MariTide (AMG 133 / maridebart cafraglutide) is Amgen’s investigational, first-in-class bispecific molecule that combines GLP-1 receptor agonism with GIP-receptor antagonism using a peptide-antibody conjugate. It is designed for monthly (or less frequent) dosing to treat obesity and related metabolic disease.

Amgen’s Role and Responsibilities

As a leading biopharmaceutical company, Amgen manages the full lifecycle of MariTide, from research to potential commercialization:

- Research & Development: Conduct preclinical and multi-phase clinical trials to ensure efficacy, safety, and optimal dosing.

- Clinical Program Leadership: Manage the MARITIME Phase-3 program, collaborating with CROs and investigators to generate robust data.

- Regulatory Submissions: Interact with agencies like FDA and EMA to prepare filings, address queries, and define post-marketing commitments.

- Manufacturing & Supply: Scale complex peptide-antibody conjugates for commercial production while maintaining quality.

- Commercial Strategy & Market Access: Develop pricing, reimbursement strategies, and health economics models to facilitate adoption.

- Medical Affairs & KOL Engagement: Educate clinicians, support guideline updates, and provide data to investigators.

- Pharmacovigilance: Monitor safety post-launch and generate real-world evidence on efficacy and adherence.

- Competitive Positioning: Differentiate MariTide against market leaders like semaglutide and tirzepatide.

Latest Announcements and Innovations

- Phase-2 Results: MariTide demonstrated up to 20% average weight loss in obesity cohorts and up to 17% in patients with type 2 diabetes, along with a reduction in HbA1c by up to 2.2 percentage points.

- Safety Profile: Discontinuation rates due to adverse effects were 11% overall, primarily gastrointestinal, with the highest dose group experiencing 27% dropout.

- Mechanistic Innovation: The bispecific design aims to enhance weight loss durability and reduce rebound weight gain.

- Phase-3 MARITIME Program: Two pivotal 72-week studies, MARITIME-1 and MARITIME-2, are underway to confirm efficacy and safety in broader populations.

GLP-1 Drugs Market Potential in 2025

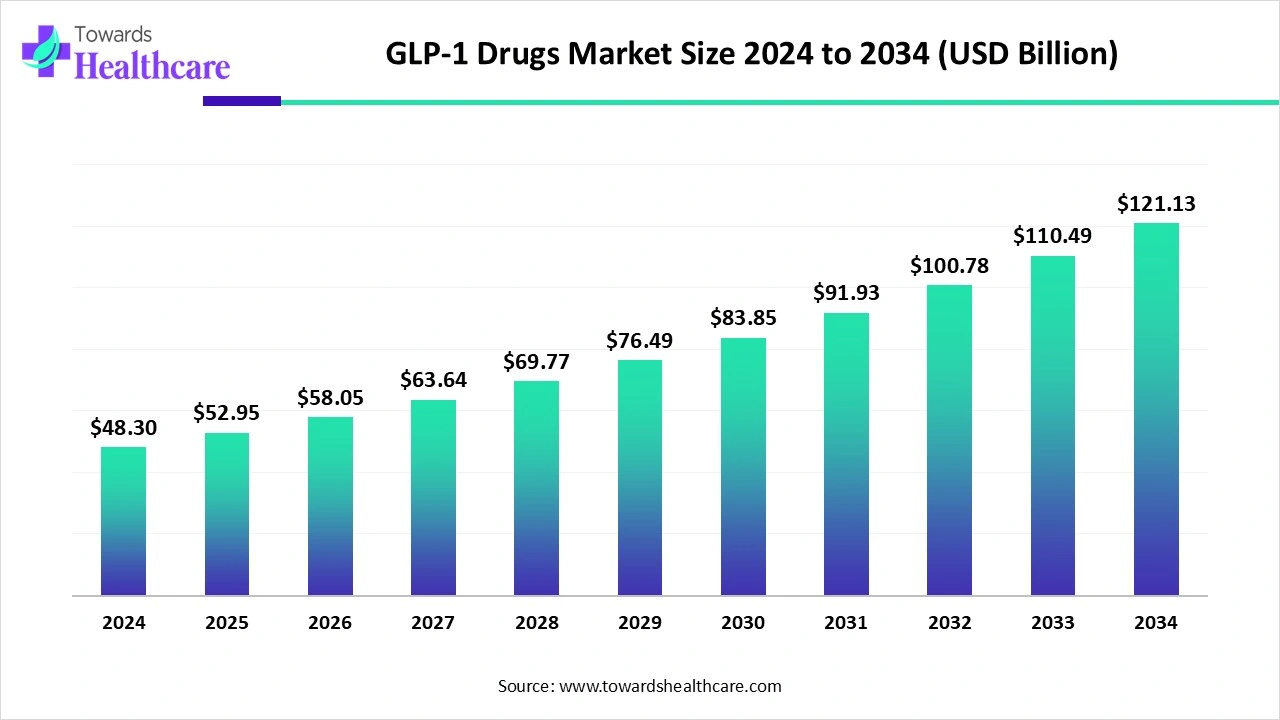

The global GLP-1 drugs market size was valued at US$ 48.3 billion in 2024 and is projected to reach US$ 52.95 billion by 2025. By the end of 2034, it is expected to grow US$ 121.13 billion, growing steadily at a CAGR of 9.63%.

MariTide enters a booming obesity drug market with strong growth projections. Its monthly dosing and novel mechanism could capture meaningful market share, especially if Phase-3 trials confirm superior or differentiated efficacy. However, adoption will depend on:

- Comparative efficacy against semaglutide, tirzepatide, and other GLP-1 therapies.

- Payer coverage and reimbursement policies.

- Manufacturing scalability and cost management.

Challenges and Considerations

- Competition: Novo Nordisk and Eli Lilly dominate the GLP-1 market, with emerging oral candidates increasing pressure.

- Comparative Effectiveness: Payers and clinicians will require strong evidence of superiority or unique benefits.

- Reimbursement: Cost-effectiveness will influence adoption, particularly in markets with evolving coverage.

- Adherence & Retention: Long-term patient adherence and management of side effects are critical.

- Manufacturing Complexity: Peptide-antibody conjugates pose challenges for large-scale production.

- Regulatory Scrutiny: Safety and long-term outcomes will be closely monitored.

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking