projected Market Size in 2035 | USD 11.10 Billion |

| CAGR (2026 - 2035) | 6.97% |

| Leading Region | North America |

| Market Segmentation | By Molecule Type, By Service Type, By Phase, By Therapeutic Area, By End Use, By Dosage Form, By Region |

| Top Key Players | AGC Biologics, Albany Molecular Research Inc. (AMRI / Curia), Asymchem, Cambrex, Catalent, CordenPharma, Eurofins CDMO, Evotec, Fujifilm Diosynth Biotechnologies, Lonza, MedPharm, Patheon (Thermo Fisher Scientific), PCI Pharma Services, Piramal Pharma Solutions, Quotient Sciences, Samsung Biologics, Siegfried Holding AG, Syngene International, Vetter Pharma, WuXi AppTec |

The Investigational New Drug CDMO Market comprises contract service providers that support pharmaceutical and biotech companies in the development and GMP manufacturing of drug candidates intended for early-phase clinical trials specifically those being submitted under IND applications to regulatory agencies such as the FDA (U.S.) or EMA (Europe). IND CDMOs offer CMC development, API and drug product manufacturing, formulation, analytical testing, and regulatory documentation support tailored to preclinical, Phase I, and Phase II studies. The IND-stage outsourcing demand is driven by high early-stage R&D activity, increasing biotech startup funding, and the need to meet accelerated regulatory timelines under programs like Fast Track or Breakthrough Therapy.

The use of AI in the investigational new drug (IND) CDMO is increasing. It helps in screening the process variability. At the same time, it helps in the optimization of the drug formulation and development process. The accuracy during the documentation and submission of an IND can be improved with the use of AI, as well as human errors can be reduced. Moreover, the risk of batch failures is also reduced. Additionally, it helps in eliminating the trial rejections and their delays.

Growing Developments in Industries

The pharmaceutical as well as biotechnological companies are continuously enhancing the development of advanced diagnostic and treatment approaches. This increases the demand for IND CMO services to support their IND development and submissions. It helps in the industries in outsourcing, provides expertise, development services, advanced technologies, platforms, etc. Thus, all these developments drive the investigational new drug CDMO market growth.

Regulatory Hurdles

The IND application must comply with the regulatory standards during its submission, especially with the chemistry, manufacturing, and controls (CMC) section. This increases the time for their manufacturing along with the IND CDMO support. This also increases the overall cost and can delay the submission of the IND application and its approval.

Growth in Cancer Treatment Approaches

To deal with the variety of cancer types, various industries are developing novel treatment approaches. This, in turn, increases the demand for IND CDMO services to enhance their development and manufacturing. The presence of expertise, advanced equipment, as well as suitable infrastructure provided by the IND CDMOs is accelerating their development. This, in turn, enhances the preparation and development of cancer treatment options. Thus, the growing developments in the cancer treatment approaches are promoting the investigational new drug CDMO market growth.

For instance,

By molecule type, the small molecules segment held the largest share in the market, with a 45-50% share in 2024. The IND CDMO provided advanced equipment that enhanced the production of small molecules. Moreover, their fewer complexities also contributed to the same. This contributed to the market growth.

By molecule type, the advanced therapies segment is expected to show the fastest growth rate at a notable CAGR during the upcoming years. Their growing development of advanced therapies for the treatment of various chronic diseases is increasing the demand for IND CDMO. Moreover, the growing innovations in gene therapies for cancer and rare diseases are also driving their demand.

By service type, the drug substance (API) services segment led the market with a 35-40% share in 2024. These services were crucial for the development of any formulation. This increased the use of IND CDMO services to enhance their development process. Moreover, the route of synthesis development and the pre-GMP & GMP API manufacturing increased its use to reduce the regulatory hurdles.

By service type, the drug product services segment is expected to show the fastest growth rate during the predicted time. The adoption of IND CDMO for these services is increasing to minimize the complexities in the development of innovative treatment approaches. Additionally, the growing fill-finish and lyophilization of advanced therapeutics is also increasing their use.

By phase type, the phase I segment held the dominating share in the market, with a 36-40% share in 2024. The lack of infrastructure and facilities in the industries increased the use of IND CDMO for their phase 1 trials. Furthermore, this accelerated the trials, which in turn enhanced the market growth.

By phase type, the preclinical segment is expected to show the fastest growth rate during the upcoming years. The increasing drug development by the industries as well as institutes is increasing the preclinical trials increasing the demand for IND CDMOs. They help in drug testing, toxicity studies, etc.

By therapeutic type, the oncology segment led the market with a 42-46% share in 2024. There was a rise in the development of various treatment approaches for oncology, which increased the use of IND CDMO services. Their development, outsourcing, trials, as well as IND submission were supported by them.

By therapeutic type, the rare diseases segment is expected to show the highest growth during the projected time. The growing development of targeted therapies for rare diseases is increasing the demand for IND CDMO. Moreover, their development is supported by funding and investments.

By end user, the emerging biotechs segment held the largest share in the market, with a 48-52% share in 2024. The emerging biotechs collaborated with an IND CDMO due to growth in their drug discovery and development. The lack of infrastructure and expertise increased their use, which promoted the market growth.

By end user, the academic spinouts segment is expected to show the highest growth during the upcoming years. The academic institutes are contributing to the growing research and development, increasing the demand for IND CDMO services. Thus, their development, testing, and IND submission are supported by these pharmaceutical CDMOs and government funding.

By dosage form type, the injectables segment led the market with a 38-42% share in 2024. The IND CDMO provides suitable infrastructure for the preparation of injectables, especially sterile liquid. This, in turn, enhanced the development of advanced treatment approaches as well as their testing.

By dosage form type, the inhalables & nasal segment is expected to show the highest growth during the predicted time. Various treatment approaches for CNS disorders and for infection, the inhalables & nasal dosage forms are being developed with the help of an IND CDMO. Furthermore, the innovations for vaccines are also contributing to the same.

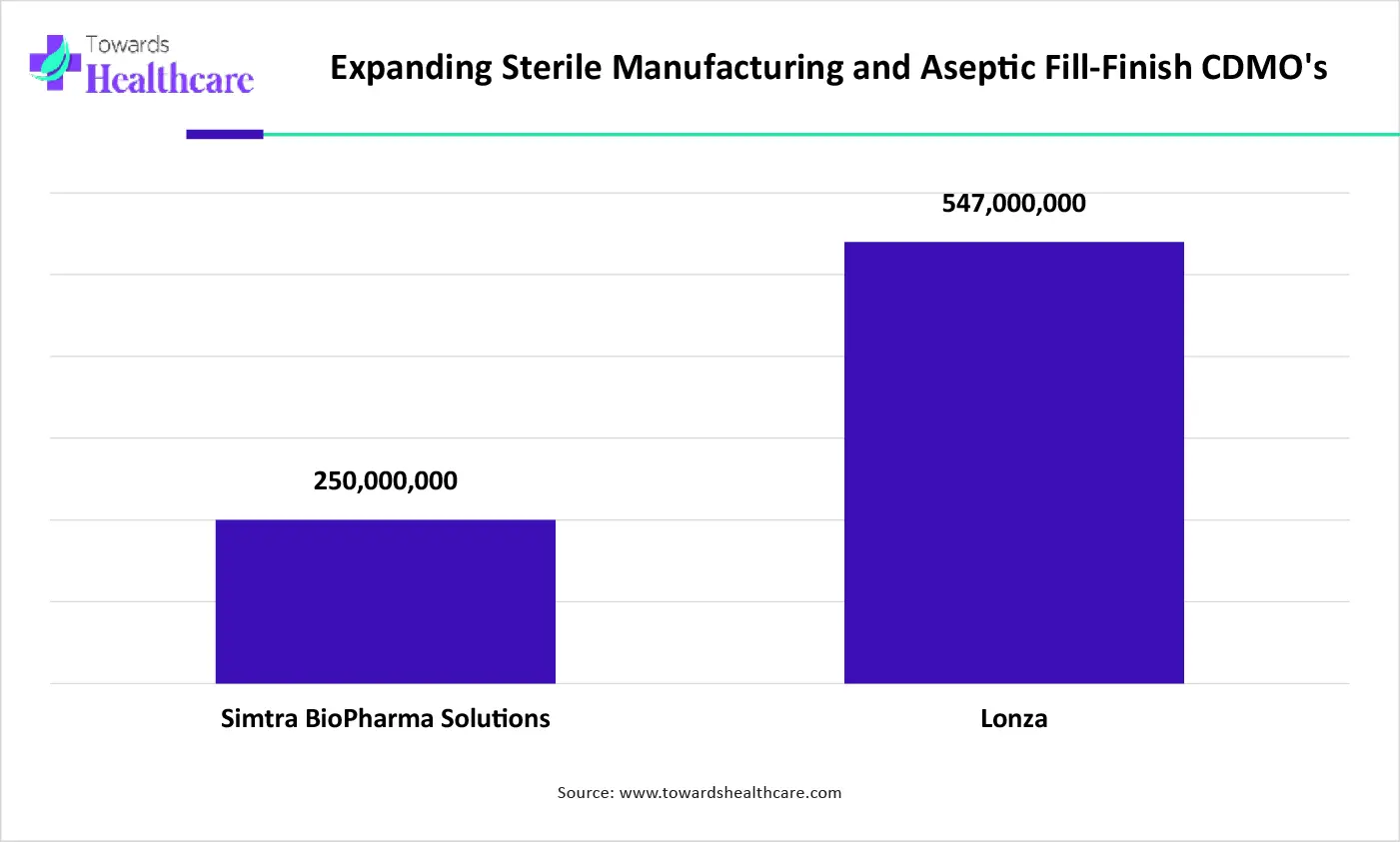

The graph represents the total investment of CDMOs for their sterile manufacturing and aseptic fill-finish expansion. It indicates that there is a rise in the expansion of CDMO manufacturing services. Hence, they will enhance the drug development, outsourcing, and IND submissions. Thus, this in turn will ultimately promote the market growth.

North America dominated the investigational new drug CDMO market in 2024. North America consists of well-developed industries with advanced technologies and skilled personnel. The increased development and production of innovative treatment approaches enhanced the use of IND CDMO. This contributed to the market growth.

The industries present in the U.S. are advanced, which in turn, increase the research and development, as well as the launch of various drugs and therapies. This, in turn, increases the adoption of IND CDMO for the submission of IND applications. It also helped in promoting the early-stage clinical trials.

The growing interest in cancer and rare diseases in Canada is increasing the research and development in various companies. Thus, to support their formulation and development, various collaborations are being formed to utilize the services of IND CDMO. Moreover, the use of advanced technologies is minimizing the regulatory hurdles.

Asia Pacific is expected to host the fastest-growing investigational new drug CDMO market during the forecast period. The industries in Asia Pacific are advancing due to growing drug development and manufacturing. At the same time, the increasing investments are also enhancing the use of IND CDMO. Thus, this enhances the market growth.

The biotech industries in China are developing advanced infrastructure to improve the IND CDMO services. This, in turn, is supported by the growing investment as well. At the same time, by providing fast-track drug approval pathways by the regulatory agency, the innovations are being supported as well as promoted.

The growing research and development in cancer in the industries of India are increasing the use of IND CDMO services. Moreover, the affordable manufacturing and development are enhancing their use. At the same time, various investments are enhancing their development. These developments are further supported by the government and regulatory bodies.

Europe is expected to grow significantly in the investigational new drug CDMO market during the forecast period. The presence of robust industries in Europe is increasing the use of IND CDMO services to promote the rising innovative therapeutic approaches. Moreover, the increasing development of cancer therapies is also promoting the market growth.

The industries as well as the institutes present in Germany are encouraging various research and development for chronic diseases. This, in turn, is leading to new collaborations with IND CDMOs. Thus, advanced platforms and expertise are accelerating the development, as well as the submission of IND applications.

The industries in the UK are developing various treatment approaches for cancer, as well as other chronic diseases. Thus, suitable infrastructure for their development and testing is provided by these IND CDMOs. Additionally, the guidelines and the investments by the regulatory agencies and the government are providing their support.

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The increasing investments, collaborations, and mergers & acquisitions foster market growth. Countries like the UAE, Saudi Arabia, and South Africa are emerging as biotech hubs in the MEA region. Government organizations support the development of new drugs through initiatives and funding. The rising prevalence of chronic disorders and advancements in genomic technologies lead to growing research activities.

It is estimated that more than half of the UAE population suffers from at least one chronic disease. Academic institutions and pharma companies are increasingly adopting AI technologies for new drug discovery. The UAE government provides the UAE Artificial Intelligence Award to encourage more organizations to develop and use AI tools for drug discovery.

Latin America is considered to be a significantly growing area, due to the presence of a suitable manufacturing infrastructure and favorable government support. Ongoing efforts are made to establish state-of-the-art research and manufacturing infrastructure, encouraging foreign companies to set up their facilities in the region. The burgeoning biotech sector and the increasing number of clinical trials also contribute to market growth.

Key players, such as PlantForm Corporation, Samsung Biologics, and Mabion, are foreign CDMOs with their manufacturing plants in Brazil. The clinicaltrials.gov website has over 10,944 clinical trials registered in Brazil. The government is also investing in pharmaceutical production, reducing dependency on imports.

By Molecule Type

By Service Type

By Phase

By Therapeutic Area

By End Use

By Dosage Form

By Region

March 2026

February 2026

February 2026

February 2026