January 2026

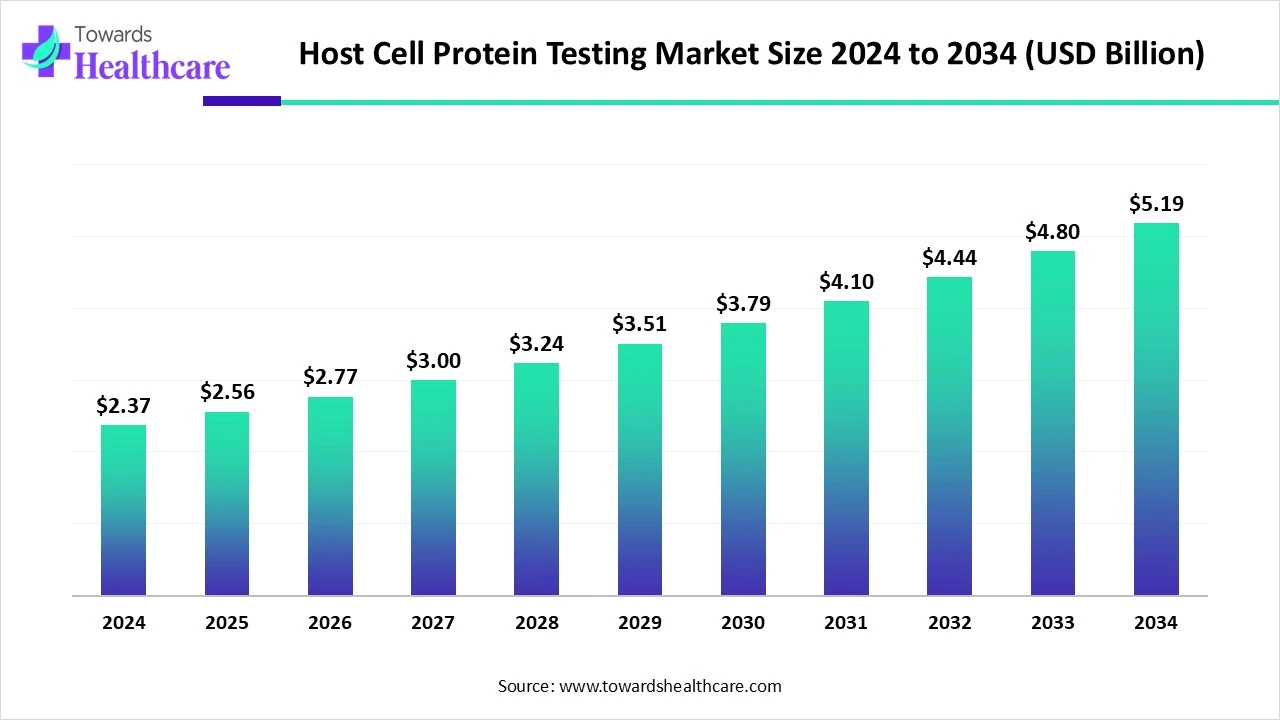

The global host cell protein testing market size is calculated at USD 2.37 billion in 2024, grew to USD 2.56 billion in 2025, and is projected to reach around USD 5.19 billion by 2034. The market is expanding at a CAGR of 8.17% between 2025 and 2034.

The host cell protein testing market is primarily driven by the growing demand for biologics and stringent regulatory frameworks. Major companies invest heavily in research and development (R&D) every year to develop innovative products, thereby expanding their product portfolios. The rapidly expanding pharmaceutical and biotechnology sectors promote the market. The future looks promising with the cutting-edge genomic technologies and advancements in analytical methods.

| Metric | Details |

| Market Size in 2025 | USD 2.56 Billion |

| Projected Market Size in 2034 | USD 5.19 Billion |

| CAGR (2025 - 2034) | 8.17% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Expression System, By Product Stage, By Application, By End-Use, By Service Type, By Region |

| Top Key Players | Abcam, Alphalyse, BioGenes GmbH, BioOutsource (Sartorius), Bio-Techne, Charles River Laboratories, Cygnus Technologies, Eurofins Scientific, GE Healthcare Life Sciences (Cytiva), Intertek Group, Kymos Pharma, Lonza, MilliporeSigma (Merck KGaA), Pacific BioLabs, PPD (Part of Thermo Fisher Scientific), Promega Corporation, SGS Life Sciences, Syngene International, Toxikon (Labcorp), WuXi Biologics |

The market refers to the segment of biopharmaceutical quality control services that detect and quantify residual host cell proteins, contaminants derived from the cells used in biologics manufacturing. These proteins can elicit immune responses and impact drug safety and efficacy. HCP testing is critical during process development, clinical production, and final product release of biologics, especially monoclonal antibodies, vaccines, enzymes, and gene therapies. Outsourcing of HCP testing is common due to regulatory requirements, the need for advanced assay technologies (e.g., ELISA, LC-MS/MS), and the complexity of developing customized reagents.

The major growth factors of the market include the growing demand for biologics and increasing research activities. Stringent regulatory policies necessitate companies to conduct an HCP test before product market approval. The increasing investments and collaborations among key players lead to the development of novel biologics. Advancements in genomic techniques and analytical methods facilitate HCP testing. The burgeoning biopharmaceutical sector and favorable government support boost the market.

Artificial intelligence (AI) can transform the way HCPs are tested by enhancing the efficiency, accuracy, and sensitivity of the test. Integrating AI in mass spectrometry and other analytical tools can improve reproducibility and detection. AI can expand the capabilities in proteomics and metabolomics. It can streamline the workflow of analysis and aid in sample preparation, thereby simplifying the task of researchers. Introducing automation can boost lab productivity, capacity, and reputation for high-quality data with faster turnaround times. AI and machine learning (ML) algorithms enable sample preparation, allowing researchers to avoid hectic tasks.

Stringent Regulations

The major growth factor of the host cell protein testing market is the stringent regulations by various regulatory agencies. Since HCP is an essential quality control indicator, it is often regarded as a Critical Quality Attribute (CQA). Regulatory agencies, like the Food and Drug Administration (FDA) and European Medicines Agency (EMA), have developed stringent policies to mandate the analysis and purification of biopharmaceuticals. The ICH Q6B provides a uniform set of international specifications for biotechnological and biological products to support new marketing applications. It provides information about HCP testing as process-related impurities.

High Heterogeneity

HCP populations are highly heterogeneous and variable. This makes it difficult for researchers to measure the level of each HCP present in biologics during and after their production process. The lack of accuracy in measuring HCPs restricts market growth.

What is the Future of the Host Cell Protein Testing Market?

The market future is promising, driven by new testing methods for HCPs. Researchers focus on developing novel testing methods to improve the accuracy, sensitivity, and specificity of HCPs. Advancements in mass spectrometry, such as LC-MS/MS and data-independent acquisition (DIA) methods, facilitate superior testing. Another novel technique, Sequential Windowed Acquisition of All Theoretical Fragment Ion Mass Spectra (SWATH-MS), is emerging as a best practice due to its numerous benefits, including high sensitivity, increased speed, and the ability to monitor protein impurities in downstream purification steps.

By technology, the ELISA segment held a dominant presence in the market in 2024. This segment dominated because the enzyme-linked immunosorbent assay is widely recognized as a gold standard for HCP testing. It is the most convenient and oldest technique used for HCP analysis. It offers superior benefits, including rapid testing, simplicity, and high-throughput. It is a suitable technique for large-scale detection. ELISA can quantify the total HCP content in a drug.

In the ELISA segment, the generic ELISA sub-segment dominated the market in 2024. Generic ELISA is widely preferred due to its simple operation and widespread use. Generic kits are useful for initial assessments and broad screening for any type of HCP, eliminating the need for specialized kits.

By technology, the liquid chromatography-mass spectrometry (LC-MS/MS) segment is expected to grow at the fastest CAGR in the market during the forecast period. Mass spectrometry is an advanced technique for analyzing HCPs. It is superior to the ELISA technique, as it takes only three months compared to 24 months. Regulatory agencies support the use of MS with ELISA or MS alone. Advancements in MS increase its demand for control and documentation of product impurities.

By expression system, the mammalian cells segment held a major revenue share of the market in 2024. This is due to the increasing use of mammalian cells for the development of therapeutic proteins. Mammalian cells are widely used due to the formation of stable formulations with high-yield expression. They are also preferred as they mimic human physiology, enabling their demand in research and biopharmaceutical production.

The CHO cells sub-segment held the largest revenue share in 2024. CHO cells are the predominant mammalian cells used for developing therapeutic proteins and monoclonal antibodies. The different types of CHO cell lines used are CHO-K1, CHO-S, CHO-DG44, and CHO-DXB11.

By expression system, the insect cells segment is expected to grow with the highest CAGR in the market during the studied years. Insect cells are used as a production host for the development of biopharmaceuticals. Sf9 is the most widely used insect cell line. The demand for insect cells is increasing as post-translational modifications of proteins are possible. This enables researchers to develop tailored biologics based on patients’ conditions. The growing demand for personalized medicines promotes the use of insect cells.

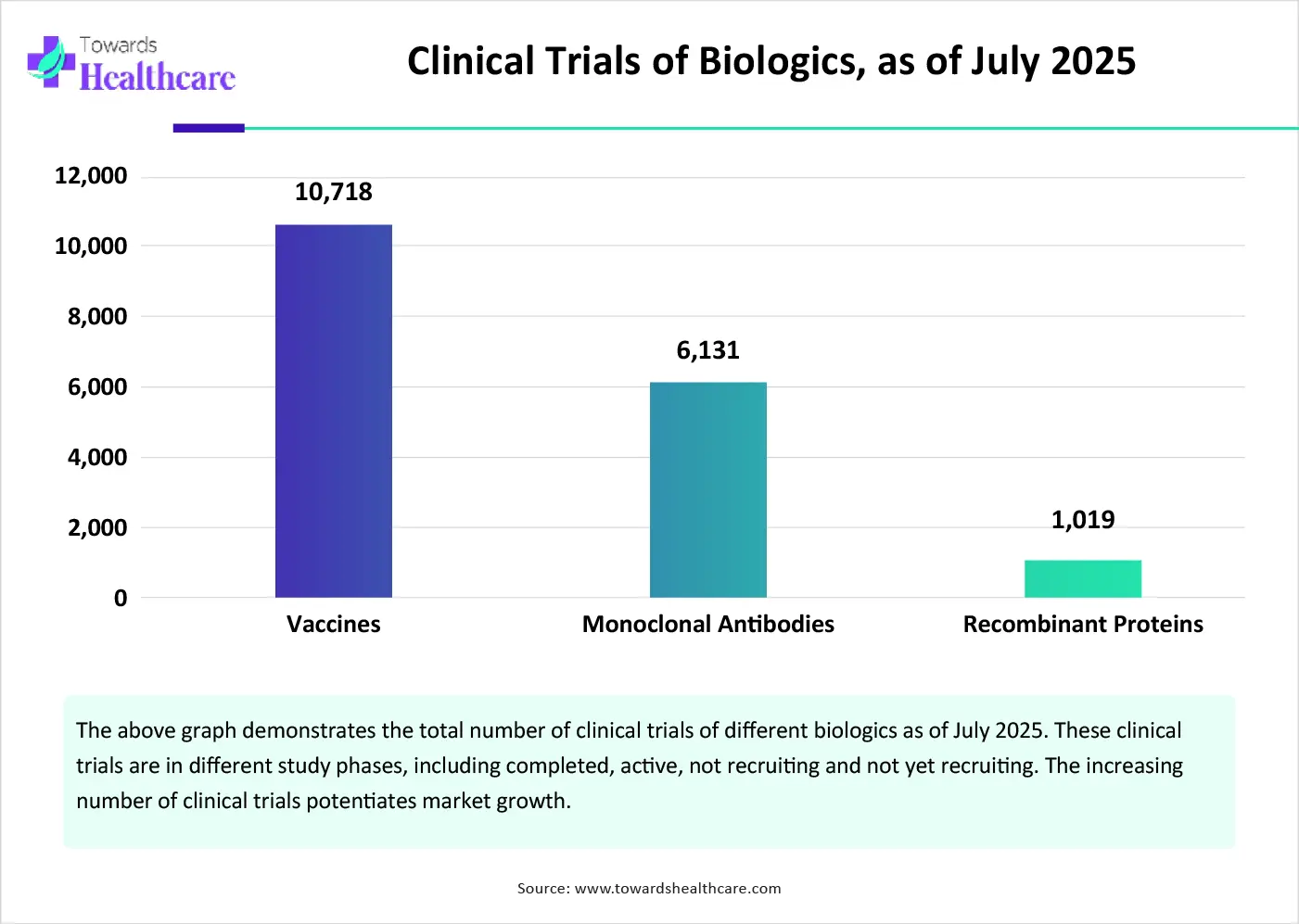

By product stage, the clinical segment contributed the biggest revenue share of the market in 2024. The segment dominated due to the increasing number of clinical trials and the growing research activities. Numerous researchers develop novel biologics and conduct clinical trials to test the safety and efficacy of those biologics. HCP testing is done before administering biologics to the patient as they elicit immune responses or affect product stability.

The Phase III sub-segment held the largest revenue share of the host cell protein testing market in 2024. Phase III clinical trials are essential as they are conducted on a large scale, involving a large human population. They are conducted at multiple centers and at different geographical locations. This necessitates companies to fulfill the regulatory requirements of biologics.

By product stage, the commercial segment is expected to expand rapidly in the market in the coming years. Several regulatory agencies mandate HCP testing for therapeutic proteins before market approval. The increasing number of new product approvals boosts the segment’s growth. The FDA and the EMA approved a total of 22 biologics and seven biosimilars in the first quarter of 2025. (Source - Aptitude Health)

By application, the monoclonal antibodies segment led the global market in 2024. Monoclonal antibodies are proteins made to stimulate the immune system. They are used to treat a wide range of chronic diseases, including some types of cancer. They can treat diseases that are otherwise untreatable by conventional drugs. They are preferred due to their high specificity of binding to a particular antigen. Tailored mAbs are developed to bind to specific antigens involved in disease progression.

By application, the gene therapy products segment is expected to witness the fastest growth in the market over the forecast period. Gene therapy products are developed by altering the genetic material to treat several genetic and rare disorders. DNA, siRNA, and mRNA are used to treat diseases through gene correction, gene silencing, and protein expression. As of January 2025, 43 cell and gene therapy products are approved by the FDA.

By end-use, the biopharmaceutical & biotechnology companies segment registered its dominance over the global market in 2024. The segmental growth is attributed to the increasing number of new product launches, favorable infrastructure, and suitable capital investments. The rising competitiveness among market players encourages them to develop novel biologics. The expansion of their product portfolios enables companies to strengthen their market position. Thus, these companies conduct HCP tests to deliver safer products in the market.

By end-use, the contract development and manufacturing organizations (CDMOs) segment is expected to demonstrate the fastest growth over the coming years. Large and small-scale companies collaborate with CDMOs to access advanced technologies. CDMOs have relevant expertise and specialized equipment. The increasing number of startups favors the segment’s growth. CDMOs enable companies to develop novel biologics and help them focus on product marketing and sales.

By service type, the HCP quantification & validation segment accounted for a bigger revenue share of the market in 2024. This is due to the growing need for accurate quantification of HCPs. HCP quantification & validation are an essential step of HCP testing. Novel testing methods like LC-MS are used to monitor HCPs, allowing risk assessment with individual HCP identification and unbiased quantification.

By service type, the HCP assay development segment is expected to show the fastest growth over the forecast period. HCP assay development is essential in multiple stages of bioprocessing development and manufacturing. These assays need to deliver robust performance on samples at varying concentration ranges. Different types of biologics need to be tested for different HCPs, necessitating the development of an HCP assay.

North America dominated the market in 2024. The presence of key players, favorable government support, and increasing R&D investments are the major growth factors of the market in North America. The availability of state-of-the-art research and development facilities enables research institutions and companies to develop novel biologics. Stringent regulatory landscape and the growing demand for advanced therapeutics foster market growth.

Key players, such as Charles River Laboratories, GE Healthcare, and Promega Corporation, are the major contributors to the market in the U.S. The FDA approved a total of 123 biologics from 2015 to 2023. The recent change in a chapter in USP mandates researchers to use advanced technology for HCP testing.

Health Canada aims to maximize the safety and effectiveness of biologics. As of March 2025, Health Canada approved 67 biosimilars, including human growth hormones, insulin, monoclonal antibodies, and TNF inhibitors. It also regulates the testing protocols of therapeutics.

Asia-Pacific is expected to grow at the fastest CAGR in the host cell protein testing market during the forecast period. The rapidly expanding biopharmaceutical & biotechnology sectors and the growing research and development activities boost the market. The increasing number of startups facilitates market growth. The rapidly evolving regulatory landscape in various countries necessitates companies to submit HCP testing data. Government organizations provide funding for research and manufacturing activities of therapeutic proteins.

China’s National Health Commission aims to develop a multipoint and efficient surveillance and early warning system for infectious diseases and improve the nation’s capabilities in detecting early signs of an epidemic and sending prompt warnings on a global level by 2030. (Source - National Health Commission of People's Republic China)

The Indian government launches several programs, including the National Viral Hepatitis Program, to combat chronic and infectious disorders and achieve country-wide elimination of infectious agents by 2030. This also leads to the development of novel biologics, thereby necessitating HCP testing.

Europe is expected to grow at a considerable CAGR in the host cell protein testing market in the upcoming period. The rising adoption of advanced technologies and favorable government policies augments market growth. The increasing investments, collaborations, and mergers & acquisitions propel the market. The growing demand for personalized medicines and targeted therapy facilitates the development of novel biologics and biosimilars. Major players, such as Abcam, Eurofins Scientific, and BioGenes GmbH, are the key players in Europe.

The burgeoning biopharmaceutical sector leads to the demand and development of biologics. In 2023, the revenue of biopharmaceutical manufacturers in Germany grew by 8.9% to EUR 19.2 billion. This revenue represents one-third of the total pharmaceutical market in Germany. The major focus is on oncology, immunology, and metabolic disorders. (Source - GTAI)

Alla Zilberman, VP of Technical Marketing & Business Development at Cygnus Technologies, commented that the collaboration between Cygnus and TriLink enables the company to bring decades of experience and advanced technology to the development of AccuRes. He also said that with the novel host cell DNA quantification kits, customers can utilize Cygnus for all their host cell protein and host cell DNA analysis needs. (Source - Businesswire)

By Technology

By Expression System

By Product Stage

By Application

By End-Use

By Service Type

By Region

January 2026

January 2026

January 2026

January 2026