Get to Know the Minds Shaping Tomorrow’s Anti-hypertensive Drugs Market

Market Forecast

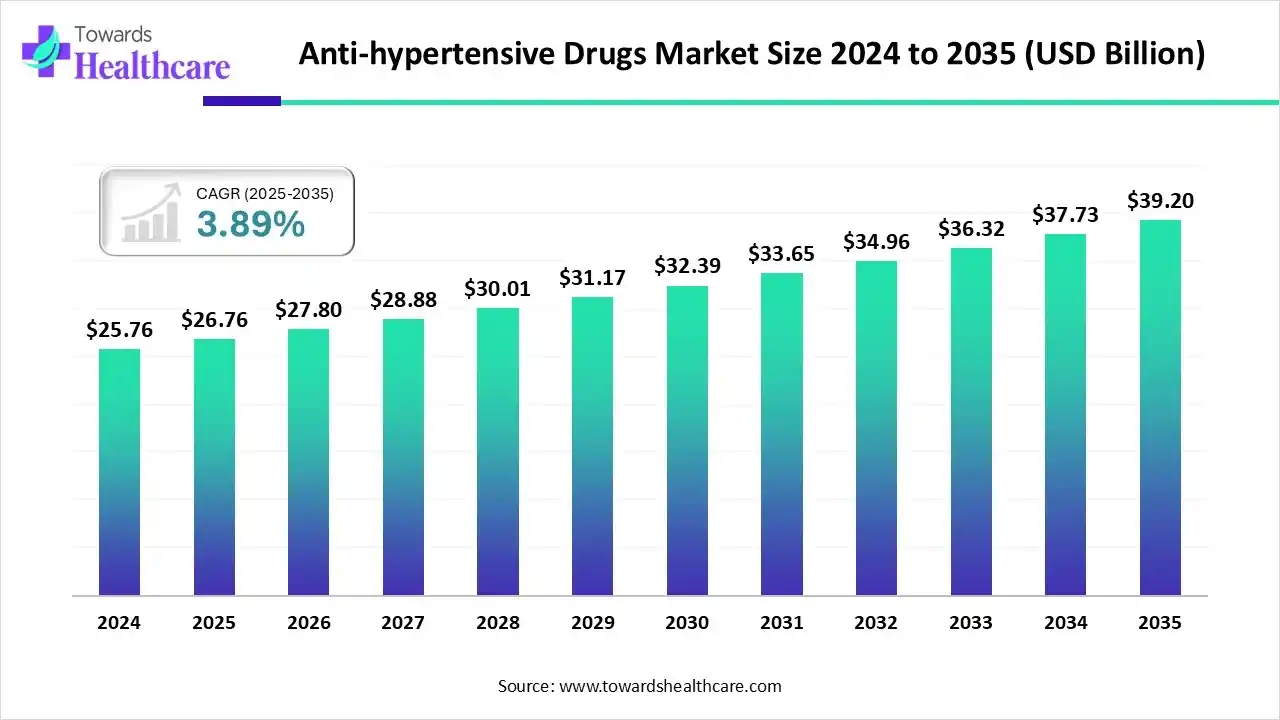

The global anti-hypertensive drugs market size is estimated at US$ 26.76 billion in 2025, grew to US$ 27.8 billion in 2026, and is projected to reach around US$ 39.2 billion by 2035. The market is expanding at a CAGR of 3.89% from 2026 to 2034.

What are Anti-hypertensive Drugs?

Advancements in drug development and digital health technologies are fueling the adoption of anti-hypertensive medications. The anti-hypertensive drugs market includes pharmaceutical products and therapies used to prevent and treat high blood pressure (hypertension), such as single-agent and combination medications across classes like ACE inhibitors, angiotensin II receptor blockers (ARBs), beta-blockers, calcium channel blockers, diuretics, and renin inhibitors. The market encompasses branded and generic prescription drugs, fixed-dose combinations, various formulations (oral tablets, extended-release, injectables), related diagnostics and monitoring devices, and services related to clinical development, regulatory approval, and distribution. Demand is driven by the global prevalence of cardiovascular disease, aging populations, screening programs, and guideline-based therapy, while pricing pressures, patent expiries, and increasing generic competition influence market dynamics.

Vendors and Their Offerings

Pfizer Inc.

Headquarters: U.S.

-

Offerings: Leading anti-hypertensive drugs and combination therapies; active in R&D for new hypertension treatments.

-

Leading anti-hypertensive drugs and combination therapies: Pfizer offers a robust portfolio of treatments specifically targeting hypertension, including combination therapies that improve patient outcomes.

-

Active in R&D for new hypertension treatments: The company dedicates significant resources to research and development, aiming to bring new, effective treatments to market.

AstraZeneca Plc

Headquarters: UK

-

Offerings: Develops ACE inhibitors, ARBs, and combination drugs for hypertension and cardiovascular diseases.

-

Develops ACE inhibitors, ARBs, and combination drugs for hypertension and cardiovascular diseases: AstraZeneca’s cardiovascular portfolio includes proven medications to manage high blood pressure and prevent heart-related diseases.

-

Focuses on research for cardiovascular health: The company prioritizes advancing cardiovascular health through ongoing research into innovative treatments and therapies.

Johnson & Johnson

Headquarters: U.S.

-

Offerings: Offers anti-hypertensive therapies and cardiovascular care products; invests in patient adherence technologies.

-

Offers anti-hypertensive therapies and cardiovascular care products: Johnson & Johnson provides a wide range of therapies designed to control blood pressure and promote overall heart health.

-

Invests in patient adherence technologies: J&J is also dedicated to enhancing patient adherence to prescribed treatments, improving long-term health outcomes.

Merck & Co., Inc.

Headquarters: U.S.

-

Offerings: ACE inhibitors and ARBs in its cardiovascular portfolio; focuses on global hypertension management.

-

ACE inhibitors and ARBs in its cardiovascular portfolio: Merck offers essential cardiovascular medications, including ACE inhibitors and ARBs, that are critical in the treatment of hypertension.

-

Focuses on global hypertension management: With a global perspective, Merck is actively working to improve hypertension treatment protocols on an international scale.

Boehringer Ingelheim GmbH

Headquarters: Germany

-

Offerings: Provides angiotensin receptor blockers (ARBs) and fixed-dose combination therapies for hypertension.

-

Provides angiotensin receptor blockers (ARBs) and fixed-dose combination therapies for hypertension: Boehringer Ingelheim specializes in effective ARBs and combination therapies, designed to improve patient outcomes in hypertension management.

-

Dedicated to improving quality of life for hypertension patients: Their therapies focus not only on controlling blood pressure but also on improving patients’ overall quality of life.

Takeda Pharmaceutical Company Limited

Headquarters: Japan

-

Offerings: Anti-hypertensive drug development, including ARBs and combination therapies; expanding market access.

-

Anti-hypertensive drug development, including ARBs and combination therapies: Takeda is committed to developing and expanding its portfolio of anti-hypertensive drugs, including ARBs and combination therapies.

-

Expanding market access: Takeda works toward increasing the availability of these therapies across a wider global market.

Bayer AG

Headquarters: Germany

-

Offerings: ACE inhibitors, ARBs, and novel formulations for hypertension; emphasizes patient-centric therapy solutions.

-

ACE inhibitors, ARBs, and novel formulations for hypertension: Bayer is known for offering innovative formulations, including ACE inhibitors and ARBs, to address hypertension effectively.

-

Emphasizes patient-centric therapy solutions: The company is dedicated to designing therapies that meet the unique needs of hypertension patients, enhancing both effectiveness and convenience.

Daiichi Sankyo Company, Limited

Headquarters: Japan

-

Offerings: Focuses on ARBs and multi-drug combinations for effective blood pressure control.

-

Focuses on ARBs and multi-drug combinations for effective blood pressure control: Daiichi Sankyo specializes in ARBs and combination drugs, ensuring comprehensive solutions for blood pressure management.

-

Striving for innovation in cardiovascular care: Their focus is on improving patient outcomes through innovative therapies for hypertension and cardiovascular diseases.

Teva Pharmaceutical Industries Ltd.

Headquarters: Israel

-

Offerings: Generic anti-hypertensive drugs portfolio; helps improve affordability and accessibility worldwide.

-

Generic anti-hypertensive drugs portfolio: Teva provides a comprehensive range of affordable generic drugs for hypertension, making treatments more accessible to a global patient population.

-

Helps improve affordability and accessibility worldwide: By offering generic versions, Teva plays a key role in improving access to essential hypertension treatments across the globe.

Recent Developments

- In August 2025, AstraZeneca’s experimental drug Baxdrostat showed promise in treating uncontrolled or resistant high blood pressure. If approved, it could be one of the first new treatment approaches in decades. Trial results were presented at the European Society of Cardiology Congress in Madrid and published in the New England Journal of Medicine.

- In June 2025, George Medicines announced FDA approval of WIDAPLIK™ (telmisartan, amlodipine, indapamide), the first triple-combination pill approved for initial hypertension therapy in adults. Available in three doses, WIDAPLIK offers a triple-mechanism approach to effectively lower blood pressure with proven safety and tolerability.

Exclusive Analysis

From the vantage point of an industry leader in the antihypertensive domain, the market for anti-hypertensive drugs presents a highopportunity corridor that demands strategic prioritisation. With persistent global epidemiologic tailwinds, aging populations, escalating prevalence of hypertension in emerging markets, and shifting lifestyle risk factors, the addressable base continues to expand.

Yet the traditional treatment classes are increasingly commoditised and marginconstrained, necessitating an inflection toward innovation. Distinct value can be captured by pioneering differentiated assets: novel mechanisms of action for treatmentresistant hypertension, fixeddose combinations (FDCs) that improve adherence, and delivery systems or digital–therapy hybrids that address patient behavioural gaps.

Concurrently, from a geographic and access standpoint, growth levers are strongest in underpenetrated geographies, specifically AsiaPacific and certain highburden middleincome markets, where market penetration, reimbursement maturity and treatment adherence remain suboptimal. Here the dual strategy of portfolio localisation (including costeffective generics/FDCs) and premium innovation (for the uncontrolledhypertension segment) aligns with lifecycleextension imperatives.

Given these dynamics, we believe the antihypertensive category presents a compelling “growthfrommaturity” paradigm: not explosive, but strategically rich, where being firstorbest in segmentspecific niches (e.g., resistant hypertension) will yield outsized returns compared to competing in commoditised massmarket segments.

Contact our experts to explore the anti-hypertensive drugs market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking