February 2026

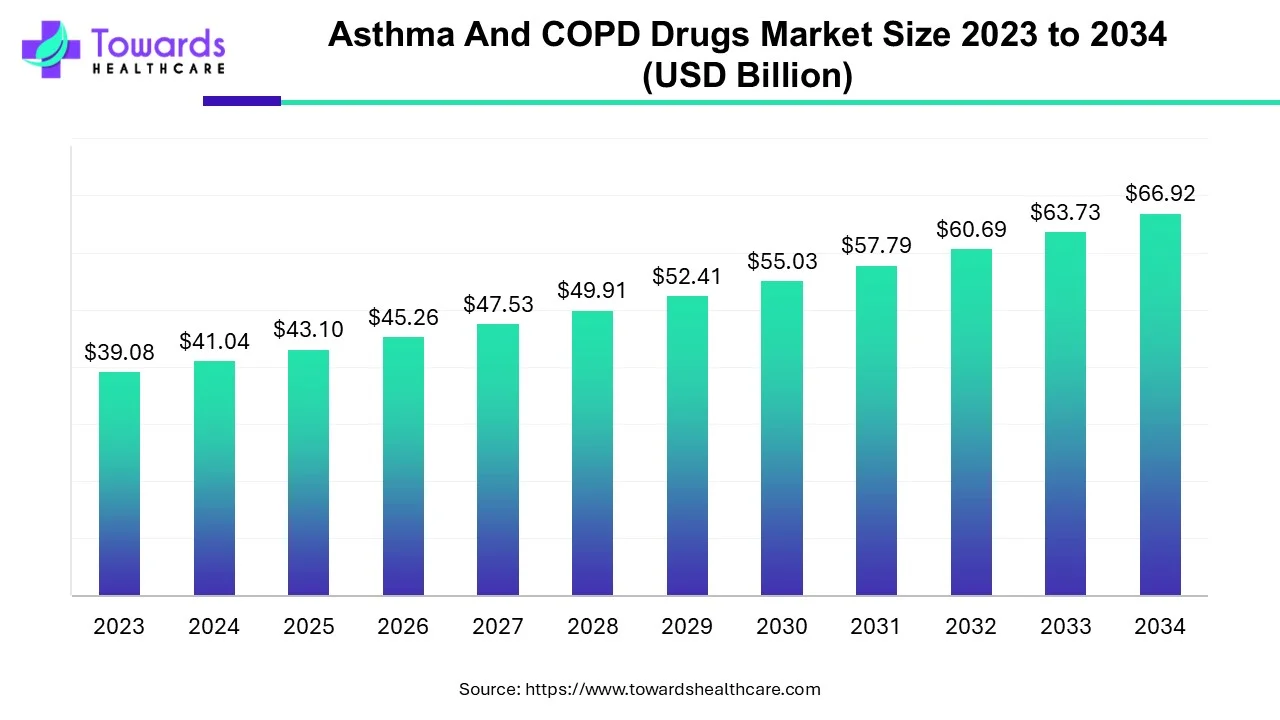

The global asthma and COPD drugs market size was calculated at USD 43.10 billion in 2025, to reach USD 45.26 billion in 2026 is expected to be worth USD 70.27 billion by 2035, expanding at a CAGR of 5.01% from 2026 to 2035. The rising incidences of respiratory disorders, growing research and development, and increasing investments drive the market.

| Key Elements | Scope |

| Market Size in 2026 | USD 45.26 Billion |

| Projected Market Size in 2035 | USD 70.27 Billion |

| CAGR (2026 - 2035) | 5.01% |

| Leading Region | North America |

| Market Segmentation | By Diseases, By Medication Class, By Distribution Channel, By Geography |

| Top Key Players | Pfizer Inc., Teva Pharmaceutical Industries Ltd, Merck & Co. Inc, Grifols S.A., Novartis AG, Cipla Inc., Abbott, Astellas Pharma, Hoffmann-La Roche Ltd, Glenmark Pharmaceuticals |

Asthma and COPD are common lung disorders caused by excessive airway constriction, making breathing difficullt. Asthma is a respiratory disorder characterized by bronchial narrowing and difficult breathing. Shortness of breath, chest tightness or pain, and a wheezing sound while exhaling are all symptoms of asthma. The term "Chronic Obstructive Pulmonary Disease" (COPD) refers to a group of respiratory disorders that primarily include emphysema and chronic bronchitis.

Asthma and COPD are diagnosed using X-ray imaging, a nitric oxide test, and a sputum examination. Bronchoconstriction is a common symptom of asthma and COPD and it can be treated with corticosteroids, anticholinergic drugs, and long-acting beta-agonists. Asthmatic patients may experience sudden bronchoconstriction, also known as an asthmatic attack. Bronchodilators are agents that can be used to treat an asthma attack. Bronchodilators are delivered in an emergency with a specially designed pump to provide immediate relief.

Functional pulmonary testing (spirometry, body-plethysmography) is essential for the diagnosis, severity determination, and management of both asthma and COPD.

“Children who have experienced trauma, such as divorce, the death of a parent, or domestic violence, are more likely to develop asthma than other children”, according to new research.

Integrating artificial intelligence (AI) and machine learning (ML) in the respiratory field allows physicians to provide advanced treatment. AI and ML can diagnose and predict the classes of asthma and COPD in patients, eliminating human errors and saving time for physicians. AI and ML can be used to design tailored treatment regimens for patients based on their respiratory conditions. They can also introduce automation in research and development activities by developing novel drugs with better efficacy and safety profile. They can predict the drug-like properties of novel compounds and patient treatment outcomes. Additionally, AI can play a vital role in streamlining the manufacturing process of asthma and COPD drugs, enhancing efficiency and reproducibility. This enables manufacturers to supply sufficient quantities due to higher demand.

Rising Public Awareness

The major growth factor of the asthma and COPD drugs market is the rising public awareness about respiratory diseases. Several government and private organizations are making efforts to increase awareness about asthma and COPD among the general public. This encourages patients for early screening and diagnosis of asthma and COPD. Recent technological advancements drive the latest innovations in screening and diagnosing respiratory disorders. Hence, this enables healthcare professionals to provide appropriate treatment for asthma and COPD at an early stage. The advent of social media also increases awareness about COPD and asthma. Research institutions organize several workshops and symposiums highlighting the significance of asthma and COPD treatment.

Influencers Fueling The Market Growth

The global increase in asthma incidence drives the growth of asthma and COPD drug markets. Additionally, rising public awareness of respiratory diseases fuels the growth of asthma and COPD drug markets. Manufacturers' and researchers' Innovation in the treatment of asthma also contributes to market expansion.

Furthermore, government initiatives to treat and improve the lifestyle of asthma and COPD patients boost the market growth. The growth of the market is also driven by the increased number of hospitals and developed healthcare infrastructure. Besides all this, the rise in tobacco smoking habits among people, as well as the rise in air pollution, contribute to the growth of the asthma and COPD drugs market. However, the rising cost of treatment for asthma and COPD is expected to limit the market growth.

Hurdles Faced During The Market Growth

The side effects of respiratory drugs are expected to limit market growth during the forecast period. Patients with asthma and COPD experience a variety of side effects from respiratory drugs. Dry mouth, headaches, constipation, fast heartbeat, muscle cramps, and shaking are the most common adverse effects. Thrush (a yeast infection in the mouth) and hoarseness can be caused occasionally due to inhaled steroid treatment. Due to this, doctors are progressively recommending alternative therapies to their patients, such as herbs and dietary supplements, yoga, relaxation, and acupuncture. In the forecast period, the rising preference for alternative therapies for the treatment of asthma and COPD have anticipated to restrain the expansion of the anti-asthmatic and COPD drugs market.

Asthma Treatment With Probiotics

Probiotics are gaining popularity in the anti-asthmatic and COPD drug markets for the treatment of asthma patients. Probiotics can boost the host immune system via the gut ecosystem and may be useful in the treatment of allergic diseases like asthma. For instance, Activated Probiotics, an Australian company that manufactures premium probiotic products, announced in November 2020, that they are expanding their range and developing probiotic products for the treatment of asthma.

Asthma Patients Can Benefit From Bioelectric Medicine

Bioelectric medicines for the treatment of asthma patients are progressively being developed by companies in the anti-asthmatics and COPD drugs markets. Bioelectronic Medicine uses miniaturized, implantable devices which can modify electrical signals that pass along nerves in the body, such as irregular or altered impulses that occur in many illnesses. ElectroCore, Inc., a bioelectronic medicine company based in the United States, received FDA approval in July 2020 for a nerve stimulator for asthma patients who were potentially affected by the novel coronavirus.

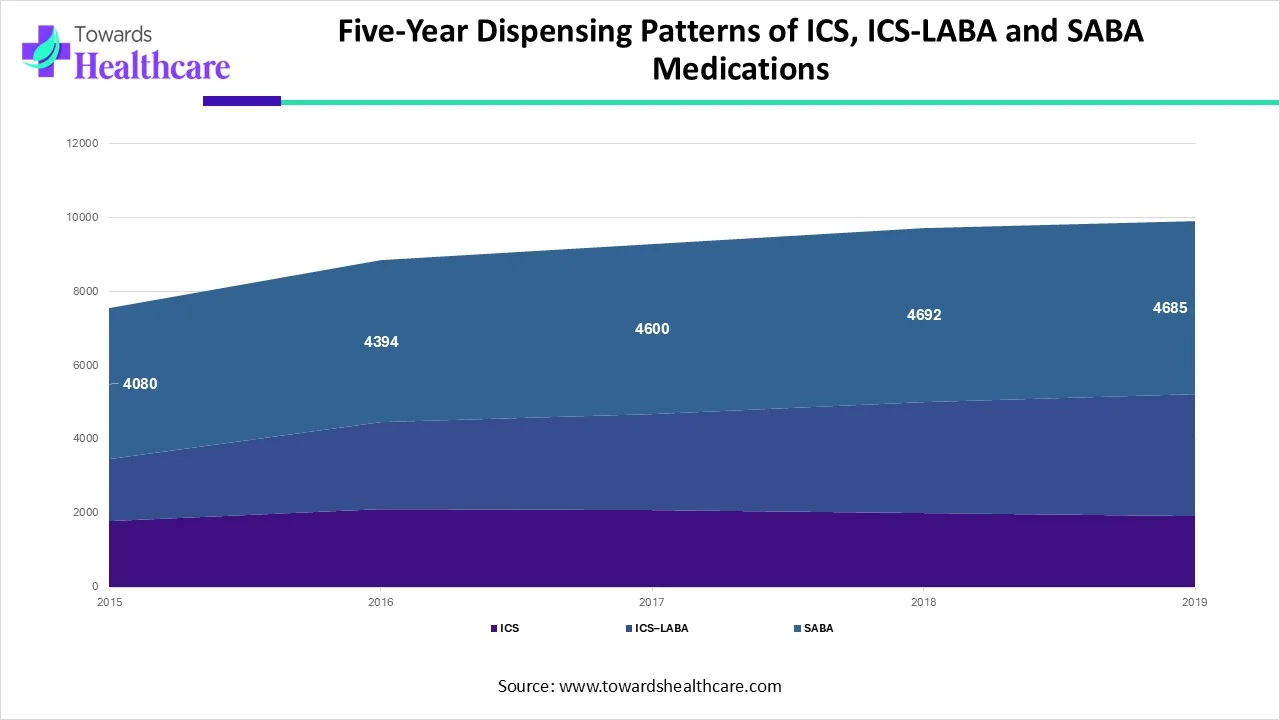

Over the five-year period from 2015 to 2019, dispensing patterns for inhaled corticosteroid and long-acting beta-agonist (ICS-LABA) medications show a steady upward trend. The number of dispensed ICS-LABA prescriptions increased from 4,080 units in 2015 to a peak of 4,692 units in 2018, followed by a slight and stable level of 4,685 units in 2019.

Although the chart also includes ICS and SABA medications, the only clearly labeled numerical values relate to ICS-LABA, which consistently remained the segment with the most significant increase. This pattern highlights the growing clinical dependence on combined ICS-LABA therapy, likely driven by a rising need for improved asthma and COPD management.

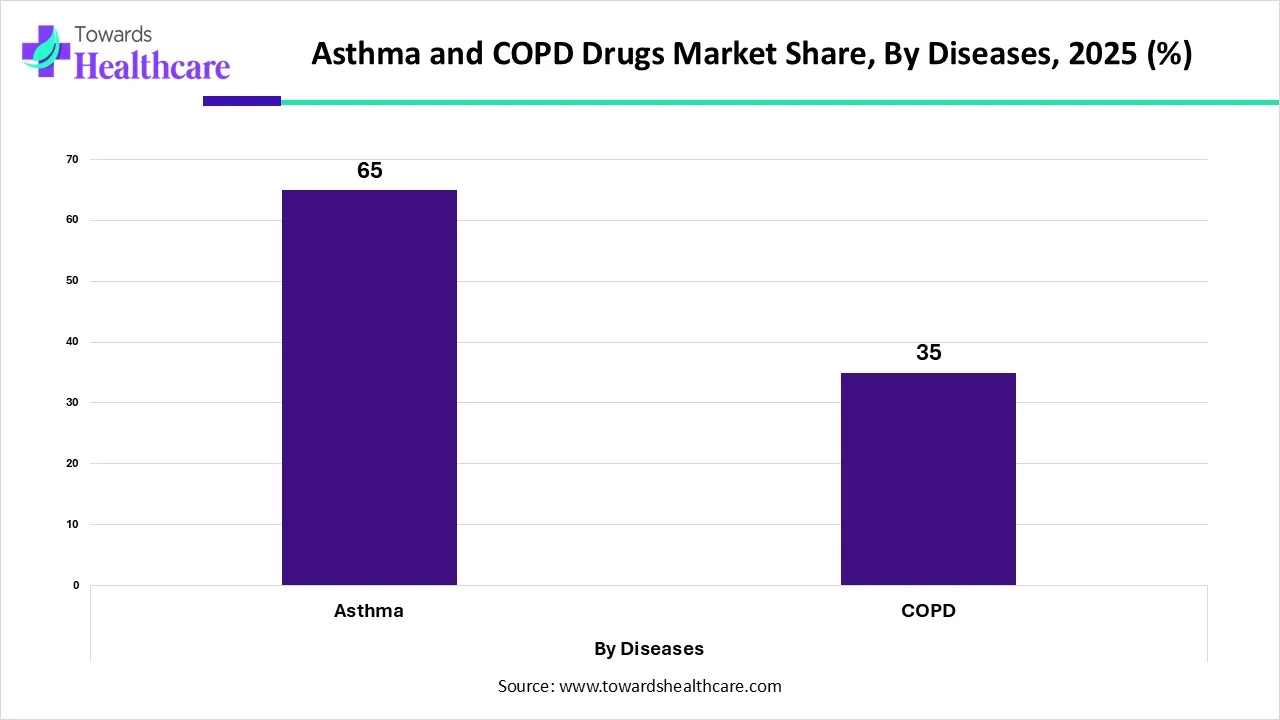

Which Disease Segment Dominated the Asthma and COPD Drugs Market?

By disease, the asthma segment dominated the market share by 65% in 2025. Asthma is a life-threatening condition that affects patients' regular breathing and is one of the world's most common diseases affecting the population. It is a chronic condition that stretches and narrows the lungs' air passages, causing attacks of breathlessness, bronchospasm, and reversible obstruction of airflow. Additionally, there is a significant increase in cigarette consumption, which contributes to asthma symptoms. Furthermore, the rise in industrialization has contributed to an increase in the number of cases of asthma, which may drive demand for asthma drugs in the forecast period.

COPD Segment: Fastest-Growing

By diseases, the COPD segment is projected to expand rapidly in the market in the coming years. Chronic obstructive pulmonary disease (COPD) is a condition caused by damage to the airways or other parts of the lung. The rising prevalence of COPD and its complexity augment the segment’s growth. According to the World Health Organization, smoking and air pollution are the most common causes of COPD. The European Respiratory Society report demonstrated that a 10 µg/m3 increase in PM2.5 levels is associated with an 18% increase in the incidence of COPD.

| Medication Class Segment | Market Share (%) |

| Combination Drugs | 30 |

| Bronchodilators | 15 |

| Inhaled Corticosteroids (ICS) | 20 |

| Short Acting Beta Agonists (SABA) | 10 |

| Long Acting Beta Agonists (LABA) | 10 |

| Leukotriene Antagonists (LTA) | 5 |

| Anticholinergics | 5 |

| Anti-Inflammatories | 3 |

| Others | 2 |

Why Did the Combination Drugs Segment Dominate the Asthma and COPD Drugs Market?

The combination drugs segment held a dominant presence in the market share by 30% in 2025. Using a combination of medications and drugs to treat a wide range of disorders has steadily increased over the last decade. According to several research studies, patients with COPD and asthma can now benefit from combination drugs. The growing research and development activities and favorable regulatory frameworks positively support the segment’s growth.

Inhaled Corticosteroids Segment: Fastest-Growing

The inhaled corticosteroids (ICS) segment will be the fastest-growing segment of the asthma and COPD drugs market. Inhaled corticosteroids (ICS) help to prevent asthma attacks while also improving lung function. They may also be used to treat other lung disorders such as COPD. When compared to other types of drugs, inhaled corticosteroids (ICS) are quite effective for the treatment of asthma.

How the General Pharmacies Segment Dominated the Asthma and COPD Drugs Market?

The general pharmacies distribution channel segment accounted for 65.3% of the total in the market segmented by distribution channel. The segmental growth is attributed to special discounts, the availability of generic alternatives, and the presence of trained professionals. The increasing number of retail stores increases the accessibility of the general public for purchasing drugs. Additionally, retail pharmacies offer home delivery facilities, potentiating the segment’s growth.

Online Pharmacies Segment: Fastest-Growing

Heading forward, the online retailer’s distribution channel market segment is anticipated to be the fastest growing segment in the anti-asthmatics and COPD drugs market. Online pharmacies offer free online consultation with a healthcare professional and the provision to order medicines in the comfort of a patient’s home. Patients can select drugs from a wide variety of manufacturers. They also offer free home delivery.

During the forecast period, the North American region is projected to dominate the Asthma and COPD drugs market. This expansion can be attributed to the rising prevalence of diseases such as COPD and asthma, the aging population, enhanced R&D activities, and the existence of key market players. There are currently 25 million people with asthma and more than 16 million people with COPD in the U.S.

US Market Trends

Asthma affects more adult women than adult men in the United States. Favorable government initiatives increase awareness for early treatment of respiratory disorders. The U.S. government launched the “Healthy People 2030” initiative to improve respiratory health. The government makes strategies to reduce environmental triggers and ensure people get the right medications to prevent hospital visits for asthma.

In contrast, Europe is expected to grow at the fastest rate during the forecast period. The United Kingdom dominates the European market for asthma and COPD medications. The growing awareness of asthma and COPD among people is attributed to the growth of the asthma and COPD drugs market in Europe. The European government has launched the “Breathe Vision 2030” to address lung health in an all-round, multidisciplinary approach. As a result, the market for asthma and COPD drugs in this region is expected to expand rapidly in the near future. The increasing investments, as well as collaborations, partnerships, and mergers & acquisitions to develop asthma and COPD drugs, also contribute to the market.

Germany Market Trends

Air pollution is the major cause of asthma and COPD in Germany. In 2024, air pollution resulted in 11% of new asthma cases, corresponding to 28,000. The European Union’s Horizon Europe programme provided funding of 3.3 million euros to the international consortium RESPIRE-EXCEL at the DZL sites to train young scientists to advance the personalized treatment of asthma and COPD.

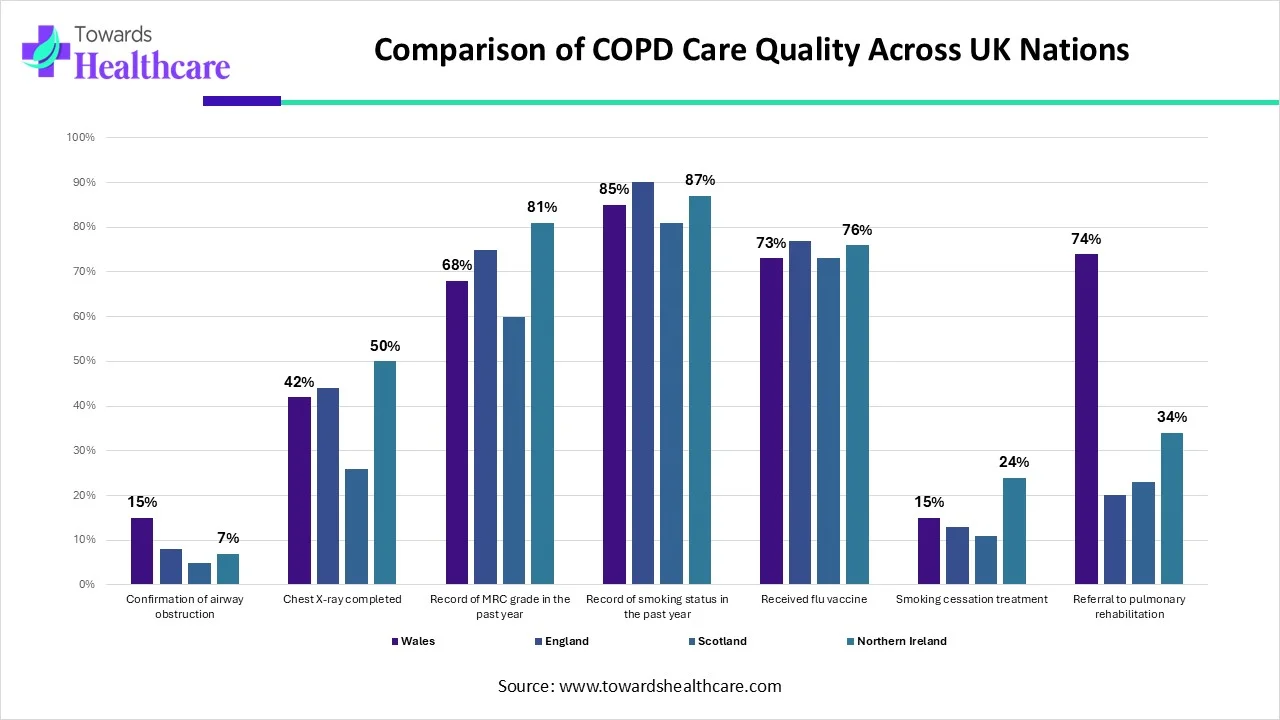

COPD Care Quality Comparison Across UK Nations

This visual compares how well the four UK nations Wales, England, Scotland, and Northern Ireland deliver key quality-of-care measures for COPD patients. The chart shows that each nation performs strongly in some areas while lagging in others.

Wales consistently performs well in several key care steps, especially in recording smoking status (85%), flu vaccination (73%), and pulmonary rehabilitation referrals (74%). Northern Ireland shows strong performance too, particularly in MRC grading (81%) and flu vaccination (76%).

England and Scotland show moderate performance across most categories, although Scotland stands out with the highest smoking-status recording rate at 87%.

Some measures, such as confirmation of airway obstruction and smoking-cessation treatment, show very low completion rates across most nations, with only Northern Ireland crossing 20% for cessation support.

Overall, the chart highlights meaningful differences in COPD care quality across the UK, revealing areas where improvement efforts and unified national standards could make a significant impact on patient outcomes.

Asia Pacific is considered a notable area in the Asthma and COPD drugs market due to the increasing incidence of respiratory diseases, a growing population with increasing smoking habits, with number of individuals affected by asthma and COPD, and a developing healthcare infrastructure. Governmental and non-governmental organizations are progressively investing in raising awareness about respiratory diseases and supporting treatment programs, which leads to higher adoption rates.

For Instance,

China Market Trends

The Chinese government is making constant efforts to establish a suitable research and clinical trial infrastructure. As of 10th December 2025, 235 trials related to asthma and 374 trials related to COPD are registered from China. This encourages foreign researchers to conduct their experiments in the nation. The Chinese institutions also offer advanced research facilities and funding programs to support asthma and COPD research.

Paul Hudson, CEO of Sanofi, commented that Dupixent is set to launch for the treatment of COPD. He said that it might take some time to drive awareness and diagnosis of COPD with type 2 inflammation, hence, the infection of sales growth will likely come in 2025. He added that COPD will become the next major growth pillar for Dupixent.

See how top manufacturers are transforming the global Asthma and COPD Market at: https://www.towardshealthcare.com/companies/asthma-and-copd-companies

By Diseases

By Medication Class

By Distribution Channel

By Geography

February 2026

February 2026

February 2026

February 2026