The sector devoted to the creation, manufacturing, and marketing of vaccinations intended to prevent dengue disease is known as the dengue vaccine market. Another significant driver of market expansion is the growing funding and assistance provided by governmental and non-governmental organizations for the development and dissemination of dengue vaccines. Increased healthcare resources and public-private partnerships are being used to hasten the release of vaccines in dengue-endemic regions.

In the WHO Region of Europe (EURO), the Regions of the Americas (PAHO), South-East Asia and West Pacific Regions (SEA RO and WPRO, respectively), the Eastern Mediterranean WHO Region (EMRO), and Africa, 101 countries and territories have reported more than 4 million dengue cases and more than 2500 dengue-related deaths since the start of 2025.

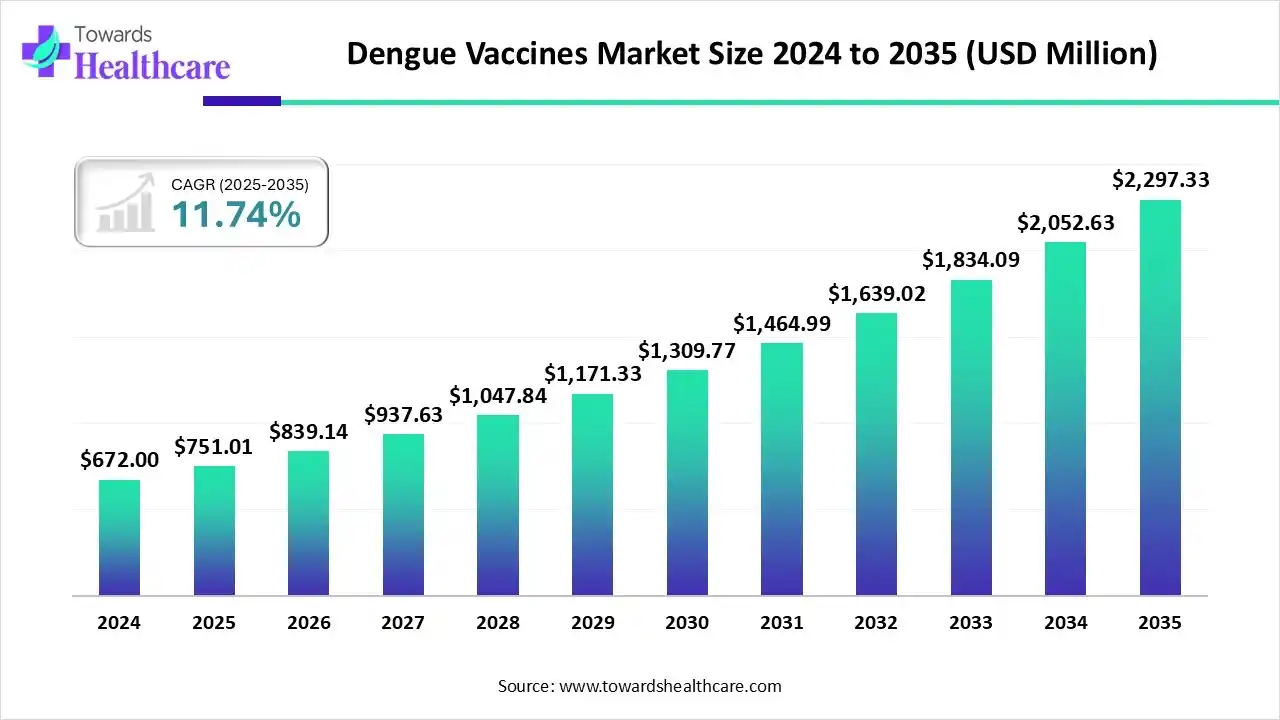

The global dengue vaccine market size is calculated at US$ 751.01 million in 2025, grew to US$ 839.14 million in 2026, and is projected to reach around US$ 2297.33 million by 2035. The market is expanding at a CAGR of 11.74% between 2026 and 2035.

Company Overview

Corporate Information

History and Background

Key Milestones/Timeline

Business Overview

A global healthcare company focused on human health through the discovery, development, manufacture, and marketing of pharmaceutical products and vaccines.

Business Segments/Divisions

Pharmaceuticals, Vaccines (Sanofi Pasteur), Consumer Healthcare.

Geographic Presence

Operates in over 70 countries worldwide, with a significant footprint in Europe, North America, and emerging markets.

Key Offerings

End-Use Industries Served

Hospitals and Specialty Clinics, Government and Public Health Agencies, Pharmacies, Retail Consumers.

Key Developments and Strategic Initiatives

Focus on strategic acquisitions to strengthen its pipeline in areas like rare diseases, immunology, and digital health.

Partnerships with academic institutions and biotechnology firms to accelerate R&D, including significant investments in mRNA technology collaborations.

Capacity Expansions/Investments

Committed to substantial annual R&D vaccine investment, approximately €1 billion.

Regulatory Approvals

Dengvaxia is approved in several endemic countries, but its use is generally restricted by the WHO to individuals with confirmed prior dengue infection due to safety concerns in seronegative individuals.

Distribution channel strategy

Utilizes a global distribution network, targeting government-led immunization programs and private healthcare channels.

Technological Capabilities/R&D Focus

Focus on next-generation vaccines, including mRNA technology platforms, to address RSV, influenza, and other infectious diseases.

Core Technologies/Patents

Holdings related to its tetravalent live attenuated dengue vaccine platform (Dengvaxia)

Research & Development Infrastructure

Global R&D centers, with a focus on advanced R&D in areas like immunology, including a commitment to make Montpellier the global hub for translational research on autoimmune diseases (October 2025).

Innovation Focus Areas

Immunology and inflammation, rare diseases, oncology, and next-generation vaccines.

Competitive Positioning

Long-standing global leader in vaccines (Sanofi Pasteur), first-to-market advantage with Dengvaxia, and broad vaccine portfolio.

Strong presence in key global vaccine markets, a critical supplier to global public health organizations.

SWOT Analysis

Recent News and Updates

Press Releases

Industry Recognitions/Awards

Continually recognized for its contributions to global health and vaccine innovation.

Company Overview

Corporate Information

History and Background

Key Milestones/Timeline

Business Overview

A patient-focused, values-based, R&D-driven global biopharmaceutical company focusing on five key business areas.

Business Segments/Divisions

Geographic Presence

Operates in over 80 countries and regions, with significant operations in Japan, the U.S., and Europe.

Key Offerings

End-Use Industries Served

Hospitals and Specialty Clinics, Government and Public Health Agencies (via immunization programs), Pharmacies.

Key Developments and Strategic Initiatives

Major acquisition of Shire plc in 2019 for approximately $62 billion, which diversified its product portfolio and global footprint.

Product Launches/Innovations

Launched Qdenga (TAK-003) as a second-generation dengue vaccine.

Capacity Expansions/Investments

Focusing on scaling up global manufacturing capacity for Qdenga, with the German facility as a primary hub and Biological E. as a key partner for future volumes and public health formats.

Regulatory Approvals

Distribution channel strategy

Strategic focus on public health programs, leveraging the WHO Prequalification for procurement by organizations like UNICEF and PAHO, alongside private market distribution.

Technological Capabilities/R&D Focus

Core technology based on a live-attenuated tetravalent vaccine, utilizing a serotype two backbone to induce robust immunity against all four serotypes (DENV-1 to DENV-4).

Core Technologies/Patents

Proprietary technology related to the DENV-2 backbone vaccine approach, Takeda's tetravalent dengue vaccine platform.

Research & Development Infrastructure

Global R&D network, including the pivotal TIDES study involving 20,000 participants across dengue-endemic countries.

Innovation Focus Areas

Complex infectious diseases, rare diseases, and advanced cell and gene therapies.

Competitive Positioning

Strengths & Differentiators

Qdenga's favorable profile for both seropositive and seronegative individuals (approved for use regardless of prior dengue exposure), strong efficacy against hospitalization, and WHO Prequalification (May 2024).

Market presence & ecosystem role

Rapidly growing presence in dengue-endemic countries, emerging as the preferred option for public health programs due to its broader label.

SWOT Analysis

Recent News and Updates

Press Releases,

Industry Recognitions/Awards

Qdenga's WHO Prequalification in May 2024 is a significant endorsement and key driver of global adoption.

To establish basic safety and immunogenicity, preclinical studies in animal models and basic research on the dengue virus are the first steps in research and development (R&D). Finding viable vaccine candidates and selecting the most promising ones for additional testing are the tasks of this stage.

Top Companies Include: Sanofi, Teva, Takeda, GSK, Merck & Co., Johnson & Johnson, Roche, Novartis, Pfizer, AstraZeneca, and Eli Lilly. Merck & Co, etc.

Phase 1 of clinical trials evaluates safety in small groups; Phase 2 studies immune response and dosage in larger groups; and Phase 3 assesses safety and efficacy in endemic areas in thousands of people. After that, data is sent to national organizations or regulatory agencies like the FDA in the form of a Biological License Application (BLA) for approval.

Top Companies Include: Sanofi, Teva, Takeda, GSK, Merck & Co., Johnson & Johnson, Roche, Novartis, Pfizer, AstraZeneca, and Eli Lilly. Merck & Co, etc.

A carefully thought-out vaccine rollout and long-term surveillance (Phase 4 trials) to track safety and effectiveness in the general population are part of patient support after approval. To guarantee proper administration, it consists of community education, precise dosage schedules (such as a three-dose series), and integration with current healthcare systems.

Top Companies Include: Merck & Co., Johnson & Johnson, Roche, Novartis, Pfizer, AstraZeneca, and Eli Lilly. Merck & Co, etc.

Collaborate with our experts to explore the Dengue Vaccine Market at sales@towardshealthcare.com