Meet the Global Leaders Transforming the Asthma And COPD Market

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd

- Merck & Co. Inc

- Grifols S.A.

- Novartis AG

- Cipla Inc.

- Abbott

- Astellas Pharma

- Hoffmann-La Roche Ltd

- Glenmark Pharmaceuticals

What Asthma and COPD Drugs Actually Means

Asthma and Chronic Obstructive Pulmonary Disease (COPD) are both chronic respiratory conditions that cause inflammation and narrowing of the airways, making breathing difficult. Asthma and COPD drugs are medications designed to relax the airways, reduce inflammation, and prevent flare-ups (exacerbations) that can worsen breathing.

These drugs are typically delivered through inhalers, nebulizers, or oral formulations, allowing direct action in the lungs.

Their main goals are:

-

To improve airflow and oxygen exchange

-

To control chronic inflammation

-

To prevent acute attacks or exacerbations

-

To enhance the quality of life for patients

While asthma and COPD drugs may overlap in type (such as bronchodilators and corticosteroids), their treatment approaches differ because of differences in disease mechanisms and progression.

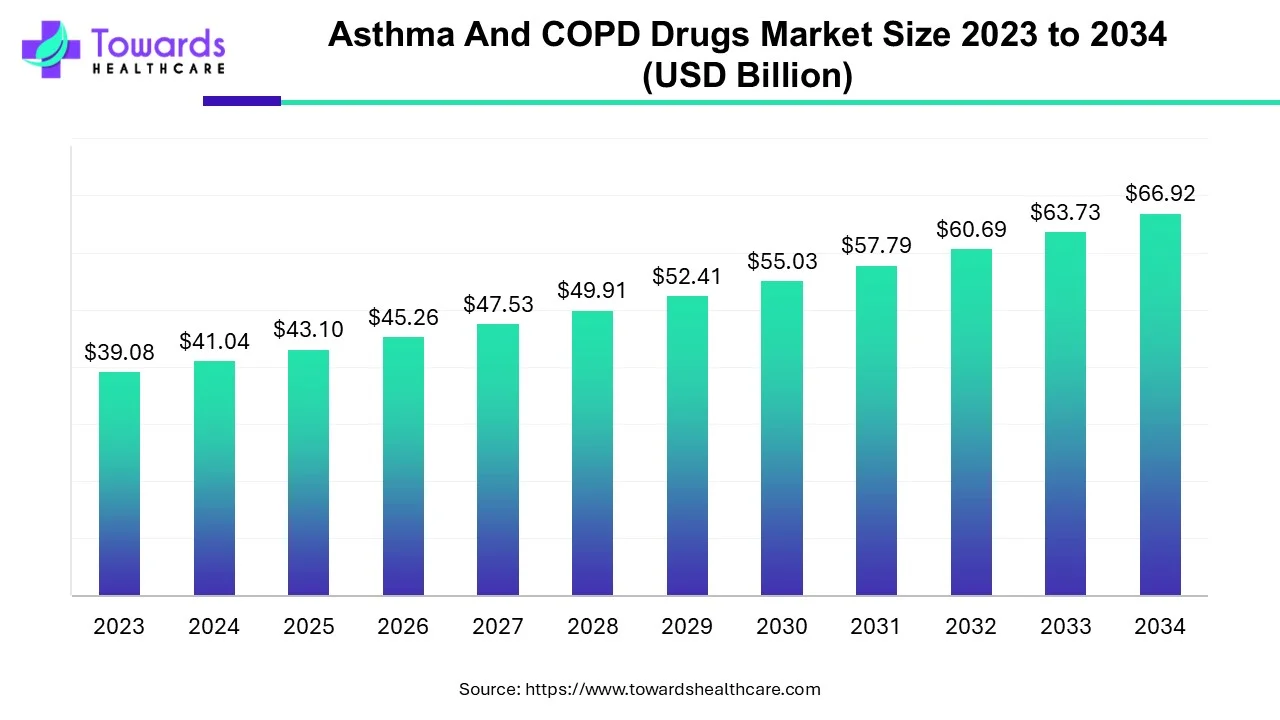

Market Growth

The global asthma and COPD drugs market size was calculated at USD 41.04 billion in 2024, to reach USD 43.1 billion in 2025 is expected to be worth USD 66.92 billion by 2034, expanding at a CAGR of 5.01% from 2024 to 2034. The rising incidences of respiratory disorders, growing research and development, and increasing investments drive the market.

Difference Between Asthma and COPD

Asthma – Key Details

Nature of the Disease:

- Asthma is a chronic inflammatory condition of the airways that causes temporary narrowing and swelling, leading to breathing difficulty.

- The airflow obstruction is reversible with proper treatment.

Main Causes:

- Triggered by allergens, dust, pollen, cold air, exercise, air pollution, or respiratory infections.

- Genetic predisposition increases risk (family history of asthma or allergies).

Age of Onset:

- Usually begins in childhood or early adulthood, though adult-onset asthma also occurs.

Symptoms:

- Wheezing (whistling sound while breathing)

- Coughing, especially at night or early morning

- Chest tightness

- Shortness of breath (especially after exertion or exposure to triggers)

Progression:

- Symptoms occur in episodes or “attacks.”

- Between attacks, patients may breathe normally.

- Does not usually cause permanent lung damage if controlled properly.

Inflammation Type:

- Involves eosinophils, mast cells, and T-helper type 2 (Th2) inflammation.

Response to Treatment:

- Very responsive to inhaled corticosteroids and bronchodilators.

- Long-term control is possible with consistent medication and avoiding triggers.

Common Treatments (2025):

- Inhaled corticosteroids (ICS) like fluticasone, budesonide

- Long-acting beta agonists (LABA) for maintenance

- Leukotriene modifiers like montelukast

- Biologic drugs like dupilumab, omalizumab, tezepelumab for severe cases

Reversibility:

- Airflow obstruction is completely or largely reversible with medication.

Lifestyle Management:

- Avoid allergens and pollutants, maintain good indoor air quality, regular exercise, and asthma action plan with the doctor.

Chronic Obstructive Pulmonary Disease (COPD) – Key Details

Nature of the Disease:

- COPD is a progressive and long-term disease that causes irreversible airflow limitation.

- It includes chronic bronchitis and emphysema as its main forms.

Main Causes:

- Long-term exposure to tobacco smoke is the leading cause (about 85–90% of cases).

- Other causes include occupational dust and fumes, air pollution, and biomass smoke (from cooking fuels).

- Rare genetic cause: Alpha-1 antitrypsin deficiency.

Age of Onset:

- Usually appears in middle-aged or older adults (above 40 years).

Symptoms:

- Persistent cough with mucus (chronic bronchitis)

- Shortness of breath, especially during exertion

- Wheezing and chest tightness

- Fatigue and frequent respiratory infections

Progression:

- Gradually worsens over time; lung damage is permanent.

- Flare-ups (exacerbations) become more frequent as the disease progresses.

Inflammation Type:

- Involves neutrophils, macrophages, and CD8+ T-cells—a different type of immune response than in asthma.

Response to Treatment:

- Only partially reversible; main goal is to control symptoms and slow progression.

- Corticosteroids have limited benefit unless combined with bronchodilators.

Common Treatments (2025):

- Long-acting bronchodilators (LABA and LAMA) such as tiotropium, indacaterol

- Combination inhalers (LABA + LAMA or LABA + ICS)

- Triple therapy inhalers like Trelegy Ellipta or Breztri Aerosphere

- Phosphodiesterase-4 inhibitor (roflumilast) for severe chronic bronchitis

- Biologic drug dupilumab (approved in 2024–2025 for eosinophilic COPD subtype)

Reversibility:

- Airflow obstruction is not fully reversible due to structural lung damage.

Lifestyle Management:

- Smoking cessation is the most important step.

- Pulmonary rehabilitation, vaccination, oxygen therapy, and regular exercise help maintain function.

Types of Drugs Used for Asthma and COPD

Treatment involves two main categories:

-

Controller (Maintenance) Medications – used daily to control symptoms and prevent attacks.

-

Reliever (Rescue) Medications – used during sudden flare-ups or shortness of breath.

Below is a breakdown of major drug classes used in asthma and COPD therapy (2024–2025):

1. Bronchodilators

These relax the muscles around the airways, widening them for easier airflow.

Types:

-

Short-Acting Beta-2 Agonists (SABAs) – quick relief (“rescue inhalers”)

-

Examples: Albuterol (Ventolin, ProAir), Levalbuterol

-

Used for: Both asthma and COPD for immediate symptom relief

-

-

Long-Acting Beta-2 Agonists (LABAs) – long-term control (12–24 hours)

-

Examples: Salmeterol, Formoterol, Indacaterol, Olodaterol

-

Used for: Maintenance therapy, often in combination with corticosteroids or antimuscarinics

-

-

Antimuscarinics (Anticholinergics):

-

Short-acting (SAMA): Ipratropium bromide

-

Long-acting (LAMA): Tiotropium (Spiriva), Umeclidinium, Glycopyrronium

-

Used more in: COPD, but also helpful in severe asthma

-

2. Corticosteroids

These reduce airway inflammation and swelling.

-

Inhaled Corticosteroids (ICS):

-

Examples: Budesonide, Fluticasone, Beclomethasone, Mometasone

-

Used mainly for: Asthma control; in COPD, used in combination with LABAs for patients with frequent exacerbations

-

-

Oral/Systemic Corticosteroids:

-

Examples: Prednisone, Methylprednisolone

-

Used for: Short-term management of severe asthma or COPD flare-ups

-

3. Combination Inhalers

These combine two or more drug classes for better control.

Examples:

-

ICS + LABA: Fluticasone/Salmeterol (Advair), Budesonide/Formoterol (Symbicort), Mometasone/Formoterol (Dulera)

-

LABA + LAMA: Umeclidinium/Vilanterol (Anoro Ellipta), Tiotropium/Olodaterol (Stiolto Respimat)

-

Triple Therapy (ICS + LABA + LAMA):

-

Examples: Fluticasone/Umeclidinium/Vilanterol (Trelegy Ellipta), Budesonide/Glycopyrrolate/Formoterol (Breztri Aerosphere)

-

Used mainly for: Severe COPD and uncontrolled asthma

-

Triple therapy is one of the fastest-growing treatment trends for COPD as of 2024–2025, supported by studies showing improved lung function and reduced exacerbations.

4. Leukotriene Modifiers (Asthma-specific)

Block leukotrienes — chemicals that cause inflammation and bronchoconstriction.

-

Examples: Montelukast (Singulair), Zafirlukast

-

Used for: Mild-to-moderate persistent asthma, especially allergy-triggered cases

5. Biologic Therapies (for Severe Asthma or COPD)

Target specific molecules driving inflammation — used when conventional treatments fail.

Approved biologics (as of 2025):

-

Anti-IgE: Omalizumab (Xolair) – for allergic asthma

-

Anti-IL5: Mepolizumab (Nucala), Reslizumab (Cinqair), Benralizumab (Fasenra) – for eosinophilic asthma

-

Anti-IL4/IL13: Dupilumab (Dupixent) – for type 2 inflammation in asthma and now explored for COPD

-

Anti-TSLP: Tezepelumab (Tezspire) – effective across asthma phenotypes

Recent advancement (2025):

-

Dupilumab and Tezepelumab are showing promise in treating a subset of COPD patients with eosinophilic inflammation, representing a new precision-medicine approach in COPD therapy.

Market Facts and Figures You Should Know

| Company | Revenue 2015 | Latest Revenue |

|---|---|---|

| Pfizer Inc. | US $48.9 billion (2015) | US $63.6 billion |

| Teva Pharmaceutical Industries Ltd | US $19.65 billion | US $16.54 billion |

| Merck & Co., Inc. | US $39.5 billion | US $64.17 billion (2024) |

| Novartis AG | Approximately US $50–52 billion | US $51.72 billion (2024) |

| Cipla Inc. | INR 11,345 crore (US $1.5 billion) in FY 2014-15 | US $3.3 billion (FY 2024-25) (approx) |

Leading Brands Powering the Asthma And COPD Drugs Market

Pfizer Inc.

Overview

Pfizer is a global biopharmaceutical company headquartered in New York City, U.S., founded in 1849. It develops and manufactures vaccines, oncology drugs, and therapies for infectious and rare diseases. The company operates in over 120 countries and is known for its strong R&D capabilities.

Annual Revenue (2024/25)

Pfizer reported approximately $63.6 billion in revenue for 2024, reflecting a continued decline in COVID-related sales but steady growth in non-COVID portfolios.

Recent Development (2025)

In 2025, Pfizer announced plans to achieve $4.5 billion in annual cost savings by optimizing operations and refocusing its pipeline on oncology and immunology. It is also progressing late-stage trials for its RSV and cancer drug candidates.

Teva Pharmaceutical Industries Ltd.

Overview

Teva is an Israeli-based pharmaceutical company headquartered in Petah Tikva, Israel, founded in 1901. It is the world’s largest generic drug manufacturer and also develops branded medicines in neurology and respiratory therapy.

Annual Revenue (2024/25)

Teva posted $16.5 billion in revenue for 2024, driven by growth in its innovative products such as Austedo and Ajovy, along with a recovery in its generics segment.

Recent Development (2025)

In 2025, Teva reported stronger operating margins and a second consecutive year of growth. The company announced new partnerships to expand its biosimilar portfolio and reduce long-term debt.

Merck & Co., Inc.

Overview

Merck & Co. (known as MSD outside the U.S. and Canada) is headquartered in Rahway, New Jersey, founded in 1891. The company focuses on oncology, vaccines, and infectious disease therapeutics.

Annual Revenue (2024/25)

Merck recorded $64.2 billion in total revenue for 2024, largely driven by its blockbuster cancer drug Keytruda and vaccine Gardasil.

Recent Development (2025)

In 2025, Merck strengthened its respiratory portfolio through acquisitions and announced plans to expand vaccine manufacturing to meet global demand.

Grifols S.A.

Overview

Grifols is a Spanish multinational healthcare company headquartered in Barcelona, founded in 1909. It specializes in plasma-derived medicines, diagnostics, and hospital pharmacy systems.

Annual Revenue (2024/25)

The company reported €6.5 billion (≈$7 billion) in 2024 revenue, supported by increasing plasma collection and U.S. market recovery.

Recent Development (2025)

In 2025, Grifols continued deleveraging efforts by selling non-core assets and reaffirmed a focus on plasma innovation, particularly in immunoglobulin therapies.

Novartis AG

Overview

Novartis is a Swiss pharmaceutical company headquartered in Basel, formed in 1996. It focuses on innovative medicines across oncology, cardiovascular, neuroscience, and ophthalmology.

Annual Revenue (2024/25)

Novartis posted $51.7 billion in revenue for 2024, reflecting strong performance from key drugs like Entresto, Kisqali, and Cosentyx.

Recent Development (2025)

In 2025, Novartis announced the acquisition of Avidity Biosciences to expand its rare-disease and RNA-based therapeutic pipeline.

Cipla Inc.

Overview

Cipla is an Indian pharmaceutical company headquartered in Mumbai, founded in 1935. It manufactures generic drugs, inhalers, APIs, and biosimilars with operations in over 80 countries.

Annual Revenue (2024/25)

Cipla reported ₹27,547 crore (around $3.3 billion) in revenue for FY2024–25, showing strong growth across domestic and export markets.

Recent Development (2025)

In 2025, Cipla reported over 30% growth in net profit for Q4 FY25 and launched new respiratory and oncology drugs in India and South Africa.

Abbott Laboratories

Overview

Abbott is a U.S.-based healthcare company headquartered in Abbott Park, Illinois, founded in 1888. It specializes in diagnostics, nutrition, medical devices, and pharmaceuticals.

Annual Revenue (2024/25)

Abbott reported $40.1 billion in revenue for 2024, with strong growth in medical devices and diagnostics.

Recent Development (2025)

In 2025, Abbott launched new continuous glucose monitoring (CGM) devices and expanded its cardiovascular device portfolio globally.

Astellas Pharma Inc.

Overview

Astellas Pharma is a Japanese multinational pharmaceutical company headquartered in Tokyo, Japan, founded in 2005 through the merger of Yamanouchi and Fujisawa. It focuses on oncology, urology, and regenerative medicine.

Annual Revenue (2024/25)

Astellas reported ¥1.55 trillion (around $10.2 billion) in 2024 revenue, with oncology as its fastest-growing segment.

Recent Development (2025)

In 2025, Astellas advanced its gene therapy programs and announced a collaboration to develop next-generation cell therapies for solid tumors.

F. Hoffmann-La Roche Ltd.

Overview

Roche is a Swiss multinational healthcare leader headquartered in Basel, founded in 1896. The company focuses on pharmaceuticals and diagnostics, particularly oncology and personalized healthcare.

Annual Revenue (2024/25)

Roche recorded $66.2 billion in revenue for 2024, achieving 7% growth at constant exchange rates.

Recent Development (2025)

In 2025, Roche launched new drugs for neurology and oncology and expanded diagnostic partnerships to support AI-based testing.

Glenmark Pharmaceuticals

Overview

Glenmark is an Indian pharmaceutical company headquartered in Mumbai, founded in 1977. It develops generic, specialty, and branded drugs across respiratory, dermatology, and oncology segments.

Annual Revenue (2024/25)

Glenmark posted ₹13,700 crore (around $1.6 billion) in FY2024–25 revenue.

Recent Development (2025)

In 2025, Glenmark completed the sale of its life sciences division to reduce debt and announced new product launches in respiratory and dermatology categories.

Asthma and COPD Drugs Market Trends

- In November 2024, researchers from King’s College London proved that benralizumab, a monoclonal antibody used for severe asthma, can be repurposed in emergency settings to reduce hospitalizations. They also showed that the drug can be used for further treatment of asthma and COPD conditions.

- In June 2024, Boehringer Ingelheim announced a first-of-its-kind program to reduce the cost of its COPD and asthma inhalers to $35 a month for eligible patients. The program was launched to provide predictable, affordable, and consistent costs for uninsured patients and those with high co-pays.

- In March 2024, the National Institute of Health and Care Research (NIHR) Patient Recruitment Center (PRC) at Bradford Teaching Hospitals recruited the first participants in Europe for two new clinical trials based on treating asthma and COPD. The trials AJAX Phase II and MIRANDA Phase III are led by AstraZeneca.

Latest Announcement by Industry Leaders

Paul Hudson, CEO of Sanofi, commented that Dupixent is set to launch for the treatment of COPD. He said that it might take some time to drive awareness and diagnosis of COPD with type 2 inflammation, hence, the infection of sales growth will likely come in 2025. He added that COPD will become the next major growth pillar for Dupixent.

Recent Events Occurring Across The Globe

- In September 2024, Regeneron and Sanofi got FDA approval for Dupixent in COPD. The approval of the antibody in a seventh indication marked the first time the regulator had authorized a biologic in COPD. The FDA approved Dupixent on the strength of clinical data showing the drug decreases exacerbations in adults on maximal standard-of-care inhaled therapy.

- In June 2024, David Zaccardelli, Pharm. D., President and Chief Executive Officer of Verona Pharma, announced that the US Food and Drug Administration approved Ohtuvayre (ensifentrine) for the maintenance treatment of chronic obstructive pulmonary disease in adult patients. Ohtuvayre is the first inhaled product with a novel mechanism of action accessible for the maintenance treatment of COPD in more than 20 years.

- In May 2024, Blackstone announced the launch of Uniquity Bio, a clinical-stage drug development company focused on immunology and inflammation. The new company is developing solrikitug for several critical respiratory and GI indications. The company also aims to launch Phase 2 clinical trials in COPD.

- In July 2023, Hormosan Pharma GmBH, Lupin’s wholly-owned subsidiary in Germany, announced the launch of Luforbec 100/6, Beclometasone 100 µg/ Formoterol 6 µg) for the treatment of asthma and COPD in Germany. Luforbec is a cost-effective, fixed combination product in a pressurized metered dose inhaler (pMDI).

Partner with our experts to explore the Asthma and COPD Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking